Evaluating the Opportunities for High Blend Liquid and Gaseous Biofuel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

APPC (I) Gateshead College (I)

Register for 1st June 2017 - 31st August 2017 Access Partnership Address(es) in the UK Contact Details 9th Floor Southside Gregory Francis 105 Victoria Street 0203 143 4921 London [email protected] SW1E 6QT www.accesspartnership.com Other Countries of Operation BELGIUM SENEGAL SINGAPORE UNITED ARAB EMIRATES UNITED STATES Practitioners (employed and sub-contracted) conducting PA activities this quarter * practitioner holds a Parliamentary pass Matthew Allison Haude Lannon Michael Laughton Matthew McDermott Jennifer McPherson Alexander Petropoulos Laura Sallstrom Fee-Paying clients for whom UK PA consultancy services provided this quarter (i) Client description available Intelsat (i) Salesforce Trustonic (i) Airport Operators Association Address(es) in the UK Contact Details 3 Birdcage Walk Karen Dee London 02077993171 SW1H 9JJ [email protected] www.aoa.org.uk Practitioners (employed and sub-contracted) conducting PA activities this quarter * practitioner holds a Parliamentary pass Ed Anderson Michael Burrell Karen Dee Roger Koukkoullis Peter O'Broin Henk van Klaveren APCO Worldwide Address(es) in the UK Contact Details 90 Long Acre Alexandra Bigland London 020 7526 3654 WC2E 9RA [email protected] www.apcoworldwide.com Other Countries of Operation BELGIUM CHINA FRANCE GERMANY HONG KONG INDIA INDONESIA ISRAEL ITALY JAPAN MALAYSIA POLAND POLAND QATAR RUSSIAN FEDERATION SINGAPORE THAILAND TURKEY UNITED ARAB EMIRATES UNITED STATES VIET NAM Practitioners (employed and sub-contracted) conducting PA activities this quarter -

Cummins Commentary

Issue 21 — December 2006 Success of the Century EGR Update: No fears for logger Leeson Cummins wins top diversity award Marlin mania in Cairns Cummins South Pacific News EVERY 2 UPDATE Bakewell fleet is immaculately presented. Catalogue of success They are lurking in virtually every Australian household and they are silently powerful. They are catalogues! The people who stick ‘No Junk Mail’ signs on their letterboxes might hate them, but the use of catalogues by Australian retailers is now huge business. In fact, more than 7 billion catalogues will be distributed in Australia in 2006, mainly into letterboxes. It is estimated that more than 65 per cent of the marketing budgets of grocery and mass merchandise giants like Woolworths, Coles and Target are now being sucked up by their catalogue marketing efforts. Franklin Web prints 200 million letterbox catalogues a month. One company in the thick of the billion-dollar catalogue industry – an industry that has shown spectacular and continued growth over the last decade — is Franklin Web, a Melbourne-based business that began in printing in 1936. Franklin Web is now the third largest web offset printer in Australia and has a customer portfolio that reads like the The right mix for ‘Who’s Who’ of the retailing industry — Australia Post, Big W, Target, Coles, K Mart, Mitre 10 and Bob Jane T-Marts. “Research has shown that a retailer’s sales jump an average 30 per cent after they have a catalogue distributed through letterboxes,” says Phil Taylor, CEO of Franklin Web, emphasising the power of the catalogue. -

Nederland De Industriële Eigendom 10 Juli 2019

Nummer 28/19 10 juli 2019 Nummer 28/19 2 10 juli 2019 Inleiding Introduction Hoofdblad Patent Bulletin Het Blad de Industriële Eigendom verschijnt The Patent Bulletin appears on the 3rd working op de derde werkdag van een week. Indien day of each week. If the Netherlands Patent Office Octrooicentrum Nederland op deze dag is is closed to the public on the above mentioned gesloten, wordt de verschijningsdag van het blad day, the date of issue of the Bulletin is the first verschoven naar de eerstvolgende werkdag, working day thereafter, on which the Office is waarop Octrooicentrum Nederland is geopend. Het open. Each issue of the Bulletin consists of 14 blad verschijnt alleen in elektronische vorm. Elk headings. nummer van het blad bestaat uit 14 rubrieken. Bijblad Official Journal Verschijnt vier keer per jaar (januari, april, juli, Appears four times a year (January, April, July, oktober) in elektronische vorm via www.rvo.nl/ October) in electronic form on the www.rvo.nl/ octrooien. Het Bijblad bevat officiële mededelingen octrooien. The Official Journal contains en andere wetenswaardigheden waarmee announcements and other things worth knowing Octrooicentrum Nederland en zijn klanten te for the benefit of the Netherlands Patent Office and maken hebben. its customers. Abonnementsprijzen per (kalender)jaar: Subscription rates per calendar year: Hoofdblad en Bijblad: verschijnt gratis Patent Bulletin and Official Journal: free of in elektronische vorm op de website van charge in electronic form on the website of the Octrooicentrum Nederland. -

Bonus Codes Call: 1900 990 0848

BONUS CODES WANT EASY ACCESS TO THE BEST BITS OF THE GAME? CALL NOW AND GET INSTANT ACCESS TO: NO DAMAGE SPEED BOOST UNLOCK ALL EVENTS AI DRIVER REPULSOR FIELD OR JUST COMPLETE THE GRID WORLD MODE! CALL: 1900 990 0848 CALLS COST $2.99 PER MINUTE OR LOG ON TO WWW.CODEMASTERS.COM/BONUSCODES TO GET STARTED, FOLLOW THESE INSTRUCTIONS: 1 From the Main Menu go to Options > Bonus Codes and write down the Access Code which appears in the bottom right-hand corner of the Bonus Codes screen. 2 Call the Hintline or log on and follow the links to the Race Driver: Grid area.** 3 When prompted, enter the Access Code and your details. 4 Either write down the codes you’re given or look at the Bonus Code email you’ve been sent. You can get as many or as few Bonus Codes as you like in one Hintline session; the email will contain them all. 5 To unlock the new features, go to Options > Bonus Codes > Enter Code and enter the bonus Code(s) in the space(s) onscreen. All game features unlocked with Bonus Codes are also available through playing the game. Please note cheats cannot be used during online gaming. Calls from mobiles vary. Calls last approx. 3 minutes. Callers must be over 16 and have permission from the bill payer. Prices correct at time of going to press. Service Provided by Premier Communications PO Box 177 Chesham HP5 1FL. **Please note: Hintline Bonus Codes are paid for through the cost of call and require a touch tone telephone. -

Reducing the Maritime Sector's Contribution to Climate Change And

REDUCING THE MARITIME SECTOR’S CONTRIBUTION TO CLIMATE CHANGE AND AIR POLLUTION Economic Opportunities from Low and Zero Emission Shipping. Technical Annexes July 2019 Frontier Economics Ltd is a member of the Frontier Economics network, which consists of two separate companies based in Europe (Frontier Economics Ltd) and Australia (Frontier Economics Pty Ltd). Both companies are independently owned, and legal commitments entered into by one company do not impose any obligations on the other company in the network. All views expressed in this document are the views of Frontier Economics Ltd. Reducing the Maritime Sector’s Contribution to Climate Change and Air Pollution Authors: Matthew Bell (Frontier Economics), Kat Deyes (Frontier Economics), Nick Fitzpatrick (Frontier Economics), Cavin Wilson (Frontier Economics), Adam Chase (E4tech) and Chester Lewis (E4tech). Expert advice was provided by Dr Tristan Smith (UMAS). The authors would like to thank David Connolly who provided technical advice relating to specific abatement options, particularly air lubrication. David is a technical advisor to University Maritime Advisory Services (UMAS) and is employed by Silverstream Technologies which is one of the companies referred to in this report. Although this report was commissioned by the Department for Transport (DfT), the findings and recommendations are those of the authors and do not necessarily represent the views of the DfT. The information or guidance in this document (including third-party information, products and services) is provided by DfT on an 'as is' basis, without any representation or endorsement made and without warranty of any kind whether express or implied. The Department for Transport has actively considered the needs of blind and partially sighted people in accessing this document. -

Sustainability Report a Legacy of Dependability and Responsibility July 2009

Sustainability Report A Legacy of Dependability and Responsibility July 2009 Profile & Governance| 1 2 | Profile & Governance 2009 marks the 90th anniversary of Cummins Inc. Over the last nine decades, the Company has grown into a global leader in the production of diesel and natural gas engines, power generation systems and related components. Our commitment to customers, employees and communities is rooted in our heritage and has made us Cummins. Dependable. Since 1919. Profile & Governance| 3 I know what my company stands for. I am ready to carry out its mission of returning value to our customers, shareholders and communities — and to be a good steward of the environment along the way. I bring my unique perspective to work every day, as do thousands of my colleagues around the world. Together we create a rich diversity of cultures and views. 4 | Sustainability Report 2008 I understand my company’s vision includes all the communities we serve around the globe, not just my own. And I believe my success will contribute to the success of everyone we serve, everywhere. I am Cummins. You can depend on me. Profile & Governance| 5 About This Report The information in this report is presented in the spirit in collaboration with the United Nations Environment of the guidelines set by the Global Reporting Initiative Program (UNEP) and the UN Secretary-General’s (GRI). The aim of the GRI is to develop a consistent way Global Compact. We are proud of the positive impact for companies around the world to voluntarily report on Cummins products and the people who manufacture the economic, environmental and social components them have on our society. -

Final-Program-TGF-20

11 th edition PROGRAM REDEFINING GLOBALIZATION PRESENTED BY OCT 30 - NOV 1, 2017 | FAIRMONT ROYAL YORK | forum-americas.org/toronto PARTNERS PRESENTING PARTNER STRATEGIC PARTNERS GOLD PARTNERS SILVER PARTNERS Z G170 B255 2 | 11 th EDITION | TORONTO GLOBAL FORUM PROGRAM | #TGF PARTNERS BRONZE PARTNERS OFFICIAL AIRLINE GOVERNMENT PARTNERS MEDIA PARTNERS INSTITUTIONAL & KNOWLEDGE PARTNERS 11 th EDITION | TORONTO GLOBAL FORUM PROGRAM |#TGF | 3 MESSAGES MESSAGE FROM THE PRIME MINISTER OF CANADA MESSAGE FROM THE PREMIER OF ONTARIO It is with great pleasure that I welcome you to the On behalf of the Government of Ontario, I am 2017 Toronto Global Forum, hosted by the delighted to welcome you to the 11 th Edition of the International Forum of the Americas. Toronto Global Forum – Redefining Globalization. This year, Canadians celebrate our 150 th anniversary There is no doubt that we are in a period of great of Confederation, an opportunity for us to reflect on economic transformation — from climate change to that which has shaped our country since its artificial intelligence, to ecommerce, advanced founding. We are, at our core, a nation that thrives manufacturing and trade. I firmly believe that we because of our differences, one which has found can harness today’s change to create more Justin success because we know that a diversity of Kathleen opportunity for people and businesses. But it won’t Trudeau opinions and experiences makes us all better off. Wynne happen without a concerted, coordinated effort. Prime Minister Premier Government and the private sector have to work of Canada It is this diversity that has made Canada uniquely of Ontario together to drive growth and ensure fairness. -

Bonus Codes Call

BONUS CODES WANT EASY ACCESS TO THE BEST BITS OF THE GAME? CALL NOW AND GET INSTANT ACCESS TO: NO DAMAGE SPEED BOOST UNLOCK ALL EVENTS AI DRIVER REPULSOR FIELD OR JUST COMPLETE THE GRID WORLD MODE! CALL: 1902250558* OR LOG ON TO WWW.CODEMASTERS.COM/BONUSCODES TO GET STARTED, FOLLOW THESE INSTRUCTIONS: 1 From the Main Menu go to Options > Bonus Codes and write down the Access Code which appears in the bottom right-hand corner of the Bonus Codes screen. 2 Call the Hintline or log on and follow the links to the Race Driver: Grid area.** 3 When prompted, enter the Access Code and your details. 4 Either write down the codes you’re given or look at the Bonus Code email you’ve been sent. You can get as many or as few Bonus Codes as you like in one Hintline session; the email will contain them all. 5 To unlock the new features, go to Options > Bonus Codes > Enter Code and enter the bonus Code(s) in the space(s) onscreen. All game features unlocked with Bonus Codes are also available through playing the game. Please note cheats cannot be used during online gaming. *Calls cost $2.75 per minute. Calls from mobiles vary. Calls last approx. 3 minutes. Callers must be over 16 and have permission from the bill payer. Prices correct at time of going to press. Service Provided by Premier Communications PO Box 177 Chesham HP5 1FL. **Please note: Hintline Bonus Codes are paid for through the cost of call and require a touch tone telephone. -

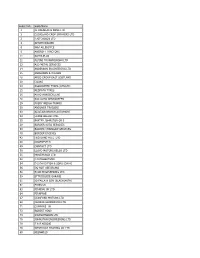

Supp Code Supp Name 1 JE DOUGLAS & SONS LTD 2

Supp Code Supp Name 1 JE DOUGLAS & SONS LTD 2 CLEVELAND CROP SPRAYERS LTD 3 J AITCHISON LTD 4 AITKEN WALKER 6 W&J ALLERDYCE 9 ANCROFT TRACTORS 11 ALPHA PLUS 12 ALPINE TRANSMISSION LTD 13 ASD METAL SERVICES 14 ANDERSON ENGINEERING LTD 15 ANDERSON & WILSON 18 ARCO GROUP EAST SCOTLAND 20 COOKS 23 ASSOCIATED TYRES (ATS)LTD 25 REDPATH TYRES 26 AUTO WINDSCREENS 28 RAC AUTO WINDSCREEN 29 AVERY WEIGH-TRONIX 30 ANDOVER TRAILERS 33 ALISTAIR BROWN AUTOPAINT 34 FRANK BALLANTYNE 35 BAXTER JOHNSTON OILS 38 BORDER AUTO SERVICES 39 BORDER CHAINSAW SERVICES 40 BORDER ENGINES 42 HIGHLAND FUEL LTD 48 GROENEVELD 49 CONTACT LTD 50 LLOYD MOTORS KELSO LTD 51 HOSEWORLD LTD 52 J CUTHBERTSON 54 D S DALGLEISH & SONS (GALA) 56 DO NOT USE BRUNO 58 ECON ENGINEERING LTD 59 ETTRICKSIDE GARAGE 61 JD FALLA & SON (BLACKSMITH) 62 ERIKS UK 63 FINNING UK LTD 64 FINNPAVE 67 CESSFORD MOTORS LTD 68 GEORGE HENDERSON LTD 71 CUMMINS UK 73 ROBERT HIND 74 INDESPENSION LTD 76 JOHNSTON ENGINEERING LTD 78 T & R KEDDIE 79 WESTQUAY TRADING CO LTD 80 KEENWELD 82 LAWRIES GARAGE 83 LOTHIAN LEYLAND DAF LTD 84 JIM INGLES 85 LOTHIAN BRAKEWAYS LTD 90 MELLOR COACHCRAFT 91 STEPHEN MONRO 92 MORRISON & MURRAY LTD 93 ROZONE LIMITED 94 MOTHERWELL BRIDGE AIR SYSTEM 96 WEBER UK 97 OSWALD RECORD & CO 99 OUTREACH PLC 100 PHOENIX ENGINEERING CO LTD 101 BERGMANN DIRECT LTD 102 PROPSHAFT SERVICE 103 ADAM PURVES 104 POWER VAMP 106 COLIN ROBERTSON 109 REEKIE PLANT LTD (COLDSTREAM) 113 GLENEAGLES CONVERSIONS LTD 114 J RUTHERFORD 117 SCOT JCB LTD 118 SCOTTISH OILS 119 KEITH HALL - CHEEKLAW GARAGE 121 SERVICELINE -

20046 the Broyle Ringmer Lewes BN8 5NP Biffpack Charles Worthington Hair & Beauty Co

Company Reg Registered Registered Registered Registered Member Company Name No Registered Address 1 Address 2 Address 3 Address 4 Address 5 Postal Code Scheme AMK Automotive Components 2806051 Greengates Mill Chickenley LaneDewsbury W. Yorks WF13 8QP Betapack BLP Group Ltd 1604770 Sandal Stones Road Kirk Sandal Doncaster S.Yorks DN3 1QR Betapack Borg Warner Automotive Ltd 2346109 Roysdale Way Euroway Ind EstBradford W. Yorks BD4 5SE Betapack Buckley Jewellery Ltd 2343583 Unit G3 Wyther Lane IndWyther Lane Leeds W. Yorks LS5 3AR Betapack Collisons Ltd 4189903 Queenbridge Works Queen Street Burton On Trent Staffs DE14 3LP Betapack CPL Industries Ltd 2993245 Mill Lane Wingerford Chesterfield Derbs S42 6NG Betapack Everts International Ltd 1741498 2nd Avenue Flixborough Ind Scunthorpe N. Lincs DN15 8SD Betapack Foodmaker Ltd 935767 16b Princewood Rd Ealstree Ind Est Corby Northants NN17 4AP Betapack Gala Group Ltd 4639005 New Castle House Castle BoulevardNottingham Notts NG7 1FT Betapack Herbert Walker Printers 405322 PO Box 321 Dockfield Road Shipley W. Yorks Betapack Jack L Barnett 1567500 Barnett House Parkside Ind EstMiddleton GroveLeeds W. Yorks LS11 5BX Betapack James Durrans & Sons Ltd 172023 Phoenix Works Penistone Sheffield S.Yorks S36 8QU Betapack John A Stephens 874901 Castle Meadow Rd Nottingham Notts NG2 1AG Betapack John Dennis Barnsley Ltd 2568706 Beevor Street Hoyle Mill Barnsley S.Yorks S71 1HN Betapack Lynx Technologies Ltd 2277581 3 Midland Way Barlbrough LinksBarlbrough Chesterfield S.Yorks S43 4XA Betapack Newton House Bakery UC1028337 Hacvelock Street Ravensthorpe Dewsbury W. Yorks Betapack Peavey Electronics Ltd 1249126 Great Folds Road Corby Northants NN18 9ET Betapack Premier Farnell PLC 876412 Armley Road Leeds W. -

Public Affairs Board

Register for 1st December 2018 - 28th February 2019 3x1 Group Address(es) in the UK Contact Details 11 Fitzroy Place W Little Glasgow 0141 221 0707 G3 7RW [email protected] 26-28 Exchange Street Aberdeen AB11 6PH 16a Walker Street Edinburgh EH3 7LP 210 Borough High Street London SE1 1JX Practitioners (employed and sub-contracted) conducting PA activities this quarter Roz Britton Cameron Grant Patrick Hogan Will Little Katrine Pearson Fee-Paying clients for whom UK PA consultancy services provided this quarter (i) Client description available Atos Edinburgh Tourism Action Group SICPA The Scottish Salmon Company Viridor Access Partnership Address(es) in the UK Contact Details 9th Floor Southside David Kaye 105 Victoria Street 0203 143 4921 London [email protected] SW1E 6QT www.accesspartnership.com Other Countries of Operation BELGIUM SENEGAL SINGAPORE UNITED ARAB EMIRATES UNITED STATES Practitioners (employed and sub-contracted) conducting PA activities this quarter Haude Lannon Michael Laughton Simona Lipstaite Matthew McDermott Laura Sallstrom Kirsten Williams Fee-Paying clients for whom UK PA consultancy services provided this quarter (i) Client description available Avanti (i): www.avantiplc.com Salesforce (i): www.salesforce.com Airport Operators Association Address(es) in the UK Contact Details 3 Birdcage Walk Henk van Klaveren London 020 7799 3171 SW1H 9JJ 020 7340 0999 [email protected] www.aoa.org.uk Practitioners (employed and sub-contracted) conducting PA activities this quarter Ed Anderson Jeff Bevan Michael -

European Pension Funds

2TOP TOP 1000 1000 Sponsor/entity Country 2016 (€’000s) 2015 (€’000s) 55 Pensioenfonds PGB Netherlands 23,620,773 21,769,000 56 UBS AG Switzerland 21,996,803 19,902,695 57 Aviva plc UK 21,713,189 18,969,446 58 Strathclyde Pension Fund (LGPS) UK 21,569,725 17,129,048 59 Zilverfonds Belgium 21,529,240 20,756,709 Top 1000 60 Pensioenfonds Vervoer Netherlands 21,443,000 19,600,000 61 Folketrygdfondet Norway 20,642,106 22,139,929 62 Elo Finland 20,513,600 19,615,800 63 Shell UK UK 20,341,637 19,842,533 64 Industriens Pension Denmark 19,600,963 19,105,793 65 Koninklijke Philips Electronics NV Netherlands 19,527,000 18,043,000 66 ERAFP France 19,503,873 17,500,000 European 67 Diageo plc UK 19,115,981 14,112,208 68 Migros Switzerland 19,076,308 17,368,679 69 Pensioenfonds Detailhandel Netherlands 18,757,162 13,003,022 70 KZVK Germany 18,730,646 15,524,094 71 Tata Steel UK Ltd. UK 18,236,441 15,323,786 72 Valtion Eläkerahasto (VER) Finland 17,900,000 17,599,900 Pension 73 KLM Royal Dutch Airlines Netherlands 17,831,001 18,220,000 74 British Broadcasting Corporation (BBC) UK 17,793,150 16,499,220 75 Daimler AG Germany 17,306,000 15,973,000 76 PenSam Denmark 17,078,514 16,807,770 77 IGFSS, IP Portugal 16,514,576 13,024,229 78 AkzoNobel UK Ltd. UK 16,484,886 14,775,119 79 West Midlands Pension Fund (LGPS) UK 16,444,301 15,839,361 Funds 80 Rolls-Royce Group plc UK 16,235,669 15,889,631 81 GlaxoSmithKline plc UK 16,124,328 15,517,530 82 Siemens AG Germany 15,906,890 16,126,000 83 FDC Luxembourg 15,812,071 14,926,523 Investable Investable 84 Fondazione