Annual Report 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FIDELITY SALEM STREET TRUST Form NPORT-P Filed 2021-03-17

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-17 | Period of Report: 2021-01-31 SEC Accession No. 0001752724-21-055741 (HTML Version on secdatabase.com) FILER FIDELITY SALEM STREET TRUST Mailing Address Business Address 245 SUMMER STREET 245 SUMMER STREET CIK:35315| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0430 BOSTON MA 02210 BOSTON MA 02210 Type: NPORT-P | Act: 40 | File No.: 811-02105 | Film No.: 21749300 617-563-7000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Holdings Report for Fidelity® SAI Emerging Markets Low Volatility Index Fund January 31, 2021 Offered exclusively to certain clients of the Adviser or its affiliates - not available for sale to the general public. Fidelity SAI is a product name of Fidelity® funds dedicated to certain programs affiliated with Strategic Advisers LLC. MLV-QTLY-0321 1.9892172.102 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks - 99.3% Shares Value Bailiwick of Jersey - 0.6% WNS Holdings Ltd. sponsored ADR (a) 133,901 $8,995,469 Bermuda - 1.3% China Resource Gas Group Ltd. 2,526,000 12,640,996 Shenzhen International Holdings Ltd. 3,307,714 5,452,241 TOTAL BERMUDA 18,093,237 Brazil - 0.2% Atacadao SA 902,600 3,140,970 Cayman Islands - 17.1% Anta Sports Products Ltd. 1,584,000 26,211,872 Bosideng International Holdings Ltd. 9,214,000 4,088,113 China Biologic Products Holdings, Inc. (a) 33,383 3,934,187 Hansoh Pharmaceutical Group Co. -

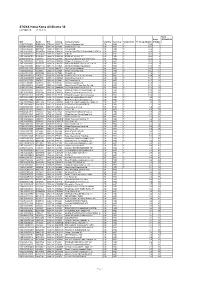

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Schedule of Investments (Unaudited) Ishares MSCI Total International Index Fund (Percentages Shown Are Based on Net Assets) September 30, 2020

Schedule of Investments (unaudited) iShares MSCI Total International Index Fund (Percentages shown are based on Net Assets) September 30, 2020 Mutual Fund Value Total International ex U.S. Index Master Portfolio of Master Investment Portfolio $ 1,034,086,323 Total Investments — 100.4% (Cost: $929,170,670) 1,034,086,323 Liabilities in Excess of Other Assets — (0.4)% (3,643,126) Net Assets — 100.0% $ 1,030,443,197 iShares MSCI Total International Index Fund (the “Fund”) seeks to achieve its investment objective by investing all of its assets in International Tilts Master Portfolio (the “Master Portfolio”), which has the same investment objective and strategies as the Fund. As of September 30, 2020, the value of the investment and the percentage owned by the Fund of the Master Portfolio was $1,034,086,323 and 99.9%, respectively. The Fund records its investment in the Master Portfolio at fair value. The Fund’s investment in the Master Portfolio is valued pursuant to the pricing policies approved by the Board of Directors of the Master Portfolio. Fair Value Hierarchy as of Period End Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows: • Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access • Level 2 – Other observable inputs (including, but not limited to, quoted prices -

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015

STOXX Hong Kong All Shares 50 Last Updated: 01.10.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 79.6 1 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 59.3 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 55.8 3 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 49.6 4 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 36.3 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 29.3 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 23.2 7 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 23.1 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 22.6 9 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 18.5 10 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 11 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 15.2 12 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 14.6 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 13.9 14 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.1 15 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 11.7 16 HK0011000095 6408374 0011.HK 640837 Hang Seng Bank Ltd. -

2019Semi-Annual Report

CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds SEMI-ANNUAL 2019 REPORT For the six months ended 30 June 2019 Value Partners Limited 43rd Floor, The Center 99 Queen’s Road Central, Hong Kong Tel: (852) 2880 9263 Fax: (852) 2565 7975 Email: [email protected] Website: www.valuepartner-group.com In the event of inconsistency, the English text of this Semi-Annual Report shall prevail over the Chinese text. This report shall not constitute an offer to sell or a solicitation of an offer to buy shares in any of the funds. Subscriptions are to be made only on the basis of the information contained in the explanatory memorandum, as supplemented by the latest semi-annual and annual reports. CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) CONTENTS Pages General information 2-3 Manager’s report 4-8 Statement of fnancial position (unaudited) 9 Investment portfolio (unaudited) 10-13 Statement of movements in portfolio holdings (unaudited) 14-15 SEMI-ANNUAL REPORT 2019 For the six months ended 30 June 2019 1 CHINA CONVERGENCE FUND A Sub-fund of Value Partners Intelligent Funds (A Cayman Islands unit trust) GENERAL INFORMATION Manager Legal Advisors Value Partners Limited With respect to Cayman Islands law: 43rd Floor, The Center Maples and Calder 99 Queen’s Road Central P.O. Box 309, Ugland House Hong Kong Grand Cayman, KY1-1104 Cayman Islands Directors of the Manager Dato’ Seri Cheah Cheng Hye With respect to Hong Kong law: Mr. So Chun Ki Louis Deacons Mr. -

Xiaomi Soars on Dualclass Shares Deal

16 BUSINESS Thursday, July 19, 2018 CHINA DAILY HONG KONG EDITION BGI officials hike equity stakes as prices fall Xiaomi soars By CHAI HUA range of its gene testing in Shenzhen, Guangdong methods. [email protected] The company said it had performed DNA-based non- on dual-class Chinese genomics giant invasive prenatal testing on BGI, known as the Beijing 3.1 million pregnant women Genomics Institute previous- globally by the end of May, ly, announced on Tuesday that and 2.48 million of their seven of its executives have babies were born. It also shares deal decided to increase their equi- admitted 70 infants with ty holdings in the company, abnormal chromosome con- after a two-day stock slump ditions were born due for Mainland, HK bourses’ agreement on triggered by a series of reports different reasons and insur- attacking its credibility. ance was provided for these Stock Connect inclusion lifts sentiment A report from tech news families. site huxiu revealed some new- DNA-based non-invasive By SUN FEIER in Hong Kong structure, Xiaomi, which borns with defects were previ- prenatal testing is generally [email protected] opened at HK$21.40 ($2.73) ously assessed as low risk by used to test for Down syn- on Wednesday, surged more BGI’s DNA-based non-inva- drome, and 98 percent of Mainland stock exchanges than six percent in the morn- sive prenatal testing. It took fetuses with the condition can and the Hong Kong stock ing trading session. It hit an the case of a boy with mental be tested, according to a study exchange have reached an intraday high of HK$22.20, disabilities and physical in the United Kingdom, said agreement on adjusting Stock before closing at HK$21.55 in deformities in Hunan prov- Cheung Ching-lung, assistant A visitor walks past a board showing big data for genomics in a BGI R&D facility in Qingdao, Connect inclusion arrange- the afternoon, up 3.11 percent ince as an example. -

Hong Kong / PRC / Asia Pacific

Hong Kong / PRC / Asia Pacific Private Equity Slaughter and May is a leading international law firm with a worldwide corporate, commercial and financing practice. We provide our clients with a professional service of the highest quality, combining technical excellence with commercial awareness and a practical, constructive approach to legal issues. Slaughter and May has a long-standing presence in Asia, opening our office in Hong Kong in 1974 and our office in Beijing in 2009. The work quality is exceptional, the legal skills are outstanding and there is a consistency among their partners on how they react to different situations, which is hard to find. Chambers Asia-Pacific 2018 Overview We have extensive experience of a wide range of Our practice includes: private equity work, and our clients include leading private equity investors from Asia and around • investment work, including due diligence the world. and structuring; We regularly advise on cross-border transactions • debt financing and refinancings, including involving multiple jurisdictions and transactions in structuring and taking security; the technology and biotechnology sectors, as well as more traditional industries. • mezzanine and other hybrid or intermediate financings; • equity structuring, ratchets, management arrangements and incentives; and • exits, including trade sales, IPOs, recapitalisations and securitisation. Sophisticated Hong Kong team with growing recognition for its strength in Mainland China. Instructed by a loyal portfolio of significant clients across -

Eligible Assets and Credit-To-Asset Ratio for Secured Credit

Eligible Assets and Credit-to-asset Ratio for Secured Credit Effective from 30 Sep 2021 List of Eligible Assets (Excluding Stocks) Asset Types Credit-to-asset Ratio HKD Time Deposits 100% Foreign Currency Time or Saving Deposits 85% Deposit Plus 70% Structured Investment Deposits (Including Capital Protected Investment Deposits) 70% Unit Trusts*/Bonds*#/Certificates of Deposit/Equity Link Notes/Equity Link Investment with Product Risk Level 1 70% Product Risk Level 2 70% Product Risk Level 3 50% Product Risk Level 4 30% Product Risk Level 5 – *exclude the Non-eligible Products listed below. #For new bonds issued on or after 17 Mar 2020, the timeline for assignment of Credit -to-asset Ratio for Secured Credit Facility will be revised follow: for new bonds issued between 1 Jan to 30 Jun each year, Credit-to-asset Ratio will be assigned in Sep of the same year (where applicable); for new bonds issued between 1 Jul to 31 Dec, Credit-to-asset Ratio will be assigned in Mar of next year (where applicable); Please refer to the relevant bond term sheet or the bond details in our website for the issue date of the relevant bond. Gold 0% (Credit-to-asset Ratio for Gold (Wayfoong Statement Gold) is removed from 20 Dec 2019) List of Non-eligible Products (Capital in Nature Instruments and Other TLAC-eligible Instruments, Hedge Funds, Liquid Alternative Funds are not eligible) Product Type Bond / Fund Code Bond / Fund Name Bonds US404280AN99 HSBC HOLDINGS PLC 4% USD BOND 3/30/2022 Bonds US404280AL34 HSBC HOLDINGS PLC 4.875% USD BOND 1/14/2022 Bonds -

2021 Semi-Annual Report (Unaudited)

FEBRUARY 28, 2021 2021 Semi-Annual Report (Unaudited) iShares, Inc. • iShares Core MSCI Emerging Markets ETF | IEMG | NYSE Arca • iShares MSCI BRIC ETF | BKF | NYSE Arca • iShares MSCI Emerging Markets Asia ETF | EEMA | NASDAQ • iShares MSCI Emerging Markets Small-Cap ETF | EEMS | NYSE Arca The Markets in Review Dear Shareholder, The 12-month reporting period as of February 28, 2021 reflected a remarkable period of disruption and adaptation, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. As the period began, the threat from the virus was becoming increasingly apparent, and countries around the world took economically disruptive countermeasures. Stay-at-home orders and closures of non-essential businesses became widespread, many workers were laid off, and unemploy- ment claims spiked, causing a global recession and a sharp fall in equity prices. After markets hit their lowest point of the reporting period in late March 2020, a steady recovery ensued, as businesses began to re-open and governments learned to adapt to life with the virus. Equity prices continued to rise throughout the summer, fed by strong fiscal and monetary support and improving Rob Kapito economic indicators. Many equity indices neared or surpassed all-time highs late in the reporting period President, BlackRock, Inc. following the implementation of mass vaccination campaigns and progress of additional stimulus through the U.S. Congress. In the United States, both large- and small-capitalization stocks posted a significant advance. International equities also gained, as both developed countries and emerging markets re- Total Returns as of February 28, 2021 bounded substantially from lows in late March 2020. -

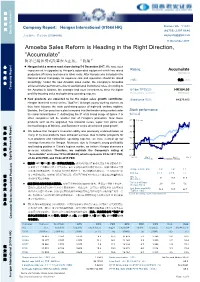

Amoeba Sales Reform Is Heading in the Right Direction, “Accumulate”

股 票 研 [Table_Title] Company Report: Hengan International (01044 HK) Barney Wu 吴宇扬 究 (86755) 2397 6680 Equity Research 公司报告: 恒安国际 (01044 HK) [email protected] 11 December 2017 Amoeba[Table_Summary Sales] Reform is Heading in the Right Direction, “Accumulate” 阿米巴销售模式改革步入正轨, “收集” 公 Hengan held a reverse road show during 5-6 December 2017. We have seen [Table_Rank] improvement in upgrades to Hengan’s automated equipment which has raised Rating: Accumulate 司 Maintained production efficiency and saved in labor costs. After Hengan was included in the 报 National Brand Campaign, its exposure rate and reputation should be raised 评级: 收集 (维持) accordingly. Under the new Amoeba sales model, the Company’s Amoebas 告 achieved better performance due to sophisticated institutional rules. According to Company Report the Amoeba in Xiamen, the manager had more incentives to strive for higher 6[Table_Price-18m TP目标价] : HK$84.00 profit by boosting sales and optimizing operating expense. Revised from 原目标价: HK$70.00 New products are expected to be the major sales growth contributor. Share price 股价: HK$79.800 Hengan launched a new series, “Spa7ce”, to target young working women, as they have become the main purchasing power of high-end sanitary napkins. Besides, the Company has a plan to expand into the female caring market under Stock performance its classic brand Space 7. Authorizing the IP of its brand image of Space 7 to 股价表现 other companies will be another trail of Hengan’s promotion. New tissue 40.025.0 % of% return of return products such as the upgraded Tea Classical series, super mini packs with 20.0 licensed images of Minions, and Bamboo π series all achieved good growth. -

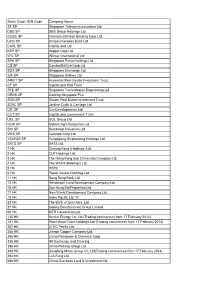

Stock Code/ ISIN Code Company Name ST SP Singapore

Stock Code/ ISIN Code Company Name ST SP Singapore Telecommunications Ltd DBS SP DBS Group Holdings Ltd OCBC SP Oversea-Chinese Banking Corp Ltd UOB SP United Overseas Bank Ltd CAPL SP CapitaLand Ltd KEP SP Keppel Corp Ltd WIL SP Wilmar International Ltd SPH SP Singapore Press Holdings Ltd CD SP ComfortDelGro Corp Ltd SGX SP Singapore Exchange Ltd SIA SP Singapore Airlines Ltd AREIT SP Ascendas Real Estate Investment Trust CT SP CapitaLand Mall Trust STE SP Singapore Technologies Engineering Ltd GENS SP Genting Singapore PLC SUN SP Suntec Real Estate Investment Trust JCNC SP Jardine Cycle & Carriage Ltd CIT SP City Developments Ltd CCT SP CapitaLand Commercial Trust UOL SP UOL Group Ltd GGR SP Golden Agri-Resources Ltd SCI SP Sembcorp Industries Ltd VMS SP Ventrure Corp Ltd YZJSGD SP Yangzijiang Shipbuilding Holdings Ltd SATS SP SATS Ltd 1 HK Cheung Kong (Holdings) Ltd. 2 HK CLP Holdings Ltd. 3 HK The Hong Kong and China Gas Company Ltd. 4 HK The Wharf (Holdings) Ltd. 5 HK HSBC 6 HK Power Assets Holdinsg Ltd 11 HK Hang Seng Bank Ltd. 12 HK Henderson Land Development Company Ltd. 16 HK Sun Hung Kai Properties Ltd. 17 HK New World Development Company Ltd. 19 HK Swire Pacific Ltd. 'A' 23 HK The Bank of East Asia, Ltd. 27 HK Galaxy Entertainment Group Limited 66 HK MTR Corporation Ltd. 135 HK Kunlun Energy Co. Ltd (Trading commences from 17 February 2014) 151 HK Want Want China Holdings Ltd (Trading commences from 17 February 2014) 267 HK CITIC Pacific Ltd. -

HSBC GIF GEM Equity Volatility Focused 31 March 2017 USD Institutional Share Class (IC) Monthly Report

HSBC GIF GEM Equity Volatility Focused 31 March 2017 USD Institutional Share Class (IC) Monthly Report Fund Objective Fund Details The aim to provide capital growth and income on your investment over time. Fund domicile The fund invests in normal market conditions a minimum of 90% of its net assets in equities and equity UCITS IV Luxembourg SICAV equivalent securities of companies which are domiciled in, based in, or carry out the larger part of their business activities in Emerging Markets. The fund may invest the remaining assets in financial derivative Benchmark instruments and/or temporarily in fixed income securities, money market instruments, cash instruments and cash. MSCI Emerging Markets Net The fund aims for a lower portfolio volatility relative to that of the MSCI Emerging Markets Index through Fund size (USD million) portfolio construction. The fund uses portfolio optimisation to lower overall portfolio volatility by selecting a 13.02 combination of lower volatility stocks and higher volatility stocks that are less correlated and thereby diversifying the portfolio. The fund may rely on market research and quantitative analysis to estimate individual Inception date stock volatility and intra-stock correlation as part of its portfolio optimisation process. 13/05/2016 The fund is actively managed and does not track a benchmark. Consideration may be given to a reference benchmark when selecting investments. The reference benchmark for the fund is MSCI Emerging Markets Net Liquidity Daily index. Performance (%) Ongoing charge* 1.05% 120 Minimum initial investment US$ 1,000,000 or equivalent ISIN code IC: LU1236621055 Bloomberg ticker HSGEVIC 110 (Rebased to 100 on 13 May 2016) 13 May on 100 to (Rebased 100 Note: Performance figures will only be published once the Fund has achieved a twelve months track record.