Reliance Communications Limited Telecom Restructuring Primer 22 May 2019 India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NEW SYLLABUS 345 : 1 : Roll No…………………

OPEN BOOK EXAMINATION NEW SYLLABUS 345 : 1 : Roll No………………… Time allowed : 3 hours Maximum marks : 100 Total number of questions : 6 Total number of printed pages : 7 NOTE : Answer ALL Questions. 1. "Telecom Industry in India" The telecommunication industry in India was one of the most swiftly growing sectors in the world with stupendous growth over the last decade. It was regarded as the third largest in the world and the second largest among the emerging economies of Asia. Besides the public sector, the private segment had made significant contribution that had turned the industry into one of the key contributors to the Indian success story. It had an impressive growth trajectory, adding nearly 9 million subscribers per month, bringing the mobile subscriber base to over 903 million by January, 2012. BCG, in January, 2011, indicated that the Indian telecom market would surpass the US $100 billion mark by 2015. This report contradicted the prevalent common belief that growth in the telecom sector had reached a saturation point. In 1994, when mobile phones were introduced in India, the country was divided into 23 circles and licences were issued as per these circles. The circles were classified into four categories — Metros, A, B and C - on the basis of revenue potential; Metro and A circles were expected to have the highest potential. The telecom market in India was highly competitive compared to other countries, and there were over 11 operators in each circle, which was unheard of anywhere else in the world. Different players included Airtel, Reliance, Vodafone (earlier Hutch), Idea, Tata, state-owned BSNL and many more. -

GC Influencers Have Been Chosen Following Research Among Private Practice Lawyers and Other In-House Counsel

v GC Influencers INDIA 2019 Thursday, 14th February 2019 Hyatt Regency Delhi Programme Engaging content, networking and celebration with leading General Counsel and top ranked lawyers globally. GC Influencers For more informationINDIA visit 2019 chambers.com A5-Advert-Forums.idml 1 22/10/2018 12:17 Welcome SARAH KOGAN Editor Chambers Asia-Pacific Meet the most influential General Counsel in India today. Chambers has provided insight into the legal profession for over 30 years. During this time, in-house lawyers and third-party experts have shared their views on the value and importance placed on the role of the General Counsel. No longer just the ethical and legal heart of a business, these professionals now sit as influential participants at board level. Effective mangers, industry pioneers, diversity and CSR champions: these Influencers show the way. Research Methodology: Our GC Influencers have been chosen following research among private practice lawyers and other in-house counsel. We identified the key areas in which GCs have displayed substantial influence: Engaging content, • Effective management and development of an in-house team • Navigation of substantial business projects such as M&A or strategic networking and business change. • Development of litigation strategy and understanding the pressures faced celebration with leading within industry General Counsel and top • Bringing diversity & inclusion and CSR to the forefront of industry. ranked lawyers globally. • Ability to influence and respond to regulatory change Our aim is to celebrate excellence within the legal profession. This dynamic hall of fame encourages collaboration among the in-house legal community. Our GC Influencers have created best practice pathways endorsed by both private practice and other in-house lawyers. -

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

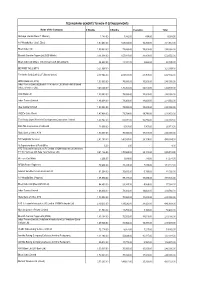

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Media Release Dreamworks Studios, Participant Media

MEDIA RELEASE DREAMWORKS STUDIOS, PARTICIPANT MEDIA, RELIANCE ENTERTAINMENT AND ENTERTAINMENT ONE FORM AMBLIN PARTNERS, A NEW FILM, TELEVISION AND DIGITAL CONTENT CREATION COMPANY Steven Spielberg Also an Investor in Amblin Partners Mumbai, December 17, 2015: Steven Spielberg, Principal Partner, DreamWorks Studios, Jeff Skoll, Chairman, Participant Media, Anil Ambani, Chairman, Reliance Group and Darren Throop, President and Chief Executive Officer, Entertainment One (eOne) announced today the formation of Amblin Partners, a new film, television and digital content creation company. The new company will create content using the Amblin, DreamWorks Pictures and Participant brands and leverage their power and broad awareness to tell stories that appeal to a wide range of audiences. Participant Media will remain a separate company that continues to independently develop, produce and finance projects with socially relevant themes. Amblin Partners will be led by CEO Michael Wright and President and COO Jeff Small. In addition, Amblin Television will become a division of Amblin Partners and continues to be run by co- presidents Justin Falvey and Darryl Frank, who maintain their longtime leadership roles. They join Producer Kristie Macosko Krieger and President of Production Holly Bario on the film side, to complete Amblin Partners’ senior management team. David Linde, Chief Executive Officer of Participant Media, and Participant’s narrative feature team, led by Executive Vice President Jonathan King, will work closely with Amblin Partners to develop and produce specific content for the new venture in addition to exploring opportunities for co-productions and other content. In making the announcement about Amblin Partners, Mr. Spielberg said, “We are thrilled to partner with Jeff Skoll, Participant Media, and to continue our prolific relationship. -

Your Partners in Growth … We Make the Winning Difference

Your Partners in Growth … We Make The Winning Difference MUMBAI | NEW DELHI | BENGALURU | AUSTRALIA | SINGAPORE 3 Decades Of Delivering Success… Full-service Investment bank with strong capabilities in M&A, PE & Corporate Finance Who We Are ➢ Over 100 completed assignments in ~8 years, transacting in 20 countries across 18 Amongst top 5 Investment Banks uniquesectors/Sub Sectors, aggregated value of transactions handled ~USD 5 Bn ➢ Deep business understanding with multi-sector focus, solution driven mind-set and >100 transactions in result-oriented approach last 8 years ➢ Strong relationships with top Indian Business houses & Global IndustryLeaders ➢ Experienced leadership with diverse background supported by well-research Transactions valued ~USD 5 Bn oriented execution team. ➢ ~350 years of collective experience among 40 professionals, completed over 1,000 assignments since inception ~40 Professionals ➢ Low profile but aggressive team, maintaining highest level of ethics & professional standards ~350 years of collective ➢ Impeccable track record of servicing and maintaining live relationship with over experience 1,500 satisfied clients Closed transactions in ➢ Confidence from existing clients with ~70% repeat business and ~70% strike rate >20 Countries ➢ Providing uncompromised and unbiased advice not encumbered by manyconflicts ➢ Strategic stakeholder & exclusive member of Mergers-Alliance (www.mergers- Strong presence in 18 unique sectors/ alliance.com), a network of 17 independent leading investment banks from across subsectors the -

Reliance Industries and Reliance Communications Sign Telecom Tower Pact

Reliance Industries and Reliance Communications Sign Telecom Tower Pact The Ambani brothers have signed a mega deal to share mobile telecom towers. The agreement would permit Reliance Jio Infocomm, a subsidiary of Mukesh Ambani's, Reliance Industries Limited to rent 45000 telecom towers of Anil's Reliance Communications for a period of 15 years. Reliance Jio Infocomm will pay Rs. 12000 crores to Reliance Communication for this lease, which translates to around Rs. 14000-15000 per tower per month. The deal is a win-win for both the companies as it provides a regular income stream for Reliance Comunications and a quicker and economical network capability to Reliance Jio Infocomm when it rolls out its 4G services. Reliance Jio Infocomm could commence occupying some of the towers in the next six months. As per the market sources, Reliance Jio Infocomm did a hard bargain as the prevailing market rental value for a telecom tower ranges around Rs. 25000 - 30000 per month. Reliance Communication will use a large part of the proceeds to retire debt. It has an outstanding debt of around Rs 39,000 crores. This is the second telecom business deal between the two Ambani brothers. Earlier, in April this year these two companies had signed a Rs. 1200 crore pact to share the optic fibre network for carrying call traffic across the country. According to Gurdeep Singh - chief executive (mobility), Reliance Communications, it is possible that these two firms will sign more deals that are mutually beneficial. Synergies in telecom operations appear to have brought the two family factions together. -

Big Data for Measuring the Information Society

BIG DATA FOR MEASURING THE INFORMATION SOCIETY COUNTRY REPORT SWEDEN 1 / 44 Acknowledgments: The big data analysis contained in this report was carried out by Ivan Vallejo Vall, Market Analyst at the ICT Data and Statistics Division within the Telecommunication Development Bureau of ITU. Fredrik Eriksson, Statistician in the same division, made substantial contributions to the analysis. The Internet Foundation in Sweden (IIS) provided the data used in this report, as well as insightful information on the methodology of the data collection. IIS’s cooperation is duly acknowledged. 2 / 44 CONTENTS Contents ........................................................................................................................................................ 3 1. Background and Context ........................................................................................................................... 4 1.1. Project Description ............................................................................................................................. 4 1.2. Pilot Country Context ......................................................................................................................... 4 1.3. Stakeholders in the pilot and project timeline .................................................................................. 6 2. Getting Access to the Data: Procedures, Legal Documents and Challenges ............................................ 7 2.1. Legal Documents and Challenges ..................................................................................................... -

![CP (IB) No. 01/MB/2018]](https://docslib.b-cdn.net/cover/7780/cp-ib-no-01-mb-2018-637780.webp)

CP (IB) No. 01/MB/2018]

NCLT Mumbai Bench IA No. 1031/2020 in [CP (IB) No. 01/MB/2018] IN THE NATIONAL COMPANY LAW TRIBUNAL MUMBAI BENCH, SPECIAL BENCH II *** *** *** IA No. 1031 of 2020 in [CP (IB) No. 01/MB/2018] Under Section 60(5) of Insolvency and Bankruptcy Code, 2016 *** *** *** In the matter of STATE BANK OF INDIA Versus VIDEOCON TELECOMMUNICATIONS LIMITED Between ABHIJIT GUHATHAKURTA, Resolution Professional for 13 Videocon Group Companies Flat No. 701, A Wing, Satyam Springs, Cts No. 272a/2/l, Off BSD Marg, Deonar, Mumbai City, Maharashtra, 400088 … Applicant and DEPARTMENT OF TELECOMMUNICATIONS Ministry of Communications, Access Service Branch, AS-1 Division, Sanchar Bhawan, 20, Ashoka Road, New Delhi- 110001 … Respondent No. 1 BANK OF BARODA 3rd Floor, 10/12, Mumbai Samachar Marg, Fort, Mumbai- 400 001 … Respondent No. 2 Date of Order: 07.10.2020 CORAM: Hon’ble Janab Mohammed Ajmal, Member Judicial Hon’ble Ravikumar Duraisamy, Member Technical Appearance: For the Applicant : Senior Counsel Mr. Gaurav Joshi with Ms. Meghna Rajadhyaksha. For the Respondents : None Page 1 of 8 NCLT Mumbai Bench IA No. 1031/2020 in [CP (IB) No. 01/MB/2018] Per: Janab Mohammed Ajmal (Member Judicial) ORDER This is an Application by the Resolution Professional of the Corporate Debtor seeking necessary direction against the Respondent(s). 2. Facts leading to the Application may briefly be stated as follows. The Videocon Telecommunications Limited (hereinafter referred to as the Corporate Debtor) had availed various credit facilities from the State Bank of India and other Banks including Bank of Baroda (Respondent No. 2). The Department of Telecommunications, Government of India (Respondent No. -

Padma Vibhushan Shri Dhirubhai H. Ambani (28Th December, 1932 - 6Th July, 2002) Reliance Group - Founder and Visionary Profile

Communications Annual Report 2015-16 Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Communications Limited is the flagship Company of Reliance Group, one of the leading business houses in India. Reliance Communications is India’s foremost and truly integrated telecommunications service provider. The Company has a customer base of over 111 million including over 2.6 million individual overseas retail customers. Reliance Communications corporate clientele includes over 39,000 Indian and multinational corporations including small and medium enterprises and over 290 global, regional and domestic carriers. Reliance Communications has established a pan-India, next generation, integrated (wireless and wireline), convergent (voice, data and video) digital network that is capable of supporting best-of-class services spanning the entire communications value chain, covering over 21,000 cities and towns and over 400,000 villages. Reliance Communications owns and operates the world’s largest next generation IP enabled connectivity infrastructure, comprising over 280,000 kilometers of fibre optic cable systems in India, USA, Europe, Middle East and the Asia Pacific region. Mission: Excellence in Communication Arena To attain global best practices and become a world-class communication service provider – guided by its purpose to move towards greater degree of sophistication and maturity. To work with vigour, dedication and innovation to achieve excellence in service, quality, reliability, safety and customer care as the ultimate goal. To earn the trust and confidence of all stakeholders, exceeding their expectations and make the Company a respected household name. To consistently achieve high growth with the highest levels of productivity. -

Rsm India - Highlights

Partnering for your success… always RSM INDIA - HIGHLIGHTS § RSM Astute Consulting Group along with Suresh Surana & Associates LLP (together referred as 'RSM India'), consistently ranks amongst India's top 6 tax, accounting and consulting groups [International Accounting Bulletin, August 2017]. § Indian member of RSM International, the sixth largest global audit, tax and consulting network with annual combined fee income of US$ 4.87 billion across 120 countries. § Indian personnel strength of over 1,400 people having expertise in diverse fields. § Nationwide presence through offices in 11 key cities across India viz. Mumbai, New Delhi-NCR, Chennai, Kolkata, Bengaluru, Surat, Hyderabad, Ahmedabad, Pune, Gandhidham and Jaipur. § Multi-disciplinary team of professionals comprising of Chartered Accountants, MBAs, Company Secretaries, CISA / ISA professionals, Cost Accountants, Law Graduates and Engineers. § Service offerings: - Internal audit and risk advisory - International and Indian tax - Corporate advisory and structuring - IT systems assurance and IT solutions - GST advisory and compliance - Ind AS advisory - Operations consulting - Financial process outsourcing - Transfer pricing - Company law and legal support § RSM India has over the years built a strong competitive presence in all its focus sectors. Our clients include several large Indian groups, multinational corporations and first generation entrepreneurs. Hindalco Industries Tata International Reliance Industries Group Zee - Essel Group UltraTech Cement Raychem RPG Welspun Group Idea Cellular Hindustan Unilever Kellogg India Cipla Sun Pharmaceuticals Axis Bank ICICI Bank IDFC Bank IndusInd Bank Yes Bank ADM Group Subway Viacom 18 Parle Agro Mattel Toys Titan Raymond Faber Castell Armstrong Industries IRB Infrastructure Total Oil HDFC Ergo Ten Sports Capital First Metropolis Healthcare Wizcraft Entertainment VIP Industries Mastek Group Future Generali GCMMF (Amul) Sustainable Luxury LG Electronics Inlaks Group Jetking JSW Steel Karp Diamonds Pantaloons Rapaport KGK Diamonds PolyplexCorporation K. -

Reliance Communications Limited Dhirubhaiambani Knowledge

Reliance Communications Limited Tel : +91 022 3038 6286 DhirubhaiAmbani Knowledge City Fax: +91 022 3037 6622 Navi Mumbai - 400 710, India www.rcom.co.in September 06, 2019 BSE Limited National Stock Exchange of India Ltd. PhirozeJeejeebhoy Towers Exchange Plaza, C/1, Block G Dalal Street, Fort, Bandra - Kurla Complex, Bandra (East) Mumbai 400 001 Mumbai 400 051 BSE Scrip Code: 532712 NSE Scrip Symbol: RCOM Dear Sir(s), Sub: Notice of 15th Annual General Meeting and Annual Report 2018-19 This is to inform that the 15th Annual General Meeting of the members of Reliance Communications Limited (“Company”) shall be held on Monday, September 30, 2019 at 4:00 p.m. at Rama & Sundri Watumull Auditorium, Vidyasagar, Principal K. M. Kundnani Chowk, 124, Dinshaw Wachha Road, Churchgate, Mumbai – 400020 (“the AGM”). The Annual Report for the financial year 2018-19, including the Notice convening the AGM, as approved by the Interim Resolution Professional of the Company in the meeting dated May 27th, 2019 is attached herewith for your records. The Company will provide to its members the facility to cast their vote(s) on all resolutions set out in the Notice by electronic means ("e-voting") and through ballot at the venue of AGM. The e-voting communication giving instructions for e-voting, being sent along with the Annual Report is also enclosed. Thanking you. Yours faithfully, For Reliance Communications Limited Rakesh Gupta Company Secretary Encl: As above (Reliance Communications Limited is under Corporate Insolvency Resolution Process pursuant to the provisions of the Insolvency and Bankruptcy Code, 2016. Vide order dated June 21, 2019, the Hon’ble NCLT has replaced the interim resolution professional of the Company and with effect from June 28, 2019, its affairs, business and assets are being managed by, and the powers of the board of directors are vested in, the Resolution Professional, Mr.