State Level Bankers Committee, Odisha

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gram Panchayat E-Mail Ids for District: Rayagada

Gram Panchayat E-mail IDs for District: Rayagada Name of Block Name of GP E-mail ID Mobile No 1 BISSAM CUTTACK 1 BETHIAPADA [email protected] 8280405315 2 BHATPUR [email protected] 8280405315 3 BISSAMCUTTACK [email protected] 8280405315 4 CHANCHARAGUDA [email protected] 8280405315 5 CHATIKONA [email protected] 8280405315 6 DUKUM [email protected] 8280405315 7 DUMURINALLI [email protected] 8280405315 8 DURGI [email protected] 8280405315 9 HAJARIDANG [email protected] 8280405315 10 HATAMUNIGUDA [email protected] 8280405315 11 JHIGIDI [email protected] 8280405315 12 KANKUBADI [email protected] 8280405315 13 KONABAI [email protected] 8280405315 14 KUMBHARDHAMUUNI [email protected] 8280405315 15 KURLI [email protected] 8280405315 16 KUTRAGADA [email protected] 8280405315 17 PAIKADAKULAGUDA [email protected] 8280405315 18 RASIKHALA [email protected] 8280405315 19 SAHADA [email protected] 8280405315 20 THUAPADI [email protected] 8280405315 2 CHANDRAPUR 1 BIJAPUR [email protected] 8280405316 2 BUDUBALI [email protected] 8280405316 3 CHANDRAPUR [email protected] 8280405316 4 DANGASORADA [email protected] 8280405316 5 HANUMANTHPUR [email protected] 8280405316 6 PISKAPANGA [email protected] 8280405316 7 TURIGUDA [email protected] 8280405316 3 GUDARI 1 ASHADA [email protected] 8280405317 2 KARLAGHATI [email protected] -

Officename a G S.O Bhubaneswar Secretariate S.O Kharavela Nagar S.O Orissa Assembly S.O Bhubaneswar G.P.O. Old Town S.O (Khorda

pincode officename districtname statename 751001 A G S.O Khorda ODISHA 751001 Bhubaneswar Secretariate S.O Khorda ODISHA 751001 Kharavela Nagar S.O Khorda ODISHA 751001 Orissa Assembly S.O Khorda ODISHA 751001 Bhubaneswar G.P.O. Khorda ODISHA 751002 Old Town S.O (Khorda) Khorda ODISHA 751002 Harachandi Sahi S.O Khorda ODISHA 751002 Kedargouri S.O Khorda ODISHA 751002 Santarapur S.O Khorda ODISHA 751002 Bhimatangi ND S.O Khorda ODISHA 751002 Gopinathpur B.O Khorda ODISHA 751002 Itipur B.O Khorda ODISHA 751002 Kalyanpur Sasan B.O Khorda ODISHA 751002 Kausalyaganga B.O Khorda ODISHA 751002 Kuha B.O Khorda ODISHA 751002 Sisupalgarh B.O Khorda ODISHA 751002 Sundarpada B.O Khorda ODISHA 751002 Bankual B.O Khorda ODISHA 751003 Baramunda Colony S.O Khorda ODISHA 751003 Suryanagar S.O (Khorda) Khorda ODISHA 751004 Utkal University S.O Khorda ODISHA 751005 Sainik School S.O (Khorda) Khorda ODISHA 751006 Budheswari Colony S.O Khorda ODISHA 751006 Kalpana Square S.O Khorda ODISHA 751006 Laxmisagar S.O (Khorda) Khorda ODISHA 751006 Jharapada B.O Khorda ODISHA 751006 Station Bazar B.O Khorda ODISHA 751007 Saheed Nagar S.O Khorda ODISHA 751007 Satyanagar S.O (Khorda) Khorda ODISHA 751007 V S S Nagar S.O Khorda ODISHA 751008 Rajbhawan S.O (Khorda) Khorda ODISHA 751009 Bapujee Nagar S.O Khorda ODISHA 751009 Bhubaneswar R S S.O Khorda ODISHA 751009 Ashok Nagar S.O (Khorda) Khorda ODISHA 751009 Udyan Marg S.O Khorda ODISHA 751010 Rasulgarh S.O Khorda ODISHA 751011 C R P Lines S.O Khorda ODISHA 751012 Nayapalli S.O Khorda ODISHA 751013 Regional Research Laboratory -

Value Chain Study on Mango in Rayagada District of Odisha 2017-18

VALUE CHAIN STUDY ON MANGO IN RAYAGADA DISTRICT OF ODISHA 2017-18 Submitted by PRINCIPAL INVESTIGATOR PRECISION FARMING DEVELOPMENT CENTRE, ORISSA UNIVERSITY OF AGRICULTURE AND TECHNOLOGY, BHUBANESWAR - 751003 Introduction: There is target of 4% increase in GDP from agriculture and allied sector. One of the strategies to achieve this growth rate has been a policy to encourage a diversification towards higher value crops and livestock. This segment of agriculture is perishable in nature and therefore needs a very different approach than has been the case in food grains. It must be recognized that development of this high value segment of agriculture will be possible only when it is pursued as a demand led strategy. Closely link to modern logistics, processing and organized retailing, all as a part of one integrated agriculture system in the form of value chain. The dietary transition from food grins to high value commodities such as foods, vegetables and livestock products are already observed and are being followed by rising demands for processed and semi-processed food products. The role of government policy is to create an enabling environment for private entrepreneurs to enter this agriculture system, coordinate the sourcing of their supplies from the farmers and deliver them to consumer in processed and fresh form. This requires high degree of coordination all along the value chain and only then the risks are minimized and benefits accrue to farmers, which encourages them to produce more. In this context we were asked to study mango value chain, recognizing the high value of the output of fruit and their contribution to farm income. -

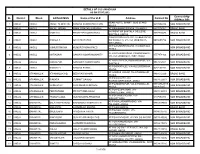

List of Elligible Candidates to Appear Written Examination in The

List of elligible candidates to appear written examination in the Recruitment-2019 for the post of Jr-Clerk/Jr-Clerk-Cum-Typist for D.L.S.A, Rayagada and TLSCs scheduled to be held on 08.12.2019(Sunday) Sl. No. Name of the Applicant Father's name Gender Category Present Address Roll No. At-Muniguda, Po-Muniguda, 1 JC/JT-001 G.Binay Kumar G.Nageswar Rao Male SEBC Dist- Rayagada, Pin-765020 Adarsh Nagar, Lane-4, Po- Haris Chandra 2 JC/JT-002 Uma Maheswari Bauri Female SC Gunupur, Dist- Rayagada, Pin- Bauri 765022 At- Haripur, Po- Kabirpur, Ps- 3 JC/JT-003 Sankarsan Das Raghunath Das Male UR Kuakhia, Jajpur, 755009 At-Bariabhata, Po- Sodabadi, Ps- 4 JC/JT-004 Debendra Khara Nila Khara Male SC Bandhugaon, Dist- Koraput Pin-764027 At-Bariabhata, Po- Sodabadi, Ps- 5 JC/JT-005 Sanjeeb Kumar Khora Nila Khora Male SC Bandhugaon, Dist- Koraput Pin-764027 Priyanka Priyadarsini At- Nuasahi, Bidanasi, Po/Ps- 6 JC/JT-006 Jayaprakas Das Female UR Das Bidanasi, Dist- Cuttack, 753014 At- Nuasahi, Bidanasi, Po/Ps- 7 JC/JT-007 Jyoti Ranjan Das Jayaprakas Das Male UR Bidanasi, Dist- Cuttack, 753014 Balamukunda At- Gouda Street, Po- Bissam- 8 JC/JT-008 Deepty Khuntia Female UR Khuntia cuttack, Dist- Rayagada, 765019 Balamukunda At- Gouda Street, Po- Bissam- 9 JC/JT-009 Tripti Khuntia Female SEBC Khuntia cuttack, Dist- Rayagada, 765019 Biswanath Nagar- 1st Lane, Po- Panchanana 10 JC/JT-010 Manas Satapathy Male UR Lanjipalli, Gosaninuagaon, Satapathy Berhampur, Ganjam, Odisha, Pin-760008 Ramatalkies Backside, Rayagada, Santosh Kumar 11 JC/JT-011 Sadasibo Tripathy Male UR Near M.S.M.E Office Rayagada Tripathy Pin- 765001 L.P-86, Stage-1, Laxmisagar, 12 JC/JT-012 Punyatoya Sahoo Ranjan Sahoo Female UR B.D.A Colony, Laxmisagar, Bhubaneswar, 751006 At- Jeypore Sambartota, Dist- 13 JC/JT-013 Sudhakar Sahu Uma Charan Sahu Male UR Koraput, 764001 Late At/Po- Omkarnagar, 14 JC/JT-014 Kunja Bihari Pattnaik Debendranath Male UR Purunagada, Jeypore, Dist- Pattnaik Koraput, 764003 At- Rrit Colony, Q.R No. -

Rayagada.Pdf

LIST OF MAJOR HEALTH INSTITUTIONS S.No BLOCK NAC PLACE HEALTH UNIT NAME RAYAGADA1 Rayagada Mty DHH Rayagada DHH ,Rayagada 2 Gunupur AH Putasingi AH ,Putasingi 3 Muniguda AH Ambadala AH ,Ambadala 4 Bisamacuttack CHC Bisamacuttack CHC ,Bisamacuttack 5 Chandrapur CHC Chandrapur CHC ,Chandrapur 6 Gunupur CHC Gunupur CHC ,Gunupur 7 Kashipur CHC Kashipur CHC ,Kashipur 8 Muniguda CHC Muniguda CHC ,Muniguda 9 Padmapur CHC Padmapur CHC ,Padmapur 10 Gudari PHC Gudari PHC ,Gudari 11 Gunupur PHC Jagannathpur PHC ,Jagannathpur 12 Kalyansinghpur PHC Kalyansinghapur PHC ,Kalyansinghapur 13 Kolanara PHC Kolanara PHC ,Kolanara 14 Ramanaguda PHC Ramanaguda PHC ,Ramanaguda 15 Rayagada PHC Jemadeipentha PHC ,Jemadeipentha 16 Bisamacuttack PHC(New) Sahada PHC(New) ,Sahada 17 Bisamacuttack PHC(New) Durgi PHC(New) ,Durgi 18 Bisamacuttack PHC(New) Khambesi PHC(New) ,Khambesi 19 Chandrapur PHC(New) Dangasorada PHC(New) ,Dangasorada 20 Chandrapur PHC(New) Budubali PHC(New) ,Budubali 21 Gudari PHC(New) Gaudadhepaguda PHC(New) ,Gaudadhepaguda 22 Gudari PHC(New) Sargiguda PHC(New) ,Sargiguda 23 Gunupur PHC(New) Dombasara PHC(New) ,Dombasara 24 Kalyansinghpur PHC(New) Majhiguda PHC(New) ,Majhiguda 25 Kalyansinghpur PHC(New) Sikarpai PHC(New) ,Sikarpai 26 Kalyansinghpur PHC(New) Badatadra PHC(New) ,Badatadra 27 Kashipur PHC(New) Kucheipadar PHC(New) ,Kucheipadar 28 Kashipur PHC(New) Sunger PHC(New) ,Sunger 29 Kashipur PHC(New) Dangasil PHC(New) ,Dangasil 30 Kashipur PHC(New) Mandibisi PHC(New) ,Mandibisi 31 Kashipur PHC(New) Tikiri PHC(New) ,Tikiri 32 Kashipur PHC(New) -

District Statistical Handbook Rayagada 2011

GOVERNMENT OF ODISHA DISTRICT STATISTICAL HAND BOOK 2011 RAYAGADA GOVERNMENT OF ODISHA DISTRICT STATISTICAL HANDBOOK RAYAGADA 2011 DISTRICT PLANNING AND MONITORING UNIT RAYAGADA ( Price : Rs.25.00 ) CONTENTS Table No. SUBJECT PAGE ( 1 ) ( 2 ) ( 3 ) Socio-Economic Profile : Rayagada … 1 Administrative set up … 4 I POSITION OF DISTRICT IN THE STATE 1.01 Geographical Area … 5 District wise Population with Rural & Urban and their proportion of 1.02 … 6 Odisha. District-wise SC & ST Population with percentage to total population of 1.03 … 8 Odisha. 1.04 Population by Sex, Density & Growth rate … 10 1.05 District wise sex ratio among all category, SC & ST by residence of Odisha. … 11 1.06 District wise Literacy rate, 2011 Census … 12 Child population in the age Group 0-6 in different district of Odisha. 1.07 … 13 II AREA AND POPULATION Geographical Area, Households and Number of Census Villages in different 2.01 … 14 Blocks and ULBs of the District. 2.02 Classification of workers (Main+ Marginal) … 15 2.03 Total workers and work participation by residence … 17 III CLIMATE 3.01 Month wise Rainfall in different Rain gauge Stations in the District. … 18 3.02 Month wise Temperature and Relative Humidity of the district. … 20 IV AGRICULTURE 4.01 Block wise Land Utilisation pattern of the district. … 21 Season wise Estimated Area, Yield rate and Production of Paddy in 4.02 … 23 different Blocks and ULBs of the district. Estimated Area, Yield rate and Production of different programmed Minor 4.03 … 25 crops in the district. 4.04 Source- wise Irrigation Potential Created in different Blocks of the district … 26 Achievement of Pani Panchayat programme of different Blocks of the 4.05 … 27 district 4.06 Consumption of Chemical Fertiliser in different Blocks of the district. -

Traditional Economy of Kondh Adivasi Community of Rayagada, Odisha

Traditional Economy of Kondh Adivasi Community of Rayagada, Odisha “Try throwing a currency note at the hen – it won’t even peck at it. Of what use is such money? One whiff of wind can take away all the (currency) notes, but if you take away our forest, we will not be able to survive”, said Landi Sikoka dramatically, gesturing at a hen happily running around the village. The other women with her like Tulasa Kurangalika, Bolo Sikoka and Tinmoli Kurungalika along with Sukumati Sukoka, who is the Bejuni of the village, nodded their heads vigorously in strong agreement. We went to Khalpadar village in Kumudabali panchayat near Muniguda, Rayagada district of Odisha to understand the economy of Kondh communities here better. Kondhs are a tribal community in the southern region of Odisha (amongst other places). They were a hunter-gatherer community, now divided into those who choose to live on the foothills and the ones who are hill- dwelling (Dongrias). Kui is their mother tongue. Shifting cultivation on the hills, forest-gathering and hunting, cultivation of lowlands and even migration out of the villages for work are all part of the Kondh lives. This piece draws on the lives of both the hill-dwelling Kondhs and the ones in Landi Sikoka (foreground) with Sukumati Sikoka the plains. In Khalpadar, a question around de-monetisation evoked much laughter from the women. “How does that affect us? We don’t have such notes with us and it does not matter what the sarkaar does with such notes”, they said, bursting into giggles. -

Sub Center Status of Rayagada District

SUB CENTER STATUS OF RAYAGADA DISTRICT Sl.No Name of the Block Name of the CHC Name of Sector Name of PHC(N) Sl.No Name of the Subcenter 1 Bissamcuttack Bissamcuttack Bhakulguda PHC (N) 1 BISSAMCUTTACK 2 Bissamcuttack 2 PAIKODAKULUGUDA 3 Bissamcuttack 3 DALIAKUJI 4 Bissamcuttack 4 PATRAGUDA 5 Bissamcuttack 5 KUTRAGADA 6 Bissamcuttack 6 NUAGADA 7 Bissamcuttack 7 GOILKONA 8 Bissamcuttack 8 HATMUNIGUDA 9 Bissamcuttack Chatikona Khambeshi PHC(N) 9 CHATIKONA 10 Bissamcuttack 10 BHATAPUR 11 Bissamcuttack 11 BODAGOTIGUDA 12 Bissamcuttack 12 KANKUBADI 13 Bissamcuttack Bissamcuttack 13 KURULI 14 Bissamcuttack CHC Durgi Durgi PHC(N) 14 DURGI 15 Bissamcuttack 15 MURTULI 16 Bissamcuttack 16 DIGELIBUDNI 17 Bissamcuttack 17 PURIKONA 18 Bissamcuttack 18 KONABAI 19 Bissamcuttack 19 KUMAR DHAMANI 20 Bissamcuttack 20 BETHIAPADA 21 Bissamcuttack 21 DUMARNALI 22 Bissamcuttack Sahada Sahada PHC(N) 22 JHIGIDI 23 Bissamcuttack 23 DUKUM 24 Bissamcuttack 24 SAHADA 25 Bissamcuttack 25 THUAPADI 26 Bissamcuttack 26 JUDO (RASKOLA) 1 Chandrapur Chandrapur Budubali PHC(N) 27 BUDUBALI 2 Chandrapur 28 JARAPA 3 Chandrapur 29 BIJAPUR 4 Chandrapur Dangasaroda Dangasaroda PHC(N) 30 BELAMGUDA 5 Chandrapur 31 CHANDRAPUR 6 Chandrapur Chandrapur CHC 32 SRIKHAMA 7 Chandrapur 33 MARICHAGUDA 8 Chandrapur 34 DANGASORADA 9 Chandrapur 35 TINAPADAR 10 Chandrapur 36 PISKAPONGA 11 Chandrapur 37 HANUMANTHPUR 1 Gudari Gudari - 38 GUDARI 2 Gudari 39 MADHUBANA (BOLIGUDA) 3 Gudari 40 SANAHUMA 4 Gudari Siriguda 41 SIRIGUDA 5 Gudari 42 SALIMI 6 Gudari 43 KHARIGUDA Gudari CHC 7 Gudari MKRai -

District Industrial Potentiality Survey Report Rayagada 2017-18

District Industrial Potentiality Survey Report Rayagada 2017-18 MSME Development Institute Vikash Sadan, College Square, Cuttack-753003 Telephone: 2548049/2548077; Fax: 2548006 E. Mail: [email protected] Website: www.msmedicuttack.gov.in FOREWORD Every year Micro, Small & Medium Enterprises Development Institute, Cuttack under the Ministry of Micro, Small & Medium Enterprises, Government of India has been undertaking the Industrial Potentiality Survey for the districts in the state of Odisha and brings out the Survey for selected districts in the state of Odisha every year and brings the Survey Report as per the guidelines of Development Commissioner (MSME). Under its Annual Action Plan 2017-2018, the district of Rayagada was taken up for the survey along with a few other districts of the state. This Industrial Potentiality Survey Report of Rayagada district covers various parameters like socio-economic indicators, present industrial structure of the district, and availability of industrial clusters, problems and prospects in the district for industrial development with special emphasis on scope for setting up of potential MSMEs. The report provides useful information and a detailed idea of the industrial potentialities of the district. I hope this Industrial Potentiality Survey Report would be an effective tool to the existing and prospective entrepreneurs, financial institutions and promotional agencies while planning for development of MSME sector in the district. I like to place on record my appreciation for Shri N. C. Samal, AD(EI) of this Institute for his concerted efforts to prepare this report under the supervision of Dr. Pragyansmita Sahoo, Dy. Director, EI, for the benefit of entrepreneurs and professionals in the district as well in the state. -

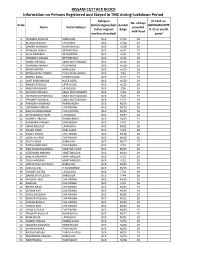

Information on Persons Registered and Stayed in TMC During Lockdown Period Category ID Card No

BISSAM CUTTACK BLOCK Information on Persons Registered and Stayed in TMC during Lockdown Period Category ID Card no. No. of days Sl.No (sick/indigent/dest Gender (ADDHAR/VOTE Name Detail Address provided . itulte/ migrant &Age R ID or any ID with food workers stranded) proof 1 JAYAMAL KUSULIA BARIGUDA SICK m/40 19 2 BELALA KUSULIA CHTIKONA SICK m/18 19 3 DAMBA MANDIKA HADA SINKULI SICK m/28 19 4 PRAKASH BIDIKA BETHIAPADA SICK m/21 19 5 KUSA KADRAKA BETHISPADA SICK m/32 19 6 HEMANTA HIKAKA BETHIAPADA SICK m/21 19 7 MANA KIRIPALA SANA MOTUKABADI SICK m/20 19 8 CHANDRA HIKAKA PEDIPADAR SICK m/19 19 9 MANAJ BATRA BARIGUDA SICK m/23 19 10 SRADHANJALI PANDA PAIKA DAKLUGUDA SICK f/22 19 11 PRAFUL RANA JHIMIRI GUDA SICK m/21 19 12 AMIT KANDHAPANI HATA PADA SICK m/20 19 13 RAJASH KUSULIA LATA GUDA SICK m/22 19 14 NIBEDANA BIVAR LATAGUDA SICK f/18 19 15 MINANTI KRUSIKA SANA MOTUKABADI SICK F/19 19 16 CHANCHALA PIDIKAKA SANA MOTUKABADI SICK F/20 19 17 HEMANTI NANAKA SANA MOTUKABADI SICK F/25 19 18 RAMESHA KADRAKA RANIBANDHA SICK M/20 19 19 UPENDRA KURUSIK CHATIKONA SICK M/20 19 20 RAJESH MNADANGID CHATRIKONA SICK M/20 19 21 SATGABADAN TAKRI LATAGUDA SICK M/24 19 22 ANANTA URLAKA RANIBANDHA SICK M/23 19 23 SAKAMARI KANJAKI CHATIKONA SICK F/19 19 24 JAPAS KUSULIA LATAGUDA SICK M/21 19 25 TULASI TAKRI BARI GUDA SICK F/19 19 26 RANJIT SWAIN CHATIKONA SICK M/18 19 27 JUGAL KU NAG CHATIKONA SICK M/18 19 28 DILIP KANDA BARIGUDA SICK M/19 19 29 NITESH MANDIKA CHATIKONA SICK F/19 19 30 SIBA PRASAD NANAKA MARTHA GUDA SICK M/23 19 31 DEBENDRA NANAKA MARTHAGUDA -

State Guidelines for Pg Medical Counselling and Admission

POST-GRADUATE (MEDICAL) SELECTION, ODISHA GUIDELINES FOR ADMISSION OF CANDIDATES FOR POST-GRADUATE (MEDICAL) COURSES IN THREE GOVT. MEDICAL COLLEGES OF THE STATE & HI-TECH MEDICAL COLLEGE, BHUBANESWAR APPROVED BY THE GOVERNMENT OF ODISHA DEPARTMENT OF HEALTH & FAMILY WELFARE Approved vide Govt. letter No 23601/H&F.W. Dt. 15.10.2020 1 GUIDELINES FOR COUNSELLING AND ADMISSION OF CANDIDATES FOR POST-GRADUATE (MEDICAL) COURSES IN THE MEDICAL COLLEGES OF ODISHA The terms and conditions of this guidelines will remain valid until further orders subject to condition that Govt. reserves the right to change any of the clause/s as per need as & when required. The DMET (O) is authorized to change the constitution of committee, schedule dates or any other changes as per requirement with intimation to Govt. The following guidelines are framed for counselling and admission of candidates against 50% state quota seats in different Govt Medical Colleges of the state& HITECH Medical College, Bhubaneswar. The seats will be filled up by way of online counselling. A. Counselling & Admission Committee & its function :- The Committee is constituted consisting of; 1) Dean & Principal, VIMSAR, Burla -Chairman 2) Dean & Principal, S.C.B. Medical College, Cuttack - Member 3) Dean Principal, MKCG MC Brahmapur - Member 4) Dean & Principal, Hi-Tech Medical College - Member 5) Prof. D M Satapathy, HoD SPM, MKCG Medical College, Berhampur,Ex Convener - Member 6) Prof. P. Ch. Panda, HoD Paediatrics, VIMSAR Burla - Convener 7) Addl. DMET, Odisha, Bhubaneswar - Coordinator (The constitution of the above committee shall be changed every year by the DMET, Odisha under intimation to Govt. -

SL District Block GP/NAC/MUN Name of the VLE Address Contact No

DETAILS OF CSCs IN ODISHA AS ON 15:05.2012 Connectivity SL District Block GP/NAC/MUN Name of the VLE Address Contact No (BB/Non BB) NEAR HOTEL SHANTI, BUS STAND, 1 ANGUL ANGUL ANGUL BLOCK HQ RANJAN KUMAR PRADHAN 9437404656 NON BROADBAND ANGUL 2 ANGUL ANGUL ANGUL URBAN BIMAL PRASAD AGRAWAL AT-BRAHMANIDEIPADA, PO-ANGUL 9437074561 BROAD BAND IN FRONT OF BANTALA COLLEGE, 3 ANGUL ANGUL BANTALA PRADEEP KUMAR SAHU 9937720486 BROAD BAND BANTALA, ANGUL C/O-PRASANTA PATRA, AT-BENTAPUR, 4 ANGUL ANGUL KANGULA GAYATRI PATRA PO-KANGULA, VIA-HULURISINGHA, 9938605756 NON BROADBAND DIST-ANGUL AT/PO-KUMURISINGHA, VIA-BANTALA, 5 ANGUL ANGUL KUMURISINGHA KUMURISINGHA PACS NON BROADBAND ANGUL AT-KARAMANGASAHI, PO-BADAKERA, 6 ANGUL ANGUL MATIASAHI SANJAY KUMAR MOHANTY 9777474166 NON BROADBAND VIA-HULURISINGHA, DIST-ANGUL AT-KARATAPATA, PO-NANDAPUR, VIA- 7 ANGUL ANGUL NANDAPUR SANTOSH KUMAR SAHU 9937212971 NON BROADBAND BANTALA AT/PO-RANTALEI, VIA-HULURISINGHA, 8 ANGUL ANGUL RANTALEI RANJAN PATRA 9437157332 NON BROADBAND ANGUL AT-GANDHI CHHAK, PO-ATHAMALLIK, 9 ANGUL ATHAMALLIK ATHAMALLIK HQ BEDVYAS MAHAR 9861612929 BROAD BAND ANGUL AT/PO-KIAKATA, VIA- 10 ANGUL ATHAMALLIK KIAKATA SUMANT SAHOO 98533 22507 NON BROADBAND RAJKISHORENAGAR, ANGUL AT/PO-MADHAPUR, VIA-ATHAMALLIK, 9938276251/9 11 ANGUL ATHAMALLIK MADHAPUR SASI BHUSAN BISWAL NON BROADBAND ANGUL 861965025 AT/PO-PEDIPATHAR, VIA- 12 ANGUL ATHAMALLIK PEDIPATHAR PRIYATTAMA SAHU 98615 94908 NON BROADBAND KISHOREGANJ, ANGUL AT/PO-THAKURGARH, VIA- 13 ANGUL ATHAMALLIK THAKURGADA SUBHAKANTA PRADHAN 9437550333 NON