United States Securities and Exchange Commission Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alkermes Public Limited Company

ALKERMES PUBLIC LIMITED COMPANY Directors’ Report and Consolidated Financial Statements For the Year Ended March 31, 2013 ALKERMES PLC Table of Contents Page Directors’ Report .......................................................... 2 Statement of Directors’ Responsibilities .......................................... 56 Independent Auditors’ Report—Group ........................................... 57 Consolidated Profit and Loss Account ........................................... 59 Consolidated Statement of Comprehensive Income (Loss) ............................. 60 Consolidated Balance Sheet ................................................... 61 Consolidated Statement of Cash Flows ........................................... 63 Consolidated Reconciliation of Shareholders’ Funds ................................. 62 Notes to the Consolidated Financial Statements .................................... 64 Independent Auditors’ Report—Company ......................................... 111 Company Balance Sheet ..................................................... 113 Notes to the Company Financial Statements ....................................... 114 1 DIRECTORS’ REPORT For the Year Ended March 31, 2013 The directors present their report and audited consolidated financial statements for the fiscal year ended March 31, 2013. The directors have elected to prepare the consolidated financial statements in accordance with section 1 of the Companies (Miscellaneous Provisions) Act, 2009, which provides that a true and fair view of the state of -

In Re: Alkermes Securities Litigation 03-CV-12091-Consolidated

Case 1:03-cv-12091-RCL Document 39 Filed 07/12/2004 Page 1 of 49 UNITED STATES DISTRICT COURT DISTRICT OF MASSACHUSETTS In re ALKERMES SECURITIES ) Master Docket No. 03-CV-12091-RCL LITIGATION ) ) CLASS ACTION This Document Relates To: ) ) ALL ACTIONS. ) ) ) CONSOLIDATED COMPLAINT FOR VIOLATION OF THE FEDERAL SECURITIES LAWS Case 1:03-cv-12091-RCL Document 39 Filed 07/12/2004 Page 2 of 49 SUMMARY AND OVERVIEW 1. This is a securities class action on behalf of all purchasers of the common stock of Alkermes, Inc. (“Alkermes” or the “Company”) between April 22, 1999 and July 1, 2002 (the “Class Period”), against Alkermes and certain of its officers and directors for violations of the Securities Exchange Act of 1934 (the “Exchange Act”). 2. Alkermes is a biopharmaceutical company focused on the development of controlled- release drug delivery technologies and their application to existing or new drug therapies. Among the drug delivery technologies defendants seek to develop are sustained-release systems based on biodegradable polymeric microspheres, including those based on Medisorb polymers. 3. In 1996, Alkermes entered into an agreement with JPI Pharmaceutical International (“Janssen”), an affiliate of pharmaceutical giant Johnson & Johnson Pharmaceutical Research & Development, L.L.C. (“Johnson & Johnson”), to develop an injectable form of the schizophrenic drug Risperdal, based upon the Medisorb polymer technology, called Risperdal Consta. Janssen has marketed the oral form of Risperdal since 1993, with sales of $2.3 billion in 2003. According to a December 12, 2001 report by analysts Thomas Weisel Partners, LLC (“Thomas Weisel”), during the Class Period, oral Risperdal was the most prescribed drug in the $5.3 billion atypical antipsychotic market. -

Explanation of Conflict of Interest Disclosure Parts: Part One: All

Explanation of Conflict of Interest Disclosure Parts: Part One: All Financial Involvement with a pharmaceutical or biotechnology company, a company providing clinical assessment, scientific, or medical companies doing business with or proposing to do business with ACNP over past 2 years (Jan. 2011-Present) Part Two: Income Sources & Equity of $10,000 or greater Part Three: Financial Involvement with a pharmaceutical or biotechnology company, a company providing clinical assessment, scientific, or medical products or companies doing business with or proposing to do business with ACNP which constitutes more than 5% of personal income (Jan. 2011-Present): Part Four: Grants from pharmaceutical or biotechnology company, a company providing clinical assessment, scientific, or medical products directly, or indirectly through a foundation, university, or any other organization (Jan. 2011-Present) Part Five: My primary employer is a pharmaceutical/biotech/medical device company. 2012 Program Committee Disclosures Anissa Abi-Dargham: Part 1: Pfizer; Otsuka; Takeda; Sunovion; Shire; Roche; Pierre Favre; Part 2: Pierre Favre William Carlezon: Part 1: Referring to 2010-2011: Scientific Advisory Board, Myneurolab.com; Consultant, Concert Pharmaceuticals; Consultant, Lantheus Medical Imaging; Consultant, Transcept Pharmaceuticals, (Spouse) Senior Scientist, EMD Serono; Part 2: (Spouse) Senior Scientist, EMD Serono, Part 3: (Spouse) Senior Scientist, EMD Serono Cameron Carter: Part1: GlaxoSmithKline research; Part 4: GlaxoSmithKline Karl Deisseroth: Part -

Objectives & Accreditation

Objectives & Accreditation ACTIVITY FORMAT Live TARGET AUDIENCE This activity is designed to meet the needs of physicians, physician assistants, pharmacists, registered nurses, nurse practitioners, advance practice registered nurses, and registered dietitians with an interest in lipid management. TYPE OF ACTIVITY Live Activity; Application/ Knowledge EDUCATIONAL OBJECTIVES At the conclusion of this activity, Registered Nurses and Nurse Practitioners should be able to provide appropriate care and counsel for patients and their families. At the conclusion of this activity, all participants should be able to: Session I: The Impact of Genetics in Lipidology? Apply insight from human population genetics studies to identify novel therapeutic targets for a better understanding for atherosclerotic cardiovascular disease. Describe the current and future technologies available for genetic screen includinghow to apply them in clinical practice both for diagnosis and risk assessment Discuss experimental techniques in development for genetic manipulation to target inherited lipid disorders Keynote I Discuss ApoC3 as both a risk factor for ASCVD and as potential for therapeutic manipulation Session II- Focus on Lipoprotein (a) Discuss the epidemiology of Lipoprotein(a) (LP(a)) for both thrombosis and ASCVD Discuss the pathophysiology of LP(a) and how this impacts increased risk of ASCVD and thrombosis Discuss the status of current and emerging treatment options targeting LP(a) Clinical Lipidology Track- Critically appraise emerging research -

Final Attendee List

Jennifer Abnet GlaxoSmithKline I GlaxoSmithKline I Jane Arboleda APRN Guardant I Molly Benson Sanjiv Agarwala MD Puma Biotechnology I Cancer Expert Now I Joe Arminger AbbVie I Seth Berkowitz LCSW, Manmeet Ahluwalia MD, CCLS MBA Patricia Armstrong The Leukemia & Lymphoma Miami Cancer Institute I Novartis I Society V Steve Albers Kim Arnold APRN CPNP Barry Berman MD, MS Alexion V CPHON Florida Cancer Specialists I Servier Pharmaceuticals I Maritza Alencar DNP, Tizano Bernard MBA, APRN, BMTCN Sheila Arrington MSN, Cancer Care Centers of Miami Cancer Institute V APRN, NP-C, AOCN Brevard I Puma Biotechnology I Carmen Allen MSIT Ana Mari Bernardini Pharmavoxx V Shannon Ashmon Novartis Oncology I Eisai, Inc I Luly Almeida Bernard Berry MBA Incyte Corporation I Sarah Ashton MS AstraZeneca Pharmaceuticals Guardant Health I I Talat Almukhtar MD Orlando Health Cancer Melissa Austin Jason Bever Institute I Cancer Care Centers of Oncopeptides I Brevard I Beatrice Alvarado Roberts Amy Bignon MD Garland Avera Doyle Caris Life Sciences I University of Florida I Jazz Pharmaceuticals I Nadeem Bilani MD Tadeu Ambros MD Francie Babcock Cleveland Clinic I FCS I AMAG Pharmaceuticals/Covis I Angela Bilik RN BSN Douglas Anderson AstraZeneca I Incyte Corporation I Craig Bailey Astra Zeneca I Jamie Bilsky BS Blesson Andrews Genentech V Genentech I Kevin Barr Daiichi Sankyo I Rohit Bishnoi MD Ollie Annum PharmD University of Florida I BHMCR I Leonard Bennett PharmD EMD Serono I Brady Blackman Susmitha Apuri MD MorphoSys I Florida Cancer Specialists I Michael Bennett As of 4-22-21 Kimberly Blandon RN MSN Rick Breitenstein Memorial Cancer Institute I Apellis Pharmaceuticals I Denise Capo Karyopharm Therapeutics I Taryn Boiteau GlaxoSmithKline I Amanda Bridges Florida Society of Clinical Heidi Caravetta Tracy Bonds RN, BSN, Oncology I Exelixis, Inc. -

Pioneering New Markets Changing the Standard of Care

ANNUAL 2020 REPORT Pioneering New Markets Changing the Standard of Care UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 □ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 000-19125 Ionis Pharmaceuticals, Inc. (Exact name of Registrant as specified in its charter) Delaware 33-0336973 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 2855 Gazelle Court, Carlsbad, CA 92010 (Address of Principal Executive Offices) (Zip Code) 760-931-9200 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common Stock, $.001 Par Value ‘‘IONS’’ The Nasdaq Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No □ Indicate by check if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes □ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

2012 Financial Markets Preview Living Creatively

REPRINT FROM JANUARY 2, 2012 BioCentury ™ THE BERNSTEIN REPORT ON BIOBUSINESS Article Reprint • Page 1 of 8 2012 Financial Markets Preview Living creatively By Stacy Lawrence “As the capital markets Viren Mehta of Mehta Partners. “Many Senior Writer companies don’t have any option but to For small, early stage biotech compa- continue to be difficult, raise at lower valuations.” nies, 2012 could be the year of living traditional investors are able He added: “Many companies are not creatively. able to defer any longer. The moment Although public biotechs raised more to extract terms that are comes for many companies when they funds last year than ever before, the vast have to swallow hard and accept painful majority of the money was debt financing more and more onerous.” dilution.” by established companies with marketed products. Thus while the overall numbers Todd Wyche, Brinson Patrick look good and are likely to continue to do Cash on hand so, precommercial companies will have to large and mid-cap companies (see “The Market volatility and macroeconomic get creative with their financings. 1% Effect,” page 2). risk had most buysiders sitting on the Many of these companies avoided rais- In 2011, public biotechs raised $43 sidelines through the back half of 2011. ing money in 2011 because they didn’t billion, easily eclipsing the record $33.1 Bankers are hopeful that this year will be like the valuations, but Wall Streeters say billion in 2000. But debt accounted for more stable, in which case investors might they are now running out of cash. As a 82% of the total dollars raised, compared be willing to support more deal flow dur- result, they will have to use the tricks at to only 19% in 2000 (see “Debt Domi- ing 1H12 (see “Fear Factor,” page 5). -

Q1 Pharma Sector Snapshot

SPECIALTY & GENERIC PHARMA Q1 2021 Report Market Commentary – Debt Capital Markets Debt Markets ▪ 2020 saw increased amounts of debt used in buyouts across the board, resulting in the highest debt / EBITDA Median US Buyout Multiples levels since 2014 − The increased use of debt was driven by 2H20 back- end loaded lending activity (primarily 4Q20) as 16.0x 12.7x 14.1x 12.2x 12.0x 11.6x 11.5x certainty around the U.S. election and vaccination 11.1x 10.0x 9.8x 12.0x 9.7x expectations increased 9.4x 8.6x 8.3x 8.2x 7.5x 7.8x 5.2x 6.7x 5.7x 5.6x ▪ 8.0x 5.9x As the effects of COVID now begin to diminish, debt 5.4x 4.4x 4.1x 3.7x 4.6x 4.3x 3.8x markets have seemingly recovered, signaling that 3.6x lenders have become increasingly comfortable with 4.0x 4.3x 6.9x 6.5x 6.3x 6.0x 5.9x 5.7x 5.7x 5.7x 5.7x 5.6x 5.3x 4.5x 4.4x macroeconomic and company-specific fundamentals 4.3x 0.0x 3.2x − With increased confidence, lenders are currently looking to provide strong leverage for high-quality assets, particularly ones that have proven their Debt/EBITDA Equity/EBITDA EV/EBITDA stability through the recent market downturn Source: PitchBook ▪ The spread on U.S. high-yield debt has returned to pre- Historical US High Yield Debt Effective Yield COVID levels − 4.22% current effective yield compared with a 12.0% 11.4% 11.38% effective yield on March 23, 2020 (peak of the pandemic) 9.0% ▪ We expect increased activity by lenders in 2021 due to: 6.0% 4.2% − Pent-up demand in M&A activity driven by the impact of COVID 3.0% − Limited Partner agreements and investor -

Perrigo Needs Deal to Thwart Mylan

November 02, 2015 Perrigo needs deal to thwart Mylan Madeleine Armstrong Perrigo continues to resist Mylan’s overtures, but a deal is looking increasingly likely after its attempts to block the buy in court failed. Mylan has until November 13 to tempt Perrigo shareholders under Irish takeover rules. An acquisition of its own might now be the only hope for Perrigo in this buy-or-be-bought saga. But, with increasing consolidation in the speciality pharma space, the pool of potential targets is dwindling (see table below). The best option looks like Endo International, though its market cap of nearly $14bn might make it too big a bite for Perrigo, which has just $5bn in cash. But if Perrigo could pull it off it would gain a company with one of the best forecast growth rates in mid-tier pharma. Jazz Pharmaceuticals, Meda or Lundbeck could be easier to digest but the last, with faltering sales, might not be such an attractive proposition. Perrigo and its potential acquisition targets Company Based Market cap ($bn) 2014 sales ($m) 2020e sales ($m) CAGR Perrigo Ireland 23.1 815 1,388 +9% Endo International US 13.6 2,053 5,616 +18% Jazz Pharmaceuticals Ireland 8.4 1,163 2,151 +11 Lundbeck Denmark 5.9 2,222 1,974 -2% Meda Sweden 5.4 1,963 2,519 +4% Last line of defence Perrigo’s chief executive, Joseph Papa, is standing firm but the company’s share price closed down 5% at $157.74 on Friday, well off its 2015 high of $203.69 in April after Mylan formalised its bid (Mylan anti-chain action as good as confirms Teva interest, April 09, 2015). -

ARK GENOMIC REVOLUTION MULTI SECTOR ETF (ARKG) HOLDINGS As of 09/27/2021

ARK GENOMIC REVOLUTION MULTI SECTOR ETF (ARKG) HOLDINGS As of 09/27/2021 Company Ticker CUSIP Shares Market Value($) Weight(%) 1 TELADOC HEALTH INC TDOC 87918A105 3,937,797 531,208,815.30 6.99 2 EXACT SCIENCES CORP EXAS 30063P105 3,971,013 381,296,668.26 5.01 3 PACIFIC BIOSCIENCES OF CALIF PACB 69404D108 13,696,148 350,347,465.84 4.61 4 VERTEX PHARMACEUTICALS INC VRTX 92532F100 1,722,281 316,228,014.41 4.16 5 FATE THERAPEUTICS INC FATE 31189P102 4,825,395 312,926,865.75 4.12 6 IONIS PHARMACEUTICALS INC IONS 462222100 8,572,965 310,341,333.00 4.08 7 REGENERON PHARMACEUTICALS REGN 75886F107 430,742 275,201,063.80 3.62 8 TWIST BIOSCIENCE CORP TWST 90184D100 2,237,350 250,829,308.50 3.30 9 TAKEDA PHARMACEUTIC-SP ADR TAK UN 874060205 13,592,076 229,570,163.64 3.02 10 ACCOLADE INC ACCD 00437E102 5,268,242 226,850,500.52 2.98 11 INTELLIA THERAPEUTICS INC NTLA 45826J105 1,508,421 224,965,907.94 2.96 12 VEEVA SYSTEMS INC-CLASS A VEEV 922475108 741,198 222,307,516.14 2.92 13 CAREDX INC CDNA 14167L103 3,433,475 220,978,451.00 2.91 14 CRISPR THERAPEUTICS AG CRSP H17182108 1,804,041 210,044,493.63 2.76 15 INCYTE CORP INCY 45337C102 2,893,385 199,643,565.00 2.63 16 INVITAE CORP NVTA 46185L103 6,059,066 182,135,523.96 2.40 17 ADAPTIVE BIOTECHNOLOGIES ADPT 00650F109 4,888,391 178,377,387.59 2.35 18 BEAM THERAPEUTICS INC BEAM 07373V105 1,849,698 175,110,909.66 2.30 19 SIGNIFY HEALTH INC -CLASS A SGFY 82671G100 8,107,683 160,937,507.55 2.12 20 UIPATH INC - CLASS A PATH 90364P105 2,955,628 155,761,595.60 2.05 21 CASTLE BIOSCIENCES INC CSTL 14843C105 2,130,211 -

Amgen Inc. V. Sanofi, No

No. IN THE Supreme Court of the United States ———— AMGEN INC., AMGEN MANUFACTURING LIMITED, AND AMGEN USA, INC., Petitioners, v. SANOFI, AVENTISUB LLC, REGENERON PHARMACEUTICALS INC., AND SANOFI-AVENTIS U.S., LLC, Respondents. ———— On Petition for a Writ of Certiorari to the United States Court of Appeals for the Federal Circuit ———— PETITION FOR A WRIT OF CERTIORARI ———— STUART L. WATT JEFFREY A. LAMKEN WENDY A. WHITEFORD Counsel of Record ERICA S. OLSON MICHAEL G. PATTILLO, JR. EMILY C. JOHNSON SARAH J. NEWMAN AMGEN INC. MOLOLAMKEN LLP One Amgen Center Drive The Watergate, Suite 660 Thousand Oaks, CA 91320 600 New Hampshire Ave., NW (805) 447-1000 Washington, D.C. 20037 (202) 556-2000 [email protected] Counsel for Petitioners :,/621(3(635,17,1*&2,1&± ±:$6+,1*721'& QUESTION PRESENTED The 1952 Patent Act requires patents to “contain a written description of the invention, and of the manner and process of making and using it.” 35 U.S.C. §112(a). The “written description” must be “in such full, clear, concise, and exact terms as to enable any person skilled in the art to which it pertains, or with which it is most nearly connected, to make and use the same.” Ibid. “The object of the statute is to require the patentee to describe his invention so that others may construct and use it after the expiration of the patent.” Schriber-Schroth Co. v. Cleveland Tr. Co., 305 U.S. 47, 57 (1938). The Federal Circuit has construed §112(a) as impos- ing separate “written description” and “enablement” re- quirements subject to different standards. -

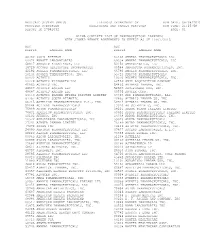

Medicaid System (Mmis) Illinois Department of Run Date: 08/08/2015 Provider Subsystem Healthcare and Family Services Run Time: 21:25:58 Report Id 2794D052 Page: 01

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 08/08/2015 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 21:25:58 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 10/01/2015 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 65162 AMNEAL PHARMACEUTICALS LLC 00074 ABBOTT LABORATORIES 69238 AMNEAL PHARMACEUTICALS, LLC 68817 ABRAXIS BIOSCIENCE, LLC 53150 AMNEAL-AGILA, LLC 16729 ACCORD HEALTHCARE INCORPORATED 00548 AMPHASTAR PHARMACEUTICALS, INC. 42192 ACELLA PHARMACEUTICALS, LLC 66780 AMYLIN PHARMACEUTICALS, INC. 10144 ACORDA THERAPEUTICS, INC. 55724 ANACOR PHARMACEUTICALS 00472 ACTAVIS 10370 ANCHEN PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 62559 ANIP ACQUISITION COMPANY 45963 ACTAVIS INC. 54436 ANTARES PHARMA, INC. 46987 ACTAVIS KADIAN LLC 52609 APO-PHARMA USA, INC. 49687 ACTAVIS KADIAN LLC 60505 APOTEX CORP. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 63323 APP PHARMACEUTICALS, LLC. 67767 ACTAVIS SOUTH ATLANTIC 42865 APTALIS PHARMA US, INC 66215 ACTELION PHARMACEUTICALS U.S., INC. 58914 APTALIS PHARMA US, INC. 52244 ACTIENT PHARMACEUTICALS 13310 AR SCIENTIFIC, INC. 75989 ACTON PHARMACEUTICALS 08221 ARBOR PHARM IRELAND LIMITED 76431 AEGERION PHARMACEUTICALS, INC. 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 50102 AFAXYS, INC. 24338 ARBOR PHARMACEUTICALS, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 59923 AREVA PHARMACEUTICALS 27241 AJANTA PHARMA LIMITED 76189 ARIAD PHARMACEUTICALS, INC. 17478 AKORN INC 24486 ARISTOS PHARMACEUTICALS, INC. 24090 AKRIMAX PHARMACEUTICALS LLC 67877 ASCEND LABORATORIES, L.L.C. 68220 ALAVEN PHARMACEUTICAL, LLC 76388 ASPEN GLOBAL INC. 00065 ALCON LABORATORIES, INC. 51248 ASTELLAS 00998 ALCON LABORATORIES, INC. 00469 ASTELLAS PHARMA US, INC. 25682 ALEXION PHARMACEUTICALS 00186 ASTRAZENECA LP 68611 ALIMERA SCIENCES, INC.