Developing Bangkok As an ASEAN Metropolis (25/2/2014)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ชื่อจังหวัด อำเภอ ตำบล เขต และแขวง Changwat, Khet and Amphoe Directory

ชื่อจังหวัด อ ำเภอ ต ำบล เขต และแขวง CHANGWAT, KHET AND AMPHOE DIRECTORY กรุงเทพมหำนคร เขตพระนคร Khet Phra Nakhon KRUNG THEP MAHA แขวงชนะสงครำม Khwaeng Chana Songkhram NAKHON (BANGKOK) แขวงตลำดยอด Khwaeng Talat Yot แขวงบวรนิเวศ Khwaeng Bowon Niwet แขวงบำงขุนพรหม Khwaeng Bang Khun Phrom แขวงบ้ำนพำนถม Khwaeng Ban Phan Thom แขวงพระบรมมหำรำชวัง Khwaeng Phra Borom Maha Ratchawang แขวงวังบูรพำภิรมย์ Khwaeng Wang Burapha Phirom แขวงวัดรำชบพิธ Khwaeng Wat Ratchabophit แขวงวัดสำมพระยำ Khwaeng Wat Sam Phraya แขวงศำลเจ้ำพ่อเสือ Khwaeng San Chao Pho Suea แขวงส ำรำญรำษฎร์ Khwaeng Samran Rat แขวงเสำชิงช้ำ Khwaeng Sao Chingcha กรุงเทพมหำนคร เขตคลองเตย Khet Khlong Toei KRUNG THEP MAHA แขวงคลองตัน Khwaeng Khlong Tan NAKHON (BANGKOK) แขวงคลองเตย Khwaeng Khlong Toei แขวงพระโขนง Khwaeng Phra Khanong กรุงเทพมหำนคร เขตคลองสำน Khet Khlong San แขวงคลองต้นไทร Khwaeng Khlong Ton Sai แขวงคลองสำน Khwaeng Khlong San แขวงบำงล ำพูล่ำง Khwaeng Bang Lamphu Lang แขวงสมเด็จเจ้ำพระยำ Khwaeng Somdet Chao Phraya กรุงเทพมหำนคร เขตคลองสำมวำ Khet Khlong Sam Wa แขวงทรำยกองดิน Khwaeng Sai Kong Din แขวงทรำยกองดินใต้ Khwaeng Sai Kong Din Tai แขวงบำงชัน Khwaeng Bang Chan แขวงสำมวำตะวันตก Khwaeng Sam Wa Tawan Tok แขวงสำมวำตะวันออก Khwaeng Sam Wa Tawan Ok กรุงเทพมหำนคร เขตคันนำยำว Khet Khan Na Yao ส ำนักงำนรำชบัณฑิตยสภำ ข้อมูล ณ วันที่ ๒๒ กุมภำพันธ์ ๒๕๖๐ ๒ แขวงคันนำยำว Khwaeng Khan Na Yao แขวงรำมอินทรำ Khwaeng Ram Inthra กรุงเทพมหำนคร เขตจตุจักร Khet Chatuchak แขวงจตุจักร Khwaeng Chatuchak แขวงจอมพล Khwaeng Chom Phon แขวงจันทรเกษม Khwaeng Chan Kasem แขวงลำดยำว Khwaeng Lat Yao แขวงเสนำนิคม -

Thailands Beaches and Islands

EYEWITNESS TRAVEL THAILAND’S BEACHES & ISLANDS BEACHES • WATER SPORTS RAINFORESTS • TEMPLES FESTIVALS • WILDLIFE SCUBA DIVING • NATIONAL PARKS MARKETS • RESTAURANTS • HOTELS THE GUIDES THAT SHOW YOU WHAT OTHERS ONLY TELL YOU EYEWITNESS TRAVEL THAILAND’S BEACHES AND ISLANDS EYEWITNESS TRAVEL THAILAND’S BEACHES AND ISLANDS MANAGING EDITOR Aruna Ghose SENIOR EDITORIAL MANAGER Savitha Kumar SENIOR DESIGN MANAGER Priyanka Thakur PROJECT DESIGNER Amisha Gupta EDITORS Smita Khanna Bajaj, Diya Kohli DESIGNER Shruti Bahl SENIOR CARTOGRAPHER Suresh Kumar Longtail tour boats at idyllic Hat CARTOGRAPHER Jasneet Arora Tham Phra Nang, Krabi DTP DESIGNERS Azeem Siddique, Rakesh Pal SENIOR PICTURE RESEARCH COORDINATOR Taiyaba Khatoon PICTURE RESEARCHER Sumita Khatwani CONTRIBUTORS Andrew Forbes, David Henley, Peter Holmshaw CONTENTS PHOTOGRAPHER David Henley HOW TO USE THIS ILLUSTRATORS Surat Kumar Mantoo, Arun Pottirayil GUIDE 6 Reproduced in Singapore by Colourscan Printed and bound by L. Rex Printing Company Limited, China First American Edition, 2010 INTRODUCING 10 11 12 13 10 9 8 7 6 5 4 3 2 1 THAILAND’S Published in the United States by Dorling Kindersley Publishing, Inc., BEACHES AND 375 Hudson Street, New York 10014 ISLANDS Copyright © 2010, Dorling Kindersley Limited, London A Penguin Company DISCOVERING ALL RIGHTS RESERVED UNDER INTERNATIONAL AND PAN-AMERICAN COPYRIGHT CONVENTIONS. NO PART OF THIS PUBLICATION MAY BE REPRODUCED, STORED IN THAILAND’S BEACHES A RETRIEVAL SYSTEM, OR TRANSMITTED IN ANY FORM OR BY ANY MEANS, AND ISLANDS 10 ELECTRONIC, MECHANICAL, PHOTOCOPYING, RECORDING OR OTHERWISE WITHOUT THE PRIOR WRITTEN PERMISSION OF THE COPYRIGHT OWNER. Published in Great Britain by Dorling Kindersley Limited. PUTTING THAILAND’S A CATALOGING IN PUBLICATION RECORD IS BEACHES AND ISLANDS AVAILABLE FROM THE LIBRARY OF CONGRESS. -

Find a Bangkok Bank Branch Which Provides a Foreign Currency Deposit Account Service

FCD Service Branches No. Province Branch Telephone 1 Bangkok Phlapphla Chai 02-222-2111, 02-221-468, 02-222-8746 2 Bangkok Future Park Rangsit 02-958-5866-8 3 Bangkok Zeer Rangsit 02-992-7387-8 4 Bangkok Abdulrahim Building 02-6360578-80 5 Bangkok Central Rama 2 02-872-4001-2 6 Bangkok U Center Chula 42 02-216-2094-5 7 Bangkok SEACON Bangkae 02-458-2966-8 8 Bangkok Silom Jewelry Trade Center 02-630-0560-2 9 Bangkok Ratchada-Huaikhwang Road 02-692-6900-4 Sukhaphiban 1 Road, 10 Bangkok Raminthra Km.8 02-948-5583-4 ต่อ 1001 11 Bangkok Rattanathibet Road 02-969-9152-3 12 Bangkok Songprapha Road, Donmuang 02-929-9719-24 13 Bangkok Raminthra Road, Km.10 02-918-0273, 02-918-0270-2 Ext. 1001 14 Bangkok Ekkamai 02-714-3100-1 15 Bangkok Lam Luk Ka Road, Khlong 2 02-995-8145-9 16 Bangkok National Science and 02-564-8028-30 Technology Development Agency 17 Bangkok Na Wa Nakhon 02-909-2071, 02-909-2148 18 Bangkok Pantip Plaza 02-656-6146-8 Thammasat University Rangsit 19 Bangkok Campus 02-564-2751-3 20 Bangkok Emporium 02-664-9291-3 21 Bangkok Ratchawong 02-222-2151-5 22 Bangkok Bang Kapi 02-653-1011 23 Bangkok Pratunum 02-252-5183-5 24 Bangkok Thon Buri 02-437-0220-3 25 Bangkok Sampheng 02-222-2141-9 26 Bangkok Pradiphat Road 02-279-8060-7 27 Bangkok Bukkhalo 02-468-0123 28 Bangkok Talat Phlu 02-466-1060-3, 02-891-3571-4 29 Bangkok Bang Lamphu 02-281-4111, 02-281-3538 30 Bangkok Silom 02-233-6080-9, 02-635-6611-30 31 Bangkok Bang Khae 02-413-1701-5 32 Bangkok Worachak 02-221-7410 33 Bangkok Samrong 02-384-1375-6 34 Bangkok Ratchathewi 02-216-1550-8, -

2002 14 2.2 Financial Position Analysis 15 2.3 Capital Requirements 18 3

Contents Selected Financial Data 3 Message from the Chairman 5 Management Discussion and Analysis 6 1. Overview 6 1.1 Economic Overview and Regulatory Changes 6 1.2 Direction of Business Operations 8 2. Operating Performance and Financial Position Analysis 14 2.1 Operating Performance 2002 14 2.2 Financial Position Analysis 15 2.3 Capital Requirements 18 3. Operations of Business Groups 18 3.1 Business Overview 18 3.2 Corporate Business Group 19 3.3 Retail Business Group 25 3.4 Treasury Group 31 4. Risk Management and Risk Factors 34 4.1 Overall Risk Management 34 4.2 Risk Management Principles 34 4.3 Risk Management 35 5. Functional Groups 49 5.1 Human Resources 49 5.2 Back Office Reconfiguration 52 5.3 Information Technology (IT) 53 6. TFBû Investments in Subsidiary and Associated Companies 54 Auditorûs Report 57 Balance Sheets 58 Statements of Income 60 Statements of Changes in Shareholdersû Equity 61 Statements of Cash Flows 62 Notes to Financial Statements 64 Operating Results and Profit Appropriation for the Year 2002 147 Financial Summary 148 Corporate Governance 150 Shareholders and Management 157 Investments of the Thai Farmers Bank Public Company Limited in Other Companies 184 Income Structure 190 Other Information 191 Board of Directors 194 Executive Board 196 498 Domestic Branches 199 Office of International Trade Centers 214 Overseas Offices 215 Summary of Specified Items per Form 56-2 in 2002 Annual Report 216 1 Annual Report 2002 Selected Financial Data Annual Report 2002 2 Selected Financial Data As at December 31, (Million -

Et Bangkok? Sam Yaek Bang Yai Bang Rak Yai Sai Ma Yaek Nonthaburi 1 Ministry of Public Health PLAN METRO-BTS

Khlong Bang Phai Talad Bang Yai Bang Phlu Bang Rak Noi Tha It Phra Nang Klao Bridge Bang Kraso Nonthaburi Civic Center Et Bangkok? Sam Yaek Bang Yai Bang Rak Yai Sai Ma Yaek Nonthaburi 1 Ministry of Public Health PLAN METRO-BTS Yaek Tiwanon Mo Chit Direction du terminal Terminal de Saitaï Direction de l’aéroport Wong Sawang de Don Muang Ha Yaek Lat Phrao Lat Phrao Phahon Yothin Ratchadaphisek Bang Son Chatuchak Park Mo Chit Sutthisan Chatuchak Market Saphan Khwai Huai Khwang Tao Poon Bang Sue Kamphaeng Phet Ari Rajadamnern Thailand Cultural Centre Stadium Sanam Pao Grand Palace Phra Ram 9 Khao San Road Victory Monument Makkasan Ramkhamhaeng Hua Mak Ban Thap Chang Lat Krabang Wat Phra Kaew Phayathai Ratchaprarop Phetchaburi Bangkok Hospital Bumrungrad Hospital Wat Po & Lying Buddha Brahma Ratchathewi shrine Ambassade Suvarnabhumi de Suisse Sukhumvit Chid Lom Nana Samitivej Hospital Suvarnabhumi National Stadium Thong Lo aéroport Phloen Chit Asok Yaowarat Siam Phrom Phong Ekkamai Ekkamai Ratchadamri Alliance Terminal Gare de Hua Lamphong Française QSNCC Phra Khanong Sam Yot Hua Lamphong Silom Lumpini On Nut Wat Mangkon Sam Yan Sala Daeng Khlong Toei Sanamchai Bang Chak Bang Wa BNH Hospital Tha Phra Ambassade Chong Nonsi Itsaraphap de France Lumphini Park Punnawithi Udom Suk Surasak Ambassade Wutthakat Pho Nimit Krung Thon Buri de Belgique Bang Na Saphan Taksin Talat Phlu Wongwian Yai Bearing Samrong Pu Chao Chang Erawan Royal Thai Naval Academy BTS Sukhumvit Line Pak Nam BTS Silom Line Srinagarindra MRT Blue Line Phraek Sa Airport Rail Link Sai Luat MRT Purple Line Kheha. -

Sathon Nonthaburi Chaophaya River

How to Travel to THE MUSEUM From Sukhumvit, Chidlom, and Siam Area Take BTS skytrain (Sukhumvit Line) bound for Mochit from any stations near your hotels. Get off at Ari Station (Exit 1). Then take a taxi into Samsen Road Soi 28. Turn left at Yaek Soi Ongkarak 13. The Museum of Floral Culture is about 30 meters away on the right. From Ari Station, it will take approximately 30 minutes to reach the museum. From Silom Area There are two options from Silom area. First is to travel by skytrain and second is to travel by Chao Phraya Express Boat. Travel by BTS skytrain Take BTS skytrain (Silom Line) bound for National Stadium from any station near your hotels. Purchase the ticket to Ari Station. Change train to Sukhumvit Line bound for Mochit at Siam Station. Get off at Ari Station (Exit 1). Then take a taxi into Samsen Road Soi 28. Turn left at Yaek Soi Ongkarak 13. The Museum of Floral Culture is about 30 meters away on the right. From Ari Station, it will take approximately 30 minutes to reach the museum. Travel by Chao Phraya Express Boat Take BTS skytrain (Silom Line) bound for Talat Phlu from any station near your hotels. Purchase ticket to Saphan Taksin Station. Get off at Saphan Taksin Station, walk down to Sathon Pier (Central Pier) using Exit 2. Travel to The Museum of Floral Culture only on the Orange Flag Chao Phraya Express Boat. Wait for the boat bound for Nonthaburi at Sathon Pier (Central Pier). Get off at Payap Pier (N18). -

Bangkok Bank Branches That Offer AIA Life Insurance Service in Bangkok and Metropolitan Areas H.O

Bangkok Bank branches that offer AIA life insurance service in Bangkok and metropolitan areas H.O. Office branch Central Bangna branch Iyara Market branch Nakhon Chaisri branch Abdulrahim Building branch Central Chaengwattana branch J. J. Mall branch Nakhon Pathom AIA Capital Center (Ratchadapisek Central Embassy branch Kamphaeng Saen branch Nakniwat Road branch Road) branch Central Festival East Ville branch Kasemkij Building Silom branch Nana Charoen Market branch All Seasons Place branch Central Ladprao 2 branch Kasetsart University branch Nana Nua branch Amporn Sathan Palace branch Central Lat Phrao branch Khae Rai branch National Institute Of Development Asok-Din Daeng branch Central Pinklao branch Khao San Road branch Administration branch Asokemontri Road branch Central Plaza Mahachai branch Khlong Chan branch National Science And Technology Assumption Rama 2 branch Central Rama 2 branch Khlong Dan branch Development Agency branch Avani Riverside branch Central Rama 3 branch Khlong Luang Pathum Thani branch Navanakorn Industrial Estate branch Ban Phaeo branch Central Rama 9 branch Khlong San branch New Phetchaburi Road branch Bang Bon branch Central Ramindra branch Khlong Tan branch Ngamwongwan Road branch Bang Bua Thong branch Central Rattanathibet branch Khlong Toei branch Nong Chok branch Bang Chak branch Central Westgate branch Khlong Yong Salaya Nakhon Pathom Nong Khaem branch Bang Kapi branch Central World branch branch Nonthaburi branch Bang Khae branch Chaengwatthana -

Safe Haven: Mon Refugees at the Capitals of Siam from the 1500S to the 1800S

151 Safe Haven: Mon Refugees at the Capitals of Siam from the 1500s to the 1800s Edward Van Roy From the 16th to the early 19th centuries Siam received a series of migrations of Mon refugees fleeing Burmese oppression, as well as sporadic inflows of Mon war captives. Large numbers of those arrivals were settled along the Chaophraya River and at the successive capitals of Ayutthaya, Thonburi, and Bangkok. This article examines the patterns of Mon settlement at the successive capitals and the patronage system whereby the Mon were granted privileged status and residence in return for military services. It considers the Old-Mon–New-Mon tensions that were generated by the series of migrations, including those that marked the transition to the Bangkok era. In closing, it refers to the waning of Mon ethnic identity and influence within Bangkok over the course of the 19th century. That analysis of the Mon role provides fresh insight into the evolving social organization and spatial structure of the three consecutive Siamese capitals. Old Mon and New Over the course of the past millennium and more, a succession of Mon migrations crossed the Tenasserim Hills to settle in the Chaophraya watershed. Each new migration encountered earlier groups of Mon settlers. In many cases the encounter entailed tensions between the old and the new settler groups, and in each case the newly settled groups, or “New Mon,” became established communi- ties or “Old Mon” who were to face yet newer Mon immigrants. The distinction between Old and New Mon thus historically presented a “moving target” in the history of Mon migration into the Chaophraya watershed and their interaction with Thai civilization. -

EN Cover AR TCRB OL

Viion and iion The Thai Credit Retail Bank Public Company Limited Thai Credit i paionate about roin our cutomer buine and improin cutomer lie by proidin uniue and innovative micro inancial erice Viion iion Core alue 1 2 Proide the bet Create a paionate inancial erice oraniation that T B to micro ement i proud o hat cutomer nationide e do Team Spirit Best Service C L 3 4 Leadership Credibility Create hareholder elp buildin alue and repect knolede and takeholder interet dicipline in R I inancial Literacy Result Oriented Integrity to all our cutomer The Thai Credit Retail Bank Public Company Limited 1 Financial Highlights Consolidated 2019 2018 Financial Position (Million Baht) Total Assets 56,494 50,034 Loans 50,916 44,770 Allowance for Doubtful Accounts 2,712 2,379 Non-Performing Loans (Net NPLs) 1,243 1,261 Non-Performing Loans (Gross NPLs) 2,490 2,552 Liabilities 49,491 43,757 Deposits 47,193 42,037 Equity 7,003 6,277 Statement of Profit and Loss (Million Baht) Interest Income 5,868 4,951 Interest Expenses 1,024 901 Net Interest Income 4,844 4,050 Non-Interest Income 293 184 Total Operating Income 5,137 4,234 Total Operating Expenses 2,995 2,416 Bad Debts, Doubtful Accounts and Impairment Loss 1,254 854 Income Tax 178 193 Net Profit 710 771 Financial Ratio Return on Average Assets (ROAA) (%) 1.35 1.62 Return on Average Equity (ROAE) (%) 10.87 13.20 Profit per Share (baht) 1.42 1.54 Non-Interest Expenses to Total Income (%) 58.30 57.06 Total Capital Fund to Risk Assets (%) 14.34 15.13 Total Tier 1 Capital Fund to Risk Assets (%) 13.30 -

Place, Power and Discourse in the Thai Image of Bangkok

PLACE, POWER AND DISCOURSE IN THE THAI IMAGE OF BANGKOK RICHARD A. O'CONNOR UNIVERSITY OF THE SOUTH SEWANEE, TENNESSEE Acknowledgments a map. It was not a map of Bangkok. In fact, so far as I know, there is no map of Bangkok. There are only maps of Bang An earlier version of this paper was presented at the kok's streets. Here I freely admit that for some well-tutored Annual Meeting of the Association for Asian Studies in San Fran people-mostly social scientists, foreign tourists and govern cisco, March 25-27, 1983. I am indebted toM. R. Rujaya Abhakorn, ment officials - a street map is an authentic image of Bang Kevin Lynch, Sumitr Pitiphat, Sharon Siddique, Nikki Tannenbaum kok. But the ordinary people I knew never used street maps. and Pinyo Teechumlong for their comments and advice. My research Of course they did use the streets, but their daily travels left was supported by an SSRC-ACLS Foreign Area Fellowship (1975- 76) and Postdoctoral Research Grant (1978-79), a Mellon Summer Sti only a vague notion of where the thoroughfares went and met. pend from the University of the South (1982), and a grant from the Lee Can we conclude that these people had no clear idea of Foundation in Singapore (1982). I gratefully acknowledge this finan Bangkok's overall physical order? Sternstein (1971) did. He cial support and the assistance of the National Archives and National interviewed 193 people and found that their shared public Research Council of Thailand and the Institute of Southeast Asian image of Bangkok was "virtually formless" and showed "a Studies in Singapore and its director K. -

The Ice Palace Pdf, Epub, Ebook

THE ICE PALACE PDF, EPUB, EBOOK Tarjei Vesaas,Elizabeth Rokkan | 176 pages | 15 Sep 2009 | Peter Owen Publishers | 9780720613292 | English | London, United Kingdom The Ice Palace PDF Book Well, i guess you can leave your coat at home. Bridie Ballantyne. Edit Did You Know? Creme Brulee. Looking for something to watch? Khlong Toei Nuea. You are zoomed out too far to see location pins. Lat Yao. Production Co: Warner Bros. Saphan Sung. The vivacious year-old Siss lives in a rural community in Norway. Release Dates. Dorothy Wendt Kennedy Jim Backus Another cold night, and a breaking storm add an atmosphere of foreboding to the awaited visit to the ice palace. Seafood Platters. Sally Carrol realizes that the winter pastimes she enjoys are all activities for children and that the Bellamy crowd is just humoring her. GuliWhere wrote a review Mar Thung Wat Don. Apple pie. Chicken Parmesan. Wang Steve Harris Thong Lo. Thanon Phaya Thai. Christine Storm Karl Swenson She shares her theory of categorizing people as feline or canine, and he shares his opinion on the Northerners becoming increasingly Scandinavian. Official Sites. Bay Husack Diane McBain Vegan Options. Poor skate selection and ran out of my size. Kudi Chin. Yes No Report this. Grace Kennedy, Age 16 Barry Kelley Breakfast Burrito. Cheese fondue. Grilled pork. There is a languid, relaxed quality to both the description and the affected dialogue in this first sequence. Carrot Cake. Director: Vincent Sherman. Dining bars. Buy Study Guide. Read the logs to find out about the experiments being done here, and get some alarm bells as you discover the executive override password for UDL communications is the same one that you used to get into the lab in Cascadia in Monarch. -

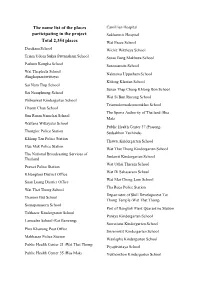

The Name List of the Places Participating in the Project

The name list of the places Camillian Hospital participating in the project: Sukhumvit Hospital Total 2,354 places Wat Pasee School Darakam School Wichit Witthaya School Triam Udom Suksa Pattanakarn School Surao Bang Makhuea School Pathum Kongka School Suraosam-in School Wat Thepleela School Naknawa Uppatham School (Singhaprasitwittaya) Khlong Klantan School Sai Nam Thip School Surao Thap Chang Khlong Bon School Sai Namphueng School Wat Si Bun Rueang School Phibunwet Kindergarten School Triamudomsuksanomklao School Chaem Chan School The Sports Authority of Thailand (Hua Sun Ruam Namchai School Mak) Wattana Wittayalai School Public Health Center 37 (Prasong- Thonglor Police Station Sudsakhon Tuchinda) Khlong Tan Police Station Thawsi Kindergarten School Hua Mak Police Station Wat That Thong Kindergarten School The National Broadcasting Services of Jindawit Kindergarten School Thailand Wat Uthai Tharam School Prawet Police Station Wat Di Sahasaram School Khlongtoei District Office Wat Mai Chong Lom School Suan Luang District Office Tha Ruea Police Station Wat That Thong School Department of Skill Development Tat Thanom But School Thong Temple (Wat That Thong) Somapanusorn School Port of Bangkok Plant Quarantine Station Tubkaew Kindergraten School Panaya Kindergarten School Lamsalee School (Rat Bamrung) Suwattana Kindergarten School Phra Khanong Post Office Srisermwit Kindergarten School Makkasan Police Station Wanlapha Kindergarten School Public Health Center 21 (Wat That Thong) Piyajitvittaya School Public Health Center 35 (Hua Mak) Yukhonthon