WEST CHINA CEMENT LIMITED|HK 2233 INDUSTRY: Cement Manufacturing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Cement Sector

China / Hong Kong Industry Focus U740 China Cement Sector Refer to important disclosures at the end of this report DBS Group Research . Equity 2 Apr 2020 Sales to pick up from an exceptionally low season HSI: 23,086 • Recovering cement sales activities nationwide; shipment rate is up while inventory level is down U740 • Seasonal price correction signals stabilisation ANALYST Duncan CHAN +852 36684178 [email protected] • Resilient demand to drive cement consumption rebound in next few quarters • Top picks are China Resources Cement (1313 HK) and Recommendation & valuation Anhui Conch (914 HK) T arget Mk t PE Cement giants delivered good results. Three major cement Price Price Cap 21F companies’ net earnings uptrend continued in 2019. China Resources Cement (CR Cement) benefitted from resilient cement Local$ Local$ Recom US$m x China Resources Cement selling prices in Southern China market. Conch leveraged on its 9 11.00 BUY 8,107 7.36 (1313 HK) U740 low-cost advantage and higher margin aggregates business Anhui Conch Cmt. 'A' expansion. CNBM’s average capacity utilisation also improved 54.8 60.00 BUY 36,947 8.44 (600585 CH) post merger with SINOMA. Average unit cement gross margin U740 Anhui Conch Cement 'H' was RMB116 (CNBM) – RMB158 per tonne (Conch). Improved 54.05 58.00 BUY 36,947 7.62 U740 (914 HK) cash inflow on operation brought down net gearing to 104% for China National Building Mat CNBM and net cash for Conch and CR Cement. Conch 8.28 8.30 HOLD 8,890 5.69 'H' (3323 HK) outperformed in terms of asset turnover at 1.0x while CNBM ranked the last at 0.6x. -

Harbor Robeco Series July 31, 2020

Quarterly Schedules of Portfolio Holdings Harbor Robeco Series July 31, 2020 Retirement Institutional Administrative Investor Class Class Class Class CONSERVATIVE EQUITY Harbor Robeco Emerging Markets Conservative Equities Fund HRERX HRETX HREAX HRENX Harbor Robeco Global Conservative Equities Fund HRGTX HRGIX HRGDX HRGNX Harbor Robeco International Conservative Equities Fund HRIRX HRIEX HRIMX HRIVX Harbor Robeco US Conservative Equities Fund HRURX HRUNX HRUAX HRUVX CORE EQUITY Harbor Robeco Emerging Markets Active Equities Fund HRMEX HRMTX HRMNX HRMOX Table of Contents Portfolios of Investments HARBOR ROBECO EMERGING MARKETS CONSERVATIVE EQUITIES FUND . 1 HARBOR ROBECO GLOBAL CONSERVATIVE EQUITIES FUND. .................. 4 HARBOR ROBECO INTERNATIONAL CONSERVATIVE EQUITIES FUND . ........ 7 HARBOR ROBECO US CONSERVATIVE EQUITIES FUND. ...................... 10 HARBOR ROBECO EMERGING MARKETS ACTIVE EQUITIES FUND. ........ 12 Notes to Portfolios of Investments ..................................... 17 Harbor Robeco Emerging Markets Conservative Equities Fund PORTFOLIO OF INVESTMENTS—July 31, 2020 (Unaudited) Value, Cost and Principal Amounts in Thousands COMMON STOCKS—94.3% COMMON STOCKS—Continued Shares Value Shares Value AUTO COMPONENTS—1.2% DIVERSIFIED TELECOMMUNICATION SERVICES—Continued 5,275 Shandong Linglong Tyre Co. Ltd. (China) ................ $ 18 2,097 KT Corp. ADR (South Korea)1......................... $ 21 5,400 Weifu High Technology Group Ltd. (China) . 17 48,200 Telekomunikasi Indonesia Persero Tbk PT (Indonesia)..... 10 35 20,330 Turk Telekomunikasyon AS (Turkey) . ................. 21 118 AUTOMOBILES—2.2% 766 KIA Motors Corp. (South Korea) . ..................... 26 ELECTRIC UTILITIES—2.5% 10,785 Tofas Turk Otomobil Fabrikasi AS (Turkey) . 39 5,200 EDP - Energias do Brasil SA (Brazil) ................... 19 65 5,400 Equatorial Energia SA (Brazil) . ..................... 26 5,700 Transmissora Alianca de Energia Eletrica SA (Brazil)* ..... 32 BANKS—18.3% 77 73,000 Agricultural Bank of China Ltd. -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

Government Pension Fund Global Holding of Equities at 31 December

Government Pension Fund Global Holding of equities at 31 December 2011 et value K) K) arket value arket ark wnership wnership ector ector oting oting NO NO S M ( V O S M ( V O AUSTRALIA David Jones Ltd Consumer Services 51 018 951 0.67% 0.67% Abacus Property Group Financials 22 995 524 0.51% 0.51% Deep Yellow Ltd Basic Materials 2 644 029 0.29% 0.29% ABC Learning Centres Ltd Consumer Services 1 672 0.50% 0.50% Dexus Property Group Financials 158 816 463 0.65% 0.65% Acrux Ltd Health Care 16 824 771 0.58% 0.58% Discovery Metals Ltd Basic Materials 25 004 853 0.71% 0.71% Adelaide Brighton Ltd Industrials 54 271 215 0.48% 0.48% Downer EDI Ltd Industrials 55 616 672 0.66% 0.66% AED Oil Ltd Oil & Gas 642 658 0.30% 0.30% DuluxGroup Ltd Industrials 104 835 466 1.61% 1.61% AGL Energy Ltd Utilities 259 696 118 0.64% 0.64% Echo Entertainment Group Ltd Consumer Services 97 268 039 0.64% 0.64% AJ Lucas Group Ltd Industrials 1 743 778 0.24% 0.24% Elders Ltd Consumer Goods 3 899 317 0.55% 0.55% Alesco Corp Ltd Industrials 3 440 168 0.52% 0.52% Emeco Holdings Ltd Industrials 24 130 089 0.65% 0.65% Alliance Resources Ltd Basic Materials 762 474 0.17% 0.17% Energy Resources of Australia Ltd Basic Materials 10 573 558 0.27% 0.27% Alumina Ltd Basic Materials 110 036 341 0.66% 0.66% Energy World Corp Ltd Utilities 35 210 692 0.48% 0.48% Amcor Ltd/Australia Industrials 474 366 213 0.89% 0.89% Envestra Ltd Utilities 31 301 292 0.46% 0.46% AMP Ltd Financials 444 770 671 0.63% 0.63% Equatorial Resources Ltd Basic Materials 6 626 114 0.57% 0.57% Ampella Mining -

Stake in WCC Likely to Cement Leadership in Northwest China

June 19, 2015 COMPANY UPDATE Anhui Conch Cement (H) (0914.HK) Buy Equity Research Stake in WCC likely to cement leadership in Northwest China What's changed Investment Profile Anhui Conch Cement announced that its wholly-owned subsidiary Conch Low High International will acquire 16.7% of the enlarged equity of West China Growth Growth Returns * Returns * Cement (2233 HK, Not Covered) for a consideration of HK$1,527mn. The Multiple Multiple implied EV/t is Rmb355/t, compared with Conch’s 2015E EV/t of Rmb492/t. Volatility Volatility Percentile 20th 40th 60th 80th 100th Implications Anhui Conch Cement (H) (0914.HK) We see strategic merit for both West China Cement and Anhui Conch. Asia Pacific Metals & Mining Peer Group Average * Returns = Return on Capital For a complete description of the investment West China Cement is Shaanxi’s biggest cement producer, with dominant profile measures please refer to the market position in South Shaanxi (75% market share), while Conch is its disclosure section of this document. major competitor in Central Shaanxi. After the acquisition, Conch and Key data Current West China Cement could control 46% of Central and South Shaanxi Price (HK$) 29.10 12 month price target (HK$) 35.80 capacity, and we note that better market cooperation should enhance 600585.SS Price (Rmb) 24.88 600585.SS 12 month price target (Rmb) 28.00 profitability in the region. Market cap (HK$ mn / US$ mn) 154,209.7 / 19,891.4 Foreign ownership (%) -- Ytd Shaanxi cement price is down 5% due to weak demand. We think any 12/14 12/15E 12/16E 12/17E EPS (Rmb) 2.07 2.11 2.44 2.54 potential improvement in the market structure post the proposed deal could EPS growth (%) 17.0 1.9 15.8 4.0 EPS (diluted) (Rmb) 2.07 2.11 2.44 2.54 help stabilize pricing in the region, and note that WCC and Conch’s Shaanxi EPS (basic pre-ex) (Rmb) 2.07 2.11 2.44 2.54 plants are well positioned to benefit from any demand uptick. -

A Gradually Improving Balance Sheet, "Accumulate"

股 票 研 [Table_Title] David Feng 冯廷帅 Company Report: CNBM (03323 HK) 究 (852) 2509 2113 Equity Research 公司报告: 中国建材 (03323 HK) [email protected] 20 June 2019 [Table_Summary] A Gradually Improving Balance Sheet, "Accumulate" 资产负债表逐渐改善,“收集” 公 Regional differentiation has become more explicit. Conditions of the [Table_Rank] 司 national cement market have been similar to the corresponding period in Rating: Accumulate 2018, while south central and northeast China was disappointing. Pressure 报 may persist in July and August due to off-season effect, but overall balance of 评级: 收集 告 supply and demand is expected to be maintained by production curtailment. Company Report Deleveraging through perpetual capital instruments, debt-for-equity swaps and strong operating cash flows. It should be achievable for CNBM 6[Table_Price]-18m TP 目标价 : HK$7.18 to lower its net gearing ratio to below 100% by 2020. Impairment of goodwill is still one concern but the risk is lowering. The Company will reorganize its Share price 股价: HK$6.740 operating entities of glass fiber, engineering and cement businesses. 告 1Q19 bottom line surged by 176.1% YoY on large fair value gains. 证 Stock performance 报 Striping off the fair value gains, the Company's adjusted profit before tax 券 increased by 43.2% YoY. Total revenue reached RMB42,878 million, 股价表现 究 [Table_QuotePic] amounting to 18.8% of our 2019F revenue. 研 5% 研 We expect CNBM's revenue to increase YoY by 4.3%/ 1.7%/ 1.5% in 0% 究 2019/ 2020/ 2021, respectively. Higher materials cost due to the -5% 券 -10% 报 abolishment of low grade cement may push up unit cost in 2020 and 2021. -

Government Pension Fund Global Holding of Equities at 31 December 2012 Sector Value Market (NOK) Voting Ownership Sector Value Market (NOK) Voting Ownership

Government Pension Fund Global Holding of equities at 31 December 2012 Sector value Market (NOK) Voting Ownership Sector value Market (NOK) Voting Ownership AUSTRALIA Energy Resources of Australia Ltd Basic Materials 117 097 468 3,08 % 3,08 % Abacus Property Group Financials 33 311 303 0,60 % 0,60 % Energy World Corp Ltd Utilities 20 630 713 0,56 % 0,56 % Acrux Ltd Health Care 100 920 243 3,68 % 3,68 % Envestra Ltd Utilities 49 417 772 0,57 % 0,57 % Adelaide Brighton Ltd Industrials 49 928 081 0,43 % 0,43 % Equatorial Resources Ltd Basic Materials 4 945 934 0,55 % 0,55 % AGL Energy Ltd Utilities 417 085 825 0,85 % 0,85 % Evolution Mining Ltd Basic Materials 31 407 025 0,45 % 0,45 % AJ Lucas Group Ltd Industrials 2 030 437 0,21 % 0,21 % Fairfax Media Ltd Consumer Services 15 665 024 0,23 % 0,23 % Alliance Resources Ltd Basic Materials 651 465 0,17 % 0,17 % FKP Property Group Financials 11 678 067 0,56 % 0,56 % ALS Ltd/Queensland Consumer Goods 138 958 495 0,65 % 0,65 % Fleetwood Corp Ltd Consumer Goods 24 263 873 0,71 % 0,71 % Alumina Ltd Basic Materials 238 923 532 1,88 % 1,88 % FlexiGroup Ltd/Australia Financials 28 706 388 0,46 % 0,46 % Amcor Ltd/Australia Industrials 523 861 555 0,93 % 0,93 % Flight Centre Ltd Consumer Services 88 298 862 0,57 % 0,57 % AMP Ltd Financials 724 074 891 0,89 % 0,89 % Flinders Mines Ltd Basic Materials 9 655 123 1,31 % 1,31 % Ampella Mining Ltd Basic Materials 2 327 111 0,54 % 0,54 % Fortescue Metals Group Ltd Basic Materials 343 060 417 0,41 % 0,41 % Ansell Ltd Health Care 67 631 724 0,58 % 0,58 % Galaxy -

Protecting Pennsylvania's Investments

Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2013 September 30, 2013 The Commonwealth of Pennsylvania has enacted legislation (Act 44 of 2010) requiring public funds to divest from companies doing business in Iran and/or Sudan that meet certain thresholds of activity. Additionally, Act 44 prohibits Pennsylvania’s public funds from purchasing securities of a company once it appears on scrutinized business activities lists, regardless of whether the funds already have direct holdings in such company. Act 44 requires that the public funds each year assemble and provide a report to the Governor, the President Pro Tempore of the Senate, the Speaker of the House of Representatives, and each member of the boards of the Pennsylvania Municipal Retirement System, the State Employees’ Retirement System, and the Public School Employees’ Retirement System. Accordingly, we have prepared this report on the activities our funds have undertaken to comply with the requirements of Act 44 during the period July 1, 2012 to June 30, 2013. This report includes: The most recent scrutinized companies lists (Sudan and Iran). A summary of correspondence with scrutinized companies. All investments sold, redeemed, divested or withdrawn in compliance with Act 44, the costs and expenses of such transfers, and a determination of net gain or loss on account of such transactions incurred in compliance with the Act. A list of publicly traded securities held by the public funds. Page 1 of 119 Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2013 A copy of Act 44 of 2010 can be downloaded from the Pennsylvania Treasury website at www.patreasury.gov. -

To the Registered Holders of American Depositary Receipts

Deutsche Bank Global Transaction Banking Deutsche Bank Trust Company Americas Global Transaction Banking To the registered holders ("Holders") of American Depositary Receipts ("ADRs" or "Receipts") evidencing American Depositary Shares ("ADSs") representing shares of each of the issuers listed in Exhibit A hereto (the "Issuers") October 25, 2017 Deutsche Bank Trust Company Americas, as depositary (the "Depositary") under the terms and conditions set forth in the Receipts for each of the unsponsored ADR programs set forth in Exhibit A hereby notifies all holders that, in accordance with the provisions of each of the Receipts, the Depositary has amended and restated the terms and conditions governing any and all outstanding Receipts issued by the Depositary. The amended and restated terms and conditions are substantially identical for all Issuers. A copy of such amended and restated terms and conditions for any particular Issuer is available for viewing on the website of the U.S. Securities and Exchange Commission at https://www.sec.gov/edgar/searchedgar/companysearch.html. Registered Holders that do not have access to the internet or that otherwise do not wish to do an online review of the amended and restated terms and conditions applicable to their Receipts may receive the text of such terms and conditions on written request to the Depositary. Pursuant to the provisions of the prior terms and conditions governing the Receipts for each of the Issuers, the amended and restated terms and conditions are effective immediately provided, however, any amendment contained therein which shall prejudice any substantial existing right of Holders shall not become effective as to outstanding Receipts until the expiration of thirty (30) days after the date of this notice. -

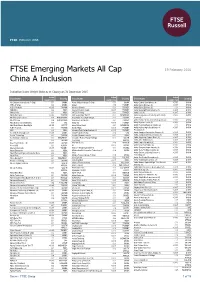

FTSE Emerging Markets All Cap China a Inclusion

FTSE PUBLICATIONS FTSE Emerging Markets All Cap 19 February 2016 China A Inclusion Indicative Index Weight Data as at Closing on 31 December 2015 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 361 Degrees International (P Chip) 0.01 CHINA Ajisen China Holdings (P Chip) 0.01 CHINA Anhui Golden Seed Winery (A) <0.005 CHINA 3SBio (P Chip) 0.03 CHINA Akbank 0.13 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA A.G.V. Products <0.005 TAIWAN Akcansa Cimento 0.01 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA ABB India 0.02 INDIA Akenerji Elektrik Uretim <0.005 TURKEY Anhui Guofeng Plastic Industry (A) <0.005 CHINA Abbott India 0.01 INDIA AKFEN Holding 0.01 TURKEY Anhui Heli (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN AKR Corporindo Tbk PT 0.02 INDONESIA Anhui Hengyuan Coal Industry & Electricity <0.005 CHINA Aboitiz Equity Ventures 0.08 PHILIPPINES Aksa Akrilik Ve Kimya Sanayii 0.01 TURKEY Power (A) Aboitiz Power 0.04 PHILIPPINES Aksa Enerji Uretim AS 0.01 TURKEY Anhui Honglu Steel Construction (group) (A) <0.005 CHINA Abu Dhabi Commercial Bank 0.09 UAE Aksigorta <0.005 TURKEY Anhui Huamao Textile (A) <0.005 CHINA Abu Dhabi Islamic Bank Egypt <0.005 EGYPT Alam Sutera Realty 0.01 INDONESIA Anhui Huaxing Chemical Industry (A) 0.01 CHINA AcBel Polytech 0.01 TAIWAN Alarko Hldgs <0.005 TURKEY Anhui Huilong Agricultural Means of <0.005 CHINA ACC 0.03 INDIA Albaraka Turk Katilim Bankasi AS <0.005 TURKEY Production (A) Accelink Technologies (A) <0.005 CHINA Aldar Properties PJSC 0.06 UAE Anhui Jianghuai Automotive Chassis (A) <0.005 CHINA Accton Technology 0.01 TAIWAN Alembic Pharmaceuticals 0.01 INDIA Anhui Jiangnan Chemical Industry (A) <0.005 CHINA Ace Hardware Indonesia 0.01 INDONESIA Alexander Forbes Equity Holdings 0.01 SOUTH Anhui Jingcheng Copper Share (A) <0.005 CHINA Acer 0.03 TAIWAN Proprietary AFRICA Anhui Jinhe Industrial (A) <0.005 CHINA Aces Electronic Co. -

China Corporate Bond Market Blue Book

China Corporate Bond Market Blue Book A 2019 Fitch China Research Initiative Publication CHINA CORPORATE BOND MARKET BLUE BOOK About Fitch Fitch Ratings opened its mainland office in Beijing in 2005, landscape. Through the Fitch China Research Initiative, we aim making it the first international ratings agency to operate in to support the efforts of investors by providing objective and China. Today the agency has offices in Beijing and Shanghai, and insightful research – both into corporate sectors within China continues to rapidly expand its mainland analytical presence. that are yet to issue, or are in the early stages of issuing, as well as into the potential issuers of the future. In mid-2014, Fitch created a separate research team of Mandarin-speaking analysts, based in its offices in China, with a Our Blue Book series represents almanac-style volumes with remit to produce world-class objective and insightful research on a tiered approach dependent on investor interest and areas of corporate sectors in China. This research focuses on helping to focus. The first tier looks into market structures and the operation educate and familiarise investors with the key credit aspects of of individual sectors, the second tier looks at key industry players corporate sectors that are unrated, or that consist of just a few and relative rankings, and the third tier dives deep into the credit rated entities. aspects of an individual entity or groups of unrated entities. The potential that a fully liberalised financial landscape in As always, the authors are at your disposal for discussion, feedback China represents for global investors is beyond compare. -

Hong Kong Marginable Securities List

MRS-101 HK Marginable Securities List (with effect from 1 September 2021) The default single counter concentration limit is up to SGD100,000 per counter. Shares with single counter concentration limit higher than SGD100,000 are also listed in the Group A/B/C list. Exch Exch Exch No HK Counter Valuation % No HK Counter Valuation % No HK Counter Valuation % Symbol Symbol Symbol 1 01530 3SBio Inc 70 28 02009 BBMG Corp 70 55 01898 China Coal Energy Co Ltd 85 China Communications 2 02018 AAC Technologies Holdings Inc 70 29 00863 BC Technology Group Ltd 50 56 01800 85 Construction Co Ltd China Communications Services 3 03383 Agile Group Holdings Ltd 70 30 06160 BeiGene Ltd 70 57 00552 85 Corp Ltd Beijing Capital International China Conch Venture Holdings 4 01288 Agricultural Bank of China Ltd 85 31 00694 85 58 00586 85 Airport Co Ltd Ltd 5 01299 AIA Group Ltd 100 32 00392 Beijing Enterprises Holdings Ltd 70 59 00939 China Construction Bank Corp 100 Beijing Enterprises Water Group 6 00753 Air China Ltd 85 33 00371 70 60 03818 China Dongxiang Group Co Ltd 50 Ltd Beijing Jingneng Clean Energy China East Education Holdings 7 01789 AK Medical Holdings Ltd 70 34 00579 50 61 00667 70 Co Ltd Ltd Beijing Tong Ren Tang Chinese 8 09926 Akeso Inc 70 35 03613 70 62 00670 China Eastern Airlines Corp Ltd 85 Medicine Co Ltd China Education Group Holdings 9 09988 Alibaba Group Holding Ltd 100 36 09626 Bilibili Inc 70 63 00839 70 Ltd Alibaba Health Information 10 00241 70 37 06993 Blue Moon Group Holdings Ltd 70 64 06818 China Everbright Bank Co Ltd 85 Technology