Liquidity Matters

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FINAL F&S / Ferrara Pan Close Release

FOR IMMEDIATE RELEASE FARLEY’S & SATHERS AND FERRARA PAN COMPLETE MERGER Round Lake, MN and Forest Park, IL – June 18, 2012 –Farley’s & Sathers Candy Company, Inc. (“Farley’s & Sathers”) and Ferrara Pan Candy Company, Inc.(“Ferrara Pan”) today announced that they have completed their previously announced merger. The combined company, which will be called Ferrara Candy Company, Inc., will be a leading general line candy manufacturer. Salvatore Ferrara II, Chairman and CEO of Ferrara Candy Company, Inc., said, “We are pleased to complete the transaction, which creates a leader in our category. The new Ferrara Candy Company will offer a robust portfolio of branded and private label confections that consumers love, from Lemonheads® and Red Hots® to Trolli®, Brach’s® and Now and Later®. Together, we are entering an exciting new chapter that will allow us to delight our customers with the same great products they know and love, while continuing to innovate our offerings. I want to thank the hard working employees of both companies for their support throughout this process and together, I am confident we will reach new heights.” Catterton Partners, the leading consumer-focused private equity firm, which owns Farley’s & Sathers, will remain as a majority investor in the combined company. “This transaction brings together the best products and people in the industry,” said Scott Dahnke, Managing Partner of Catterton Partners. “The combination will leverage Ferrara Pan’s and Farley’s & Sathers’ combined portfolio of iconic brands, collective knowledge and expertise, and broad supply chain to create a powerhouse in confections. As shareholders, we look forward to the significant upside that will result through this compelling combination.” About Farley’s & Sathers Since its inception on February 20, 2002, Farley's & Sathers Candy Company, Inc. -

Download and Print the List

Boston Children’s Hospital GI / Nutrition Department 300 Longwood Avenue, Boston, MA 02115 617-355-2127 - CeliacKidsConnection.org This is a list of gluten-free candy by company. Many of your favorite candies may be made by a company you do not associate with that candy. For example, York Peppermint Patties are made by Hershey. If you do not know the parent company, you can often find the name on the product label. In addition, this list is searchable. Open the list in Adobe reader and use the search or magnifying glass icon and search for the name of your favorite candy. Ce De Candy / Smarties Ferrara Candy Co. Continued www.smarties.com • Brach’s Chocolates - Peanut Caramel From the Ce De “Our Candy” Page Clusters, Peanut Clusters, Stars, All Smarties® candy made by Smarties Candy Chocolate Covered Raisins Company is gluten-free and safe for people with • Brach's Double Dipped Peanuts/Double Celiac Disease. Dippers (they are processed in a facility that processes wheat) If the UPC number on the packaging begins with • Brach’s Cinnamon Disks “0 11206”, you can be assured that the product • Brach's Candy Corn - All Varieties is gluten-free, manufactured in a facility that • Brach's Cinnamon Imperials makes exclusively gluten-free products and safe • Brach's Conversation Hearts to eat for people with Celiac Disease. • Brach's Halloween Mellowcremes - All Varieties • Brach's Jelly Bean Nougats Ferrara Candy Company • Brach's Lemon Drops 800-323-1768 • Brach's Wild 'N Fruity Gummi Worms www.ferrarausa.com • Butterfinger (Formerly a Nestle candy) From an email dated 9/15/2020 & 9/18/2020 • Butterfinger bites (Formerly a Nestle Ferrara products contain only Corn Gluten. -

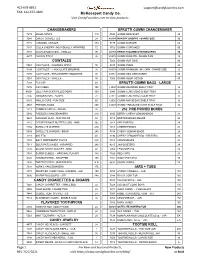

Master Candy List

412-678-8851 [email protected] FAX: 412-673-4406 McKeesport Candy Co. Visit CandyFavorites.com to view products. CHANGEMAKERS EFRUTTI GUMMI CHANGEMAKER 7272 ANGEL MINTS 110 4090 GUMMI BRACELET 40 7248 CANDY CIGARETTES 24 42134 BAKERY SHOPPE - SHARE SIZE 12 7171 CARAMEL CREAMS 170 7177 GUMMI BURGER 60 7347 CELLA CHERRY- INDIVIDUALLY WRAPPED 72 3752 GUMMI CUPCAKES 60 7173 CHARLSTON CHEW - VANILLA 96 42133 EFRUTTI GUMMI CHEESECAKES 30 4277 CHICKO STICK 36 40078 GUMMI DONUTS - SHARE SIZE 12 COWTALES 7262 GUMMI HOT DOG 60 5067 COWTALES - CARAMEL APPLE 36 4105 GUMMI PIZZA 48 5304 COWTALES - CHOCOLATE BROWNIE 36 40079 GUMMI RAINBOW UNICORN - SHARE SIZE 12 7270 COWTALES - STRAWBERRY SMOOTHIE 36 63151 GUMMI SEA CREATURES 60 7263 COWTALES - VANILLA 36 7266 GUMMI SOUR GECKO 40 7269 FUN DIP 48 EFRUTTI GUMMI BAGS - LARGE 7275 ICE CUBES 100 43030 GUMMIUNIVERSE SHELF TRAY 12 46001 JOLLY RANCHER FILLED POPS 100 6943 GUMMI LUNCH BAG SHELF TRAY 12 7286 JUNIOR MINTS - BOXES 72 42111 GUMMI LUNCH BAG SOUR TRAY 12 5443 MALLO CUPS - FUN SIZE 60 42008 GUMMI MOVIE BAG SHELF TRAY 12 4848 PRETZEL RODS 450 43203 GUMMI TREASURE HUNT SHELF TRAY 12 7313 PUMPKIN SEEDS - INDIAN 36 25¢ PRE-PRICED BOXES 5040 RAZZLES CHANGEMAKERS 240 3395 BERRY CHEWY LEMONHEADS 24 4423 RAIN-BLO GUM - MINI PACKS 48 4018 BOSTON BAKED BEANS 24 7215 REESE PEANUT BUTTER CUPS - MINI 105 7912 APPLEHEADS 24 7156 SATELLITE WAFERS 240 7913 CHERRYHEADS 24 5089 SATELLITE WAFERS - SOUR 240 5154 CHEWY LEMONHEADS 24 7318 SIXLETS 48 3396 CHEWY LEMONHEADS - REDRIFIC 24 7154 SOFT PEPPERMINT PUFFS -

Product Catalog

2018 OUR PRODUCT LINE INCLUDES: • Automotive Merchandise • Beverages • Candy • Cigarettes • Cigars • Cleaning Supplies • Dry Groceries • General Merchandise • Health & Beauty Care • Hookah • Medicines • Smoking Accessories • Snacks • Store Supplies • Tobacco Since 1941, James J. Duffy Inc. has been servicing retailers in Eastern Massachusetts with quality candy and tobacco products at a first class level of service you will only find in a family business that has been in business for 4 generations. This past year we have been striving to upgrade our technology to better serve you, our business partners. We have upgraded computers, software, and have added online ordering. Our mission is to provide quality service at an affordable price to all of our customers. Our staff will conduct themselves at all times in a professional manner and assist our retailers where needed. We will strive to expand our product lines to make available the latest items. Our passion to succeed and improve can only be achieved by our customer’s success. TO PLACE AN ORDER OR CONTACT A DUFFY SALESPERSON: CALL 617-242-0094 FAX 617-242-0099 EMAIL [email protected] WEB www.jamesjduffy.com Page 2 • James J. Duffy Inc. • 617-242-0094 • 781-219-0000 • www.jamesjduffy.com INDEX 1. Candy .25 30. Deodorants 1. Novelties 30. Shaving 6. Gum 31. Oral Hygiene 7. Mints 31. Personal Care 7. Count Goods 32. Body Lotion 11. Cough Drops 32. Hair Products 11. Antacids 33. Body Care 11. Changemakers 33. Cleaning Supplies 12. Peg Bags 34. Detergents 13. King Size 35. Plastic Bags 14. Sathers 35. Paper Bags 14. -

Hershey Foods Corp

HERSHEY FOODS CORPORATION MANAGEMENT’S DISCUSSION AND ANALYSIS Hershey Foods Corporation, its wholly-owned subsidiaries and entities in which it has a controlling financial interest (the “Company”) are engaged in the manufacture, distribution and sale of confectionery and grocery products. The Company was organized under the laws of the State of Delaware on October 24, 1927, as a successor to a business founded in 1894 by Milton S. Hershey. OVERVIEW The Company concluded a strong year in 2003. Operating results were consistent with management’s strategies, which provide for profitable growth in sales by focusing on key brands, such as Hershey’s, Reese’s and Hershey’s Kisses, among others; gross margin expansion through enhanced price realization, improved sales mix and supply chain efficiencies; and increases in earnings per share through increased operating profits and share repurchases. These strategies have been successful in improving profitability and have enabled expanded marketing support. Marketing support, which includes promotional allowances that reduce net sales, combined with advertising and consumer promotions expense, increased approximately 200 basis points, as a percentage of gross sales before allowances during the three-year period ended December 31, 2003. The increase was focused on promotional allowances to the Company’s customers, which market research has shown are effective in supporting profitable growth. The Company’s advertising strategy has been focused on key brands and new products which, along with more efficient agency contracts, has resulted in reduced spending. Results show that these marketing strategies have been successful in achieving performance goals and gaining market share. Strategies providing for profitable sales growth, gross margin expansion and earnings growth, along with a disciplined approach toward capital investment, have resulted in increased economic returns for the Company. -

In Search of the Reasonable Consumer: When Courts Find Food Class Action Litigation Goes Too Far

University of Cincinnati Law Review Volume 86 Issue 1 Article 1 October 2018 In Search of the Reasonable Consumer: When Courts Find Food Class Action Litigation Goes Too Far Cary Silverman Follow this and additional works at: https://scholarship.law.uc.edu/uclr Recommended Citation Cary Silverman, In Search of the Reasonable Consumer: When Courts Find Food Class Action Litigation Goes Too Far, 86 U. Cin. L. Rev. 1 (2018) Available at: https://scholarship.law.uc.edu/uclr/vol86/iss1/1 This Article is brought to you for free and open access by University of Cincinnati College of Law Scholarship and Publications. It has been accepted for inclusion in University of Cincinnati Law Review by an authorized editor of University of Cincinnati College of Law Scholarship and Publications. For more information, please contact [email protected]. Silverman: In Search of the Reasonable Consumer: When Courts Find Food Class IN SEARCH OF THE REASONABLE CONSUMER: WHEN COURTS FIND FOOD CLASS ACTION LITIGATION GOES TOO FAR Cary Silverman* Do parents who serve Cocoa Puffs, Lucky Charms, and Trix view these cereals as nutritious breakfast choices for their kids since the boxes tout that they are made with whole grain?1 When they pour soy milk in the bowl, do they believe it came from a cow?2 Are dreary-eyed consumers skimped out of the amount of coffee they paid for when a Starbucks barista includes ice in iced coffee3 or foam in a hot latte?4 On their lunch break, are workers duped to believe that Subway’s “Footlong” sandwiches are precisely twelve inches?5 -

Sensory Evaluation Techniques

Food & Culinary Science Meilgaard Civille • Carr FIFTH EDITION FIFTH EDITION Sensory Evaluation Techniques Sensory Evaluation Techniques Sensory This new edition of a bestseller covers all phases of performing sensory evaluation studies, from listing the steps involved in a sensory evaluation project to presenting advanced statistical methods. Like its predecessors, Sensory Evaluation Techniques, Fifth Edition gives a clear and concise Evaluation presentation of practical solutions, accepted methods, standard practic- es, and some advanced techniques. The fifth edition is comprehensively reorganized, revised, and updated. Key highlights of this book include: Techniques • A more intuitive organization • Statistical methods adapted to suit a more basic consumer methodology • Rearranged material to reflect advances in Internet testing • New time-intensity testing methods • New chapters on advanced sensory processes, quality control testing, advertis- ing claims, and business challenges • New material on mapping and sorting, graph theory, multidimensional scaling, and flash profiling techniques • Explanations of theories of integrity, amplitude, and balance and blend • Updated appendices for SpectrumTM method scales • Updated references Sensory Evaluation Techniques remains a relevant and flexible resource, providing how-to information for a wide variety of users in industry, government, and academia who need the most current information to conduct effective sensory evaluation and interpretations of results. It also supplies students with the necessary theoretical background in sensory evaluation methods, applications, and implementations. FIFTH K22081 EDITION ISBN: 978-1-4822-1690-5 90000 Morten C. Meilgaard 9 781482 216905 Gail Vance Civille • B. Thomas Carr FIFTH EDITION Sensory Evaluation Techniques This page intentionally left blank FIFTH EDITION Sensory Evaluation Techniques Morten C. Meilgaard Gail Vance Civille • B. -

Iglesias V. Ferrara Candy Co., Et

Case 3:17-cv-00849 Document 1 Filed 02/21/17 Page 1 of 30 1 CLARKSON LAW FIRM, P.C. Ryan J. Clarkson (SBN 257074) 2 [email protected] Shireen M. Clarkson (SBN 237882) 3 [email protected] Shalini M. Dogra (SBN 309024) 4 [email protected] 9255 Sunset Blvd., Ste. 804 5 Los Angeles, CA 90069 Tel: (213) 788-4050 6 Fax: (213) 788-4070 7 Attorneys for Plaintiff Thomas Iglesias 8 9 UNITED STATES DISTRICT COURT 10 FOR THE NORTHERN DISTRICT OF CALIFORNIA 11 THOMAS IGLESIAS, individually and on ) Case No. 12 behalf of all others similarly situated, ) P.C. , ) CLASS ACTION COMPLAINT Plaintiff, ) IRM 13 F ) 1. VIOLATION OF CALIFORNIA AW vs. ) CONSUMERS LEGAL REMEDIES ACT, L 14 ) CIVIL CODE § 1750, et. seq. 15 FERRARA CANDY CO., and DOES 1 ) LARKSON through 10, inclusive, ) 2. VIOLATION OF CALIFORNIA FALSE Los Angeles, 90069CA C 16 ) ADVERTISING LAW, BUSINESS & 9255 Blvd., Sunset Suite 804 Defendants. ) PROFESSIONS CODE § 17500, et. seq. 17 ) ) 3. VIOLATION OF CALIFORNIA UNFAIR 18 ) COMPETITION LAW, BUSINESS & ) PROFESSIONS CODE § 17200, et. seq. 19 ) ) 20 ) DEMAND FOR JURY TRIAL ) 21 ) ) 22 ) ) 23 ) ) 24 25 Plaintiff Thomas Iglesias, individually and on behalf of all others similarly 26 situated, brings this class action complaint against Ferrara Candy Co. (“Defendant”) 27 and Does 1 through 10, inclusive (collectively referred to herein as “Defendants”) and 28 alleges as follows: 1 Error! Unknown document property name. 1 CLASS ACTION COMPLAINT Case 3:17-cv-00849 Document 1 Filed 02/21/17 Page 2 of 30 1 SUMMARY OF THE ACTION 2 1. -

The CEO Action for Diversity & Inclusion™ Aims to Rally The

The CEO Action for Diversity & Inclusion™ aims to rally the business community to advance diversity & inclusion within the workplace by working collectively across organizations and sectors. It outlines a specific set of actions the undersigned companies will take to cultivate a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to discuss diversity & inclusion. All the signatories serve as leaders of their companies and have committed to implementing the following pledge within their workplaces. Where companies have already implemented one or several of the commitments, the undersigned commit to support other companies in doing the same. The persistent inequities across our country underscore our urgent, national need to address and alleviate racial, ethnic and other tensions and to promote diversity within our communities. As leaders of some of America’s largest corporations, we manage thousands of employees and play a critical role in ensuring that inclusion is core to our workplace culture and that our businesses are representative of the communities we serve. Moreover, we know that diversity is good for the economy; it improves corporate performance, drives growth and enhances employee engagement. Simply put, organizations with diverse teams perform better. We recognize that diversity & inclusion are multifaceted issues and that we need to tackle these subjects holistically to better engage and support all underrepresented groups within business. To do this, we believe we also need to address honestly and head-on the concerns and needs of our diverse employees and increase equity for all, including Blacks, Latinos, Asians, Native Americans, LGBTQ, disabled, veterans and women. -

Middle Market Growth

MIDDLE MARKET Growth // OCTOBER 2015 PE’S NEW VIRTUAL REALITY: ONLINE DEAL SOURCING PLATFORMS A QUALIFIED OPINION: RICH KENNELLY, CHIEF EXECUTIVE OFFICER, CONNOTATE IRI: CRAFTING A CRYSTAL BALL WITH CONSUMER SPENDING DATA The official publication of INDUSTRY INSIGHTS // Robert Tomei oversees IRI’s consumer and shopper data offerings IRI: CRAFTING A CRYSTAL BALL WITH CONSUMER SPENDING DATA BY S.A. SWANSON Photos by Matthew Gilson and Alyssa Schukar n the loft-style Chicago headquarters of consumer IRI // research firmIRI , a brick wall hints at the company’s Business: past, present and future. It displays a dozen patents, Consumer research I spanning 1990 to 2014. Four involve an updated technology Growth engine: Predictive analytics, platform called IRI Liquid Data. If you’re not fluent in software licensing data science speak—“perturbation of non-unique Private equity owner: values,” anyone?—the patent specifics can induce eye- New York-based New Mountain Capital glazing. Clients usually aren’t interested in the “how” Sales: behind IRI Liquid Data, but they care deeply about the Nearly $1 billion “what.” As in, what can it do to make sense of big data? Website: Andrew Appel, IRI’s CEO, knows this well. “We are in www.iriworldwide.com the middle of the single largest change in consumer buying in 100 years,” he says, noting that companies that have existed for decades are trying to reinvent themselves, and they’d like help. “They want their market research provid- ers to have a significantly greater impact on the business,” Appel says. “‘Stop telling us what happened, and help us take actions to differentiate our business.’” For nearly 30 years, IRI—formally Information “WE ARE IN THE MIDDLE Resources Inc.—gave clients plenty of “what happened” OF THE SINGLE LARGEST by studying buying behavior using consumer panels and CHANGE IN CONSUMER point-of-sale, or POS, data from retailers. -

Ferrero Inks $2.8B Deal for Nestle's US Confectionery

Portfolio Media. Inc. | 111 West 19th Street, 5th Floor | New York, NY 10011 | www.law360.com Phone: +1 646 783 7100 | Fax: +1 646 783 7161 | [email protected] Ferrero Inks $2.8B Deal For Nestle’s US Confectionery Biz By Adam Rhodes Law360, New York (January 16, 2018, 5:46 PM EST) -- Ferrero, the Italian company behind Nutella, Tic Tacs and its branded pralines, on Tuesday inked a $2.8 billion cash deal to swallow Nestle SA’s domestic confectionery business — including its Butterfinger, Baby Ruth and Wonka brands — to become the third-largest confectionery company in the United States. Under the deal, the Ferrero Group said it would snap up 20 of Nestle’s American brands, as well as the company’s three manufacturing locations in Illinois and its related employees. In its announcement, Nestle, considered by Forbes to be the world’s largest food company, said the business, which raked in $900 million in sales in 2016, accounts for 3 percent of Nestle Group’s sales in the U.S. While the deal also covers the food giant’s sugar brands such as Laffy Taffy, Nerds and SweeTarts, among others, it does not involve its Toll House baking products, Nestle clarified. A Ferrero spokesperson told Law360 Tuesday that under the deal, which Nestle accepted at the end of last week, it plans to keep its current Parsippany, New Jersey, offices as well as Nestle’s U.S. confectionery office in Glendale, California. Nestle’s CEO Mark Schneider said Ferrero is an “exceptional home” for the business. “This move allows Nestle to invest and innovate across a range of categories where we see strong future growth and hold leadership positions, such as pet care, bottled water, coffee, frozen meals and infant nutrition,” he said in Nestle’s announcement. -

Ferrara Candy Company Ribbon Cutting June 30 2021

THURSDAY, JULY 1, 2021 • $1.50 DAILY CHRONICLE SERVING DeKALB COUNTY SINCE1879 Daily-Chronicle.com LOCALNEWS Company grows Syngenta Seeds building new research facility, adding 100 new jobs / 6 LOCALNEWS Contract renewed Social workers will help police department for second straight year / 4 BUZZ Bill Cosby freed Pennsylvania Supreme Court throws out sexual assault conviction / 18 HOWSWEET IT IS Candy companyopens distribution center in DeKalb /3 TODAY’SWEATHER HIGH 79 LOW 54 Complete forecast on page 10 3 A CLOSER LOOK LOCAL Sweet addition to business park NEWS Daily Ferrara Candy Co. opens new 1.6 million-square-foot distribution center Chronicle/Daily-Chronicle.com By KATIE FINLON [email protected] DeKALB – More than a year after the project was announced in early 2020 and before the COVID-19 pan- demic hit northern Illinois, Ferrara Candy Company officially opened its long-awaited distribution center during a Wednesday ribbon-cutting • ceremony. Thursday, According to a news release from the state of Illinois, the facility will pro- vide more than 500 local jobs. The proj- Jul ect, located in the city’s Chicago West 1, Business Park off Gurler Road, also 2021 creates one of the state’s largest distri- bution and warehousing centers, according to the release. DeKalb Mayor Cohen Barnes said it’s “absolutely wonderful” to have Ferrara as part of the community. He said the City of DeKalb is looking for- ward to being a continued partner with the company. “We’re really excited to just con- tinue our partnership that we have and look forward to mutual success in this particular endeavor,” Barnes said during Wednesday’s ribbon-cutting.