Project Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Some Pre-Boom Developers of Dade County : Tequesta

Some Pre-Boom Developers of Dade County By ADAM G. ADAMS The great land boom in Florida was centered in 1925. Since that time much has been written about the more colorful participants in developments leading to the climax. John S. Collins, the Lummus brothers and Carl Fisher at Miami Beach and George E. Merrick at Coral Gables, have had much well deserved attention. Many others whose names were household words before and during the boom are now all but forgotten. This is an effort, necessarily limited, to give a brief description of the times and to recall the names of a few of those less prominent, withal important develop- ers of Dade County. It seems strange now that South Florida was so long in being discovered. The great migration westward which went on for most of the 19th Century in the United States had done little to change the Southeast. The cities along the coast, Charleston, Savannah, Jacksonville, Pensacola, Mobile and New Orleans were very old communities. They had been settled for a hundred years or more. These old communities were still struggling to overcome the domination of an economy controlled by the North. By the turn of the century Progressives were beginning to be heard, those who were rebelling against the alleged strangle hold the Corporations had on the People. This struggle was vehement in Florida, including Dade County. Florida had almost been forgotten since the Seminole Wars. There were no roads penetrating the 350 miles to Miami. All traffic was through Jacksonville, by rail or water. There resided the big merchants, the promi- nent lawyers and the ruling politicians. -

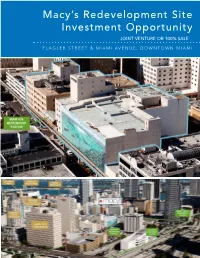

Macy's Redevelopment Site Investment Opportunity

Macy’s Redevelopment Site Investment Opportunity JOINT VENTURE OR 100% SALE FLAGLER STREET & MIAMI AVENUE, DOWNTOWN MIAMI CLAUDE PEPPER FEDERAL BUILDING TABLE OF CONTENTS EXECUTIVE SUMMARY 3 PROPERTY DESCRIPTION 13 CENTRAL BUSINESS DISTRICT OVERVIEW 24 MARKET OVERVIEW 42 ZONING AND DEVELOPMENT 57 DEVELOPMENT SCENARIO 64 FINANCIAL OVERVIEW 68 LEASE ABSTRACT 71 FOR MORE INFORMATION, CONTACT: PRIMARY CONTACT: ADDITIONAL CONTACT: JOHN F. BELL MARIANO PEREZ Managing Director Senior Associate [email protected] [email protected] Direct: 305.808.7820 Direct: 305.808.7314 Cell: 305.798.7438 Cell: 305.542.2700 100 SE 2ND STREET, SUITE 3100 MIAMI, FLORIDA 33131 305.961.2223 www.transwestern.com/miami NO WARRANTY OR REPRESENTATION, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OF THE INFORMATION CONTAINED HEREIN, AND SAME IS SUBMITTED SUBJECT TO OMISSIONS, CHANGE OF PRICE, RENTAL OR OTHER CONDITION, WITHOUT NOTICE, AND TO ANY LISTING CONDITIONS, IMPOSED BY THE OWNER. EXECUTIVE SUMMARY MACY’S SITE MIAMI, FLORIDA EXECUTIVE SUMMARY Downtown Miami CBD Redevelopment Opportunity - JV or 100% Sale Residential/Office/Hotel /Retail Development Allowed POTENTIAL FOR UNIT SALES IN EXCESS OF $985 MILLION The Macy’s Site represents 1.79 acres of prime development MACY’S PROJECT land situated on two parcels located at the Main and Main Price Unpriced center of Downtown Miami, the intersection of Flagler Street 22 E. Flagler St. 332,920 SF and Miami Avenue. Macy’s currently has a store on the site, Size encompassing 522,965 square feet of commercial space at 8 W. Flagler St. 189,945 SF 8 West Flagler Street (“West Building”) and 22 East Flagler Total Project 522,865 SF Street (“Store Building”) that are collectively referred to as the 22 E. -

I MAR-92Ms I STEVEN M

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA IN RE: APPOINTMENT OF FEDERAL MAGISTRATE JUDGE MERIT SELECTION PANEL I MAR-92mS I STEVEN M. LARIMORE CLERK U. S. DIST. CT. uS. D. of FLA. - MIAMI Pursuant to the provisions of the Federal Magistrates Act, 28 U.S.C. 5 63 l(b)(5), and the regulations of the Judicial Conference of the United States establishing standards and procedures for the appointment and reappointment of United States Magistrate Judges, and by action of the Judges of this Court, the residents of this district listed below are appointed as members of the Federal Magistrate Judge Merit Selection Panel. The duty of this Panel is to consider and recommend to the United States District Court for the Southern District of Florida reappointment or non-reappointment of Magistrate Judge William C. Turnoff, whose Miami term expires on February 23,2010. The members of Federal Magistrate Judge Merit Selection Panel are as follows: Chair: David Rothman, Esq. Rothrnan & Associates, P.A. 200 S. Biscayne Blvd. Ste 2770 Miami, Florida 33 13 1 (305)3 58-9000 [email protected] Members: Robert Brochin, Esq. Morgan Lewis & Bockius 200 S. Biscayne Blvd. Ste 5300 Miami, Florida 33 13 1 (305)415-3456 rbrochin@,mor~anlewis.com Maria Christina Enriquez (non-attorney) 1234 Andora Avenue Coral Gables, Florida 33 146 (305)798-5833 enriquezOS@aol .com Cynthia Everett, Esq. 7700 N. Kendall Drive, Ste 703 Miami, Florida 33 156 (305)598-4454 cae@,caeverett.com- Celeste Higgins, Esq. Federal Public Defender's Office 150 West Flagler Street, Suite 1700 Miami, Florida 33 130 (305)530-7000 Ricardo Martinez-Cid, Esq. -

Tri-Rail 2013 On-Board Survey

TRI-RAIL 2013 ON-BOARD SURVEY Prepared for: July 2013 South Florida Regional Transportation Authority 800 NW 33rd Street Pompano Beach, FL 33064 Prepared by: HNTB Corporation 8700 West Flagler Street, Suite 402 Miami, FL 33174 TABLE OF CONTENTS 1.0 INTRODUCTION ............................................................................................. 1 1.1 Scope of the Effort ........................................................................................................... 3 1.2 Previous Tri-Rail Surveys .................................................................................................. 3 2.0 SURVEY DESIGN ............................................................................................. 4 2.1 Sampling Plan ................................................................................................................... 4 2.2 Survey Instrument ............................................................................................................ 7 2.2.1 Overview / Comparison to Previous Survey Results ................................................................................ 7 2.2.2 Pretest ...................................................................................................................................................... 8 3.0 MINIMIZATION/MITIGATION OF NON-RESPONSE BIAS ................................. 9 4.0 IMPLEMENTATION ....................................................................................... 10 4.1 Training .......................................................................................................................... -

Southern District of Florida Certified Mediator List Adelso

United States District Court - Southern District of Florida Certified Mediator List Current as of: Friday, March 12, 2021 Mediator: Adelson, Lori Firm: HR Law PRO/Adelson Law & Mediation Address: 401 East Las Olas Blvd. Suite 1400 Fort Lauderdale, FL 33301 Phone: 954-302-8960 Email: [email protected] Website: www.HRlawPRO.com Specialty: Employment/Labor Discrimination, Title Vll, FCRA Civil Rights, ADA, Title III, FMLA, Whistleblower, Non-compete, business disputes Locations Served: Broward, Indian River, Martin, Miami, Monroe, Palm Beach, St. Lucie Mediator: Alexander, Bruce G. Firm: Ciklin Lubitz Address: 515 N. Flagler Drive, 20th Floor West Palm Beach, FL 33401 Phone: 561-820-0332 Fax: 561-833-4209 Email: [email protected] Website: www.ciklinlubitz.com Languages: French Specialty: Construction Locations Served: Broward, Highlands, Indian River, Martin, Miami, Monroe, Okeechobee, Palm Beach, St. Lucie Mediator: Arrizabalaga, Markel Firm: K&A Mediation/Kleinman & Arrizabalaga, PA Address: 169 E. Flagler Street #1420 Miami, FL 33131 Phone: 305-377-2728 Fax: 305-377-8390 Email: [email protected] Website: www.kamediation.com Languages: Spanish Specialty: Personal Injury, Insurance, Commercial, Property Insurance, Medical Malpractice, Products Liability Locations Served: Broward, Miami, Palm Beach Page 1 of 24 Mediator: Barkett, John M. Firm: Shook Hardy & Bacon LLP Address: 201 S. Biscayne Boulevard Suite 2400 Miami, FL 33131 Phone: 305-358-5171 Fax: 305-358-7470 Email: [email protected] Specialty: Commercial, Environmental, -

Miami DDA Master Plan

DOWNTOWN MIAMI DWNTWN MIAMI... Epicenter of the Americas 2025 Downtown Miami Master Plan 9 200 ber Octo TABLE OF CONTENTS: INTRODUCTION 05 About the Downtown Development Authority 06 Master Plan Overview 06 Foundation 06 Districts 08 Principles 09 Considerations 09 Acknowledgements 10 How to Use this Document 12 VISION 13 Vision Statement 14 GOALS 15 1. Enhance our Position as the Business and 19 Cultural Epicenter of the Americas 2. Leverage our Beautiful and Iconic Tropical Waterfront 27 3. Elevate our Grand Boulevards to Prominence 37 4. Create Great Streets and Community Spaces 45 5. Promote Transit and Regional Connectivity 53 IMPLEMENTATION 61 Process 62 Matrix 63 CONCLUSION 69 APPENDIX 71 Burle Marx Streetscape Miami DDA DOWNTOWN MIAMI MASTER PLAN 2025 2025 DOWNTOWN MIAMI... EPICENTER OF THE AMERICAS 2 3 INTRODUCTION About the DDA Master Plan Overview Foundation Districts Principles Considerations Acknowledgements How to Use the Document DOWNTOWN MIAMI MASTER PLAN 2025 4 Introduction Introduction ABOUT THE DDA FOUNDATION “Roadmap to Success” Downtown Master Plan Study Miami 21 (Duany Plater-Zyberk): 2009 A Greenprint for Our Future: The Miami-Dade Street CRA Master Plans (Dover Kohl / Zyscovich): (Greater Miami Chamber of Commerce (GMCoC), Tree Master Plan (Miami-Dade County Community 2004 / 2006 Miami 21’s mission is to overhaul the City of Miami’s The Miami Downtown Development Authority (DDA) is The Master Plan stands on a foundation of various New World Center (NWC) Committee): 2009 Image Advisory Board): 2007 a quasi-independent -

24-UNIT APARTMENT BUILDING 181 NW 57Th Avenue, Miami, FL 33126 TABLE of CONTENTS

FOR SALE 24-UNIT APARTMENT BUILDING 181 NW 57th Avenue, Miami, FL 33126 TABLE OF CONTENTS 1 Executive Summary Investment Summary Investment Highlights 2 Property Overview Rent Roll Income & Expenses Rental Market Analysis Recent Sales Aerial Area Market Overview 3 Affiliated Business Disclosure Confidentiality Agreement 181 NW 57th Avenue, Miami, FL 33126 1 EXECUTIVE SUMMARY INVESTMENT SUMMARY 4 CBRE is pleased to exclusively offer for sale a 20,960 SF parcel of land 181 NW 57th Avenue Address improved with a 24-unit apartment building. The property is located on Miami, FL 33126 busy NW 57th Avenue (Red Road) just north of Flagler Street. The Parcel Size 20,960 SF apartments are 100% leased with a waiting list of renters. Rents average $1.80 per square foot per month which is approximately 20% under 15,498 SF on three stories market at $2.20 per square foot. The property has a frontage of 24 units total approximately 200 feet on Red Road. The property is connected to Sewer. Building Size 3 units are 2/1 21 units are 1/1 The Red Road corridor is one of the busiest north-south arteries in Miami- 30 parking spaces Dade County leading all the way from the Miami International Airport and the 836 Expressway south to South Miami and Coral Gables. 24,000 Price per Unit $136,250 vehicles per day transit on Red Road every day. West Flagler Street also Zoning T6-8 has a high rate of traffic with 43,000 vehicles per day. There is a large Publix anchored shopping center blocks away from the site to the north. -

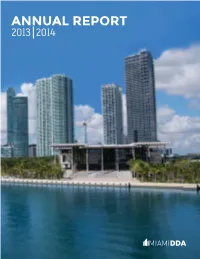

Annual Report 2013 2014 Message to Our About Us

ANNUAL REPORT 2013 2014 MESSAGE TO OUR ABOUT US: The Miami Downtown Development Authority is an independent agency of the City of Miami DWNTWNRS funded by a special tax levy on properties within its district boundaries. The agency is governed by a 15-member board of directors, which includes three public appointees and 12 downtown property As we look back on the past year and embark on the one ahead, the facts are undeniable: Downtown Miami owners, business owners, and/or residents. The board sets policy direction, which is implemented by continues to defy expectations as one of the largest and most viable urban centers in the country. With dozens of a multi-disciplinary team under the oversight of the executive director. cranes proliferating our skyline and new construction on the rise, a livable and walkable urban core has gone from being a promise to a reality. Today, Downtown Miami stands tall with more than 220,000 people working and 80,750 people living in the district. This marks a population growth of more than 100 percent over the past decade – painting a picture of one of the fastest growing and youngest demographics in the country. Although the past year has welcomed a flurry of exciting developments, next year holds even more promise. Yet, we don’t need to tell you of this transformation; you see it unfold each and every day. From the launch of Pérez Art Museum Miami, to the soon-to-be-completed Patricia and Phillip Frost Museum of Science, to the successful Adrienne Arsht Center for the Performing Arts and the AmericanAirlines Arena, Downtown Miami is earning its reputation as an epicenter for arts and culture. -

South Florida Transit Resource Guide

SECOND EDITION Improving the Connection between Transit and Land Use SOUTH FLORIDA TRANSIT RESOURCE GUIDE June 2015 June 15, 2015 Dear Colleague: The South Florida Regional Transportation Authority (SFRTA) is pleased to introduce the second edition of the South Florida Transit Resource Guide, which demonstrates the vital connection between transportation and land use throughout Broward, Miami-Dade, and Palm Beach Counties. The first edition was well received and was awarded an honorable mention in the 2010 Transportation Planning Excellence Awards sponsored by the Federal Highway Administration (FHWA) and the Federal Transit Administration (FTA). Decisions involving transportation and land use directly affect our quality of life and the economic vitality of the region. The choices we make influence how much free time we have, where we live and work, our recreational activities, how we travel, the state of our environment, and so much more. The SFRTA seeks to coordinate, develop and implement, in cooperation with all appropriate levels of government, private enterprise and citizens a regional transportation system in South Florida that ensures mobility, the advancement of sustainable growth and improvement in the quality of life for future generations. Increased development around Tri-Rail stations not only positively impacts Tri-Rail ridership, but can also influence regional growth as it pertains to transportation and land use. Station area- development decisions are governed by the city or county in which each station is located. This publication profiles the many factors which affect how the cities and counties promote station- area development. In summary, we hope this document provides the information needed to help communities and organizations make decisions which can improve the connection between land use and transportation. -

Covid Community Vaccination Sites

Miami-Dade County COVID-19 Community-Based Testing & Vaccination Sites Updated as of 4/28/2021 7:49 AM COVID COMMUNITY VACCINATION SITES County Second Dose Hours of Fee Vaccine Sites Contact number Address Requirements Location Scheduling Operation Schedule Miami- Jackson No appointment required; Schedule second dose N/A N/A Free All Florida residents ages Dade Health https://jacksonhealth.org/keep on-site after you get 16 and older County System ing-you-safe or call 305-585- your first dose Closing 1111 4.30.21 Miami- Nicklaus Appointments required; N/A N/A Free All Florida residents ages Dade Children’s Nicklauschildrens.org/Covid19 16-21 County Hospital Vaccine Miami- MDNow Appointment Required; Select locations N/A Free All Florida residents ages Dade Urgent Care https://www.mymdnow.com/c 18 and older with County ovid-19/vaccine/ insurance Miami- Miami-Dade Appointment required; The Miami-Dade N/A N/A Free All Florida residents ages Dade County https://vaccines.nomihealth.co County Vaccination 18 and older County m/mdc or call 305-614-2014 Program will contact you by email, text or phone a few days prior to your return date to schedule the appointment for your second dose. Miami Hard Rock No appointment required Schedule second dose 347 Don Shula Daily, 8 AM – Free All Florida residents ages Gardens Stadium on-site after you get Drive 10PM 18 and older (FDEM site) your first dose Miami Gardens, FL All state-supported 33056 vaccination sites that offer the Pfizer vaccine 1 Miami-Dade County COVID-19 Community-Based Testing & Vaccination Sites Updated as of 4/28/2021 7:49 AM will administer the vaccine to individuals under the age of 18 who are accompanied by a guardian and have the completed COVID-19 vaccine screening and consent form. -

Metromover System Expansion Study Final Report

Metromover System Expansion Study Final Report Work Order #GPC V-16 Metromover System Expansion Study Final Report Work Order #GPC V-16 Metromover System Expansion Study Final Report Work Order #GPC V-16 Metromover System Expansion Study Final Report Prepared for: Miami-Dade County Metropolitan Planning Organization Prepared by: Work Order # GPC V-16 September 2014 This Page Intentionally Left Blank Miami-Dade MPO Metromover System Expansion Study Table of Contents Table of Contents .................................................................................................................................................................................................i List of Figures ..................................................................................................................................................................................................... iv List of Tables ........................................................................................................................................................................................................ v List of Appendices ............................................................................................................................................................................................ vi 1.0 Introduction ............................................................................................................................................................................................. 1 1.1 Study Need .................................................................................................................................................................................. -

Department of Transportation and Public Works Passenger

Department of Transportation and Public Works Passenger Transportation Regulatory Division 601 NW 1 st Court, 18 th Floor Miami, FL 33136 Tel (786) 469-2300 Fax (786) 469-2313 [email protected] 1 Taxicab Stands at: Shopping Malls & Marketplaces # OF LOCATION COMMENTS VEHICLES 2 Located by Cheesecake Factory 2 Located by Bloomingdale’s Aventura Mall (19501 Biscayne Blvd.) 3 Located by Forever XXI Bal Harbour Shops (9700 Collins Ave.) 2 Operational from 10am – 10pm Coco Walk (3015 Grand Ave.) 2 Located on Virginia Street. Dadeland Mall (7535 N. Kendall Drive.) 2 Located by the front. 9 Located in front of T.G.I Dolphin Mall (11481 NW 12 th Street.) 5 Located by entry # 8 – Food court. 24 Feeder-line parking lot 4 | Area J. Downtown Miami Shopping District. (SE 3 rd Ave. & SE 1 st St.) 2 Located between Flagler and SE 1 st St. Downtown Miami Shopping District. (NE 3 rd Ave. & NE 1 st St.) 2 Closed Due To Construction Downtown Miami Shopping District. (SW 1 st Ave. & Flagler St) 3 Adjacent to Cacique Rest. The Falls (8888 SW 136 th Street) 1 Located by Los Ranchos Restaurant. 1 Located by the food court Florida Keys Outlet Center (250 East Palm Drive, Florida City) 1 Located by the Bus Station. The Mall of the Americas (7827 W. Flagler Street.) 2 Located by the Main Entrance. Located on the south side of Lincoln Rd & Collins Lincoln Road Mall (200 Block Lincoln Rd.) 2 Ave. East side of Washington Avenue, just south of Lincoln Road Mall (Washington Ave. & Lincoln Rd.) 3 Lincoln Road.