• • • Market Summary Headlines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universal Robina Corporation and Subsidiaries

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 9 1 7 0 Company Name U N I V E R S A L R O B I N A C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) 1 1 0 E . R o d r i g u e z A v e n e u e , B a g u m b a y a n , Q u e z o n C i t y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A N / A COMPANY INFORMATION Company’s Email Address Company’s Telephone Number/s Mobile Number 671-2935; 635-0751; 671-3954 Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 1,066 4/18 9/30 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Mr. Constante T. Santos [email protected] (02) 633-7631 +63 922 813 0129 Contact Person’s Address 41st Floor, Robinsons Equitable Tower ADB Ave., cor Poveda St., Ortigas, Pasig City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

On Balance Weekly Notes for May 6 to 10, 2019

Philstocks Research Weekly Notes JUSTINO B. CALAYCAY, JR 06 May 2019 AVP-Head, Research & Engagement (632)588-1962 OUR VIEW: JAPHET LOUIS O TANTIANGCO Sr. Research Analyst Anticipated rate cuts signal a strong buy on property and consumer retail issues (632)588-1927 given their advantages amid a loose monetary environment. Avoid banks as lower borrowing costs may reduce net interest margins. PIPER CHAUCER E TAN Property stocks (DMW, HOUSE, MEG, SMPH and ALI) Engagement Officer/Research Consumer Retail (URC , FB, WLCON, MRSGI and JFC) Associate (632)588-1928 Possible Catalyst for th3 week : Q1 2019 GDP, April Inflation, and BSP policy rate meeting CLAIRE T ALVIAR PSEi may trade within the 7900- 8200 range with upward bias on Research Associate economic data Ground Floor, East Tower PSE Center, Tektite Towers MARKET WRAP: Ortigas Center, Pasig City PHILIPPINES S&P’s upgrade on the Philippines’ credit rating sent local stocks higher by DISCLAIMER 99.70 points or 1.27% w/w to 7,967.98. The opinion, views and Average value turnover widened by 8.24% w/w to P7.283 billion. Gainers recommendations contained in this rout losers 110 to 101. material were prepared by the Philstocks Research Team, Industrials led the sectors, climbing 3.81%. Miners were the main individually and separately, based laggards, falling 0.79%. on their specific sector assignments, contextual framework, personal Universal Robina Corporation [PSE: URC] led the index, surging 17.52%. judgments, biases and prejudices, Bloomberry Resorts Corporation [PSE: BLOOM] landed on bottom, sliding time horizons, methods and other 5.55%. factors. The reader is enjoined to take this into account when perusing For all shares, Phinma Energy Corporation [PSE: PHEN] advanced the most and considering the contents of the by 18.06%. -

JG Summit Holdings Inc. Annual Report 2014

Contents 2 Financial Highlights 4 Message from the Chairman and President 11 JG Summit Businesses 12 HOLDING COMPANY JG Summit Holdings, Inc. 16 FOOD, AGRO-INDUSTRIAL & COMMODITIES Universal Robina Corporation 24 REAL ESTATE & HOTELS Robinsons Land Corporation 29 AIR TRANSPORTATION Cebu Air, Inc. 36 PETROCHEMICALS JG Summit Petrochemicals Group 42 BANKING & FINANCIAL SERVICES Robinsons Bank Corporation 46 CORE INVESTMENTS Philippine Long Distance Telephone Company (PLDT) United Industrial Corporation Limited (UIC) Manila Electric Company (MERALCO) 50 Corporate Social Responsibility 53 Board of Directors 59 Executive Officers 60 Financial Statements 248 Corporate Directory 2014 Annual Report JG SUMMIT HOLDINGS, INC. AND SUBSIDIARIES Financial Highlights DECEMBER 31 (IN MILLION PESOS EXCEPT PER SHARE AND STATISTICAL DATA) 2014 vs 2013 Increase (Decrease) For the Year 2014 2013 Amount % Revenues 184,812 150,348 34,464 23% Core Net Income after Taxes 20,303 13,654 6,649 49% Net Income (Equity Holders of the Parent) 18,245 10,434 7,811 75% EBIT 37,475 25,405 12,070 48% EBITDA 49,235 35,436 13,799 39% As of the Year Total Assets 558,779 473,620 85,159 18% Total Liabilities 297,168 237,753 59,415 25% Total Equity 261,610 235,867 25,743 11% Per Share Basic Earnings 2.60 1.53 1.07 70% Book Value 29.58 27.39 2.19 8% Other Financial Data Current Ratio 1.10 0.74 0.36 49% Gearing Ratio 0.77 0.53 0.24 45% Net Debt Equity Ratio 0.59 0.32 0.27 84% Revenues Core Net Income after Taxes 2014 2014 49% 23% 184,812 20,303 2013 2013 150,348 13,654 2 Revenue Contribution 7% 52% Core Investments Food, Agro-industrial and Commodities 2% Banking 2% Petrochemicals 28% Air Transportation 9% Real Estate and Hotels EBITDA Contribution 24% 39% Other Businesses Food, Agro-industrial and Commodities 1% Banking 19% 17% Real Estate and Hotels Air Transportation Net Income 2014 75% 18,245 2013 10,434 3 Message from the Chairman and President We are pleased to report that your alliance, Cebu Pacific signed and company, JG Summit Holdings, completed a share purchase agreement Inc. -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Philippines USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Aboitiz Power 1.55 PHILIPPINES JG Summit Holdings 6.55 PHILIPPINES Semirara Mining and Power 0.48 PHILIPPINES Alliance Global 1.11 PHILIPPINES Jollibee Foods 2.48 PHILIPPINES SM Investments 16.27 PHILIPPINES Ayala Corporation 8.63 PHILIPPINES LT Group 1.16 PHILIPPINES SM Prime Hldgs 10.52 PHILIPPINES Ayala Land 9.44 PHILIPPINES Manila Electric 2.7 PHILIPPINES Universal Robina 4.26 PHILIPPINES Bank of The Philippine Islands 4.65 PHILIPPINES Megaworld 1.25 PHILIPPINES BDO Unibank 6.27 PHILIPPINES Metro Pacific Investments 1.97 PHILIPPINES Bloomberry Resorts 0.9 PHILIPPINES Metropolitan Bank & Trust 2.63 PHILIPPINES DMCI Holdings 0.65 PHILIPPINES PLDT 4.32 PHILIPPINES Globe Telecom 2.08 PHILIPPINES Puregold Price Club 1.44 PHILIPPINES GT Capital Holdings 1.51 PHILIPPINES San Miguel 1.28 PHILIPPINES International Container Terminal Service 4.37 PHILIPPINES San Miguel Food and Beverage 1.52 PHILIPPINES Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. Where very small values are concerned, which would display as 0.00 using this rounding method, these weights are shown as <0.005. Timing of data Constituents & Weights are generally published in arrears and contain the data as at the most recent quarter-end. However, some spreadsheets are updated on a more frequent basis. -

Annual Report

2013 Annual Report 2013 Annual Report Our Company 2 Organizational Chart 4 Financial Highlights 5 Message from the Chairman and the President and Chief Executive Officer 6 Branded Consumer Foods Group Philippines 10 Branded Consumer Foods Group International 20 Commodity Foods Group 23 Agro-Industrial Group 26 Corporate Governance 28 Corporate Social Responsibility 32 Board of Directors 34 Financial Statements 42 Directory 150 Universal Robina Corporation (URC) Our is one of the largest branded food product companies in the Philippines Company and has a growing presence in other ASEAN markets. URC is among the Philippines’ pioneers in the industry. It has been in operations for over 50 years since John Gokongwei, Jr. established Universal Corn Products, Inc., a cornstarch manufacturing plant in Pasig, in 1954. URC is engaged in a wide range of food-related businesses, including the manufacture and distribution of branded consumer foods, hog farming, manufacture of animal feeds, glucose, soya products and veterinary compounds, flour milling and pasta manufacturing, and sugar milling and refining. In the Philippines, URC is a dominant player with leading market shares in savory snacks, candies and chocolates, and is a significant player in biscuits, with leading positions in cookies and pretzels. It is also the largest player in the RTD tea market, and is a respectable 2nd player in the noodles and coffee categories. The Company has started building its Jack ‘n Jill, C2 and Great Taste brands across the ASEAN, with a market leading position in both biscuits and wafers in Thailand and the number one RTD tea brand in Vietnam. -

First Metro Consumer Fund

FUND FACT SHEET | JUNE 26, 2020 FIRST METRO CONSUMER FUND INVESTMENT OBJECTIVE NAVPS GRAPH The Consumer Fund seeks long-term return from investments with concentration in companies that are part of the consumer industry 1.20 and derive its revenues largely on consumer related business activities. The Fund is suitable for investors who are willing to take 1.00 higher risk for potentially high capital return over the medium to 0.80 long term. 0.60 INVESTMENT INFORMATION 0.40 Fund Classification Equity Fund 0.20 Risk Profile Aggressive Fund Currency Philippine Peso 0.00 Jun-18 Jun-19 Jun-20 Inception Date January 12, 2018 Net Asset Value per Share (NAVPS) Php 0.6680 Fund Size Php 385 M YOY Return (06/26/2020) -24.80% HISTORICAL PERFORMANCE Annualized Volatility 19.35% YTD 1YR S.I.* Management Fee up to 1.750% per annum Annualized - -24.80% -13.18% Min. Initial Investment Php 5,000 Cumulative -21.35% -24.80% -29.15% Min. Add’l Investment Php 1,000 Min. Holding Period 6 months *Since Inception – January 12, 2018 Sales Load max. of 2% Exit Fee 1.00% within 6 months Redemption Notice Period max. of 7 days ASSET ALLOCATION PORTFOLIO MIX Valuation Method Marked-to-Market Custodian Bank Citibank HOLDING FIRMS Transfer Agent Metrobank Trust 53% EQUITY 87.55% 2% INDUSTRIAL CASH & 12.45% MARKET COMMENTARY OTHER ASSETS PSEi : 6,191.84, YTD : -20.77% 45% SERVICES PSEi ended at 6,191.84 pts, down by 123.23 pts. Majority of the sectors ended the week as losers: Conglomerates TOP 10 HOLDINGS (-2.35%), Industrials (-0.94%), Properties (-2.89%), Mining (+3.75%), Services (-0.04%), and Banks (-0.94%). -

Bloomberry 1Q2021 EBITDA at P1.4 Billion, Net Loss at P781 Million Lower Year-Over-Year, but Improved from Previous Quarter

BLOOMBERRY RESORTS CORPORATION ! (incorporated in the Philippines) PSE: BLOOM FIRST QUARTER 2021 UNAUDITED RESULTS ANNOUNCEMENT Bloomberry 1Q2021 EBITDA at P1.4 billion, net loss at P781 million Lower year-over-year, but improveD from previous quarter 1Q2021 HIGHLIGHTS: Solaire recorded 88 days of limited operations in the first quarter and was closed on March 29, 2021 as the government reverted Metro Manila and nearby provinces to Enhanced Community Quarantine (ECQ) – the strictest form of quarantine. The ECQ was eased to Modified Enhanced Community Quarantine (MECQ) on April 12, 2021. Solaire remains closed to the public. Jeju Sun in South Korea remains closed. Total GGR at Solaire was P6.9 billion, representing a decrease of 44% from P12.2 billion in the first quarter of 2020. GGR at Solaire improved by 29% compared to the fourth quarter of 2020 as domestic patron confidence improved prior to the return to ECQ at the end of March. Consolidated net revenue was P5.5 billion, representing a decline of 41% year-over-year. Consolidated EBITDA was P1.4 billion, representing a decrease of 59% from P3.5 billion in the same quarter last year and meaningfully higher than the P129.3 million consolidated EBITDA recorded in the fourth quarter of 2020. Consolidated net loss was P780.8 million, representing a reversal from P1.4 billion net profit in the same quarter last year. Net loss improved by 68% compared to the P2.5 billion net loss reported in the fourth quarter of 2020. Consolidated cash and cash equivalents balance as of March 31, 2021 was P23.4 billion. -

JG Summit Holdings Inc. Annual Report 2020

Annual Report 2020 About the Cover When faced with a monumental challenge, few are able to swiftly form high- impact solutions to make the situation better. It requires agility and adaptability to achieve a transformational outcome. This year, JG Summit swiftly addressed the effects of the pandemic, using its “How to Win” and “Where to Play” strategies to maximum effect. The company was agile in business, as well as steady and firm in uplifting communities to better endure this critical time. By focusing on employee health and safety, operations and supply chain continuity, cash, costs and liquidity management, and helping communities deal with the pandemic, JGS was able to weather the unexpected storm. The company also doubled its efforts to explore new business opportunities. This year’s cover demonstrates the diverse response throughout JG Summit’s businesses - its fluid and agile response that demonstrated firm leadership, mindfulness, and strength to balance business in the face of turmoil and change. 2 Annual Report 2020 Table of Contents JGS at a Glance 4 2020 Key Developments 7 JGS Investment Portfolio 9 Corporate Structure 10 Geographic Presence 12 Chairman’s Message 13 President and CEO’s Report 17 Leadership 21 Our COVID-19 Response 23 Laying the Foundation for the New Normal 27 Strategic Business Units & Investments 38 Strategic Business Units 39 Ecosystem Plays 57 Core Investments 63 Sustainability 65 Sustainability Performance in 2020 66 Gokongwei Brothers Foundation 77 Corporate Governance 86 Financial Statements 96 Contact Info 221 3 Annual Report 2020 JGS at a Glance 4 Annual Report 2020 JGS At A Glance: Key Business Metrics Our portfolio diversity cushioned the impact of COVID-19, driven by The Company’s robust balance sheet provides Continuous shareholder value maximization as JGS’ the resiliency of our food, banking, and office segments, while heavily- enough ballast to weather the pandemic. -

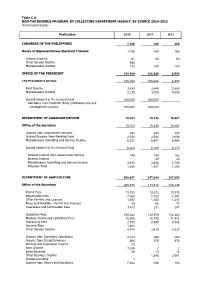

Table C.4 NON-TAX REVENUE PROGRAM, by COLLECTING DEPARTMENT/AGENCY, by SOURCE 2010-2012 (In Thousand Pesos)

Table C.4 NON-TAX REVENUE PROGRAM, BY COLLECTING DEPARTMENT/AGENCY, BY SOURCE 2010-2012 (In thousand pesos) Particulars 2010 2011 2012 CONGRESS OF THE PHILIPPINES 1,106 160 160 House of Representatives Electoral Tribunal 1,106 160 160 Interest Income 61 60 60 Other Service Income 935 - - Miscellaneous Income 110 100 100 OFFICE OF THE PRESIDENT 105,154 106,646 6,950 The President's Offices 105,154 106,646 6,950 Rent Income 2,935 2,946 2,950 Miscellaneous Income 2,219 3,700 4,000 Special Account in the General Fund 100,000 100,000 - Donations from PAGCOR (Early Childhood Care and Development Council) 100,000 100,000 - DEPARTMENT OF AGRARIAN REFORM 15,163 15,334 15,487 Office of the Secretary 15,163 15,334 15,487 Income from Government Services 242 245 247 Interest Income from Working Fund 2,554 2,580 2,606 Miscellaneous Operating and Service Income 6,337 6,401 6,465 Special Account in the General Fund 6,029 6,109 6,170 Interest Income from Government Service 149 150 152 Interest Income - 20 20 Miscellaneous Operating and Service Income 4,612 4,658 4,705 Fiduciary Fund 1,268 1,281 1,293 DEPARTMENT OF AGRICULTURE 460,647 347,840 387,099 Office of the Secretary 265,570 173,918 178,235 Permit Fees 13,102 12,673 13,013 Registration Fees 7,060 7,203 7,341 Other Permits and Licenses 1,697 1,155 1,217 Fines and Penalties - Permit and Licenses 59 65 72 Clearances and Certification Fees 3,573 231 247 Inspection Fees 194,382 130,579 132,380 Medical, Dental and Laboratory Fees 18,306 10,780 11,572 Processing Fees 2,910 2,939 2,968 Seminar Fees 1,803 -

Securities Clearing Corporation of the Philippines, a Subsidiary of the PSE

Table of Contents i About PSE 37 Connecting with Stakeholders 1 Financial Highlights 41 Advocating Good Corporate Governance 2 Message from the Chairman 42 Report of Subsidiaries 4 Message from the President 46 Sustainability Report Statement of Management’s Corporate Governance at the PSE 6 56 Responsibility for Financial Statements 22 Stock Market Highlights 57 Financial Statements 32 Operational Highlights 120 Listed Companies and Issues Accelerating Product Offerings and Corporate Information 34 Technological Developments 128 ABOUT THE COVER Converging roads heading towards one direction is the central metaphor for the PSE annual report this year. The cover uses infrastructure and dynamic motion to symbolize the advances that PSE achieved through the years in reference to innovations in products and services, improvements in regulations, upgrades in technology, and enrichment of partnerships. These undertakings have geared the Exchange for growth. PSE is guided by its core values and commitment to its stakeholders as it lives out its mission and works toward the realization of its vision. Inside back of the cover: The triangular edge of the PSE Tower’s glass canopy creates the illusion of a second tower rising. This panoramic vertical shot is suggestive of PSE’s innovations and dynamism. About PSE The Philippine Stock Exchange, Inc. (PSE) is one of the fastest growing markets in the region. Among the pioneer exchanges in Asia, it traces its origins from the country’s two former stock exchanges, the Manila Stock Exchange (MSE), which was established in 1927, and the Makati Stock Exchange (MkSE), which was established in 1963. Although both the MSE and the MkSE traded the same stocks of the same companies, the bourses were separate stock exchanges for nearly 30 years until December 23, 1992, when both exchanges were unified to become the present-day Philippine Stock Exchange. -

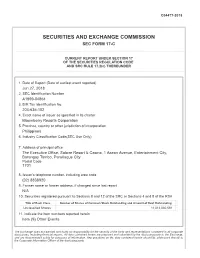

Securities and Exchange Commission Sec Form 17-C

C04477-2018 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. Date of Report (Date of earliest event reported) Jun 27, 2018 2. SEC Identification Number A1999-04864 3. BIR Tax Identification No. 204-636-102 4. Exact name of issuer as specified in its charter Bloomberry Resorts Corporation 5. Province, country or other jurisdiction of incorporation Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office The Executive Office, Solaire Resort & Casino, 1 Asean Avenue, Entertainment City, Barangay Tambo, Parañaque City Postal Code 1701 8. Issuer's telephone number, including area code (02) 8838920 9. Former name or former address, if changed since last report N/A 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Unclassified Shares 11,013,030,591 11. Indicate the item numbers reported herein Item (9) Other Events The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Bloomberry Resorts Corporation BLOOM PSE Disclosure Form 10-1 - Acquisition or Disposition of Shares by Subsidiaries/Affiliates Reference: Section 10 of the Revised Disclosure Rules Subject of the Disclosure Acquisition and/or Sale of BLOOM Shares by Bloomberry Resorts & Hotels Inc.