Generic Pharma

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Final Attendee List

Jennifer Abnet GlaxoSmithKline I GlaxoSmithKline I Jane Arboleda APRN Guardant I Molly Benson Sanjiv Agarwala MD Puma Biotechnology I Cancer Expert Now I Joe Arminger AbbVie I Seth Berkowitz LCSW, Manmeet Ahluwalia MD, CCLS MBA Patricia Armstrong The Leukemia & Lymphoma Miami Cancer Institute I Novartis I Society V Steve Albers Kim Arnold APRN CPNP Barry Berman MD, MS Alexion V CPHON Florida Cancer Specialists I Servier Pharmaceuticals I Maritza Alencar DNP, Tizano Bernard MBA, APRN, BMTCN Sheila Arrington MSN, Cancer Care Centers of Miami Cancer Institute V APRN, NP-C, AOCN Brevard I Puma Biotechnology I Carmen Allen MSIT Ana Mari Bernardini Pharmavoxx V Shannon Ashmon Novartis Oncology I Eisai, Inc I Luly Almeida Bernard Berry MBA Incyte Corporation I Sarah Ashton MS AstraZeneca Pharmaceuticals Guardant Health I I Talat Almukhtar MD Orlando Health Cancer Melissa Austin Jason Bever Institute I Cancer Care Centers of Oncopeptides I Brevard I Beatrice Alvarado Roberts Amy Bignon MD Garland Avera Doyle Caris Life Sciences I University of Florida I Jazz Pharmaceuticals I Nadeem Bilani MD Tadeu Ambros MD Francie Babcock Cleveland Clinic I FCS I AMAG Pharmaceuticals/Covis I Angela Bilik RN BSN Douglas Anderson AstraZeneca I Incyte Corporation I Craig Bailey Astra Zeneca I Jamie Bilsky BS Blesson Andrews Genentech V Genentech I Kevin Barr Daiichi Sankyo I Rohit Bishnoi MD Ollie Annum PharmD University of Florida I BHMCR I Leonard Bennett PharmD EMD Serono I Brady Blackman Susmitha Apuri MD MorphoSys I Florida Cancer Specialists I Michael Bennett As of 4-22-21 Kimberly Blandon RN MSN Rick Breitenstein Memorial Cancer Institute I Apellis Pharmaceuticals I Denise Capo Karyopharm Therapeutics I Taryn Boiteau GlaxoSmithKline I Amanda Bridges Florida Society of Clinical Heidi Caravetta Tracy Bonds RN, BSN, Oncology I Exelixis, Inc. -

Q1 Pharma Sector Snapshot

SPECIALTY & GENERIC PHARMA Q1 2021 Report Market Commentary – Debt Capital Markets Debt Markets ▪ 2020 saw increased amounts of debt used in buyouts across the board, resulting in the highest debt / EBITDA Median US Buyout Multiples levels since 2014 − The increased use of debt was driven by 2H20 back- end loaded lending activity (primarily 4Q20) as 16.0x 12.7x 14.1x 12.2x 12.0x 11.6x 11.5x certainty around the U.S. election and vaccination 11.1x 10.0x 9.8x 12.0x 9.7x expectations increased 9.4x 8.6x 8.3x 8.2x 7.5x 7.8x 5.2x 6.7x 5.7x 5.6x ▪ 8.0x 5.9x As the effects of COVID now begin to diminish, debt 5.4x 4.4x 4.1x 3.7x 4.6x 4.3x 3.8x markets have seemingly recovered, signaling that 3.6x lenders have become increasingly comfortable with 4.0x 4.3x 6.9x 6.5x 6.3x 6.0x 5.9x 5.7x 5.7x 5.7x 5.7x 5.6x 5.3x 4.5x 4.4x macroeconomic and company-specific fundamentals 4.3x 0.0x 3.2x − With increased confidence, lenders are currently looking to provide strong leverage for high-quality assets, particularly ones that have proven their Debt/EBITDA Equity/EBITDA EV/EBITDA stability through the recent market downturn Source: PitchBook ▪ The spread on U.S. high-yield debt has returned to pre- Historical US High Yield Debt Effective Yield COVID levels − 4.22% current effective yield compared with a 12.0% 11.4% 11.38% effective yield on March 23, 2020 (peak of the pandemic) 9.0% ▪ We expect increased activity by lenders in 2021 due to: 6.0% 4.2% − Pent-up demand in M&A activity driven by the impact of COVID 3.0% − Limited Partner agreements and investor -

Perrigo Needs Deal to Thwart Mylan

November 02, 2015 Perrigo needs deal to thwart Mylan Madeleine Armstrong Perrigo continues to resist Mylan’s overtures, but a deal is looking increasingly likely after its attempts to block the buy in court failed. Mylan has until November 13 to tempt Perrigo shareholders under Irish takeover rules. An acquisition of its own might now be the only hope for Perrigo in this buy-or-be-bought saga. But, with increasing consolidation in the speciality pharma space, the pool of potential targets is dwindling (see table below). The best option looks like Endo International, though its market cap of nearly $14bn might make it too big a bite for Perrigo, which has just $5bn in cash. But if Perrigo could pull it off it would gain a company with one of the best forecast growth rates in mid-tier pharma. Jazz Pharmaceuticals, Meda or Lundbeck could be easier to digest but the last, with faltering sales, might not be such an attractive proposition. Perrigo and its potential acquisition targets Company Based Market cap ($bn) 2014 sales ($m) 2020e sales ($m) CAGR Perrigo Ireland 23.1 815 1,388 +9% Endo International US 13.6 2,053 5,616 +18% Jazz Pharmaceuticals Ireland 8.4 1,163 2,151 +11 Lundbeck Denmark 5.9 2,222 1,974 -2% Meda Sweden 5.4 1,963 2,519 +4% Last line of defence Perrigo’s chief executive, Joseph Papa, is standing firm but the company’s share price closed down 5% at $157.74 on Friday, well off its 2015 high of $203.69 in April after Mylan formalised its bid (Mylan anti-chain action as good as confirms Teva interest, April 09, 2015). -

Management Team

Management Team Bruce C. Cozadd Executive Chairman Bruce Cozadd joined Jazz Pharmaceuticals at its inception. From 2001 until he joined Jazz Pharmaceuticals, Mr. Cozadd served as a consultant to companies in the biopharmaceutical industry. From 1991 until 2001, he held various positions with ALZA Corporation, a pharmaceutical company now owned by Johnson & Johnson, most recently as its Executive Vice President and Chief Operating Officer, with responsibility for research and development, manufacturing and sales and marketing. Previously at ALZA Corporation he held the roles of Chief Financial Officer and Vice President, Corporate Planning and Analysis. Mr. Cozadd received a B.S. from Yale University and an M.B.A. from the Stanford Graduate School of Business. Mr. Cozadd serves on the boards of Cerus Corporation, a biopharmaceutical company; Threshold Pharmaceuticals, a biotechnology company; and The Nueva School and Stanford Hospital and Clinics, both non-profit organizations. Samuel R. Saks, MD Chief Executive Officer Samuel Saks, M.D., joined Jazz Pharmaceuticals at its inception. From 2001 until he joined Jazz Pharmaceuticals, Dr. Saks was Company Group Chairman of ALZA Corporation and served as a member of the Johnson & Johnson Pharmaceutical Group Operating Committee. From 1992 until 2001, he held various positions with ALZA Corporation, most recently as its Chief Medical Officer and Group Vice President, where he was responsible for clinical and commercial activities. Dr. Saks received a B.S. and an M.D. from the University of Illinois. Dr. Saks serves on the board of Trubion Pharmaceuticals and Cougar Biotechnology. Robert M. Myers President Robert Myers joined Jazz Pharmaceuticals at its inception and was appointed as Jazz Pharmaceuticals’ President in March 2007. -

Medicaid System (Mmis) Illinois Department of Run Date: 08/08/2015 Provider Subsystem Healthcare and Family Services Run Time: 21:25:58 Report Id 2794D052 Page: 01

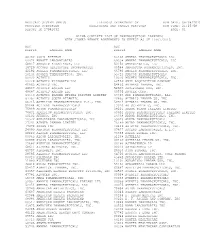

MEDICAID SYSTEM (MMIS) ILLINOIS DEPARTMENT OF RUN DATE: 08/08/2015 PROVIDER SUBSYSTEM HEALTHCARE AND FAMILY SERVICES RUN TIME: 21:25:58 REPORT ID 2794D052 PAGE: 01 ALPHA COMPLETE LIST OF PHARMACEUTICAL LABELERS WITH SIGNED REBATE AGREEMENTS IN EFFECT AS OF 10/01/2015 NDC NDC PREFIX LABELER NAME PREFIX LABELER NAME 68782 (OSI) EYETECH 65162 AMNEAL PHARMACEUTICALS LLC 00074 ABBOTT LABORATORIES 69238 AMNEAL PHARMACEUTICALS, LLC 68817 ABRAXIS BIOSCIENCE, LLC 53150 AMNEAL-AGILA, LLC 16729 ACCORD HEALTHCARE INCORPORATED 00548 AMPHASTAR PHARMACEUTICALS, INC. 42192 ACELLA PHARMACEUTICALS, LLC 66780 AMYLIN PHARMACEUTICALS, INC. 10144 ACORDA THERAPEUTICS, INC. 55724 ANACOR PHARMACEUTICALS 00472 ACTAVIS 10370 ANCHEN PHARMACEUTICALS, INC. 00228 ACTAVIS ELIZABETH LLC 62559 ANIP ACQUISITION COMPANY 45963 ACTAVIS INC. 54436 ANTARES PHARMA, INC. 46987 ACTAVIS KADIAN LLC 52609 APO-PHARMA USA, INC. 49687 ACTAVIS KADIAN LLC 60505 APOTEX CORP. 14550 ACTAVIS PHARMA MFGING PRIVATE LIMITED 63323 APP PHARMACEUTICALS, LLC. 67767 ACTAVIS SOUTH ATLANTIC 42865 APTALIS PHARMA US, INC 66215 ACTELION PHARMACEUTICALS U.S., INC. 58914 APTALIS PHARMA US, INC. 52244 ACTIENT PHARMACEUTICALS 13310 AR SCIENTIFIC, INC. 75989 ACTON PHARMACEUTICALS 08221 ARBOR PHARM IRELAND LIMITED 76431 AEGERION PHARMACEUTICALS, INC. 60631 ARBOR PHARMACEUTICALS IRELAND LIMITED 50102 AFAXYS, INC. 24338 ARBOR PHARMACEUTICALS, INC. 10572 AFFORDABLE PHARMACEUTICALS, LLC 59923 AREVA PHARMACEUTICALS 27241 AJANTA PHARMA LIMITED 76189 ARIAD PHARMACEUTICALS, INC. 17478 AKORN INC 24486 ARISTOS PHARMACEUTICALS, INC. 24090 AKRIMAX PHARMACEUTICALS LLC 67877 ASCEND LABORATORIES, L.L.C. 68220 ALAVEN PHARMACEUTICAL, LLC 76388 ASPEN GLOBAL INC. 00065 ALCON LABORATORIES, INC. 51248 ASTELLAS 00998 ALCON LABORATORIES, INC. 00469 ASTELLAS PHARMA US, INC. 25682 ALEXION PHARMACEUTICALS 00186 ASTRAZENECA LP 68611 ALIMERA SCIENCES, INC. -

Current Sustaining Member Companies

CURRENT SUSTAINING MEMBER COMPANIES MEMBER FOR OVER: 10 Years 25 Years 50 Years Member Since (alphabetical order) 1976 3M Medical Solutions Division 2020 D2 Pharma Consulting, LLC 1989 J & J Health Care Systems, Inc. 2011 Remund Group, LLC 1985 Abbott Laboratories, Inc. 2007 Daiichi Sankyo, Inc. 2014 Jazz Pharmaceuticals Inc. 2018 Rigel Pharmaceuticals 2013 AbbVie Inc. 2020 Deciphera Pharmaceuticals, LLC 2007 Karl Storz Endoscopy America 2000 Sanofi 2021 Adaptive Biotechnologies 2009 Deloitte 2021 Lantheus Holdings 2020 Seattle Genetics 2017 ACADIA Pharmaceuticals, Inc. 2020 Dexcom, Inc. 2020 Lipogems 2004 Siemens Medical Solutions 2020 AcelRx Pharmaceuticals, Inc. 2020 Drip Drop Hydration 2010 LLC Federal Solutions 2019 SK Life Science, Inc. 2020 Acorda Therapeutics 2017 Eagle Pharmaceuticals, Inc. 2014 Lovell Government Services LLC 2002 Smith & Nephew, Inc. 2019 Aimmune 2005 Eisai, Inc. 2021 Mainstay Medical 2019 Sobi Inc. 2003 Alcon Laboratories, Inc. 2019 electroCore, Inc. 2014 Mallinckrodt Pharmaceuticals 2013 Stryker Orthopaedics 2019 Alexion Pharmaceuticals, Inc. 2010 Endo Pharmaceuticals 2020 MannKind Corporation 2018 Sun Pharmaceutical 2017 Alkermes, Inc. 2017 Exelixis 1999 Marketing Assessment, Inc. 1999 Sunovion Pharmaceuticals, Inc. 2019 Alnylam Pharmaceuticals 2016 Express Scripts Federal Pharmacy 2009 Masimo Corporation 2016 Taiho Oncology, Inc. 2019 Altarum Institute 2010 Federal Practitioner 2019 Medical Strategies International, LLC 2015 Takeda Oncology 2020 Amarin Corporation 2021 Ferring Pharmaceuticals Inc. 2016 Melling Medical 2000 Takeda Pharmaceutical USA, Inc. 1994 AmerisourceBergen 2018 Foundation Medicine, Inc. 1954 Merck & Co., Inc. 2020 Telemynd 1992 Amgen 2021 Frontier Technology Inc. (FTI) 2002 MerzNorth America 2020 TerSera Therapeutics 2020 Amneal Pharmaceutical 2020 Fresenius Medical Care North America 2018 Mitsubishi Tanabe Pharma America 1990 Teva 2019 Aptive Resources LLC 1989 Genentech Inc. -

Downloads That May Be Necessary

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 December 20, 2018 Date of Report (Date of earliest event reported) JAZZ PHARMACEUTICALS PUBLIC LIMITED COMPANY (Exact name of registrant as specified in its charter) Ireland 001-33500 98-1032470 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File No.) Identification No.) Fifth Floor, Waterloo Exchange, Waterloo Road, Dublin 4, Ireland (Address of principal executive offices, including zip code) 011-353-1-634-7800 (Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Ligand Partner Jazz Pharmaceuticals Launches RYLAZE™ (Asparaginase Erwinia Chrysanthemi (Recombinant)-Rywn), Formerly JZP458

July 21, 2021 Ligand Partner Jazz Pharmaceuticals Launches RYLAZE™ (asparaginase erwinia chrysanthemi (recombinant)-rywn), Formerly JZP458 Ligand expects to receive $7 million in milestone payments Rylaze for the treatment of ALL or LBL utilizes Ligand’s Pelican Expression Technology™ Platform EMERYVILLE, Calif.--(BUSINESS WIRE)-- Ligand Pharmaceuticals Incorporated (NASDAQ: LGND) today announced Jazz Pharmaceuticals plc (NASDAQ: JAZZ) has launched Rylaze™ (asparaginase erwinia chrysanthemi (recombinant)-rywn), also known as JZP458. Rylaze, which was approved by the FDA on June 30, 2021, is a recombinant erwinia asparaginase used as a component of a multi-agent chemotherapeutic regimen for the treatment of acute lymphoblastic leukemia (ALL) or lymphoblastic lymphoma (LBL) in adult and pediatric patients 1 month or older who have developed hypersensitivity to E. coli- derived asparaginase. Under the terms of the license agreement with Jazz Pharmaceuticals, Ligand received a $2 million payment upon FDA’s acceptance for review of the product BLA and is entitled to receive a $5 million payment upon the first commercial sale following launch. Ligand is eligible to receive up to an additional $155.5 million in milestone payments and tiered low to mid-single digit royalties based on worldwide net sales of any products resulting from this collaboration, including Rylaze. “This partnership with Jazz Pharmaceuticals is one of the core scientific programs that catalyzed our acquisition of Pfenex last year. The Rylaze commercial launch really showcases our highly productive partnership with Jazz and the exceptional ability of our Pelican Expression Technology to enable life-saving therapeutics,” said John Higgins, CEO of Ligand. “The robust manufacturing afforded by Ligand’s Pelican Expression Technology combined with Jazz’s demonstrated success in development and commercialization has enabled the delivery of a high-quality recombinant asparaginase option for patients with hypersensitivity to E. -

Outcomes of Relapsed Or Refractory Acute Myeloid Leukemia After Frontline Hypomethylating Agent and Venetoclax Regimens

Haematologica HAEMATOL/2020/252569 Version 4 Outcomes of relapsed or refractory acute myeloid leukemia after frontline hypomethylating agent and venetoclax regimens Abhishek Maiti, Caitlin R. Rausch, Jorge E. Cortes, Naveen Pemmaraju, Naval G. Daver, Farhad Ravandi, Guillermo Garcia-Manero, Gautam Borthakur, Kiran Naqvi, Maro Ohanian, Nicholas J. Short, Yesid Alvarado, Tapan M. Kadia, Koichi Takahashi, Musa Yilmaz, Nitin Jain, Steven Kornblau, Guillermo Montalban Bravo, Koji Sasaki, Michael Andreeff, Prithiviraj Bose, Alessandra Ferrajoli, Ghayas C. Issa, Elias J. Jabbour, Lucia Masarova, Philip A. Thompson, Sa Wang, Sergej Konoplev, Sherry A. Pierce, Jing Ning, Wei Qiao, John S. Welch, Hagop M. Kantarjian, Courtney D. DiNardo, and Marina Y. Konopleva Disclosures: AM: Research funding from Celgene Corporation CRR: None JEC: Research funding from Ambit BioSciences, ARIAD, Arog, Astellas Pharma, AstraZeneca, Bristol-Myers Squibb, Celator, Celgene, Novartis, Pfizer, Sanofi, Sun Pharma, Teva; consultant for Ambit BioSciences, ARIAD, Astellas Pharma, BiolineRx, Bristol-Myers Squibb, Novartis; Pfizer. NP: Consulting/honorarium: Celgene; Stemline; Incyte; Novartis; MustangBio; Roche Diagnostics, LFB; Research funding/clinical trials support: Stemline; Novartis; Abbvie; Samus; Cellectis; Plexxikon; Daiichi-Sankyo; Affymetrix; Grants/funding: Affymetrix, SagerStrong Foundation NGD: Sunesis Pharmaceuticals, Inc.: Consultancy, Research Funding; Karyopharm: Consultancy, Research Funding; Immunogen: Research Funding; Pfizer Inc.: Consultancy, Research -

IHE Ishares US Pharmaceuticals ETF Gray Swan Event Factor For

ETF Risk Report: IHE Buyer beware: Every ETF holds the full risk of its underlying equities Disclosures in the best interest of investors iShares US Pharmaceuticals ETF Gray Swan Event Risks exist for every equity held by IHE. Gray swan events include accounting fraud, management failures, failed internal controls, M&A problems, restatements, etc. These risks occur infrequently, but Gray Swan Event Factor for IHE 2.72% consistently for all equities. Equities account for 99.86% of IHE’s assets. Most investors ignore these risks until after they are disclosed; whereupon a stock’s price drops precipitously. Just as insurance companies can predict likely costs for a driver’s future car accidents based on the driver’s history, Watchdog Research contacts each ETF asking how they notify investors about we predict the likely cost (price drop) for IHE following accounting governance risks in equities in their fund. We will publish their response gray swan disclosures within its holdings. The expected when received. price decrease across the IHE equity portfolio is 2.72%. However, individual equity risks vary signicantly. This report helps investors know their risk exposure. Inception Date: 05/01/2020 Year-to-Date Return: -0.64% The iShares U.S. Pharmaceuticals ETF tracks the investment results of the Dow Jones U.S. Select Net Assets: $355m 1-Year Return: 33.74% Pharmaceuticals Index, composed of U.S. equities in the pharmaceuticals sector. The Fund uses a passive or Price: $177.65 3-Year Return: 7.84% indexing approach and invests by sampling the Index, Net Asset Value (NAV): $177.38 5-Year Return: 6.78% holding a collection of securities that approximates the full Index in key investment characteristics (such as Net Expense Ratio: 0.42% Yield: 1.23% market capitalization and industry weightings), fundamentals (such as return variability and yield), and As of: 03/31/2021 liquidity. -

Fact Sheet As of 06/30/2021

iShares U.S. Pharmaceuticals ETF IHE Fact Sheet as of 06/30/2021 The iShares U.S. Pharmaceuticals ETF seeks to track the investment results of an index composed of U.S. equities in the pharmaceuticals sector. KEY FACTS Fund Launch Date 05/01/2006 Expense Ratio 0.42% WHY IHE? Benchmark Dow Jones U.S. Select 1 Exposure to U.S. companies that manufacture prescription or over-the-counter Pharmaceuticals Index drugs or vaccines 30 Day SEC Yield 1.38% 2 Targeted access to domestic pharmaceutical stocks Number of Holdings 47 Net Assets $380,501,356 3 Use to express a sector view Ticker IHE CUSIP 464288836 GROWTH OF 10,000 USD SINCE INCEPTION Exchange NYSE Arca TOP HOLDINGS (%) JOHNSON & JOHNSON 22.43 PFIZER INC 18.04 ZOETIS INC CLASS A 4.76 MERCK & CO INC 4.74 ELANCO ANIMAL HEALTH INC 4.61 BRISTOL MYERS SQUIBB 4.61 ELI LILLY 4.58 CATALENT INC 4.54 JAZZ PHARMACEUTICALS PLC 4.20 Fund Benchmark VIATRIS INC 4.17 The Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes 76.68 reinvestment of dividends and capital gains. Fund expenses, including management fees and Holdings are subject to change. other expenses were deducted. PERFORMANCE 1 Year 3 Year 5 Year 10 Year Since Inception NAV 22.49% 8.57% 6.52% 11.28% 10.59% Market Price 22.69% 8.61% 6.55% 11.29% 10.59% Benchmark 22.94% 8.92% 6.82% 11.64% 11.01% The performance quoted represents past performance and does not guarantee future results. -

Rebateable Manufacturers

Rebateable Labelers – July 2021 Manufacturers are responsible for updating their eligible drugs and pricing with CMS. Montana Healthcare Programs will not pay for an NDC not updated with CMS. Note: Some manufacturers on this list may have some NDCs that are covered and others that are not. Manufacturer ID Manufacturer Name 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC Page 1 of 19 Manufacturer ID Manufacturer Name 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC.