Surcharge Or Not to Surcharge! the Plight of Small and Medium Merchants

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bharat Bill Payment System: Note for Agent Institutions

Bharat Bill Payment System: Note for Agent Institutions BBPS – A Brief Introduction BBPS stands for Bharat Bill Payment System. The Bharat bill payment system is a Reserve Bank of India (RBI) conceptualised system driven by National Payments Corporation of India (NPCI). It is a one-stop payment platform for all bills providing an interoperable and accessible “Anytime Anywhere” bill payment service to all customers across India with certainty, reliability and safety of transactions. BBPS a One-stop access: BBPS has multiple modes of payment and provides instant confirmation of payment via an SMS or receipt. BBPS offers myriad bill collection categories like electricity, telecom, DTH, gas, water bills etc. through a single window. In future biller categories may be expanded to include insurance premium, mutual funds, school fees, institution fees, credit cards, local taxes, invoice payments, etc. An effective mechanism for handling consumer complaints has also been put in place to support consumer regarding any bill related problems in BBPS. The system participants are entities authorised by Reserve Bank of India (RBI) thereby providing assurance to the customer for a trusted experience between the service providers and billers. 1 | P a g e Bharat Bill Payment System: Note for Agent Institutions Different Payment Channels BBPS transaction can be initiated through multiple payment channels like Internet, Internet Banking, Mobile, Mobile-Banking, POS (Point of Sale terminal), Mobile Wallets, MPOS (Mobile Point of Sale terminal), Kiosk, ATM, Bank Branch, Agents and Business Correspondents. Different Payment Modes BBPS facilitates myriad payment modes enabling bill payments. The payment modes options facilitated under BBPS are Cash, Cards (Credit, Debit & Prepaid), IMPS, Internet Banking, UPI, Wallets & AEPS. -

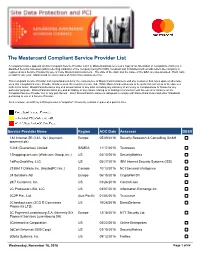

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

Payment Services)

2018 Business Briefing (Payment Services) December 10, 2018 Representative Director and Senior Executive Vice President Shigeki Yamaguchi © 2018 NTT DATA Corporation Self-introduction ■Business experience Apr 1984 Joined NTT DATA • Engaged in development of middle software for shared scientific computation systems • Project leader of system development for distribution industry, etc. Jul 2010 Head of Enterprise Business Consulting Marketing Sector • Engaged in establishment of NTT Data Business Consulting Corporation, a predecessor of QUNIE CORPORATION, a consulting firm of NTT DATA Group, and concurrently served as Director and Executive Vice President Jan 2013 Representative Director and Senior Managing Director of JSOL Corporation • Engaged in expansion of SAP business Jun 2013 Senior Vice President, Head of Business Consulting & Marketing Sector • In charge of consulting and ERP (Biz∫) business Jun 2014 Senior Vice President, Head of Third Enterprise Sector Shigeki Jun 2016 Executive Vice President, Head of IT Services & Payments Services Sector • In charge of payment business, distribution and service industries Yamaguchi Jun 2017 Director and Executive Vice President, Responsible for Enterprise & Solutions Segment and China & APAC Segment Jun 2018 Representative Director and Senior Executive Vice President ■Area of expertise Digital commerce, payment, and consulting 2 © 2018 NTT DATA Corporation Organizational structure • IT Services & Payments Services Sector of Enterprise & Solutions Segment provides services for Japanese payment -

India Fintech Sector a Guide to the Galaxy

India FinTech Sector A Guide to the Galaxy G77 Asia Pacific/India, Equity Research, 22 February 2021 Research Analysts Ashish Gupta 91 22 6777 3895 [email protected] Viral Shah 91 22 6777 3827 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Contents Payments leading FinTech scale-up in India .................................. 8 8 FinTechs: No longer just payments ..............................................14 Account Aggregator to accelerate growth of digital lending ...............................................................................22 Digital platforms and partnerships driving 50-75%of bank business ...28 Company section ..........................................................................32 PayTM (US$16 bn) ......................................................................33 14 Google Pay ..................................................................................35 PhonePe (US$5.5 bn) ..................................................................37 WhatsApp Pay .............................................................................39 -

Making Payment to R Wadiwala – Faqs

Making payment to R Wadiwala – FAQs # Description Page No. 01 General 2 02 Cheque Deposit – Directly at HDFC Bank or at our Branch/Associates 3 03 NEFT / RTGS 4 04 Direct Debit Facility / ACH System 5 06 Payment Gateway 6 R Wadiwala Securities/Commodities Pvt Ltd. General 1. What are the different modes of making payment to R Wadiwala? You can make payment to us using any of the following modes: Cheque deposit 1. You can submit cheques to our branches/associates, or 2. You can deposit cheque directly in our bank. NEFT/RTGS You can transfer funds directly from your bank to R. Wadiwala’s bank account using online banking. Payment Gateway / Online You can make payment using our payment gateway platform by login into: Payment 1. Mobile App or Web based trading platform or 2. Our client back office on the web or mobile app. Bank Mandate / Direct debit Simply designate a bank account using ACH system and we automatically deduct your payment from the registered banks. 2. What care should be taken while making payment? Payment should always be made from your registered bank account. Registered bank account is the bank account given by the customer at the time of opening his/her trading account with us. If you want to make payment from any other bank account, you will have to get the new bank account registered with us. You can <Click Here> to get application form to add new bank account with R. Wadiwala. There is no limitation to number of accounts that can be registered with us provided that the name in the bank accounts is same as that of trading account. -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Document No: EPR: 01 Version: 1.0 November, 2016 Guidelines for Adoption of Electronic Payments and Receipts (EPR) Government of India Ministry of Electronic and Information Technology (MeitY) New Delhi –110003 Guidelines for Adoption of Electronic Payments and Receipts (EPR) Metadata of Document Framework for Electronic Payments and Receipts S. No. Data elements Values 1. Title Guidelines for Adoption of Electronic Payments and Receipts (EPR) 2. Title Alternative EPR 3. Document Identifier EPR:01 4. Document Version, month, year of Version 1, Nov 2016 release 5. Present Status Approved by Secretary Ministry of Communication & IT 6. Publisher Ministry of Electronics and Information Technology (MeitY), Government of India (GoI) 7. Date of Publishing Nov 2016 8. Type of Standard Document Guidelines ( Policy / Technical Specification/ Best Practice /Guidelines/ Framework/ Process) 9. Enforcement Category Recommended ( Mandatory/ Recommended) 10. Creator Ministry of Electronics and Information Technology (An entity primarily responsible for making (MeitY), Government of India (GoI) the resource) 11. Contributor Ministry of Electronics and Information Technology (An entity responsible for making (MeitY) and Controller General of Accounts (CGA) contributions to the resource) 12. Brief Description The Guidelines for Adoption of Electronic Payments and Receipts (EPR)of Government of India aims to harness the potential of electronic cashless payments platforms for various Payments or Receipts handled by Departments / Institutions. 13. Target Audience State Governments, Govt. of India Autonomous Bodies, (Who would be referring / using the Central Public Sector Undertakings and Municipalities document) 14. Owner of approved standard MeitY, New Delhi Version: 01 Page 2 of 39 Guidelines for Adoption of Electronic Payments and Receipts (EPR) S. -

Trade Marks Journal No: 1902 , 20/05/2019 Class 35 2291349 29

Trade Marks Journal No: 1902 , 20/05/2019 Class 35 2291349 29/02/2012 NITIN TEX ENGINEER INDIA PVT,LTD. trading as ;NITIN TEX ENGINEER INDIA PVT,LTD. REGD OFFICE AT NO-110, CO- OPERATIVE COLONY, UPPLIPALAYAM POST, COIMBATORE-641 015, COIMBATORE DIST, TAMILNADU, INDIA. SERVICE PROVIDER A COMPANY REGISTERED UNDER THE COMPANIES ACT, 1956 Address for service in India/Attorney address: K.SHANMUGASUNDARAM ADVACATE "SRI ANDAL IIIAM" NO, 37-1, ARUMUGAM NAGAR, RAMANATHAPURAM, COIMBATORE-641 045. Used Since :12/08/2011 CHENNAI Wholesale & Retail in respect of Textiles Machineries, Spares Electricals, Electronics Components, Chemicals, Cotton Yarn, Fabrics and Automobile Spares The mark should be used as a whole. 3103 Trade Marks Journal No: 1902 , 20/05/2019 Class 35 2308276 30/03/2012 MS.NAAZNEEN MANECK KATRAK trading as ;MUSTANG ENTERPRISES 219, MILAN INDUSTRIAL ESTATE, T.J. ROAD, COTTON GREEN, MUMBAI-400033 SERVICE PROVIDERS AN INDIAN NATIONAL Address for service in India/Agents address: USHA A. CHANDRASEKHAR. 3-E1, COURT CHAMBERS, NEW MARINE LINES ROAD, MUMBAI - 400 020. Used Since :26/03/2012 MUMBAI ADVERTISING , MARKETING, DISTRIBUTION, EXPORT, WHOLESALE AND RETAIL SERVICES RELATING TO HOSIERY, SOCKS, LEGGINGS, TIGHTS, LEGWARMERS, ARM WARMERS FOR INFANTS, CHILDREN AND LADIES, KNITTED CAPS AND MITTENS FOR INFANTS AND CHILDREN, UNDERGARMENTS I.E. BRIEFS/PANTIES/VESTS, CAMISOLES AND HANDKERCHIEFS 3104 Trade Marks Journal No: 1902 , 20/05/2019 Class 35 2390975 06/09/2012 TOYO ENGINEERING INDIA PRIVATE LTD. TOYO HOUSE, LAL BAHADUR SHASTRI MARG, -

Cmdrfdonation.Pdf

Reminiscences on implementation from the war-room – The donation platform for Chief Minister’s Distress Relief Fund i FOREWORD The Chief Ministers Distress Relief Fund (CMDRF) is a unique e-governance application developed by Centre for Development of Imaging Technology (C-DIT) as a part of the Chief Ministers Office (CMO) Suite. This is eventually envisaged as an integrated monitoring and decision support tool for innovative policy interventions. The donation portal was developed a sequel to the CMO suite in the context of the August’18 natural calamity and has contributed substantively to the efforts towards rebuilding Kerala. The effort was unique in that it could bring together several partner banks, partner technology companies, start-ups, and individuals many of whom worked pro-bono. The solution had withstood tough weather and has shown its metal. I am happy that the endeavour has been systematically documented so that the product could be evaluated and further improved. M Sivasankar IAS Director, C-DIT Centre for Development and Imaging Technology (C-DIT) V 7.0 Reminiscences on implementation from the war-room – The donation platform for Chief Minister’s Distress Relief Fund ii Centre for Development and Imaging Technology (C-DIT) V 7.0 Reminiscences on implementation from the war-room – The donation platform for Chief Minister’s Distress Relief Fund iii ACKNOWLEDGEMENT The Finance Department Government of Kerala had entrusted the responsibility of developing a donation portal for the Chief Minister’s Distress Relief Fund on 11 August 2018. The donation portal is the outcome of a systematic effort by C-DIT during the last two months. -

Tokyo 100Ventures 101 Digital 11:FS 1982 Ventures 22Seven 2C2P

Who’s joining money’s BIGGEST CONVERSATION? @Tokyo ACI Worldwide Alawneh Exchange Apiture Association of National Advertisers 100Ventures Acton Capital Partners Alerus Financial AppBrilliance Atlantic Capital Bank 101 Digital Actvide AG Align Technology AppDome Atom Technologies 11:FS Acuminor AlixPartners AppFolio Audi 1982 Ventures Acuris ALLCARD INC. Appian AusPayNet 22seven Adobe Allevo Apple Authomate 2C2P Cash and Card Payment ADP Alliance Data Systems AppsFlyer Autodesk Processor Adyen Global Payments Alliant Credit Union Aprio Avant Money 500 Startups Aerospike Allianz Apruve Avantcard 57Blocks AEVI Allica Bank Limited Arbor Ventures Avantio 5Point Credit Union AFEX Altamont Capital Partners ARIIX Avast 5X Capital Affinipay Alterna Savings Arion bank AvidXchange 7 Seas Consultants Limited Affinity Federal Credit Union Altimetrik Arroweye Solutions Avinode A Cloud Guru Affirm Alto Global Processing Aruba Bank Aviva Aadhar Housing Finance Limited African Bank Altra Federal Credit Union Arvest Bank AXA Abercrombie & Kent Agmon & Co Alvarium Investments Asante Financial Services Group Axway ABN AMRO Bank AgUnity Amadeus Ascension Ventures AZB & Partners About Fraud AIG Japan Holdings Amazon Ascential Azlo Abto Software Aimbridge Hospitality American Bankers Association Asian Development Bank Bahrain Economic Development ACAMS Air New Zealand American Express AsiaPay Board Accenture Airbnb Amsterdam University of Applied Asignio Bain & Company Accepted Payments aircrex Sciences Aspen Capital Fund Ballard Spahr LLP Acciones y Valores -

Technology and Mobile Payment Service Providers Landscape in India

Technology and Mobile Payment Service Providers Landscape in India Summary This section gives the overview of the non banking ecosystem in the Indian mobile payment space. It describes the evolution of the ecosystem, the key participants and the roles they play, which includes the technology developers, technology service providers, application developers, the mobile wallet companies, and the MNOs (Mobile network operators). The market dynamics is covered from the non banking perspective. Some key companies have been profiled in detail. The section also covers the merchants’ scenario in India with respect to mobile payments and explains their opinion about the market. The Indian mobile payment market has been compared with some other developed and developing countries across the world. Finally section includes mobile payment case studies. The survey methodology includes in-depth survey based discussion with the non banking stakeholders in the Indian market. The survey respondents include end to end mobile financial solution providers, mobile wallet developers, telecom operators, POS solution developers and mobile payment application developers. One-on-one discussions were conducted with senior level management in these companies to understand the development of the non banking ecosystem, and to obtain their viewpoint on several aspects of the mobile payment market. The Non Banking Ecosystem Chart 1 Indian mobile payment ecosystem Mobile Payment Stakeholders Consumer Facing •MNOs •Banks •Retailers •Ecommerce Companies Technology Providers •End to end solution providers •Application Developers •Wallet Technology Providers • POS Solution Developers • Payment Network Companies Source: Group IBI Analysis Technology and Service Providers in Indian Mobile Payment market The main categories of participants in the technology payment landscape in India is summarised in the figure below.