Acquisition of Shares in Noatum Port Holdings, S.L.U

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Carbon Footprint of Valencia Port: a Case Study of the Port Authority of Valencia (Spain)

International Journal of Environmental Research and Public Health Article The Carbon Footprint of Valencia Port: A Case Study of the Port Authority of Valencia (Spain) Víctor Cloquell Ballester 1 , Vanesa G. Lo-Iacono-Ferreira 2,* , Miguel Ángel Artacho-Ramírez 1 and Salvador F. Capuz-Rizo 1 1 Department of Engineering Projects, Valencia Campus, Universitat Politècnica de València, Camino de Vera, s/n, E-46022 Valencia, Spain; [email protected] (V.C.B.); [email protected] (M.Á.A.-R.); [email protected] (S.F.C.-R.) 2 Department of Engineering Projects, Alcoy Campus, Universitat Politècnica de València, Plaza Ferrándiz y Carbonell, s/n, E-03690 Alcoy, Spain * Correspondence: [email protected] Received: 12 September 2020; Accepted: 29 October 2020; Published: 4 November 2020 Abstract: Maritime transport is responsible for 13% of the Greenhouse Gases (GHG) emissions of the transport sector. Port authorities, terminals, shipping companies, and other stakeholders have joined efforts to improve this sector’s environmental performance. In Spain, the Ministry for Ecological Transition and Demographic Challenge has developed a methodology to assess the carbon footprint. This methodology has been adapted to ports and applied to processes under the Port Authority of Valencia’s umbrella achieving scopes 1, 2, and 3. The results highlight that ship traffic, within the port, of containers and cruises (categorized in scope 3) had a major impact on the carbon footprint. Buildings lighting managed by the terminals has a significant effect on scope 2. Diesel consumption shares with gasoline consumption the primary representation in scope 1. The carbon footprint between 2008 and 2016 was maintained, although traffic in the port increased by 24% during this period. -

Medcruise Newsletter Issue 52 Nov 2016.Qxp 22/11/2016 14:48 Page 1

MedCruise Newsletter Issue 52 Nov 2016.qxp 22/11/2016 14:48 Page 1 MedCruise News MedCruise members discuss November 2016 “Guidelines for Cruise Terminals” Issue 52 MedCruise News pg. 1-7 Barcelona), Chairman of the Port facilities & PIANC International Destinations pg. 8-22 Working Group that developed this major project over the course of the last Meet the MedCruise four years, revealed members pg. 23 to the MedCruise membership the just completed study List of MedCruise that embodies a Members pg. 24 flexible design approach so that terminals can be adapted to the various current and and ground transportation area. future needs of In view of the importance to the cruise n Friday, September 23rd, MedCruise cruise companies. industry of port security and operational and members had an excellent opportunity Following the presentation, MedCruise financial aspects, special emphasis has been to discuss best strategies to invest in members had the opportunity to engage in an laid on these two topics. O extended Q&A session, while each member This report has been drafted by an cruise terminals, during a special session held in Santa Cruz de Tenerife on the occasion of also received a copy of the study that provides international working group (WG 152) set up Seatrade Cruise Med 2016. technical guidelines for assisting the by PIANC in 2012. The main objective of the During the session, MedCruise members also development of cruise port facilities. Based on work was to provide a guideline for the discussed in detail the results of the most the newest trends in cruise ships and the functional design of cruise terminals, by recent PIANC study on cruise terminals industry in general, the document covers all reviewing the needs of modern cruise ships investment, planning & design. -

Early Warning System Secures Spanish Ports

CASE STUDY TETRA AND SCADA SOLUTIONS KEEPING SPANISH PORTS SAFE EARLY WARNING SYSTEM SECURES SPANISH PORTS COMBINED TETRA AND SCADA SOLUTION PROMOTES SAFER MARITIME TRADE To safeguard the handling of potentially hazardous cargo along one of the CUSTOMER PROFILE Company: Mediterranean’s primary shipping routes, the Port Authority of Valencia (PAV) has Port Authority of Valencia, Ministry of Development, installed a resilient, automated early warning system. Government of Spain The solution has been integrated into a Dimetra IP Compact TETRA and Motorola Industry Name: Ports and Harbours MOSCAD/ACE3600 RTU network, covering approximately 80 kilometres of Spain’s Motorola Solutions Partners: eastern coastline. It connects the three state-owned ports of Valencia, Sagunto ANFER Radiocomunicaciones (ANFER and Gandia, which are managed and administered by the PAV. Strategically located F.P.C., S.L.) near the Straits of Gibraltar, these ports play a pivotal role in the shipping of goods Key Benefits: • Fully integrated SCADA solutions between America, the Mediterranean Basin and the Far East. into TETRA network • Enhanced voice and data communications The Port of Valencia has a big impact on the state economy, generating more than • Highly reliable, scalable and robust • Cost-effective: single network for 15,000 working places and over 1.1 billion Euros of revenue. During 2010, over voice and data 64 million tons of containerised cargo passed through its ports and the number of Product Name: passengers has escalated to over 470,000 annually. • Motorola Supervisory Control And Data Acquisition (SCADA) system • ACE3600 Remote Terminal Units The Port of Valencia also provides vital road and rail connections for the distribution and ACE3600 Front End Processor • Dimetra IP Compact TETRA of goods to southern Europe and North Africa. -

Puerto De 2018

DECEMBER PUERTO DE 2018 BILBAO CLH Completes its logistic offer with the maritime transport of NEWS fuels from Bilbao CLH has expanded its logistic system and by pi- offer of services in its hy- peline to other terminals. drocarbon storage facility in the port of Bilbao. From now on, its regu- 83 lar and potential custo- mers have the possibility to perform, with total fle- xibility, maritime trans- port operations for fuels and biofuels from Bilbao and other nearby ports, to destinations in Spain, France and Portugal. During this month of December, CLH has po- sitioned in the area the Tinerfe, a tank vessel of 15,000 tonnes of dead weight, of which it CLH is In addition, the facility the disponent ship-owner. has the commercial ca- In this way, CLH comple- pacity for the storage of tes its logistic offer from different product qualities the port of Bilbao, where and has the authorization it operates a 312,000 m3 for customs deposit and storage facility. temporary deposit, which facilitates the manage- This facility can receive ment of the client's pro- and dispatch both gaso- duct lines and diesels, as well as kerosene and biofuels, and the products can be sent by ship to the CLH PORT TRAFFIC (JANUARY - NOVEMBER 2018) To the month of November, the traffic of Bilbao port has closed with 32.8 million tons and a year- on-year increase of +6.3%, an increase to which all the goods groups have contributed. The conventional goods with +7.7%, the solid bulk with +8.4%, the liquid bulk with +4.7% and the contai- ner goods with +39.3%. -

Port of Amsterdam Port of Athens (Piraeus) Port of Auckland Port Of

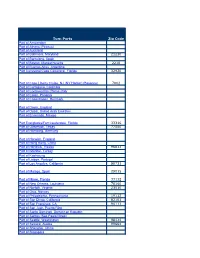

Turn Ports Zip Code Port of Amsterdam Port of Athens (Piraeus) Port of Auckland Port of Baltimore, Maryland 21230 Port of Barcelona, Spain Port of Boston, Massachusetts 2210 Port of Buenos Aires, Argentina Port Canaveral/Cape Canaveral, Florida 32920 Port of Cape Liberty Cruise, NJ (NY Harbor) (Bayonne) 7002 Port of Cartagena, Colombia Port of Civitavecchia (Rome) Italy Port of Colon, Panama Port of Copenhagen, Denmark Port of Dover, England Port of Dubai, United Arab Emirates Port of Ensenada, Mexico Port Everglades/Fort Lauderdale, Florida 33316 Port of Galveston, Texas 77550 Port of Hamburg, Germany Port of Harwich, England Port of Hong Kong, China Port of Honolulu, Hawaii 96813 Port of Istanbul, Turkey Port of Kaohsiung Port of Lisbon, Portugal Port of Los Angeles, California 90731 Port of Malaga, Spain 29015 Port of Miami, Florida 33132 Port of New Orleans, Louisiana 70160 Port of Norfolk, Virginia 23510 Port of Oslo, Norway Port of Philadelphia, Pennsylvania 19112 Port of San Diego, California 92101 Port of San Francisco, CA 94111 Port of San Juan, Puerto Rico Port of Santo Domingo, Dominican Republic Port of Santos (Sao Paulo) Brazil Port of Seattle, Washington 98134 Port of Seward, Alaska 99664 Port of Shanghai, China Port of Singapore Port of Southampton, England Port of Stockholm, Sweden Port of Sydney, Australia Port of Tampa, Florida 33602 Port of Tianjin, China Port of Valencia TBA Port of Valparaiso, Chile Port of Vancouver (Ballantyne Pier & Canada Place Pier) Port of Venice, Italy Approxi to the DISTANCIA Port in EN KM Closest Airport Miles* Schipol International (AMS) 13 20.8 Athens Elefterios Venizelos International (ATH) 50 80 Aucklund International (AKL) 14 22.4 Baltimore/Washington International (BWI) 11 17.6 El Prat International (BCN) 10 16 Logan International (BOS) 4 6.4 Ministro Ezeiza International Airport (EZE) 18 28.8 Orlando International (MCO) 46 73.6 Newark Liberty International (EWR) 9 14.4 LaGuardia International (LGA) 20.5 32.8 John F. -

The Bay of Bizkaia Plentzia Aizkorri / La Salvaje / Gorrondatxe Aixerrota Sopela Barinatxe Windmill Ibarbengoa Bidezabal

SAN JUAN DE GAZTELUGATXE THE BAY OF BIZKAIA PLENTZIA AIZKORRI / LA SALVAJE / GORRONDATXE AIXERROTA SOPELA BARINATXE WINDMILL IBARBENGOA BIDEZABAL ALGORTA CARRETERA A LA GALEA FISHERMEN´S AIBOA GUILD BIZKAIA NEGURI i GETXO BRIDGE BILBAO GOBELA AIRPORT AREETA i 34 SANTURTZI P KABIEZES PEÑOTA Line 2 Line 1 PORTUGALETE ABATXOLO BILBAO THE SALAZAR TOWER ANSIO ZIENTOETXE BEC CASCO VIEJO BILBAO EXHIBITION CENTRE SAN MAMÉS P E INDAUTXU Ñ ABANDO A MOYUA D E GUGGENHEIM BILBAO S A TXE N ZIENTOE TA M A R IN A M AR T IT U R R I GABRIEL RAMOS URANGA N A G P A CARRETERA A LA GALEA GUST D I A M 32 A M VO ADOLFO BÉCQUER RI A UR R TIT T R I A T M U R R L I E THE BAY OF BIZKAIA 4 G N . A 33 DA AV GOÑI IBARBENGOA A VDA. ANGEL A ARRIGUNAGA ORMAZA A MARÍA AIXERROT PLENTZIA-SOPELACR. SANT A FERRY VDA. ANGEL B ALTUBE A ALTUBE J N BIDEZABAL A A D G A TA BIDEZABAL D AR ANDENE E L A R R GETXO IG U N A BILBAO G SANTANDER A OLLARRETXE TELLETXE M U E L L E D E A L G TA O 7 T R 27 E P L T AVDA. ALGOR A RETXONDO L AVDA. DE SALSIDU A E HARRA ZA U T T X R VDA. DE SALSIDU E A PO IDAD ZIERBENA 26 AR C 31 E ALGORTA 25 EN 29 RR TO 28 T 3 M U E L AMEZTI TELLETXE L E D HERRIA E E R E A 12 G P A ASEO SARDINERA EUSKAL 22 ILUNBE A URIMENDI S T P O P EREAGA P 21 MONTAÑO O 30 i H C 2 3 MENDIGANE E S U S O 23 VDA. -

Shipping Emissions in the Iberian Peninsula and Its Impacts on Air Quality Rafael A.O

Shipping emissions in the Iberian Peninsula and its impacts on air quality Rafael A.O. Nunes1, Maria C.M. Alvim-Ferraz1, Fernando G. Martins1, Fátima Calderay-Cayetano2, Vanessa Durán-Grados2, Juan Moreno-Gutiérrez2, Jukka-Pekka Jalkanen3, Hanna Hannuniemi3, Sofia 5 I.V. Sousa1 1LEPABE – Laboratory for Process Engineering, Environment, Biotechnology and Energy, Faculty of Engineering, University of Porto, Rua Dr. Roberto Frias, 4200-465, Porto, Portugal 2Departamento de Máquinas y Motores Térmicos, Escuela de Ingenierías Marina, Náutica y Radioelectrónica, Campus de Excelencia Internacional del Mar (CEIMAR), Universidad de Cádiz, Spain 10 3Finnish Meterological Institute, P.O. Box 503, 00101 Helsinki, Finland Correspondence to: Sofia I.V. Sousa ([email protected]) Abstract. Marine traffic has been identified as a relevant source of pollutants, which cause known negative effects on air quality. The Iberian Peninsula is a central point in the connection of shipping traffic between the Americas and Africa and the rest of Europe. To estimate the effects of shipping emissions inland and around the Iberian Peninsula, EMEP MSC-W model 15 was run considering and not considering shipping emissions (obtained with STEAM3 model). Total estimated emissions of CO, CO2, SOx, NOx and particulate matter (subdivided in elementary carbon (EC), organic carbon (OC), sulphate and ash) for the study domain in 2015 were, respectively, 49 ktonnes y-1, 30000 ktonnes y-1, 360 ktonnes y-1, 710 ktonnes y-1, 4.5 ktonnes -1 -1 -1 -1 y , 11 ktonnes y , 32 ktonnes y and 3.3 ktonnes y . Shipping emissions increased SO2 and NO2 concentrations especially near port areas and also increased the O3, sulphate, and particulate matter (PM2.5 and PM10) concentrations around all over the 20 Iberian Peninsula coastline (especially in the south coastal region). -

Metamorfosis Del Espacio Portuario Fluvial De Bilbao

Iñaki Uriarte La configuración física del perfil de la costa vasca en el Golfo de Bizkaia frente al Océano Atlántico ofrece una Metamorfosis enorme apertura entre elevados acantilados desde la costa occidental en Punta Lucero, Santurtzi, hasta la costa oriental en Punta Galea, Getxo, distantes , km. del espacio Asimismo, entre éste teórico frente dotado de una gran profundidad, hasta m, y el final de la corriente fluvial, portuario fluvial inicio del estuario del Ibaizabal, hay una distancia de , km. Este enorme espacio oceánico, en forma de embudo, constituye el Abra de la ría donde se crea una gran de Bilbao ensenada que por problemas de oleaje, vientos dominantes, y principalmente, no era un puerto natural de refugio con garantía. Un inmenso vacío repleto de mar. El río Ibaizabal que recibe, en Urbi (dos aguas) Basauri, el caudal procedente del Nerbioi forma un sinuoso cauce que fusiona y enfrenta sus aguas, entorno a la antigua isla de San Cristóbal, con las procedentes de la mar a través de su estuario en el paraje hasta donde llegaba el flujo y reflujo de las mareas, a dos leguas y media (unos km) de la mar. Aprovechando, según la historia, un lugar vadeable junto al camino de Castilla se construirá “la puente” de piedra de San Antón anexo a una peña sobre la que se edificó un alcázar, posteriormente iglesia de San Antón, donde existía un fondeadero natural para los barcos. El puente unía las orillas que acogían a dos pueblas diferentes. La de la izquierda, según la corriente del río, Bilbao Zaharra (la vieja) minera, ferrona e industrial; la derecha, un lugar constituido por una ermita dedicada al apóstol Santiago, vía marítima del camino de peregrinaje, con una casa solariega y algunas de pescadores, navegantes y comerciantes. -

Study on Public Perception of Lng As a Marine Fuel

m res.co o sult n aco i l o f @ a i fol : il ma - e m tores.co l nsu o c a i l .fo w ww Madrid. +34/918 651 413. C/ Encina 71. 28213 Colmenar del Arroyo. Madrid. España STUDY ON PUBLIC PERCEPTION OF LNG AS A MARINE FUEL February 2017 STUDY ON PUBLIC PERCEPTION OF LNG AS A MARINE FUEL February 2017 TABLE OF CONTENTS 1. INTRODUCTION .................................................................................................................................................. 3 2. METHODOLOGICAL PROPOSAL FOR THE STUDY ................................................................................................ 4 3. EXECUTION OF THE WORK ................................................................................................................................. 6 3.1. IDENTIFICATION, COLLECTION AND ANALYSIS OF DOCUMENTARY SOURCES .......................................... 6 3.1.1. WORLD WIDE VIEWS ........................................................................................................................ 6 3.1.2. TRANSPORT & ENVIRONMENT ......................................................................................................... 7 3.1.3. CLEAN SHIPPING COALITION ............................................................................................................ 8 3.1.4. RICARDO ENERGY & ENVIRONMENT ................................................................................................ 8 3.1.5. FUNDACIÓN ECOLOGÍA Y DESARROLLO (ECODES) .......................................................................... -

Container Shipping Lines

HEADING TOWARDS THE FUTURE The Port of Bilbao is progressing in all directions. In logistics capacity, new infrastructures and services, in innovation. Besides its privileged geographical location, it offers modern and functional services with a wide range of maritime services open to all international markets. It has marvellous land and rail connections improving its logistical potential, its intermodalism. We have made constant progress for over 700 years to keep ahead of our users’ require- ments. Over the last 15 years we have been preparing for the future, executing our most important extension and improvement project to date. This project is converting us into one of the biggest European ports of reference. 2 CONTENTS IN THE CENTRE INTERMODAL SUSTAINABLE OF THE ATLANTIC TRANSPORT DEVELOPMENT Page 04 Page 06 Page 12 OPERATIONS AND INDUSTRIAL COMMERCIAL PASSENGER COMMERCIAL COMMERCIAL TERMINALS TERMINALS TERMINALS SERVICES SERVICES Page 14 Page 16 Page 20 Page 28 Page 30 RIVER INDUSTRIES AND INVESTMENT MARKETS DIRECT SHIPPING LINES PORT OF BILBAO SHIPYARDS FEEDER SERVICES PLAN PORT COMPANIES Page 36 Page 38 Page 42 Page 43 Page 54 3 BILBAO IN THE CENTRE OF THE ATLANTIC LOCATION 4 IN THE CENTRE OF THE ATLANTIC In the middle of the Bay of Biscay, equidistant between Brest and Finisterre, the Port of Bilbao is central in the European Atlantic. For almost 700 years, this central location has made Bilbao a privileged link with the main ports in both the American continent and the north of Europe. An offer of regular services connects it with 800 ports worldwide. The Port of Bilbao works with all classes of goods and vessels. -

A Guide to Sources of Information on Foreign Investment in Spain 1780-1914 Teresa Tortella

A Guide to Sources of Information on Foreign Investment in Spain 1780-1914 Teresa Tortella A Guide to Sources of Information on Foreign Investment in Spain 1780-1914 Published for the Section of Business and Labour Archives of the International Council on Archives by the International Institute of Social History Amsterdam 2000 ISBN 90.6861.206.9 © Copyright 2000, Teresa Tortella and Stichting Beheer IISG All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher. Niets uit deze uitgave mag worden vermenigvuldigd en/of openbaar worden gemaakt door middel van druk, fotocopie, microfilm of op welke andere wijze ook zonder voorafgaande schriftelijke toestemming van de uitgever. Stichting Beheer IISG Cruquiusweg 31 1019 AT Amsterdam Table of Contents Introduction – iii Acknowledgements – xxv Use of the Guide – xxvii List of Abbreviations – xxix Guide – 1 General Bibliography – 249 Index Conventions – 254 Name Index – 255 Place Index – 292 Subject Index – 301 Index of Archives – 306 Introduction The purpose of this Guide is to provide a better knowledge of archival collections containing records of foreign investment in Spain during the 19th century. Foreign in- vestment is an important area for the study of Spanish economic history and has always attracted a large number of historians from Spain and elsewhere. Many books have already been published, on legal, fiscal and political aspects of foreign investment. The subject has always been a topic for discussion, often passionate, mainly because of its political im- plications. -

Impacto Comercial Y Urbanístico Del Buque-Tienda

<< Betting on competitiveness of Valencia companies >> Report from the Council of Chambers of Commerce of Valencia Region to put forward the allegations at the public consultation document of the European Commission “ The Networks for the Peace and Development: Extension of the major trans-European transport axes to the neighbouring countries and regions. Betting on competitiveness of Valencia enterprises Introduction: Finally the High Level Group (the HLG) chaired by the Commission Vice President Loyola de Palacio has put forward a report on trans-European Networks, under the title of “ Networks for the peace and Development” whose main conclusions regarding our regional interest are drawn following: 1) Mediterranean corridor, mainly the section from Tarragona towards the South, has no importance for the European Union. 2) In spite of this situation, and on the grounds of the negotiation where the Countries have played an essential role, the UE is going to invest in Spain, and thus, Algeciras-Barcelona axe is one benefited section, using the central corridor from Madrid to Zaragoza, thus binding Lleida with Barcelona. 3) In the end, the Mediterranean corridor has not been granted any major function, despite its importance regarding economic terms, and what is worse; there is a wrong definition on the maritime priorities that disregard our position on the new scenery shaped along the Motorways of the Seas. 4) Taking into account that the last report of Van Miert Group focused on the connections towards the accessing Europe countries, in the title of the new plan 2005, the reference is made to certain concepts such as peace, development and relationships with the Neighbouring countries, to this picture, the Group has undervalued the Mediterranean corridor as a bias for the division of development and cooperation with the North African countries.