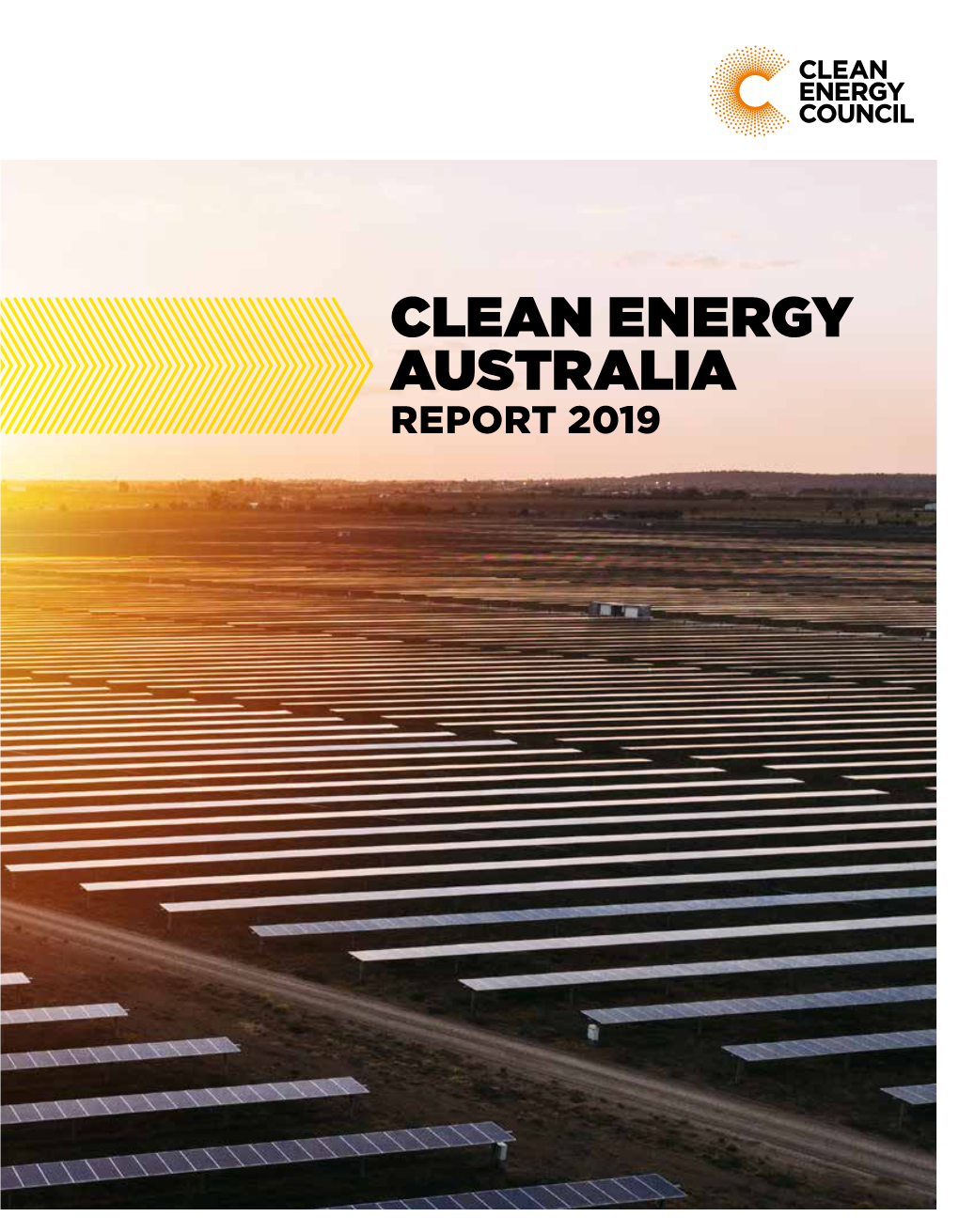

CLEAN ENERGY AUSTRALIA REPORT 2019 REPORT 2019 We Put More Energy Into Your Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cattle Hill Wind Farm Collision Avoidanceanddetectionplan (CADP)

1 Joule Logic Renewable Energy and Environment Specialists Cattle Hill Wind Farm Collision Avoidance and Detection Plan (CADP) Developed to satisfy the requirements of Condition 6A of the Commonwealth Approval EPBC 2009/4839 for the Cattle Hill Wind Farm Date Revision Prepared Reviewed Approved 22/05/2018 5 Cindy Hull Sue Marsh Jeff Bembrick Joule Logic Joule Logic Goldwind Australia 2 Disclaimer Reports produced by Joule Logic Pty Ltd are prepared based on the Client’s objective and are based on a specific scope, conditions and limitations, as agreed between Joule Logic and the Client. Information and/or report(s) prepared by Joule Logic may not be suitable for uses other than the original intended objective. No parties other than the Client should use any information and/or report(s) without first conferring with Joule Logic. Although Joule Logic has taken all necessary steps to ensure that an accurate report has been prepared, the Company accepts no liability for any damages or loss incurred as a result of reliance placed upon the report and its contents. Copyright The concepts and information contained in this document are the property of Joule Logic. Use or copying of this document in whole or in part without the written permission of Joule Logic constitutes an infringement of copyright. Information shall not be assigned to a third party without prior consent. 3 Definitions In this Collision Avoidance and Detection Plan the following definitions apply: Cattle Hill Wind Farm Comprising 48 wind turbines and 150 MW capacity Central Highlands Region Is that described in Environment Protection Notice No. -

Wind Turbine Transportation

Wind Turbine Transportation Temporary delays – Gateway Motorway / Mt Gravatt-Capalaba Road intersection May 2019 – July 2019 Saturday to Thursday nights between 10pm and 12am Saturday to Thursday nights (six nights per week), between 10pm and 12am, the intersection of the Gateway Motorway and Mt Gravatt-Capalaba Road will be closed intermittently, for approximately 15-20 minutes, to allow for the safe movement of oversize vehicles transporting wind turbine blades and large tower sections to the Coopers Gap Wind Farm near Cooranga North. Traffic will be held at the Gateway Motorway / Mt Gravatt-Capalaba Road intersection and on the motorway off-ramp until it is safe to continue. We will try to minimise the disruption to other road users where possible, but some delays are to be expected. These temporary closures will be in place between May and July 2019. Closure times Gateway Motorway / Mt Gravatt-Capalaba Road intersection • Saturday to Thursday nights (six nights per week), intermittent closures between 10pm – 12am, from May to July 2019 Transportation of oversize wind turbine components Between January and November 2019, components for the wind farm’s 123 GE wind turbines will be transported over 300km from the Port of Brisbane to the Coopers Gap Wind Farm site. In total there will be approximately 1200 oversize transport movements to deliver all of the wind turbine components to site – including blades, tower sections, hubs and nacelles. The blades, which are up to 67.2 metres long, are the largest wind turbine blades ever transported in Australia. The movement of such large pieces of equipment requires detailed planning and coordination. -

Project Updates Further Details Are Available in the Application Week Ending 28 April 2017 for Electricity Generation Authority: AGL Hydro

approximately 50km south-west of Kingaroy and 65km north of Dalby. The Regulator is seeking feedback from interested persons with regards to issuing AGL Hydro Partnership (the operator of the proposed generator) a generation authority for the Coopers Gap Wind Farm. Project Updates Further details are available in the Application Week ending 28 April 2017 for electricity generation authority: AGL Hydro Partnership for the Coopers Gap Wind Farm information paper. Off-Site Renewable Energy EOI 26 April Have your say Monash University (Monash) is inviting Written submissions about the proposed Expressions of Interest (EOI) from suitably Coopers Gap Wind Farm are welcome. Please qualified, experienced and resourced send your submissions to: providers for the long-term contract supply of 45 to 55 GWh of electricity from a renewable Email: energy source. The contract will also include [email protected] the provision of renewable energy certificates, namely Large-scale Generation Mail: Attn: Andrea Wold Certificates (LGC's). Regulation, Governance and Analytics Department of Energy and Water Supply More information available from PO Box 15456 https://www.tenderlink.com/monashuni/ CITY EAST QLD 4002 Source: Monash University Submissions close at 5pm on Monday, 1 May 2017. Source: Queensland Government Coopers Gap Wind Farm Click on project to go to online datasheet: Coopers Gap Wind Farm Under the Electricity Act 1994, the Regulator (i.e. the Director-General of the Department of Energy and Water Supply) issues authorities (licences) for generation, transmission and distribution activities in Queensland’s electricity industry. Storage to strengthen Victoria’s energy system When an applicant applies for a generation 27 April authority to connect generating plant with The Andrews Labor Government is calling for capacity greater than 30 megawatts (MW) to detailed proposals for large scale battery a transmission grid or supply network, the energy storage facilities in western Victoria. -

Download Section

[ 142 ] CEFC ANNUAL REPORT 2018 Section 4 Appendices SECTION 4 • APPENDICES [ 143 ] Appendices Appendix A: Index of Annual Reporting Requirements 144 Appendix B: Equal Employment Opportunity Report 2017-18 147 Appendix C: Environmental Performance and Ecologically Sustainable Development Report 2017-18 149 Appendix D: Work Health and Safety Report 2017-18 153 Appendix E: Summary of Operating Costs and Expenses and Benchmark 155 Appendix F: Realised Investments 159 Glossary and Abbreviations 162 List of figures 168 Index 169 [ 144 ] CEFC ANNUAL REPORT 2018 Appendix A: Index of Annual Reporting Requirements As a corporate Commonwealth entity, the CEFC has a range of Annual Reporting requirements set by legislation, subordinate legislation and reporting guidelines. Figure 20: Index of CEFC Annual Reporting Requirements Statutory Requirement Legislation Reference Section Page Index of Public Governance, Performance and Accountability Act 2013 (PGPA Act) and Public Governance, Performance and Accountability Rule 2014 (PGPA Rule) Annual Reporting Requirements Provision of Annual Report (including financial PGPA Act, section 46 Letter of iii statements and performance report) to Transmittal responsible Minister by 15 October each year Board statement of approval of Annual Report PGPA Act, section 46 Letter of iii with section 46 of the PGPA Act PGPA Rule, section 17BB Transmittal Annual performance statements PGPA Act, section 39 1 PGPA Rule, section 16F and 17BE(g) Board statement of compliance of performance PGPA Act, section 39 1 report with -

GOLDWIND AUSTRALIA PTY LTD Level 25, Tower 1, International Towers Sydney 100 Barangaroo Ave, Barangaroo NSW 2000

GOLDWIND AUSTRALIA PTY LTD Level 25, Tower 1, International Towers Sydney 100 Barangaroo Ave, Barangaroo NSW 2000 www.goldwindaustralia.com 11 September 2020 The Hon. Guy Barnett, MP Minister for Energy Department of State Growth 4 Salamanca Pl Hobart TAS 7000 Dear Minister Barnett Re: Response to the Draft Tasmanian Renewable Energy Action Plan Goldwind Australia (Goldwind) is pleased to present this response to the Tasmanian Governments Draft Renewable Energy Action Plan. Goldwind has over ten years’ experience of building renewable energy projects across Australia, with 562MW operating including the 144MW Cattle Hill Wind Farm in Tasmania, 960MW of wind farms currently under construction and a further 1.3 GW in the immediate development pipeline. As an experienced renewable energy developer, Goldwind shares the vision expressed in the Tasmanian Renewable Energy Action Plan and applauds the goal of achieving a 200% renewable energy target by 2040. We consider this long-term vision will bring substantial economic, social and environmental benefits for Tasmanian. We have made several suggestions that Goldwind considers would help achieve the stated goals in an efficient and effective manner. These are detailed in our submission, which is attached as Attachment A. We will continue to pursue opportunities for further renewable energy generation in Tasmania. John Titchen Managing Director, Goldwind Australia Goldwind Australia Pty Ltd (ABN 32 140 108 390) GOLDWIND AUSTRALIA PTY LTD Level 25, Tower 1, International Towers Sydney 100 Barangaroo Ave, Barangaroo NSW 2000 www.goldwindaustralia.com Attachment A Goldwind Australia Response to the Draft Renewable Energy Action Plan (Action Plan) 1. Introduction Goldwind supports the vision for Tasmania to become a powerhouse of sustainable, low cost and reliable energy production. -

Alinta Energy with the Opportunity to Provide Comment on the WEM Effectiveness Report Issues Paper

16 December 2019 Transmission via online submission form: https://www.erawa.com.au/consultation Report to the Minister for Energy on the Effectiveness of the Wholesale Electricity Market 2019 Issues paper Thank you for providing Alinta Energy with the opportunity to provide comment on the WEM effectiveness report issues paper. The ERA has identified that the reform process is addressing many of the elements raised in previous WEM effectiveness reports. However, the ERA has highlighted an issue that does not appear to be within the reform scope, specifically the impact that network decisions can have in influencing outcomes in the WEM (and the resultant impacts on market cost optimisation). Alinta Energy supports a mechanism to ensure that network outage planning chooses the overall least cost plan Western Australia is an attractive market for renewables investment given the abundance of natural resources and the market design characteristics. However, significant support and industry leadership was required to allow new renewable generators to connect to the network in a timely manner under the interim access solution (known as the Generator Interim Access or GIA). The underlying principle of the GIA solution is that it applies constraints to limit the output of a GIA generator when network capacity is limited. This includes: • A dynamic (real-time) assessment and application of constraints during system normal; and • Manual assessment and application of constraints in other circumstances (i.e. when there is a planned outage on any network element that impacts the GIA generator). Badgingarra Wind Farm (BWF)1 is the first GIA generator in commercial operation on SWIS. -

Zielmarktanalyse Australien

www.exportinitiative.bmwi.de (A) Bereich für Bild AUSTRALIEN Energieeffiziente Lösungen für Infrastrukturentwicklung und Verkehr Zielmarktanalyse 2019 mit Profilen der Marktakteure www.german-energy-solutions.de Impressum Herausgeber German-Australian Chamber of Industry and Commerce Deutsch-Australische Industrie- und Handelskammer 8 Spring Street, Level 6 Sydney NSW 2000 Telefon: +61 2 8296 0400 E-Mail: [email protected] Webseite: www.germany-australia.com.au Stand 10.04.2019 Bildnachweis AHK Australien Redaktion Anja Kegel Director Consulting Services, Projects [email protected] Jürgen Wallstabe Consultant, Consulting Services, Projects [email protected] Mareile Teegen Consultant, Consulting Services, Projects & GTAI [email protected] Inhaltsverzeichnis I Tabellen 3 II Abbildungen 3 III Abkürzungen 4 1 Zusammenfassung 5 2 Länderprofil 6 2.1 Politischer Hintergrund 6 2.2 Wirtschaft, Struktur und Entwicklung 7 2.2.1 Aktuelle wirtschaftliche Lage 7 2.2.2 Außenhandel 8 2.2.3 Wirtschaftliche Beziehungen zu Deutschland 9 2.2.4 Investitionsklima und -förderung 9 3 Der Energiemarkt in Australien 10 3.1 Energieverbrauch 10 3.1.1 Energiebedarf und Aufteilung nach Sektoren 10 3.1.2 Energiequellen 12 3.1.3 Stromerzeugung und -verbrauch 13 3.2 Energiepreise 15 3.2.1 Strompreise 15 3.2.2 Gaspreise 15 3.2.3 Treibstoffpreise 16 3.3 Gesetzliche Rahmenbedingungen 17 3.4 Aktuelle Entwicklungen auf dem Energiemarkt 18 4 Energieeffiziente Lösungen für Infrastrukturentwicklung und Verkehr 21 4.1 Australische Trends mit -

Community Information Booklet

Community Information Booklet capitalbattery.com.au Gina Zheng, Project Manager [email protected] 1800 966 216 CONTENTS About Neoen 1 South Australia’s Big Battery 2 Delivering cheaper energy 3 Contribution to the Capital 5 What does a battery look like? 7 Project lifecycle 8 What can a battery do? 9 Facts & Figures 11 Choosing the site 12 Managed & operated in Canberra 13 Community Co-investment 14 FAQs 15 GLOBALLY The company is headquartered in Paris, EUROPE & AFRICA France, and has two Australian offices – in Finland Sydney and Canberra. AMERICAS Ireland USA France We operate across renewable energy Mexico Portugal technologies including solar, wind and storage El Salvador Zambia in Europe, Central America, Africa, the Middle Jamaica AUSTRALIA Mozambique East and Australia. Ecuador Australia Colombia Neoen’s total capacity in operation and under Argentina construction is currently over 3 GW and we are aiming for more than 5GW by 2021. LOCALLY Neoen Australia began operations in DeGrussa Solar and Storage Project Western Downs 2012. Over the last eight years the Green Power Hub company has initiated the development Dubbo Solar Hub Hornsdale Wind Farms 1, 2, 3 Parkes Solar Farm of more than 1.5GW of solar and wind Hornsdale Power Reserve Griffith Solar Farm projects through organic growth, local Coleambally Solar Farm partnerships and strategic acquisitions. Bulgana Green Power Hub Numurkah Solar Farm Neoen produce clean electricity from renewable sources such as sunlight and wind using mature, tried and tested technologies. -

Clean Energy Fact Sheet We All Want Affordable, Reliable and Clean Energy So We Can Enjoy a Good Quality of Life

Clean Energy fact sheet We all want affordable, reliable and clean energy so we can enjoy a good quality of life. This fact sheet sets out how we’re leading a transition from fossil fuels to cleaner forms of energy. Background Minimising or, where we can, avoiding financial EnergyAustralia is one of the country’s biggest hardship is part of the challenge as we transition generators of power from fossil fuels. Each to cleaner generation. We need to do this while preserving the reliability of supply. +800 MW year we produce around 20 million tonnes Rights to of greenhouse gases, mostly carbon dioxide Our approach involves supporting the renewable energy or CO₂, from burning coal and gas to supply development of clean energy while helping our electricity to our 2.4 million accounts across customers manage their own consumption so eastern Australia. they use less energy. Because when they do For around a century, coal-fired power plants that, they generate fewer emissions and they ~$3B have provided Australians with reliable and save money. Long term affordable power and supported jobs and renewable Supporting renewable energy agreements economic development. The world is changing with fossil fuel generation being replaced by Right now, EnergyAustralia has the rights to lower emissions technologies. more than 800 MW worth of renewable energy, combining solar and wind farm power purchase The way we generate, deliver and use energy agreements, and we half-own the Cathedral 7.5% has to change. As a big emitter of carbon, it’s Rocks wind farm. Of large-scale up to us to lead the transition to cleaner energy wind and solar in a way that maintains that same reliable and project in the NEM affordable access to energy for everyone. -

Infigen Energy Annual Report 2018

Annual Report 2019. Infigen Energy Image: Capital Wind Farm, NSW Front page: Run With The Wind, Woodlawn Wind Farm, NSW Contents. 4 About Infigen Energy 7 2019 Highlights 9 Safety 11 Chairman & Managing Director’s Report Directors’ Report 16 Operating & Financial Review 31 Sustainability Highlights 34 Corporate Structure 35 Directors 38 Executive Directors & Management Team 40 Remuneration Report 54 Other Disclosures 56 Auditor’s Independence Declaration 57 Financial Report 91 Directors’ Declaration 92 Auditor’s Report Additional Information 9 Investor Information 8 10 Glossary 1 10 4 Corporate Directory Infigen Energy Limited ACN 105 051 616 Infigen Energy Trust ARSN 116 244 118 Registered office Level 17, 56 Pitt Street Sydney NSW 2000 Australia +61 2 8031 9900 www.infigenenergy.com 2 Our Strategy. We generate and source renewable energy. We add value by firming. We provide customers with reliable clean energy. 3 About Infigen Energy. Infigen is leading Australia’s transition to a clean energy future. Infigen generates and sources renewable energy, increases the value of intermittent renewables by firming, and provides customers with clean, reliable and competitively priced energy solutions. Infigen generates renewable energy from its owned wind farms in New South Wales (NSW), South Australia (SA) and Western Australia (WA). Infigen also sources renewable energy from third party renewable projects under its ‘Capital Lite’ strategy. Infigen increases the value of intermittent renewables by firming them from the Smithfield Open Cycle Gas Turbine facility in Western Sydney, NSW, and its 25MW/52MWh Battery at Lake Bonney, SA, where commercial operations are expected to commence in H1FY20. Infigen’s energy retailing licences are held in the National Electricity Market (NEM) regions of Queensland, New South Wales (including the Australian Capital Territory), Victoria and South Australia. -

Automate CP.Xlsm

FCAS Causer Pays Settlement Factors Issued: 10/12/2020 Period of Application: 27/12/2020 to 23/01/2021 Sample Period: 12:05AM, 8/11/2020 to 12:00AM, 6/12/2020 Queensland, New South Wales, Victoria, South Australia and Tasmania Region Causer Pays Factors Scheduled and Semi-Scheduled Aggregations Factor AETV Pty Ltd 0.013562453 AGL Hydro Partnership 4.012190653 AGL Loy Yang Marketing Pty Ltd 0 AGL Macquarie Pty Limited 0 AGL PARF NSW Pty Ltd 2.310470219 AGL PARF QLD Pty Limited 0.46800389 AGL SA Generation Pty Limited 1.849553623 Alinta Energy Retail Sales Pty Ltd 0.449145117 Ararat Wind Farm Pty Ltd 0.875407241 Arrow Southern Generation Pty Ltd And Arrow Braemar 2 Pty Ltd 0.042579354 Boco Rock Wind Farm Pty Ltd 0.433630577 Bodangora Wind Farm Pty Limited 0.382480317 Bomen Solar Farm Pty Ltd As Trustee For Bomen SF Trust 0.556490672 Braemar Power Project Pty Ltd 0.706700821 Bulgana Wind Farm Pty Ltd 0.837111039 Callide Power Trading Pty Limited 0 Cherry Tree Wind Farm Pty Ltd As Trustee For The Cherry Tree Project Trust 0.156136526 Childers Solar Pty Ltd ATF The Childers Solar Trust 0.080755682 Clare Solar Farm Pty Ltd 0.651235137 CleanCo Queensland Limited 1.758098911 Clermont Asset Co Pty Ltd ATF Clermont Solar Unit Trust 0 Coleambally Solar Pty Ltd 1.111648664 Collector Wind Farm Pty Ltd 0.185651799 Crookwell Development Pty Ltd 0.401146682 CRWF Nominees Pty Ltd As Trustee For The CRWF Trust 0 CS Energy Limited 0 Darling Downs Solar Farm Pty Ltd 0.875202842 Darlington Point Solar Farm Pty Ltd 0.660040796 Daydream Solar Farm Pty Ltd As -

ROAM Consulting Report on Security of Supply and Tranmission Impacts Of

ROAM Consulting Pty Ltd A.B.N. 54 091 533 621 Report (EMC00017) to Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation 13 September 2011 Report to: Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation EMC00017 13 September 2011 VERSION HISTORY Version History Revision Date Issued Prepared By Approved By Revision Type Jenny Riesz Joel Gilmore Sam Shiao 0.9 2011-07-04 Ian Rose Preliminary Draft David Yeowart Richard Bean Matthew Holmes Jenny Riesz 1 2011-07-07 Ian Rose Complete Matthew Holmes 1.1 2011-07-07 Jenny Riesz Ian Rose Minor text edits Minor text edits - Appendix B 1.2 2011-09-01 Jenny Riesz - and explanation of Badgingarra Minor text edits – further 1.3 2011-09-13 Jenny Riesz - explanation of Badgingarra ROAM Consulting Pty Ltd VERSION HISTORY www.roamconsulting.com.au Report to: Impact of the LRET on the costs of FCAS, NCAS and Transmission augmentation EMC00017 13 September 2011 EXECUTIVE SUMMARY At the request of the Ministerial Council on Energy, the Australian Energy Market Commission (AEMC) is conducting an assessment of the impact of the Large-scale Renewable Energy Target (LRET) on security of energy supply, the price of electricity and emissions levels from the energy sector. The AEMC appointed consultants to develop a long-term generation expansion plan for meeting the LRET. Consequently, the ‘core’ scenarios for the portfolio and geographic distribution of technologies have been determined. ROAM Consulting was subsequently appointed to utilise these scenarios to forecast the cost of Frequency Control Ancillary Services (FCAS), Network Support and Control Ancillary Services (NSCAS) and transmission augmentation associated with the LRET for the National Electricity Market (NEM) and the South West Interconnected System (SWIS).