Moscow Exchange Secondary Listing Approval and Admission to Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HEDGE EFFECTIVENESS of the RTS INDEX FUTURES Anastasia Musorgina a Thesis Submitted to the University of North Carolina in Part

HEDGE EFFECTIVENESS OF THE RTS INDEX FUTURES Anastasia Musorgina A Thesis Submitted to the University of North Carolina in Partial Fulfillment of the Requirements for the Degree of Master of Business Administration Cameron School of Business University of North Carolina Wilmington 2011 Approved by Advisory Committee Nivine Richie Rob Burrus Cetin Ciner Chair Accepted by _____________________________ Dean, Graduate School TABLE OF CONTENTS ABSTRACT ............................................................................................................................. iii DEDICATION .......................................................................................................................... iv ACKNOWLEDGEMENTS ....................................................................................................... v LIST OF TABLES .................................................................................................................... vi LIST OF FIGURES ................................................................................................................. vii INTRODUCTION ..................................................................................................................... 1 Hedging .................................................................................................................................. 1 Russian Derivatives Market ................................................................................................... 2 Moscow Interbank Currency Exchange ................................................................................ -

Russian Ecm November 6, 2006

1 Russian ecm November 6, 2006 1. Investment banks index wars 2. 35 companies will raise $19bn in 2007, Deutsche Bank 3. RTS to launch a Russian NASDAQ 4. Market players to be licensed 5. Gazprombank finally to sell off media, petrochemical assets in IPO 6. Owner of the Chelyabinsk zinc plant (CZP) will sell 3% of their shares 7. Chemical firm share price collapses after dilutive share issue 8. Dymov Sausage to IPO 9. Eastern Property Holdigns increases capital by $125m 10. Far Eastern Sea Shipping Company will IPO 11. Mosenergo places in favour of Gazprom 12. OGK-5 sale a big success 13. Pharmaceutical producer to IPO 14. Pipemaker TMK IPOs 15. Russian commodity exchange plans to launch wheat futures 16. Severstal sets IPO price 17. Sistema-Hals IPO price range set 18. Uralkaliy decreases 9-month dividends by a third following flood 19. Uranium company to IPO 20. WBD owners sell small stake Investment banks index wars Monday, November 6, 2006 A veritable war of indexes is breaking out as Two of Russia's top investment banks launched new indexes, better to track Russia's increasingly sophisticated growth, that will compete with the proliferating number of indexes tracking Russia. Renaissance Capital has teamed up with emerging market gurus Morgan Stanley that puts together the widely quoted MSCI index - a benchmark for emerging market stock market preformace - to produce the MSCI http://businessneweurope.eu 2 Renaissance Index of TOP Liquid Russian Stocks (the MSCI Rencap Index, for short). Likewise, Troika Dialog launched a third tier index that tracks 50 companies that are on the up and up but currently fall below all the investment bank's radar screens. -

Годовой Отчет Annual Report

годовой отчет 2 0 0 6 annual report STATEMENT OF THE offices. The Bank continues with regional CHIEF EXECUTIVE expansion, and has already in place 13 branch% es in Russian cities in 2006 compared to 7 branches by the year end 2005. MBRD's Dear shareholders, customers and partners regional network comprises 54 offices regis% of the Bank: tered with the Bank of Russia and located in 22 Today, the banking sector dramatically shows most industrialised federal constituencies of it can be a development engine not only for home the Russian Federation. In so doing, the Bank financial system, but also for the Russian econo% intends to step up efforts in further building up my at large. By meeting demands of domestic the banking chain in the future. companies, deposit%taking institutions are MBRD, no doubt, notably strengthened its becoming, in essence, national circulatory sys% positions in the Russian financial market over the tem giving access to financing. To comply with reporting year. To illustrate, net assets increased such an important role, Russian banks should by nearly RUR23.28 billion, while capital rose have adequate capital, technologies, diversified more than by RUR1.7 billion. Total income was network and quality products. RUR5.154 billion against 2.9 billion in 2005, and Presently, Moscow Bank for Reconstruction net profit increased by 65% to RUR442 million. and Development strategically focuses on retail In March 2006, a US$60m 10%year subordi% business development. It means expanding the nated eurobond issue placed on the Luxembourg existent spectrum of services, implementing Stock Exchange was an important event. -

Share Listing

Annual Report 2018 | MAGNIT MAGNIT TODAY 3-11 99 STRATEGIC REPORT 13-27 PERFORMANCE REVIEW 29-53 CORPORATE GOVERNANCE 55-113 APPENDICES 115-189 Structure of share capital1 Name Number of registered entities Proportion of authorized capital, % National Settlement Depositary 1 95.54 Including: PJSC VTB Bank 18.342 LLC VTB Infrastructure Investments 7.723 Legal entities and individuals 24 4.46 Total: 25 100 Share listing Listing of shares on the Moscow Exchange The Company’s shares have been listed on the Moscow Stock Exchange since April 24, 2006 (MGNT ticker) and are included in the first quotation list. The shares are included in the following indices: Stock Subindex, MOEX Index, MOEX Index 10, Blue Chip Index, Broad Market Index, Consumer Sector Index / Consumer Sector Index, RTS Consumer Sector Index, RTS Index, and Broad Market RTS Index, among others. 1. Shareholding structure is provided in accordance with the list of shareholders registered in the register of PJSC “Magnit” shareholders as of 31.12.2018 2. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 3. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 100 101 Weight of shares in indices Ticker Index name Weight in index, % RDXUSD Russian Depositary Index USD 2.85 RDX Russian Depositary Index EUR 2.85 NU137529 MSCI EM IMI (VRS Taxes) Net Return USD Index 0.09 RIOB FTSE Russia IOB -

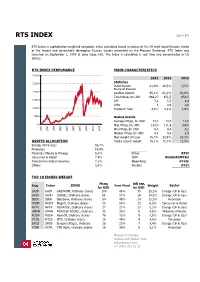

RTS INDEX Dec-15

RTS INDEX Dec-15 RTS Index is capitalization-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. RTS Index was launched on September 1, 1995 at base value 100. The Index is calculated in real time and denominated in US dollars. RTS INDEX PERFOMANCE MAIN CHARACTERISTICS 3 000 2013 2014 2015 Statistics 2 500 Index Return -5,5% -45,2% -4,3% Share of Russian 2 000 equities market 82,8% 84,8% 86,2% Total Mcap, bn USD 650,53 365,7 345,5 1 500 P/E 6,4 6,91163 12,8 P/BV 0,8 0,7 0,8 1 000 Dividend Yield 3,6% 5,3% 4,8% 500 Basket details Average MCap, bn USD 13,0 7,3 6,9 0 Max MCap, bn USD 100,0 55,5 44,0 Min MCap, bn USD 0,2 0,2 0,2 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Median MCap, bn USD 3,9 3,0 3,2 Max weight of issue 14,3% 15,1% 14,9% ASSETS ALLOCATION Top10 issues’ weight 72,5% 71,7% 72,9% Energy (Oil & Gas) 49,9% Financials 20,5% Materials (Metals & Mining) 10,4% Ticker RTSI Consumer & Retail 8,3% ISIN RU000A0JPEB3 Telecommunication Services 4,3% Bloomberg RTSI$ Others 6,5% Reuters .RTSI TOP 10 ISSUES WEIGHT Mcap, Adj cap, Ticker ISSUE Free-Float Weight Sector bn USD bn USD GAZP GAZPROM, Ordinary shares 44 46% 17 14,9% Energy (Oil & Gas) SBER LUKOIL, Ordinary shares 30 48% 14 12,7% Financials LKOH Sberbank, Ordinary shares 27 46% 13 11,1% Energy (Oil & Gas) MGNT Magnit, Ordinary shares 14 54% 8 6,9% Consumer & Retail NVTK NORILSK NICKEL, Ordinary -

Company News SECURITIES MARKET NEWS LETTER Weekly

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody March 5, 2020 Issue No. 2020/08 Company News Polyus to become Moscow Exchange’s blue chip instead of Severstal On February 28, 2020 it was reported that the Moscow Exchange planned to include the ordinary shares of Russian gold producer Polyus in its Blue Chip index instead of the shares of steelmaker Severstal on March 20. The depository receipts of multi-industry holding En+ Group will be replaced with its shares, and the shares together with the depository receipts of payment system operator Qiwi will be considered to be added to the MOEX Russia Index and the RTS Index. Other changes to the indices include addition of depository receipts of real estate developer Etalon Group and exclusion of Seligdar from the Broad Market Index, inclusion of ordinary shares of fertilizer producer Acron and Pharmacy Chain 36.6 in the SMID Index, and exclusion of ordinary shares of oil company RussNeft and oil and gas pipe producer TMK from the Oil and Gas Index. The committee also recommended that the Moscow Exchange launch a new sectorial index for the Russian real estate industry. Mail.ru’s board of directors approves listing on Moscow Exchange On March 2, 2020 the board of directors of Russian Internet company Mail.ru Group approved a listing of global depositary receipts (GDRs) on the Moscow Exchange. The plan is for Mail.ru Group’s GDRs to begin trading in Moscow by July. There will not be any secondary issuance accompanying the listing. Russian antitrust clears Fortum to buy stake in Uniper On March 2, 2020 it was announced that Russia’s Federal Antimonopoly Service cleared Finland’s Fortum to acquire a 20.5% stake in Germany’s Uniper. -

Russia Through a Lens Deloitte Research Centre | 12Th Issue | 3Q 2018

Russia through a lens Deloitte Research Centre | 12th issue | 3Q 2018 Macroeconomic Media consumption Russian Pharmaceutical Business and Financial outlook in Russia 2018 Market Trends in 2018 Climate in the Far Key Russian macroeconomic Recovery of tolerance Digital strategy: building digital Eastern region indicators in 3Q 2018 for Internet advertising bridges to end consumers Asian markets are a key destination to expand business geography Page 04 Page 18 Page 26 Page 34 Россия: сквозь призму последних событий 02 Russia through a lens Contents We are pleased to present the latest edition of Russia Through a Lens, the macroeconomic 04 18 journal produced by the Deloitte Research Centre in Moscow. Russia in figures Research Centre Macroeconomic outlook market analysis Established in December 2015, the journal (GDP, inflation, trade indicators, • Media consumption is published quarterly and falls under currency rate, Central Bank in Russia 2018 the Research Centre’s monitoring activities. key rate, commodity price • Russian Pharmaceutical dynamics etc.) Market Trends in 2018 In Russia Through a Lens, we focus on current • Business and Financial key trends in the Russian economy and present Climate in the Far our research in the following fields: Eastern region • Russia in Figures – statistical analysis • Research Centre market analysis • Top-5 M&As 40 41 If you have any questions or suggestions Top M&A Global wind regarding this research, please do not Top news: Russia and China hesitate to contact us at: Top news: Russia and Europe [email protected] 42 43 Useful stickers Contacts Designed by the Deloitte Design Group, Moscow 03 Russia through a lens | Russia in figures Russia in figures GDP GDP dynamics 24.6 23.5 24.2 30.2 19.3 13.1 7.3 8.3 5.3 6.8 10.8 6.8 -6.0 3.3 8.5 8.2 5.2 4.5 4.3 3.7 1.8 1.5 1.8 1.6 «For this [economic] cycle, we expect -7.8 0.7 -2.5 -0.2 to get past the lowest growth point in Q1 2019. -

MICEX & RTS Indices

RUSSIAN EQUITY AND BOND INDICES May 2017 Value Return over the period, % Index 31.05.17 Month Quarter Year In May, Moscow Exchange’s Indices reflected Composite Indices the negative trend on the Russian stock market. The MICEX Index 1,900.38 -5.77% -6.65% 0.07% MICEX Index was down 5.77% to 1,900.38 (from RTS Index 1,053.30 -5.49% -4.20% 16.47% 2,016.71 on 28 April), while the dollar-denominated Blue-Chip Index 12,272.49 -6.14% -7.18% -1.44% RTS Index fell 5.49% to 1,053.30 (from 1,114.43). Second-Tier Index 6,430.47 3.00% 4.82% 58.80% The dollar depreciated 0.80% against the Broad Market Index 1,357.80 -5.58% -6.40% 1.09% rouble. Sectoral Indices (in RUB) Oil & Gas 4,717.99 -5.57% -7.32% -3.27% Volatility increased, with the Russian Volatility Electric Utilities 1,774.83 -6.25% -9.10% 38.08% Index rising 15.40% to 25.93 (from 22.47). Consumer goods & 6,331.06 3.77% -2.99% -1.96% Retail The most of the key sectors made losses. The largest downturn was in Financials, the sector index Telecommunication 1,620.82 -9.41% -11.60% -13.68% of which fell 11.01%. Telecommunication and Industrials 1,643.05 1.73% -6.50% 14.77% Electric Utilities climbed down a respective 9.41% Financials 6,916.81 -11.01% -11.73% -3.54% and 6.25%. The largest rose in Transport is 4.96%. -

Jpmorgan Russian Securities Plc Half Year Report & Financial Statements for the Six Months Ended 30Th April 2020 KEY FEATURES

JPMorgan Russian Securities plc Half Year Report & Financial Statements for the six months ended 30th April 2020 KEY FEATURES Your Company Investment Objective To maximise total return to shareholders from a diversified portfolio of investments primarily in quoted Russian securities. Investment Policies To maintain a diversified portfolio of investments primarily in quoted Russian securities or other companies which operate principally in Russia. The Company may also invest up to 10% of its gross assets in companies that operate or are located in former Soviet Union Republics. Investment Limits and Restrictions The Board seeks to manage some of the Company’s risks by imposing various investment limits and restrictions. • No more than 10% of the Company’s gross assets are to be invested in companies that operate or are located in former Soviet Union Republics. • The Company will not normally invest in unlisted securities. • At the time of purchase, the maximum permitted exposure to each individual company is 15% of the Company’s gross assets. • The Company will not normally invest in derivatives. • The Company will utilise liquidity and borrowings in a range of 10% net cash to 15% geared in typical market conditions. • No more than 15% of gross assets are to be invested in other UK listed investment companies (including investment trusts). Benchmark The RTS Index in sterling terms (RTS). Capital Structure At 30th April 2020, the Company’s share capital comprised 45,557,032 ordinary shares of 1p each. Continuation Vote and Tender A resolution that the Company continue as an investment trust will be put to Shareholders at the Annual General Meeting in 2022 and every five years thereafter. -

Exchange Rate Risk Related to MICEX and RTS Indices

Journal of Business and Economics, ISSN 2155-7950, USA July 2015, Volume 6, No. 7, pp. 1375-1383 DOI: 10.15341/jbe(2155-7950)/07.06.2015/014 © Academic Star Publishing Company, 2015 http://www.academicstar.us Exchange Rate Risk Related to MICEX and RTS Indices Hana Florianová, Barbora Chmelíková (Masaryk University, Brno, Czech Republic) Abstract: This paper examines the exchange rate risk on the Moscow Exchange. Two main Russian equity indices — MICEX and RTS — were chosen as the objects of research. These indices are calculated as capitalization-weighted, based on prices of fifty most liquid stocks of Russian companies related to the main sectors of the Russian economy. Both indices are calculated in real time and their bases are composed of identical stocks. The difference between MICEX and RTS is the currency in which they are denominated. While MICEX index is denominated in rubles, RTS index is denominated in US dollars. Data has been gathered from June 2000 till June 2014. Daily closing prices have been used. The main hypothesis was tested by using linear regression model and its adjustments. The established hypothesis that two correspondent indices, which differ only in currency in which they are denominated, have different price development in time was proven. Key words: equity indices; exchange rate risk; Moscow exchange JEL codes: G15, F31 1. Introduction The connection of financial markets is thanks to the modern technologies closer than ever. Authors narrowed their focus on Russian financial market, Moscow Exchange, where two formally identical indices MICEX and RTS are quoted. The question posed is whether or not these two indices, differing only in the currency they are denominated in, have the same performance in time. -

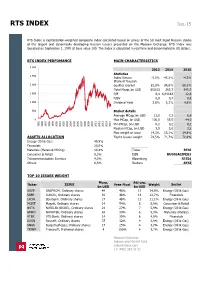

RTS INDEX Jun-14

RTS INDEX Jun-14 RTS Index is capitalization-weighted composite index calculated based on prices of the 50 most liquid Russian stocks of the largest and dynamically developing Russian issuers presented on the Moscow Exchange. RTS Index was launched on September 1, 1995 at base value 100. The Index is calculated in real time and denominated in US dollars. RTS INDEX PERFOMANCE MAIN CHARACTERISTICS 3 000 2011 2012 2013 2 500 Statistics Index Return -21,9% 10,5% -5,5% Share of Russian 2 000 equities market 85,1% 82,2% 82,8% Total Mcap, bn USD 669,27 671,5 650,5 1 500 P/E 7,2 5,7 6,4 P/BV 1 0,9 0,8 1 000 Dividend Yield 4,0% 3,1% 3,6% 500 Basket details Average MCap, bn USD 13,4 13,4 13,0 0 Max MCap, bn USD 126,4 111,8 100,0 Min MCap, bn USD 0,4 0,4 0,2 1995 1997 2011 2013 1999 2001 2003 2005 2007 2009 Median MCap, bn USD 4,1 4,4 3,9 Max weight of issue 15,7% 14,9% 14,3% ASSETS ALLOCATION Top10 issues’ weight 76,1% 72,7% 72,5% Energy (Oil & Gas) 50,7% Financials 19,9% Materials (Metals & Mining) 9,2% Ticker RTSI Consumer & Retail 7,4% ISIN RU000A0JPEB3 Telecommunication Services 7,2% Bloomberg RTSI$ Others 5,6% Reuters .RTSI TOP 10 ISSUES WEIGHT Mcap, Adj cap, Код Ticker ISSUE Free-Float Weight Sector bn USD bn USD GAZP GAZP GAZPROM, Ordinary shares 104 46% 30 15,3% Energy (Oil & Gas) LKOH LKOH LUKOIL, Ordinary shares 51 57% 28 14,1% Energy (Oil & Gas) SBER SBER Sberbank, Ordinary shares 54 48% 24 12,5% Financials MGNT MGNT Magnit, Ordinary shares 25 54% 13 6,5% Consumer & Retail NVTK NVTK NOVATEK, Ordinary shares 37 27% 10 5,2% Energy (Oil & Gas) GMKN GMKN NORILSK NICKEL, Ordinary 31 30% 9 4,8% Materials (Metals) ROSN ROSN Rosneft, Ordinary shares 78 12% 9 4,8% Energy (Oil & Gas) MTSS MTSS МТS, Ordinary shares 18 49% 9 4,6% Telecoms SNGS SNGS Surgutneftegas, Ordinary 28 25% 7 3,4% Energy (Oil & Gas) VTBR VTBR VTB Bank, Ordinary shares 16 39% 6 3,1% Financials Moscow Exchange Indices and Market Data [email protected] +7 (495) 363 32 32 The report has been prepared and issued by Moscow Exchange∙ This report has been prepared and issued by MOSCOW EXCHANGE (the “Company”). -

Federal Grid Company of Unified Energy System

FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM ANNUAL REPORT WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 ANNUAL REPORT 2008 WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 Address to Shareholders Operating Corporate Operating Development of the Human Resources Environmental policy. Attachments of Chairmen of Board Results (13) Governance (23) Activity (51) Corporate Information management and Corporate Social (127) of Directors and Management System Social policy. Responsibility (117) Management Board (5) (CIMS) and Telecom- Social Partnership (103) munication Network (91) History of Establishing Scientific and Technical Contact information Most Important and Core Types Economics and work and Innovative for Shareholders Events in 2008 (9) of Activity (17) Securities (43) Finance (71) Investments (81) Procurement (99) Technologies (111) and Investors (123) WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 CHAPTER 1. ADDRESS TO SHAREHOLDERS OF CHAIRMEN OF BOARD OF DIRECTORS AND MANAGEMENT BOARD 4 5 WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 FGC UES Annual Report 2008 Chapter 1 Address to Shareholders of Chairmen of Board of Directors and Management Board Address to shareholders of Chairmen of Board of Directors and Management Board During 2008 the Company continued realization of its large-scale investment program. JSC FGC UES invested RUR 136.221 billion into modernization of assets within the Unified national energy grid (UNEG) enabling to put into service 1,047 km of electric energy transmis- sion facilities; 10,314 MVA of transformer capacity; 1,285 MVA of reactor capacity, back up commissioning of future periods. Key UNEG facilities were commissioned during 2008. In particular, modernization of substations 500 kV Beskudnikovo and 500 kV Otchakovo was completed and substation 500 kV Zapadnaya was built within the Moscow energy system that increased reliability, transmission capacity of the backbone grid and provided for con- necting new customers in Moscow and Moscow region.