Russian Ecm November 6, 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

2014 ANNUAL REPORT TABLE OF CONTENTS Sistema today 2 Corporate governance system 91 History timeline 4 Corporate governance principles 92 Company structure 8 General Meeting of shareholders 94 President’s speech 10 Board of Directors 96 Strategic Review 11 Commitees of the Board of Directors 99 Strategy 12 President and the Management Board 101 Sistema’s financial results 20 Internal control and audit 103 Shareholder capital and securities 24 Development of the corporate 104 governance system in 2014 Our investments 27 Remuneration 105 MTS 28 Risks 106 Detsky Mir 34 Sustainable development 113 Medsi Group 38 Responsible investor 114 Lesinvest Group (Segezha) 44 Social investment 115 Bashkirian Power Grid Company 52 Education, science, innovation 115 RTI 56 Culture 117 SG-trans 60 Environment 119 MTS Bank 64 Society 121 RZ Agro Holding 68 Appendices 124 Targin 72 Binnopharm 76 Real estate 80 Sistema Shyam TeleServices 84 Sistema Mass Media 88 1 SISTEMA TODAY Established in 1993, today Sistema including telecommunications, companies. Sistema’s competencies is a large private investor operating utilities, retail, high tech, pulp and focus on improvement of the in the real sector of the Russian paper, pharmaceuticals, healthcare, operational efficiency of acquired economy. Sistema’s investment railway transportation, agriculture, assets through restructuring and portfolio comprises stakes in finance, mass media, tourism, attracting industry partners to predominantly Russian companies etc. Sistema is the controlling enhance expertise and reduce -

Russian Withholding Tax Refund

Russian withholding tax refund Tax & Legal If you or your clients invested in Russian securities and are entitled to a substantial dividend or interest income, there is a chance that you overpaid your taxes and may qualify for a tax refund © 2018 Deloitte Consulting LLC Background Investors may apply a According to the The Russian The tax refund reduced tax rate for Russian tax withholding tax rate is practice in Russia is their interest and/or authorities, they are set at 15% on not well-developed: dividend income, ready to reimburse dividends and 20 the tax legislation depending on the overpaid taxes, if a percent on interest. does not provide for a conditions set by the full package of Effective from 1 specific list of Russian Tax Code or documents confirming January 2014, the documents to be applicable Double Tax the income payment duties of the tax collected and Treaties. Calculations chain and the agent for WHT requirements to be of a standard Russian investor’s rights to purposes were met. For these rate or the standard the income is transferred to the reasons, the process reduced Double Tax submitted. local Russian can be lengthy and Treaty rate, as well as custodian or, in a sometimes fruitless. submission of claims limited number of However, the trend is on tax can be cases, to the reassuring: the refunded, should be fiduciary, broker or number of successful made by investors issuer. refund claims and themselves within positive court three calendar years, decisions is growing. following the year in which it was withheld. -

CAPITAL MARKETS DAY ______FRIDAY, 30 Th MAY at ONE GREAT GEORGE STREET, LONDON

CAPITAL MARKETS DAY ____________________________________________________________________________ FRIDAY, 30 th MAY AT ONE GREAT GEORGE STREET, LONDON Sistema (LSE: SSA), the largest diversified corporation in Russia and the CIS, is pleased to invite you to the Capital Markets Day, which will be held at the One Great George Street, Westminster, London SW1P 3AA, on Friday 30 th May, 2008. The conference will comprise presentations on a range of strategic, operational and financial aspects of the Group’s businesses, as well as a number of group and one-on-one meetings with the management of Sistema and its public and non-public businesses. Registration will take place at the One Great George Street, Westminster, London SW1P 3AA, starting from 8:30am. The conference will commence at 9:00am followed by lunch, group and one-on-one meetings from 2:00pm till 7:00pm. The detailed schedule for the day is attached. To register for the event by email to: [email protected] . You may also register by filling out the information below and returning it by fax to +44 (0)207 321 5020 or contact Shared Value on +44 (0)20 7321 5010 for further details. NAME: COMPANY: FUNCTION: SECTOR / COVERAGE: MOBILE PHONE: EMAIL: Yes, I will participate in the Capital Markets Day in London on Friday 30 th May, 2008 I am unable to attend the Capital Markets Day Please remove my name from the Sistema mailing list I would like to participate in group meetings with * If you would like to participate in group meetings, please provide the name of the company you would like to meet: _____________________________________________________________________________ *Sistema may not be able to guarantee a meeting slot as availability is subject to demand Sistema is the largest public diversified corporation in Russia and the CIS, which manages fast growing companies operating in the consumer services sector and has over 80 million customers. -

HEDGE EFFECTIVENESS of the RTS INDEX FUTURES Anastasia Musorgina a Thesis Submitted to the University of North Carolina in Part

HEDGE EFFECTIVENESS OF THE RTS INDEX FUTURES Anastasia Musorgina A Thesis Submitted to the University of North Carolina in Partial Fulfillment of the Requirements for the Degree of Master of Business Administration Cameron School of Business University of North Carolina Wilmington 2011 Approved by Advisory Committee Nivine Richie Rob Burrus Cetin Ciner Chair Accepted by _____________________________ Dean, Graduate School TABLE OF CONTENTS ABSTRACT ............................................................................................................................. iii DEDICATION .......................................................................................................................... iv ACKNOWLEDGEMENTS ....................................................................................................... v LIST OF TABLES .................................................................................................................... vi LIST OF FIGURES ................................................................................................................. vii INTRODUCTION ..................................................................................................................... 1 Hedging .................................................................................................................................. 1 Russian Derivatives Market ................................................................................................... 2 Moscow Interbank Currency Exchange ................................................................................ -

Deal Drivers Russia

February 2010 Deal Drivers Russia A survey and review of Russian corporate finance activity Contents Introduction 1 01 M&A Review 2 Overall deal trends 3 Domestic M&A trends 6 Cross-border M&A trends 8 Private equity 11 Acquisition finance 13 Valuations 14 02 Industries 15 Automotive 16 Energy 18 Financial Services 20 Consumer & Retail 22 Industrial Markets 24 Life Sciences 26 Mining 28 Technology, Media & Telecommunications 30 03 Survey Analysis 32 Introduction Prediction may be fast going out of fashion. At the end of 2008, CMS commissioned mergermarket to interview 100 Russian M&A and corporate decision makers to find out what they thought about the situation at the time and what their views on the future were. Falling commodity prices were viewed as the biggest threat, the Financial Services sector was expected to deliver the greatest growth for M&A activity and the bulk of inward investment was expected from Asia. The research revealed that two thirds of the respondents expected the overall level of M&A activity to increase over the course of 2009, with only one third predicting a fall. That third of respondents was right and, in general, the majority got it wrong or very wrong. The survey did get some things right – the predominance of Who knows? What’s the point? We consider the point to be the domestic players, the increase of non-money deals, the in the detail. Our survey looks at the market in 2009 sector number of transactions against a restructuring background, by sector – what was ‘in’ and what was ‘out’. -

Годовой Отчет Annual Report

годовой отчет 2 0 0 6 annual report STATEMENT OF THE offices. The Bank continues with regional CHIEF EXECUTIVE expansion, and has already in place 13 branch% es in Russian cities in 2006 compared to 7 branches by the year end 2005. MBRD's Dear shareholders, customers and partners regional network comprises 54 offices regis% of the Bank: tered with the Bank of Russia and located in 22 Today, the banking sector dramatically shows most industrialised federal constituencies of it can be a development engine not only for home the Russian Federation. In so doing, the Bank financial system, but also for the Russian econo% intends to step up efforts in further building up my at large. By meeting demands of domestic the banking chain in the future. companies, deposit%taking institutions are MBRD, no doubt, notably strengthened its becoming, in essence, national circulatory sys% positions in the Russian financial market over the tem giving access to financing. To comply with reporting year. To illustrate, net assets increased such an important role, Russian banks should by nearly RUR23.28 billion, while capital rose have adequate capital, technologies, diversified more than by RUR1.7 billion. Total income was network and quality products. RUR5.154 billion against 2.9 billion in 2005, and Presently, Moscow Bank for Reconstruction net profit increased by 65% to RUR442 million. and Development strategically focuses on retail In March 2006, a US$60m 10%year subordi% business development. It means expanding the nated eurobond issue placed on the Luxembourg existent spectrum of services, implementing Stock Exchange was an important event. -

US Sanctions on Russia

U.S. Sanctions on Russia Updated January 17, 2020 Congressional Research Service https://crsreports.congress.gov R45415 SUMMARY R45415 U.S. Sanctions on Russia January 17, 2020 Sanctions are a central element of U.S. policy to counter and deter malign Russian behavior. The United States has imposed sanctions on Russia mainly in response to Russia’s 2014 invasion of Cory Welt, Coordinator Ukraine, to reverse and deter further Russian aggression in Ukraine, and to deter Russian Specialist in European aggression against other countries. The United States also has imposed sanctions on Russia in Affairs response to (and to deter) election interference and other malicious cyber-enabled activities, human rights abuses, the use of a chemical weapon, weapons proliferation, illicit trade with North Korea, and support to Syria and Venezuela. Most Members of Congress support a robust Kristin Archick Specialist in European use of sanctions amid concerns about Russia’s international behavior and geostrategic intentions. Affairs Sanctions related to Russia’s invasion of Ukraine are based mainly on four executive orders (EOs) that President Obama issued in 2014. That year, Congress also passed and President Rebecca M. Nelson Obama signed into law two acts establishing sanctions in response to Russia’s invasion of Specialist in International Ukraine: the Support for the Sovereignty, Integrity, Democracy, and Economic Stability of Trade and Finance Ukraine Act of 2014 (SSIDES; P.L. 113-95/H.R. 4152) and the Ukraine Freedom Support Act of 2014 (UFSA; P.L. 113-272/H.R. 5859). Dianne E. Rennack Specialist in Foreign Policy In 2017, Congress passed and President Trump signed into law the Countering Russian Influence Legislation in Europe and Eurasia Act of 2017 (CRIEEA; P.L. -

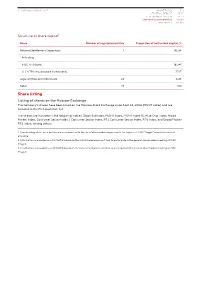

Share Listing

Annual Report 2018 | MAGNIT MAGNIT TODAY 3-11 99 STRATEGIC REPORT 13-27 PERFORMANCE REVIEW 29-53 CORPORATE GOVERNANCE 55-113 APPENDICES 115-189 Structure of share capital1 Name Number of registered entities Proportion of authorized capital, % National Settlement Depositary 1 95.54 Including: PJSC VTB Bank 18.342 LLC VTB Infrastructure Investments 7.723 Legal entities and individuals 24 4.46 Total: 25 100 Share listing Listing of shares on the Moscow Exchange The Company’s shares have been listed on the Moscow Stock Exchange since April 24, 2006 (MGNT ticker) and are included in the first quotation list. The shares are included in the following indices: Stock Subindex, MOEX Index, MOEX Index 10, Blue Chip Index, Broad Market Index, Consumer Sector Index / Consumer Sector Index, RTS Consumer Sector Index, RTS Index, and Broad Market RTS Index, among others. 1. Shareholding structure is provided in accordance with the list of shareholders registered in the register of PJSC “Magnit” shareholders as of 31.12.2018 2. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 3. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 100 101 Weight of shares in indices Ticker Index name Weight in index, % RDXUSD Russian Depositary Index USD 2.85 RDX Russian Depositary Index EUR 2.85 NU137529 MSCI EM IMI (VRS Taxes) Net Return USD Index 0.09 RIOB FTSE Russia IOB -

Investment from Russia Stabilizes After the Global Crisis 1

Institute of World Economy and International Relations (IMEMO) of Russian Academy of Sciences Investment from Russia stabilizes after the global crisis 1 Report dated June 23, 2011 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before June 23, 2011, 3:00 p.m. Moscow; 11 a.m. GMT; and 7 a.m. New York. Moscow and New York, June 23, 2011 : The Institute of World Economy and International Relations (IMEMO) of the Russian Academy of Sciences, Moscow, and the Vale Columbia Center on Sustainable International Investment (VCC), a joint undertaking of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their second joint survey of Russian outward investors today 2. The survey is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The present survey, conducted at the beginning of 2011, covers the period 2007-2009. Highlights Despite the global crisis of the last few years, Russia has remained one of the leading outward investors in the world. The foreign assets of Russian MNEs have grown rapidly and only China and Mexico are further ahead among emerging markets. As the results of our survey show, several non- financial 3 Russian MNEs are significant actors in the world economy. The foreign assets of the 20 leading non-financial MNEs were about USD 107 billion at the end of 2009 (table 1). Their foreign sales 4 were USD 198 billion and they had more than 200,000 employees abroad. -

Dmitri V. Kovalenko

Dmitri V. Kovalenko Partner, Moscow Mergers and Acquisitions; Private Equity; Capital Markets Dmitri Kovalenko is co-head of the Moscow office and represents international and Russian clients on a broad range of mergers and acquisitions, private equity and joint venture transac- tions in Russia and other countries covering various industries and sectors. Mr. Kovalenko has practiced law in Skadden’s Moscow, Chicago and Paris offices since 1994. He is ranked in the top tier for Russia M&A and Russia capital markets work by Chambers Global and Chambers Europe, as well as for private equity in Russia by Chambers Europe. Mr. Kovalenko also was named as the 2021 Mergers and Acquisitions Lawyer of the Year and the 2020 Capital Markets Lawyer of the Year by The Best Lawyers in Russia, and was listed in the publication’s Global Business Edition. Additionally, he is listed as a leading individual in IFLR1000 and Who’s Who Legal, as well as repeatedly in The Legal 500 EMEA as a member of its Commercial, Corporate and M&A: Moscow Hall of Fame. T: 7.495.797.4600 F: 7.495.797.4601 His M&A and private equity experience has included advising: [email protected] - Mercury Retail Group in its US$1.2 billion sale of JSC Dixy Group to PJSC Magnit; - Horvik Limited in relation to its preconditional mandatory offer to acquire Trans-Siberian Gold Education plc, an AIM-quoted gold producer; LL.M. (with honors), Northwestern - Kismet Acquisition One, a special purpose acquisition company, in its US$1.9 billion initial University School of Law, Chicago, merger with Nexters Global Limited, the first-ever de-SPAC transaction involving a Russian USA, 1996 company. -

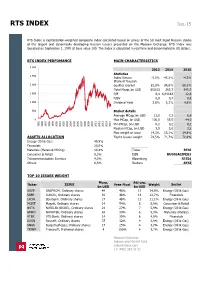

RTS INDEX Dec-15

RTS INDEX Dec-15 RTS Index is capitalization-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. RTS Index was launched on September 1, 1995 at base value 100. The Index is calculated in real time and denominated in US dollars. RTS INDEX PERFOMANCE MAIN CHARACTERISTICS 3 000 2013 2014 2015 Statistics 2 500 Index Return -5,5% -45,2% -4,3% Share of Russian 2 000 equities market 82,8% 84,8% 86,2% Total Mcap, bn USD 650,53 365,7 345,5 1 500 P/E 6,4 6,91163 12,8 P/BV 0,8 0,7 0,8 1 000 Dividend Yield 3,6% 5,3% 4,8% 500 Basket details Average MCap, bn USD 13,0 7,3 6,9 0 Max MCap, bn USD 100,0 55,5 44,0 Min MCap, bn USD 0,2 0,2 0,2 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Median MCap, bn USD 3,9 3,0 3,2 Max weight of issue 14,3% 15,1% 14,9% ASSETS ALLOCATION Top10 issues’ weight 72,5% 71,7% 72,9% Energy (Oil & Gas) 49,9% Financials 20,5% Materials (Metals & Mining) 10,4% Ticker RTSI Consumer & Retail 8,3% ISIN RU000A0JPEB3 Telecommunication Services 4,3% Bloomberg RTSI$ Others 6,5% Reuters .RTSI TOP 10 ISSUES WEIGHT Mcap, Adj cap, Ticker ISSUE Free-Float Weight Sector bn USD bn USD GAZP GAZPROM, Ordinary shares 44 46% 17 14,9% Energy (Oil & Gas) SBER LUKOIL, Ordinary shares 30 48% 14 12,7% Financials LKOH Sberbank, Ordinary shares 27 46% 13 11,1% Energy (Oil & Gas) MGNT Magnit, Ordinary shares 14 54% 8 6,9% Consumer & Retail NVTK NORILSK NICKEL, Ordinary -

Company News SECURITIES MARKET NEWS LETTER Weekly

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody March 5, 2020 Issue No. 2020/08 Company News Polyus to become Moscow Exchange’s blue chip instead of Severstal On February 28, 2020 it was reported that the Moscow Exchange planned to include the ordinary shares of Russian gold producer Polyus in its Blue Chip index instead of the shares of steelmaker Severstal on March 20. The depository receipts of multi-industry holding En+ Group will be replaced with its shares, and the shares together with the depository receipts of payment system operator Qiwi will be considered to be added to the MOEX Russia Index and the RTS Index. Other changes to the indices include addition of depository receipts of real estate developer Etalon Group and exclusion of Seligdar from the Broad Market Index, inclusion of ordinary shares of fertilizer producer Acron and Pharmacy Chain 36.6 in the SMID Index, and exclusion of ordinary shares of oil company RussNeft and oil and gas pipe producer TMK from the Oil and Gas Index. The committee also recommended that the Moscow Exchange launch a new sectorial index for the Russian real estate industry. Mail.ru’s board of directors approves listing on Moscow Exchange On March 2, 2020 the board of directors of Russian Internet company Mail.ru Group approved a listing of global depositary receipts (GDRs) on the Moscow Exchange. The plan is for Mail.ru Group’s GDRs to begin trading in Moscow by July. There will not be any secondary issuance accompanying the listing. Russian antitrust clears Fortum to buy stake in Uniper On March 2, 2020 it was announced that Russia’s Federal Antimonopoly Service cleared Finland’s Fortum to acquire a 20.5% stake in Germany’s Uniper.