Compulsory Income Management: a Critical Examination of the Emergence of Conditional Welfare in Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inside Australian Online Shopping 2017

Inside Australian Online Shopping 2017 eCommerce Industry Paper Contents About this paper About this paper 2 Industry overview This Inside Australian Online Shopping report offers insights Department & Variety Stores 13 Contents 2 into the delivery of goods bought Fashion 19 online in 2016 – it’s based on: Foreword 3 Health & Beauty 25 Hobbies & Recreational Goods 31 A subset of Australia Post Executive summary 4 data, collected between Homewares & Appliances 37 January 2015 and December 2016, from across our nation- eCommerce overview 5 Media 43 wide network of 11.5 million delivery points, aggregated What’s making us buy online? 5 Specialty Food & Liquor 49 to postcode level. Consumer trends 5 Methodology & references 55 The state of Australian eCommerce 7 Reported figures Contacts 58 are for the 2016 What are Australian’s buying online? 9 calendar year. YOY Where are Australian’s buying online? 11 figures compare to 2015 calendar year. eCommerce events 12 Inside Australian Online Shopping © Australia Post Foreword The Australian economy has broken a world Together, Australia Post and StarTrack deliver record. We have claimed the title of 104 quarters more than four billion items to 11.5 million of growth without a recession. This achievement addresses across the country annually. Our vast, of long term economic expansion has created a nationwide processing and delivery network has strong retail environment, where demand for a enabled us to deliver the data-driven insights broad range of products at a competitive price contained in this paper. The 2017 report provides has benefited online retailers across the country. an in-depth look at online shopping and delivery trends across Australia; growth patterns and Australian consumers’ expectations around insights on popular products to buy online, convenience, value and choice have driven a where the nation’s top online shoppers live higher proportion of the population to shop and predictions for future growth areas. -

Burgher Association (Australia) Inc

BURGHER ASSOCIATION (AUSTRALIA) INC Postal Address: PO Box 75 Clarinda VIC 3169 ABN - 28 890 322 651 ~ INC. REG. NO. A 0007821F Web Site: http://www.burgherassocn.org.au September 2016 Spring News Bulletin Sponsored by Victorian Multicultural Commission COMMITTEE OF MANAGEMENT 2015/16 President Mr Hermann Loos - 03 9827 4455 hermann r [email protected] Vice President Mrs Tamaris Lourensz - 03 5981 8187 [email protected] Secretary Mr Harvey Foenander - 03 8790 1610 [email protected] Assistant Secretary Mrs Rosemary Quyn - 03 9563 7298 [email protected] Treasurer Mr Bert Van Geyzel - 03 9557 3576 [email protected] Assistant Treasurer Mr Tyrone Pereira - 0418 362 845 [email protected] Editor Mr Neville Davidson - 03 97111 922 [email protected] Public Relations Manager Mrs Elaine Jansz - 03 9798 6315 [email protected] Premises Manager Mr Bevill Jansz - 03 9798 6315 [email protected] Customer Relations Manager Mrs Breeda Foenander - 03 8790 1610 [email protected] COMMITTEE Mrs Carol Loos - 03 9827 4455 Mr Fred Clarke - 03 8759 0920 Mrs Dyan Davidson - 03 97111 922 2 Meet the Sri Lankan crepe that Australians are hopping mad for Described as the love child of a crepe and a crumpet, Australia can't get enough of the Sri Lankan bowl-shaped pancake known as the hopper. By Mariam Digges 22 Jul 2016 In 2013, pancakes and crepes were two of most searched recipes on Google. Fast-forward to 2016 and there's a new trend battering up around the country. Meet the hopper: Sri Lanka's street food answer to the pancake. -

Clean Energy Australia

CLEAN ENERGY AUSTRALIA REPORT 2016 Image: Hornsdale Wind Farm, South Australia Cover image: Nyngan Solar Farm, New South Wales CONTENTS 05 Introduction 06 Executive summary 07 About us 08 2016 snapshot 12 Industry gears up to meet the RET 14 Jobs and investment in renewable energy by state 18 Industry outlook 2017 – 2020 24 Employment 26 Investment 28 Electricity prices 30 Energy security 32 Energy storage 34 Technology profiles 34 Bioenergy 36 Hydro 38 Marine 40 Solar: household and commercial systems up to 100 kW 46 Solar: medium-scale systems between 100 kW and 5 MW 48 Solar: large-scale systems larger than 5 MW 52 Solar water heating 54 Wind power 58 Appendices It’s boom time for large-scale renewable energy. Image: Greenough River Solar Farm, Western Australia INTRODUCTION Kane Thornton Chief Executive, Clean Energy Council It’s boom time for large-scale of generating their own renewable renewable energy. With only a few energy to manage electricity prices that years remaining to meet the large-scale continue to rise following a decade of part of the Renewable Energy Target energy and climate policy uncertainty. (RET), 2017 is set to be the biggest year The business case is helped by for the industry since the iconic Snowy Bloomberg New Energy Finance Hydro Scheme was finished more than analysis which confirms renewable half a century ago. energy is now the cheapest type of While only a handful of large-scale new power generation that can be renewable energy projects were built in Australia, undercutting the completed in 2016, project planning skyrocketing price of gas and well below and deal-making continued in earnest new coal – and that’s if it is possible to throughout the year. -

Clean Energy Australia 2020

CLEAN ENERGY AUSTRALIA CLEAN ENERGY AUSTRALIA REPORT 2020 AUSTRALIA CLEAN ENERGY REPORT 2020 CONTENTS 4 Introduction 6 2019 snapshot 12 Jobs and investment in renewable energy by state 15 Project tracker 16 Renewable Energy Target a reminder of what good policy looks like 18 Industry outlook: small-scale renewable energy 22 Industry outlook: large-scale renewable energy 24 State policies 26 Australian Capital Territory 28 New South Wales 30 Northern Territory 32 Queensland 34 South Australia 36 Tasmania 38 Victoria 40 Western Australia 42 Employment 44 Renewables for business 48 International update 50 Electricity prices 52 Transmission 54 Energy reliability 56 Technology profiles 58 Battery storage 60 Hydro and pumped hydro 62 Hydrogen 64 Solar: Household and commercial systems up to 100 kW 72 Solar: Medium-scale systems between 100 kW and 5 MW 74 Solar: Large-scale systems larger than 5 MW 78 Wind Cover image: Lake Bonney Battery Energy Storage System, South Australia INTRODUCTION Kane Thornton Chief Executive, Clean Energy Council Whether it was the More than 2.2 GW of new large-scale Despite the industry’s record-breaking achievement of the renewable generation capacity was year, the electricity grid and the lack of Renewable Energy Target, added to the grid in 2019 across 34 a long-term energy policy continue to projects, representing $4.3 billion in be a barrier to further growth for large- a record year for the investment and creating more than scale renewable energy investment. construction of wind and 4000 new jobs. Almost two-thirds of Grid congestion, erratic transmission solar or the emergence this new generation came from loss factors and system strength issues of the hydrogen industry, large-scale solar, while the wind sector caused considerable headaches for by any measure 2019 was had its best ever year in 2019 as 837 project developers in 2019 as the MW of new capacity was installed grid struggled to keep pace with the a remarkable year for transition to renewable energy. -

Clean Energy Australia Report 2014 Table of Contents

CLEAN ENERGY AUSTRALIA REPORT 2014 TABLE OF CONTENTS 02 Introduction 04 Executive summary 06 Snapshot 10 2014 in review 16 Industry outlook 2015–2020 18 Employment 20 Investment 22 Electricity prices 24 Demand for electricity 26 Energy efficiency 28 Energy storage 30 Summary of clean energy generation 33 Bioenergy 35 Geothermal 37 Hydro 39 Marine 41 Solar power 47 Large-scale solar power 51 Solar water heating 55 Wind power 61 Appendices Front cover and this page: Royalla Solar Farm, Australian Capital Territory. Image courtesy FRV Services Australia 2 INTRODUCTION While the future for renewable energy in Australia is extremely bright, the industry always knew there would be a few clouds along the way. Image: Snowtown 2 Wind Farm, South Australia Kane Thornton Chief Executive, Clean Energy Council 3 Last year was a tough one for most Household solar fared better than the Globally, the installation of renewable forms of renewable energy, from large-scale sector last year. Increased energy in the last decade has large-scale technologies such as consumer engagement and awareness surpassed all expectations. Costs for bioenergy, wind and solar to emerging about electricity prices and the benefits most technologies have come down technologies like geothermal. of solar technology meant more than significantly, and supporting policies 230,000 households and businesses have continued to spread throughout An expert panel for the Federal installed either solar power or solar the world. However, Australia went Government’s review of the national hot water. sharply backwards on large-scale Renewable Energy Target (RET) was renewable energy last year while the announced early in the year. -

Review of National Competition Policy Reforms, Report No

Review of National Productivity Competition Commission Policy Reforms Inquiry Report No. 33, 28 February 2005 © Commonwealth of Australia 2005 ISSN 1447-1329 ISBN 1 74037 169 0 This work is subject to copyright. Apart from any use as permitted under the Copyright Act 1968, the work may be reproduced in whole or in part for study or training purposes, subject to the inclusion of an acknowledgment of the source. Reproduction for commercial use or sale requires prior written permission from the Attorney-General’s Department. Requests and inquiries concerning reproduction and rights should be addressed to the Commonwealth Copyright Administration, Attorney-General’s Department, Robert Garren Offices, National Circuit, Canberra ACT 2600. This publication is available in hard copy or PDF format from the Productivity Commission website at www.pc.gov.au. If you require part or all of this publication in a different format, please contact Media and Publications (see below). Publications Inquiries: Media and Publications Productivity Commission Locked Bag 2 Collins Street East Melbourne VIC 8003 Tel: (03) 9653 2244 Fax: (03) 9653 2303 Email: [email protected] General Inquiries: Tel: (03) 9653 2100 or (02) 6240 3200 An appropriate citation for this paper is: Productivity Commission 2005, Review of National Competition Policy Reforms, Report no. 33, Canberra. The Productivity Commission The Productivity Commission, an independent agency, is the Australian Government’s principal review and advisory body on microeconomic policy and regulation. It conducts public inquiries and research into a broad range of economic and social issues affecting the welfare of Australians. The Commission’s independence is underpinned by an Act of Parliament. -

List-Of-All-Postcodes-In-Australia.Pdf

Postcodes An alphabetical list of postcodes throughout Australia September 2019 How to find a postcode Addressing your mail correctly To find a postcode simply locate the place name from the alphabetical listing in this With the use of high speed electronic mail processing equipment, it is most important booklet. that your mail is addressed clearly and neatly. This is why we ask you to use a standard format for addressing all your mail. Correct addressing is mandatory to receive bulk Some place names occur more than once in a state, and the nearest centre is shown mail discounts. after the town, in italics, as a guide. It is important that the “zones” on the envelope, as indicated below, are observed at Complete listings of the locations in this booklet are available from Australia Post’s all times. The complete delivery address should be positioned: website. This data is also available from state offices via the postcode enquiry service telephone number (see below). 1 at least 40mm from the top edge of the article Additional postal ranges have been allocated for Post Office Box installations, Large 2 at least 15mm from the bottom edge of the article Volume Receivers and other special uses such as competitions. These postcodes follow 3 at least 10mm from the left and right edges of the article. the same correct addressing guidelines as ordinary addresses. The postal ranges for each of the states and territories are now: 85mm New South Wales 1000–2599, 2620–2899, 2921–2999 Victoria 3000–3999, 8000–8999 Service zone Postage zone 1 Queensland -

2012 Annual Report

Telecommunications Industry Ombudsman TELECOMMUNICATIONS INDUSTRY OMBUDSMAN 2012 ANNUAL REPORT PREPARING FOR THE FUTURE CONTENTS ABOUT US 1 COMPLAINT STATISTICS 16 ENGAGEMENT 32 About the TIO 1 Dashboard 16 Awareness of TIO services 32 Ombudsman’s message 2 New Complaints by quarter 16 Resilient Consumers 32 New Complaints v. concilations TIO Talks 32 Board Chairman’s message 3 and investigations 16 First online annual report 32 Council Chairman’s message 4 New complaints by consumer type 16 Accessibility 32 New complaints by service type 17 A new website 32 Board and Council in 2011-12 5 Conciliations and Investigations Community engagement 33 Board members in 2011-12 5 by service type 17 Council members in 2011-12 8 Top 7 issues in new complaints 17 Industry engagement 34 Trends overview 18 Account management model 34 Ombudsman roadshow 34 PERFORMANCE 11 Complaints about the “big three” service providers 18 MNews 34 Conciliation 11 Complaints about mobile phone Our membership 34 services 18 Live transfers 11 Government and regulation 34 Small business complaints 19 Conciliation snapshot 11 Highlights 34 Increase in enquiries 19 List of submissions 35 Timeliness 12 Geographical trends 20 Consumer satisfaction Australia wide 20 ORGANISATION 36 with TIO services 12 Victoria 21 Feedback about the TIO 12 South Australia 21 Staff overview 36 Amendments to the Australian Capital Territory 22 New teams 36 TIO Constitution 13 New South Wales 22 TIO organisational structure 36 Queensland 23 Wellness program 36 Monetary limits 13 Western Australia -

Mortgage Delinquency Map: Home Loan Arrears Rising in All Australian States

STRUCTURED FINANCE SECTOR IN-DEPTH RMBS - Australia 6 April 2017 Mortgage Delinquency Map: Home Loan Arrears Rising in All Australian States Summary Contacts » Delinquencies increased Australia-wide: The proportion of Australian residential mortgages that were more than 30 days in arrears (30+ delinquency rate) increased Alena Chen 612-9270-8131 Vice President to 1.52% in November 2016 from 1.20% in November 2015. Mortgage delinquencies [email protected] increased in all eight Australian states and territories over the year to November 2016, hitting record highs in Western Australia, South Australia and the Northern Territory. A significant portion of the increase in delinquencies can be attributed to the inclusion of loans under hardship arrangements in the calculation of delinquency rates, but delinquencies increased irrespective of this development. » Delinquencies highest in Western Australia, lowest in NSW and ACT: Western Australia had the highest 30+ delinquency rate of any state or territory in Australia. The Western Australian economy is heavily reliant on the resources sector and growth has slowed since the end of the mining boom. The Australian Capital Territory (ACT) had the lowest 30+ delinquency rate. Mortgage performance in New South Wales (NSW) was also relatively strong, despite an increase in delinquencies over the year to November 2016. Over the four years to November 2016, delinquencies in NSW have fallen notably, a decline that has coincided with the run-up in home prices in Sydney. » Mining regions dominate worst performing areas, Sydney suburbs top best- performing list: Regions in Western Australia and Queensland with exposure to the resource and mining sectors dominated the list of areas with the highest delinquencies. -

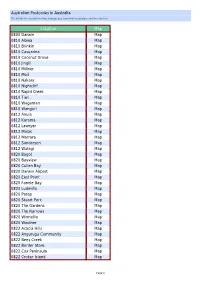

Australian Postcodes in Australia Location Map 0800 Darwin Map

Australian Postcodes in Australia This GPS POI file is available here: https://www.gps-data-team.info/poi/australia/postcodes/Postcodes.html Location Map 0800 Darwin Map 0810 Alawa Map 0810 Brinkin Map 0810 Casuarina Map 0810 Coconut Grove Map 0810 Jingili Map 0810 Millner Map 0810 Moil Map 0810 Nakara Map 0810 Nightcliff Map 0810 Rapid Creek Map 0810 Tiwi Map 0810 Wagaman Map 0810 Wanguri Map 0812 Anula Map 0812 Karama Map 0812 Leanyer Map 0812 Malak Map 0812 Marrara Map 0812 Sanderson Map 0812 Wulagi Map 0820 Bagot Map 0820 Bayview Map 0820 Cullen Bay Map 0820 Darwin Airport Map 0820 East Point Map 0820 Fannie Bay Map 0820 Ludmilla Map 0820 Parap Map 0820 Stuart Park Map 0820 The Gardens Map 0820 The Narrows Map 0820 Winnellie Map 0820 Woolner Map 0822 Acacia Hills Map 0822 Angurugu Community Map 0822 Bees Creek Map 0822 Border Store Map 0822 Cox Peninsula Map 0822 Croker Island Map Page 1 Location Map 0822 Daly River Community Map 0822 Darwin River Map 0822 Fly Creek Map 0822 Galiwinku Map 0822 Goulburn Island Map 0822 Gunn Point Map 0822 Hayes Creek Map 0822 Lee Point Map 0822 Maningrida Map 0822 Mcminns Lagoon Map 0822 Middle Point Map 0822 Milingimbi Community Map 0822 Minjilang Map 0822 Mitchell Map 0822 Nguilu Community Map 0822 Oenpelli Map 0822 Pularumpi Community Map 0822 Pulumpa Map 0822 Ramingining Community Map 0822 Umbakumba Community Map 0822 Wadeye Map 0822 Wagait Beach Map 0822 Woolaning Map 0828 Berrimah Map 0830 Driver Map 0830 Durack Map 0830 Gray Map 0830 Marlow Lagoon Map 0830 Moulden Map 0830 Palmerston Map 0830 -

Mortgage Delinquency Map - Home Loan Arrears Will Increase Moderately on Housing

STRUCTURED FINANCE SECTOR IN-DEPTH RMBS - Australia 12 April 2018 Mortgage delinquency map - Home loan arrears will increase moderately on housing TABLE OF CONTENTS slowdown Summary 1 NATIONAL PERFORMANCE 2 Summary PERFORMANCE BY REGION 7 Australian mortgage delinquencies will increase moderately through 2018 on softer housing PERFORMANCE BY POSTCODE 9 market conditions, following a decline in home loan arrears over the year to November 2017. STATES IN FOCUS 11 Moody’s related publications 17 » Mortgage delinquencies have declined. The proportion of Australian residential mortgages that were more than 30 days in arrears (30-plus delinquency rate) was 1.45% in November 2017, compared with 1.52% in November 2016. Delinquencies declined in all states except New South Wales (NSW) over the year. Despite an increase, Contacts delinquencies in NSW remained low compared to most other states and territories. Alena Chen +61.2.9270.8131 VP-Senior Analyst Delinquency rates were lower in capital cities than other regions of each state or territory. [email protected] » Delinquencies will increase moderately through 2018. Softening housing market conditions, particularly in the key states of NSW and Victoria, will drive delinquencies CLIENT SERVICES moderately higher. Less favourable income dynamics and ongoing volatility in the Americas 1-212-553-1653 resources sector will also weigh on mortgage performance. Asia Pacific 852-3551-3077 » Western Australia and Queensland dominate the list of worst-performing regions. Japan 81-3-5408-4100 Nine of the 10 regions with the highest 30-plus delinquency rates in November 2017 EMEA 44-20-7772-5454 were in either Western Australia or Queensland, and many of these regions are exposed to employment industries directly or indirectly related to mining and resources. -

AMP NATSEM Report 08

Trends in spatial income inequality, 1996 to 2001 AMP.NATSEM Income and Wealth Report Issue 8. September 2004 Money, money, money – is this a rich man’s world? Contents 1 Where are the most affluent areas? 1 2 The good news: Strong growth across all of Australia 4 3 The cities vs the bush 6 4 A profile of difference 7 Work rich: work poor? Profession and industry Educational divides 5 Housing: A nation of homeowners 11 6 Indigenous Australians 12 7 Conclusions 13 Introduction Many of us empathise with the line in Midnight Oil’s song, This time, the report divides postcodes into ten equal Read about it, where, ‘The rich get richer, the poor get groups according to gross income to reveal: the picture’. Surveys reveal that Australians believe the • where the most affluent and poorest areas of Australia gap between rich and poor is growing. But is this just a are located perception or is it based on fact? • who has benefited from the past few years of strong In this issue of the AMP.NATSEM Income and Wealth Report, economic growth and falling unemployment we compare the income of households by postcode based on figures from the 1996 and 2001 Census to determine • how household incomes in 2001 compare with those who exactly is getting richer, and whether any groups have of 1996 been left behind. • which regions have fared well and which ones haven’t This report follows on from the first AMP.NATSEM Report during the five years between 1996 and 2001, and on ‘Trends in Taxable Income’ which examined taxation • income, education, employment and homeownership statistics by postcode to determine the most affluent and differences between the Top 10% and Bottom 10%, the poorest areas of the nation.