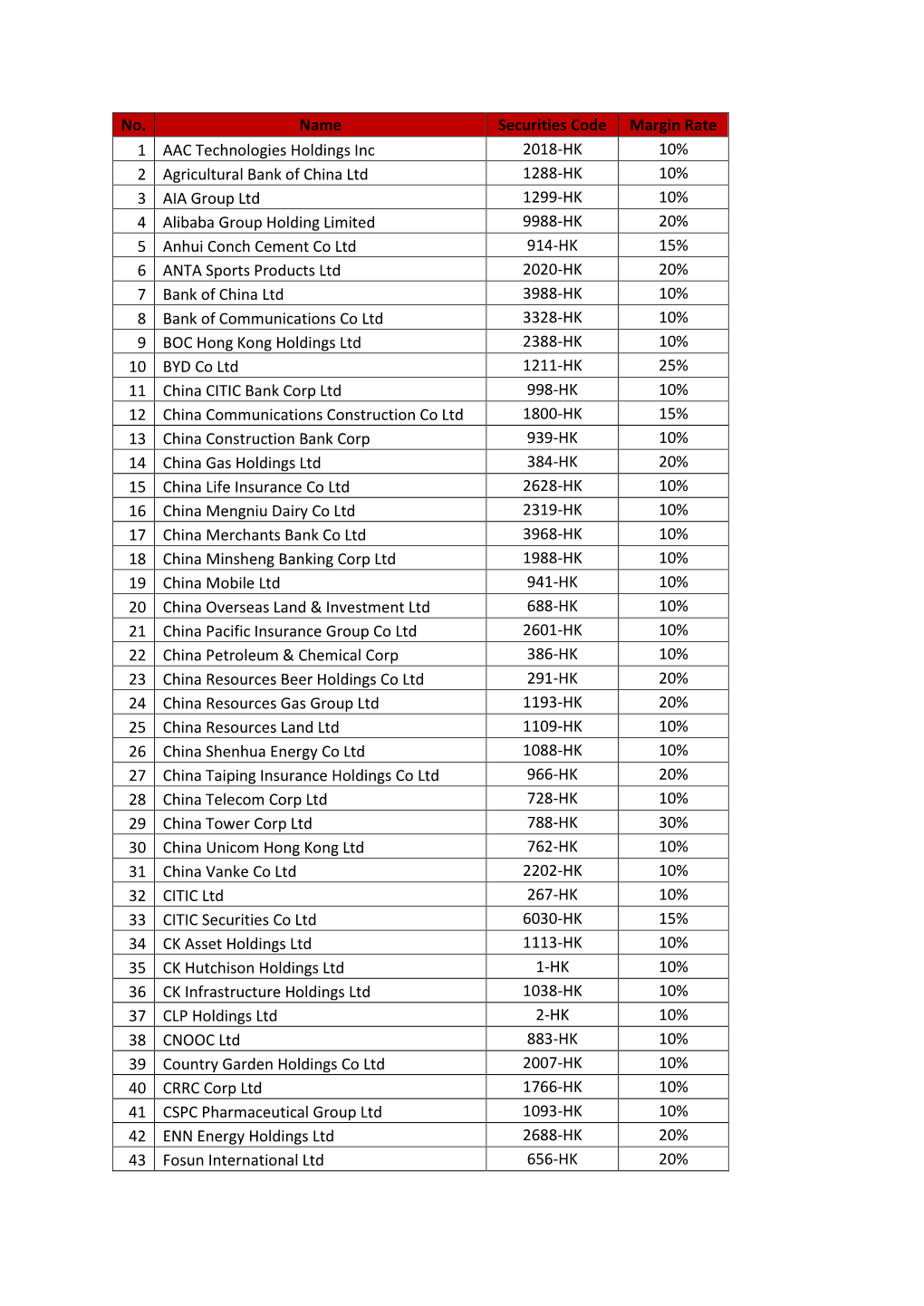

No. Name Securities Code Margin Rate 1 AAC Technologies Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MKS/EQD/07/21 日期 Date: 01/02/2021

編號 Ref. No.: MKS/EQD/07/21 日期 Date: 01/02/2021 香港聯合交易所有限公司 (香港交易及結算所有限公司全資附屬公司) THE STOCK EXCHANGE OF HONG KONG LIMITED (A wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited) 通告 CIRCULAR Subject: Introduction of New Stock Option Class on Kuaishou Technology Enquiry: Mr. Wallace Chan (Tel: 2211-6139 E-mail: [email protected]) The Stock Exchange of Hong Kong Limited (the “Exchange”) is pleased to announce that stock option class on Kuaishou Technology (“KST”) will commence trading on Friday, 5 February 2021 (“Commencement Date”), subject to the successful listing of KST: Expiry Months Contract Min. No. of Trading Underlying Stock HKATS Tier Available Size Fluctuation Board Tariff (Stock Code) Code Level on the (shares) (HK$) Lots (HK$) Commence ment Date Feb 21, Mar 21, Apr 21, Kuaishou Technology May 21, KST 500 $0.01 5 1 $3 (1024) Jun 21, Sep 21 & Dec 21 The list of stock option classes available for trading is set forth in Attachment I. For details of the contract specifications, please refer to Appendix B of the Operational Trading Procedures for Options Trading Exchange Participants (“Options Contract Specifications”). Strike Price In order to offer more choices for investors, 28 strikes above and below HK$115 (which is the offer price of the underlying stock) will be available for trading on the Commencement Date (see Attachment II). New strike prices subsequent to the Commencement Date will be introduced according to the Operational Trading Procedures for Options Trading Exchange Participants. 2 Position Limit The position limit for KST options contracts will be 50,000 open contracts in any one market direction for all expiry months combined. -

ICBC, Alibaba, and Ant Financial Enter Comprehensive

ICBC, Alibaba and Ant Financial Form Comprehensive Strategic Partnership Bringing enhanced fintech and financial services to users Beijing, China, December 16th, 2019 – Industrial and Commercial Bank of China (“ICBC”), Alibaba Group (“Alibaba”), and Ant Financial Services Group (“Ant Financial”) today entered a comprehensive strategic partnership to enhance the services available to users by deepening their level of cooperation in the key areas of fintech and financial services. Under the partnership agreement, parties will work together more closely, improving the quality of fintech offerings by using smart technologies and product innovation. To take financial services forward, the partners will use their collective experience and expertise to focus on areas that include electronic payment settlement, cross-border finance, and scenario-based financial services. “Complementing each other’s strength, ICBC and the Alibaba digital economy have been working together to build a range of products. Our cooperation expands beyond payment and e-commerce to more areas including global corporate finance, scenario-based finance and financial innovation. We hope to generate more chemistry to promote innovations in Chinese finance industry and further improve the quality of finance services in the coming future,” said Chen Siqing, Chairman of ICBC. The collaboration started as early as March 2005 when Alipay and ICBC joined hands to offer online payment services to users. ICBC was the first bank in China to partner with Alipay to deliver online payments, demonstrating the bank’s innovation and inclusivity. “Alibaba Group and Ant Financial highly value our long-standing relationship with ICBC. Their commitment to building a better future has helped fuel the rapid growth of Alipay as well the broader digital economy in China,” said Daniel Zhang, Chairman and CEO of Alibaba Group. -

2016/2017 Annual Results Presentation 7 June 2017

2016/2017 Annual Results Presentation 7 June 2017 Consistently Strong Financial Performance Revenue Net Property Income (HK$’M) (HK$’M) 6,994 9,255 +5.9% +7.4% 6,513 8,740 2015/16 2016/17 2015/16 2016/17 Valuation Distribution per unit (HK$’M) (HK cents) 174,006 160,672 228.41 +8.3% 206.18 +10.8% 2015/16 2016/17 2015/16 2016/17 P.2 A Platform for Tenants to Flourish High productivity (1) Community engagement Hong Kong Mainland China HK$38.1M 96% 100% Donated since 2013 Occupancy Occupancy 28.2% Reduction in energy Hong Kong Hong Kong consumption since +4.0% 12.1% 2010 ~18,000 Tenant sales Rent to sales Tenant Academy growth ratio participants since 2008 Improving portfolio quality Global recognitions 53 enhancement 8 acquisitions (2) projects & completed 28 disposals to date to date Notes: (1) For the year ended 31 March 2017. (2) Including the acquisition of Metropolitan Plaza which was completed in May 2017. P.3 Link’s Value Creation Model Our communities Our investors Our business partners Our employees Our tenants Be a world class real estate investor and manager, serving and improving the lives of those around us 1. Building a productive and quality portfolio 2. Maintaining a prudent and flexible capital structure 3. Developing a strong management team 4. Helping our tenants and communities grow while delighting shoppers P.4 Financial Review Robust Revenue Growth Year ended Year ended 31 Mar 2017 31 Mar 2016 HK$’M HK$’M Change Revenue 9,255 (1) 8,740 +5.9% Property operating expenses (2,261) (2,227) +1.5% Net property income 6,994 (2) 6,513 +7.4% Total distributable income 4,992 4,567 +9.3% Discretionary distribution 83 (3) 67 +23.9% Total distributable amount 5,075 4,634 +9.5% Distribution Per Unit (HK cents) 228.41 206.18 +10.8% Total distributable amount as a percentage of total 102% (3) 101% +1ppt distributable income (%) Notes: (1) Includes revenue of HK$574M (2016: HK$421M) from Mainland China portfolio. -

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword

Shanghai Municipal Commission of Commerce Belt and Road Countries Investment Index Report 2018 1 Foreword 2018 marked the fifth year since International Import Exposition Municipal Commission of Commerce, President Xi Jinping first put forward (CIIE), China has deepened its ties releasing the Belt and Road Country the Belt and Road Initiative (BRI). The with partners about the globe in Investment Index Report series Initiative has transformed from a trade and economic development. to provide a rigorous framework strategic vision into practical action President Xi Jinping has reiterated at for evaluating the attractiveness during these remarkable five years. these events that countries should of investing in each BRI country. enhance cooperation to jointly build Based on extensive data collection There have been an increasing a community of common destiny and in-depth analysis, we evaluated number of participating countries for all mankind , and the Belt and BRI countries' (including key and expanding global cooperation Road Initiative is critical to realizing African nations) macroeconomic under the BRI framework, along with this grand vision. It will take joint attractiveness and risks, and identified China's growing global influence. By efforts and mutual understanding to key industries with high growth the end of 2018, China had signed overcome the challenges ahead. potential, to help Chinese enterprises BRI cooperation agreements with better understand each jurisdiction's 122 countries and 29 international Chinese investors face risks in the investment environment. organizations. According to the Big BRI countries, most of which are Data Report of the Belt and Road developing nations with relatively The Belt and Road Country (2018) published by the National underdeveloped transportation and Investment Index Report 2017 Information Center, public opinion telecommunication infrastructures. -

The Data Behind Netflix's Q3 Beat Earnings

The Data Behind Netflix’s Q3 Beat Earnings What Happened -- Earnings per share: $1.47 vs. $1.04 expected -- International paid subscriber additions: 6.26 million vs. 6.05 million expected -- Stock price surged more than 8% in extended trading Grow your mobile business 2 Apptopia’s data was a strong leading indicator of new growth -- Netflix increased new installs of its mobile app 8.4% YOY and 13.5% QOQ. -- New international installs of Netflix are up 11.3% YOY and 17.3% QOQ. -- New domestic installs of Netflix are down 3.6% YOY and 8.3% QOQ. Grow your mobile business 3 Other Indicators of Netflix’s Q3 2019 performance Netflix Domestic Growth YoY Netflix Global Growth YoY Q3 2018 - 19 Q3 2018 - 19 Netflix +6.4% Netflix +21.4% Reported: Paid Reported: Paid Subscribers Subscribers Apptopia +7.2% Apptopia +15.1% Estimate: Time Estimate: Time Spent In App Spent In App Apptopia +7.7% Apptopia +16% Estimate: Mobile Estimate: Mobile App Sessions App Sessions Grow your mobile business Other Indicators of Netflix’s Q3 2019 performance -- Netflix reported adding 517k domestic paid subscriber vs. 802k expected -- Its growth this quarter clearly came from international markets -- More specifically, according to Apptopia, it came from Vietnam, Indonesia, Saudi Arabia and Japan Grow your mobile business We’ve Got You Covered Coverage includes 10+ global stock exchanges and more than 3,000 tickers. Restaurants & Food Travel Internet & Media Retail CHIPOTLE MEXICAN CRACKER BARREL ALASKA AIR GROUP AMERICAN AIRLINES COMCAST DISH NETWORK ALIBABA GROUP AMBEST BUY -

Chinese Makers Roll out Wave of Apple Watch Lookalikes 12 March 2015, Byjoe Mcdonald

Chinese makers roll out wave of Apple watch lookalikes 12 March 2015, byJoe Mcdonald taking steps to reduce the problem. The flood of "me too" smartwatches reflects China's mix of skilled electronics manufacturers and a growing consumer market for bargain-price style. Most of the world's personal computers and mobile phones are assembled in China. But this country's own companies are only starting to develop design skills and the ability to create breakthrough products. That has led to the rise of an industry known as "shanzhai," or "mountain forts"—hundreds of small, anonymous manufacturers that quickly copy the An e-commerce website with a vendor selling the "Apple design or features of popular foreign mobile phones Smart Watch Bluetooth Bracelet" starting from 288 yuan or other products at a fraction of the price. (US$45) is displayed on a computer screen in Beijing Thursday, March 12, 2015. A month before Apple Inc.'s At least eight vendors on Taobao advertised smartwatch hits the market, China's thriving copycat watches as "Apple Watch" or "Apple Watch manufacturers are selling lookalikes, some openly lookalike." Most said they were compatible with advertised as Apple copies. (AP Photo/Ng Han Guan) Apple's iOS or Google Inc.'s rival Android operating system. A month before Apple Inc.'s smartwatch hits the market, China's thriving copycat manufacturers are selling lookalikes, some openly advertised as Apple copies. "Apple Smart Watch with Bluetooth Bracelet," says one vendor on Alibaba Group's popular Taobao e- commerce website. Photos on the vendor's page appear to be the real Apple Watch. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Hang Lung Properties Wait with Patience

30 May 2018 Hong Kong EQUITIES Hang Lung Properties 101 HK Neutral Wait with patience Price (at 06:50, 30 May 2018 GMT) HK$17.96 Valuation HK$ 33.32 Key points - DCF (WACC 7.7%, beta 1.1, ERP 6.0%, RFR 1.5%) Acquired a land king in Hangzhou with good growth potential 12-month target HK$ 18.43 Large cost leads to slim yield, and long investment period impacts NAV Upside/Downside % +2.6 12-month TSR % +6.8 Benefit from strong retail sales but renovations temporarily hurt Volatility Index Low GICS sector Real Estate Event Market cap HK$m 80,779 We believe the acquisition of the new land king gives the company a good Market cap US$m 10,296 opportunity to ride on the strong retail growth and development of a quasi tier- Free float % 42 1 city. We believe the Hangzhou mall can charge the highest unit rental at 30-day avg turnover US$m 7.8 Rmb700 psm/mth among Hang Lung’s mainland shopping malls except for Number shares on issue m 4,498 Shanghai projects, which are charging more than Rmb1,500. However, as it will take six years to complete in 2024 and total investment cost could be as Investment fundamentals high as Rmb19bn with a 4-5% gross yield, the acquisition should negatively Year end 31 Dec 2017A 2018E 2019E 2020E impact the earnings, cash flow and NAV in recent years. Some previous Revenue m 11,199 10,721 11,107 9,449 EBIT m 7,330 7,452 7,704 6,020 projects have had a long development cycle for five to nine years and EBIT growth % -11.8 1.7 3.4 -21.9 experienced disappointing rentals. -

Hang Lung Properties Version 9 | Bloomberg: 101 HK EQUITY | Reuters: 101.HK Refer to Important Disclosures at the End of This Report

China / Hong Kong Company Guide Hang Lung Properties Version 9 | Bloomberg: 101 HK EQUITY | Reuters: 101.HK Refer to important disclosures at the end of this report DBS Group Research . Equity 31 Jul 2019 BUY Retail sales growth gathering Last Traded Price ( 30 Jul 2019):HK$18.64 (HSI : 28,147) momentum Price Target 12-mth: HK$22.38 (20.1% upside) (Prev HK$20.35) BUY with HK$22.38 TP. The stock is trading at a 49% discount to Analyst our estimated current NAV and offers an attractive dividend yield Jeff YAU CFA, +852 36684180 [email protected] of 4.0% for FY19. Stellar tenants’ sales growth at its retail malls in Ian CHUI +852 36684174 [email protected] Jason LAM +852 36684179 [email protected] China augurs well for reversionary growth. Portfolio expansion and asset enhancement initiatives should provide additional What’s New momentum to drive rental income, offering better earnings quality • Improving retail tenants’ sales to underpin and in turn providing share price upside. HLP is among our preferred landlords. BUY with HK$22.38 TP. reversionary growth Portfolio expansion to lift rental income. The progressive opening • New properties to spice up rental earnings of new properties in Kunming, Wuhan, Wuxi, and Shenyang in • BUY with HK$22.38 TP 2019-20 should give an additional boost to Hang Lung Properties’ recurrent earnings growth, and its ability to raise dividends. Pre- leasing at Spring City 66 in Kunming is progressing smoothly, with Price Relative 88% of retail space already pre-committed. This mall is scheduled to open for business in late Aug. -

3I Group PLC 3M Co 58.Com Inc A2A Spa AAC Technologies Holdings

3i Group PLC 3M Co 58.com Inc A2A SpA AAC Technologies Holdings Inc ABB Ltd Abbott Laboratories AbbVie Inc Accenture PLC Accton Technology Corp ACS Actividades de Construccio Activision Blizzard Inc Acuity Brands Inc Adani Ports & Special Economic Adaro Energy Tbk PT Adecco Group AG Adelaide Brighton Ltd adidas AG Adient PLC Adobe Systems Inc Advance Auto Parts Inc Advanced Ceramic X Corp Advanced Micro Devices Inc Advanced Semiconductor Enginee Aegon NV AES Corp/VA Aetna Inc Affiliated Managers Group Inc Aflac Inc Aga Khan Fund for Economic Dev AGFA-Gevaert NV Agilent Technologies Inc AGL Energy Ltd Agnaten SE AIA Group Ltd Air Products & Chemicals Inc AirAsia Bhd Airtac International Group Akamai Technologies Inc Akbank Turk AS Akzo Nobel NV Alaska Air Group Inc Albemarle Corp Alcoa Corp Alexandria Real Estate Equitie Alexion Pharmaceuticals Inc Alibaba Group Holding Ltd Align Technology Inc ALK-Abello A/S Allegion PLC Allergan PLC Alliance Data Systems Corp Alliant Energy Corp Allianz SE Allstate Corp/The Ally Financial Inc Alphabet Inc ALS Ltd Altaba Inc/Fund Family Altice NV Altran Technologies SA Altria Group Inc Alumina Ltd Amadeus IT Group SA Amazon.com Inc Amcor Ltd/Australia Ameren Corp America Movil SAB de CV American Airlines Group Inc American Axle & Manufacturing American Electric Power Co Inc American Express Co American International Group I American Tower Corp American Water Works Co Inc Ameriprise Financial Inc AmerisourceBergen Corp AMETEK Inc Amgen Inc Amorepacific Corp AMOREPACIFIC Group AMP Ltd Amphenol Corp ams AG -

FIDELITY SALEM STREET TRUST Form NPORT-P Filed 2021-03-17

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-17 | Period of Report: 2021-01-31 SEC Accession No. 0001752724-21-055741 (HTML Version on secdatabase.com) FILER FIDELITY SALEM STREET TRUST Mailing Address Business Address 245 SUMMER STREET 245 SUMMER STREET CIK:35315| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 0430 BOSTON MA 02210 BOSTON MA 02210 Type: NPORT-P | Act: 40 | File No.: 811-02105 | Film No.: 21749300 617-563-7000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Quarterly Holdings Report for Fidelity® SAI Emerging Markets Low Volatility Index Fund January 31, 2021 Offered exclusively to certain clients of the Adviser or its affiliates - not available for sale to the general public. Fidelity SAI is a product name of Fidelity® funds dedicated to certain programs affiliated with Strategic Advisers LLC. MLV-QTLY-0321 1.9892172.102 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks - 99.3% Shares Value Bailiwick of Jersey - 0.6% WNS Holdings Ltd. sponsored ADR (a) 133,901 $8,995,469 Bermuda - 1.3% China Resource Gas Group Ltd. 2,526,000 12,640,996 Shenzhen International Holdings Ltd. 3,307,714 5,452,241 TOTAL BERMUDA 18,093,237 Brazil - 0.2% Atacadao SA 902,600 3,140,970 Cayman Islands - 17.1% Anta Sports Products Ltd. 1,584,000 26,211,872 Bosideng International Holdings Ltd. 9,214,000 4,088,113 China Biologic Products Holdings, Inc. (a) 33,383 3,934,187 Hansoh Pharmaceutical Group Co. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co.