Dixon Technologies (India) (DIXTEC)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dixon Technologies (India) Ltd. (Formerly Known As Dixon Technologies (India) Pvt

Dixon An ISO 9001 : 2008, 14001 : 2004 Company Dixon Technologies (India) Ltd. (Formerly Known as Dixon Technologies (India) Pvt. Ltd ) CIN : L32101UP1993PLC066581 Regd. Office: B-14 & 15, Phase-II, Noida-201305, (U.P.) India,Ph.: 0120-4737200 E-mail : [email protected]. Website : http://www.dixoninfo.com, Fax : 0120-4737263 5th July, 2018 To To Secretary �cretary Listing Department sting Department BSE Limited 'v National Stock Exchange of India Limited Department of Corporate Services Exchange Plaza, Bandra Kurla Complex Phiroze Jeejeebhoy Towers, Mumbai - 400 050 Dalal Street, Mumbai - 400 001 Scrip Code - 540699 Scrip Code- DIXON !SIN: INE935N01012 !SIN: INE935N01012 Subject: Appointment of President - Chief Operating Officer (COO) of the Company Dear Sir/Ma'am, We wish to inform you that Mr. Abhijit Kotnis has joined the Company as President - Chief Operating Officer (COO) of the Company. A detailed announcement in this respect is enclosed herewith. We request you to kindly take the same on record and oblige. Thanking you, Encl: as above Dixon Technologies appoints Mr. Abhijit Kotnis as President -Chief Operating Officer (COO) of the Company 5th July, Noida: Dixon Technologies (India) Limited (“Company”) has appointed Mr. Abhijit Kotnis as President- COO who shall be spearheading the Company’s LED Television division & New Projects. Mr. Kotnis has over 28 years of rich and extensive experience across Manufacturing, Technology Business Development and sourcing fields. His knowledge and expertise is proven in the areas of Strategic Planning & Executions, New Business Development, Supply Chain Management, Business transformations etc . Mr. Kotnis holds an MBA in Marketing & Operations & B.E. in Electronics & Telecommunications from Marathawada University, Aurangabad and has also completed his Post Graduate Programme in Management (MEP) from IIM, Ahmedabad. -

Dixon Technologies (India) Limited Corporate Presentation

Dixon Technologies (India) Limited Corporate Presentation October 2017 Company Overview Dixon Technologies (India) Limited Corporate Presentation 2 Dixon Overview – Largest Home Grown Design-Focused Products & Solutions Company Business overview Engaged in manufacturing of products in the consumer durables, lighting and mobile phones markets in India. Company also provide solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels Fully integrated end-to-end product and solution suite to original equipment manufacturers (“OEMs”) ranging from global sourcing, manufacturing, quality testing and packaging to logistics Diversified product portfolio: LED TVs, washing machine, lighting products (LED bulbs &tubelights, downlighters and CFL bulbs) and mobile phones Leading Market position1: Leading manufacturer of FPD TVs (50.4%), washing machines (42.6%) and CFL and LED lights (38.9%) Founders: 20+ years of experience; Mr Sunil Vachani has been awarded “Man of Electronics” by CEAMA in 2015 Manufacturing Facilities: 6 state-of-the-art manufacturing units in Noida and Dehradun; accredited with quality and environmental management systems certificates Backward integration & global sourcing: In-house capabilities for panel assembly, PCB assembly, wound components, sheet metal and plastic moulding R&D capabilities: Leading original design manufacturer (“ODM”) of lighting products, LED TVs and semi-automatic washing machines Financial Snapshot: Revenue, EBITDA and PAT has grown at -

“Dixon Technologies India Limited 4QFY2020 Earnings Conference Call”

“Dixon Technologies India Limited 4QFY2020 Earnings Conference Call” June 11, 2020 ANALYST: MR. DHRUV JAIN – AMBIT CAPITAL MANAGEMENT: MR. ATUL B LALL – CHIEF EXECUTIVE OFFICER – DIXON TECHNOLOGIES LIMITED MR. SAURABH GUPTA – CHIEF FINANCIAL OFFICER – DIXON TECHNOLOGIES LIMITED Page 1 of 20 Dixon Technologies India Limited June 11 2020 Moderator: Ladies and gentlemen, good day and welcome to the Dixon Technologies India Limited 4QFY2020 Earnings Conference Call hosted by Ambit Capital. As a reminder, all participant lines will be in the listen-only mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing “*” then “0” on your touchtone phone. Please note that this conference is being recorded. I would now like to hand the conference over to Mr. Dhruv Jain from Ambit Capital. Thank you and over to you Sir! Dhruv Jain: Thank you. Welcome to the 4QFY2020 Earnings call of Dixon Technologies. From the management, we have with us Mr. Atul Lall, CEO and Mr. Saurabh Gupta, CFO. Over to you Sir for your opening comments! Atul B. Lall: Thank you Dhruv. This is Atul Lall and we also have with us Saurabh Gupta, CFO. Good afternoon ladies and gentlemen, thanks for joining this call. Before I touch upon our 4QFY2020 results, I would like to update you on how we have fared during the lockdown and the latest update on the post relaxation. So we resumed our operations in all our factories in all the nine factories between May 4, 2020 and May 18, 2020. -

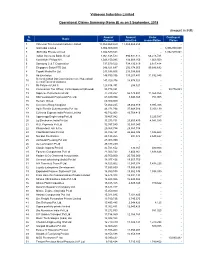

Videocon Industries Limited Operational Claims Summary (Form

Videocon Industries Limited Operational Claims Summary (Form B) as on 3 September, 2018 (Amount in INR) S. Amount Amount Under Contingent Name No. Claimed Admitted reconciliation Claims 1 Videocon Telecommunications Limited 17,869,469,659 17,869,469,659 - - 2 Gail India Limited 3,906,000,000 - - 3,906,000,000 3 IBM India Private Limited 1,352,539,824 - - 1,352,539,824 4 Indian Overseas Bank, Seoul 1,061,148,533 994,931,813 66,216,721 - 5 Koninklijke Philips N.V. 1,043,150,095 134,003,250 1,563,509 - 6 Samsung C & T Corporation 737,679,522 734,130,819 2,617,414 - 7 Singapore Satori PTE Ltd. 346,821,647 256,174,955 90,646,692 - 8 Topaki Media Pvt Ltd 233,598,606 233,598,606 - - 9 Ab Electrolux 148,790,336 137,257,491 11,532,845 - Secunderabad Gst Commissionerate Hyderabad 10 141,829,376 18,874,523 - - Central Tax And Customs 11 Rs Polymers Unit Ii 128,814,341 294,521 - - 12 Commercial Tax Officer, Circle Spaecial1,Bhiwadi 93,775,891 - - 93,775,891 13 Supreme Petrochemical Ltd 77,748,257 66,179,401 11,568,856 - 14 Shri Venkatesh Polymould Pvt. Ltd. 63,880,934 3,940,369 751,905 - 15 Hemant Group 60,300,000 - - - 16 Covestro (Hong Kong)Ltd 53,462,245 49,466,919 3,995,326 - 17 Agile Electric Sub Assembly Pvt Ltd 46,271,794 37,948,586 5,203,139 - 18 Cj Korea Express India Private Limited 42,782,958 16,768,416 - - 19 Approcopp Engineering Pvt Ltd 39,467,942 - 3,225,587 - 20 Lg Electronics India Pvt Ltd 33,273,731 23,653,430 4,541,580 - 21 R.G. -

Earnings Presentation Q3 & 9M,Fy 19-20

R I S E Research Innovation Scale Excellence EARNINGS PRESENTATION Q3 & 9M,FY 19 - 20 Disclaimer Certain statements in this communication may be ‘forward looking statements’ within the meaning of applicable laws and regulations. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. Important developments that could affect the Company’s operations include changes in the industry structure, significant changes in political and economic environment in India and overseas, tax laws, import duties, competition, inflationary pressures, litigation and labour relations. Dixon Technologies (India) Limited and its subsidiaries and joint ventures will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances. 2 Table of contents Latest Business Updates 04 Highlights of Q3 & 9M,FY 19-20 05 Consolidated Results Summary 06 Segment Wise Performance 7-8 ODM Revenue Share & Segment wise ROCE 09 Expenditure Analysis 10 Balance Sheet 11 Cash Flow 12 Key Financial Ratios 13 3 Latest Business Updates Commenced production of Home appliances for Voltas Beko Commenced Production of Samsung Feature Phone from 1st Nov 2019 To commence production of LED TV’s for Samsung from Feb 2020 Commenced production of entire range of Lighting products for HPL Electric & Power Got order -

Dixon Technologies Q3FY21 Financial Results & Highlights

Dixon Technologies Q3FY21 Financial Results & Highlights Brief Introduction: Dixon Technologies (India) Limited is the largest home grown design-focused and solutions company engaged in manufacturing products in the consumer durables, lighting and mobile phones markets in India. Its diversified product portfolio includes Consumer electronics like LED TVs, Home appliances like washing machines, Lighting products like LED bulbs and tubelights, downlighters and CFL bulbs, Mobile phones like feature phones and smartphones, Security Surveillance Systems like CCTV & DVRs. The company manufactures and supplies these products to well-known companies in India who in turn distribute these products under their own brands. Standalone Financials (In Crs) Q3FY21 Q3FY20 YoY % Q2FY21 QoQ % 9MFY21 9MFY20 YoY% Sales 1897 810 134.20% 1473 28.78% 3836 2913 31.69% PBT 76 30 153.33% 66 15.15% 145 103 40.78% PAT 57 22 159.09% 48 18.75% 107 80 33.75% Consolidated Financials (In Crs) Q3FY21 Q3FY20 YoY % Q2FY21 QoQ % 9MFY21 9MFY20 YoY% Sales 2183 996 119.18% 1639 33.19% 4339 3548 22.29% PBT 82 35 134% 72 13.89% 156 120 30.00% PAT 62 26 138% 52 19.23% 116 93 24.73% Detailed Results: 1. The company had a phenomenal quarter with Q3 revenues rising 119% YoY and profits rising 138% YoY. 2. The EBITDA margin for the company has fallen by 80 bps to 4.6% in Q3FY21 & EBITDA has risen 89% YoY. 3. Segment-wise Q3 Revenue performance is as follows: 1. Consumer Electronics: Up 199% YoY (62% of current revenues) 2. Lighting Products: Up 26% YoY (16% of current revenues) 3. -

Dixon Technologies India Limited Q2 FY2021 Earnings Conference Call”

“Dixon Technologies India Limited Q2 FY2021 Earnings Conference Call” October 30, 2020 ANALYST: MR. DHRUV JAIN – AMBIT CAPITAL MANAGEMENT: MR. ATUL B LALL – MANAGING DIRECTOR – DIXON TECHNOLOGIES LIMITED MR. SAURABH GUPTA – CHIEF FINANCIAL OFFICER – DIXON TECHNOLOGIES LIMITED Page 1 of 17 Dixon Technologies India Limited October 30 2020 Moderator: Ladies and gentlemen, good day and welcome to the Dixon Technologies India Limited Q2 FY2021 Earnings Conference Call hosted by Ambit Capital. As a reminder, all participant lines will be in the listen-only mode and there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing “*” then “0” on your touchtone phone. Please note that this conference is being recorded. I now hand the conference over to Mr. Dhruv Jain from Ambit Capital. Thank you and over to you Sir! Dhruv Jain: Thanks. Welcome to the Q2 FY2021 Earnings call of Dixon Technologies. From the management today, we have with us Mr. Atul Lall, Managing Director of the company and Mr. Saurabh Gupta, Chief Financial Officer. Over to you Sir for your opening comments! Atul B. Lall: Thank you so much. Good afternoon ladies and gentlemen this is Atul Lall and we also have on the call today my colleague Saurabh Gupta, CFO. I hope that you and your family are safe and healthy.I will just share with you an insight into Dixon numbers of Q2 2021. Our consolidated revenues for the quarter ended September 30, 2020 was Rs.1639 Crores against Rs.1405 Crores in the same period last year, that is a resilient growth of 17%, consolidated EBITDA for the quarter ended September 30, 2020 was Rs.89.6 Crores against Rs.65.9 Crores in the same period last year that is a growth of 36%. -

Dixon Technologies (India) (DIXTEC)

Dixon Technologies (India) (DIXTEC) CMP: | 3996 Target: | 4635 ( 16%) Target Period: 12 months BUY May 30, 2021 Long term growth outlook remains intact Dixon witnessed strong revenue, PAT growth of 47%, 33%, respectively, in Particulars FY21 despite loss of sales in Q1. The strong growth came on the back of Particular Amount customer additions in consumer electronics and mobile & EMS segments in Market Cap (| Crore) 23,396.3 FY21. The company has outlined a capex of | 200 crore in FY22 for a Total Debt (FY21) (| Crore) 151.3 brownfield expansion in TVs, washing machines, mobile phones and to start Cash & Inv (FY21) (| Crore) 68.8 a new manufacturing unit for direct cool refrigerators. Dixon has also applied EV (| Crore) 23,478.8 for PLI schemes in electronics/technology products, telecom products and 52 week H/L 4588/ 914 LED lights & AC component manufacturing. The approval for all applications Equity capital (| Crore) 11.6 Face value (|) 2.0 Update Result are expected within H2FY22. Entry into new product categories and se ffff customer additions into existing product categories (especially in washing Price Performance machines, LED lights & mobile phones) would help drive revenue at a CAGR sse of 63% in FY21-23E. The company’s balance sheet remains strong with 5000 20000 stringent working capital policy (with cash conversion cycle of seven days) 4000 with RoE, RoCE at ~22%, 24% in FY21, respectively. 15000 3000 10000 Strong revenue growth led by TV, mobile business 2000 1000 5000 In Q4FY21, consolidated revenue growth at ~146% YoY to | 2110 crore was 0 0 led by 381% and ~200% revenue growth in mobile & EMS and consumer electronics (LED TV) segment, respectively. -

Barclays Hurun India Rich List 2018

Rank Name Wealth INR crore Company Name Industry Residence 1 Mukesh Ambani 371,000 Reliance Industries Diversified Mumbai 2 SP Hinduja & family 159,000 Hinduja Diversified London 3 LN Mittal & family 114,500 ArcelorMittal Metals & Mining London 4 Azim Premji 96,100 Wipro Software & Services Bengaluru 5 Dilip Shanghvi 89,700 Sun Pharmaceutical Industries Pharmaceuticals Mumbai 6 Uday Kotak 78,600 Kotak Mahindra Bank Financial Services Mumbai 7 Cyrus S Poonawalla 73,000 Serum Institute of India Pharmaceuticals Pune 8 Gautam Adani & family 71,200 Adani Enterprises Diversified Ahmedabad 9 Cyrus Pallonji Mistry 69,400 Shapoorji Pallonji Investments Mumbai 9 Shapoor Pallonji Mistry 69,400 Shapoorji Pallonji Investments Monaco 11 Acharya Balkrishna 57,000 Patanjali Ayurved FMCG Haridwar 12 Nusli Wadia & family 56,100 Britannia Industries FMCG Mumbai 13 Rahul Bajaj & family 55,300 Bajaj Auto Automobile & Auto Components Pune 14 Sri Prakash Lohia 46,700 Indorama Chemicals & Petrochemicals London 15 Kumar Mangalam Birla 46,300 Aditya Birla Diversified Mumbai 15 Radhakishan Damani 46,300 Avenue Supermarts Retailing Mumbai 17 Adi Godrej 44,600 Godrej Consumer Durables Mumbai 17 Jamshyd Godrej 44,600 Godrej Consumer Durables Mumbai 17 Nadir Godrej 44,600 Godrej Consumer Durables Mumbai 17 Rishad Naoroji 44,600 Godrej Consumer Durables Mumbai 17 Smita V Crishna 44,600 Godrej Consumer Durables Mumbai 22 Benu Gopal Bangur & family 41,100 Shree Cement Cement & Cement Products Kolkata 23 Yusuff Ali MA 39,200 Lulu Retailing Abu Dhabi 24 Ajay Piramal 38,900 -

Ambit Strategy Thematic

STRATEGY August 26, 2020 Scouting for giants Head of Research Author / Consultant Nitin Bhasin Ritika Mankar Mukherjee, CFA [email protected] [email protected] Tel: +91 22 6623 3241 Tel: +91 98333 49668 Research Analyst Nikhil Pillai [email protected] Tel: +91 22 6623 3265 [email protected] 2020-12-07 Monday 13:17:41 Strategy CONTENTS Strategy: Scouting for giants ………………………………………………………………….3 Section1: India’s High GDP growth rate ≠ high revenue growth rates ………………..4 for listed firms! Section 2: Listed Indian firms’ susceptibility to dwarfism > EM peers ……………….11 Section 3: India’s High GDP growth rate ≠ high revenue growth for ………………..15 unlisted firms too Section 4: So why do Indian businesses suffer from scalability challenge? ………….20 Section 5: A deep-dive into five key sectors ……………………………………………..26 Section 5.1: Consumers – Market appears optically large! …………………………….27 Section 5.2: Pharma: High competition along with high capital intensity! …………..29 Section 5.3: IT - Only sector to present an organic scalability example! ……………..31 Section 5.4: Metals & Mining – High presence in the +1tn revenue club! ….33 Section 5.5: Oil & Gas – Maintaining leadership on ‘scale’ in India ………..35 for decades Section 5: Why check for scale? Scale quintiles persist but high ……………37 growth rarely Section 6: Highly probable scalable bets ……………………………………….42 COMPANIES Aarti Industries (BUY): Leader in the making …………………………………..47 Aavas Financiers (NOT RATED): Wired to play in big league ……………….57 Amber Enterprises (BUY): Ride the import -

Q3FY21 - Results Update Sector: Consumer Electronics

Dixon Technologies (India) Ltd. Q3FY21 - Results Update Sector: Consumer Electronics 04-February-2021 Brief Overview Dixon posted strong Q3FY21 results led by LED TV, Mobiles and Washing Machines. Margins down slightly by 60bps YoY at 4.6%, due to increase in RM cost; Order book CMP (INR) (As on 03-Feb-2021) 15,879 continues to Remain Strong; FY22E margins expected at ~4.6%; Expecting PLI scheme Previous Target (INR) 13,053 in LED lighting & IT Hardware soon; FTL WM production to start from early Q1FY22E. Current Target 16,119 Q3FY21 Consolidated Earnings Analysis Upside(%) ~1.5% Q3FY21 revenue jumped 120% YoY at Rs 21,828 million, mainly led by strong revenue Recommendation HOLD growth in LED TVs, Mobiles and Washing Machine segment. The consumer durables attracted strong demand due to festive season buying and improved consumer BSE Code 540699 sentiments on reduction in Covid cases. EBITDA rose 95% YoY at Rs 1,005 million. However, margins were down slightly by 60bps at 4.6% vs 5.2% YoY. Fall in the margins NSE Code DIXON was largely contributed by WM segment, which saw decline in margins at 10.2% vs Reuters Ticker DIXO.NS 13.4% YoY. The raw material cost, as % of revenue during the quarter stood higher at 90.4% vs 87.2% YoY . PBT increased 130% YoY at Rs 817 million, as depreciation (0.5% Bloomberg Ticker DIXON:IN vs 1% YoY) and Interest cost (0.4% vs 0.8% YoY) share as % of total revenue declined. Consolidated PAT was up 134% YoY at Rs 616 million. -

Acche Din Keyone, Samsung on Max, Panasonic Eluga A3 Pro and Now P55 Max, Moto Z2 Play, Mafe Shine for M820, Xolo Era 1X Pro and More

www.mymobileindia.comwww.mymobileindia.com SEPTEMBER 2017 Rs 100 ® FOR A CONNECTED LIFESTYLE Tested Asus ZenFone AR, BlackBerry ACCHE DIN KEYone, Samsung On Max, Panasonic Eluga A3 Pro and NOW P55 Max, Moto Z2 Play, Mafe Shine For M820, Xolo Era 1x Pro and more... Smartphone Market FACE TO FACE Kenichiro Hibi Web Series Managing Director, Redefining Sony India Entertainment PHONE OF THE MONTH HONOR 8 PRO FIRSTCALL espite prolonged Indo-China border stand-off at Doklam and attempts by some misguided groups to call for the boycott of Chinese goods EDITORIAL including mobile handsets, Indian consumers D Pankaj Mohindroo | Editor-in-Chief have shown remarkable maturity by generally not heeding to such calls. This in itself should awaken Shelley Vishwajeet | Editor Chinese leadership to view India and Indian people in a Ramesh Kumar Raja | Assistant Editor new light and, should be reflective of the inherent good Haider Ali Khan | Senior Correspondent naturedness of we the Indians while encouraging it to explore a peaceful and amicable solution to the border Nijhum Rudra | Correspondent disputes rather than engaging in bullying tactics or encouraging a section Vanshika Malhotra | Reporter of its state-owned media to fuel battle cries. Editorpage Today, China is India’s biggest trading partner with BoP tilted heavily DESIGN in favour of the former. Despite deep rooted suspicions about China Ajit Kumar Parashar | Sr. Graphic Designer in Indian establishment’s psyche worsened by its open support to Pakistan’s nefarious activities, we have not let these factors come in MARKETING the way of successful Indo-China trade engagement or growing people to people contacts.