Central Bank Cryptocurrencies1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A History of Money in Palestine: from the 1900S to the Present

A History of Money in Palestine: From the 1900s to the Present The Harvard community has made this article openly available. Please share how this access benefits you. Your story matters Citation Mitter, Sreemati. 2014. A History of Money in Palestine: From the 1900s to the Present. Doctoral dissertation, Harvard University. Citable link http://nrs.harvard.edu/urn-3:HUL.InstRepos:12269876 Terms of Use This article was downloaded from Harvard University’s DASH repository, and is made available under the terms and conditions applicable to Other Posted Material, as set forth at http:// nrs.harvard.edu/urn-3:HUL.InstRepos:dash.current.terms-of- use#LAA A History of Money in Palestine: From the 1900s to the Present A dissertation presented by Sreemati Mitter to The History Department in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the subject of History Harvard University Cambridge, Massachusetts January 2014 © 2013 – Sreemati Mitter All rights reserved. Dissertation Advisor: Professor Roger Owen Sreemati Mitter A History of Money in Palestine: From the 1900s to the Present Abstract How does the condition of statelessness, which is usually thought of as a political problem, affect the economic and monetary lives of ordinary people? This dissertation addresses this question by examining the economic behavior of a stateless people, the Palestinians, over a hundred year period, from the last decades of Ottoman rule in the early 1900s to the present. Through this historical narrative, it investigates what happened to the financial and economic assets of ordinary Palestinians when they were either rendered stateless overnight (as happened in 1948) or when they suffered a gradual loss of sovereignty and control over their economic lives (as happened between the early 1900s to the 1930s, or again between 1967 and the present). -

Virtual Currency Schemes of 2012

VIRTUAL CURRENCY SCHEMES OCTOBER 2012 VIRTUAL CURRENCY SCHEMES OctoBer 2012 In 2012 all ECB publications feature a motif taken from the €50 banknote. © European Central Bank, 2012 Address Kaiserstrasse 29 60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Website http://www.ecb.europa.eu Fax +49 69 1344 6000 All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISBN: 978-92-899-0862-7 (online) CONTENTS EXECUTIVE SUMMARY 5 1 INTRODUCTION 9 1.1 Preliminary remarks and motivation 9 1.2 A short historical review of money 9 1.3 Money in the virtual world 10 2 VIRTUAL CURRENCY SCHEMES 13 2.1 Definition and categorisation 13 2.2 Virtual currency schemes and electronic money 16 2.3 Payment arrangements in virtual currency schemes 17 2.4 Reasons for implementing virtual currency schemes 18 3 CASE STUDIES 21 3.1 The Bitcoin scheme 21 3.1.1 Basic features 21 3.1.2 Technical description of a Bitcoin transaction 23 3.1.3 Monetary aspects 24 3.1.4 Security incidents and negative press 25 3.2 The Second Life scheme 28 3.2.1 Basic features 28 3.2.2 Second Life economy 28 3.2.3 Monetary aspects 29 3.2.4 Issues with Second Life 30 4 THE RELEVANCE OF VIRTUAL CURRENCY SCHEMES FOR CENTRAL BANKS 33 4.1 Risks to price stability 33 4.2 Risks to financial stability 37 4.3 Risks to payment system stability 40 4.4 Lack of regulation 42 4.5 Reputational risk 45 5 CONCLUSION 47 ANNEX: REFERENCES AND FURTHER INFORMATION ON VIRTUAL CURRENCY SCHEMES 49 ECB Virtual currency schemes October 2012 3 EXECUTIVE SUMMARY Virtual communities have proliferated in recent years – a phenomenon triggered by technological developments and by the increased use of the internet. -

Cryptocurrency: the Economics of Money and Selected Policy Issues

Cryptocurrency: The Economics of Money and Selected Policy Issues Updated April 9, 2020 Congressional Research Service https://crsreports.congress.gov R45427 SUMMARY R45427 Cryptocurrency: The Economics of Money and April 9, 2020 Selected Policy Issues David W. Perkins Cryptocurrencies are digital money in electronic payment systems that generally do not require Specialist in government backing or the involvement of an intermediary, such as a bank. Instead, users of the Macroeconomic Policy system validate payments using certain protocols. Since the 2008 invention of the first cryptocurrency, Bitcoin, cryptocurrencies have proliferated. In recent years, they experienced a rapid increase and subsequent decrease in value. One estimate found that, as of March 2020, there were more than 5,100 different cryptocurrencies worth about $231 billion. Given this rapid growth and volatility, cryptocurrencies have drawn the attention of the public and policymakers. A particularly notable feature of cryptocurrencies is their potential to act as an alternative form of money. Historically, money has either had intrinsic value or derived value from government decree. Using money electronically generally has involved using the private ledgers and systems of at least one trusted intermediary. Cryptocurrencies, by contrast, generally employ user agreement, a network of users, and cryptographic protocols to achieve valid transfers of value. Cryptocurrency users typically use a pseudonymous address to identify each other and a passcode or private key to make changes to a public ledger in order to transfer value between accounts. Other computers in the network validate these transfers. Through this use of blockchain technology, cryptocurrency systems protect their public ledgers of accounts against manipulation, so that users can only send cryptocurrency to which they have access, thus allowing users to make valid transfers without a centralized, trusted intermediary. -

Cryptocurrencies As an Alternative to Fiat Monetary Systems David A

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Digital Commons at Buffalo State State University of New York College at Buffalo - Buffalo State College Digital Commons at Buffalo State Applied Economics Theses Economics and Finance 5-2018 Cryptocurrencies as an Alternative to Fiat Monetary Systems David A. Georgeson State University of New York College at Buffalo - Buffalo State College, [email protected] Advisor Tae-Hee Jo, Ph.D., Associate Professor of Economics & Finance First Reader Tae-Hee Jo, Ph.D., Associate Professor of Economics & Finance Second Reader Victor Kasper Jr., Ph.D., Associate Professor of Economics & Finance Third Reader Ted P. Schmidt, Ph.D., Professor of Economics & Finance Department Chair Frederick G. Floss, Ph.D., Chair and Professor of Economics & Finance To learn more about the Economics and Finance Department and its educational programs, research, and resources, go to http://economics.buffalostate.edu. Recommended Citation Georgeson, David A., "Cryptocurrencies as an Alternative to Fiat Monetary Systems" (2018). Applied Economics Theses. 35. http://digitalcommons.buffalostate.edu/economics_theses/35 Follow this and additional works at: http://digitalcommons.buffalostate.edu/economics_theses Part of the Economic Theory Commons, Finance Commons, and the Other Economics Commons Cryptocurrencies as an Alternative to Fiat Monetary Systems By David A. Georgeson An Abstract of a Thesis In Applied Economics Submitted in Partial Fulfillment Of the Requirements For the Degree of Master of Arts May 2018 State University of New York Buffalo State Department of Economics and Finance ABSTRACT OF THESIS Cryptocurrencies as an Alternative to Fiat Monetary Systems The recent popularity of cryptocurrencies is largely associated with a particular application referred to as Bitcoin. -

The Nature of Decentralized Virtual Currencies: Benefits, Risks and Regulations

MILE 14 Thesis | Fall 2014 The Nature of Decentralized Virtual Currencies: Benefits, Risks and Regulations. Paul du Plessis Supervisor: Prof. Dr. Kern Alexander 1 DECLARATION This master thesis has been written in partial fulfilment of the Master of International Law and Economics Programme at the World Trade Institute. The ideas and opinions expressed in this paper are made independently, represent my own views and are based on my own research. I confirm that this work is my own and has not been submitted for academic credit in any other subject or course. I have acknowledged all material and sources used in this paper. I understand that my thesis may be made available in the World Trade Institute library. 2 ABSTRACT Virtual currency schemes have proliferated in recent years and have become a focal point of media and regulators. The objective of this paper is to provide a description of the technical nature of Bitcoin and the reason for its existence. With an understanding of the basic workings of this new payment system, we can draw comparisons to fiat currency, analyze the associated risks and benefits, and effectively discusses the current regulatory framework. 3 TABLE OF CONTENTS Page 1. Introduction .............................................................................................. 4 2. The Evolution of Money .......................................................................... 6 2.1. Defining Money ................................................................................. 6 2.2. The Origin of Money ........................................................................ -

Coin Changer

Technical Documentation Coin changer Manual for confi guration 03.15 Schn/JMo/Roe Version 1.2 HB.C2K-EN Crane Payment Innovations GmbH • Zum Fruchthof 6 • D-21614 Buxtehude Phone: +49 (0) 41 61-729-0 • Fax: +49 (0) 41 61-729-115 • E-mail: [email protected] • www.cranepi.com c2 Confi guration TABLE OF CONTENT Tabel of contents 1 About this manual 7 Text conventions 7 Additional technical documentation 8 2 General information 9 The vending machine interfaces 9 The user interfaces 9 When to use the HENRI service tool? 9 Connecting HENRI 10 3 Presettings 11 Selecting menu language 11 Setting display contrast (only c2 blue) 12 Specifying display message for operating mode (only c2 blue) 13 4 Settings for fi lling and emptying cassette 14 Which settings should be done? 14 Settings for tube refi lling by coin insertion 14 Settings for direct refi lling the removed cassette 14 Confi guring fl oat levels 15 Specifying fl oat level per tube 15 Activating/deactivating fl oat-up function 16 Setting tube counters to fl oat levels automatically 17 Correcting tube counters according to fi lling level sensors 18 Resetting tube counters before fi ll-up 19 Redirecting cash-box coins to return area 20 Reporting inserted coins to machine (only c2 MDB) 21 Disabling/enabling inventory keys / disabling/enabling inventory keys using MDB/BDV protocol (only c2 blue/green) 22 3 TABLE OF CONTENTS c2 Confi guration 5 Prices and vending modes (only c2 BDV/Executive) 23 Price holding in the coin changer 23 Setting prices 24 Activating coin changer price holding 25 Displaying price -

Time to Rekindle Local Currrency Concept; from Berkshire Trade and Commerce, June 2004 by Susan Witt

Time to Rekindle Local Currrency Concept; from Berkshire Trade and Commerce, June 2004 By Susan Witt Those of us living in the Southern Berkshires realize how lucky we are to have the complex of locally owned stores and restaurants that help shape our community. Main Street hums with activity. Consumers know that Great Barrington shops are unique to the Berkshires; a welcome change from the monoculture look and products of franchises. Visitors are surprised by the originality; regulars are proud and loyal patrons. The owners and clerks and chefs and waitpersons are our neighbors and friends. We sit on school boards together, gather at town meetings, and stroll past each other on the River Walk. Our youth prefer to spend free time on Main Street rather than at the mall. They experience and contribute to the vibrancy of our "downtown." Part of what has led to this successful local entrepreneurship is an informed citizenry who understands that keeping dollars local supports the cultural, environmental, and social fabric of the Berkshires. They ask for locally grown food at restaurants; they make weekly visits to the farmer¹s market as a household ritual; and they hire local professionals before distant impersonal firms. Another factor in the success of our local businesses is the plethora of still locally owned and managed banks in the Berkshires. With all of the changes in regulation and the consolidation in the banking industry, a handful of local banks remain in our region‹an important resource for the health of our Berkshire economy. One of those quintessential local bankers, Eugene Hannon, died at the end of April. -

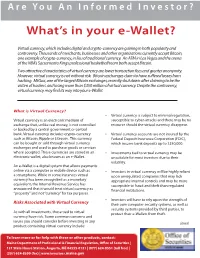

What's in Your E-Wallet?

Are You An Informed Investor? What’s in your e-Wallet? Virtual currency, which includes digital and crypto-currency are gaining in both popularity and controversy. Thousands of merchants, businesses and other organizations currently accept Bitcoin, one example of crypto-currency, in lieu of traditional currency. An ATM in Las Vegas and the arena of the NBA’s Sacramento Kings professional basketball team both accept Bitcoin. Two attractive characteristics of virtual currency are lower transaction fees and greater anonymity. However, virtual currency is not without risk. Bitcoin exchanges claim to have suffered losses from hacking. MtGox, one of the largest Bitcoin exchanges, recently shut down after claiming to be the victim of hackers and losing more than $350 million of virtual currency. Despite the controversy, virtual currency may find its way into your e-Wallet. What is Virtual Currency? • Virtual currency is subject to minimal regulation, Virtual currency is an electronic medium of susceptible to cyber-attacks and there may be no exchange that, unlike real money, is not controlled recourse should the virtual currency disappear. or backed by a central government or central bank. Virtual currency includes crypto-currency • Virtual currency accounts are not insured by the such as Bitcoin, Ripple or Litecoin. This currency Federal Deposit Insurance Corporation (FDIC), can be bought or sold through virtual currency which insures bank deposits up to $250,000. exchanges and used to purchase goods or services where accepted. These currencies are stored in an • Investments tied to virtual currency may be electronic wallet, also known as an e-Wallet. unsuitable for most investors due to their volatility. -

CFTC Whistleblower Alert: Be on the Lookout for Virtual Currency Fraud

CFTC Whistleblower Alert: Be on the Lookout for Virtual Currency Fraud The Whistleblower Office of the Commodity Futures Trading Commission (CFTC) is issuing this alert to inform members of the public about how they may make themselves eligible for both financial awards and certain protections while helping stop fraud and manipulation relating to virtual currencies. What is a virtual currency? The Internal Revenue Service defines a virtual currency, such as Bitcoin, as a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. Virtual currencies are commodities under the Commodity Exchange Act (CEA). When a virtual currency is used in a derivatives contract, or if there is fraud or manipulation involving a virtual currency traded in interstate commerce, CFTC enforcement of the CEA comes into play. What types of misconduct should you be on the lookout for? The CFTC has sued companies and individuals for fraudulently soliciting investments in virtual currencies. Conduct like that in the CabbageTech and My Big Coin cases is always of concern to the CFTC. Other concerns include: • Price manipulation (like pump-and-dump schemes) involving virtual currencies and other virtual assets. • Pre-arranged or wash trading of virtual currencies, or swaps or futures contracts based on virtual currencies. • Virtual currency futures or option contracts or swaps traded on an unregistered domestic platform or facility. • Certain schemes involving virtual currencies marketed to retail customers by unregistered persons, such as off-exchange leveraged, margined, or financed commodity transactions with persons, even without direct evidence of fraud or manipulation. -

Money Norms Julia Y

Penn State Law eLibrary Journal Articles Faculty Works 2017 Money Norms Julia Y. Lee Penn State Law Follow this and additional works at: http://elibrary.law.psu.edu/fac_works Part of the Commercial Law Commons, Law and Economics Commons, and the Law and Society Commons Recommended Citation Julia Y. Lee, Money Norms, 49 Loy. U. Chi. L.J. 57 (2017). This Article is brought to you for free and open access by the Faculty Works at Penn State Law eLibrary. It has been accepted for inclusion in Journal Articles by an authorized administrator of Penn State Law eLibrary. For more information, please contact [email protected]. Money Norms Julia Y. Lee* Money norms present a fundamental contradiction. Norms embody the social sphere, a system of internalized values, unwritten rules, and shared expectations that informally govern human behavior. Money, on the other hand, evokes the economic sphere of markets, prices, and incentives. Existing legal scholarship keeps the two spheres distinct. Money is assumed to operate as a medium of exchange or as a tool for altering the payoffs of different actions. When used to make good behavior less costly and undesirable behavior more costly, money functions to incentivize, sanction, and deter. Although a rich literature on the expressive function of law exists, legal scholars have generally confined money to the economic sphere of sanctions and subsidies. This Article attempts to bridge that gap. Money elicits a strong, visceral, and emotional reaction, triggering (and creating expectations of) selfishness, individualism, and self-reliance that is unaccounted for in current legal scholarship. Money norms not only insulate our moral values from market encroachment, but they also prescribe modes of behavior that encourage cooperation and counteract the impulse to act selfishly. -

The Cleansing of the Temple in the Fourth Gospel As a Call to Action for Social Justice

Gardner-Webb University Digital Commons @ Gardner-Webb University MA in Religion Theses Department of Religious Studies and Philosophy 2014 The leC ansing of the Temple in the Fourth Gospel as a call to action for social justice Douglas Thompson Goodwin Gardner-Webb University Follow this and additional works at: https://digitalcommons.gardner-webb.edu/religion_etd Part of the Biblical Studies Commons, and the Philosophy Commons Recommended Citation Goodwin, Douglas Thompson, "The leC ansing of the Temple in the Fourth Gospel as a call to action for social justice" (2014). MA in Religion Theses. 1. https://digitalcommons.gardner-webb.edu/religion_etd/1 This Thesis is brought to you for free and open access by the Department of Religious Studies and Philosophy at Digital Commons @ Gardner-Webb University. It has been accepted for inclusion in MA in Religion Theses by an authorized administrator of Digital Commons @ Gardner-Webb University. For more information, please see Copyright and Publishing Info. THE CLEANSING OF THE TEMPLE IN THE FOURTH GOSPEL AS A CALL TO ACTION FOR SOCIAL JUSTICE By Douglas Thompson Goodwin A thesis submitted to the faculty of Gardner-Webb University in partial fulfillment of the requirements for the degree of Master of Arts in the Department of Religious Studies and Philosophy Boiling Springs, NC 2014 Approved by: ___________________________ ___________________________ Scott Shauf, Advisor Kent Blevins, MA Coordinator ___________________________ ___________________________ James McConnell, Reader Eddie Stepp, Department Chair ___________________________ Steven Harmon, Reader GARDNER-WEBB UNIVERSITY BOILING SPRINGS, NORTH CAROLINA THE CLEANSING OF THE TEMPLE IN THE FOURTH GOSPEL AS A CALL TO ACTION FOR SOCIAL JUSTICE SUBMITTED TO DR. -

A History of Merchant, Central and Investment Banking Learning

Chapter 2: A History of Merchant, Central and Investment Banking Learning Objectives: To apply the history and evolution of money and banking to comprehension of existing systems To diagnose and calculate seniorage and debasement To recount how conditions drawn from history led to today's instruments and institutions To examine how economic problems lead to banking and capital market innovations To describe how money and banking integrated into the many economies over thousands of years To summarize the many artistic, literary, technological and scientific achievements that were funded or otherwise facilitated by banking To recognize the problems associated with usury in religious, social and economic contexts To express how academic, exploration, technological, trading, religious and other cultural developments contributed to the practice of banking A. Early History of Money In Chapter 1, we briefly discussed the economic roles of a number of types of financial institutions along with their origins. In this chapter, we discuss in greater detail the history of money and banking, beginning with the early history of money and extending through the advent of modern banking in the early 20th century. In later chapters, we will discuss the repeated occurrence and consequences of banking crises and development of banking regulation from a historical perspective. Commodity and Representative Money The earliest forms of money tended to have alternative intrinsic value as commodities. For example, grain-money has been used since the dawn of agriculture. Neolithic peoples in what is now China are believed to have used cowrie (sea snail) shells as money perhaps as long ago as 4,500 years.