“Phantom” Markets: How Do Equity Markets Not Function?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Experts Needed an All-Male One

THIS WEEK EDITORIALS academia. Undaunted, for many years she lectured in Erlangen and, symmetry led her to discover that the symmetries of a physical system from 1915, at the University of Göttingen — often for free. are inextricably linked to physical quantities that are conserved, At the time, that city was the centre of the mathematical world, such as energy. These ideas became known as Noether’s theorem largely due to the presence of two of its titans — Felix Klein and David (E. Noether Nachr. d. Ges. d. Wiss. zu Göttingen, Math.-phys. Kl. 1918, Hilbert. But even when Noether was being paid to teach at Göttingen 235–257; 1918). and making her most important contributions, fate and further dis- As well as answering a conundrum in general relativity, this theorem crimination intervened: Hitler took power in 1933 and she was fired for became a guiding principle for the discovery of new physical laws. For being Jewish. She escaped to the United States and taught at Bryn Mawr example, researchers soon realized that the conservation of net electric College in Pennsylvania, until she died in 1935, at the age of just 53. charge — which can neither be created nor Noether devoted her career to algebra and came to see it in a striking “Before Noether, destroyed — is intimately related to the rota- new light. “All of us like to rely on figures and formulas,” wrote Bartel topologists tional symmetry of a plane around a point. van der Waerden, her former student, in his obituary of Noether. “She had been The impact was profound: those who created was concerned with concepts only, not with visualization or calculation.” counting holes in the standard model of particle physics, and Noether saw maths as what are now called structures. -

Annual Report 2014-15

Annual Report 2014-15 Contents Director’s note 1 About CERP 3 Implementing Partners 4 Donors 4 CERP’s Network Affiliates 5 General Body 5 Board of Directors 5 Finance and Audit Committee 6 Procurement Committee 6 Company Secretary 6 Auditors 6 Financial Consultants 6 Legal Advisers 6 Financial Statement 7 Catalyzing Rigorous Policy Research About CERP CERP’s Implementing Partners The Center for Economic Research in Pakistan (CERP) is a non-profit research center with the strategic objective * Adult Basic Education Society of informing policy and practice by filling socio-economic research gaps in Pakistan using rigorous economic * Agriculture Department, Government of Punjab research tools. CERP also facilitates an environment where the international academic community both within and * Aman Foundation outside Pakistan can work with program implementers to answer research questions that matter, bringing together * Communication and Works Department, Government of Punjab academic findings, policy advice, and focused debate. * Excise and Taxation Department, Government of Punjab * Finance Department, Government of Punjab Initiated in 2008 by economists at the Harvard Kennedy School, University of Chicago, Pomona College and Lahore * Health Department, Government of Punjab University of Management Sciences, CERP is continually expanding in both size and scope. The organization * Higher Education Department, Government of Punjab currently enjoys an inspirational roster of over 30 economists and social scientists working on numerous research * Livestock and Dairy Development Department (LDDD), Government of Punjab projects in collaboration with the government of Pakistan and several international organizations. Partnerships * Local Government Department, Government of Punjab with various government departments have included those with Punjab Livestock Development Department, * National Commission for Human Development (NCHD), Punjab Excise & Taxation Department and Punjab Resource Management Program. -

MAN with a MISSION Hyun-Sung Khang Profiles Princeton’S Atif Mian, Who Sees the Fight Against Inequality As a Moral Imperative PHOTO: JIM GRAHAM JIM PHOTOGRAPHYPHOTO

PEOPLE IN ECONOMICS MAN WITH A MISSION Hyun-Sung Khang profiles Princeton’s Atif Mian, who sees the fight against inequality as a moral imperative PHOTO: JIM GRAHAM JIM PHOTOGRAPHYPHOTO: 40 FINANCE & DEVELOPMENT | September 2019 ©International Monetary Fund. Not for Redistribution PEOPLE IN ECONOMICS veryone knows someone who buys more overshadowed by his fluent, fast-talking writing than he or she can afford. This has been partner. But in person, and away from the camera, characterized mockingly as millennials Mian’s mildness comes across as kind, thought- spending beyond their means on avocado ful, and charming. He brings an easily overlooked toast and expensive lattes, often borrow- passion to the dismal science and is attracted by the ing to fund those wants. But in the modern era, allure of the greater efficiencies it promises. Edependence on credit isn’t a sign of profligacy, “The reason I get so excited about economics according to Atif Mian, a Princeton professor of is—and this is my definition of economics: how economics, public policy, and finance. Rather, can we better organize ourselves to do something he argues, excessive borrowing is evidence of an where the sum is bigger than the parts?” says Mian. economic system that has become distorted by “I think economics is the unique field that exactly widening income inequality. focuses on those kinds of questions.” “It’s almost as though the modern economy has Mian’s wife of almost 20 years, Ayesha, jokes become addicted to credit,” Mian says. “We need that the pursuit of efficiency prevails even in his to understand how, and why, that happened.” personal life, manifesting itself in an obsession The 44-year-old Pakistani-American has done with “space utilization around the house,” during much to shed fresh light on our modern-day frequent evenings hosting guests. -

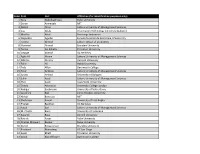

1 Atila Abdulkadiroglu Duke University 2 Daron

ColumFirst Last Affiliation (for identification purposes only) 1 Atila Abdulkadiroglu Duke University 2 Daron Acemoglu MIT 3 Nazish Afraz Lahore University of Management Sciences 4 Izza Aftab Information Technology University (Lahore) 5 Madiha Afzal Brookings Institution 6 Alejandra Aguilar Escuela Superior de Economia, Mexico City 7 Hamna Ahmad Lahore School of Economics 8 Shameel Ahmad Brandeis University 9 Yacine Ait-Sahalia Princeton University 10 George Akerlof UC Berkeley 11 Agha Ali Akram Lahore University of Management Sciences 12 Alberto Alesina Harvard University 13 Fahd Ali Habib University 14 Treb Allen Dartmouth College 15 Tahir Andrabi Lahore University of Management Sciences 16 Junaid Arshad University of Bologna 17 Saher Asad Lahore University of Management Sciences 18 Sher Asad Iowa State University 19 Orazio Attanasio University College London 20 Rüdiger Bachmann University of Notre Dame 21 Laurence Ball Johns Hopkins University 22 Abhijit Banerjee MIT 23 Sheheryar Banuri University of East Anglia 24 Pranab Bardhan UC Berkeley 25 Faisal Bari Lahore University of Management Sciences 26 M. Chatib Basri University of Indonesia 27 Kaushik Basu Cornell University 28 Patrick Bayer Duke University 29 Charles Maxwell Becker Duke University 30 Daniel Bergstresser Brandeis University 31 Prashant Bharadwaj UC San Diego 32 Swati Bhatt Princeton University 33 David Blanchflower Dartmouth College 34 Alan Blinder Princeton University 35 Patrick Bolton Columbia University 36 Michael D. Bordo Rutgers University 37 Leah Boustan Princeton -

LOW INTEREST RATES, MARKET POWER, and PRODUCTIVITY GROWTH Ernest Liu Atif Mian Amir Sufi WORKING PAPER 25505 NBER WORKING PAPER SERIES

LOW INTEREST RATES, MARKET POWER, AND PRODUCTIVITY GROWTH Ernest Liu Atif Mian Amir Sufi WORKING PAPER 25505 NBER WORKING PAPER SERIES LOW INTEREST RATES, MARKET POWER, AND PRODUCTIVITY GROWTH Ernest Liu Atif Mian Amir Sufi Working Paper 25505 http://www.nber.org/papers/w25505 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2019, Revised August 2020 We thank Manuel Amador, Abhijit Banerjee, Nick Bloom, Timo Boppart, V. V. Chari, Itay Goldstein, Andy Haldane, Chad Jones, Pete Klenow, Erzo Luttmer, Christopher Phelan, Thomas Philippon, Tomasz Piskorski, Tommaso Porzio, Ali Shourideh, Michael Song, Kjetil Storesletten, Aleh Tsyvinski, Venky Venkateswaran, David Weil, Fabrizio Zilibotti and seminar participants at the NBER Productivity, Innovation, and Entrepreneurship meeting, NBER Economic Fluctuations and Growth meeting, NBER Summer Institute “Income Distribution and Macroeconomics” session, Barcelona Summer Forum, Minnesota Macro Workshop, Stanford SITE, University of Chicago, Wharton, HBS, Bocconi, HKUST, CUHK, JHU and LBS for helpful comments. We thank Sebastian Hanson, Thomas Kroen, Julio Roll, and Michael Varley for excellent research assistance and the Julis Rabinowitz Center For Public Policy and Finance at Princeton for financial support. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2019 by Ernest Liu, Atif Mian, and Amir Sufi. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

Download the 2020-2021 Annual Report

The Julis-Rabinowitz Center for Public Policy & Finance 2020–2021 ANNUAL REPORT about the center Established in 2011, the Julis-Rabinowitz Center for Public Policy & Finance at the Princeton School of Public and International Affairs promotes teaching and research about the interactions between financial markets and the macroeconomy, with the aim of improving the design and implementation of public policies. The Center offers opportunities for collaborations among students and faculty in the Princeton School of Public & International Affairs, other departments and the wider policy community. The Center encourages crossing boundaries both within economics and across disciplines such as economics, finance, law, politics, history and ethics. acknowledgments Princeton University gratefully acknowledges the generous support of the Center’s sponsors: THE JULIS-RABINOWITZ FAMILY for the founding gift that made the Center possible. PHILIP D. BENNETT, *79 MARK R. GENENDER, ’87 AND FAMILY NOAH GOTTDIENER, ’78 DEAN N. MENEGAS, ’83 For a more comprehensive view of the Center’s programs and activities, visit us at jrc.princeton.edu TABLE OF CONTENTS Message from the Director 2 Faculty 2020–2021 faculty affiliates 3 Faculty research, publications and news 5 Researchers visitors, fellows and postdoctoral associates 12 Research Initiatives macrofinance lab 14 1 Research Initiatives workshops 15 Teaching & Learning student associates 16 Teaching & Learning curriculum 23 Teaching & Learning financial markets for public policy professionals 24 Center Events ninth annual conference: development finance in fragile states 26 Center Events calendar 28 Leadership external advisory council 30 MESSAGE FROM THE DIRECTOR en years ago, the Julis-Rabinowitz Center was founded in the wake of a major global T financial crisis. -

What Drove PTI Govt to Reverse Atif Mian's Nomination

Analysis: What drove PTI govt to reverse Atif Mian's nomination Page No.01 Co lNo.01 ISLAMABAD: Despite his firm resolve till the last moment to retain Dr Atif Mian as a member of the Economic Advisory Council(EAC), internal dissent, coupled with “reports” of possible countrywide violent protests by religious organisations, forced Prime Minister Imran Khan to take back the decision. Highly-placed sources told Dawn that the government had to swallow the bitter pill of taking a U-turn on the issue of Atif Mian’s nomination as EAC member within three days after receiving reports that some religious groups were planning to stage sit-ins in Islamabad on Friday (Sept 7) at a time when foreign dignitaries from China and Saudi Arabia werescheduled to arrive here. Moreover, the sources said, some members of the federal cabinet, including the religious affairs minister, suggested to the prime minister to review his decision and warned him that the situation could become ugly for the government at a time when it was still in the process of settling down. Prime Minister Khan was told that the government could face an embarrassing situation if the protests continued in the presence of Chinese Foreign Minister Wang Yi and Saudi Minister for Information Dr Awwad Bin Saleh Al Awwad in Islamabad. Non-availability of political support on the issue, mainly from the two major opposition parties, also played a key role in forcing the government to review the decision, the sources added. On the other hand, the opposition parties claim that the government had appointed Dr Atif Mian as EAC member without consulting them and, later, withdrew his nomination in haste, again without taking them or the parliament into confidence. -

Download the Transcript

PAKISTAN-2018/11/08 1 THE BROOKINGS INSTITUTION FALK AUDITORIUM 100 DAYS OF IMRAN KHAN Washington, D.C. Thursday, November 8, 2018 Introduction: NATAN SACHS Senior Fellow and Director, Center for Middle East Policy The Brookings Institution Discussants: MICHAEL O’HANLON, Moderator Senior Fellow and Director of Research, Foreign Policy The Brookings Institution MADIHA AFZAL Nonresident Fellow, Foreign Policy, Global Economy and Development The Brookings Institution BRUCE RIEDEL Senior Fellow and Director, The Intelligence Project The Brookings Institution * * * * * ANDERSON COURT REPORTING 500 Montgomery Street, Suite 400 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 PAKISTAN-2018/11/08 2 P R O C E E D I N G S MR. SACHS: Good afternoon, everyone, and thank you very much for joining this afternoon here at the Brookings Institution. My name is Natan Sachs. I’m the director of the Center for Middle East Policy. And it’s my distinct pleasure to welcome you all on behalf of the Foreign Policy program at Brookings for what should be a very important discussion of a very important country that does not get enough attention and when it does it’s solely security. We have a stellar panel to speak about the first 100 days of Imran Khan’s government. And with us today are a nonresident fellow here with the Foreign Policy program and the program on global development at Brookings, Madiha Afzal over here in the center. She is an expert on Pakistan and the author in just 2018 of “Pakistan Under Siege: Extremism, Society, and the State,” published by Brookings Institution Press. -

Speakers' Notes

SPEAKERS INFORMATION SESSION I: CASE STUDY: WHAT WAS THE MACRO-PRUDENTIAL RESPONSE TO THE 1990S SWEDISH CRISIS? ANIL KASHYAP Edward Eagle Brown Professor of Economics and Finance University of Chicago Anil K Kashyap is the Edward Eagle Brown Professor of Economics and Finance at the University Of Chicago Booth School Of Business. His research focuses on banking, business cycles, financial regulation, and monetary policy. He is a consultant/advisor for Federal Reserve Banks of Chicago and New York, the Congressional Budget Office, the U.S. Office of Financial Research, the International Monetary Fund, the Swedish Riksbank, and is on the Board of Directors of the Bank of Italy’s Einuadi Institute of Economics and Finance. His bachelor's degree in economics and statistics is from the University of California at Davis and his PhD in economics is from the Massachusetts Institute of Technology. PETER ENGLUND Professor of Banking Stockholm School of Economics Peter Englund Peter Englund is a professor of banking at the Stockholm School of Economics. He holdsDirector a PhD from Stockholm School of Economics and has previously been a professor of economics at Uppsala University and a professor of real estate finance at Swedishthe University Institute of Amsterdam.for Financial He Research is a member of ERDT the Prize Committee of the Prize in Economic Sciences in Memory of Alfred Nobel and has participated in various public committees in the fields of taxation and financial marketsHOUBEN and institutions. He has published in academic journals in the fields of banking, public economics and housing and real estate. Director, Financial Stability Division De Nederlandsche Bank PATRICK HONOHAN Governor Central Bank of Ireland Patrick Honohan has been Governor of the Central Bank of Ireland since September 2009, and a member of the Governing Council of the European Central Bank. -

IMF Lists 25 Brightest Young Economists

IMF Lists 25 Brightest Young Economists http://www.ibtimes.co.uk/imf-lists-25-brightest-young-economists... UK EDITION THURSDAY, 28TH AUGUST, 2014 Economy IMF Lists 25 Brightest Young Economists By Boby Michael August 27, 2014 14:52 BST IMF Headquarters REUTERS The International Monetary Fund (IMF) has identified twenty-five young economists who it expects 1 of 7 8/28/14 10:25 AM IMF Lists 25 Brightest Young Economists http://www.ibtimes.co.uk/imf-lists-25-brightest-young-economists... News Business Economy Technology Sport Entertainment & Arts Viewpoint Video share US nationality with other countries like France, India, Australia and Canada. There are also representatives from the UK, Russia and Argentina. The IMF has prepared the list after surveying international economists, journalists and other readers, which will appear in the September volume of Finance & Development, published on 27 August. Another important feature most of those who made it to the list share is their place of study. Except two, all had their advanced studies done in a famous US institute. Here is the list of institutes: MIT-five, Harvard - six, Princeton - two, University of Chicago - three, New York University - two, University of California - one, University of Columbia - one, University of Stanford - two, Peterson Institute - one. The non-US institutions are the London Business School, and Paris School of Economics. American Melissa Dell and Russian Oleg Itskhoki, both 31, are the youngest ones in the list. And here is the list of economists. 1. Nicholas Bloom, 41, British, Stanford University, uses quantitative research to measure and explain management practices across firms and countries. -

'Thematisch Ambtsbericht Over De Positie Van Ahmadi's En Christenen

Thematisch ambtsbericht over de positie van ahmadi’s en christenen in Pakistan 2017-2020 Datum December 2020 Colofon Plaats: Den Haag Directie Afrika, Cluster AmbtsBerichten (CAB) Pagina 1 van 125 Thematisch ambtsbericht over de positie van ahmadi's en christenen in Pakistan 2017-2020 | december 2020 Inleiding In dit thematisch ambtsbericht wordt de situatie in Pakistan beschreven voor zover deze van belang is voor de beoordeling van asielverzoeken van ahmadi’s en christenen afkomstig uit Pakistan, en voor de besluitvorming over de terugkeer van afgewezen Pakistaanse ahmadi’s en christenen. Dit ambtsbericht is een actualisering van eerdere berichten over de positie van ahmadi’s en christenen in Pakistan, laatstelijk het bericht van april 2017, in de tekst kortheidshalve “het vorige ambtsbericht” genoemd. Dit thematisch ambtsbericht beslaat de periode van 1 maart 2017 tot 1 september 2020. Dit ambtsbericht betreft een feitelijke, zoveel mogelijk neutrale en objectieve weergave van de bevindingen gedurende de onderzochte periode en biedt geen beleidsaanbevelingen. Het bericht is opgesteld aan de hand van openbare en vertrouwelijke bronnen waarbij gebruik is gemaakt van zorgvuldig geselecteerde, geanalyseerde en gecontroleerde informatie. Gebruik van een bron betekent niet dat het Ministerie van Buitenlandse Zaken de opinie van een bron deelt. Numerieke gegevens, beschrijvingen en duidingen van specifieke gebeurtenissen en omstandigheden kunnen uiteenlopen, afhankelijk van de geraadpleegde bron, resulterend in een zekere bandbreedte die ook in dit ambtsbericht kan worden aangetroffen. Bij de opstelling is gebruik gemaakt van informatie van verschillende organisaties van de Verenigde Naties, niet-gouvernementele organisaties (ngo’s), buitenlandse overheden waaronder de Pakistaanse overheid, kennisinstituten, Youtube, vakliteratuur en berichtgeving in de Pakistaanse en internationale media. -

September 2018 PAKISTAN NEWS DIGEST a Selected Summary of News, Views and Trends from Pakistani Media

September 2018 PAKISTAN NEWS DIGEST A Selected Summary of News, Views and Trends from Pakistani Media Prepared by Dr. Zainab Akhter Dr. Nazir Ahmad Mir Dr. Mohammad Eisa Dr. Ashok Behuria PAKISTAN NEWS DIGEST September 2018 A Select Summary of News, Views and Trends from the Pakistani Media Prepared by Dr. Zainab Akhter Dr. Nazir Ahmad Mir Dr. Mohammad Eisa Dr. Ashok Behuria INSTITUTE FOR DEFENCE STUDIES AND ANALYSES 1-Development Enclave, Near USI Delhi Cantonment, New Delhi-110010 PAKISTAN NEWS DIGEST, September 2018 CONTENTS EDITORIAL ............................................................................................................. 03 POLITICAL DEVELOPMENTS ........................................................................... 08 ECONOMIC ISSUES .............................................................................................. 10 SECURITY SITUATION ........................................................................................ 15 URDU & ELECTRONIC MEDIA ......................................................................... 16 Urdu ………………………………………………………………………………...21 Electronic…………………………………………………………………………....24 STATISTICS ............................................................................................................. 25 BOMBINGS, SHOOTINGS AND DISAPPEARANCES ...................................... 26 IDSA, New Delhi 1 Editorial The hyped Economic Advisory Committee (EAC) constituted by Prime Minster Imran Khan to restore the ailing economy of Pakistan faced the public’s ire when noted