Business Case Proposal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CAMP KADIMAH Maccabiah Games Halifax Heroes

WINTER 2018 PJ Library News AJC Annual report Jewish Legion in N.S. Shalom to be commemorated CONNECTING THE ATLANTIC JEWISH COMMUNITY CAMP KADIMAH TO CELEBRATE 75 YEARS IN 2018 20TH MACCABIAH GAMES IN ISRAEL HALIFAX HEROES LOCAL COUPLE HELPS FUNDRAISE MILLIONS FOR CHARITIES Thank you to all our sponsors, supporters, volunteers and audience, we couldn’t have done it without you. We hope to see you again next year! SPONSORS PRODUCER Israel Bonds Canada DIRECTORS Charm Diamond Centres Cineplex Entertainment LP Menemsha Films TOP BILLINGS Andy Fillmore, MP Centre for Israel and Jewish Affairs My Mother’s Bloomers FIN: Atlantic International Film Festival EL AL Airlines Pavia Bishop’s Cellar Mahone Bay Trading Co. Photopolis Bluenose Seafood Moskowitz Capital SOMA Vein & Laser Centre Cast MEmbER SPONSORS Rosalind and Phil Belitsky Shirlee and Ralph Medjuck Joan and Ron Pink Dawn Frail and Tim Margolian Jo-Anne Nozick and Michael Argand Lynda Suissa Linda Law and Lloyd Newman Lezlie Oler and David Zitner The Zive Family Cast MEmbER ADVERTISERS About Care Healthcare Inc. Labi Kousoulis MLA Shaar Shalom Synagogue Jamie Baillie, PC Leader Live Art Dance Studio 14 Gifts & Gallery Designer Craft Shop Jessica Margolian, Royal LePage Websavers Halcraft BDO Canada, Mark Rosen FILM FANS Carol and Simmy Airst Rhonna and Tom Gaum Gloria and Steven Pink Jane and David Alexander Judith and Victor Goldberg Rita and Joel Pink Nancy and Seth Bloom Roselle Green and Family Molly Rechnitzer Karen and Howard Conter Wendy Katz and Alan Young Jeff Schelew Howard Epstein Valerie MacDonald and Jim Spatz Ann and Howard Thaw The Honourable Myra Freeman Jennifer and Wayne O’Connor Myrna and Harold Yazer and Mr. -

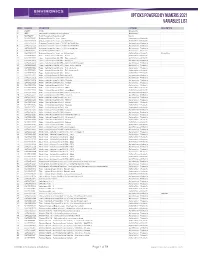

Opticks Powered by Numeris 2021 Variables List

Opticks Powered by Numeris 2021 Variables list Order Variable Description Category CONSUMPTION 0 CODE Code Geography 0 GEO Geographic Summarization Indicator Geography 1 NBAS12HP Total Household Population 12+ Basics 2 Q470010C01 Distance Driven Per Year - None Automotive - Products 3 Q470010C02 Distance Driven Per Year - 1 to 9,999 Km Automotive - Products 4 Q470010C03 Distance Driven Per Year - 10,000 to 19,999 Km Automotive - Products 5 Q470010C04 Distance Driven Per Year - 20,000 to 29,999 Km Automotive - Products 6 Q470010C05 Distance Driven Per Year - 30,000 or more Km Automotive - Products 7 Q4700100I0 Distance Driven Per Year - 1+ Automotive - Products 8 Q4700100A0 Distance Driven Per Year - 1+ (Kilometres) Automotive - Products Kilometres 9 Q470030C01 Type - Vehicle Driven [M Oft] - Sedan Automotive - Products 10 Q470030C02 Type - Vehicle Driven [M Oft] - Sub-compact Automotive - Products 11 Q470030C03 Type - Vehicle Driven [M Oft] - Sports car Automotive - Products 12 Q470030C04 Type - Vehicle Driven [M Oft] - Minivan/station wagon Automotive - Products 13 Q470030C05 Type - Vehicle Driven [M Oft] - Sport utility vehicle Automotive - Products 14 Q470030C06 Type - Vehicle Driven [M Oft] - Pick-up truck Automotive - Products 15 Q470030C07 Type - Vehicle Driven [M Oft] - Full-sized van (!) Automotive - Products 16 Q470030C08 Type - Vehicle Driven [M Oft] - Other Automotive - Products 17 Q470020C01 Make - Vehicle Driven [M Oft] - Buick (!) Automotive - Products 18 Q470020C03 Make - Vehicle Driven [M Oft] - Chevrolet Automotive - -

STORE 2018 Full Delegate List Company Title A. Lassonde Inc

STORE 2018 Full Delegate List Company Title A. Lassonde Inc. Key Account Manager A. Lassonde Inc. Director of Private Brands A. Lassonde Inc. Category Management Director A. Lassonde Inc. VP, R&D A. Lassonde Inc. VP Sales A. Lassonde Inc. VP Marketing A. Lassonde Inc. Executive VP and GM A. Lassonde Inc. Director, Business Development AB World Foods Category Insight Manager AB World Foods General Manager Americas AB World Foods Brand Manager ABM Integrated Solutions CTO ABM Integrated Solutions Director, Application Development Accenture Senior Manager Accenture Managing Director Accenture Senior Manager ACCEO Solutions Inc. ACCEO Retail-1 Director Global Sales Accessibility Directorate of Ontario Sr. Program Advisor Acosta Vice President Acosta Senior Vice President, Customer Development Active International VP, Strategic Partnerships ADA - Association des brasseurs du Québec Directeur des affaires publiques Adidas Group Canada Senior Marketing Manager Adidas Group Canada Senior Platform Operations Manager Adidas Group Canada Visual Merchandising Coordinator Adidas Group Canada Marketing Activations Manager Adidas Group Canada Senior Marketing Manager, Digital Adidas Group Canada Director of Ecommerce Adidas Group Canada President Adidas Group Canada Director of Store Adidas Group Canada VP, Direct to Consumer Adidas Group Canada In-store Communications Manager Adult Fun Superstore - AEDIFICA Director, Design Studio AGR Dynamics Group Sales Director AGR Dynamics Managine Director, NA AGR Dynamics Technical Consultant AGR Dynamics Canada -

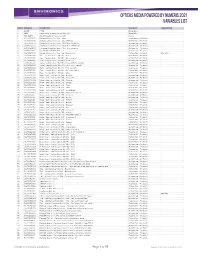

Opticks Media Powered by Numeris 2021 Variables List

Opticks media Powered by Numeris 2021 Variables list Order Variable Description Category CONSUMPTION 0 CODE Code Geography 0 GEO Geographic Summarization Indicator Geography 1 NBAS12HP Total Household Population 12+ Basics 2 Q470010C01 Distance Driven Per Year - None Automotive - Products 3 Q470010C02 Distance Driven Per Year - 1 to 9,999 Km Automotive - Products 4 Q470010C03 Distance Driven Per Year - 10,000 to 19,999 Km Automotive - Products 5 Q470010C04 Distance Driven Per Year - 20,000 to 29,999 Km Automotive - Products 6 Q470010C05 Distance Driven Per Year - 30,000 or more Km Automotive - Products 7 Q4700100I0 Distance Driven Per Year - 1+ Automotive - Products 8 Q4700100A0 Distance Driven Per Year - 1+ (Kilometres) Automotive - Products Kilometres 9 Q470030C01 Type - Vehicle Driven [M Oft] - Sedan Automotive - Products 10 Q470030C02 Type - Vehicle Driven [M Oft] - Sub-compact Automotive - Products 11 Q470030C03 Type - Vehicle Driven [M Oft] - Sports car Automotive - Products 12 Q470030C04 Type - Vehicle Driven [M Oft] - Minivan/station wagon Automotive - Products 13 Q470030C05 Type - Vehicle Driven [M Oft] - Sport utility vehicle Automotive - Products 14 Q470030C06 Type - Vehicle Driven [M Oft] - Pick-up truck Automotive - Products 15 Q470030C07 Type - Vehicle Driven [M Oft] - Full-sized van (!) Automotive - Products 16 Q470030C08 Type - Vehicle Driven [M Oft] - Other Automotive - Products 17 Q470020C01 Make - Vehicle Driven [M Oft] - Buick (!) Automotive - Products 18 Q470020C03 Make - Vehicle Driven [M Oft] - Chevrolet Automotive -

Connecting the Atlantic Jewish Community

Shalom WINTER 2020 CONNECTING THE ATLANTIC JEWISH COMMUNITY CYJ HALIFAX’S FLAGSHIP TEEN PROGRAM JOLT HAS BEEN OFF TO A GREAT START THE PREMIERE SHOWING OF “CAMP KADIMAH—THE STORY OF OUR LIVES” SPENCER HOUSE SENIORS ENJOY CHRISTMAS, THANKS TO AJC VOLUNTEERS Mazel Tov! ON BEHALF OF THE AJC FAMILY WE WISH A HEARTY MAZEL TOV TO Naomi Rosenfeld & Jeff Grî nberg ON THEIR UPCOMING MARRIAGE IN THIS ISSUE WINTER 2020 VOL. 44 | NO. 3 Shalom TEVET 5780 SHALOM MAGAZINE FEATURES President 10 Partnership2gether Update MARILYN KAUFMAN 13 CYJ Halifax’s Flagship Teen Program Executive Director JOLT Has Been Off To A Great Start NAOMI ROSENFELD 15 The Premiere Showing Of “Camp Editor Kadimah—The Story Of Our Lives” EDNA LEVINE 17 Spencer House Seniors Enjoy Christmas, Contributing Editor Thanks To AJC Volunteers JOEL JACOBSON ON THE COVER Scholarship Information Design Judean Desert from on pages 25 and 29 MEGHAN RUSHTON Mount Scopus Campus, by Tom Forrestall Advertising This beautiful, original watercolour is 15” x 22” on IN EVERY ISSUE EDNA LEVINE paper, from the series 35 Days in Israel is available for 4 President’s message: Marilyn Kaufman purchase from the AJC: $4,100 framed (plus delivery). Address all correspondence, please contact Naomi Rosenfeld, AJC executive director, 5 From the desk of Naomi Rosenfeld, including advertising enquires, to: [email protected] Executive Director Tom Forrestall is one of Canada’s most acclaimed and EDITOR, C/O SHALOM exciting realist painters. Forrestall was born in Annapolis 7 From the desk of Edna LeVine, ATLANTIC JEWISH COUNCIL Valley of Nova Scotia in 1936. -

Talking to Jewellers

Talking to jewellers The jewellery retail industry in Canada is made up of a few large retail chains, and thousands of independent jewellers. Below you will find some information and suggestions on approaching independent jewellers and chains. We suggest that you focus your efforts with the jewellers postcards on the jewellery retail chains listed in the “Top 5” document – once these industry leaders support actions to end the trade in conflict diamonds, the rest won’t be far behind. Jewellery Retail Chains Jewellery retail chains will likely have previous knowledge and policies around conflict diamonds and the Kimberley Process. Managers of local stores will not be able to make decisions about joining Canadian Jewellers for Conflict-free Diamonds; the manager will likely refer you to someone higher-up in the chain of command. However, be assured that your visit will be noted, and passed on to decision-makers at the head office! Your visit will be an important part of the overall pressure to encourage these jewellery retail chains to join Canadian Jewellers for Conflict-free Diamonds. Guidelines for talking to jewellery retail chains 1. Pick a jeweller from the “Top 5” document that has a location near to you (visit their website to find local locations, or go to www.canadianjewellers.com for a list of Canadian jewellery retailers near you). 2. On the back of the postcard, sign your name and fill in the jeweller’s name and address. 3. Prepare for questions you might encounter by referring to Q&A documents in your Activist Package. 4. Ask to speak to the store manager. -

Research in Progress – September 2013

CAPITAL HEALTH Research in Progress Volume 6, Issue 4 Capital Health to House Maritime Strategic The Maritime SPOR Support Unit rapid access to high quality and cost- Patient-Oriented(MSSU) was recently established Research in the effectiveSupport health Unitcare. By (SPOR)basing the Centre for Clinical Research at Capital research on real world data, the MSSU Health on University Avenue. The Unit is SPOR will provide policy- and decision- headed by Nominated Principal Investi- makers with evidence of the effective- gator Adrian Levy, Head and ness, safety and cost-effectiveness of District Chief of the Department of alternative management and policy Community Health and Epidemiology. interventions. A key element is patient It is staffed by the recent addition of engagement in the selection of research Glenn Davis as Program Director, priorities for study and interpretation of Angela Hire and Terrilyn Chiasson as results. Coordinators, and Marsha Bennett pro- viding administrative support. The MSSU will provide strategic and technical expertise in observational and The research and analysis arm of the experimental research, consultancy unit will include Lynn Lethbridge as services, training and access to linked Research Manager and will rely on the databases that can be used to validate services of the Research Methods Unit technology and therapeutic options. In (RMU), support from Capital Health addition to the increased application of Research Services, the NS Cochrane data in healthcare research, the MSSU Centre, and Health Data NS (formerly will support: the Population Health Research Unit). 1. Methodology The MSSU is the Maritime province’s (Support and Development) contribution to the national Strategic 2. -

Shalom Evokes Memories CONNECTING the ATLANTIC JEWISH COMMUNITY

WINTER 2019 AJC President Michael Argand Retires 15th Annual Holocaust Education Week St. John’s Sign Discovery Shalom Evokes Memories CONNECTING THE ATLANTIC JEWISH COMMUNITY POWER AND VICTORY BY MAXWELL SMART, 1972 Thank you to all our sponsors, supporters, volunteers and audience, we couldn’t have done it without you. WE HOPE TO SEE YOU AGAIN NEXT YEAR! AJFF.ca SPONSORS Nova Scotia Department of Communities, Culture and Heritage EXECUTIVE PRODUCER Israel Bonds Canada PRODUCERS Charm Diamond Centres | Cineplex Entertainment LP | Menemsha Films DIRECTOR Mahone Bay Trading Co. TOP BILLINGS Autism NS | Bishop’s Cellar | Bluenose Seafood | Centre for Israel and Jewish Affairs EL AL Airlines | FIN: Atlantic Film Festival | Labi Kousoulis, MLA Halifax Citadel—Sable Island Moskowitz Capital | My Mother’s Bloomers | Photopolis | SOMA Vein & Laser Centre CAST MEMBER SPONSORS Rosalind & Philip Belitsky | Dawn Frail & Tim Margolian | Victor & Judith Goldberg Linda Law & Lloyd Newman | Lezlie Oler & David Zitner | Joan and Ron Pink | Lynda Suissa CAST MEMBER ADVERTISERS About Care Healthcare Inc. | Andy Fillmore, MP | Barrie Green, CPA, CA | Designer Craft Shop Gary Burrill, MLA Halifax Chebucto | Halcraft | Jessica Margolian, Royal LePage | PC Caucus Shaar Shalom Synagogue | Studio 14 Gifts & Gallery | Websavers FILM FANS Jane & David Alexander | Karen & Howard Conter | Howard Epstein The Honourable Myra Freeman & Mr. Lawrence Freeman | Roselle Green & Family | Julie Kristoff Valerie MacDonald & Jim Spatz | Jo-Anne Nozick & Michael Argand | Jennifer & Wayne O’Connor Gloria & Steven Pink | Rita & Joel Pink | Molly Rechnitzer | Ethel & Mark Rosen | Victoria & Ed Rosenberg Jeff Schelew & Debbie Stover | Ann & Howard Thaw | Louise & Andrew Wolfson A SPECIAL THANKS TO Chabad Kosher Delights | East Coast Bakery | Sweet Ideas IN THIS ISSUE WINTER 2019 VOL. -

Feature Article

Labour Market Bulletin Ontario January 2017 This Labour Market Bulletin provides an analysis of Labour Force Survey results for the province of Ontario, including the regions of Hamilton–Niagara Peninsula, Kingston–Pembroke, Kitchener–Waterloo–Barrie, London, Muskoka–Kawarthas, Northeast, Northwest, Ottawa, Stratford–Bruce Peninsula, Toronto and Windsor–Sarnia. OVERVIEW Labour Force Trends – Ontario employment increases again in January • Ontario employment figures increased by 28,800 in January for the sixth consecutive monthly gain • Both full-time (+5,300) and part-time (+23,500) employment experienced gains • The unemployment rate held steady at 6.4% compared with the previous month In January, Ontario employment climbed for the sixth consecutive month with an increase of 28,800. January saw gains in both full-time (+5,300) and part-time (+23,500) employment, although the majority of the gains came from part-time employment. Compared with December, the provincial unemployment rate in January held steady at 6.4%, as unemployment marginally increased by 5,600. The labour force expanded by 34,300 and the participation rate increased to 65.1% in January from 64.9% in December. In Canada, employment increased by 48,300 in January which continued two months of employment gains and beat the expected employment decline of 5,000.1 The gains came from a mix of full-time (15,800) and part-time (32,400) employment. National employment growth in January was driven mainly by gains in Ontario and British Columbia, alongside losses in New Brunswick and Saskatchewan. The national unemployment rate in January was down to 6.8% from 6.9% in December. -

STORE2019 Delegatelist Final

STORE2019 DelegateList Final Company Name Title 3M Canada A, Lassonde Inc Key Account Manager A. Lassonde Inc. Senior Marketing Director A. Lassonde Inc. Vice President R&D A. Lassonde Inc. A. Lassonde Inc. Director of Sales National Accounts A.G. Brown President A.G. Brown VP Business Development A.Lassonde VP Sales A1 Counting Solutions President A1 Counting Solutions Vice President Marketing & BD ABLE BC Executive Director ACCEO Vice President of Acquirer Relations and Product Innovation Active International Director, Client Solutions Active International SVP, Media Active International VP Strategic Partnerships Active International VP, Marketing and Culture Ad Display Vice President AD Display President Adidas Group Canada Senior Manager Marketing & Visual Merchandising Adidas Group Canada Director Merchandising, Planning & Allocation Adidas Group Canada DTC Marketing Manager Adidas Group Canada Director of Stores Adidas Group Canada VP, Direct to Consumer Administration portuaire de Montréal Directrice, Croissance et développement Adobe Account Director Adult Fun Superstore Owner Adult Fun Superstore General Manager Advanced Symbolics Business Development and Marketing Specialist Adyen Account Executive Adyen Country Manager, Canada AEO Inc. Vice President, Financial Planning & Analysis Aeroplan Inc. Director, Retail & Commercial Development Aeroplan Inc. Vice President - Business & Commercial Development AIR MILES Reward Program AD, Content & Communications AIR MILES Reward Program Senior Vice President, Collector Experience & Marketing -

JSN Jewellery Group (Staff Organization Chart)

Court File No. CV-16-011478-00CL ONTARIO SUPERIOR COURT OF JUSTICE COMMERCIAL LIST BETWEEN: SALUS CAPITAL PARTNERS, LLC Applicant and - J.S.N. JEWELLERY INC., J.S.N. JEWELLERY UK LIMITED, GMJ CORP., 2373138 ONTARIO INC., ALWAYS & FOREVER FAMILY COLLECTION INCORPORATED AND P.M.R. INC. Respondents APPLICATION UNDER SUBSECTION 243(1) OF THE BANKRUPTCY AND INSOLVENCY ACT, R.S.C. 1985, c. B-3, AS AMENDED AND SECTION 101 OF THE COURTS OF JUSTICE ACT, R.S.0.1990, c. C.43, AS AMENDED RESPONDING MOTION RECORD OF THE RECEIVER, RICHTER ADVISORY GROUP INC., IN ITS CAPACITY AS RECEIVER OF J.S.N. JEWELLERY INC., J.S.N. JEWELLERY UK LIMITED, GMJ CORP., 2373138 ONTARIO INC., ALWAYS & FOREVER FAMILY COLLECTION INCORPORATED AND P.M.R. INC. (Re: Utopia/Sharon Stone Motion) Volume 1 of 2 September 22, 2016 FASKEN MARTINEAU DUMOULIN LLP Barristers and Solicitors 333 Bay Street, Suite 2400 Bay Adelaide Centre, Box 20 Toronto, ON M5H 2T6 Stuart Brotman (LSUC# 43430D) Tel: 416 865 5419 Fax: 416 364 7813 sbrotman@fasken. com Aubrey E. Kauffman (LSUC# 18829N) Tel: 416 868 3538 Fax: 416 364 7813 [email protected] Lawyers for the Receiver, Richter Advisory Group Inc. 300245.00004/93848920.1 -2- TO: TORKIN MANES LLP Barristers & Solicitors 151 Yonge Street, Suite 1500 Toronto, ON M5C 2W7 Jeffrey J. Simpson Tel: (416) 863-1188 Fax: (4176)863-0305 j simpson@torkinmanes. com Lawyers for Utopia Jewellery Ltd. and Sharon Stone Inc. AIRD & BERLIS Barristers & Solicitors Brookfield Place 181 Bay Street, Suite 1800 Toronto, ON M5J 2T9 Kenneth R.