Form F-20 2001, 1.39 MB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Telenor Hungary Sustainability Report 2014

1. sustainability report Telenor hungary 2014 Contents 1. CEO STATEMENT 3 6.4 Telenor’s contribution to transparent business 36 11. ENVIRONMENT 58 6.5. Sustainable supply chain 36 11.1. Environmental management 59 2. ABOUT THE REPORT 4 6.6. Human rights due diligence 38 11.2. Energy usage and CO2 emissions 61 2.1 Our reporting system 5 11.3. Radiation 65 2.2 This report 5 7. CUSTOMERS 39 11.4. Collecting used mobile phones 65 2.3 Defining report content 6 7.1 Innovation 40 11.5. Waste management 65 7.2 Responsible marketing 40 11.6. Paper usage 66 3. OUR SUSTAINABILITY PERFORMANCE IN FIGURES 8 7.3 Customer satisfaction 40 11.7. Water consumption 66 Environmental protection 9 7.4. Privacy 42 Economic 15 7.5. Safety 43 12. FOLLOW-UP OF PREVIOUS GOALS Social 17 AND SETTING OF NEW GOALS 67 8. INFOCOMMUNICATIONS TECHNOLOGY 4. COMPANY INFORMATION 24 FOR THE BENEFIT OF THE SOCIETY 44 13. GRI CONTENT INDEX 70 4.1 Telenor Hungary 25 8.1. Safe and responsible internet use by children 45 4.2 Governing bodies 25 8.2. ICT in education 46 ACRONYMS 82 4.3. Our services 26 8.3 Educational events 47 4.4 Our customers 26 8.4 Animal protection 47 INDEPENDENT ASSURANCE LETTER 84 4.5. Economic performance 27 8.5 Supporting NGO activities 47 4.6. Membership in organisations 29 8.6 Disaster protection 48 IMPRINT 85 8.7 Supporting law enforcement 48 5. OUR STRATEGY 30 5.1. Corporate strategy 31 9. COMMUNITY ENGAGEMENT 49 5.2. -

Telenor-ASA-Base-Prospectus-18-June-2019.Pdf

Base Prospectus TELENOR ASA (incorporated as a limited company in the Kingdom of Norway) €10,000,000,000 Debt Issuance Programme Under the Debt Issuance Programme described in this Base Prospectus (the "Programme"), Telenor ASA (the "Issuer" or "Telenor") may from time to time issue debt securities (the "Notes"). The aggregate nominal amount of Notes outstanding will not at any time exceed €10,000,000,000 (or the equivalent in other currencies), subject to compliance with all relevant laws, regulations and directives. Notes may be issued in bearer form only ("Bearer Notes"), in registered form only ("Registered Notes") or in uncertificated book entry form cleared through the Norwegian Central Securities Depository, the Verdipapirsentralen ("VPS Notes" and the "VPS" respectively). An investment in Notes issued under the Programme involves certain risks. For a discussion of these risks see "Risk Factors". This Base Prospectus comprises a base prospectus for the purposes of Article 5.4 of the Prospectus Directive. "Prospectus Directive" means Directive 2003/71/EC (as amended or superseded, including by Directive 2010/73/EU), and includes any relevant implementing measure in a relevant Member State of the European Economic Area. Application has been made to the Luxembourg Stock Exchange for the Notes issued under the Programme (other than VPS Notes) during the period of 12 months from the date of this Base Prospectus to be admitted to trading on the Luxembourg Stock Exchange's regulated market and to be listed on the Official List of the Luxembourg Stock Exchange. However, Notes may also be issued under the Programme which are listed and traded on another stock exchange or which will not be listed and traded on any stock exchange. -

Vimpelcom Ltd

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F Registration Statement Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 OR ⌧ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2012 OR Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 OR Shell Company Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Commission File Number: 1-34694 VIMPELCOM LTD. (Exact name of registrant as specified in its charter) Bermuda (Jurisdiction of incorporation or organization) Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands (Address of principal executive offices) Jeffrey D. McGhie Group General Counsel & Chief Corporate Affairs Officer Claude Debussylaan 88, 1082 MD, Amsterdam, the Netherlands Tel: +31 20 797 7200 Fax: +31 20 797 7201 (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares, or ADSs, each representing one common share New York Stock Exchange Common shares, US$ 0.001 nominal value New York Stock Exchange* * Listed, not for trading or quotation purposes, but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 1,628,199,135 common shares, US$ 0.001 nominal value. -

Liste Des Nouvelles Destinations Roaming Au Cameroun

POSTPAID Country Operator Outbound 1 New-Zealand Vodafone New-Zealand Live 2 Albania Vodafone Albania Live 3 Algerie Optimum Telecom Algeria Spa Live 4 Algerie Wataniya Télécom Algérie Live 5 Angola Unitel S.A. Live 6 Armenia MTS Armenia CJSC Live 7 Armenia UCOM LLC Live 8 Armenia VEON Armenia CJSC/ArmenTel Live 9 Australia Vodafone Hutchison Australia Pty Limited Live 10 Australia SingTel Optus Pty Limited Live 11 Australia Vodafone Hutchison Australia Pty Limited Live 12 Austria A1 Telekom Austria AG Live 13 Austria Hutchison Drei Austria GmbH Live 14 Azerbaijan Azerfon LLC Live 15 Azerbaijan Bakcell Limited Liable Company Live 16 Bahrain Zain Bahrain B.S.C Live 17 Bangladesh Grameenphone Ltd Live 18 Belgium Telenet Group BVBA/SPRL Live 19 Belgium ORANGE Belgium nv/SA Live 20 Belgium Proximus PLC Live 21 Benin Etisalat Benin SA Live 22 Benin Spacetel-Benin Live 23 Botswana Orange Botswana (Pty) Ltd Live 24 Brazil Claro S.A Live 25 Brazil TIM Celular S.A. Live 26 Brazil TIM Celular S.A. Live 27 Brazil TIM Celular S.A. Live 28 Bulgaria Telenor Bulgaria EAD Live 29 Burkina Faso Orange Burkina Faso S.A Live 30 Burkina Faso Onatel Live 31 Burkina Faso Telecel Faso S.A. Live 32 Burundi Africell PLC Company Live 33 Burundi Econetleo Live 34 Burundi Africell Live 35 Burundi Lacell SU Live 36 Cambodge metfone/Viettel Live 37 Cambodia Smart Axiata Co., Ltd. Live 38 Canada Rogers Communications Canada Inc. Live 39 Canada Rogers Communications Canada Inc. Live 40 Canada Bell Mobility Inc. Live 41 Canada TELUS Communications Inc. -

OPERA SOFTWARE ANNOUNCES FIRST QUARTER RESULTS Strong Revenue Growth and Significant Increase in Profitability

OPERA SOFTWARE ANNOUNCES FIRST QUARTER RESULTS Strong revenue growth and significant increase in profitability Oslo, Norway – May 11, 2011 – Opera Software (OSEBX: OPERA) today reported financial results for the first quarter ended March 31, 2011. 1Q 2011 financial highlights include: . Revenues of MNOK 207.3, up 37% (up 42% on a constant currency basis) versus 1Q10 . EBIT of MNOK 41.4, up 661% versus 1Q10* . Adjusted EBITDA** of MNOK 53.0, up 259% versus 1Q10*** . Operating Cash Flow of MNOK 22.5 versus MNOK -10.2 in 1Q10 Free Cash Flow of MNOK 9.9 versus MNOK -17.2 in 1Q10 . Revenues Revenue in 1Q11 was MNOK 207.3, up 37% from 1Q10, when revenue was MNOK 151.4. On a constant currency basis, 1Q11 revenues increased 42% compared to 1Q10. Revenue from Internet Devices grew to MNOK 136.4 in 1Q11 compared to MNOK 99.4 in 1Q10, an increase of 37%. 1Q11 saw very strong revenue growth from Operators, solid revenue growth from Device OEMs and falling revenue from Mobile OEMs compared to 1Q10. In general, Opera continued to see a marked shift in the revenue mix towards license revenue and away from development revenue. Revenue from Desktop rose 36% in 1Q11 to MNOK 70.9, compared to MNOK 52.0 in 1Q10, with users up approximately 13% versus 1Q10. Revenue growth from Desktop was strong due to growth in ARPU (average revenue per user). The main contributors to higher ARPU in the quarter were higher searches per user and strong growth in revenue from Opera’s local search partners. -

Årsrapport 2010

Telenor Årsrapport 2010 Årsrapport Telenor built around people Årsrapport 2010 Growth comes from truly understanding the needs of people, to drive relevant change www.telenor.com /SIDE 113/ TELENOR årsraPPORT 2010 Telenor-konsernets mobilvirksomheter Uninor – India Innhold Telenor – Pakistan Telenor har en 67,25 % eierandel Til aksjonærene /01/ Telenor eier 100 % av Telenor i Uninor i India, som lanserte sine i Pakistan, som er landets nest tjenester i desember 2009. Årsberetning 2010 /02/ største mobiloperatør. Årsregnskap Telenor – Norge Grameenphone Telenor Konsern Telenor er Norges ledende – Bangladesh tilbyder av telekommunikasjon. Telenor har en 55,8 % eierandel i Resultatregnskap /16/ Grameenphone, som er den største mobiloperatøren i Bangladesh. Oppstilling av totalresultat /17/ Grameenphone er notert på Dhaka Oppstilling av finansiell stilling /18/ Stock Exchange (DSE) Ltd. og Chittagong Telenor – Sverige Stock Exchange (CSE) Ltd. OppstillingTelenor av eier kontantstrømmmer 100 % av Telenor /19/ i Sverige, som er landets tredje Oppstillingstørste av mobiloperatør. endringer i egenkapital /20/ Noter til konsernregnskapet /21/ Telenor ASA Resultatregnskap /90/ Oppstilling av totalresultat /91/ dtac – Thailand Telenors finansielle eksponering Oppstilling av finansiell stilling /92/ i Dtac er 65,5 %. dtac er den nest Telenor – Danmark største mobiloperatøren i Thailand Oppstilling av kontantstrømmmer /93/ og er børsnotert i Thailand og Telenor eier 100 % av Telenor Singapore. Oppstillingi Danmark, av endringersom er landets nest i egenkapital /94/ Noter tilstørste regnskapet mobiloperatør. /95/ Erklæring fra styret og daglig leder /108/ Revisjonsberetning for 2010 /109/ Uttalelse fra bedriftsforsamlingen i Telenor ASA /111/ Finansiell kalender 2011 /111/ DiGi – Malaysia Telenor – Ungarn Telenor har en 49 % eierandel i DiGi, Telenor eier 100 % av Telenor den tredje største mobiloperatøren i Ungarn, som er landets nest i Malaysia. -

Ambank and Digi Partner to Lower Barriers for Smes to Adopt Epayments

Media Release 6 August 2018 AmBank and Digi partner to lower barriers for SMEs to adopt e- payments Partnership aims to enable 10,000 terminals to accept Digi’s e-payment solution in the next 12 months AmBank (M) Berhad (AmBank) continues to step up its digital strategy by opening up its wide merchant network to accept Digi’s vcash QR code as an additional payment service. This ‘e-payment partnership’ with Digi Telecommunications Sdn Bhd (Digi) takes on a two-pronged approach. Firstly, AmBank’s merchant point-of- sale (POS) terminals will be enabled to accept vcash QR code transactions. What this means is that vcash users can pay for their transactions via Digi’s vcash mobile app. vcash users only need to scan the QR code to pay. Secondly, Digi will be signing up small and mid-sized enterprise (SME) merchants under the Master Merchant programme with AmBank. This will translate to more merchants accepting vcash payments, while growing AmBank’s merchant base. “This strategic tie-up with Digi complements our efforts in broadening our product offerings to existing merchants as well as new merchants, while staying relevant and competitive in the digital landscape. It is also part of our ongoing efforts to support Bank Negara Malaysia’s agenda to accelerate the country's migration to electronic payments (e-payments) as we move towards becoming a cashless society,” said Dato’ Sulaiman Mohd Tahir, Group Chief Executive Officer, AmBank Group. “In advancing eWallet payment technology, we are working on more strategic partnerships to offer wider acceptance to our customers. -

Management Team Profile

Management Team The key roles of the Management Team, headed by the Chief Executive Officer, include running the day-to-day business of the Company. Collectively, they inspire our teams and steer the success of our business. 36 Management Team Profile Mr. Yasir Azman was appointed as Chief Executive Officer (CEO) from 01 February 2020. Prior to that, he served as Deputy Chief Executive Officer (DCEO) from 26 May 2017. He also served as Chief Marketing Officer (CMO) from 15 June 2015. Mr. Azman is an experienced professional with vast international experience in multiple countries and cultures. Before joining as CMO Grameenphone, Mr. Azman served as Telenor Group’s Head of Distribution & eBusiness and worked across all Telenor Operations. He has also worked in Telenor India operations as EVP & Circle Business Head for Orissa and Karnataka circles during 2010-2012. In his previous tenure in Grameenphone, Mr. Azman played a leading role to set up Grameenphone sales and distribution organisation and to transform Grameenphone distribution structure. As a CMO in Grameenphone, Mr. Azman has transformed Grameenphone towards a high performing and a digital-centric organisation. Throughout his career, Mr. Azman has a proven track record as a leader in transformation, change management and Yasir Azman business development. Chief Executive Officer He has an MBA from Institute of Business Administration, Dhaka University, and also Nationality Age Gender Bangladeshi 46 Male attended several executive educational programmes in the London Business School and INSEAD, France. Mr. Jens Becker was appointed as Chief Financial Officer (CFO) effective from 15 August 2019. Prior to joining Grameenphone, he served as CFO of T-Mobile Poland (formerly Polska Telefonia Cyfrowa) from 2007 to 2016 and was engaged with consultancy and entrepreneur ventures since then. -

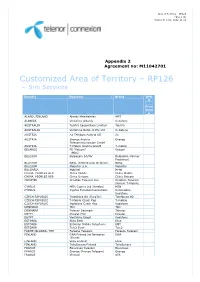

Customized Area of Territory – RP126 – Sim Services

Area of Territory – RP126 Page 1 (3) Version D rel01, 2012-11-21 Appendix 2 Agreement no: M11042701 Customized Area of Territory – RP126 – Sim Services Country Operator Brand GPR S Price Grou p ALAND, FINLAND Alands Mobiltelefon AMT ALBANIA Vodafone Albania Vodafone AUSTRALIA Telstra Corporation Limited Telstra AUSTRALIA Vodafone Network Pty Ltd Vodafone AUSTRIA A1 Telekom Austria AG A1 AUSTRIA Orange Austria Orange Telecommunication GmbH AUSTRIA T-Mobile Austria GmbH T-mobile BELARUS FE “Velcom” Velcom (MDC) BELGIUM Belgacom SA/NV Belgacom (former Proximus) BELGIUM BASE (KPN Orange Belgium) BASE BELGIUM Mobistar S.A. Mobistar BULGARIA Mobiltel M-tel CHINA, PEOPLES REP. China Mobile China Mobile CHINA, PEOPLES REP. China Unicom China Unicom CROATIA Croatian Telecom Inc. Croatian Telecom (former T-Mobile) CYPRUS MTN Cyprus Ltd (Areeba) MTN CYPRUS Cyprus Telecommunications Cytamobile- Vodafone CZECH REPUBLIC Telefónica O2 (EuroTel) Telefónica O2 CZECH REPUBLIC T-Mobile Czech Rep T-mobile CZECH REPUBLIC Vodafone Czech Rep Vodafone DENMARK TDC TDC DENMARK Telenor Denmark Telenor EGYPT Etisalat Misr Etisalat EGYPT Vodafone Egypt Vodafone ESTONIA Elisa Eesti Elisa ESTONIA Estonian Mobile Telephone EMT ESTONIA Tele2 Eesti Tele2 FAROE ISLANDS, THE Faroese Telecom Faroese Telecom FINLAND DNA Finland (fd Networks DNA (Finnet) FINLAND Elisa Finland Elisa FINLAND TeliaSonera Finland TeliaSonera FRANCE Bouygues Telecom Bouygues FRANCE Orange (France Telecom) Orange FRANCE Vivendi SFR Area of Territory – RP126 Page 2 (3) Version D rel01, 2012-11-21 GERMANY E-Plus Mobilfunk E-plus GERMANY Telefonica O2 Germany O2 GERMANY Telekom Deutschland GmbH Telekom (former T-mobile) Deutschland GERMANY Vodafone D2 Vodafone GREECE Vodafone Greece (Panafon) Vodafone GREECE Wind Hellas Wind Telecommunications HUNGARY Pannon GSM Távközlési Pannon HUNGARY Vodafone Hungary Ltd. -

The Annual Report 2002 Documents Telenor's Strong Position in the Norwegian Market, an Enhanced Capacity to Deliver in The

The Annual Report 2002 documents Telenor’s strong position in the Norwegian market, an enhanced capacity to deliver in the Nordic market and a developed position as an international mobile communications company. With its modern communications solutions, Telenor simplifies daily life for more than 15 million customers. TELENOR Telenor – internationalisation and growth 2 Positioned for growth – Interview with CEO Jon Fredrik Baksaas 6 Telenor in 2002 8 FINANCIAL REVIEW THE ANNUAL REPORT Operating and financial review and prospects 50 Directors’ Report 2002 10 Telenor’s Corporate Governance 18 Financial Statements Telenor’s Board of Directors 20 Statement of profit and loss – Telenor Group 72 Telenor’s Group Management 22 Balance sheet – Telenor Group 73 Cash flow statement – Telenor Group 74 VISION 24 Equity – Telenor Group 75 Accounting principles – Telenor Group 76 OPERATIONS Notes to the financial statements – Telenor Group 80 Activities and value creation 34 Accounts – Telenor ASA 120 Telenor Mobile 38 Auditor’s report 13 1 Telenor Networks 42 Statement from the corporate assembly of Telenor 13 1 Telenor Plus 44 Telenor Business Solutions 46 SHAREHOLDER INFORMATION Other activities 48 Shareholder information 134 MARKET INFORMATION 2002 2001 2000 1999 1998 MOBILE COMMUNICATION Norway Mobile subscriptions (NMT + GSM) (000s) 2,382 2,307 2,199 1,950 1,552 GSM subscriptions (000s) 2,330 2,237 2,056 1,735 1,260 – of which prepaid (000s) 1,115 1,027 911 732 316 Revenue per GSM subscription per month (ARPU)1) 346 340 338 341 366 Traffic minutes -

Telenor Third Quarter: Restructuring and Cost Reductions

Telenor third quarter: Restructuring and cost reductions Telenor's third quarter results for 2002 show a strong profit and revenue growth in international operations, whereas the growth in the Norwegian market is in decline. Domestic operations are characterised by restructuring and a focus on efficiency and cost reductions. This has resulted in improved margins and lower investments in fixed and mobile networks in Norway. Major write-downs, primarily in Telenor Business Solutions, have produced a loss before taxes. Telenor's revenues in the third quarter were NOK 12,210 million, which is an increase of 21 per cent or NOK 2,146 million compared to the same period in 2001. Revenues increased in the first nine months by NOK 5,664 million, or 19 per cent, to NOK 35,784 million compared to the same period last year. Despite the increase in revenues, Telenor reports a loss before taxes and minority interests of NOK 105 million in the third quarter. This figure includes write-downs of NOK 738 million, which are primarily related to the restructuring of managed services in Telenor Business Solutions. For the first nine months the profit before taxes and minority interests was NOK 309 million. Telenor's third quarter results for 2002 are characterised by restructuring and a focus on cost reductions as a result of the decline in the domestic growth. The group programme Delta 4, of which the aim is to reduce the cost base by NOK 4 billion gross by the end of 2004 compared to 2001, is proceeding according to plan. Total savings of approximately NOK 700 million had been achieved by the end of the third quarter and by the end of the year the cost reductions will be around NOK 1 billion. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ Region Country Operator LTE Advanced 5G Advanced Pro Eastern Europe 92 57 4 3 Albania Total 32 0 0 Albania ALBtelecom 10 0 0 Albania Telekom Albania 11 0 0 Albania Vodafone Albania 11 0 0 Armenia Total 31 0 0 Armenia MTS Armenia (VivaCell‐MTS) 10 0 0 Armenia Ucom (formerly Orange Armenia) 11 0 0 Armenia VEON Armenia (Beeline) 10 0 0 Azerbaijan Total 43 0 0 Azerbaijan Azercell 10 0 0 Azerbaijan Azerfon (Nar) 11 0 0 Azerbaijan Bakcell 11 0 0 Azerbaijan Naxtel (Nakhchivan) 11 0 0 Belarus Total 42 0 0 Belarus A1 Belarus (formerly VELCOM) 10 0 0 Belarus Belarusian Cloud Technologies (beCloud) 11 0 0 Belarus Belarusian Telecommunications Network (BeST, life:)) 10 0 0 Belarus MTS Belarus 11 0 0 Bosnia and Total Herzegovina 31 0 0 Bosnia and Herzegovina BH Telecom 11 0 0 Bosnia and Herzegovina HT Mostar (HT Eronet) 10 0 0 Bosnia and Herzegovina Telekom Srpske (m:tel) 10 0 0 Bulgaria Total 53 0 0 Bulgaria A1 Bulgaria (Mobiltel) 11 0 0 Bulgaria Bulsatcom 10 0 0 Bulgaria T.com (Bulgaria) 10 0 0 Bulgaria Telenor Bulgaria 11 0 0 Bulgaria Vivacom (BTC) 11 0 0 Croatia Total 33 1 0 Croatia A1 Hrvatska (formerly VIPnet/B.net) 11 1 0 Croatia Hrvatski Telekom (HT) 11 0 0 Croatia Tele2 Croatia 11 0 0 Czechia Total 43 0 0 Czechia Nordic Telecom (formerly Air Telecom) 10 0 0 Czechia O2 Czech Republic (incl. CETIN) 11 0 0 Czechia T‐Mobile Czech Republic 11 0 0 Czechia Vodafone Czech Republic 11 0 0 Estonia Total 33 2 0 Estonia Elisa Eesti (incl.