Annual Report 2017 Table of Contents Previous Page Next Introduction ◀◀◀ ◀ 1 ▶

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Suppliers for the Fairphone 2 Understanding Our List of Suppliers

List of Suppliers for the Fairphone 2 Consumer electronics supply chains include layers of our supply chain. In addition to our several complex, often opaque tiers of first-tier assembly manufacturer, we have suppliers, ranging from first-tier assembly mapped all second-tier suppliers, and are manufacturers (direct suppliers) to second, progressively including third and fourth-tier third and sometimes even fourth-tier suppliers in our research. By uncovering all component manufacturers. Many electronics of the different players and manufacturing manufacturers only have insight into their locations in our smartphone supply chain, we direct suppliers and perhaps some second-tier can start engaging with suppliers, establishing component manufacturers. relationships and initiating programs for improvement. At Fairphone, we are working to gain an in-depth understanding of the complicated Understanding our List of Suppliers The list below includes all of the first, second Locations: Whenever possible, we have listed and third-tier suppliers that we know of to the (approximate) manufacturing location. If this date, and it is accurate to the best of our information was not available, we have provided the location of the company headquarters. knowledge at the time of publication. We will periodically update the information in this Categories: Suppliers are grouped by the type of document as we learn more. components they produce. Some suppliers may be mentioned more than once because they produce Here is a bit more information about how the different kinds of components, sometimes with list is arranged: different manufacturing locations. Tiers: Supplier tiers are calculated from the point of the final assembly. -

Phoenix Unit Trust Managers Manager's Interim Report Putm Bothwell Japan Tracker Fund

PHOENIX UNIT TRUST MANAGERS MANAGER’S INTERIM REPORT For the half year: 1 February 2016 to 31 July 2016 PUTM BOTHWELL JAPAN TRACKER FUND Contents Investment review 2-3 Portfolio of investments 4-51 Top ten purchases and sales 52 Statistical information 53-56 Statements of total return & change in net assets attributable to unitholders 57 Balance sheet 58 Distribution table 59 Corporate information 60-61 1 Investment review Dear Investor Performance Review Welcome to the PUTM Bothwell Japan Tracker Fund Over the review period, the PUTM Bothwell Japan interim report for the six months to 31 July 2016. Tracker Fund returned 17.59% (Source: HSBC, Gross of AMC, GBP, based upon the movement in the Cancellation Price for the six months to 31/07/16). This compares with its benchmark index return of 17.94% (Source: Datastream, FTSE World Japan Index until 04/03/14 and thereafter the Topix Index, Total Return in GBP terms for six months to 31/07/16). In the table below, you can see how the Fund performed against its benchmark index over the last five discrete one-year periods. Standardised Past Performance Jul 15-16 Jul 14-15 Jul 13-14 Jul 12-13 Jul 11-12 % growth % growth % growth % growth % growth PUTM Bothwell Japan Tracker Fund 15.15 17.3 -0.6 29.8 -8.2 Benchmark Index 15.66 17.7 -0.4 30.2 -8.1 Source: Fund performance is HSBC, Gross of AMC, GBP, based upon the movement in the Cancellation Price to 31 July for each year. Benchmark Index performance is Datastream, FTSE World Japan Index until 04/03/14 and thereafter the Topix Index, Total Return in GBP terms to 31 July for each year. -

Sony Kabushiki Kaisha

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F n REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or ¥ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2010 or n TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or n SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) Samuel Levenson, Senior Vice President, Investor Relations Sony Corporation of America 550 Madison Avenue New York, NY 10022 Telephone: 212-833-6722, Facsimile: 212-833-6938 (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

Sony Corporation – Restructuring Continues, Problems Remain

BSTR/361 IBS Center for Management Research Sony Corporation – Restructuring Continues, Problems Remain This case was written by Indu P, under the direction of Vivek Gupta, IBS Center for Management Research. It was compiled from published sources, and is intended to be used as a basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation. 2010, IBS Center for Management Research. All rights reserved. To order copies, call +91-08417-236667/68 or write to IBS Center for Management Research (ICMR), IFHE Campus, Donthanapally, Sankarapally Road, Hyderabad 501 504, Andhra Pradesh, India or email: [email protected] www.icmrindia.org BSTR/361 Sony Corporation – Restructuring Continues, Problems Remain “Seven out of eight years, Sony has failed to meet its own initial operating profit forecast. This is probably the worst track record amongst most major exporters. That means that either management is not able to anticipate challenges … or they fail on execution almost every time. Either way, it does not reflect well on Sony’s management.”1 - Atul Goyal, Analyst, CLSA2, in January 2009. SONY IN CRISIS, AGAIN In May 2009, Japan-based multinational conglomerate, Sony Corporation (Sony) announced that it posted its first full year operating loss since 1995, and only its second since 1958, for the fiscal year ending March 2009. Sony announced annual loss of ¥ 98.9 billion3, with annual sales going down by 12.9% to ¥ 7.73 trillion. Sony also warned that with consumers worldwide cutting back on spending in light of the recession, the losses could be to the extent of ¥ 120 billion for the year ending March 2010 (Refer to Exhibit IA for Sony‘s five year financial summary and Exhibit IB for operating loss by business segment). -

DEV-Informationdisplay

0 I Chapter News • (See also Page 13} Information JAPAN CHAPTER wins the Editor's Prize this month for B. A second meeting chaired by Chuji Sujuki, SID content and humor. On July 23 this chapter had two Chapter Committeeman was attended by 14 SID meetings at the Sharp Corporation offices in Tokyo as members and 15 non-members. This meeting was follows: primarily for yo ung engineers and research scientists. A. Meeting chaired by lwao Ohishi, Chai rman of SID Topics discussed included: Display Japan Chapter and Masao Sugimoto, Vice-Chairman, BCEE Group, IEEE Tokyo Chapter, attended by 29 SID * Topics i n author interviews at the 1981 SID members and 29 non-members. The program was as symposium j The Official Journal of t he Society For Information D isplay NOVEM BER, 1981 follows: * Sinclair's f lat CRTs * Application of POPs v * Cost down of Flat Panel Displays 1. Report on the 1981 SID International Symposium * Kanji Displays and Human Fa ctors General Review Koh-ichi Miyaji, * Penetration CRTs Shibaura Institute of Technology 1 .2 Session VII Human Factors * Eurodisplay '81 and Japan Display '83 Hideo Kusaka, NHK Broadcasting Science Research Labs., Tokyo 1.3 Session X Color CATs Humor: Ryuichi Kaneko, Japan Chapter Secretary, sent CATs your Editor a package of material which arrived just too Osamu Takeuchi, Sony Corp., Tokyo 1.4 Session IX Passive Displays I late for our September/ October issue. But don't ever let Noboru Kaneko, Daini Seikosha anyone tell you that our Japanese friends lack a sense of Co., Ltd., Tokyo humor. -

2020 Integrated Report

Integrated Report 2020 Year ended March 31, 2020 Basic Commitment of the Toshiba Group Committed to People, Committed to the Future. At Toshiba, we commit to raising the quality of life for people around The Essence of Toshiba the world, ensuring progress that is in harmony with our planet. Our Purpose The Essence of Toshiba is the basis for the We are Toshiba. We have an unwavering drive to make and do things that lead to a better world. sustainable growth of the Toshiba Group and A planet that’s safer and cleaner. the foundation of all corporate activities. A society that’s both sustainable and dynamic. A life as comfortable as it is exciting That’s the future we believe in. We see its possibilities, and work every day to deliver answers that will bring on a brilliant new day. By combining the power of invention with our expertise and desire for a better world, we imagine things that have never been – and make them a reality. That is our potential. Working together, we inspire a belief in each other and our customers that no challenge is too great, and there’s no promise we can’t fulfill. We turn on the promise of a new day. Our Values Do the right thing We act with integrity, honesty and The Essence of Toshiba comprises three openness, doing what’s right— not what’s easy. elements: Basic Commitment of the Toshiba Group, Our Purpose, and Our Values. Look for a better way We continually s trive to f ind new and better ways, embracing change With Toshiba’s Basic Commitment kept close to as a means for progress. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Form 20-F for the Fiscal Year Ended March 31, 2017

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 20-F ‘ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 or Í ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2017 or ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from/to or ‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report: Commission file number 1-6439 Sony Kabushiki Kaisha (Exact Name of Registrant as specified in its charter) SONY CORPORATION (Translation of Registrant’s name into English) Japan (Jurisdiction of incorporation or organization) 7-1, KONAN 1-CHOME, MINATO-KU, TOKYO 108-0075 JAPAN (Address of principal executive offices) J. Justin Hill, Senior Vice President, Investor Relations Sony Corporation of America 25 Madison Avenue, 26th Floor New York, NY 10010-8601 Telephone: 212-833-6722 E-mail: [email protected] (Name, Telephone, E-mail and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered American Depositary Shares* New York Stock Exchange Common Stock** New York Stock Exchange * American Depositary Shares evidenced by American Depositary Receipts. Each American Depositary Share represents one share of Common Stock. ** No par value per share. Not for trading, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the New York Stock Exchange. -

Offering of 1St Series Unsecured Subordinated Convertible Bonds

[English Translation] December 21, 2016 Offering of 1st Series Unsecured Subordinated Convertible Bonds with Stock Acquisition Rights to be Issued through Third-Party Allotment and Fund Raising through Subordinated Loan Japan Display Inc. (“JDI”) hereby announces that it has resolved, at its meeting of the board of directors as of December 21, 2016, to conduct (i) an offering of Japan Display Inc. 1st series unsecured subordinated convertible bonds with stock acquisition rights (hereinafter referred to as the “Bonds with Stock Acquisition Rights” with the stock acquisition rights portion thereof referred to as the “Stock Acquisition Rights” and the bond portion thereof referred to as the “Bonds”) to be issued through a third-party allotment (the “Third-Party Allotment”) to Innovation Network Corporation of Japan (“INCJ”) and (ii) fund raising through a subordinated loan from INCJ (the “Subordinated Loan”), as set forth below. 1. Purpose of and Reason for Fund Raising The JDI group was established under an agreement between INCJ, Sony Corporation, Toshiba Corporation and Hitachi, Ltd. with the aim of establishing its status as a global leading company with both technological and production capabilities in the field of small- to medium-sized displays. Its main business activities are development, design, production and sale of small- to medium-sized display devices and related products. In order to (i) enhance supply capacity and cost competitiveness by making large investments to increase production capabilities for high resolution displays, based on INCJ’s mission “to make impactful, global and long-term investments to grow next-generation businesses nationwide”, and (ii) secure an advantage over overseas competitors, a Memorandum of Understanding with respect to the integration of the small- to medium-sized display businesses of Sony Corporation, Toshiba Corporation and Hitachi, Ltd. -

Presentation Slides for 2Q-FY 2019

Second Quarter of FY 2019 (July 1 to September 30, 2019) Consolidate Financial Results Japan Display Inc. November 13, 2019 2Q-FY2019 Summary Sales: 2Q-FY19 sales increased QoQ and YoY due to the launch of major new products and advanced shipments of some other products. For the 1H sales were up 11%. Op. income: QoQ: Higher sales, write down effects and the effects of the Hakusan Plant production suspension reduced the operating loss to about ¥19bn. YoY: Contribution of an inventory increase in the 1H of last year to operating profit is absent this year. Major costs: Non-operating costs: Equity method investment loss of ¥2.1bn, Typhoon No. 15-related costs of ¥600mn Extraordinary losses: Business restructuring expenses of ¥12.1bn. (Billion yen) Net Operating Ordinary Net Dep. & R&D FX rate sales income income income Amort. expense (\/US$) 2Q-FY19 147.3 (8.1) (12.2) (25.4) 4.3 2.6 107.4 1Q-FY19 90.4 (27.5) (31.6) (83.3) 7.5 2.8 109.9 2Q-FY18 111.0 (4.7) (6.3) (7.8) 11.0 2.8 110.3 1H-FY19 237.8 (35.6) (43.8) (108.7) 11.8 5.5 108.6 Copyright © 2019 Japan Display Inc. All Rights Reserved. 2 Quarterly Sales by Region & Business Category Quarterly Sales Trends 2Q-FY19 Sales by Category (Billion yen) US/Euro China Mobile ■ Mobile category 251.1 Other regisons • Sales almost doubled QoQ due to the Non-mobile launch of new products and advanced Automotive shipments of some other products. -

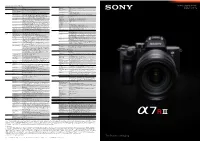

Interchangeable-Lens Digital Camera Viewfinder (Cont.) Field Coverage 100% Lens Mount E-Mount Magnification Aapprox

Main specifications of Interchangeable-lens General Camera Type Interchangeable-lens digital camera Viewfinder (Cont.) Field Coverage 100% Lens mount E-mount Magnification Aapprox. 0.78 x (with 50mm lens at infinity, -1m-1) digital camera Image sensor Type 35mm full frame (35.9×24.0mm), Exmor R CMOS sensor Dioptre Adjustment -4.0 to +3.0m-1 Number of Pixels Approx. 42.4 megapixels (effective), Approx. 43.6 (Total) Eye Point Approx. 23mm from the eyepiece lens, 18.5mm from the eyepiece frame at -1m-1 (CIPA Image sensor Aspect Ratio 3:2 standard) Anti-Dust System Charge protection coating on optical filter and image sensor shift mechanism Finder Frame Rate Selection NTSC mode: STD 60fps / HI 120fps Recording System Recording Format JPEG (DCF Ver. 2.0, Exif Ver.2.31, MPF Baseline compliant), RAW (Sony ARW 2.3 format) PAL mode: STD 50fps / HI 100fps (still image) Image Size (pixels) [3:2] [35mm full frame] L: 7952 x 5304 (42M), M: 5168 x 3448 (18M), S: 3984 x 2656 (11M) Display Content Graphic Display, Display All Info., No Disp. Info., Digital Level Gauge, Histogram [APS-C] L: 5168 x 3448 (18M), M: 3984 x 2656 (11M), S: 2592 x 1728 (4.5M) LCD Screen Type 7.5cm (3.0-type) type TFT Image Size (pixels) [16:9] [35mm full frame] L: 7952 x 4472 (36M), M: 5168 x 2912 (15M), S: 3984 x 2240 (8.9M) Number of Dots 1,440,000 dots [APS-C] L: 5168 x 2912 (15M), M: 3984 x 2240 (8.9M), S: 2592 x 1456 (3.8M) Touch Panel Yes Image Quality modes RAW, RAW & JPEG (Extra fine, Fine, Standard), JPEG (Extra fine, Fine, Standard) Brightness Control Manual (5 steps between -2 and +2), Sunny Weather mode Picture Effect 8 types: Posterization (Color), Posterization (B/W), Pop Color, Retro Photo, Partial Color (R/ Adjustable Angle Up by approx. -

LG, Samsung and Others: the Battle for the Next Generation of TV Displays1

Press Release July 29, 2020 LYON, France LG, Samsung and others: the battle for the next generation of 1 TV displays OUTLINES: • Industry status: The TV2 market is at a crossroad with stagnating unit volume sales, commoditization and looming extended excess capacity. 2020 is a transition year for the TV panel industry due to strategic technical choices and competitive battlefield. • LCD3 will hold 98.2% of the TV market in 2020 and remain unchallenged on entry and mid-range segments. • Competitive landscape: LG, Samsung and others readying complex and expensive technology investments to fight the battle for the next generation of TVs. Samsung Display and LG Display’s LCD TV panel business turned unprofitable. There will be no coming back: China will soon own the LCD market, control prices, rapidly close the technology gap and leave no opportunities for differentiation. • COVID-19 outbreak: COVID-19 pandemic impacted the supply chain and demand in the first half of the year. TV sales will decrease by 8.3% in 2020 to 205 million units but growth will resume from 2021 (+7.3%), although still below 2019 levels. “The TV panel market was disrupted by the rise of large players in China that increased capacity regardless of demand.” asserts Eric Virey, Ph.D., Principal Display Technology and Market Analyst, Photonics & Sensing at Yole Développement (Yole). “In 2019, oversupply sent prices to their lowest levels ever, below cash cost for most players. Thanks to subsidies, lower depreciation, more recent and efficient fabs, BOE and CSOT can control price to eliminate competition. Korean and Taiwanese LCD panel makers turned unprofitable and it became clear that China would soon close the technology gap, leaving no opportunity for differentiation, controlling prices and owning the market.