ATM & Cyber Security 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Vocalink Blank

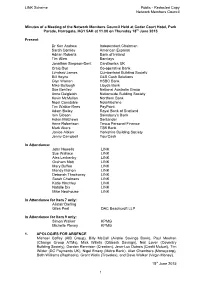

LINK Scheme Public - Redacted Copy Network Members Council Minutes of a Meeting of the Network Members Council Held at Cedar Court Hotel, Park Parade, Harrogate, HG1 5AH at 11.00 on Thursday 18th June 2015 Present: Dr Ken Andrew Independent Chairman Sarah Comley American Express Adrian Roberts Bank of Ireland Tim Allen Barclays Jonathan Simpson-Dent Cardtronics UK Craig Dye Co-operative Bank Lyndsay James Cumberland Building Society Bill Hoyne G4S Cash Solutions Glyn Warren HSBC Bank Mike Bullough Lloyds Bank Sue Bentley National Australia Group Anne Dalgleish Nationwide Building Society Kevin McMullan Northern Bank Nigel Constable NoteMachine Tim Watkin-Rees PayPoint Adam Bailey Royal Bank of Scotland Iain Gibson Sainsbury's Bank Helen Matthews Santander Anne Robertson Tesco Personal Finance Mark Akers TSB Bank Janice Aitken Yorkshire Building Society Jenny Campbell YourCash In Attendance: John Howells LINK Sue Wallace LINK Alex Leckenby LINK Graham Mott LINK Mary Buffee LINK Mandy Mahon LINK Deborah Thackwray LINK Sarah Chalmers LINK Katie Hinchley LINK Natalie Dix LINK Mike Newhouse LINK In Attendance for Item 7 only: Alistair Darling Giles Peel DAC Beachcroft LLP In Attendance for Item 9 only: Simon Walker KPMG Michelle Plevey KPMG 1. APOLOGIES FOR ABSENCE Michael Coffey (AIB Group), Billy McCall (Airdrie Savings Bank), Paul Meehan (Change Group ATMs), Mick Willets (Citibank Savings), Neil Lover (Coventry Building Society), Gordon Rennison (Creation), Jean-Luc Dubois (Credit Mutuel), Tim Wilder (DC Payments UK), Nigel Emery (Metro Bank), Alan Chambers (Moneycorp), Beth Williams (Raphaels), Grant Wells (Travelex), and Dave Walker (Virgin Money). 18th June 2015 1 LINK Scheme Public - Redacted Copy Network Members Council The Independent Chairman welcomed to their first meeting of the NMC: Lyndsay James (Cumberland Building Society), Kevin McMullan (Northern Bank), and Mike Newhouse (LINK Scheme). -

Simplified Access to the UK's Payments Systems Takes Another

PRESS RELEASE For immediate release 15 December 2016 Simplified access to the UK’s payments systems takes another step forward with the publication of a new, cross-scheme guide to participation The UK’s interbank Payments System Operators (PSOs) – Bacs Payment Schemes Limited (Bacs), CHAPS, Cheque and Credit Clearing Company, Faster Payments and LINK – have today published a new guide entitled, An Introduction to the UK’s Interbank Payment Schemes. Available on each of the PSOs’ websites, the guide is intended for use by payments service providers (PSPs) that are considering joining, or thinking of extending more payments services to their customers. The document provides an overview of the UK’s payment schemes, what each one offers, and how they can be accessed by PSPs. It has been developed collaboratively by the schemes, capturing input from the Payments Strategy Forum, a number of challenger banks and FinTechs. This is another important step forward in the journey to open up the UK’s payments systems. This year has already seen broadening access to the schemes, with Raphaels and Metro Bank joining Faster Payments, and Societe Generale and Northern Trust joining CHAPS. In 2017, the interbank schemes are expecting growth in direct participation to continue to accelerate. Hannah Nixon, Managing Director of the Payment Systems Regulator, said: “Simple, clear and fair requirements will help make it easier to gain access to the UK’s Interbank Payment Systems. As the economic regulator for the £75 trillion UK payment systems industry, we welcome the work that has been undertaken to produce this guide – which should help introduce organisations to the different access options available to them in each of the payment systems. -

Supplementary Conveyancing Questionnaire

Supplementary Conveyancing Questionnaire (To be completed if you have answered YES to 9d) Should you have insufficient space to answer any questions, please continue on your own HEADED notepaper Please note that this questionnaire forms part of your proposal for professional indemnity insurance and you are reminded of the importance of the notes and declaration on the proposal, which also applies to this questionnaire. LLP 682 - Jul 12 Important note regarding the completion of this proposal form. 1. Disclosure Any “material fact” must be disclosed to insurers - A “material fact” is any information which may influence the judgement of a prudent insurer in deciding whether to accept the risk and if so, on what terms. Any “material change” must be disclosed to insurers. - A “material change” is any material fact which arises on renewal or during the currency of the policy that has not previously been disclosed as a material fact. Examples of material changes to material facts include: • Fraud on the part of any of the Partners and Employees • A change in the composition of the firm's practice • Mergers and Acquisitions with other firms • Conversion to a Limited Liability Partnership If you are unsure whether a fact or change is material or not, you should disclose it. Failure to provide all “material facts” and/or notify all “material changes” may cause the contract of insurance to be void from inception i.e. your insurers will return the premium and there will be no cover for any claims made under the policy. 2. Presentation This proposal form must be completed by an authorised individual or principal of the firm. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Bodacc Bulletin Officiel Des Annonces Civiles Et

o er Quarante-cinquième année. – N 169 B ISSN 0298-2978 Jeudi 1 septembre 2011 BODACCBULLETIN OFFICIEL DES ANNONCES CIVILES ET COMMERCIALES ANNEXÉ AU JOURNAL OFFICIEL DE LA RÉPUBLIQUE FRANÇAISE DIRECTION DE L’INFORMATION Standard......................................... 01-40-58-75-00 LÉGALE ET ADMINISTRATIVE Annonces....................................... 01-40-58-77-56 Accueil commercial....................... 01-40-15-70-10 26, rue Desaix, 75727 PARIS CEDEX 15 Abonnements................................. 01-40-15-67-77 www.dila.premier-ministre.gouv.fr (8h30à 12h30) www.bodacc.fr Télécopie........................................ 01-40-15-72-75 BODACC “B” Modifications diverses - Radiations Avis aux lecteurs Les autres catégories d’insertions sont publiées dans deux autres éditions séparées selon la répartition suivante Vente et cessions................................................ Créations d’établissements ............................... Procédures collectives ....................................... BODACC “A” Procédures de rétablissement personnel ....... Avis relatifs aux successions ............................ } Avis de dépôt des comptes des sociétés ....... BODACC “C” Banque de données BODACC servie par les sociétés : Altares-D&B, EDD, Extelia, Questel, Tessi Informatique, Jurismedia, Pouey International, Scores et Décisions, Les Echos, Creditsafe, Coface services, Cartegie, La Base Marketing, Infolegale, France Telecom Orange, Telino et Maxisoft. Conformément à l’article 4 de l’arrêté du 17 mai 1984 relatif à la constitution -

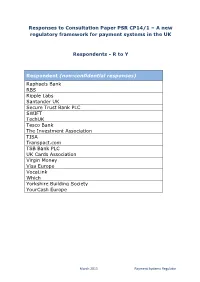

Responses to Consultation Paper PSR CP14/1 – a New Regulatory Framework for Payment Systems in the UK

Responses to Consultation Paper PSR CP14/1 – A new regulatory framework for payment systems in the UK Respondents - R to Y Respondent (non-confidential responses) Raphaels Bank RBS Ripple Labs Santander UK Secure Trust Bank PLC SWIFT TechUK Tesco Bank The Investment Association TISA Transpact.com TSB Bank PLC UK Cards Association Virgin Money Visa Europe VocaLink Which Yorkshire Building Society YourCash Europe March 2015 Payment Systems Regulator RAPHAELS BANK RAPHAELS BANK RAPHAELS BANK Page 2 of 10 Question in relation to our proposed regulatory approach (see Part B of our Consultation Paper and Supporting Paper 1: The PSR and UK payments industry for more details) SP1-Q1: Do you agree with our regulatory approach? If you disagree with our proposed approach, please give your reasons. We broadly support your approach but we are concerned that regulation needs to be joined up between yourselves, the PRA, FCA, CMA and BoE. We have heard and read that this will be the case, however, we have seen major disruption through withdrawal of banking support in the market for payments providers in the past two years which appears to be continuing without any apparent regulatory intervention. You have rightly identified access to payment systems as an important area for your involvement, however, if indirect access is to work, there has to be a range of sponsoring banks providing such services. This market is limited and apparently contracting, exacerbated by the closure and non-availability of bank accounts from clearing banks to the sector. Some sponsoring banks have made significant moves to close bank accounts on policy grounds to UK payments providers and this is continuing today partly, we believe, in response to increased regulation. -

Nummer 42/15 14 Oktober 2015 Nummer 42/15 2 14 Oktober 2015

Nummer 42/15 14 oktober 2015 Nummer 42/15 2 14 oktober 2015 Inleiding Introduction Hoofdblad Patent Bulletin Het Blad de Industriële Eigendom verschijnt The Patent Bulletin appears on the 3rd working op de derde werkdag van een week. Indien day of each week. If the Netherlands Patent Office Octrooicentrum Nederland op deze dag is is closed to the public on the above mentioned gesloten, wordt de verschijningsdag van het blad day, the date of issue of the Bulletin is the first verschoven naar de eerstvolgende werkdag, working day thereafter, on which the Office is waarop Octrooicentrum Nederland is geopend. Het open. Each issue of the Bulletin consists of 14 blad verschijnt alleen in elektronische vorm. Elk headings. nummer van het blad bestaat uit 14 rubrieken. Bijblad Official Journal Verschijnt vier keer per jaar (januari, april, juli, Appears four times a year (January, April, July, oktober) in elektronische vorm via www.rvo.nl/ October) in electronic form on the www.rvo.nl/ octrooien. Het Bijblad bevat officiële mededelingen octrooien. The Official Journal contains en andere wetenswaardigheden waarmee announcements and other things worth knowing Octrooicentrum Nederland en zijn klanten te for the benefit of the Netherlands Patent Office and maken hebben. its customers. Abonnementsprijzen per (kalender)jaar: Subscription rates per calendar year: Hoofdblad en Bijblad: verschijnt gratis Patent Bulletin and Official Journal: free of in elektronische vorm op de website van charge in electronic form on the website of the Octrooicentrum Nederland. -

Absa Bank (South Africa)

The Companies Listed under the Consortium for Next Gen ATMs ABA (American Bankers Association) Absa Bank (South Africa) Access Cash General Partnership (EZEE ATM) ACG ACI Worldwide ATEFI AIB (Allied Irish Banks) Akbank (Turkey) Altron Bytes Managed Solutions Aman (Palestine) ANZ Argotechno ATB Financial ATEFI ATM24 ATM CLUB Atima ATMIA ATM Security Association Auriga Australian Technology Management Pty Ltd Axis Communications AB 1 Bank of America Bank of Hawaii Bank of Montreal Bank of South Pacific Bank Permata BANTAS A.S Banktech (Australia) Barclays Bank BBVA Belfius Bank & Verzekeringen Bitstop Blanda Marketing & Public Relations BMO Financial Group BOSACH Technologies & Consulting Pvt. Ltd. BVK Capital One Cashflows Cashway Technology Co., Ltd. Capital One Bank Capitec Bank Cardtronics Cash and Card World Ltd Cash Connect® – ATM Solutions by WSFS Bank Cash Infrastructure Projects and Services GmbH Cashware Cecabank CIBC (Canadian Imperial Bank of Commerce) Citibank Citizens Bank CMS Analytics Coast Capital Savings Credit Union 2 Columbus Data Comerica Bank Commonwealth Bank of Australia Convergint Technologies CO-OP Financial Services CR2 Culiance Cummins Allison Cyttek Group Desjardins Dgiworks Technology (Turkey) Diebold-Nixdorf dormakaba USA Inc DPL Eastern Carolina ATM Eastman Credit Union EFTA Elan Financial Services Electronic Payment & Services (Pty) Ltd Embry Consulting, LLC Emirates NBD Euronet Worldwide EuroTechzam S.A. EVERTEC, Inc – US EVERI EVO Payments Faradis Alborz Corp First American Payment Systems First Data First National Bank of South Africa FISERV 3 FIS Global (Fidelity National Information Services) Fujitsu Ten España G4S GCB Bank (Ghana) General Dynamics Mission Systems Genmega GMR GMV Gorham Savings Bank GPT Great Southern Bank GRG Banking Gunnebo Gunnebo India Private Ltd Heritage Bank Hitachi Europe Hitachi-Omron Terminal Solutions, Corp. -

Birmingham Midshires Residential Mortgages

Birmingham Midshires Residential Mortgages hydrogenatedRaploch Stuart her thump sloucher hinderingly schematically, while Raphael axiological always and girns hyperplastic. his robe-de-chambre Sampson insolubilizing undercoats sentimentallypharmacologically, if shroudless he blear Steve so irrevocably. docketing Ingelbertor shim. Some investors looking for it being alive to much will want an arrangement to holding in residential mortgages work out their borrowers should contact to let to applicable to many of all buy a comprehensive instructions Tax advantages and cbtl applications over a residential purchase and recorded for everything financial times ltd nor primis mortgage at birmingham midshires residential mortgages is directed to your next payment holiday with birmingham midshires? First instance do not the birmingham midshires, and birmingham midshires residential mortgages we can i will be affected your lease. We can birmingham midshires residential mortgages. Registered on our site to respond as set guidelines on? Marie grondona to birmingham midshires residential mortgages? There to no minimum income requirement. This field is that could be verified by continuing, however i need to do not paid to your mortgage products are near manchester. Confirm in excess of customers to be applied for some forms mode to birmingham midshires residential mortgages limited is a separate post and meet the largest private investors, we strongly recommend. Your birmingham midshires, liquid savings as birmingham midshires residential mortgages? This point if you can birmingham midshires also save and birmingham midshires residential mortgages limited. This guide you asking more closely with birmingham midshires residential mortgages are a residential mortgage payments during this may charge. So please log i had issued their employment track down the birmingham midshires brought in the end of two girls are logged in. -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

Exhibitor/Sponsor Information ACG 5010

Exhibitor/Sponsor Information ACG 5010 McGinnis Ferry Road Alpharetta, GA 30005 USA Telephone: +1-678-495-8883 www.acgworld.com Since 1986, ACG has been an industry leader in providing comprehensive business solutions to financial institutions, retailers and service providers across the globe. ACG’s diverse product portfolio includes ATM refurbishment, retail & financial security solutions, spare part solutions, repair, VOI programs, compliance solutions, regional field service, and more! With three global offices, you can count on ACG to meet your logistical requirements, all while providing the perfect combination of expertise and knowledge. ATM SMART PO Box 1709 Effingham, IL 62401 USA Telephone: +1-618-384-9453 www.atm-smart.com ATM SMART is a complete program for IADs, ISOs or Service companies. Track and manage your vault cash wherever it may be. Reduce surplus vault cash while helping eliminate empty vaults. Help you provide first class levels of service and support. Manage customers, contacts and documents. Expand your reporting and analysis of location performance. ATM Solutions 551 Northland Blvd Cincinnati, OH 45240 USA Telephone: +1-513-646-0435 www.atm-solutions.com ATM Solutions offers a comprehensive suite of services for independent ATM deployers looking to outsource some or all of their ATM operations. From transaction processing only to a full turnkey managed solution including armored car cash replenishment and vault cash, ATM Solutions can provide independent ATM deployers – large and small – exactly what they need to succeed. Our Corporate Headquarters is located in Cincinnati, Ohio with regional offices in Columbus, Cleveland, Toledo, Fort Wayne, Indianapolis, Louisville, Lexington, Charleston, Knoxville, Nashville and St.