Investor Presentation H1 2021 Update Safe Harbor Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation

Investor Presentation www.lancashiregroup.com Safe harbour statements NOTE REGARDING FORWARD-LOOKING STATEMENTS: CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION, STATEMENTS CONTAINING THE WORDS “BELIEVES”, “ANTICIPATES”, “PLANS”, “PROJECTS”, “FORECASTS”, “GUIDANCE”, “INTENDS”, “EXPECTS”, “ESTIMATES”, “PREDICTS”, “MAY”, “CAN”, “LIKELY”, “WILL”, “SEEKS”, “SHOULD”, OR, IN EACH CASE, THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. ALL SUCH STATEMENTS OTHER THAN STATEMENTS OF HISTORICAL FACTS INCLUDING, WITHOUT LIMITATION, THE FINANCIAL POSITION OF THE COMPANY AND ITS SUBSIDIARIES (THE “GROUP”), THE GROUP’S TAX RESIDENCY, LIQUIDITY, RESULTS OF OPERATIONS, PROSPECTS, GROWTH, CAPITAL MANAGEMENT PLANS AND EFFICIENCIES, ABILITY TO CREATE VALUE, DIVIDEND POLICY, OPERATIONAL FLEXIBILITY, COMPOSITION OF MANAGEMENT, BUSINESS STRATEGY, PLANS AND OBJECTIVES OF MANAGEMENT FOR FUTURE OPERATIONS (INCLUDING DEVELOPMENT PLANS AND OBJECTIVES RELATING TO THE GROUP’S INSURANCE BUSINESS) ARE FORWARD-LOOKING STATEMENTS. SUCH FORWARD-LOOKING STATEMENTS INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO: THE ACTUAL -

Close Brothers Group Plc (Incorporated with Limited Liability in England and Wales with Registered Number 00520241)

PROSPECTUS DATED 8 JUNE 2021 Close Brothers Group plc (incorporated with limited liability in England and Wales with registered number 00520241) £200,000,000 2.00% Subordinated Tier 2 Notes Issue price: 99.531 per cent. The £200,000,000 2.00% Subordinated Tier 2 Notes (the “Notes”) will be issued by Close Brothers Group plc (the “Issuer”) on or about 11 June 2021 (the “Issue Date”). The terms and conditions of the Notes are set out herein in “Terms and Conditions of the Notes” below (the “Conditions”, and references to a numbered “Condition” shall be construed accordingly). The Notes will bear interest on their outstanding principal amount from (and including) the Issue Date to (but excluding) 11 September 2026 (the “Reset Date”), at a rate of 2.00 per cent. per annum and thereafter at the Reset Interest Rate as provided in Condition 5. Interest will be payable on the Notes semi-annually in arrear on each Interest Payment Date, commencing on 11 September 2021 (with a short first Interest Period from (and including) the Issue Date to (but excluding) 11 September 2021). Unless previously redeemed or purchased and cancelled, or (pursuant to Condition 7(f)) substituted, the Notes will mature on 11 September 2031 and shall be redeemed at their principal amount, together with any accrued and unpaid interest on such date. The Noteholders will have no right to require the Issuer to redeem or purchase the Notes at any time. The Issuer may, in its discretion but subject to Regulatory Approval, elect to (a) redeem all (but not some only) of the -

FTSE Factsheet

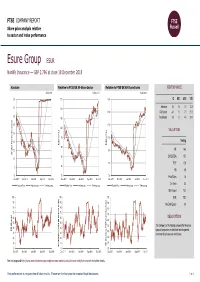

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 18 December 2018 Esure Group ESUR Nonlife Insurance — GBP 2.796 at close 18 December 2018 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Dec-2018 18-Dec-2018 18-Dec-2018 2.8 115 130 1D WTD MTD YTD Absolute 0.0 0.0 0.1 12.5 2.7 110 120 Rel.Sector -0.1 1.0 7.1 21.2 2.6 105 Rel.Market 0.8 1.9 4.5 29.7 2.5 110 100 VALUATION 2.4 (local currency) (local 95 100 2.3 Trailing Relative Price Relative Price 90 2.2 90 PE 14.6 Absolute Price Price Absolute 85 EV/EBITDA 10.7 2.1 80 PCF 12.8 2 80 PB 3.9 1.9 75 70 Price/Sales 1.5 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Dec-2017 Mar-2018 Jun-2018 Sep-2018 Dec-2018 Div Yield 3.4 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 70.1 100 100 100 ROE 28.2 90 90 90 Net Debt/Equity 0.4 80 80 80 70 70 70 60 60 DESCRIPTION 60 50 50 50 The Company is the holding company for the esure 40 40 RSI (Absolute) RSI 40 group of companies, established to write general 30 30 insurance for private cars and homes. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Market Notice N12 2020

Instruments for which suspension from execution under RPW is to be revoked effective 13 August Symbol ISIN Name LREl BMG5361W1047 Lancashire Holdings Ltd LO24d DE000LTT0243 Lotto24 CHRc DK0060227585 Chr Hansen Holding A/S EDPRu ES0127797019 EDP Renovaveis SA UPONOh FI0009002158 Uponor Oyj SPIEp FR0012757854 SPIE SA DVOl GB0002670437 Devro PLC FSJl GB0003395000 James Fisher & Sons PLC HTGl GB0004478896 Hunting PLC MTOl GB0004657408 Mitie Group PLC LOOKl GB00B17MMZ46 Lookers PLC DNLMl GB00B1CKQ739 DUNELM GROUP PLC LAMl GB00B1CL5249 Lamprell PLC International Personal Finance IPFl GB00B1YKG049 PLC FOXTl GB00BCKFY513 Foxtons Group PLC RSAl GB00BKKMKR23 RSA Insurance Group PLC CARDl GB00BLY2F708 Card Factory PLC SPIl GB00BNLPYF73 Spire Healthcare Group PLC DTYl GB00BRB37M78 Dignity PLC DOMl GB00BYN59130 Domino's Pizza Group PLC TBCGl GB00BYT18307 TBC Bank Group PLC EQNl GB00BYWWHR75 Equiniti Group PLC GOCOl GB00BZ02Q916 GoCo Group PLC KRXi IE0004927939 Kingspan Group PLC PGSo NO0010199151 PGS ASA GRNGs SE0006288015 Granges AB Instruments to be suspended or re-suspended from execution under RPW effective 12 August Symbol ISIN Name Scope Action BVIp FR0006174348 Bureau Veritas SA EU Level Suspended MGGTl GB0005758098 Meggitt PLC EU Level Suspended FOURl GB0006640972 4imprint Group PLC EU Level Suspended RTNl GB00B0YG1K06 Restaurant Group PLC/The EU Level Suspended OCDOl GB00B3MBS747 Ocado Group PLC EU Level Suspended RMVl GB00BGDT3G23 Rightmove PLC EU Level Suspended AAFl GB00BKDRYJ47 Airtel Africa PLC EU Level Suspended TRNl GB00BKDTK925 Trainline -

Hiscox Ltd Report and Accounts 2020

Hiscox Ltd Report and Accounts 2020 Ownership Passionate, commercial and accountable. Ownership means making it your business.. Why ownership is so important to us Taking ownership means making it your business. It means being passionate, curious and restless, always looking for a better way of doing things. We strive to be the kind of people who take responsibility, are ambitious, accountable, pragmatic, tenacious and proudly high-achieving. In a growing business like ours, taking initiative is something we expect of everyone, regardless of their role. It shows itself in a willingness to speak up, to confront problems, to avoid easy excuses, and to embrace hard work. These are qualities we have always valued and nurtured. But in 2020, Covid-19 meant that instinct to step up and take ownership was more vital than ever before. It is in difficult times that our values are tested, but it is also in difficult times that they prove the greatest guide. Throughout this report, you will find some examples of how we showed ownership in 2020. Hiscox is a diversified international insurance group with a powerful brand, strong balance sheet and plenty of room to grow. We are headquartered in Bermuda, listed on the London Stock Exchange, and currently have over 3,000 staff across 14 countries and 35 offices. Our products and services reach every continent, and we are one of the only insurers to offer everything from small business and home insurance to reinsurance and insurance-linked securities. Chapter 1: Chapter 2: Chapter 3: Chapter 4: A balanced -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021

FTF - FTF Franklin UK Mid Cap Fund August 31, 2021 FTF - FTF Franklin UK Mid Cap August 31, 2021 Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B132NW2 ASHMORE GROUP PLC 5,750,000 £22,954,000 1.89% N/A N/A 0066701 AVON PROTECTION PLC 701,792 £13,186,671 1.08% N/A N/A 0090498 BELLWAY PLC 925,000 £32,550,750 2.68% N/A N/A B3FLWH9 BODYCOTE PLC 4,450,000 £42,920,250 3.53% N/A N/A BMH18Q1 BYTES TECHNOLOGY GROUP PLC 4,500,000 £23,130,000 1.90% N/A N/A 0231888 CRANSWICK PLC 935,000 £37,082,100 3.05% N/A N/A 0265274 DERWENT LONDON PLC 825,000 £31,292,250 -

Lancashire Holdings Limited 2010 Annual Report

Lancashire Holdings Limited Lancashire Annual Report & Accounts 2010 Accounts & Report Annual www.lancashiregroup.com Five years of Lancashire Four business segments Three strategic priorities Two underwriting centres One goal ANNUAL REPORT & ACCOUNTS 2010 CONTACT INFOrmaTION REGISTERED OFFICE LEGAL COUNSEL TO THE COMPANY Lancashire Holdings Limited As to English and U.S. law: Power House Dewey & LeBoeuf LLP Contents 7 Par-la-Ville Road No 1 Minster Court Hamilton HM 11 Mincing Lane Bermuda London EC3R 7YL United Kingdom Overview 01 Corporate responsibility 32 Phone: + 1 441 278 8950 Fax: + 1 441 278 8951 As to Bermuda law: Five reasons to invest in Lancashire 01 Our values and ethics 32 Conyers, Dill & Pearman Strategic priorities 02 Brokers and clients 33 BERMUDA OFFICE Clarendon House At a glance - Financial highlights 06 Employees 33 Lancashire Insurance Company Limited 2 Church Street At a glance - How we operate 08 Regulators 35 Power House Hamilton HM 11 Chairman’s statement 10 Rating agencies 35 7 Par-la-Ville Road Bermuda Letter to shareholders from the CEO and President 12 Investor relations 35 Hamilton HM 11 Letter to shareholders from the CFO 15 Environment 36 Bermuda AUDITORS In the community 36 Ernst & Young LLP Phone: + 1 441 278 8950 1 More London Place UNDERWRITING COMES FIRST Fax: + 1 441 278 8951 London SE1 2AF EFFECTIVELY BALANCE OPERATE NIMBLY RISK AND RETURN THROUGH THE CYCLE United Kingdom CROSS-CYCLE RETURN OF RISK FREE PLUS 13% PROFITABLE 4 YEARS OUT OF 5 11 PEAK – ZONE PML LIMITS OF UK OFFICE 25% OF CAPITAL Our strategy 37 Lancashire Insurance Company (UK) Limited REGISTRAR SHAREHOLDER RETURN The Level 11, Vitro Capita Registrars (Jersey) Limited Lancashire 60 Fenchurch Street P.O. -

Understanding Risk. Seeing the Opportunity. Annual Report & Accounts 2019 Report Annual

Lancashire Holdings Limited Holdings Lancashire Holdings Limited Understanding risk. Seeing the opportunity. Annual Report 2019 & Accounts Annual Report & Accounts 2019 OUR PURPOSE IS TO… • Deliver bespoke risk solutions that protect our clients and support economies, businesses and communities in the face of uncertain loss events; • Manage our risk exposures and capital resources to generate returns for our investors; and • Support our people and work with our stakeholders; fostering a positive, sustainable and open business culture to the benefit of society. STRATEGIC REPORT Overview 1 Lancashire Group at a glance 8 Chairman’s statement 10 Business model Strategy GOVERNANCE 12 Chief Executive’s review 48 Chairman’s introduction 14 Our strategy 50 Board of Directors Performance 52 Principles for Sustainable Insurance 16 Financial review 55 Corporate governance report 18 Key performance indicators 59 Committee reports 20 Underwriting review 74 Directors’ Remuneration Report 24 Business review 96 Directors’ report 30 Enterprise risk management 100 Statement of Directors’ 33 Principal risks responsibilities 40 Engagement and sustainability FINANCIAL STATEMENTS ADDITIONAL INFORMATION 101 Independent auditor’s report 170 Shareholder information 107 Consolidated primary statements 171 Glossary 111 Accounting policies 176 Alternative performance measures 118 Risk disclosures 177 Contact information 143 Notes to the accounts FROM OUR BEGINNING 2012: Focusing our core portfolio In a year of flat demand and ample industry capacity, Lancashire optimised its 2009: Listing on the LSE portfolio, in order to better balance our exposure and Our listing on the main focus on more profitable market of the LSE was areas. We launched the built on four years of client-facing third-party strong performance capital reinsurance facility, and the indication of Saltire, and issued $130m of 2005: Inception pricing improvements senior debt. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

Complaint to the FCA Lancashire Holdings Limited

Complaint to the FCA - Lancashire Holdings Limited 2 August 2018 Complaint to the FCA Lancashire Holdings Limited 1 Complaint to the FCA - Lancashire Holdings Limited 2 August 2018 Contents 1 Executive Summary.......................................................................................................... 3 2 Factual Background.......................................................................................................... 4 2.1 ClientEarth ....................................................................................................................... 4 2.2 Lancashire Holdings Limited ............................................................................................. 4 3 The Materiality of Climate Change .................................................................................... 4 3.1 The Materiality of Climate Change-related Financial Risks to Property and Casualty Insurers ....................................................................................................................................... 4 3.1.1 Physical Risks .................................................................................................................. 5 3.1.2 Transition Risks ................................................................................................................ 9 3.1.3 Liability Risks.................................................................................................................. 12 3.1.3.1 Claims for Failing to Mitigate the Impacts of Climate Change .................................