Universal Robina Corp URC.PS, URC PM a True Pan ASEAN Consumption Play; Initiate with OW Price: Php148.50 Price Target: Php170.00

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universal Robina Corporation and Subsidiaries

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 9 1 7 0 Company Name U N I V E R S A L R O B I N A C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 1 1 0 E . R o d r i g u e z A v e n e u e , B a g u m b a y a n , Q u e z o n C i t y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number 671-2935; 635-0751; 671-3954 Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 1,066 4/18 9/30 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Mr. Constante T. Santos [email protected] (02) 633-7631 +63 922 813 0129 Contact Person’s Address 41st Floor, Robinsons Equitable Tower ADB Ave., cor Poveda St., Ortigas, Pasig City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

On Balance Weekly Notes for May 6 to 10, 2019

Philstocks Research Weekly Notes JUSTINO B. CALAYCAY, JR 06 May 2019 AVP-Head, Research & Engagement (632)588-1962 OUR VIEW: JAPHET LOUIS O TANTIANGCO Sr. Research Analyst Anticipated rate cuts signal a strong buy on property and consumer retail issues (632)588-1927 given their advantages amid a loose monetary environment. Avoid banks as lower borrowing costs may reduce net interest margins. PIPER CHAUCER E TAN Property stocks (DMW, HOUSE, MEG, SMPH and ALI) Engagement Officer/Research Consumer Retail (URC , FB, WLCON, MRSGI and JFC) Associate (632)588-1928 Possible Catalyst for th3 week : Q1 2019 GDP, April Inflation, and BSP policy rate meeting CLAIRE T ALVIAR PSEi may trade within the 7900- 8200 range with upward bias on Research Associate economic data Ground Floor, East Tower PSE Center, Tektite Towers MARKET WRAP: Ortigas Center, Pasig City PHILIPPINES S&P’s upgrade on the Philippines’ credit rating sent local stocks higher by DISCLAIMER 99.70 points or 1.27% w/w to 7,967.98. The opinion, views and Average value turnover widened by 8.24% w/w to P7.283 billion. Gainers recommendations contained in this rout losers 110 to 101. material were prepared by the Philstocks Research Team, Industrials led the sectors, climbing 3.81%. Miners were the main individually and separately, based laggards, falling 0.79%. on their specific sector assignments, contextual framework, personal Universal Robina Corporation [PSE: URC] led the index, surging 17.52%. judgments, biases and prejudices, Bloomberry Resorts Corporation [PSE: BLOOM] landed on bottom, sliding time horizons, methods and other 5.55%. factors. The reader is enjoined to take this into account when perusing For all shares, Phinma Energy Corporation [PSE: PHEN] advanced the most and considering the contents of the by 18.06%. -

JG Summit Holdings Inc. Annual Report 2014

Contents 2 Financial Highlights 4 Message from the Chairman and President 11 JG Summit Businesses 12 HOLDING COMPANY JG Summit Holdings, Inc. 16 FOOD, AGRO-INDUSTRIAL & COMMODITIES Universal Robina Corporation 24 REAL ESTATE & HOTELS Robinsons Land Corporation 29 AIR TRANSPORTATION Cebu Air, Inc. 36 PETROCHEMICALS JG Summit Petrochemicals Group 42 BANKING & FINANCIAL SERVICES Robinsons Bank Corporation 46 CORE INVESTMENTS Philippine Long Distance Telephone Company (PLDT) United Industrial Corporation Limited (UIC) Manila Electric Company (MERALCO) 50 Corporate Social Responsibility 53 Board of Directors 59 Executive Officers 60 Financial Statements 248 Corporate Directory 2014 Annual Report JG SUMMIT HOLDINGS, INC. AND SUBSIDIARIES Financial Highlights DECEMBER 31 (IN MILLION PESOS EXCEPT PER SHARE AND STATISTICAL DATA) 2014 vs 2013 Increase (Decrease) For the Year 2014 2013 Amount % Revenues 184,812 150,348 34,464 23% Core Net Income after Taxes 20,303 13,654 6,649 49% Net Income (Equity Holders of the Parent) 18,245 10,434 7,811 75% EBIT 37,475 25,405 12,070 48% EBITDA 49,235 35,436 13,799 39% As of the Year Total Assets 558,779 473,620 85,159 18% Total Liabilities 297,168 237,753 59,415 25% Total Equity 261,610 235,867 25,743 11% Per Share Basic Earnings 2.60 1.53 1.07 70% Book Value 29.58 27.39 2.19 8% Other Financial Data Current Ratio 1.10 0.74 0.36 49% Gearing Ratio 0.77 0.53 0.24 45% Net Debt Equity Ratio 0.59 0.32 0.27 84% Revenues Core Net Income after Taxes 2014 2014 49% 23% 184,812 20,303 2013 2013 150,348 13,654 2 Revenue Contribution 7% 52% Core Investments Food, Agro-industrial and Commodities 2% Banking 2% Petrochemicals 28% Air Transportation 9% Real Estate and Hotels EBITDA Contribution 24% 39% Other Businesses Food, Agro-industrial and Commodities 1% Banking 19% 17% Real Estate and Hotels Air Transportation Net Income 2014 75% 18,245 2013 10,434 3 Message from the Chairman and President We are pleased to report that your alliance, Cebu Pacific signed and company, JG Summit Holdings, completed a share purchase agreement Inc. -

Annual Report

2013 Annual Report 2013 Annual Report Our Company 2 Organizational Chart 4 Financial Highlights 5 Message from the Chairman and the President and Chief Executive Officer 6 Branded Consumer Foods Group Philippines 10 Branded Consumer Foods Group International 20 Commodity Foods Group 23 Agro-Industrial Group 26 Corporate Governance 28 Corporate Social Responsibility 32 Board of Directors 34 Financial Statements 42 Directory 150 Universal Robina Corporation (URC) Our is one of the largest branded food product companies in the Philippines Company and has a growing presence in other ASEAN markets. URC is among the Philippines’ pioneers in the industry. It has been in operations for over 50 years since John Gokongwei, Jr. established Universal Corn Products, Inc., a cornstarch manufacturing plant in Pasig, in 1954. URC is engaged in a wide range of food-related businesses, including the manufacture and distribution of branded consumer foods, hog farming, manufacture of animal feeds, glucose, soya products and veterinary compounds, flour milling and pasta manufacturing, and sugar milling and refining. In the Philippines, URC is a dominant player with leading market shares in savory snacks, candies and chocolates, and is a significant player in biscuits, with leading positions in cookies and pretzels. It is also the largest player in the RTD tea market, and is a respectable 2nd player in the noodles and coffee categories. The Company has started building its Jack ‘n Jill, C2 and Great Taste brands across the ASEAN, with a market leading position in both biscuits and wafers in Thailand and the number one RTD tea brand in Vietnam. -

JG Summit Holdings Inc. Annual Report 2020

Annual Report 2020 About the Cover When faced with a monumental challenge, few are able to swiftly form high- impact solutions to make the situation better. It requires agility and adaptability to achieve a transformational outcome. This year, JG Summit swiftly addressed the effects of the pandemic, using its “How to Win” and “Where to Play” strategies to maximum effect. The company was agile in business, as well as steady and firm in uplifting communities to better endure this critical time. By focusing on employee health and safety, operations and supply chain continuity, cash, costs and liquidity management, and helping communities deal with the pandemic, JGS was able to weather the unexpected storm. The company also doubled its efforts to explore new business opportunities. This year’s cover demonstrates the diverse response throughout JG Summit’s businesses - its fluid and agile response that demonstrated firm leadership, mindfulness, and strength to balance business in the face of turmoil and change. 2 Annual Report 2020 Table of Contents JGS at a Glance 4 2020 Key Developments 7 JGS Investment Portfolio 9 Corporate Structure 10 Geographic Presence 12 Chairman’s Message 13 President and CEO’s Report 17 Leadership 21 Our COVID-19 Response 23 Laying the Foundation for the New Normal 27 Strategic Business Units & Investments 38 Strategic Business Units 39 Ecosystem Plays 57 Core Investments 63 Sustainability 65 Sustainability Performance in 2020 66 Gokongwei Brothers Foundation 77 Corporate Governance 86 Financial Statements 96 Contact Info 221 3 Annual Report 2020 JGS at a Glance 4 Annual Report 2020 JGS At A Glance: Key Business Metrics Our portfolio diversity cushioned the impact of COVID-19, driven by The Company’s robust balance sheet provides Continuous shareholder value maximization as JGS’ the resiliency of our food, banking, and office segments, while heavily- enough ballast to weather the pandemic. -

May 2021 Based on 31 May 2021 NAVPU

Fund Fact Sheet | May 2021 Based on 31 May 2021 NAVPU Peso Moderate Fund Objective Client Suitability Fund Manager The Peso Moderate Fund aims to This Fund is suitable for individuals The Peso Moderate Fund is managed by the Trust and Investments achieve capital appreciation over the willing to accept moderate risk for their Group of Banco De Oro Unibank, Inc. (BDO), which is the financial medium term by investing primarily in investment in exchange for moderate services flagship of the SM Group of Companies, one of the most equities and in some fixed income growth. Generally, these individuals are successful conglomerates spanning retail, mall operations, property, securities. willing to accept some losses on capital banking, hotels, convention and leisure facilities. as long as the expected return over the medium to long-term is significantly Today, BDO is multi-awarded by various leading financial institutions, higher. which include Finance Asia, Alpha Southeast Asia, The Banker, The Asset, Asia Money, and the Asia CEO Awards. FUND INFORMATION Inception Date: July 1, 2013 Peso Moderate Fund NAVPU Fund Manager: BDO Trust & Investments Group 1.50 Currency: Philippine Peso (PHP) 1.35 1 Valuation Schedule : Daily 1.20 Net Asset Value Per Unit (NAVPU): 0.98070 1.05 Lowest NAVPU (Mar. 19, 2020) 0.81570 0.90 Highest NAVPU (Jun. 07, 2017) 1.34890 0.75 Year to Date Return: -4.14% Jul 2013 Return Since Inception (from Jul. 1, 2013) -1.93% Dec 2013Jun 2014Dec 2014Jun 2015Dec 2015Jun 2016Dec 2016Jun 2017Dec 2017Jun 2018Dec 2018May 2019Nov 2019May 2020Nov 2020May 2021 Year on Year Return: 5.27% 1The NAVPU of the Fund is computed daily beginning January 2014. -

URC Top 100 Stockholders and PDTC

BPI STOCK TRANSFER OFFICE UNIVERSAL ROBINA CORPORATION TOP 100 STOCKHOLDERS AS OF JUNE 30, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10002999 JG SUMMIT HOLDINGS INC. FIL U 1,320,223,061 60.5189% 1,320,223,061 43/F ROBINSONS EQUITABLE TOWER ADB AVE.,COR.POVEDA ST. ORTIGAS CENTER, PASIG CITY 2 16011312 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 498,136,847 22.8345% 498,136,847 G/F MAKATI STOCK EXCHANGE BLDG 6767 AYALA AVE., MAKATI CITY 3 16011313 PCD NOMINEE CORPORATION (FILIPINO) FIL U 350,133,639 16.0501% 350,133,639 G/F MSE BLDG. 6767 AYALA AVE., MAKATI CITY 4 07015995 ELIZABETH Y. GOKONGWEI AND/OR JOHN GOKONGWEI JR. FIL U 2,479,400 0.1136% 2,479,400 43/F ROBINSONS EQUITABLE TOWER ADB AVE. COR POVEDA ROAD PASIG CITY 5 12009862 LITTON MILLS, INC. FIL U 2,237,434 0.1025% 2,237,434 URC CORPORATE TOWER I ROBINSON GALLERIA ORTIGAS AVENUE, PASIG METRO MANILA 6 07015993 LISA YU GOKONGWEI AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 16029927 ROBINA GOKONGWEI PE AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 15006669 FAITH GOKONGWEI ONG AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 19026738 MARCIA GOKONGWEI SY AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE., COR POVEDA ST. -

URC-Top-100-Stockholders-And-PDTC-Participants-December-31-2012.Pdf

BPI STOCK TRANSFER OFFICE UNIVERSAL ROBINA CORPORATION TOP 100 STOCKHOLDERS AS OF DECEMBER 31, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10002999 JG SUMMIT HOLDINGS INC. FIL U 1,320,223,061 60.5189% 1,320,223,061 43/F ROBINSONS EQUITABLE TOWER ADB AVE.,COR.POVEDA ST. ORTIGAS CENTER, PASIG CITY 2 16011312 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 600,971,785 27.5485% 600,971,785 G/F MAKATI STOCK EXCHANGE BLDG 6767 AYALA AVE., MAKATI CITY 3 16011313 PCD NOMINEE CORPORATION (FILIPINO) FIL U 246,967,597 11.3209% 246,967,597 G/F MSE BLDG. 6767 AYALA AVE., MAKATI CITY 4 07015995 ELIZABETH Y. GOKONGWEI AND/OR JOHN GOKONGWEI JR. FIL U 2,479,400 0.1136% 2,479,400 43/F ROBINSONS EQUITABLE TOWER ADB AVE. COR POVEDA ROAD PASIG CITY 5 12009862 LITTON MILLS, INC. FIL U 2,237,434 0.1025% 2,237,434 URC CORPORATE TOWER I ROBINSON GALLERIA ORTIGAS AVENUE, PASIG METRO MANILA 6 07015993 LISA YU GOKONGWEI AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 16029927 ROBINA GOKONGWEI PE AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 15006669 FAITH GOKONGWEI ONG AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 19026738 MARCIA GOKONGWEI SY AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE., COR POVEDA ST. -

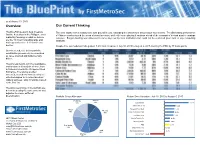

Overview Our Current Thinking

as of August 10, 2015 Overview Our Current Thinking The BluePrint seeks to help investors The local equity market continued to lose ground in July, extending the losses from the previous four months. The distressing performance find the best plays in the Philippine stock of Chinese stocks soured the mood of many investors, while others are playing it cautious ahead of the companies’ second quarter earnings market by focusing on what we believe releases. Bargain-hunting was observed in some days led by local institutions but could not be sustained given lack of any compelling are the 10 most compelling large and catalysts. mid-cap stocks on a 6-12 month time horizon. Despite this, our model portfolio gained 3.6% from inception in July 10, 2015 to August 6, 2015, beating the PSEi by 87 basis points. Our structured, rule-driven portfolio construction process can be described as value oriented and fundamentally driven. The process begins with the quantitative and fundamental analysis of more than 270 stocks listed in the Philippine Stock Exchange. The stocks are then screened, scored and ranked using set criteria designed to increase investors’ odds of success. Only 10 stocks make it to the final list. The stock weightings in the portfolio are determined using the same process and adjusted to ensure sufficient diversification. Portfolio Sector Allocation Return Since Inception : July 10, 2015 to August 6, 2015 Holdings Airlines 13% 10% Cebu Air Inc 13.7% Metro Pacific Inv 6.2% Retail Puregold Price Club 5.6% Electric 10% 18% Universal Robina Corp 5.4% First Gen Corp 5.0% 18/F PSBank Center Manila Electric Co 3.1% 777 Paseo de Roxas cor. -

Historical Credit Rating

Short-Term CREDIT RATING THROUGH THE YEARS PHILRATINGS DOCUMENT Companies 1985 1986year-end 1987 1988 1989 Amt. Rated Rating Amt. Rated Rating Amt. Rated Rating Amt. Rated Rating Amt. Rated Rating A. Soriano Corporation N.A. 3 100.00 3- 100.00 3- 100.00 3- 200.00 2- Aboitiz & Co., Inc. All Asia Capital & Leasing Corp. N.A. 2- Atlantic Gulf & Pacific Co of Mla N.A. 2 N.A. 3 100.00 3- Ayala Land, Inc. BPI Leasing Corporation CFC Corporation N.A. 3+ 200.00 3+ 200.00 3+ N.A. 3+ 200.00 3+ Cagayan Elec Power & Light Co. California Mfg. Co. Inc. N.A. 2 Chemical Industries of the Phils. Chemphil Albright & Wilson Corp Coca-Cola Bottlers Phils., Inc. 400.00 2+ 400.00 2+ 400.00 1- 800.00 1- Consolidated Orix Leasing & Fin Del Monte Phils., Inc. N.A. 2+ N.A. 2+ N.A. 2+ 200.00 2+ Dharmala Philippines, Inc. Eveready Battery Co. Phils., Inc. N.A. 3+ 50.00 2 50.00 2 50.00 2 50.00 2 FEB Investments, Inc. 500.00 2 FEB Leasing & Finance Fort Bonifacio Development Corp General Electric Phils., Inc. N.A. 3+ 50.00 2 Jollibee Foods Corporation N.A. 2 50.00 2 Kimberly Clark Phils. N.A. 2 LMG Chemicals Corporation La Tondeña Distillers, Inc. MB Finance Corporation 30.00 2- Magnolia Corporation Manila Electric Co. N.A. 5 450.00 3 600.00 3 600.00 2- 600.00 2- Mariwasa Manufacturing Inc. Mercury Drug Corporation N.A. 3+ 100.00 2 100.00 2 100.00 2 N.A. -

• • • Market Summary Headlines

TUESDAY, 02 APRIL 2013 Headlines: (As of April 01, 2013) • LC: Commercialization in Far Southeast pushed to 2022 INDICESINDICES • MER: Meralco completes transaction for Singapore LNG plant Close Points % YTD% PSEi 6,839.59Close Points -7.88 -0.12 % 56.44 YTD% PSEiAll Shares 4,236.905,210.89 2.5921.52 0.06 0.41 39.14 19.19 AllFinancials Shares 1,781.153,459.02 0.2014.18 0.01 0.41 83.83 13.60 FinancialsHolding Firms 6,036.901,304.87 77.52 5.26 1.30 0.40 72.31 34.67 HoldingIndustrial Firms 10,238.614,369.45 -35.68 10.57 -0.35 0.24 44.72 24.71 IndustrialMining & Oil 21,106.937,907.14 -397.41 21.75 -1.85 0.28 -10.20 11.77 Property 2,800.61 -31.00 -1.09 89.07 Market Summary Mining & Oil 23,177.28 -59.86 -0.26 -1.39 Services 1,997.80 -16.58 -0.82 23.60 Property 1,908.65 31.58 1.68 28.85 • After reaching a new high and breaching the 6,900 mark, the PSEi reversed and dipped by Services 1,783.59 -1.00 -0.06 10.35 7.88 points or 0.12%. As such, the index closed lower at 6,839.59 as investors took early profits during the afternoon session. • Index decliners led gainers 14 to 13 while 3 issues remained unchanged. The Mining and Oil (-1.85%) and Property (-1.09%) sectors were the weakest yesterday. Significant decliners were INDEXINDEX GAINERS GAINERS ALI (-3.98%), BLOOM (-2.67%), MER (-2.33%), TEL (-2.14%), and URC (-1.77%). -

Universal Robina Corporation URC

CR05574-2017 The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Universal Robina Corporation URC PSE Disclosure Form 17-18 - Other SEC Forms/Reports/Requirements Form/Report Type General Information Sheet Report Period/Report Jun 28, 2017 Date Description of the Disclosure Please find attached the General Information Sheet of Universal Robina Corporation for the year 2017. Filed on behalf by: Name Rosalinda Rivera Designation Corporate Secretary COVER SHEET 9 1 7 0 SEC Registration Number U N I V E R S A L R O B I N A C O R P O R A T I O N (Company’s Full Name) 8 t h F l o o r , T e r a T o w e r , B r i d g e t o w n e , E . R o d r i g u e z , J r . A v e n u e ( C 5 R o a d ) , U g o n g N o r t e , Q u e z o n C i t y , M e t r o M a n i l a (Business Address: No. Street City/Town/Province) Atty. Rosalinda F. Rivera 633-7631 to 40 Corporate Secretary (Contact Person) (Company Telephone Number) 1 2 3 1 G I S last Wednesday of May Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting) General Information Sheet for 2017 Issuer of Securities under SEC-BED Order No.