Jazz Pharmaceuticals Plc Proxy Statement 2018 Annual Report Proxy Statement — 2018 Annual Report June 14, 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 Financial Markets Preview Living Creatively

REPRINT FROM JANUARY 2, 2012 BioCentury ™ THE BERNSTEIN REPORT ON BIOBUSINESS Article Reprint • Page 1 of 8 2012 Financial Markets Preview Living creatively By Stacy Lawrence “As the capital markets Viren Mehta of Mehta Partners. “Many Senior Writer companies don’t have any option but to For small, early stage biotech compa- continue to be difficult, raise at lower valuations.” nies, 2012 could be the year of living traditional investors are able He added: “Many companies are not creatively. able to defer any longer. The moment Although public biotechs raised more to extract terms that are comes for many companies when they funds last year than ever before, the vast have to swallow hard and accept painful majority of the money was debt financing more and more onerous.” dilution.” by established companies with marketed products. Thus while the overall numbers Todd Wyche, Brinson Patrick look good and are likely to continue to do Cash on hand so, precommercial companies will have to large and mid-cap companies (see “The Market volatility and macroeconomic get creative with their financings. 1% Effect,” page 2). risk had most buysiders sitting on the Many of these companies avoided rais- In 2011, public biotechs raised $43 sidelines through the back half of 2011. ing money in 2011 because they didn’t billion, easily eclipsing the record $33.1 Bankers are hopeful that this year will be like the valuations, but Wall Streeters say billion in 2000. But debt accounted for more stable, in which case investors might they are now running out of cash. As a 82% of the total dollars raised, compared be willing to support more deal flow dur- result, they will have to use the tricks at to only 19% in 2000 (see “Debt Domi- ing 1H12 (see “Fear Factor,” page 5). -

Q1 Pharma Sector Snapshot

SPECIALTY & GENERIC PHARMA Q1 2021 Report Market Commentary – Debt Capital Markets Debt Markets ▪ 2020 saw increased amounts of debt used in buyouts across the board, resulting in the highest debt / EBITDA Median US Buyout Multiples levels since 2014 − The increased use of debt was driven by 2H20 back- end loaded lending activity (primarily 4Q20) as 16.0x 12.7x 14.1x 12.2x 12.0x 11.6x 11.5x certainty around the U.S. election and vaccination 11.1x 10.0x 9.8x 12.0x 9.7x expectations increased 9.4x 8.6x 8.3x 8.2x 7.5x 7.8x 5.2x 6.7x 5.7x 5.6x ▪ 8.0x 5.9x As the effects of COVID now begin to diminish, debt 5.4x 4.4x 4.1x 3.7x 4.6x 4.3x 3.8x markets have seemingly recovered, signaling that 3.6x lenders have become increasingly comfortable with 4.0x 4.3x 6.9x 6.5x 6.3x 6.0x 5.9x 5.7x 5.7x 5.7x 5.7x 5.6x 5.3x 4.5x 4.4x macroeconomic and company-specific fundamentals 4.3x 0.0x 3.2x − With increased confidence, lenders are currently looking to provide strong leverage for high-quality assets, particularly ones that have proven their Debt/EBITDA Equity/EBITDA EV/EBITDA stability through the recent market downturn Source: PitchBook ▪ The spread on U.S. high-yield debt has returned to pre- Historical US High Yield Debt Effective Yield COVID levels − 4.22% current effective yield compared with a 12.0% 11.4% 11.38% effective yield on March 23, 2020 (peak of the pandemic) 9.0% ▪ We expect increased activity by lenders in 2021 due to: 6.0% 4.2% − Pent-up demand in M&A activity driven by the impact of COVID 3.0% − Limited Partner agreements and investor -

Amgen Inc. V. Sanofi, No

No. IN THE Supreme Court of the United States ———— AMGEN INC., AMGEN MANUFACTURING LIMITED, AND AMGEN USA, INC., Petitioners, v. SANOFI, AVENTISUB LLC, REGENERON PHARMACEUTICALS INC., AND SANOFI-AVENTIS U.S., LLC, Respondents. ———— On Petition for a Writ of Certiorari to the United States Court of Appeals for the Federal Circuit ———— PETITION FOR A WRIT OF CERTIORARI ———— STUART L. WATT JEFFREY A. LAMKEN WENDY A. WHITEFORD Counsel of Record ERICA S. OLSON MICHAEL G. PATTILLO, JR. EMILY C. JOHNSON SARAH J. NEWMAN AMGEN INC. MOLOLAMKEN LLP One Amgen Center Drive The Watergate, Suite 660 Thousand Oaks, CA 91320 600 New Hampshire Ave., NW (805) 447-1000 Washington, D.C. 20037 (202) 556-2000 [email protected] Counsel for Petitioners :,/621(3(635,17,1*&2,1&± ±:$6+,1*721'& QUESTION PRESENTED The 1952 Patent Act requires patents to “contain a written description of the invention, and of the manner and process of making and using it.” 35 U.S.C. §112(a). The “written description” must be “in such full, clear, concise, and exact terms as to enable any person skilled in the art to which it pertains, or with which it is most nearly connected, to make and use the same.” Ibid. “The object of the statute is to require the patentee to describe his invention so that others may construct and use it after the expiration of the patent.” Schriber-Schroth Co. v. Cleveland Tr. Co., 305 U.S. 47, 57 (1938). The Federal Circuit has construed §112(a) as impos- ing separate “written description” and “enablement” re- quirements subject to different standards. -

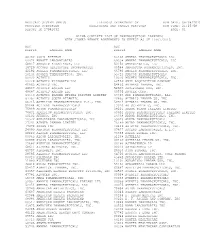

Medicaid System (Mmis) Illinois Department of Run Date: 08/08/2015 Provider Subsystem Healthcare and Family Services Run Time: 21:25:58 Report Id 2794D052 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 08/08/2015 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 21:25:58 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 10/01/2015 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 65162 AMNEAL PHARMACEUTICALS LLC 00074 ABBOTT LABORATORIES 69238 AMNEAL PHARMACEUTICALS, LLC 68817 ABRAXIS BIOSCIENCE, LLC 53150 AMNEAL-AGILA, LLC 16729 ACCORD HEALTHCARE INCORPORATED 00548 AMPHASTAR PHARMACEUTICALS, INC. 42192 ACELLA PHARMACEUTICALS, LLC 66780 AMYLIN PHARMACEUTICALS, INC. 10144 ACORDA THERAPEUTICS, INC. 55724 ANACOR PHARMACEUTICALS 00472 ACTAVIS 10370 ANCHEN PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 62559 ANIP ACQUISITION COMPANY 45963 ACTAVIS INC. 54436 ANTARES PHARMA, INC. 46987 ACTAVIS KADIAN LLC 52609 APO-PHARMA USA, INC. 49687 ACTAVIS KADIAN LLC 60505 APOTEX CORP. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 63323 APP PHARMACEUTICALS, LLC. 67767 ACTAVIS SOUTH ATLANTIC 42865 APTALIS PHARMA US, INC 66215 ACTELION PHARMACEUTICALS U.S., INC. 58914 APTALIS PHARMA US, INC. 52244 ACTIENT PHARMACEUTICALS 13310 AR SCIENTIFIC, INC. 75989 ACTON PHARMACEUTICALS 08221 ARBOR PHARM IRELAND LIMITED 76431 AEGERION PHARMACEUTICALS, INC. 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 50102 AFAXYS, INC. 24338 ARBOR PHARMACEUTICALS, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 59923 AREVA PHARMACEUTICALS 27241 AJANTA PHARMA LIMITED 76189 ARIAD PHARMACEUTICALS, INC. 17478 AKORN INC 24486 ARISTOS PHARMACEUTICALS, INC. 24090 AKRIMAX PHARMACEUTICALS LLC 67877 ASCEND LABORATORIES, L.L.C. 68220 ALAVEN PHARMACEUTICAL, LLC 76388 ASPEN GLOBAL INC. 00065 ALCON LABORATORIES, INC. 51248 ASTELLAS 00998 ALCON LABORATORIES, INC. 00469 ASTELLAS PHARMA US, INC. 25682 ALEXION PHARMACEUTICALS 00186 ASTRAZENECA LP 68611 ALIMERA SCIENCES, INC. -

Amgen 2008 Annual Report and Financial Summary Pioneering Science Delivers Vital Medicines

Amgen 2008 Annual Report and Financial Summary Pioneering science delivers vital medicines About Amgen Products Amgen discovers, develops, manufactures Aranesp® (darbepoetin alfa) and delivers innovative human therapeutics. ® A biotechnology pioneer since 1980, Amgen Enbrel (etanercept) was one of the fi rst companies to realize ® the new science’s promise by bringing EPOGEN (Epoetin alfa) safe and effective medicines from the lab Neulasta® (pegfi lgrastim) to the manufacturing plant to patients. NEUPOGEN® (Filgrastim) Amgen therapeutics have changed the practice of medicine, helping millions of Nplate® (romiplostim) people around the world in the fi ght against ® cancer, kidney disease, rheumatoid Sensipar (cinacalcet) arthritis and other serious illnesses, and so Vectibix® (panitumumab) far, more than 15 million patients worldwide have been treated with Amgen products. With a broad and deep pipeline of potential new medicines, Amgen remains committed to advancing science to dramatically improve people’s lives. 0405 06 07 08 0405 06 07 08 0405 06 07 08 0405 06 07 08 Total revenues “Adjusted” earnings Cash fl ow from “Adjusted” research and ($ in millions) per share (EPS)* operations development (R&D) expenses* (Diluted) ($ in millions) ($ in millions) 2008 $15,003 2008 $4.55 2008 $5,988 2008 $2,910 2007 14,771 2007 4.29 2007 5,401 2007 3,064 2006 14,268 2006 3.90 2006 5,389 2006 3,191 2005 12,430 2005 3.20 2005 4,911 2005 2,302 2004 10,550 2004 2.40 2004 3,697 2004 1,996 * “ Adjusted” EPS and “adjusted” R&D expenses are non-GAAP fi nancial measures. See page 8 for reconciliations of these non-GAAP fi nancial measures to U.S. -

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry

The Impact of Secondary Innovation on Firm Market Value in the Pharmaceutical Industry By: Maitri Punjabi Honors Thesis Economics Department The University of North Carolina at Chapel Hill March 2016 Approved: ______________________________ Dr. Jonathan Williams Punjabi 2 Abstract This paper analyzes the effect of the changing nature of innovation on pharmaceutical firm market value from the years 1987 to 2010 by using U.S. patent and claim data. Over the years, firms have started shifting focus from primary innovation to secondary innovation as new ideas and new compounds become more difficult to generate. In this study, we analyze the impact of this patent portfolio shift on the market capitalization of pharmaceutical firms. After using firm fixed effects and the instrumental variable approach, we find that there exists a strong positive relationship between secondary innovations and the market value of the firm– in fact, we find a stronger relationship than is observed between primary innovation and market value. When focusing on the different levels of innovation within the industry, we find that this relationship is stronger for less-innovative firms (those that have produced fewer patents) than it is for highly- innovative firms. We also find that this relationship is stronger for firms that spend less on research and development, complementing earlier findings that research productivity is declining over time. Punjabi 3 Acknowledgements I would primarily like to thank my adviser, Dr. Jonathan Williams, for his patience and constant support. Without his kind and helpful attitude, this project would have been a much more frustrating process. Through his knowledge of the industry, I have gained valuable insight and have learned a great deal about a unique and growing field. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Form

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF ☒ 1934 For the fiscal year ended December 31, 2008 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT ☐ OF 1934 Commission file number 000-12477 Amgen Inc. (Exact name of registrant as specified in its charter) Delaware 95-3540776 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) One Amgen Center Drive, 91320-1799 Thousand Oaks, California (Zip Code) (Address of principal executive offices) (805) 447-1000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(g) of the Act: Common stock, $0.0001 par value; preferred share purchase rights (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Fidelity® Select Portfolio® Pharmaceuticals Portfolio

Quarterly Holdings Report for Fidelity® Select Portfolio® Pharmaceuticals Portfolio November 30, 2020 PHR-QTLY-0121 1.810707.116 Schedule of Investments November 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 98.3% Shares Value Shares Value Biotechnology – 17.6% Bausch Health Cos., Inc. (Canada) (a) 535,300 $ 9,937,694 Biotechnology – 17.6% Bristol‑Myers Squibb Co. 1,295,680 80,850,432 Acceleron Pharma, Inc. (a) 128,800 $ 15,207,416 Catalent, Inc. (a) 75,400 7,248,956 Amgen, Inc. 137,400 30,508,296 Elanco Animal Health, Inc. (a) 172,400 5,273,716 Argenx SE (a) 17,400 4,983,924 Eli Lilly & Co. 416,961 60,730,370 Ascendis Pharma A/S sponsored ADR (a) 51,300 8,655,849 GlaxoSmithKline PLC sponsored ADR 348,300 12,813,957 Atea Pharmaceuticals, Inc. 39,800 1,326,136 Harmony Biosciences Holdings, Inc. 133,077 5,467,801 Athenex, Inc. (a) (b) 166,800 2,273,484 Horizon Therapeutics PLC (a) 316,100 22,262,923 BioNTech SE ADR (a) (b) 50,148 6,230,388 Intra‑Cellular Therapies, Inc. (a) 107,000 2,529,480 Blueprint Medicines Corp. (a) 80,300 8,678,824 Johnson & Johnson 337,850 48,880,138 ChemoCentryx, Inc. (a) 6,400 352,960 Merck & Co., Inc. 515,936 41,476,095 Galapagos Genomics NV sponsored ADR (a) 36,900 4,524,309 Nektar Therapeutics (a) (b) 368,233 6,035,339 Generation Bio Co. (b) 16,738 807,106 Novartis AG sponsored ADR 441,496 40,101,082 Generation Bio Co. -

United States Securities and Exchange Commission Form 10-K Shire Pharmaceuticals Group

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 1999 អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 0-29630 SHIRE PHARMACEUTICALS GROUP PLC (Exact name of registrant as specified in its charter) England and Wales (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) N.A. East Anton, Andover, Hampshire SP10 5RG England (Address of principal executive offices) (Zip Code) 44 1264 333455 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered American Depository Shares, each representing Nasdaq National Market 3 Ordinary Shares, 5 pence nominal value per share Securities registered pursuant to Section 12(g) of the Act: None (Title of class) Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ፤ No អ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference to Part III of this Form 10-K or any amendment to this Form 10-K. -

12/31/20 at 0.06% Due 01/04/21 $ 969,572 969,572 Barclays Capital, Inc

Biotechnology Fund SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2020 Shares Value COMMON STOCKS† - 99.6% Biotechnology - 72.9% Amgen, Inc. 46,124 $ 10,604,830 Gilead Sciences, Inc. 137,327 8,000,671 Vertex Pharmaceuticals, Inc.* 30,030 7,097,290 Illumina, Inc.* 18,293 6,768,410 Regeneron Pharmaceuticals, Inc.* 13,496 6,520,053 Biogen, Inc.* 22,700 5,558,322 Moderna, Inc.* 49,814 5,204,069 Corteva, Inc. 125,161 4,846,234 Alexion Pharmaceuticals, Inc.* 30,030 4,691,887 Seagen, Inc.* 26,529 4,646,289 Exact Sciences Corp.* 31,204 4,134,218 Incyte Corp.* 44,634 3,882,265 Bio-Rad Laboratories, Inc. — Class A* 6,450 3,759,963 BioMarin Pharmaceutical, Inc.* 38,909 3,411,930 Alnylam Pharmaceuticals, Inc.* 25,838 3,358,165 Guardant Health, Inc.* 25,656 3,306,545 Mirati Therapeutics, Inc.* 13,253 2,910,889 Ionis Pharmaceuticals, Inc.* 48,279 2,729,695 ACADIA Pharmaceuticals, Inc.* 49,103 2,625,046 CRISPR Therapeutics AG* 16,740 2,563,061 BeiGene Ltd. ADR* 9,710 2,508,967 Acceleron Pharma, Inc.* 18,632 2,383,778 Iovance Biotherapeutics, Inc.* 50,194 2,329,002 Arrowhead Pharmaceuticals, Inc.* 30,137 2,312,412 United Therapeutics Corp.* 15,148 2,299,315 BioNTech SE ADR*,1 27,800 2,266,256 Ultragenyx Pharmaceutical, Inc.* 16,339 2,261,808 Twist Bioscience Corp.* 15,850 2,239,446 Exelixis, Inc.* 111,104 2,229,857 Novavax, Inc.*,1 19,860 2,214,589 Amicus Therapeutics, Inc.* 95,070 2,195,166 Halozyme Therapeutics, Inc.* 50,560 2,159,418 Blueprint Medicines Corp.* 18,770 2,105,056 Fate Therapeutics, Inc.* 23,040 2,095,027 Sage Therapeutics, Inc.* 23,286 2,014,472 Biohaven Pharmaceutical Holding Company Ltd.* 22,920 1,964,473 Arena Pharmaceuticals, Inc.* 25,260 1,940,726 ChemoCentryx, Inc.* 30,270 1,874,318 PTC Therapeutics, Inc.* 29,928 1,826,506 Emergent BioSolutions, Inc.* 20,360 1,824,256 Bluebird Bio, Inc.* 36,415 1,575,677 Global Blood Therapeutics, Inc.* 34,845 1,509,137 Inovio Pharmaceuticals, Inc.*,1 125,840 1,113,684 Total Biotechnology 143,863,178 Pharmaceuticals - 17.5% AbbVie, Inc. -

Horizon Pharma Plc 2018 Irish Statutory Accounts

Horizon Pharma plc 2018 Irish Statutory Accounts (“Irish Annual Report”) CONTENTS Page DIRECTORS AND OTHER INFORMATION 2 DIRECTORS' REPORT 3 – 69 INDEPENDENT AUDITOR’S REPORT 70 – 75 CONSOLIDATED PROFIT AND LOSS ACCOUNT 76 CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS 77 CONSOLIDATED BALANCE SHEET 78 – 79 CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY 80 CONSOLIDATED STATEMENT OF CASH FLOWS 81 – 82 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 83 – 142 PARENT COMPANY FINANCIAL STATEMENTS 143 – 153 DIRECTORS AND OTHER INFORMATION Board of Directors at December 31, 2018 Timothy P. Walbert Michael Grey William F. Daniel Jeff Himawan, Ph.D. Ronald Pauli Gino Santini James Shannon, M.D. H. Thomas Watkins Pascale Witz Secretary and Registered Office Anne-Marie Dempsey Connaught House 1st Floor 1 Burlington Road Dublin 4 D04 C5Y6 Ireland Registered Number: 507678 Auditor PricewaterhouseCoopers Chartered Accountants and Statutory Audit Firm One Spencer Dock North Wall Quay Dublin 1 D01 X9R7 Ireland Solicitor Matheson 70 Sir John Rogerson’s Quay Grand Canal Dock Dublin 2 D02 R296 Ireland 2 DIRECTORS’ REPORT The directors present their report and the audited financial statements of the Company (as defined below) for the financial year ended December 31, 2018. Basis of Presentation The Company is a public limited company formed under the laws of Ireland. The Company operates through a number of international and U.S. subsidiaries with principal business purposes to either perform research and development or manufacturing operations, serve as distributors -

Biopharma Leaders Join Trump and Thunberg in Davos

No. 3989 January 31, 2020 again a key theme at Davos, and many biopharma executives are joining the con- versation this year. These include Werner Baumann, CEO of Bayer, who spoke on a panel on 21 Janu- ary about ‘When Humankind Overrides Evolution,’ focusing on gene-editing tech- nologies for use in agriculture, food and medicine. Meanwhile Takeda CEO Chris- tophe Weber joins a discussion on shap- ing the future of health and healthcare systems on 22 January. Speaking on the gene-editing panel, Baumann said there was “less and less trust in society for the advances of tech- nology,” adding that “the only way to get beyond it is that we do a better job in terms of explaining what we are doing.” Bayer is working with CRISPR Thera- peutics on CRISPR/Cas9 gene-editing in hemophilia, ophthalmology and autoim- Biopharma Leaders Join Trump mune diseases, but also has a major stake in genetically modified seeds via its Mon- And Thunberg In Davos santo division. He called for absolute transparency ANDREW MCCONAGHIE [email protected] from corporations and governments on gene-editing technology, but also decried fter focusing on the year ahead tive to plant 1 trillion trees, an effort aimed the previous “insane dominance” that anti- in biopharma business at the J.P. at soaking up rising levels of carbon diox- GM crop campaigners have been allowed AMorgan conference in San Fran- ide in the atmosphere. to wield. cisco last week, the sector’s attention has 17-year-old environmental campaigner Others taking part include Stéphane switched to the World Economic Forum in Greta Thunberg made her own address to Bancel, Moderna Therapeutics’ chief exec- Davos, Switzerland from 21-24 January.