Wonderla Holidays Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SECTION -A READING 20 MARKS (A) Wood Beetle (B) Red-Wattled Lapwing 1

English IX Language and Literature Sample Paper 5 Solved www.rava.org.in CLASS IX (2019-20) ENGLISH (CODE 0184) LANGUAGE AND LITERATURE SAMPLE PAPER-5 Time Allowed : 3 Hours Maximum Marks : 80 General Instructions : (i) This paper is divided into three sections: A, B and C. All questions are compulsory. (ii) Separate instructions are given with each section and question, wherever necessary. Read these instructions very carefully and follow them. (iii) Do not exceed the prescribed word limit while answering the questions SECTION -A READING 20 MARKS (a) Wood Beetle (b) red-wattled lapwing 1. Read the following passage and answer the questions (c) the white-breasted kingfisher that follow. [8] (d) Indian eagle owl Birds are natural wonders of beauty. Flying is the (v) Which of the following is a migratory bird ? prerogative solely of birds. The entire universe is their (a) Lion Tailed Macaque home. Their mellifluous calls, queenly dance, gossamer (b) Indian eagle owl quill and artistic sculpture make them special. India has quite a few forest reserves which are home to some (c) Siberian Stork rarely seen and endangered species of birds. (d) The Nilgiri Tahr Located about 24km from the Chennai City (vi) The word in para 3 whose antonym is ‘Foreign’ is Centre, Namnangalam is a massive forest sprawling (a) home (b) endemic across 2400 hectares, of which 320 is reserved. It is a (c) national (d) reserve bird watcher’s paradise and houses about 85 species (vii) Which of the following is true about Kumarakom of birds including the red-wattled lapwing, the white- bird sanctuary ? breasted kingfisher, Indian eagle owl and several (a) It is home to rare territorial orchids. -

Wonderla Holidays Limited Opening Up, Eyeing Gradual Recovery

Wonderla Holidays Limited Opening up, eyeing gradual recovery Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: WONDERLA Result Update Update Stock 3R MATRIX + = - Summary Wonderla Holidays Limited (WHL) didn’t clock any revenue in H1FY2021 as parks were shut Right Sector (RS) ü during the lockdown. Yet, cost control was at its best with the company saving Rs. 15-20 crore. Right Quality (RQ) ü Now, with the government allowing entertainment parks to open with a limited capacity and standard protocols, the company will open its Bengaluru park with a 50% capacity on weekends. Right Valuation (RV) ü Opening of some international amusement parks (in France and China) on a limited scale also received an encouraging response. This offers WHL hope to achieve gradual recovery + Positive = Neutral - Negative in footfalls in the near term. Stock has corrected by ~14% in the last three months (~43% in last one year), trading at an EV/EBIDTA of 10.8x its FY2023E. We maintain our Hold recommendation on the stock with revised PT of Rs. 174. Reco/View Change H1FY2021 performance was affected by closure of amusement parks during COVID-led Reco: Hold lockdowns. However, what stood out during the period was the stringent cost savings, which helped the company save Rs. 15-20 crore. The company has reduced costs (related to payroll, CMP: Rs. 160 advertising & marketing overheads) and undertaken rationalisation measures including deferral of avoidable operating costs (~70% of operating cost is direct cost). Monthly expenses Price Target: Rs. 174 á fell to Rs. 3 crore in July from Rs. -

Payment Locations - Muthoot

Payment Locations - Muthoot District Region Br.Code Branch Name Branch Address Branch Town Name Postel Code Branch Contact Number Royale Arcade Building, Kochalummoodu, ALLEPPEY KOZHENCHERY 4365 Kochalummoodu Mavelikkara 690570 +91-479-2358277 Kallimel P.O, Mavelikkara, Alappuzha District S. Devi building, kizhakkenada, puliyoor p.o, ALLEPPEY THIRUVALLA 4180 PULIYOOR chenganur, alappuzha dist, pin – 689510, CHENGANUR 689510 0479-2464433 kerala Kizhakkethalekal Building, Opp.Malankkara CHENGANNUR - ALLEPPEY THIRUVALLA 3777 Catholic Church, Mc Road,Chengannur, CHENGANNUR - HOSPITAL ROAD 689121 0479-2457077 HOSPITAL ROAD Alleppey Dist, Pin Code - 689121 Muthoot Finance Ltd, Akeril Puthenparambil ALLEPPEY THIRUVALLA 2672 MELPADAM MELPADAM 689627 479-2318545 Building ;Melpadam;Pincode- 689627 Kochumadam Building,Near Ksrtc Bus Stand, ALLEPPEY THIRUVALLA 2219 MAVELIKARA KSRTC MAVELIKARA KSRTC 689101 0469-2342656 Mavelikara-6890101 Thattarethu Buldg,Karakkad P.O,Chengannur, ALLEPPEY THIRUVALLA 1837 KARAKKAD KARAKKAD 689504 0479-2422687 Pin-689504 Kalluvilayil Bulg, Ennakkad P.O Alleppy,Pin- ALLEPPEY THIRUVALLA 1481 ENNAKKAD ENNAKKAD 689624 0479-2466886 689624 Himagiri Complex,Kallumala,Thekke Junction, ALLEPPEY THIRUVALLA 1228 KALLUMALA KALLUMALA 690101 0479-2344449 Mavelikkara-690101 CHERUKOLE Anugraha Complex, Near Subhananda ALLEPPEY THIRUVALLA 846 CHERUKOLE MAVELIKARA 690104 04793295897 MAVELIKARA Ashramam, Cherukole,Mavelikara, 690104 Oondamparampil O V Chacko Memorial ALLEPPEY THIRUVALLA 668 THIRUVANVANDOOR THIRUVANVANDOOR 689109 0479-2429349 -

V-Guard Industries Limited

RED HERRING PROSPECTUS Dated: 28th January, 2008 Please read section 60 B of the Companies Act, 1956 100% Book Building Issue V-GUARD INDUSTRIES LIMITED (Our Company was originally incorporated as V- Guard Industries Limited on February 12, 1996 under the Companies Act, 1956, with the Registration No. 09-10010 of 1996.With effect from Novermber15, 2001 our Company was converted into a Private Limited Company and subsequently got converted into a Public Limited Company on August 1, 2007 and received a fresh certificate of incorporation in the name of “V-Guard Industries Limited”. Our Corporate Identity Number is U31200KL1996PLC010010) Registered cum Corporate Office : 44/1037, Little Flower Church Road, Kaloor, Cochin- 682017, Kerala, India; Our Company has not changed its registered office since its incorporation. Tel. No. +91-484-2539911, 2530912; Fax No.+ 91-484-2539958, Website: www.vguard.in Contact Person & Compliance Officer : Mr. T. Nandakumar, E-mail: [email protected] PUBLIC ISSUE OF 80,00,000 EQUITY SHARES OF RS. 10 EACH FOR CASH AT A PRICE OF RS. [●] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF RS. [●] PER EQUITY SHARE) FOR CASH AGGREGATING TO RS. [●] LAKHS (THE “ISSUE”) OUT OF WHICH 4,00,000 EQUITY SHARES HAVE BEEN RESERVED FOR ELIGIBLE EMPLOYEES OF OUR COMPANY (“EMPLOYEE RESERVATION PORTION”). THE NET ISSUE TO THE PUBLIC SHALL BE 76,00,000 EQUITY SHARES OF RS.10 EACH FOR CASH AT A PRICE OF RS.[●] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF RS. [●] PER EQUITY SHARE) FOR CASH AGGREGATING TO RS. [●] LAKHS (THE “NET ISSUE TO PUBLIC”) THE ISSUE WILL CONSTITUTE 26.80 % OF THE FULLY DILUTED POST ISSUE PAID-UP CAPITAL OF OUR COMPANY AND THE NET ISSUE TO PUBLIC WILL CONSTITUTE 25.46 % OF THE FULLY DILUTED POST ISSUE PAID -UP CAPITAL OF OUR COMPANY. -

Wonderla Holidays Q3FY21 Financial Results & Highlights

Wonderla Holidays Q3FY21 Financial Results & Highlights Brief Company Introduction Wonderla Holidays Limited operates amusement parks and resorts in India. It operates through Amusement Parks and Resort, and Others segments. The company's amusement parks offer land, water, high thrill, and kid rides. It operates three amusement parks in Kochi, Bengaluru, and Hyderabad; and the Wonderla resort in Bengaluru under the brand name Wonderla. The company operates Wonder Kitchen, a food takeaway outlet. It also sells merchandise, cooked food, packed foods, etc. The company was incorporated in 2002 and is based in Bengaluru, India. Consolidated Financials (In Crs) Q3FY21 Q3FY20 YoY % Q2FY21 QoQ % 9MFY21 9MFY20 YoY% Sales 6 73 -91.78% 2 200.00% 10 238 -95.80% PBT -19 33* -158% -20 -5.00% -60 77* -177.92% PAT -15 21 -171% -16 -6.25% -45 63 -171.43% *Contains exceptional item of Rs 15.56 Cr Detailed Results 1. The company saw revenues stay down in Q3 as well due operating at 50% capacity from 15th Oct in Q3. 2. Bangalore park opened on 13th Nov with parks open only on weekends and holidays. 3. Kochi park was opened on 24th Dec. Hyderabad park opened on 7th Jan. 4. Bangalore Park achieved footfalls of 36,121 and Kochi Park achieved footfalls of 8,591 during the period. Total footfalls were 44,712. 5. In Wonder Kitchen, the company opened up new branches in Bangalore and Kochi in Q2. Another branch was opened in Hyderabad in Sep. The company now has 4 branches in total. 6. Wonderla Resort Bangalore was reopened for customers from 3rd October 2020 and saw occupancy of 12% and ARR of Rs 3169. -

TOURISM INFRASTRUCTURE INVESTMENTS Leveraging Partnerships for Exponential Growth

TOURISM INFRASTRUCTURE INVESTMENTS Leveraging Partnerships for Exponential Growth THEME PARKS CRUISE INFRASTRUCTURE HEALTHCARE WELLNESS ADVENTURE MICE MEDICAL TITLE Tourism Infrastructure Investments: Leveraging Partnerships for Exponential Growth YEAR July, 2018 AUTHORS STRATEGIC GOVERNMENT ADVISORY (SGA), YES Global Institute, YES BANK No part of this publication may be reproduced in any form by photo, photoprint, microfilm or any COPYRIGHT other means without the written permission of YES BANK Ltd. & FICCI. This report is the publication of YES BANK Limited (“YES BANK”) & FICCI and so YES BANK & FICCI have editorial control over the content, including opinions, advice, Statements, services, offers etc. that is represented in this report. However, YES BANK & FICCI will not be liable for any loss or damage caused by the reader’s reliance on information obtained through this report. This report may contain third party contents and third-party resources. YES BANK & FICCI take no responsibility for third party content, advertisements or third party applications that are printed on or through this report, nor does it take any responsibility for the goods or services provided by its advertisers or for any error, omission, deletion, defect, theft or destruction or unauthorized access to, or alteration of, any user communication. Further, YES BANK & FICCI do not assume any responsibility or liability for any loss or damage, including personal injury or death, resulting from use of this report or from any content for communications or materials available on this report. The contents are provided for your reference only. The reader/ buyer understands that except for the information, products and services clearly identified as being supplied by YES BANK & FICCI, it does not operate, control or endorse any information, products, or services appearing in the report in any way. -

Experiential Learning- Projectwork- Fieldwork

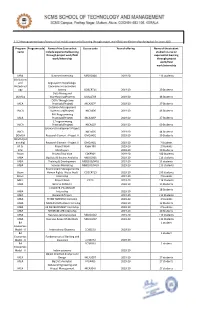

1.3.2 Average percentage of courses that include experiential learning through project work/field work/internship during last five years (10) Program Program code Name of the Course that Course code Year of offering Name of the student name include experiential learning studied course on through project work/field experiential learning work/internship through project work/field work/internship MBA Summer Internship MB010304 2019-20 113 students BSc Botany and Angiosperm morphology, Biotechnol taxonomy and economic ogy botany BO6CRT11 2019-20 20 Students Data Mining and DDMCA Warehousing(Project) DMCA703 2019-20 48 Students OOPs Through Java MCA Practicals(Project) MCA307P 2019-20 27 Students Database Management IMCA Systems Lab(Project) IMCA406 2019-20 46 Students PHP Programmimg MCA Practicals(Project) MCA306P 2019-20 27 Students C Programmomg IMCA Practicals(Project) IMCA107 2019-20 59 Students SoGware Development-Project IMCA I IMCA605 2019-20 44 Students DDMCA Research Element - Project II DMCAX01 2019-20 39 Students DDMCA(Int ernship) Research Element - Project II DMCAX01 2019-20 7 Students M.Sc Project Work Paper XIII 2019-20 2 Students B.Sc MiniProject 2019-20 20 Students Bcom Project/Viva Voce C06PR01 2019-20 100 Students MBA Big Data & Busines Analytics MB010301 2019-20 113 students MBA Training & Development MB82 03/0401 2019-20 13 students MBA Services Marketing MB81 03/0403 2019-20 113 students Environment Management & Bcom Human Rights- Water Audit CO5CRT15 2019-20 100 Students Bcom Internship 2019-20 7 Students MBA Project Work -

Josephitenewsletter

1 JosephiteNewsletter Volume 13 | Issue 3 | St Joseph’s College (Autonomous), Bangalore- 27 | January - March 2020 birth certificates that are the to confront this emergency daily obsessions of the powers together, and find innovative that be, have sharper relevance ways to take our unfinished work now in the wake of the pandemic forward. caused by the coronavirus. We see markets crashing, people When we look at our institution’s in panic, and misinformation history, we will find many everywhere. instances in the past when the Josephite spirit has been tested, In these dark times, we must each and has responded in abundance. find an internal compass that This, too, is an opportunity for us must guide us. If we look within, to forget small differences and we will find the discernment that rise to the challenge of being will guide us to the necessary human. next step. At the fag end of the semester, at a time reserved for Principal’s Note goodbyes to those leaving the institution, we must instead focus In my last message, I spoke of on staying safe, and on the well- how simple acts of nature can being of our loved ones. remind us of the fragility of human presence on this planet. We do not know what the next Those remarks, made in the few weeks might bring, but let context of focusing on serious us resolve first to rally around the issues like climate change rather institutional ideals of faith and than the trivia of ancestry and toil. Let us be strong in our resolve 1 2 2 College Events Republic Day Protocol in charge: Mr. -

Ridership Updation Kochi Metr

Ridership Updation on Kochi Metro and Impact on Pollutants Final Report DISCLAIMER “The present study cannot be construed and be substituted as an investment grade study to secure project financing. Professional practices and available procedures were used in the development of the study findings. However, there is considerable uncertainty inherent in future traffic prediction and reduction in carbon emission forecasts for any Mass transport facility due its dependence on future planning assumptions and master plan predictions. These differences could be material. It should be recognized that traffic and revenue forecasts in this document are intended to reflect the overall estimated long-term trend and not for year on year comparison as for any given year, it may vary due to economic conditions and other factors. The report and its contents are confidential and intended solely for use for the study project. Any use by third parties for use or for publication without the express written consent of CDM Smith is prohibited. CDM Smith i Kochi Metro Rail Ltd. Ridership Updation on Kochi Metro and Impact on Pollutants Final Report LIST OF ACRONYMS LNG: Liquefied Natural Gas GDP: Gross Domestic Product KMRL: Kochi Metro Rail Limited GCDA: Greater Cochin Development Authority IT: Information technology VOC: Vehicle Operation Cost VOT: Value of Time FACT: Fertilisers and Chemicals Travancore Limited TELK: Transformers and Electricals Kerala Limited NH: National Highway KSRTC: Karnataka State Road Transport Corporation JNNURM: Jawaharlal Nehru -

![Wonderla Holidays Limited: Ratings Downgraded to [ICRA]A+ (Stable)/A1](https://docslib.b-cdn.net/cover/6741/wonderla-holidays-limited-ratings-downgraded-to-icra-a-stable-a1-1686741.webp)

Wonderla Holidays Limited: Ratings Downgraded to [ICRA]A+ (Stable)/A1

July 29, 2021 Wonderla Holidays Limited: Ratings downgraded to [ICRA]A+ (Stable)/A1 Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]A+ (Stable); downgraded Long Term – Fund based/CC 10.00 10.00 from [ICRA]AA-(Negative) [ICRA]A+ (Stable); downgraded Long Term – Term Loan 80.00 80.00 from [ICRA]AA-(Negative) [ICRA]A1; downgraded from Short Term – Non-fund based 15.00 15.00 [ICRA]A1+ Total 105.0 105.0 *Instrument details are provided in Annexure-1 Rationale The rating revision factors in significant decline in operational performance of Wonderla Holidays Limited (WHL) in FY2021 and the same being susceptible to evolving nature of the pandemic in FY2022. The operating income of the company declined by 85.8% in FY2021 to Rs. 38.4 crore from 270.9 crore in FY2020 owing to decline in footfall with parks remaining shut in Q1 and Q2 of FY2021 and majority of days in Q3 FY2021 due to the first wave of Covid-19 pandemic. The company incurred operational loss in FY2021 owing to significant decline in scale of operations. The company’s parks have remained shut from April 18, 2021 owing to the second wave of the Covid-19 pandemic (only the Bangalore resort has been allowed to open from July 5, 2021 at 50% capacity and the Hyderabad park will be open from August 5, 2021) and consequently, the company’s performance is expected to remain subdued in the near-term. While ICRA takes cognisance of the company’s healthy cash balances which are available to fund the operating losses while the parks are shut, it expects the industry recovery to be slower than previously anticipated. -

Urbanization and Environment – Issues, Challenges and Potentials

PROCEEDINGS OF KERALA ENVIRONMENT CONGRESS 2016 FOCAL THEME URBANIZation AND ENVIRONMENT ISSUES CHALLENGES AND POTENTIALS 28th & 29th November, 2016 at Energy Management Centre - Kerala Thiruvananthapuram Organised by CENTRE FOR ENVIRONMENT AND Development THIRUVANANTHAPURAM In Association with ENERGY Management CENTRE – Kerala Supported by Kerala State Council for Science Technology and Environment & Kerala State Biodiversity Board Proceedings of the Kerala Environment Congress - 2016 Editors Dr Vinod T R Dr T Sabu Dr Thrivikramji K P Dr Babu Ambat Published by Centre for Environment and Development Thozhuvancode, Vattiyoorkavu Thiruvananthapuram, Kerala, India-695013 Design & Pre-press Godfrey’s Graphics Sasthamangalam, Thiruvananthapuram Printed at Newmulti Offset, Thiruvananthapuram Kerala State Council for Science Technology & Environment Sasthrabhavan, Pattom P.O Thiruvananthapuram-695 004, Kerala, India Ph: +91471-2543557 (Direct), Fax: +91471-2540085 E-mail: [email protected] Official Email:[email protected] Dr. Suresh Das Executive Vice President FOREWORD Worldwide, rapid urbanization is leading to several challenges related to housing, infrastructure, encroachment of land, pollution, sewerage, waste and traffic management. In addition, the difficulties of providing sufficient jobs in urban areas has led to poverty, expanding slums and social unrest making urban governance a difficult task. This is especially true of the developing world and more so for the two rapidly developing countries, China and India. At present, more than half of the world’s population is living in small towns and cities with about half a million population. By 2050, the world population is projected to be 9.2 billion, of which 6.7 billion or 73% are estimated to live in urban areas. -

Annual Report 2018-19 – Rajagiri

RAJAGIRI outREACH Professional Service Wing of Rajagiri College of Social Sciences Annual report 2018-19 MANAGEMENT & STAFF OF RAJAGIRI OUTREACH TABLE OF CONTENTS Sl. CONTENTS PAGE No. No. 1. SOCIAL IMPACT ASSESSMENT STUDIES 1 2. RESEARCH, TRAINING & CONSULTANCY 14 3. CORPORATE SOCIAL RESPONSIBILITY (CSR) PROJECTS 19 4. CHILD CENTERED PROGRAMMES 22 5. PROGRAMMES FOR WOMEN EMPOWERMENT 87 6. PROGRAMMES FOR ELDERS 112 7. PROGRAMMES FOR ENVIRONMENT – NATURAL RESOURCE 122 MANAGEMENT 8. PROGRAMMES FOR COMMUNITY HEALTH 132 9. AMALA AWARD 2018 136 10. NEW COLLABORATION WITH AGRICULTURAL UNIVERSITY, 137 VELLAYANI, THIRUVANANTHAPURAM 11. POST FLOOD INTERVENTIONS BY RAJAGIRI OUTREACH 138 12. STAFF RETREAT 156 13. ACHIEVEMENTS 157 14. IMPORTANT DAY OBSERVATION 159 15. KEY INTERNAL UPDATES 160 16. RESOURCE SESSIONS 161 17. PUBLICATIONS 161 18. STUDENTS INTERNSHIP 162 19. PHOTO GALLERY 167 20. NEWSPAPER CLIPPING 189 Message from Director Rev. Dr. Fr. Mathew Vattaathara CMI The core value of Rajagiri outREACH stems from a quote “The day in which you do not do some help to others will not be counted in the days of your life” by Saint Kuriakose Elias Chavara, Social Reformer and Founder of CMI congregation. The combined efforts of professionals in Rajagiri outREACH help the community and environment to strive every day. This was evident when Kerala was confronted with the Flood in August 2018, one of the drastic catastrophes in the history of the State. Our integrated efforts to rehabilitate the affected people and their eco-systems have been well appreciated by the government and community and we as a team are determined to do good every day.