2019 FULL YEAR RESULTS Performance Highlights (Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Limits of Punishment Transitional Justice and Violent Extremism

i n s t i t u t e f o r i n t e g r at e d t r a n s i t i o n s The Limits of Punishment Transitional Justice and Violent Extremism May, 2018 United Nations University – Centre for Policy Research The UNU Centre for Policy Research (UNU-CPR) is a UN-focused think tank based at UNU Centre in Tokyo. UNU-CPR’s mission is to generate policy research that informs major UN policy processes in the fields of peace and security, humanitarian affairs, and global development. i n s t i t u t e f o r i n t e g r at e d t r a n s i t i o n s Institute for Integrated Transitions IFIT’s aim is to help fragile and conflict-affected states achieve more sustainable transitions out of war or authoritarianism by serving as an independent expert resource for locally-led efforts to improve political, economic, social and security conditions. IFIT seeks to transform current practice away from fragmented interventions and toward more integrated solutions that strengthen peace, democracy and human rights in countries attempting to break cycles of conflict or repression. Cover image nigeria. 2017. Maiduguri. After being screened for association with Boko Haram and held in military custody, this child was released into a transit center and the care of the government and Unicef. © Paolo Pellegrin/Magnum Photos. This material has been supported by UK aid from the UK government; the views expressed are those of the authors. -

Elemental Fluorine Product Information (Pdf)

Elemental Fluorine Contents 1 Introduction ............................................................................................................... 4 2.1 Technical Application of Fluorine ............................................................................. 5 2.2 Electronic Application of Fluorine ........................................................................... 7 2.3 Fluorine On-Site Plant ............................................................................................ 8 3 Specifications ............................................................................................................ 9 4 Safety ...................................................................................................................... 10 4.1 Maintenance of the F2 system .............................................................................. 12 4.2 First Aid ................................................................................................................ 13 5.1 Chemical Properties ............................................................................................. 14 5.2 Physical Data ....................................................................................................... 15 6 Toxicity .................................................................................................................... 18 7 Shipping and Transport ........................................................................................... 20 8 Environment ........................................................................................................... -

Logistics Efficiency Development in Distribution and Damage Control”

Internship report On “Logistics Efficiency Development in Distribution and Damage Control” Prepared For: Ms. Mahtab Faruqui Senior Lecturer BRAC Business School BRAC University. Prepared By: Irfan Rafique ID: 08104001 BRAC Business School BRAC University. Date: 23rd January, 2012. Letter of transmittal January 23rd, 2012 Ms. Mahtab Faruqui Senior Lecturer BRAC Business School BRAC University. Subject: Submission of internship report. Dear Madam, I would like to take the opportunity to thank you for the guidance and support you have provided me during the course of this report. I also want to express deep gratuities to Mr. Rezwan Hamid, Territory manager, Tejgoan territory for his cooperation and supervision. In this report this report I tried my level best to provide authentic information. I also tried to reflect my experience driven learning and findings. I request you to excuse me for any mistake despite my best effort. I also appreciate if you enlighten me with your thoughts and views regarding the report. Also, if you wish to enquire about any aspect of my report, I would gladly answer your questions. Yours Sincerely, Irfan Rafique ID: 08104001 BRAC Business School BRAC University ACKNOWLEDGEMENT Prosperous conclusion of any course requires support from various personal and I was fortunate to have support, direction and supervision in every aspect from my teacher, Unilever officials and friends. I would also like to express my cordial thanks and gratitude to my supervisor of internship program Ms. Mahtab Faruqui, senior lecturer for farm encouragement as well as guidance in preparing this report. I acknowledge my gratitude to Mr. Rezwan Hamid for his guidance, cooperation and help. -

Companies That Do Test on Animals

COMPANIES THAT DO TEST ON ANIMALS Frequently Asked Questions Why are these companies included on the 'Do Test' list? The following companies manufacture products that ARE tested on animals. Those marked with a are currently observing a moratorium (i.e., current suspension of) on animal testing. Please encourage them to announce a permanent ban. Listed in parentheses are examples of products manufactured by either the company listed or, if applicable, its parent company. For a complete listing of products manufactured by a company on this list, please visit the company's Web site or contact the company directly for more information. Companies on this list may manufacture individual lines of products without animal testing (e.g., Clairol claims that its Herbal Essences line is not animal-tested). They have not, however, eliminated animal testing from their entire line of cosmetics and household products. Similarly, companies on this list may make some products, such as pharmaceuticals, that are required by law to be tested on animals. However, the reason for these companies' inclusion on the list is not the animal testing that they conduct that is required by law, but rather the animal testing (of personal-care and household products) that is not required by law. What can be done about animal tests required by law? Although animal testing of pharmaceuticals and certain chemicals is still mandated by law, the arguments against using animals in cosmetics testing are still valid when applied to the pharmaceutical and chemical industries. These industries are regulated by the Food and Drug Administration and the Environmental Protection Agency, respectively, and it is the responsibility of the companies that kill animals in order to bring their products to market to convince the regulatory agencies that there is a better way to determine product safety. -

Cocamidopropyl Betaine

COCAMIDOPROPYL BETAINE Your patch test result indicates that you have a contact allergy to cocamidopropyl betaine. This contact allergy may cause your skin to react when it is exposed to this substance although it may take several days for the symptoms to appear. Typical symptoms include redness, swelling, itching and fluid-filled blisters. Where is cocamidopropyl betaine found? Cocamidopropyl betaine is used in personal care products like shampoos, hand soaps, and toothpastes, and in cosmetics as an emulsifying agent and thickener. It is also used in conditioners to reduce static cling. How can you avoid contact with cocamidopropyl betaine? Avoid products that list any of the following names in the ingredients: • 1-Propanaminium, N-(carboxymethyl)- N,N-dimethyl-3-((1-oxococonut)amino)-, hydroxide, inner salt • N-(2-Aminoethyl)-N-(2-(2- carboxyethoxy)ethyl) beta-alanine, norcoco acyl derivs., disodium salts • N-(Carboxymethyl)-N,N-dimethyl-3-((1- oxococonut)amino)-1-propanam- inium • Cocamidopropyl betaine • Cocamidopropyl dimethyl glycine • CAS RN: 61789-40-0 What are some products that may contain cocamidopropyl betaine? Anti-fungal: Shampoo/Conditioner: • Mycocide NS • Alberto VO5 Extra Body Shampoo • Alberto VO5 Herbal Escapes Moisturizing Shampoo Cosmetics: • Alberto VO5 Moisture Milks Nourishing Shampoo • Gillette Multi-Glide Shave Gel B,CPB • Alberto VO5 Normal Shampoo Hair Coloring Kits: • Aveeno Baby Wash & Shampoo • Clairol Natural Instincts Haircolor, Level 2, Hazelnut-20 • Charles Worthington Big Hair Full Volume Shampoo • -

Product & Service Guide

Product & Service Guide Your complete guide to JohnsonDiversey cleaning and hygiene solutions www.johnsondiversey.co.uk 2 Your complete guide to 1 JohnsonDiversey cleaning and hygiene solutions Whether you are a new or existing customer we want you to get the most from this guide. Contents Contents Features of this guide: There is a product index at the back Sustainability 2 72 Product Index A A Cif Wood Floor Cleaner 65 Enhance Foam Shampoo 27 Supply Chain 4 Agressor 31 CLAX 100 OB 48 Enhance Spot & Stain 27 Aquamat 10 56 CLAX 100 S 48 Ensign 360/460 55 Aquamat 20 56 CLAX 500 49 Ensign SM1/2 55 Aquamat 30 56 CLAX Bright 47 Ensign Stealth 1/2 55 Aquamat 45 56 CLAX Build 48 Ergodisc 1200 57 Customer Service Commitment 5 CLAX Diamond 47 Ergodisc 165 56 CLAX Elegant 3CL2 47 Ergodisc 200 56 B B CLAX Hypo 48 Ergodisc 238 56 Bactosol Beerline Cleaner 11 CLAX Kombi Citric 48 Ergodisc 400 56 Product Index Bactosol Cabinet Detergent 11 CLAX Mild 3RL1 47 Ergodisc 438 57 Bactosol Cabinet Glasswash Rinse Aid 11 CLAX Novix 49 Ergodisc Accessories 60 Kitchen Hygiene 6 Bactosol Glass Renovator 11 CLAX Oxy 4EP1 49 Ergodisc duo 56 Bactosol Hand Glasswashing Liquid 11 CLAX Perfect 48 Ergodisc Foam Generator 56 Balimat 45 58 CLAX Profi 47 Ergodisc Mini 56 Bourne Aqua Seal 27 CLAX Revita 49 Ergodisc omni 57 Bourne Seal 27 Clax Revoflow 45 Exact System 40 Bar & Cellar Cleaning 11 Bourne Traffic Liquid Wax 27 CLAX Saturn 49 Brillo Catering Scourers No.96 69 CLAX Sigma 48 Brillo Cleaner & Degreaser 68 CLAX Silver 48 F B Florzip Sweeping System 54 Brillo Concentrated -

Unilever to Spread Magnum Vegan Reach As Trend Set to Mainstream In

Food and Beverage Innovation December 2018 - 2019 February Volume 17 ISSN 1570-9108 DOUBLE ISSUE Unilever to spread Magnum Vegan reach as trend set to mainstream in 2019 Unilever has introduced its Magnum suitability going forward, with plant-based Vegan ice cream to Australian markets milks and meat substitutes already rapidly with more European markets to follow this moving into the mainstream. year, as the trend towards reformulating The rise of veganism is indicative classic items in vegan forms accelerates. of a growing theme towards mindful At launch, Unilever, described it as a consumption. “velvety plant-based product” that provides Animal welfare and environmental “a creamy experience without the need concerns form clear goals among the for dairy.” “A first for the Australian following of such a strict diet. Vegan market, the 100 percent dairy-free range products are increasingly associated to will feature two of the brand’s signature ethical packaging (50 percent), organic flavors…allowing vegans the opportunity (31 percent), gluten-free (34 percent) and to enjoy and share a moment of pure GMO-free (27 percent) (CAGR 2014-2018). pleasure,” the company said. In 2018, 60 percent of all products with Last year, two new vegan versions vegan claims were reported in Europe. of the popular Magnum ice cream bars continued on page 3 were launched in Sweden and Finland. TOP MARKETTop SUBCATEGORIES market subcategories OF FOOD & BEVERAGES of food LAUNCHES & beverages WITH A “VEGAN” launches CLAIM (GLOBAL, 2018) Magnum Vegan Classic and Magnum with a “vegan” claim (Global, 2018) Vegan Almond, which are European Vegetarian Union approved, are made 6 from a pea protein base and covered in smooth dark chocolate. -

Unilever Time to Lead Us out of the Plastics Crisis © Greenpeace© © Justin© Hofman Greenpeace

Unilever Time to lead us out of the plastics crisis © Greenpeace© © JustinHofman Greenpeace/ 2 Greenpeace Nederland Unilever Time to lead us out of the plastics crisis The problem with plastics Unilever’s plastic footprint and impact Every year, millions of tonnes of plastic waste is polluting our oceans, A 2019 audit of plastic waste (brand audit) by NGO GAIA reveals waterways and communities and impacting our health. Plastic Unilever as the second worst polluter in terms of collected plastic packaging, designed to be used once and thrown away, is one of pollution in the Philippines,7 and it has featured among the top the biggest contributors to the global plastics waste stream.1 The polluters in several other brand audits recently: Unilever was the vast majority of the 8.3 billion tonnes of plastic that has ever been number 2 polluter in a Manila brand audit in 2017, and number produced has been dumped into landfills or has ended up polluting 7 in a global brand audit in 2018, which represented 239 clean- our rivers, oceans, waterways and communities and impacting our ups spanning 42 countries. Therefore Unilever has both a huge health.2 Every year, between 4.8 to 12.7 million tonnes of plastic responsibility for the plastic pollution crisis, and an opportunity to enter our oceans,3 with only nine percent of plastic waste recycled tackle the problem at the source by reducing its use of single-use globally.4 We don’t know exactly how long oil-based plastic will take plastic packaging units. to break down, but once it’s in the environment, it is impossible to clean up; and so the plastic waste crisis continues. -

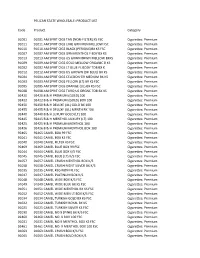

(NON-FILTER) KS FSC Cigarettes: Premiu

PELICAN STATE WHOLESALE: PRODUCT LIST Code Product Category 91001 91001 AM SPRIT CIGS TAN (NON‐FILTER) KS FSC Cigarettes: Premium 91011 91011 AM SPRIT CIGS LIME GRN MEN MELLOW FSC Cigarettes: Premium 91010 91010 AM SPRIT CIGS BLACK (PERIQUE)BX KS FSC Cigarettes: Premium 91007 91007 AM SPRIT CIGS GRN MENTHOL F BDY BX KS Cigarettes: Premium 91013 91013 AM SPRIT CIGS US GRWN BRWN MELLOW BXKS Cigarettes: Premium 91009 91009 AM SPRIT CIGS GOLD MELLOW ORGANIC B KS Cigarettes: Premium 91002 91002 AM SPRIT CIGS LT BLUE FL BODY TOB BX K Cigarettes: Premium 91012 91012 AM SPRIT CIGS US GROWN (DK BLUE) BX KS Cigarettes: Premium 91004 91004 AM SPRIT CIGS CELEDON GR MEDIUM BX KS Cigarettes: Premium 91003 91003 AM SPRIT CIGS YELLOW (LT) BX KS FSC Cigarettes: Premium 91005 91005 AM SPRIT CIGS ORANGE (UL) BX KS FSC Cigarettes: Premium 91008 91008 AM SPRIT CIGS TURQ US ORGNC TOB BX KS Cigarettes: Premium 92420 92420 B & H PREMIUM (GOLD) 100 Cigarettes: Premium 92422 92422 B & H PREMIUM (GOLD) BOX 100 Cigarettes: Premium 92450 92450 B & H DELUXE (UL) GOLD BX 100 Cigarettes: Premium 92455 92455 B & H DELUXE (UL) MENTH BX 100 Cigarettes: Premium 92440 92440 B & H LUXURY GOLD (LT) 100 Cigarettes: Premium 92445 92445 B & H MENTHOL LUXURY (LT) 100 Cigarettes: Premium 92425 92425 B & H PREMIUM MENTHOL 100 Cigarettes: Premium 92426 92426 B & H PREMIUM MENTHOL BOX 100 Cigarettes: Premium 92465 92465 CAMEL BOX 99 FSC Cigarettes: Premium 91041 91041 CAMEL BOX KS FSC Cigarettes: Premium 91040 91040 CAMEL FILTER KS FSC Cigarettes: Premium 92469 92469 CAMEL BLUE BOX -

Dove Packaging Mucell Technology

22 April 2014 ZOTEFOAMS plc ("Zotefoams" or "the Company") Unilever to use Zotefoams’s MuCell® Extrusion technology for its Dove Body Wash bottles in Europe, saving up to 275 tonnes of plastic a year Zotefoams, a world leader in cellular material technology, is pleased to note today’s announcement by Unilever that Unilever’s Dove Body Wash bottles will contain 15% less plastic as a result of a breakthrough packaging technology based on Zotefoams’s MuCell Extrusion microcellular technology. The full text of Unilever’s announcement follows: UNILEVER LAUNCHES BREAKTHROUGH PACKAGING TECHNOLOGY THAT USES 15% LESS PLASTIC Newly developed MuCell® Technology will first feature in Dove Body Wash bottles in Europe, saving up to 275 tonnes of plastic a year London/Rotterdam, 22 April 2014. Dove Body Wash bottles will contain at a minimum 15% less plastic as a result of a newly developed packaging technology launched by Unilever today. Unilever intends to widen the availability of this technology to be used more broadly across the industry. The new technology represents another substantial contribution to the target set out in the Unilever Sustainable Living Plan to halve waste footprint by 2020. The MuCell ® Technology for Extrusion Blow Moulding (EBM) was created in close collaboration with two of Unilever’s global packaging suppliers, Alpla and MuCell Extrusion. It represents a breakthrough in bottle technology: by using gas-injection to create gas bubbles in the middle layer of the bottle wall, it reduces the density of the bottle and the amount of plastic required. The technology will be deployed first in Europe across the Dove Body Wash range, before rolling the technology out. -

Unilever Pakistan Product Catalogue

UNILEVER PAKISTAN PRODUCT CATALOGUE Brand: Lipton Product: Tea, Green Tea Product Variant Lipton - box 95g Lipton - box 190g Lipton - pouch 475g Lipton – jar 475g Lipton – pouch 950g Lipton – tea bag sachet 25/ box Lipton – tea bag sachet 100/ box Lipton Green Tea (plain/ lemon/ mint/ 25/ box jasmine) * All prices will be communicated via email * All products subject to availability Brand: Brooke Bond Supreme Product: Tea Product Variant Supreme - box 95g Supreme - box 190g Supreme - pouch 475g Supreme - jar 450g Supreme - pouch 950g * All prices will be communicated via email * All products subject to availability Brand: Knorr Product: Sauces, Noodles Product Variant Flavour Noodles 40g Chicken, chatpatta Note: Products Noodles 66g Chicken, chatpatta, containing meat, achari masti, lemon milk or egg twist, pepper derivatives cannot chicken, cream be exported to the onion USA Noodles 264g Chicken, chatpatta Cube 20g Chicken, pulao * All prices will be communicated via email * All products subject to availability Brand: Knorr Product: Sauces, Noodles Note: Products containing meat, milk or egg derivatives cannot be exported to the USA Product Variant Chilli Garlic Sauce 300g Chilli Garlic Sauce 800g Tomato Ketchup 300g Tomato Ketchup 800g Yakhni 4g * All prices will be communicated via email * All products subject to availability Brand: Rafhan Product: Custard, Jelly, Pudding Product Variant Flavour Custard 50g Strawberry, vanilla, banana, mango Custard 120g Strawberry, vanilla Custard 300g Strawberry, vanilla, banana, mango Jelly 80g Strawberry, -

Q2 2011 Full Announcement

2011 FIRST HALF YEAR RESULTS CONTINUING GOOD PROGRESS DESPITE DIFFICULT MARKETS First Half Highlights • Strong second quarter underlying sales growth 7.1%; first half underlying sales growth 5.7% comprising volume growth 2.2% and price growth 3.5%. • Turnover up 4.1% at €22.8 billion with a negative impact from foreign exchange of 1.6%. • Underlying operating margin down 20bps; impact of high input cost inflation mitigated by pricing and savings. Stepped-up continuous improvement programmes generated efficiencies in advertising and promotions and led to lower indirect costs. • Advertising and promotions expenditure, at around €3 billion, was higher than the second half of 2010 but down 150bps versus the exceptionally high prior year comparator. • Fully diluted earnings per share up 10% at €0.77. • Integration of Sara Lee brands largely complete and Alberto Culver progressing rapidly. The acquisition of the laundry business in Colombia completed. Chief Executive Officer “We are making encouraging progress in the transformation of Unilever to a sustainable growth company. In a tough and volatile environment we have again delivered strong growth. Volumes were robust and in line with the market, despite having taken price increases. This shows the strength of our brands and innovations. Our emerging markets business continues to deliver double digit growth. Performance in Western Europe was also strong in the second quarter so that the half year results reflect the true progress we have been making. Bigger and better innovation rolled out faster and moving our brands into white spaces continue to be the biggest drivers of growth. We are now striving to go further and faster still.