Mattel, Inc: Vendor Operations in Asia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Painful Barbie in a Global Marketing Perspective Patrick Sim MM* Capital Advisors Partners Asia Pte Ltd, Singapore

ounting cc & A f M Patrick Sim, J Account Mark 2015, 4:3 o a l r a k e n Journal of Accounting & DOI: 10.4172/2168-9601.1000142 t r i n u g o J ISSN: 2168-9601 Marketing Review Article Open Access Painful Barbie in a Global Marketing Perspective Patrick Sim MM* Capital Advisors Partners Asia Pte Ltd, Singapore Abstract The essay discusses the American doll, Barbie within a global marketing perspective. It will summarize the main points of the case and explain how the material in the global marketing review relates to the case. The issues to be discussed will involve Mattel’s global marketing strategy for Barbie and its success. This will be negotiated with its brand strength as well as its icon status and how to create more marketing opportunities and turn the sales around in the US. These issues will also be taken from the perspective of the local Middle East culture when Mattel goes global in search for a befitting cultural nuance from its customers as well as seeking the perfect media response. The essay will also highlight the future suggestions for the product and the company. Keywords: Global marketing; Barbie branding; Sustainable efforts; Branding and key success factors for sustainable efforts Cultural nuance; Iconic marketing Mattel is a big, successful brand, which has good brand strength, Introduction financially and through its strong customer based loyalty. It can be analyzed that Mattel/Barbie must maintain these success factors and Global marketing strategy be sustainable in marketing efforts to be able to increase their future Global marketing as defined by Doyle [1] suggests “marketing on a opportunities:- worldwide scale reconciling or taking commercial advantage of global • Economies of scale in production and distribution; operational differences, similarities and opportunities in order to meet global objectives”. -

FAQ & Troubleshooting Settings

FAQ & Troubleshooting Settings Issue: Controller volume is too loud or quiet The controller may be set to volume level that is too loud or quiet. You can increase or decrease the volume in the system settings menu. Press the ο button, then use the steering stick to toggle left and right through the settings. When you reach “speaker volume,” press the check button to enter. Toggle left and right to adjust the controller volume from 1 to 5, then press the check button to confirm. Issue: I want to mute the engine sounds Press the ο button, then use the steering stick to toggle left and right through the settings. When you reach “engine sounds,” press the check button to enter. Toggle left and right to turn engine sounds on and off, then press the check button to confirm. Issue: The controller is not speaking the language I require The incorrect language was selected at startup. Switch on the controller while holding down the X button to reset. Will the Hot Wheels AI system interfere with my home Wi-Fi if it’s also 2.4GHz? Our code is designed to behave in much the same way as a wireless router does. The controller will scan for unused channels in the 2.4 GHz range (there are lots of them), and select a free one to use. It works perfectly, without you even noticing. Do I need to be connected to a Wi-Fi network to play with Hot Wheels AI? No. Hot Wheels AI creates its own connections between cars and controllers. -

Fisher-Price.Com Fisher-Price.Com.Cn Instructions for Use 使使用说明用说明 • Keep Instructions for Future Reference, As It Contains Important Information

WARNING 警警告告 For your child’s safety and health: • Always use this product with adult supervision. • Continuous and prolonged sucking of fl uids will cause tooth decay. • Always check food temperature before feeding. • Never allow child to walk or run with this product. 为为了您孩子的安全和健康着想:了您孩子的安全和健康着想: • 请务必在成人的监护下使用本产品。 • 长时间连续吸食液体会引起蛀牙。 • 每次喂食前,请先试试食物的温度。 • 请勿让儿童携带本产品奔跑或行走。 fisher-price.com fisher-price.com.cn Instructions for Use 使使用说明用说明 • Keep instructions for future reference, as it contains important information. • Before use, thoroughly wash all parts that may contact food. Wash in warm, soapy water. • Do not use harsh or abrasive cleaners or sponges. Rinse to remove residue. • Do not use in microwave. Do not use with carbonated beverages or pulpy juices. • Inspect the spout before each use. Pull the spout in all directions and throw away at the first sign of damage or weakness. • Do not leave the spout in direct sunlight/heat or leave in a disinfectant for longer than what is recommended. • Top-rack dishwasher safe. • 请妥善保管本说明书,因为含有重要信息。 • 在使用之前,请彻底清洗可能会接触到食物的 所有部位。请用温和的肥皂水进行清洗。 • 请勿使用具有刺激性或腐蚀性的清洁剂或海绵。 请用冲洗的方式去除残留物。 • 请勿置于微波炉中。请勿盛放碳酸饮料或果汁 饮料。 • 在每次使用之前,请先对杯嘴进行检查。向任意 方向拉伸杯嘴,一旦发现破损或缺陷,请弃用。 • 请勿使阳光/热气直射杯口或置于消毒剂中超过 消毒剂厂商建议时长。 • 可置于洗碗机的顶层清洗。 Taiwan: Mattel Taiwan Corporation, 2F-1, No.188, Nan King East Road, Sec.5, Taipei, Taiwan Customer Care line: 0800-212-797 美泰兒股份有限公司 台北市南京東路五段188號二樓1室 免付費諮詢專線: 0800-212-797 Hong Kong: Mattel East Asia Ltd., Room 503-09, North Tower, World Finance Centre, Harbour City, 17 Canton Road, Tsimshatsui, HK, China Customer Care line: +852 - 3185 6500 香港九龍尖沙咀廣東道十七號 海港城環球金融中心北座五樓五零三至九室 免付費諮詢專線: +852 - 3185 6500 Mattel Barbie (Shanghai) Trading Co., Ltd. Room 2201, 2207, 22/F., Ascendas Plaza, 333 Tian Yao Qiao Road, Shanghai 200030, P.R.C. -

TOYS Balls Barbie Clothes Board Books-English and Spanish Books

TOYS Balls Ping Pong Balls Barbie clothes Ping Pong Paddles Board Books-English and Spanish Play Food and Dishes Books-English and Spanish Playskool KickStart Cribgym Busy Boxes Pool Stick Holder Colorful Rainsticks Pool Stick repair kits Crib Mirrors Pool sticks Crib Mobiles-washable (without cloth) Pop-up Toys Etch-A-Sketch Puzzles Fisher Price Medical Kits Rattles Fisher Price people and animals See-n-Say FisherPrice Infant Aquarium Squeeze Toys Infant Boppy Toddler Riding Toys Magna Doodle Toys that Light-up Matchbox Cars Trucks Musical Toys ViewMaster and Slides Nerf Balls-footballs, basketballs GAMES Battleship Life Scattergories Boggle Lotto Scattergories Jr. Boggle Jr. Lucky Ducks Scrabble Checkers Mancala Skipbo Cards Chess Mastermind Sorry Clue Monopoly Taboo Connect Four Monopoly Jr. Trivial Pursuit-90's Cranium Operation Trouble Family Feud Parchesi Uno Attack Guess Who Pictionary Uno Cards-Always Needed Guesstures Pictionary Jr Upwords Jenga Playing Cards Who Wants to Be a Millionaire Lego Game Rack-O Yahtzee ARTS AND CRAFTS Beads & Jewelry Making Kits Crayola Washable Markers Bubbles Disposable Cameras Children’s Scissors Elmer's Glue Coloring Books Fabric Markers Construction Paper-esp. white Fabric Paint Craft Kits Foam shapes and letters Crayola Colored Pencils Glitter Crayola Crayons Glitter Pens Glue Sticks Play-Doh tools Journals Scissor w/Fancy edges Letter Beads Seasonal Crafts Model Magic Sizzex Accessories Paint Brushes Stickers Photo Albums ScrapBooking Materials Plain White T-shirts -all sizes Play-Doh ELECTRONICS -

16-18 October 2019 Shanghai New International Expo Center Message from CTJPA President

Visitor Guide E6 16-18 October 2019 Shanghai New International Expo Center Message from CTJPA President Dear participants, On behalf of China Toy & Juvenile Products Association (CTJPA), the organizer of China Toy Expo (CTE), China Kids Expo (CKE), China Preschool Expo (CPE) and China Licensing Expo (CLE), I would like to extend our warmest welcome to all of you and express our sincere thanks for all your support. Launched in 2002, the grand event has been the preferred platform for leading brands from around the world to present their newest products and innovations, connect with customers and acquire new sales leads. In 2019, the show will feature 2,508 global exhibitors, 4,859 worldwide brands, 100,000 professional visitors from 134 countries and regions, showcasing the latest products and most creative designs in 230,000 m² exhibition space. It is not only a platform to boost trade between thousands of Chinese suppliers and international buyers, but also an efficient gateway for international brands to tap into the Chinese market and benefit from the huge market potential. CTJPA has designed the fair as a stage to show how upgraded made-in-China will influence the global market and present worldwide innovative designs and advanced technologies in products. Moreover, above 1800 most influential domestic and international IPs will converge at this grand event to empower the licensing industry. IP owners are offered opportunities to meet with consumer goods manufacturers, agents and licensees from multi-industries to promote brands and expand licensing business in China and even Asia. Whether you are looking to spot trends, build partnerships, or secure brand rights for your products, we have the answer. -

ARCHITECTS of INTELLIGENCE for Xiaoxiao, Elaine, Colin, and Tristan ARCHITECTS of INTELLIGENCE

MARTIN FORD ARCHITECTS OF INTELLIGENCE For Xiaoxiao, Elaine, Colin, and Tristan ARCHITECTS OF INTELLIGENCE THE TRUTH ABOUT AI FROM THE PEOPLE BUILDING IT MARTIN FORD ARCHITECTS OF INTELLIGENCE Copyright © 2018 Packt Publishing All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, without the prior written permission of the publisher, except in the case of brief quotations embedded in critical articles or reviews. Every effort has been made in the preparation of this book to ensure the accuracy of the information presented. However, the information contained in this book is sold without warranty, either express or implied. Neither the author, nor Packt Publishing or its dealers and distributors, will be held liable for any damages caused or alleged to have been caused directly or indirectly by this book. Packt Publishing has endeavored to provide trademark information about all of the companies and products mentioned in this book by the appropriate use of capitals. However, Packt Publishing cannot guarantee the accuracy of this information. Acquisition Editors: Ben Renow-Clarke Project Editor: Radhika Atitkar Content Development Editor: Alex Sorrentino Proofreader: Safis Editing Presentation Designer: Sandip Tadge Cover Designer: Clare Bowyer Production Editor: Amit Ramadas Marketing Manager: Rajveer Samra Editorial Director: Dominic Shakeshaft First published: November 2018 Production reference: 2201118 Published by Packt Publishing Ltd. Livery Place 35 Livery Street Birmingham B3 2PB, UK ISBN 978-1-78913-151-2 www.packt.com Contents Introduction ........................................................................ 1 A Brief Introduction to the Vocabulary of Artificial Intelligence .......10 How AI Systems Learn ........................................................11 Yoshua Bengio .....................................................................17 Stuart J. -

Master List of Games This Is a List of Every Game on a Fully Loaded SKG Retro Box, and Which System(S) They Appear On

Master List of Games This is a list of every game on a fully loaded SKG Retro Box, and which system(s) they appear on. Keep in mind that the same game on different systems may be vastly different in graphics and game play. In rare cases, such as Aladdin for the Sega Genesis and Super Nintendo, it may be a completely different game. System Abbreviations: • GB = Game Boy • GBC = Game Boy Color • GBA = Game Boy Advance • GG = Sega Game Gear • N64 = Nintendo 64 • NES = Nintendo Entertainment System • SMS = Sega Master System • SNES = Super Nintendo • TG16 = TurboGrafx16 1. '88 Games ( Arcade) 2. 007: Everything or Nothing (GBA) 3. 007: NightFire (GBA) 4. 007: The World Is Not Enough (N64, GBC) 5. 10 Pin Bowling (GBC) 6. 10-Yard Fight (NES) 7. 102 Dalmatians - Puppies to the Rescue (GBC) 8. 1080° Snowboarding (N64) 9. 1941: Counter Attack ( Arcade, TG16) 10. 1942 (NES, Arcade, GBC) 11. 1943: Kai (TG16) 12. 1943: The Battle of Midway (NES, Arcade) 13. 1944: The Loop Master ( Arcade) 14. 1999: Hore, Mitakotoka! Seikimatsu (NES) 15. 19XX: The War Against Destiny ( Arcade) 16. 2 on 2 Open Ice Challenge ( Arcade) 17. 2010: The Graphic Action Game (Colecovision) 18. 2020 Super Baseball ( Arcade, SNES) 19. 21-Emon (TG16) 20. 3 Choume no Tama: Tama and Friends: 3 Choume Obake Panic!! (GB) 21. 3 Count Bout ( Arcade) 22. 3 Ninjas Kick Back (SNES, Genesis, Sega CD) 23. 3-D Tic-Tac-Toe (Atari 2600) 24. 3-D Ultra Pinball: Thrillride (GBC) 25. 3-D WorldRunner (NES) 26. 3D Asteroids (Atari 7800) 27. -

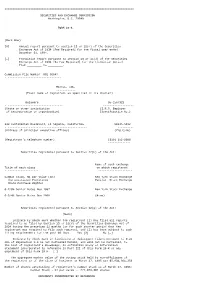

Page 1 of 2) COMPUTATION of INCOME PER COMMON and COMMON EQUIVALENT SHARE ------(In Thousands, Except Per Share Amounts)

================================================================================ SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) [X] Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 [Fee Required] for the fiscal year ended December 31, 1994. [_] Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 [No Fee Required] for the transition period from _________ to _________. Commission File Number 001-05647 - --------------------------------- MATTEL, INC. ------------ (Exact name of registrant as specified in its charter) Delaware 95-1567322 - ---------------------------------- ------------------- (State or other jurisdiction (I.R.S. Employer of incorporation or organization) Identification No.) 333 Continental Boulevard, El Segundo, California 90245-5012 - ------------------------------------------------- ---------- (Address of principal executive offices) (Zip Code) (Registrant's telephone number) (310) 252-2000 -------------- Securities registered pursuant to Section 12(b) of the Act: Name of each exchange Title of each class on which registered - ------------------- --------------------- Common stock, $1 par value (and New York Stock Exchange the associated Preference Pacific Stock Exchange Share Purchase Rights) 6-7/8% Senior Notes Due 1997 New York Stock Exchange 6-3/4% Senior Notes Due 2000 (None) Securities registered pursuant to Section 12(g) of the Act: (None) Indicate by check mark whether the registrant (1) has filed all reports -

Electric Drive by '25

ELECTRIC DRIVE BY ‘25: How California Can Catalyze Mass Adoption of Electric Vehicles by 2025 September 2012 About this Report This policy paper is the tenth in a series of reports on how climate change will create opportunities for specific sectors of the business community and how policy-makers can facilitate those opportunities. Each paper results from one-day workshop discussions that include representatives from key business, academic, and policy sectors of the targeted industries. The workshops and resulting policy papers are sponsored by Bank of America and produced by a partnership of the UCLA School of Law’s Environmental Law Center & Emmett Center on Climate Change and the Environment and UC Berkeley School of Law’s Center for Law, Energy & the Environment. Authorship The author of this policy paper is Ethan N. Elkind, Bank of America Climate Policy Associate for UCLA School of Law’s Environmental Law Center & Emmett Center on Climate Change and the Environment and UC Berkeley School of Law’s Center for Law, Energy & the Environment (CLEE). Additional contributions to the report were made by Sean Hecht and Cara Horowitz of the UCLA School of Law and Steven Weissman of the UC Berkeley School of Law. Acknowledgments The author and organizers are grateful to Bank of America for its generous sponsorship of the workshop series and input into the formulation of both the workshops and the policy paper. We would specifically like to thank Anne Finucane, Global Chief Strategy and Marketing Officer, and Chair of the Bank of America Environmental Council, for her commitment to this work. -

60 Years of Collecting Barbie®! by Christopher Varaste

60 Years of Collecting Barbie®! by Christopher Varaste Muse. Pioneer. Icon. That’s Barbie® doll, a fashion model whose stride down an endless runway inspired an entire line of quality collectibles for an astounding 60 years! An elevation of design and fashion, Barbie doll appeals to anyone interested in contemporary fashion trends. With her online presence, Barbie also serves as a major influencer. Barbie always encapsulates that intangible quality known as “style.” Under Mattel owner Ruth Handler’s influence and designer Charlotte Johnson’s tutelage, the world was first taken by surprise when Barbie was introduced at the New York Toy Fair on March 9th, 1959, along with her pink fashion booklet. Sales took off after Barbie appeared in a commercial aired during The Mickey Mouse Club™. All it took was one look and everyone wanted a Barbie doll! From the beginning, astute collectors recognized the ingenuity and detail that had gone into the doll and her wardrobe, which began to grow along with Barbie doll’s popularity. Today, those early tailored fashions are a veritable freeze frame of the era, reminiscent of Balenciaga, Schiaparelli, Givenchy and Dior. Many clever girls handled their precious Barbie dolls with care, and that eventually marked the beginning of the very first Barbie™ Fan Club in 1961, which set the stage for more clubs where Barbie™ fans could gather and make new friends. There was so much to collect! Nothing stopped Barbie from constantly evolving with hairstyles like Ponytails, Bubble Cuts, Mod hairstyles and an eclectic wardrobe that showcased the latest looks from smart suits, career outfits and go-go boots! Mattel advertisement from 1967 introducing Mod Twist ‘N Turn Barbie®. -

Retail Innovations

eyond every horizon, new horizons always rise B (Michael Ende) The crisis under way is accentuating the polarisation between the mass of operators on the one hand who are shy of innovating, and on the other those of a more daring and long-sighted nature who continue to allocate resources and ideas toward renewal, and even undertake restructuring and streamlining operations in parallel if necessary. Investing in innovative projects at the present juncture therefore represents an even greater opportunity. Confirming this is the wide range of projects we present in this year’s overview of retail innovations. Thanks to our partnership with the World Retail Congress, we have been entrusted with assessing the cases competing for the Retail Innovation Award and of selecting six finalists. Despite the recession, Retail new project ideas are being explored everywhere. (…) As always, time will determine which of these innovative strategies will enjoy enduring success. And though these projects all got off on the right foot, every retailer knows that success must be renewed each day. So, we wish the best of luck to those who (like ourselves) have found inspiration from their stores. Innovations 6 2010 Shaping the future of retail Innovation trends • Socialtailing • Accessible dreams • “I trust you” • Greentailing • Pro-client efficiency • Liquid retail • Glocalism • Emerging retail territories Research coordinated by Fabrizio Valente - Kiki Lab Founder member of Ebeltoft Ebeltoft is a business alliance, which was founded in 1990 and is comprised of 19 firms that have a founder Ebeltoft and Lab Kiki - Valente Fabrizio by coordinated Research common, strong focus on the retail and service business, and provide consulting a wide range of services to help retailers and suppliers in the retail sector remain competitive and achieve their goals. -

Big Tires! Big Smashing!

® MONSTER TRUCKS YOU CANHOT COLLECT WHEELS ALL THE NEW 2020 HOT WHEELS™ MONSTER TRUCKS LIVE BIG 1 OF 6 2 OF 6 3 OF 6 TIRES! SMASHING!BIG ANIMAL ATTACK™ 1 OF 10 2 OF 10 3 OF 10 4 OF 10 5 OF 10 BONE SHAKER® V8 BOMBER® TIGER SHARK 4 OF 6 5 OF 6 6 OF 6 MOTOSAURUS® STEER CLEAR HISSY FIT™ MEGA-WREX® HOTWEILER® 6 OF 10 7 OF 10 8 OF 10 9 OF 10 10 OF 10 HW DEMO DERBY™ BIGFOOT® HOT WHEELS® RACING #1 COLORFUL CRASHING! RATICAL RACER™ TINTED WHEELS™ 1 OF 5 2 OF 5 3 OF 5 4 OF 5 5 OF 5 HW METRO™ 1 OF 10 2 OF 10 3 OF 10 4 OF 10 5 OF 10 ONE BAD GHOUL™ BAD CATTITUDE™ EL SUPERFASTO® MEGA-WREX® INVADER® LOCO PUNK® 5 ALARM GUTTER GROWLER™ ’70 DODGE HOTWEILER® CHARGER R/T STUNT STORM™ 6 OF 10 7 OF 10 8 OF 10 9 OF 10 10 OF 10 1 OF 10 2 OF 10 3 OF 10 4 OF 10 5 OF 10 HOT WHEELS® JEEP WRANGLER HOUND HAULER® POLICE 5 ALARM POTTY CENTRAL™ PSYCHO-DELIC® BONE SHAKER® V8 BOMBER® 6 OF 10 7 OF 10 8 OF 10 9 OF 10 10 OF 10 CRASH LEGENDS™ 1 OF 5 2 OF 5 3 OF 5 4 OF 5 5 OF 5 TWIN MILL® ’18 CHEVY® HOT WHEELS® CAMARO® SSTM RACING #3 STEALTH SMASHERS™ 1 OF 5 2 OF 5 3 OF 5 4 OF 5 5 OF 5 FAST FOODIE™ 1 OF 5 2 OF 5 3 OF 5 4 OF 5 5 OF 5 OPERATION STOMP™ INVADER® SRIRACHA® MILK MONSTER™ ALL FRIED UP™ ALL BEEFED UP™ OSCAR MAYER™ WIENERMOBILE™ STAR WARS™ NICKELODEON™ 1 OF 2 2 OF 2 1 OF 2 2 OF 2 IN PUTTIHOTNG ® THE T WHEELS HW FLAMES™ HO 1 OF 5 2 OF 5 3 OF 5 4 OF 5 5 OF 5 ™ ™ DARTH VADER CHEWBACCA SPONGEBOB SQUAREPANTS ® ® SHARK WREAK DAIRY DELIVERY 5 ALARM MARVEL NINTENDO™ 1 OF 3 2 OF 3 3 OF 3 1 OF 3 BLACK & WHITE 1 OF 6 2 OF 6 3 OF 6 HULK MARVEL SPIDER-MAN DONKEY KONG NEW TRUCKS? ® ® 5 ALARM BONE SHAKER MEGA-WREX THAT’SNEWS BIG 4 OF 6 5 OF 6 6 OF 6 SKELETON CREW® Bigfoot - “BIGFOOT"® and "THE ORIGINAL MONSTER TRUCK"® are registered trademarks of BIGFOOT 4X4, Inc., 2286 Rose Ln., Pacific, MO, 63069 USA, Bigfoot4x4.com.