Bloomberry 1Q2021 EBITDA at P1.4 Billion, Net Loss at P781 Million Lower Year-Over-Year, but Improved from Previous Quarter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

FTSE Publications

2 FTSE Russell Publications 28 October 2020 FTSE Philippines USD Net Tax Index Indicative Index Weight Data as at Closing on 27 October 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country Aboitiz Power 1.55 PHILIPPINES JG Summit Holdings 6.55 PHILIPPINES Semirara Mining and Power 0.48 PHILIPPINES Alliance Global 1.11 PHILIPPINES Jollibee Foods 2.48 PHILIPPINES SM Investments 16.27 PHILIPPINES Ayala Corporation 8.63 PHILIPPINES LT Group 1.16 PHILIPPINES SM Prime Hldgs 10.52 PHILIPPINES Ayala Land 9.44 PHILIPPINES Manila Electric 2.7 PHILIPPINES Universal Robina 4.26 PHILIPPINES Bank of The Philippine Islands 4.65 PHILIPPINES Megaworld 1.25 PHILIPPINES BDO Unibank 6.27 PHILIPPINES Metro Pacific Investments 1.97 PHILIPPINES Bloomberry Resorts 0.9 PHILIPPINES Metropolitan Bank & Trust 2.63 PHILIPPINES DMCI Holdings 0.65 PHILIPPINES PLDT 4.32 PHILIPPINES Globe Telecom 2.08 PHILIPPINES Puregold Price Club 1.44 PHILIPPINES GT Capital Holdings 1.51 PHILIPPINES San Miguel 1.28 PHILIPPINES International Container Terminal Service 4.37 PHILIPPINES San Miguel Food and Beverage 1.52 PHILIPPINES Source: FTSE Russell 1 of 2 28 October 2020 Data Explanation Weights Weights data is indicative, as values have been rounded up or down to two decimal points. Where very small values are concerned, which would display as 0.00 using this rounding method, these weights are shown as <0.005. Timing of data Constituents & Weights are generally published in arrears and contain the data as at the most recent quarter-end. However, some spreadsheets are updated on a more frequent basis. -

First Metro Consumer Fund

FUND FACT SHEET | JUNE 26, 2020 FIRST METRO CONSUMER FUND INVESTMENT OBJECTIVE NAVPS GRAPH The Consumer Fund seeks long-term return from investments with concentration in companies that are part of the consumer industry 1.20 and derive its revenues largely on consumer related business activities. The Fund is suitable for investors who are willing to take 1.00 higher risk for potentially high capital return over the medium to 0.80 long term. 0.60 INVESTMENT INFORMATION 0.40 Fund Classification Equity Fund 0.20 Risk Profile Aggressive Fund Currency Philippine Peso 0.00 Jun-18 Jun-19 Jun-20 Inception Date January 12, 2018 Net Asset Value per Share (NAVPS) Php 0.6680 Fund Size Php 385 M YOY Return (06/26/2020) -24.80% HISTORICAL PERFORMANCE Annualized Volatility 19.35% YTD 1YR S.I.* Management Fee up to 1.750% per annum Annualized - -24.80% -13.18% Min. Initial Investment Php 5,000 Cumulative -21.35% -24.80% -29.15% Min. Add’l Investment Php 1,000 Min. Holding Period 6 months *Since Inception – January 12, 2018 Sales Load max. of 2% Exit Fee 1.00% within 6 months Redemption Notice Period max. of 7 days ASSET ALLOCATION PORTFOLIO MIX Valuation Method Marked-to-Market Custodian Bank Citibank HOLDING FIRMS Transfer Agent Metrobank Trust 53% EQUITY 87.55% 2% INDUSTRIAL CASH & 12.45% MARKET COMMENTARY OTHER ASSETS PSEi : 6,191.84, YTD : -20.77% 45% SERVICES PSEi ended at 6,191.84 pts, down by 123.23 pts. Majority of the sectors ended the week as losers: Conglomerates TOP 10 HOLDINGS (-2.35%), Industrials (-0.94%), Properties (-2.89%), Mining (+3.75%), Services (-0.04%), and Banks (-0.94%). -

Securities and Exchange Commission Sec Form 17-C

C04477-2018 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. Date of Report (Date of earliest event reported) Jun 27, 2018 2. SEC Identification Number A1999-04864 3. BIR Tax Identification No. 204-636-102 4. Exact name of issuer as specified in its charter Bloomberry Resorts Corporation 5. Province, country or other jurisdiction of incorporation Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office The Executive Office, Solaire Resort & Casino, 1 Asean Avenue, Entertainment City, Barangay Tambo, Parañaque City Postal Code 1701 8. Issuer's telephone number, including area code (02) 8838920 9. Former name or former address, if changed since last report N/A 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Unclassified Shares 11,013,030,591 11. Indicate the item numbers reported herein Item (9) Other Events The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Bloomberry Resorts Corporation BLOOM PSE Disclosure Form 10-1 - Acquisition or Disposition of Shares by Subsidiaries/Affiliates Reference: Section 10 of the Revised Disclosure Rules Subject of the Disclosure Acquisition and/or Sale of BLOOM Shares by Bloomberry Resorts & Hotels Inc. -

2020 BRC Sustainability Report.Pdf

ABOUT THE REPORT 102-45, 102-50, 102-51, 102-52, 102-53, 102-54 United in Resilience is the theme of Solaire business and profit interests while keeping in mind Resort and Casino's ("Solaire") 2020 Economic, its responsibilities to its customers, employees, Environmental, Social, and Governance (EESG) society and the environment. The company’s Report. Solaire is owned and operated by Sureste efforts toward ethical business practices in its value Properties Inc. (Sureste), and Bloomberry Resorts chain are similarly presented in this publication. and Hotels Inc. (BRHI) - both subsidiaries of The reporting framework prescribed in the Global Bloomberry Resorts Corporation (Bloomberry). Reporting Initiative (GRI) Standards: Core option is applied throughout this publication, along with the Since its first report in 2019, Solaire continues to Hotel & Lodging, Casino & Gaming, and Restaurants provide an annual published summary of Solaire’s Standards from the Sustainability Accounting triple bottom line performance for the year. This Standards Board (SASB). The report also builds on report, covering January 1 to December 31, 2020, the initial alignments of Solaire’s operations with accounts for Solaire’s operations in the Philippines the UN Sustainable Development Goals (SDGs). — from the company’s gaming and resort operations The complete list of GRI material topics and its to its retail and performing arts platforms. It also boundaries are presented in pages 16-20. These includes actions that were taken during the natural disclosure levels are detailed in the GRI Index at calamities in 2020, including the Taal eruption and the end of this report (page 59). The company the COVID-19 Pandemic. -

2018 Annual Report

2018 ANNUAL REPORT Chairman’s Report Review of Operations Corporate Citizenship Corporate Governance Management’s Discussion and Analysis Consolidated Financial Statements Independent Auditor’s Report Consolidated Statements of Financial Position Consolidated Statements of Comprehensive Income Consolidated Statements of Changes in Equity Consolidated Statements of Cash Flow Notes to Consolidated Financial Statements Board of Directors Corporate Management Investor Relations SOLAIRE FACADE CHAIRMAN’S REPORT Ladies and gentlemen: and Sky Towers was 92.6 percent compared to 90.7 percent in the previous year. 2018 was a challenging year for the Philippine economy as it grappled with the inflation impact of the TRAIN law, higher oil prices and interest In 2018, our consolidated operating costs and expenses increased rates, and a weaker peso. However, despite all these challenges, the by only 8 percent to P27.096 billion, from P25.094 billion owing to economy showed its resilience, recording real GDP growth of 6.2 diligence in managing our expenses by rolling out cost-containment percent for the year. This marked the seventh straight year that the initiatives and programs. Philippine economy grew by at least 6 percent. Apart from consumer spending, which accounts for over 70 percent of GDP, gross fixed Bloomberry’s consolidated EBITDA increased by 21 percent to P14.895 capital formation sustained economic growth, particularly due to the billion, from P12.348 billion. Solaire’s EBITDA was P15.135 billion, government’s pursuit of its Build Build Build program. The country representing an increase of 20 percent. The Korea business reduced remained one of the fastest-growing economies in Asia, just next to its negative EBITDA to P240 million, from a negative P259 million in India, Vietnam and China, and ahead of Indonesia and Thailand. -

Parametric Emerging Markets Fund

Click here to view the Fund’s Summary Prospectus STATEMENT OF Click here to view the Fund’s Prospectus ADDITIONAL INFORMATION June 1, 2021 Parametric Emerging Markets Fund Investor Class Shares - EAEMX Class C Shares - ECEMX Institutional Class Shares - EIEMX Class R6 Shares - EREMX Two International Place Boston, Massachusetts 02110 1-800-260-0761 This Statement of Additional Information (“SAI”) provides general information about the Fund. The Fund is a diversified, open-end management investment company. The Fund is a series of Eaton Vance Mutual Funds Trust. Capitalized terms used in this SAI and not otherwise defined have the meanings given to them in the Prospectus. This SAI contains additional information about: Page Page Strategies and Risks 2 Sales Charges 22 Investment Restrictions 4 Disclosure of Portfolio Holdings and Related Information 23 Management and Organization 6 Taxes 24 Investment Advisory and Administrative Services 15 Portfolio Securities Transactions 34 Other Service Providers 18 Potential Conflicts of Interest 37 Calculation of Net Asset Value 19 Financial Statements 43 Purchasing and Redeeming Shares 20 Additional Information About Investment Strategies and Risks 43 Appendix A: Investor Class Fees and Ownership 76 Appendix D: Class R6 Ownership 79 Appendix B: Class C Fees and Ownership 77 Appendix E: Eaton Vance Funds Proxy Voting Policy and Procedures 80 Appendix C: Institutional Class Ownership 78 Appendix F: Parametric Portfolio Associates LLC Proxy Voting Policies and Procedures 82 This SAI is NOT a prospectus and is authorized for distribution to prospective investors only if preceded or accompanied by the Fund Prospectus dated June 1, 2021, as supplemented from time to time, which is incorporated herein by reference. -

Business Continuity in the Era of Covid-19

BUSINESS CONTINUITY IN THE ERA OF COVID-19 LIZA B. SILERIO VICE PRESIDENT ARISE PHILIPPINES SECRETARIAT CONFIRMEDNATIONALNATIONAL COVID GOVERNMENT GOVERNMENT-19 CASES RESPONSE(as RESPONSE of May 2, 2020, 4PM Treatment of COVID 19 patients Benefits for health workers Emergency Subsidy: USD $100 - USD $160 Mandatory grace period for: Loans Residential rent Taxes Supporting Measures Private hospitals / clinics Public transportation Contract for materials and services Source: DOH, 2020. https://www.doh.gov.ph/covid-19/case-tracker Source: https://www.plm.edu.ph/news/special-reports/infographic-bayanihan-to-heal-as-one-act-a-summary/ NATIONAL / LOCAL GOVERNMENT UNITS FOUR PILLARS OF THE PHILIPPINE GOVERNMENT LGU INNOVATIVE RESPONSES Socioeconomic Strategy Mobile applications CT scan analysis system Enhanced Screening Areas Emergency Support Resources Drive thru COVID-19 testing site 18M Low Income Families Healthcare System Disinfection drones $6.1B $23.4B $714.4B DIY PPEs / Protective Suits (Php 1.17T) Online “wet” markets Market-on-wheels/mobile palengke Emergency Support Economic Bounce Anti-hoarding ordinances Securities, Banks, Taxes Back Plan Soup Kitchens $16.6B Recovery Plan Source: Department of Finance: https://www.dof.gov.ph/govt-raising-additional- Source: https://www.lguvscovid.ph/all-inspirations funds-for-economic-bounce-back-plan/ PRIVATE SECTOR COVID-19 RESPONSE National Grid Project San Miguel Alliance Global Ayala Group* Corporation of the Bloomberry Group Ugnayan Corp* Phils $48M $12M $8M $34M $22.9M $20M -

BLOOMBERRY RESORTS CORPORATION List of Top 100 Stockholders As of 06/30/2015 Rank Name Citizenship Holdings Percentage ------1

BLOOMBERRY RESORTS CORPORATION List of Top 100 Stockholders As of 06/30/2015 Rank Name Citizenship Holdings Percentage ----------------------------------------------------------------------------------------------------------------------- 1. PRIME METROLINE HOLDINGS, INC. Filipino 6,407,472,4441 58.08% 2. PCD NOMINEE CORPORATION (NON-FILIPINO) Foreign 2,430,327,978 22.03% 3. PCD NOMINEE CORPORATION (FILIPINO) Filipino 976,978,626 08.86% 4. QUASAR HOLDINGS, INC. Filipino 921,184,0562 08.35% 5. FALCON INVESTCO HOLDINGS INC Filipino 225,000,000 02.04% 6. ENRIQUE K. RAZON, JR. Filipino 31,232,8323 00.28% 7. A. SORIANO CORPORATION Filipino 12,587,000 00.11% 8. CHRISTIAN R. GONZALEZ Filipino 11,046,0334 00.10% 9. JON RAMON M. ABOITIZ Filipino 9,910,6325 00.09% 10. SILVERIO BENNY J. TAN Filipino 1,980,7196 00.02% 11. CHADBRAD MANAGEMENT INC. Filipino 833,400 00.01% 12. ABODAX MANAGEMENT INC. Filipino 833,300 00.01% 13. CROKER ISLAND MANAGEMENT INC. Filipino 833,300 00.01% 14. ESTELLA T. OCCENA Filipino 600,1007 00.01% 15. NOSSAHEAD MANAGEMENT INC. Filipino 366,667 00.00% 16. LESOTHEA MANAGEMENT INC. Filipino 366,667 00.00% 17. DIJIBOUTI MANAGEMENT INC. Filipino 366,666 00.00% 18. LORRAINE KOO MANN LOO Singaporean 300,0008 00.00% 19. MEDY CHUA SEE Filipino 250,000 00.00% 20. CLARITA M. AVILA Filipino 72,000 00.00% 21. YAN YANG Filipino 60,000 00.00% 22. ANNA VANESSA ROBLES VIOLA Filipino 50,000 00.00% 23. LORENZO CHING Filipino 30,000 00.00% 24. MA. THERESA F. ROBLES Filipino 30,000 00.00% 25. TORIBIO EVANGELISTA RAMOS Filipino 23,000 00.00% 26. -

Securities and Exchange Commission Sec Form 17-C

C03858-2020 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. Date of Report (Date of earliest event reported) May 29, 2020 2. SEC Identification Number A1999-04864 3. BIR Tax Identification No. 204-636-102 4. Exact name of issuer as specified in its charter Bloomberry Resorts Corporation 5. Province, country or other jurisdiction of incorporation Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office The Executive Office, Solaire Resort & Casino, 1 Asean Avenue, Entertainment City, Barangay Tambo, Paranaque City Postal Code 1701 8. Issuer's telephone number, including area code +632-88838920 9. Former name or former address, if changed since last report N/A 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Unclassified Shares 10,959,646,295 11. Indicate the item numbers reported herein Item 5. Legal Proceedings The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Bloomberry Resorts Corporation BLOOM PSE Disclosure Form 4-26 - Legal Proceedings References: SRC Rule 17 (SEC Form 17-C) and Section 4.4 of the Revised Disclosure Rules Subject of the Disclosure Singapore High Court Decision dated 29 May 2020 on Petition to Set Aside the Final Award dated 27 September 2019. -

BLOOMBERRY RESORTS CORPORATION (Incorporated in the Philippines) PSE: BLOOM SECOND QUARTER and FIRST HALF 2021 UNAUDITED RESULTS

BLOOMBERRY RESORTS CORPORATION ! (incorporated in the Philippines) PSE: BLOOM SECOND QUARTER AND FIRST HALF 2021 UNAUDITED RESULTS ANNOUNCEMENT Bloomberry 2Q2021 EBITDA reaches P1. 0 billion despite limited operating days First half 2021 EBITDA higher by 63% year -over-year 2Q2021 HIGHLIGHTS: On March 29, 2021 the government reverted Metro Manila and nearby provinces to Enhanced Community Quarantine (ECQ). The ECQ was eased to Modified Enhanced Community Quarantine (MECQ) on April 12, 2021 and further eased to General Community Quarantine (GCQ) on May 15, 2021. Solaire virtually had no gaming activity in the first 44 days of the quarter. Total GGR at Solaire was P5.7 billion, representing a decrease of 18% from P6.9 billion in the previous quarter when Solaire had 88 days limited capacity operations . Year-over-year, GGR was higher by P5.0 billion since Solaire had minimal gaming activity for the whole second quarter of 2020. Consolidated net revenue was P4.7 billion, representing a P3.8 billion increase from P940.9 million in the same period last year. Consolidated cash operating expenses were lower by 9% compared to the first quarter due to lower gaming taxes paid and cost of sales as well as cost savings realized in salaries and benefits, general office expenses, advertising and promotions, and other cost areas. Consolidated EBITDA was P1.0 billion, representing a P3.0 billion reversal from LBITDA of P2.0 billion in the second quarter of 2020. Consolidated net loss was P1.2 billion, representing a P3.5 billion improvement from net loss of P4.7 billion in the same quarter last year. -

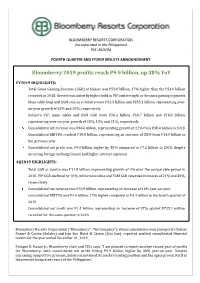

Bloomberry 2019 Profits Reach P9.9 Billion, up 38% Yoy

BLOOMBERRY RESORTS CORPORATION ! (incorporated in the Philippines) PSE: BLOOM FOURTH QUARTER AND FY2019 RESULTS ANNOUNCEMENT Bloomberry 2019 profits reach P9.9 billion, up 38% YoY FY2019 HIGHLIGHTS: Total Gross Gaming Revenue (GGR) at Solaire was P59.8 billion, 17% higher than the P51.0 billion recorded in 2018. Growth was aided by higher hold in VIP and strength in the mass gaming segments Mass table drop and EGM coin-in at Solaire were P51.5 billion and P255.1 billion, representing year- on-year growth of 15% and 20%, respectively Solaire’s VIP, mass tables and EGM GGR were P26.2 billion, P16.7 billion and P16.8 billion, representing year-on-year growth of 20%, 10% and 21%, respectively Consolidated net revenue was P46.6 billion, representing growth of 22% from P38.4 billion in 2018 Consolidated EBITDA reached P19.8 billion, representing a n increase of 33% from P14.9 billion in the previous year Consolidated net profit was P9.9 billion, higher by 38% compared to P7.2 billion in 2018, despite incurring foreign exchange losses and higher interest expenses 4Q2019 HIGHLIGHTS: Total GGR at Solaire was P14.5 billion, representing growth of 9% over the comparable period in 2018. VIP GGR declined by 10%, while mass table and EGM GGR recorded increases of 21% and 30%, respectively Consolidated net revenue was P10.9 billion, representing an increase of 1 6% year-on-year Consolidated EBITDA was P4.0 billion, 17% higher compared to P3.4 billion in the fourth quarter of 2018 Consolidated net profit was P1.4 billion, representing an increase of 87% against P725.1 million recorded for the same quarter in 2018 Bloomberry Resorts Corporation (“Bloomberry”, “the Company”), whose subsidiaries own and operate Solaire Resort & Casino (Solaire) and Jeju Sun Hotel & Casino (Jeju Sun), reported audited consolidated financial results for the year ended December 31, 2019.