Einhell's Pros at a Glance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2364. Equipment and Hand Tools

2364. Equipment and hand tools Sale Information Number of items : 102 Location : Aye (Belgium) Start date : 25 January 2021 as from 17:00 End date : 08 February 2021 as from 18:30 Viewing day : BY APPOINTMENT ONLY Rue du Vivier, 8 6900 Aye (BE) Removal day : 19 February 2021 from 14:00 to 18:00 Rue du Vivier, 8 6900 Aye (BE) WWW.AUCTELIA.COM The General Terms and Conditions and the Specific conditions of sale apply to this online Auction SPECIFIC CONDITIONS - 2364. Equipment and hand tools START DATE 25 January 2021 as from 17:00 END DATE 08 February 2021 as from 18:30 VIEWING BY APPOINTMENT ONLY Rue du Vivier, 8 6900 Aye (BE) REMOVAL 19 February 2021 from 14:00 to 18:00 Rue du Vivier, 8 6900 Aye (BE) In order to be able to pick up the Lots, the total amount due has to be paid. The Lots can only be removed if the Buyer shows on the removal day the proforma invoice and signs the delivery note. WARNING: The Buyer is fully responsible for the dismantling, loading and transportation of the bought Lots. WARNING: If Buyers do not collect their goods at the removal date, time and address mentioned above, extra storage and transport costs will be charged. AUCTION FEES Auction Fees (based on Final Selling Price per Piece) - Amounts less than €15,000 17% of the final selling price - Amounts more than €15,000 12% of the final selling price VAT 21.00 % on the highest bid and/or accepted by the Seller and on the Auction fees PAYMENT Within 3 business days of reception by e-mail of the proforma invoice, the Buyer must transfer the total amount due to the bank account below and mention the invoice number: Auctelia ING 363-4520918-79 / IBAN : BE58 3634 5209 1879 / BIC BBRUBEBB BNPPF 035-7704702-33 / IBAN : BE79 0357 7047 0233 / BIC : GEBABEBB ORGANIZER AUCTELIA Rue Emile Francqui 6/3 B-1435 Mont-Saint-Guibert, Belgique, 6 1435 Mont-Saint-Guibert (BE) SUPERVISION This online Auction sale is held under the supervision of court Bailiffs Etude Bordet, 4031 Angleur-Liège. -

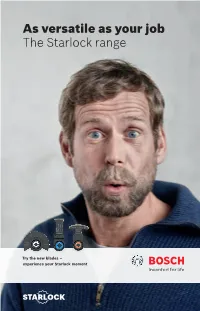

SCIN-017400 Starlock Product Finder EN.Indd 1 31.03.16 08:34 Starlock from Bosch – a Range As Versatile As Never Before

As versatile as your job The Starlock range Try the new blades – experience your Starlock moment SCIN-017400 Starlock Product Finder EN.indd 1 31.03.16 08:34 Starlock from Bosch – a range as versatile as never before 48 blades for the best results in sawing, routing, rasping, cutting, scraping, sanding and polishing The main advantages of Starlock from Bosch Japan tooth configuration made of BiM for clean cuts in hardwood Tapered base body Sturdy mount reduces jamming of reduces blade wobbling the base body to enable a controlled, precise cut Curved-Tec New Starlock mount Rounded cutting edge for Maximum power transfer precise, smooth plunge thanks to 3-dimensional cutting and less tooth quick-clamping system breakout on the sides (SDS) SCIN-017400 Starlock Product Finder EN.indd 2 31.03.16 08:34 Easy blade selection at the point of sale and in the toolbox thanks to unique color coding system Starlock accessory fits all existing multi-tools from Bosch and other brands Starlock ● –– Starlock Plus ● ● – Starlock Max ● ● ● Other Multi-Tool Bosch GOP / PMF with OIS, Fein MultiMaster, Fein ● Multitalent, Makita, Hitachi, –– Metabo, Milwaukee, AEG, Einhell, Ryobi, Skil, etc. ● compatible – not compatible Maximum power transfer No more mismatching and damaging of due to tight-fitting 3D connection of power tools thanks to the three performance machine and Starlock accessory classes Starlock, Starlock Plus, Starlock Max Accessory change within 3 seconds thanks to the new onehand snap-in system 1 2 3 4 SCIN-017400 Starlock Product Finder EN.indd 3 31.03.16 08:34 Long Lifetime: Bi-Metal technology meets the greatest demand in wood, plastic and metal 80 mm long blade Flat blade for deep cuts, a larger ampli- allows a controlled tude leads to more speed and precise cut BIM for long lifetime Slim design Rounded cutting edge reduces stress on the tool drive, for precise jolt-free and allowing operating at full speed and smooth plunge cutting allows perfect span removal AII 65 APB 65 × 40 mm, Curved-Tec, Long life Pack quantity 1 Part no. -

Einhell.Co.Uk

BRAND QUALITY + FULL AFTER SALES & PARTS SERVICE UK RANGE CATALOGUE 2016-17 GB: 0151 649 1500 IRL: 1890 946244 +44 (0)151 649 1501 Unit 9 Stadium Court, Plantation Road, Bromborough, Wirral, CH62 3QG [email protected] twitter.com/EinhellUK Mon-Thu: 8:45am-5:00pm Fri: 8:45am-3:15pm Visit us online at: einhell.co.uk einhellpowerxchange.co.uk Einhell UK Limited, reserves the right to alter products and / or specications without prior notice. E. & O. E. © 2016. Published by Einhell UK Limited. No part of this publication may be reproduced without prior permission from Einhell UK Limited. Art. No. 0001002016 / 5k / 02-16 NEW 2016 RANGE POWER TOOLS | STATIONARY | GARDEN TOOLS | ACCESSORIES POWER TOOLS STATIONARY EINHELL – QUALITY POWER X-CHANGE RED ELECTRIC INNOVATION & Twin packs 10-11 Mitre saws & E-stand 62-64 Lawnmowers 104-106 Drills & screwdrivers 12-14 Table saws 65-67 Tiller 107 VALUE FOR MONEY Rotary hammer 15 Tile cutter 68 Scarifier & aerator 107 Saws 16-18 Scroll saw 68 Grass trimmers 108 Einhell is one of the world’s Multi-sander 19 Bandsaw 68 Hedge trimmers 109 leading suppliers of hand-held Angle grinder 20 Wet & dry vacs 69-71 Pole-mounted tools 110 power tools, stationary and Radio 21 Chainsaw 111 Torch 21 Log splitter 112 garden tools. Accessories 22-23 GARDEN TOOLS Blower, shredder & vac 112 Garden shredders 113 Based in Landau/Isar in Germany, its in-house POWER X-CHANGE Water pumps 114-115 design team are committed to continual RED development, working tirelessly to develop Lawnmowers 76-77 Screwdriver 26 innovative, new products for the DIY Scarifier & aerator 78 MANUAL enthusiast and trade professional. -

Section 26 Workshop, Power Tools, Fuel and Lubrication

Section 26 Workshop, Power Tools, Fuel and Lubrication Norbar Torque Wrenches Page 612 Sealant & Caulking Guns Page 620 Grease Filler Pumps Page 633 G.P Air Tools Page 612 General Maintenance Adblue Nozzles Page 634 & Workshop Tools Page 621 Air Tool Oil Page 612 Fuel Delivery Nozzles Page 635 Soldering Irons Pages 621 - 622 Total Power Tools Page 613 Fuel Meters Page 636 Torches, Work Lamps Einhell Power Tools Pages 613 - 614 & Lighting Pages 622 - 623 Driven Fuel & Water Transfer Pumps Page 637 Einhell Wet & Dry Vacuums Page 615 Jamec Tyre In ation Pages 623 - 624 Fuel Filters & Water Elements Page 637 V-TUF M Class JWL Tyre In ation Page 625 Dust Extraction Page 615 Hose Reels For Fuel Page 637 PCL Tyre In ation Pages 625 - 627 Chicago Pneumatic Oil Control Guns Pages 637 - 638 Air Tools Pages 616 - 617 JWL, Cleaning Soda & Sand Blasting Guns Page 628 Hand Operated PCL Air Tools Pages 618 - 619 Liquid Pumps Page 638 Grease Nipples Air Tool Hoses Page 619 & Adaptors Pages 629 - 631 Pneumatic Oil Pumps & Dispensers Page 639 Micro Inline Tool Filter, Spray Guns Page 631 Regulator, Lubricator Page 620 Drum Taps, Funnels Manual Grease Guns & Waste Oil Drainers Page 640 Staple & Nailing Guns Page 620 & Grease Pages 632 - 633 26 Workshop, Power Tools, Fuel and Lubrication Composite 3/8” Reversible Air Drill c/w Torque Wrenches G.P Air Tools Jacobs Type Chuck Norbar Part Number Description Price .3/8” Reversible Drill (Jacobs Type FS9950 51.05 Norbar Professional Torque Wrenches Composite 3/8” Twin Hammer Impact Chuck) Wrench ● Full Range Shown -

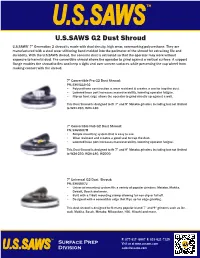

U.S.SAWS G2 Dust Shroud U.S.SAWS’ 7” Generation 2 Shroud Is Made with Dual Density, High Wear, Non-Marking Polyurethane

U.S.SAWS G2 Dust Shroud U.S.SAWS’ 7” Generation 2 shroud is made with dual density, high wear, non-marking polyurethane. They are manufactured with a steel wear stiffening band molded into the perimeter of the shroud for extra-long life and durability. With the U.S.SAWS shroud, the concrete dust is extracted so that the operator may work without exposure to harmful dust. The convertible shroud allows the operator to grind against a vertical surface. A support flange enables the shroud to flex and keep a tight seal over uneven surfaces while preventing the cup wheel from making contact with the shroud. 7” Convertible Pro G2 Dust Shroud: PN: SX60115-G2 • Polyurethane construction is wear resistant & creates a seal to trap the dust. • Lowered hose port increases maneuverability, lowering operator fatigue. • Flip up front edge allows the operator to grind directly up against a wall. This Dust Shroud is designed to fit 7” and 9” Metabo grinders including but not limited to W24-230, W24-180. 7” Convertible Hub G2 Dust Shroud: PN: SX65807M • Simple mounting system that is easy to use. • Wear resistant and creates a good seal to trap the dust. • Lowered hose port increases maneuverability, lowering operator fatigue. This Dust Shroud is designed to fit 7” and 9” Metabo grinders including but not limited to W24-230, W24-180, W2000. 7” Universal G2 Dust Shroud: PN: SX65807U • Universal mounting system fits a variety of popular grinders: Metabo, Makita, Dewalt, Bosch and more. • Built with a T-Bolt mounting clamp allowing for non-slip or fall off. -

Cordless Alliance System (CAS): a Cross-Manufacturer Battery Pack System of Leading Power Tool Brands

THE MOST ADVANCED 18V BATTERY SYSTEM The Cordless Alliance System (CAS): A cross-manufacturer battery pack system of leading power tool brands. Electronic Single Cell Protection (ESCP): Each cell evenly charges and discharges, extending the life of the battery, helping protect the motor and extending the life of the tool. 3-Year The Cordless Alliance System (CAS): A cross-manufacturer battery pack system of Battery Warranty leading power tool brands. 10 01 Cordless Solutions Over 90 tools on our cordless lineup, and many more coming! Most complete range of cordless metalworking and industrial tools on the market n Powered by the breakthrough LiHD (Lithium High-Density) battery technology, Metabo cordless tools deliver true industrial productivity, replacing the need for cords and hoses n Metabo offers more specialty metalworking tools than any other tool manufacturer n Using the most advanced charging system, Metabo batteries charge faster and last longer, making sure you are always ready to work 11 3 CLASSES OF POWER 1 CHARGINGClasses ofPLATFORM Power 12V 18V 36V BS 12 BL Q WPB 18 LTX BL 150 WPB 36-18 LTX BL 230 12V Power Tool Line 16 Assembly Solutions 18 Angle Grinders 20-21 Saws 21 (Metal), 30-31 (Wood) Welding Prep: Die Grinders and Beveling 22 Stainless Steel and Metal Finishing 23 Rivet Gun, Tapping Tool 24 Impact Drivers, Drill/Drivers 25-27 Drywall Screw Gun, Mixer, Heat Gun 28 Rotary Hammers 29 Shop Fan, Blower, Cordless Vac, Radio 32 Lighting Solutions and Measuring Laser 33 Batteries, Chargers and Accessories 34-39 12 Ultra-M: The Most Advanced Battery System The best metalworking cordless tools deserve the best battery system: Metabo offers a unique set of technologies designed to provide users with the power to tackle the most demanding applications. -

Hardware World & Association News

117 五金產業與協會新聞 Accuride Adds BorgWarner Executive Robin Kendrick to Its Board of Directors Hardware 美國工業零配件供應商Accuride新增Robin Kendrick為董事會成員 Accuride Corporation – a supplier of components to the North American and European commercial vehicle industries – announced that Robin Kendrick, World & Vice President and corporate officer of BorgWarner Inc., has been elected to the company’s board of directors as an independent director, effective immediately. He brings extensive global operations leadership experience in the automotive supply, Association metal-forming and fastening industries to the role. Kendrick is currently the President and General Manager of the Turbo Systems turbocharger business unit of BorgWarner, a leading supplier of highly engineered components News and systems for powertrain applications worldwide. He previously served as President and General Manager of BorgWarner Transmission Systems compiled by Fastener World after joining the company in September 2011. P r i o r t o Stanley Black & Decker Elects Dmitri L. B o r g W a r n e r , Kendrick was Stockton To Its Board Of Directors Vice President and 美國Stanley Black & Decker指派Dmitri L. Stockton General Manager of 成為董事會新成員 the European business unit of Acument Global Stanley Black & Decker (NYSE: SWK) has elected Dmitri L. Technologies, a supplier Stockton, 54, former Chairman, President and Chief Executive of fastening systems for Officer of GE Asset Management to the company's Board of automotive, aerospace Directors. and industrial applications "Dmitri is an excellent addition to our Board, bringing an worldwide. He joined Acument in 2008 following a 10- impressive set of experiences managing and leading complex, year tenure with driveline, metal forming and powertrain global organizations," said George W. -

Hvilken Maskine Har Brug for Hvilket Slibeblad?

20 | Slibemidler | Oversigt Bosch-tilbehør Hvilken maskine har brug for hvilket slibeblad? Excenterslibere Type Ø mm Antal huller Type Ø mm Antal huller Type Ø mm Antal huller Bosch Felisatti Makita GEX 125A/AC 125 8 TP 521/(E)AS 150 6 BO 6040 150 8 GEX 125/150 AVE 125/150 8 TP 522/AS/CE 150 6 BO 5041K 125 8 GEX 150AC/ACE 150 6 RGF 150/600E 150 6 Metabo GEX 150 Turbo 150 6 Festo/Festool SXE 125 125 8 PEX 11A/AE 115 8 ES 125/E 125 8 SXE 425 125 8 PEX 12A/AE 125 8 ETS 125 EQ-Plus 125 17/9 SXE 425XL 150 6 PEX 15AE 150 6 ETS 125 EQ 125 17/9 SXE 450 DUO 150 6 PEX 115 115 8 ETS 125 Q-Plus 125 17/9 FSX 200 Intec 125 8 PEX 125A 125 8 ETS 125 Q 125 17/9 SXE 325 Intec 125 8 PEX 125AE 125 8 ES 150/3 EQ/-C 150 17/9 Milwaukee PEX 220A 125 8 ES 150/5 EQ/-C 150 17/9 PRS 125E 125 8 PEX 270A/AE 125 8 ET 2E 150 17/9 ROS 150E 150 6 PEX 300A/E 125 8 ETS 150/3 EQ 150 17/9 Peugeot PEX 400AE 125 8 RO 150 FEQ-Plus 150 17/9 PAE 115 115 8 PEX 420AE 150 6 RO 150 FEQ 150 17/9 PRX 150E 150 6 AEG ETS 150/3 EQ-C 150 17/9 Protool EX 400 125 8 ETS 150/3 EQ-Plus 150 17/9 ESP 150E 15 9 EX 450 125 8 ETS 150/5 EQ 150 17/9 Ryobi EX 450 (150) 150 16 ETS 150/5 EQ-C 150 17/9 ERO 2412VN 125 8 EXE 400 125 8 ETS 150/5 EQ-Plus 150 17/9 P410 125 8 EXE 450 150 8 RO 150E 150 17/9 RS 290 125 8 EXE 460 (125) 125 8 RO 150 E(-Plus) 150 17/9 Skil EXE 460 125/150 8 WTS 150/7E (-Plus) 150 17/9 7400 125 8 EXE 460 (150) 150 16 ET 2E/E-Plus 150 17/9 7402 125 8 ROS 150E 150 6 ES 125 (Plus) 125 8 7415 115 8 EX 150 E 150 6 Flex 7425 125 8 EX 125 ES 125 8 XS 712A 125 8 7430 125 8 Atlas Copco X/XS -

Stanley Black and Decker Techtronic Industries Co Ltd (TTI) Chevron

Who Owns What? Andrew Davis May, 2019 This is a redacted version of an article II found on protoolreviews.com. I remember growing up when General Motors offered different brands at different price points (until they all the brands started to overlap before GM collapsed) – Cadillac at the top end, followed by Oldsmobile, Buick, Pontiac, and Chevy. We have a similar situation in woodworking tools (also in kitchen appliances) except that in the case of tools, the multi-brand company is more often a case of acquisitions rather than organic development. Anyway, for those readers interested in the business side of tools, this column, which is a departure from my usual thread, may be of interest. Stanley Black and Decker Stanley Black & Decker (SBD) turned heads when it bought Craftsman Tools in 2017 after Sears closed 235 stores in 2015. Dating back to 1843 with a man named Frederick Stanley, the company merged in 2010 with Black and Decker. As of 2017, the company maintains a $7.5 billion business in tools & storage alone. SBD brands include: DeWalt Stanley Black + Decker Bostitch Craftsman Vidmar Mac Tools Irwin Lenox Proto Porter-Cable Powers Fasteners Lista Sidchrome Emglo USAG Techtronic Industries Co Ltd (TTI) TTI owns Milwaukee Tool and a host of other power tool companies. It also licenses the RIDGID and RYOBI names for cordless power tools (Emerson actually owns RIDGID and makes the red tools). Founded in 1985 in Hong Kong, TTI sells tools all over the world and employs over 22,000 people. TTI had worldwide annual sales of over US$6 billion in 2017. -

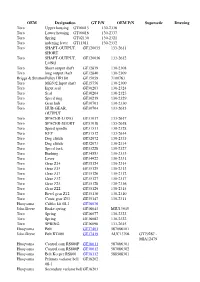

Oem Ref Cross List

OEM Designation GT P/N OEM P/N Supersede Drawing Toro Upper housing GT00415 130-2336 Toro Lower housing GT00416 130-2337 Toro Spring GT02130 130-2321 Toro indexing lever GT11011 130-2332 Toro SHAFT-OUTPUT, GT120035 133-2611 SHORT Toro SHAFT-OUTPUT, GT120036 133-2612 LONG Toro Short output shaft GT12839 130-2308 Toro long output shaft GT12840 130-2309 Briggs & StrattonPulley HR180 GT15059 7100763 Toro MG502 Input shaft GT15756 130-2300 Toro Input seal GT30203 130-2324 Toro Seal GT30204 130-2325 Toro Speed ring GT30219 130-2329 Toro Gear hub GT30701 130-2330 Toro HUB-GEAR, GT30704 133-2613 OUTPUT Toro SPACER-LONG GT31017 133-2617 Toro SPACER-SHORT GT31018 133-2618 Toro Speed spindle GT31511 130-2328 Toro KEY GT31512 133-2614 Toro Dog clutch GT32072 130-2335 Toro Dog clutch GT32073 130-2334 Toro Speed fork GT33228 130-2327 Toro Bushing GT34553 130-2333 Toro Lever GT34922 130-2331 Toro Gear Z14 GT35124 130-2314 Toro Gear Z15 GT35125 130-2313 Toro Gear Z17 GT35126 130-2312 Toro Gear Z32 GT35127 130-2317 Toro Gear Z25 GT35128 130-2316 Toro Gear Z22 GT35129 130-2315 Toro Bevel gear Z12 GT35130 130-2310 Toro Conic gear Z53 GT35147 130-2311 Husqvarna Cables kit 08-1 GT36030 John Deere Brake spring GT36043 MIU13945 Toro Spring GT36077 130-2323 Toro Spring GT36082 130-2322 Toro SPRING GT36098 133-2615 Husqvarna Belt GT37401 587086101 John Deere Belt RT400 GT37419 AUC13704 GT79267 - MIA12479 Husqvarna Control cam RS800F GT38011 587086301 Husqvarna Control cam RS800P GT38012 587086302 Husqvarna Belt Keeper RS800 GT38112 588508301 Husqvarna Primary -

Milwaukee Electric Tool Corporation Product Catalog 2005-2006

Catalog Cover05_001_188 #2 6/10/05 5:10 PM Page 1 Product Catalog 2005-2006 Corporation Milwaukee Electric Tool MILWAUKEE ELECTRIC TOOL CORPORATION 13135 West Lisbon Road • Brookfield, WI 53005-2550 • Phone: 262-781-3600 • Fax: 262-783-8555 • CUSTOMER SERVICE: Phone: 800-SAWDUST • Fax: 800-638-9582 CANADA: 755 Progress Avenue • Scarborough, Ontario M1H 2W7 • Phone: 416-439-4181 • Fax: 416-439-6210 MEXICO: Blvd. Abraham Lincoln, #13 • Colonia Los Reyes, Zona Industrial • Tlalnepantla, C.P. 54073 • Edo. de Mexico • Telefono (55) 5565-1414 • Fax (55) 5565-0925 www.milwaukeetool.com CAT2005-06/6-05/350M/VH/Printed in U.S.A. MILWAUKEE ELECTRIC TOOL CORPORATION Catalog Cover05_002_187 6/8/05 5:12 PM Page 1 V28 Li-ion RUN TIME DIFFERENCE COMPARE THE TECHNOLOGY. INTRODUCING V28Power.com POWERFUL TOOLS CHOOSE FROM SIX REVOLUTIONARY REVOLUTIONARY 18V NiCd BATTERY FUEL GAUGE BATTERY VOLTS THE NEXT CORDLESS LITHIUM-ION 28 VOLT BAND SAW HAMMER-DRILL CIRCULAR SAW Finally, a cordless band saw that’s The V28 hammer-drill provides awesome Cut faster, longer and with as fast and powerful as Milwaukee’s power with its 28 volt motor giving you more power than any 24 volt corded. V28 gives you 4-3/4” x 600 in.-lbs. of max. torque and up to saw on the market. Get up to 4-3/4” deep-cutting capacity for 27,000 BPM. It drills up to twice the twice the run time of an 18 volt high speed cutting where and when number of holes as an 18 volt. with no extra battery weight. -

FEIN General Catalog 2018/2019

2018/2019 FEIN General Catalog 2018/2019 E\)(,1 FEIN General Catalog 2018/2019 Welcome to FEIN In the new FEIN General Catalog 2018, you’ll find our complete range of professional and extremely reliable power tools for trades and industry. Designed to be as user-friendly as our products, the new FEIN General Catalog provides a quick overview of the complete FEIN product range. We’ve organized it even more clearly to make it easy to find what you’re looking for. It’s concise with all the key information you need to make an informed choice. Expert advice with all the facts and figures you need, along with all the relevant FEIN system accessories. 2 Cordless Tools 2 Drill/Drivers 4 MULTIMASTER 22 Sheet metal processing 29 Drywall / Metal Screwdrivers 13 SUPERCUT 25 Power Drills 34 Impact Wrenches 16 Drilling 38 Power Drills 40 Tappers 45 Fastening 46 Tek Screwdrivers 48 Drywall / Deck Screwdrivers 49 Grinding 52 Compact Angle Grinders 54 Die Grinders 64 HF-Die Grinders 73 Large Angle Grinders 62 HF-Angle Grinders 70 Frequency Converter 74 Sheet metal work 78 Slitting Shears 80 Sheet Metal Shears 83 Nibblers 86 Sawing and Cutting 92 Reciprocating saws for pipe 94 Metal Cutting Saws 99 Magnetic base drilling 102 Endurance series 105 Universal series 110 Compact series 105 Auto series 110 Wet/Dry Dust Extractor 132 Wet/Dry Dust Extractor 134 Surface Finishing 140 Surface Finishing Tools 142 Polisher 154 Oscillating 158 FEIN MULTIMASTER / MULTITALENT 160 FEIN SUPERCUT CONSTRUCTION 163 FEIN SUPERCUT AUTOMOTIVE 182 Stationary Belt Grinding Machines 188 GHB hand-held belt grinder 190 GRIT GX Supplemental Modules, trade 198 GRIT GI supplemental module, industrial 205 GRIT GX basic belt grinder, trade 194 GRIT GI basic belt grinder, industrial 199 Numerical section Roto-Star 214 Machines in numerical order 216 1 Cordless Tools The FEIN cordless range – unique, reliable and extremely durable.