Download Article (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Anurag Sharma | 1 © Vivekananda International Foundation Published in 2021 by Vivekananda International Foundation

Anurag Sharma | 1 © Vivekananda International Foundation Published in 2021 by Vivekananda International Foundation 3, San Martin Marg | Chanakyapuri | New Delhi - 110021 Tel: 011-24121764 | Fax: 011-66173415 E-mail: [email protected] Website: www.vifindia.org Follow us on Twitter | @vifindia Facebook | /vifindia All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form, or by any means electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher. Anurag Sharma is a Research Associate at Vivekananda International Foundation (VIF). He has completed MPhil in Politics and International Relations on ‘International Security’ at the Dublin City University in Ireland, in 2018. His thesis is titled as “The Islamic State Foreign Fighter Phenomenon and the Jihadi Threat to India”. Anurag’s main research interests are terrorism and the Internet, Cybersecurity, Countering Violent Extremism/Online (CVE), Radicalisation, Counter-terrorism and Foreign (Terrorist) Fighters. Prior to joining the Vivekananda International Foundation, Anurag was employed as a Research Assistant at Institute for Conflict Management. As International affiliations, he is a Junior Researcher at TSAS (The Canadian Network for Research on Terrorism, Security, And Society) in Canada; and an Affiliate Member with AVERT (Addressing Violent Extremism and Radicalisation to Terrorism) Research Network in Australia. Anurag Sharma has an MSc in Information Security and Computer Crime, major in Computer Forensic from University of Glamorgan (now University of South Wales) in United Kingdom and has an online certificate in ‘Terrorism and Counterterrorism’ from Leiden University in the Netherlands, and an online certificate in ‘Understanding Terrorism and the Terrorist Threat’ from the University of Maryland, the United States. -

Prohibited Agreements with Huawei, ZTE Corp, Hytera, Hangzhou Hikvision, Dahua and Their Subsidiaries and Affiliates

Prohibited Agreements with Huawei, ZTE Corp, Hytera, Hangzhou Hikvision, Dahua and their Subsidiaries and Affiliates. Code of Federal Regulations (CFR), 2 CFR 200.216, prohibits agreements for certain telecommunications and video surveillance services or equipment from the following companies as a substantial or essential component of any system or as critical technology as part of any system. • Huawei Technologies Company; • ZTE Corporation; • Hytera Communications Corporation; • Hangzhou Hikvision Digital Technology Company; • Dahua Technology company; or • their subsidiaries or affiliates, Entering into agreements with these companies, their subsidiaries or affiliates (listed below) for telecommunications equipment and/or services is prohibited, as doing so could place the university at risk of losing federal grants and contracts. Identified subsidiaries/affiliates of Huawei Technologies Company Source: Business databases, Huawei Investment & Holding Co., Ltd., 2017 Annual Report • Amartus, SDN Software Technology and Team • Beijing Huawei Digital Technologies, Co. Ltd. • Caliopa NV • Centre for Integrated Photonics Ltd. • Chinasoft International Technology Services Ltd. • FutureWei Technologies, Inc. • HexaTier Ltd. • HiSilicon Optoelectronics Co., Ltd. • Huawei Device Co., Ltd. • Huawei Device (Dongguan) Co., Ltd. • Huawei Device (Hong Kong) Co., Ltd. • Huawei Enterprise USA, Inc. • Huawei Global Finance (UK) Ltd. • Huawei International Co. Ltd. • Huawei Machine Co., Ltd. • Huawei Marine • Huawei North America • Huawei Software Technologies, Co., Ltd. • Huawei Symantec Technologies Co., Ltd. • Huawei Tech Investment Co., Ltd. • Huawei Technical Service Co. Ltd. • Huawei Technologies Cooperative U.A. • Huawei Technologies Germany GmbH • Huawei Technologies Japan K.K. • Huawei Technologies South Africa Pty Ltd. • Huawei Technologies (Thailand) Co. • iSoftStone Technology Service Co., Ltd. • JV “Broadband Solutions” LLC • M4S N.V. • Proven Honor Capital Limited • PT Huawei Tech Investment • Shanghai Huawei Technologies Co., Ltd. -

Undersampled Pulse Width Modulation for Optical Camera Communications

Undersampled Pulse Width Modulation for Optical Camera Communications Pengfei Luo1, Tong Jiang1, Paul Anthony Haigh2, Zabih Ghassemlooy3,3a, Stanislav Zvanovec4 1Research Department of HiSilicon, Huawei Technologies Co., Ltd, Beijing, China E-mail: {oliver.luo, toni.jiang}@hisilicon.com 2Department of Electronic and Electrical Engineering, University College London, London, UK Email: [email protected] 3Optical Communications Research Group, NCRLab, Faculty of Engineering and Environment, Northumbria University, Newcastle-upon-Tyne, UK 3aQIEM, Haixi Institutes, Chinese Academy of Sciences, Quanzhou, China Email: [email protected] 4Department of Electromagnetic Field, Faculty of Electrical Engineering, Czech Technical University in Prague, 2 Technicka, 16627 Prague, Czech Republic Email: [email protected] Abstract—An undersampled pulse width modulation (UPWM) According to the Nyquist sampling theorem, if these FRs are scheme is proposed to enable users to establish a non-flickering adopted for sampling, the transmitted symbol rate Rs must be optical camera communications (OCC) link. With UPWM, only a lower than half the sampling rate. However, this will clearly digital light emitting diode (LED) driver is needed to send signals lead to light flickering due to the response time of the human using a higher order modulation. Similar to other undersample- eye. Therefore, a number of techniques have been proposed to based modulation schemes for OCC, a dedicated preamble is support non-flickering OCC using low speed cameras (e.g., ≤ required to assist the receiver to indicate the phase error 60 fps). More precisely, there are three main modulation introduced during the undersampling process, and to compensate categories for LFR-based OCC using both global shutter (GS) for nonlinear distortion caused by the in-built gamma correction and rolling shutter (RS) digital cameras: i) display-based [3], ii) function of the camera. -

Hi3519a V100 4K Smart IP Camera Soc Breif Data Sheet

Hi3519A V100 4K Smart IP Camera SoC Breif Data Sheet Issue 02 Date 2018-06-20 Copyright © HiSilicon Technologies Co., Ltd. 2018. All rights reserved. No part of this document may be reproduced or transmitted in any form or by any means without prior written consent of HiSilicon Technologies Co., Ltd. Trademarks and Permissions , , and other HiSilicon icons are trademarks of HiSilicon Technologies Co., Ltd. All other trademarks and trade names mentioned in this document are the property of their respective holders. Notice The purchased products, services and features are stipulated by the contract made between HiSilicon and the customer. All or part of the products, services and features described in this document may not be within the purchase scope or the usage scope. Unless otherwise specified in the contract, all statements, information, and recommendations in this document are provided "AS IS" without warranties, guarantees or representations of any kind, either express or implied. The information in this document is subject to change without notice. Every effort has been made in the preparation of this document to ensure accuracy of the contents, but all statements, information, and recommendations in this document do not constitute a warranty of any kind, express or implied. HiSilicon Technologies Co., Ltd. Address: New R&D Center, Wuhe Road, Bantian, Longgang District, Shenzhen 518129 P. R. China Website: http://www.hisilicon.com Email: [email protected] HiSilicon Proprietary and Confidential Issue 02 (2018-06-20) 1 Copyright © HiSilicon Technologies Co., Ltd. Hi3519A V100 Hi3519A V100 4K Smart IP Camera SoC Introduction Key Features Hi3519A V100 is a high-performance and low-power 4K Low Power Smart IP Camera SoC designed for IP cameras, action cameras, 1.9 W power consumption in a typical scenario for 4K x panoramic cameras, rear view mirrors, and UAVs. -

Google Nexus 6P (H1512) Google Nexus 7

GPSMAP 276Cx Google Google Nexus 5X (H791) Google Nexus 6P (H1512) Google Nexus 7 Google Nexus 6 HTC HTC One (M7) HTC One (M9) HTC One (M10) HTC One (M8) HTC One (A9) HTC Butterfly S LG LG V10 H962 LG G3 Titan LG G5 H860 LG E988 Gpro LG G4 H815 Motorola Motorola RAZR M Motorola DROID Turbo Motorola Moto G (2st Gen) Motorola Droid MAXX Motorola Moto G (1st Gen) Samsung Samsung Galaxy Note 2 Samsung Galaxy S4 Active Samsung Galaxy S6 edge + (SM-G9287) Samsung Galaxy Note 3 Samsung Galaxy S5 Samsung Galaxy S7 edge (SM- G935FD) Samsung Galaxy Note 4 Samsung Galaxy S5 Active Samsung GALAXY J Samsung Galaxy Note 5 (SM- Samsung Galaxy S5 Mini Samsung Galaxy A5 Duos N9208) Samsung Galaxy S3 Samsung Galaxy S6 Samsung Galaxy A9 (SM- A9000) Samsung Galaxy S4 Sony Sony Ericsson Xperia Z Sony Xperia Z3 Sony Xperia X Sony Ericsson Xperia Z Ultra Sony Xperia Z3 Compact Sony XPERIA Z5 Sony Xperia Z2 Sony XPERIA E1 Asus ASUS Zenfone 2 ASUS Zenfone 5 ASUS Zenfone 6 Huawei HUAWEI P8 HUAWEI M100 HUAWEI P9 HUAWEI CRR_L09 XIAOMI XIAOMI 2S XIAOMI 3 XIAOMI 5 XIAOMI Note GPSMAP 64s Google Google Nexus 4 Google Nexus 6P (H1512) Google Pixel Google Nexus 6 Google Nexus 7 HTC HTC One (M7) HTC One (A9) HTC Butterfly S HTC One (M8) HTC One (M10) HTC U11 HTC One (M9) LG LG Flex LG E988 Gpro LG G5 H860 LG V10 H962 LG G4 H815 LG G6 H870 Motorola Motorola RAZR M Motorola DROID Turbo Motorola Moto G (2st Gen) Motorola Droid MAXX Motorola Moto G (1st Gen) Motorola Moto Z Samsung Samsung Galaxy Note 2 Samsung Galaxy S5 Samsung Galaxy J5 Samsung Galaxy Note 3 Samsung Galaxy -

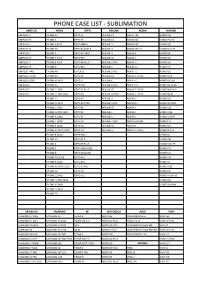

Qikink Product & Price List

PHONE CASE LIST - SUBLIMATION ONEPLUS APPLE OPPO REALME NOKIA HUAWEI ONEPLUS 3 IPHONE SE OPPO F3 REALME C1 NOKIA 730 HONOR 6X ONEPLUS 3T IPHONE 6 OPPO F5 REALME C2 NOKIA 640 HONOR 9 LITE ONEPLUS 5 IPHONE 6 PLUS OPPO FIND X REALME 3 NOKIA 540 HONOR Y9 ONEPLUS 5T IPHONE 6S OPPO REALME X REALME 3i NOKIA 7 PLUS HONOR 10 LITE ONEPLUS 6 IPHONE 7 OPPO F11 PRO REALME 5i NOKIA 8 HONOR 8C ONEPLUS 6T IPHONE 7 PLUS OPPO F15 REALME 5S NOKIA 6 HONOR 8X ONEPLUS 7 IPHONE 8 PLUS OPPO RENO 2F REALME 2 PRO NOKIA 3.1 HONOR 10 ONEPLUS 7T IPHONE X OPPO F11 REALME 3 NOKIA 2.1 HONOR 7C ONEPLUS 7PRO IPHONE XR OPPOF13 REALME 3 PRO NOKIA 7.1 HONOR 5C ONEPLUS 7T PRO IPHONE XS OPPO F1 REALME C3 NOKIA 3.1 PLUS HONOR P20 ONEPLUS NORD IPHONE XS MAX OPPO F7 REALME 6 NOKIA 5.1 HONOR 6PLUS ONEPLUS X IPHONE 11 OPPO A57 REALME 6 PRO NOKIA 7.2 HONOR PLAY 8A ONEPLUS 2 IPHONE 11 PRO OPPO F1 PLUS REALME X2 NOKIA 7.1 PLUS HONOR NOVA 3i ONEPLUS 1 IPHONE 11 PRO MAX OPPO F9 REALME X2 PRO NOKIA 6.1 PLUS HONOR PLAY IPHONE 12 OPPO A7 REALME 5 NOKIA 6.1 HONOR 8X IPHONE 12 MINI OPPO R17 PRO REALME 5 PRO NOKIA 8.1 HONOR 8X MAX IPHONE 12 PRO OPPO K1 REALME XT NOKIA 2 HONOR 20i IPHONE 12 PRO MAX OPPO F9 REALME 1 NOKIA 3 HONOR V20 IPHONE X LOGO OPPO F3 REALME X NOKIA 5 HONOR 6 PLAY IPHONE 7 LOGO OPPO A3 REALME 7 PRO NOKIA 6 (2018) HONOR 7X IPHONE 6 LOGO OPPO A5 REALME 5S NOKIA 8 HONOR 5X IPHONE XS MAX LOGO OPPO A9 REALME 5i NOKIA 2.1 PLUS HONOR 8 LITE IPHONE 8 LOGO OPPO R98 HONOR 8 IPHONE 5S OPPO F1 S HONOR 9N IPHONE 4 OPPO F3 PLUS HONOR 10 LITE IPHONE 5 OPPO A83 (2018) HONOR 7S IPHONE 8 -

Analyzing Android GNSS Raw Measurements Flags Detection

Analyzing Android GNSS Raw Measurements Flags Detection Mechanisms for Collaborative Positioning in Urban Environment Thomas Verheyde, Antoine Blais, Christophe Macabiau, François-Xavier Marmet To cite this version: Thomas Verheyde, Antoine Blais, Christophe Macabiau, François-Xavier Marmet. Analyzing Android GNSS Raw Measurements Flags Detection Mechanisms for Collaborative Positioning in Urban Envi- ronment. ICL-GNSS 2020 International Conference on Localization and GNSS, Jun 2020, Tampere, Finland. pp.1-6, 10.1109/ICL-GNSS49876.2020.9115564. hal-02870213 HAL Id: hal-02870213 https://hal-enac.archives-ouvertes.fr/hal-02870213 Submitted on 17 Jun 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Analyzing Android GNSS Raw Measurements Flags Detection Mechanisms for Collaborative Positioning in Urban Environment Thomas Verheyde, Antoine Blais, Christophe Macabiau, François-Xavier Marmet To cite this version: Thomas Verheyde, Antoine Blais, Christophe Macabiau, François-Xavier Marmet. Analyzing Android GNSS Raw Measurements Flags Detection Mechanisms -

Page 1 of 9 Huawei Pay Frequently Asked Questions (“Faqs”)

Huawei Pay Frequently Asked Questions (“FAQs”) 1. What is Huawei Pay? Huawei Pay is a mobile payment service launched by Huawei. Huawei Pay allows on-the-go payments with phones capable of Near Field Communication (NFC), instead of using your physical ICBC cards. With Huawei Pay, you can make secured and convenient payments, simply by tapping your NFC-capable phone against a contactless payment terminal or card reader. Huawei Pay also allows payments to be made via a barcode or QR code. To use Huawei Pay, simply download Huawei Wallet Application (“Wallet”) from Huawei AppGallery (“AppGallery”) and complete the registration process. 2. Are all ICBC Cards eligible for Huawei Pay? For now, only ICBC UnionPay Credit Cards issued by ICBC Singapore are eligible for use on Huawei Pay. This includes ICBC Horoscope Credit Card, ICBC UnionPay Dual Currency Credit Card and ICBC Koipy Dual Currency Credit Card. 3. How to set up Huawei Pay? Before using Huawei Pay, please ensure that your Huawei phone and Wallet is updated with the latest version. Please follow the steps below: 3.1 Open Wallet and log in to your HUAWEI ID. If you do not yet have a HUAWEI ID, follow the onscreen instructions to register. Please note that the service area of your HUAWEI ID indicated must be the same as the country/region where you use Huawei Pay. To check or change the HUAWEI ID service area, open AppGallery and select to Me > Settings > Country/Region – Singapore. If you have previously added other cards to Huawei Pay in other country/regions, you may not be able to add cards in the current country/region. -

Hi3798m V200 Brief Data Sheet

Hi3798M V200 Hi3798M V200 Brief Data Sheet Key Specifications Processor Security Processing Multi-core 64-bit high-performance ARM Cortex Advanced CA and downloadable CA A53 DRM Multi-core high-performance GPU Secure boot, secure storage, and secure upgrade Memory Control Interfaces Graphics and Display Processing (Imprex 2.0 DDR3/4 interface Processing Engine) eMMC/NOR/NAND flash interface Multiple HDR formats Video Decoding (HiVXE 2.0 Processing Engine) 3D video processing and display Maximum 4K x 2K@60 fps 10-bit decoding 2D graphics acceleration engine Multiple decoding formats, including Audio and Video Interfaces H.265/HEVC, AVS, H.264/AVC MVC, MPEG-1/2/4, VC-1, and so on HDMI 2.0b output Analog video interface Image Decoding Digital and analog audio interfaces Full HD JPEG and PNG hardware decoding Peripheral Interfaces Video and Image Encoding GE and FE network ports 1080p@30 fps video encoding Multiple USB ports Audio Encoding and Decoding SDIO, UART, SCI, IR, KeyLED, and I2C interfaces Audio decoding in multiple formats Audio encoding in multiple formats Others DVB Interface Ultra-low-power design with less than 30 mW standby power consumption Multi-channel TS inputs and outputs BGA package Solution Is targeted for the DVB/Hybrid STB market. Complies with the broadcasting television-level Supports full 4K decoding. picture quality standards. Supports Linux, Android, and TVOS intelligent Metes the increasing value-added service operating systems requirements. Copyright © HiSilicon (Shanghai) Technologies -

ASUS A002 2 Asus Zenfone AR ASUS A002 1 Asus Zenfone AR (ZS571KL) ASUS A002

FAQ for Toyota AR MY (iOS and Android) Q1. What types of devices are required to operate Toyota AR MY? A1. Toyota AR MY requires the latest high-end Apple and Android mobile devices with ARKit and ARcore to operate smoothly. Q2. What types of Apple devices can support Toyota AR MY? A2. The Apple iPhone (iPhone 6S and above), iPhone SE, iPad Pro (2nd Generation and above) and iPad (5th Generation and above). Q3. What types of Android mobile devices support Toyota AR MY? A3. Android devices such as AndroidOS 8 and above support the AR core framework. Other supporting Android devices are listed as below: Manufacturer Model Name Model Code Asus ROG Phone ASUS_Z01QD_1 Asus ZenFone Ares (ZS572KL) ASUS_A002_2 Asus ZenFone AR ASUS_A002_1 Asus ZenFone AR (ZS571KL) ASUS_A002 Manufacturer Model Name Model Code Google Pixel 3 blueline Google Pixel sailfish Google Pixel 2 walleye Google Pixel XL marlin Google Pixel 3 XL crosshatch Google Pixel 2 XL taimen Manufacturer Model Name Model Code Huawei Honor 8X HWJSN-H Huawei Honor 8X Max HWJSN-HM Huawei P20 Pro HWCLT Huawei P20 Pro HW-01K Huawei Honor 10 HWCOL Huawei P20 lite HWANE Huawei Nexus 6P angler Huawei Mate 20 X HWEVR Huawei Mate 20 Pro HWLYA Huawei nova 3 HWPAR Huawei Honor Magic 2 HWTNY Huawei HUAWEI Y9 2019 HWJKM-H Huawei Mate 20 HWHMA Huawei Mate 20 lite HWSNE Huawei nova 3i HWINE Manufacturer Model Name Model Code LG Electronics Q8 anna LG Electronics Q8 cv7an LG Electronics G7 One phoenix_sprout LG Electronics LG G6 lucye LG Electronics JOJO L-02K LG Electronics LG G7 ThinQ judyln LG Electronics -

Huawei Google Nexus 6P Data Erasing Instructions

Huawei Google Nexus 6P The following instruction will give you all the information you need to remove your personal information from your phone. Before recycling your device please also remember to: The account for the device has been fully paid and service has been deactivated. Any headsets and chargers for the device are included with your donation. (These accessories also contain recyclable and salvageable materials). The SIM card is removed if there is one. If mailing your used device, be sure that the device and its accessories are packaged in a box or envelope using protective materials and securely attach a label to the box or envelope with its barcode visible. Data Erasing Instructions Before you start a factory reset: For a successful factory reset, you'll want to take these key steps before you start. 1. Know a Google username and password for the device. 2. Back up your data to your Google Account. 3. Plug your device in to a power source. 4. Make sure you have an Internet connection. Option 1: Reset device from the Settings app: To factory data reset ("format") your device in the fewest steps, use the Settings app. (If you can't get to the Settings app, see Option 2 below.) After following all the Before you start steps above: 1. Open your device's Settings app. 2. Under "Personal," tap Backup & reset. CWTA - 2016 3. Tap Factory data reset > Reset phone or Reset tablet. 4. If you have a screen lock, you'll need to enter your pattern, PIN, or password. 5. -

KONYKS Ampoule LED Wi-Fi Antalya A70 Et E27 Konyks

KONYKS Ampoule LED Wi-Fi Antalya A70 et E27 Konyks Contrôlez vos appareils à la voix ou à distance avec votre smartphone GENCODE : 3770008652026 REF. : KONYANTALYAA70 Caractéristiques Ampoule LED Wi-Fi pour Antalya A70 et E27 Konyks : - Nécessite un réseau Wifi 2.4 Ghz - Format A70 avec culot E27 - Ampoule LED - Intensité 1050 lumens - Puissance 10W (équivalent +75W pour une ampoule à incandescence) - Ampoule RGB : Couleurs RGB et luminosité réglables par smartphone ou contrôle vocal - Pilotage à la voix: avec Google Home ou Amazon Alexa vous pilotez l'ampoule très simplement - Contrôle depuis son Smartphone, de n'importe où dans le monde grâce aux applis iOS et Android Atout LED Installation facile Couleurs Blanc 1 ampoule LED Wi-Fi Antalya A70 et Contenu du pack E27 Konyks Wifi oui MOBILES COMPATIBLES ACER LIQUID Z200 ALCATEL 1X (5059) / 3 (5052) / 3C (5026) / 3V (5099) / 3X (5058) / 5 (5086) / A3 / A3 XL / A5 LED / IDOL 3 (4.7) / IDOL 3 (5.5) / IDOL 4 / ONE TOUCH GOPLAY / ONE TOUCH PIXI 3 4 POUCES / PIXI 3 3.5 / PIXI 3 4 / PIXI 3 4.5 / PIXI 4 3G / PIXI 4 5 / POP 2 4.5 / POP 3 5.0 / POP 4 / POP S7 / U5 / 5V (5060) APPLE IPAD MINI / IPAD MINI 3 / IPAD MINI 4 / IPAD PRO / IPAD PRO 9.7 / IPHONE 5 / IPHONE 6S / IPHONE 6S PLUS / IPHONE 7 / IPHONE 7 RED / IPHONE 8 / IPHONE 8 PLUS / IPHONE SE / IPHONE X / IPAD 9.7 (2018) / IPAD PRO 10.5 / IPHONE XR / IPHONE XS / IPHONE XS MAX ARCHOS SAPHIR 50X ASUS ZENFONE 2 ZE500 CL / ZENFONE 2 ZE550 ML / ZENFONE 3 MAX ZC520TL / ZENFONE 4 MAX PLUS ZC554KL / ZENFONE 4 MAX ZC520KL / ZENFONE LIVE ZB501KL / ZENFONE