Queensland Rural Debt Survey 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Maranoa Mail

David Littleproud MP View this email in your browser A New Year I hope you had a wonderful Christmas with family and friends and you were able to relax with some New Year cheer! A new year means new beginnings and the parliamentary sittings are set to resume in a few weeks’ time. I’ll continue to work hard and be your voice in Federal Parliament and this Coalition Government has real plans to make our nation stronger and to better support you, your family, business and community. What it means to be Australian In the lead-up to Australia Day this week, I’ve found myself contemplating what it means to be Australian. Australian citizenship should be cherished and entering, or remaining, in Australia is a privilege. 1 We need to strengthen citizenship laws so they better align with Australian values. That’s why I strongly support a tougher citizenship test that would strengthen character requirements for any new potential Australian following concerns that Australia’s short-term visa pathways could be exploited by terrorists seeking access to our country. Immigration Minister Peter Dutton has also flagged other reforms for consideration, including dropping the age at which good character provisions apply for citizenship from 18 to 16 years. If young people are breaking the law, I don’t think they deserve to part of our society. At the end of the day, we have secure borders that are envied by most European countries because of this government’s strong stance on border protection. These reforms are really about making sure Australia remains safe and I strongly support any move by this government to make our citizenship rules more robust a priority when we head back to Canberra next month. -

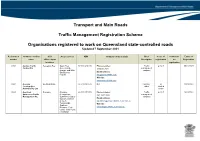

Traffic Management Scheme

Transport and Main Roads Traffic Management Registration Scheme Organisations registered to work on Queensland state-controlled roads Updated 7 September 2021 Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0202 Aaction Traffic Deception Bay South East 37 128 649 445 Phone number: Traffic O, S, D 30/11/2023 Control P/L Queensland, 1300 055 619 management Gympie and Wide company Bay Burnett Email address: regions [email protected] Website: www.aactiontraffic.com 0341 Acciona South Brisbane 66 618 030 872 N/A Industry - D 31/01/2023 Construction other Limited Australia Pty Ltd scope 0043 Acquired Brendale Brisbane 45 831 570 559 Phone number: Traffic O, S, D 15/12/2022 Awareness Traffic Metropolitan, (07) 3881 3008 management Management P/L Sunshine Coast to company Gympie, western Email address: areas to [email protected] Toowoomba, Website: Southern Brisbane, Gold www.acquiredawareness.com.au Coast, Gold Coast Hinterland Registration Company / trading QLD Areas services ABN Company contact details Brief Scope of Conditions Expiry of number name office / depot Description registration on Registration locations registration 0278 Action Control Labrador South East 92 098 736 899 Phone Number: Traffic O, S 31/10/2021 (Aust) P/L Queensland 0403 320 558 management Limited company scope Email address: [email protected] Website: www.actioncontrol.com.au 0271 -

Council Meeting Notice & Agenda 15

COUNCIL MEETING NOTICE & AGENDA 15 December 2020 49 Stockyard Street Cunnamulla Qld 4490 www.paroo.qld.gov.au Agenda General Meeting of Council Notice is hereby given that the Ordinary Meeting of Council is to be held on Tuesday, 15th December 2020 at the Cunnamulla Shire Hall, Jane Street Cunnamulla, commencing at 9.00am 1 OPENING OF MEETING 2 ACKNOWLEDGEMENT OF TRADITIONAL OWNERS 3 ATTENDANCES AND APOLOGIES 4 MOTION OF SYMPATHY • Mr Peter Doyle • Ms Grace Brown • Pat Cooney 5 CONFIRMATION OF MINUTES Recommendation: That Council adopt the minutes of the General Meeting of Council held Tuesday, 17th November 2020 as a true and correct record of that meeting. 6 DECLARATION OF INTEREST BEING 6.1 Material Personal Interest 6.2 Conflict Of Interest 7 MAYOR 1 7.1 Mayor’s Report 8 OFFICER REPORTS 8.1 DIRECTOR INFRASTRUCTURE 8.1.1 Operations Report 3 8.1.2 Rubbish Truck Replacement Report 12 8.2 DIRECTOR COMMUNITY SUPPORT AND ENGAGEMENT 8.2.1 Community Services Report 15 8.2.2 Library Services Report 20 8.2.3 Tourism Report 23 8.2.4 Local Laws Report 29 8.2.5 Rural Lands and Compliance Report 32 8.2.6 Community Support – Strides Blue Tree 34 10.30 First 5 Forever Video Competition Winners announced – Winners to attend to receive awards Morning Tea 8.3 CHIEF FINANCE OFFICER 8.3.1 Finance Report 36 8.4 CHIEF EXECUTIVE OFFICER 8.4.1 Action Item Register 52 8.4.2 Office of the Chief Executive Officer’s Report 57 8.4.3 Grants Report 63 8.4.4 Project Management Report 66 8.4.5 Policy Report 69 9 LATE REPORTS 10 CLOSED SESSION - CONFIDENTIAL 11 CORRESPONDENCE 11.1 Special Gazetted Public Holiday 132 11.2 2021 QOGM Paroo 141 11.3 MDA Change of Name Consultation 143 12 CLOSURE OF MEETING 155 Ms Cassie White Chief Executive Officer 09th December 2020 General Council Meeting Notice & Agenda 15 December 2020 7.1 Mayor’s Report Council Meeting: 15 December 2020 Department: Office of the Mayor Author: Suzette Beresford, Mayor Purpose The purpose of this report is to provide an update on the meetings and teleconferences that Mayor Beresford has attended. -

Central Queensland Tourism Opportunity Plan

Central Queensland Tourism Opportunity Plan 2009–2019 DISCLAIMER – STATE GOVERNMENT The Queensland Government makes no claim as to the accuracy of the information contained in the Central Queensland Tourism Opportunity Plan. The document is not a prospectus and the information provided is general in nature. The document should not be relied upon as the basis for financial and investment related decisions. This document does not suggest or imply that the Queensland State Government or any other government, agency, organisation or person should be responsible for funding any projects or initiatives identified in this document. DISCLAIMER – CENTRAL QUEENSLAND REGIONAL TOURISM DISCLAIMER – EC3 GLOBAL ORGANISATIONS Any representation, statement, opinion or advice, expressed or implied in The Central Queensland Regional Tourism Organisations make no claim this document is made in good faith but on the basis that EC3 Global is as to the accuracy of the information contained in the Central not liable (whether by reason of negligence, lack of care or otherwise) to Queensland Tourism Opportunity Plan. The document is not a any person for any damage or loss whatsoever which has occurred or prospectus and the information provided is general in nature. The may occur in relation to that person taking or not taking (as the case may document should not be relied upon as the basis for financial and be) action in respect of any representation, statement or advice referred investment related decisions to in this document. Emu Park, Executive Summary Capricorn Coast Purpose Central Queensland in 2019 The purpose of this Tourism Opportunity Plan (TOP) is to provide The Central Queensland Region encompasses the two tourism direction for the sustainable development of tourism in the regions of Capricorn and Gladstone and is made up of the four Central Queensland Region over the next ten years to 2019. -

Longreach Info

Nice to know!!! Some interesting information about Longreach and what you can do here. The Longreach Region, Capital of the Outback, incorporates the vibrant towns of Ilfracombe, Isisford, Yaraka and Longreach, each offering unique attractions: The traditional owners of the land are the Iningai people, accord- ing to records there are no known Iningai people in existence to- day. The Iningai people lived along the Thomson River from near Stonehenge to Muttaburra prior to European occupation. Innin- gai Park is a nature reserve that is part of the Longreach Town Common and includes sections of floodplain and waterholes along Gin Creek. Unfortunately, there are no recognized Iningai tradi- tional owners remaining. Several Indigenous families from the Barcaldine and Longreach areas are now the historical custodians of what is left of the Iningai culture; these people are the custodi- ans of the Iningai Keeping Place. Visit world class attractions in Longreach, Qantas Founders Mu- seum, Powerhouse Museum and the Australian Stockman’s Hall of Fame. Take a Cobb ‘n’ Co ride thru the scrub or a cruise on the Thomson River. Discover Ilfracombe, renowned throughout Australia for its pre- served history, the ‘Great Machinery Mile”, Langenbaker House, and the Historic Wellshot Hotel and Centre. Yaraka, offers an historical railway museum, with Mount Slowcombe a short distance away providing breathtaking views. Emmet has an interesting historical display and revamped railway Experience Isisford, home to “Isisfordia duncani” a pre-historic crocodile fossil housed in the Outer Barcoo Interpretive Centre, camp or fish along the Barcoo or stroll along St Mary’s Street and discover the many examples of pioneering heritage architecture. -

ANNUAL REPORT 2014-2015 Contents

Central Highlands Regional Council ANNUAL REPORT 2014-2015 Contents WELCOME TO OUR ANNUAL REPORT .........................4 PROTECTING OUR PEOPLE AND OUR ENVIRONMENT .............................................................................39 MISSION VISION & VALUES ...................................................5 Planning & Development ............................................40 OUR REGION ......................................................................................6 Ranger Services ....................................................................42 MESSAGE FROM MAYOR & CEO ......................................8 Disaster Management ....................................................43 OUR MAYOR & COUNCILLORS .......................................10 Environment ...........................................................................44 EXECUTIVE LEADERSHIP TEAM ......................................10 Environmental Health ....................................................45 STRONG VIBRANT COMMUNITIES ...............................13 PROACTIVE RESPONSIBLE LEADERSHIP ...................47 Community Plan 2022 ....................................................14 Corporate Communications ......................................48 Arts & Culture .......................................................................15 Technology ..............................................................................49 Events ...........................................................................................16 STRONG -

Central Highlands Economic Master Plan 2017-2022

Central Highlands Economic Master Plan An Economic Master Plan to 2047 and Action Plan for 2017-2022 Central Highlands Development Corporation Final September 2017 Contents 1 Executive Summary 1 2 Introduction 6 2.1 Context 6 2.2 Scope 8 3 Economic Baseline 10 3.1 Pillar One: Export Drivers 13 3.2 Pillar Two: Population Services 23 3.3 Pillar Three: Workforce 28 3.4 Pillar Four: Governance 31 3.5 Central Highlands Economic Snapshot 33 4 What is coming for the Central Highlands? 34 4.1 Understanding key global disruptors 34 4.2 What impact may disruptors have on the economy? 36 5 Developing an Economic Master Plan for the Central Highlands 39 5.1 Methodology 39 5.2 Summary of stakeholder engagement 39 5.3 Key objectives for the region’s economy 43 6 Central Highlands 2047 Economic Master Plan 46 6.1 30 Year Vision for Central Highlands Economy 46 6.2 Achieving Economic Aspirations 49 6.3 CHEMP 2017-2022 Action Plan 51 6.4 Infrastructure to unlock economic opportunities 69 7 Implementing the CHEMP 2017 – 2022 Action Plan 70 Inherent Limitations This report has been prepared as outlined in the Scope Section. The services provided in connection with this engagement comprise an advisory engagement, which is not subject to assurance or other standards issued by the Australian Auditing and Assurance Standards Board and, consequently no opinions or conclusions intended to convey assurance have been expressed. The findings in this report are based on a qualitative study and the reported results reflect a perception of Central Highlands Development Corporation (CHDC) but only to the extent of the sample surveyed, being CHDC’s approved representative sample of management, personnel, and stakeholders. -

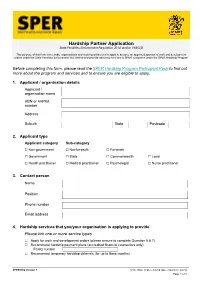

SPER Hardship Partner Application Form

Hardship Partner Application State Penalties Enforcement Regulation 2014 section 19AG(2) This purpose of this form is to enable organisations and health practitioners to apply to become an approved sponsor of work and development orders under the State Penalties Enforcement Act 1999 and/or provide advocacy services to SPER customers under the SPER Hardship Program Before completing this form, please read the SPER Hardship Program Participant Pack to find out more about the program and services and to ensure you are eligible to apply. 1. Applicant / organisation details Applicant / organisation name ABN or AHPRA number Address Suburb State Postcode 2. Applicant type Applicant category Sub-category ☐ Non-government ☐ Not-for-profit ☐ For-profit ☐ Government ☐ State ☐ Commonwealth ☐ Local ☐ Health practitioner ☐ Medical practitioner ☐ Psychologist ☐ Nurse practitioner 3. Contact person Name Position Phone number Email address 4. Hardship services that you/your organisation is applying to provide Please tick one or more service types ☐ Apply for work and development orders (please ensure to complete Question 6 & 7) ☐ Recommend hardship payment plans (accredited financial counsellors only) FCAQ number ☐ Recommend temporary hardship deferrals (for up to three months) SPER6002 Version 1 ©The State of Queensland (Queensland Treasury) Page 1 of 8 5. Locations where you/your organisation will provide these services ☐ All of Queensland or Select Local Government Area(s) below: ☐ Aurukun Shire ☐ Fraser Coast Region ☐ North Burnett Region ☐ Balonne -

Epidemiology and Genetic Diversity of Tobacco Streak Virus and Related Subgroup 1 Ilarviruses

Epidemiology and genetic diversity of Tobacco streak virus and related subgroup 1 ilarviruses Murray Sharman Bachelor of Applied Science (Biology) A thesis submitted for the degree of Doctor of Philosophy at The University of Queensland in 2015. Queensland Alliance for Agriculture and Food Innovation 1 2 Abstract A quarter of Australia’s sunflower production is from the central highlands region of Queensland and is currently worth six million dollars ($AUD) annually. From the early 2000s a severe necrosis disorder of unknown aetiology was affecting large areas of sunflower crops in central Queensland, leading to annual losses of up to 20%. Other crops such as mung bean and cotton were also affected. This PhD study was undertaken to determine if the causal agent of the necrosis disorder was of viral origin and, if so, to characterise its genetic diversity, biology and disease cycle, and to develop effective control strategies. The research described in this thesis identified Tobacco streak virus (TSV; genus Ilarvirus, family Bromoviridae) as the causal agent of the previously unidentified necrosis disorder of sunflower in central Queensland. TSV was also the cause of commonly found diseases in a range of other crops in the same region including cotton, chickpea and mung bean. This was the first report from Australia of natural field infections of TSV from these four crops. TSV strains have previously been reported from other regions of Australia in several hosts based on serological and host range studies. In order to determine the relatedness of previously reported TSV strains with TSV from central Queensland, we characterised the genetic diversity of the known TSV strains from Australia. -

Outback Regional Tourism Workforce Plan 2018-2020

June 2018 Outback Regional Tourism Workforce Plan 2018–2020 Front cover photo: Tree of Knowledge, Barcaldine. Photographer: Paul Ewart. Photo courtesy of Tourism & Events Queensland. Copyright This publication is protected by the Copyright Act 1968. Licence This work is licensed by Jobs Queensland under a Creative Commons Attribution (CC BY) 3.o Australia licence. To view a copy of this licence, visit: http://www.creativecommons.org/licenses/by/3.0/au/ You are free to copy, communicate and adapt this publication, as long as you attribute it as follows: © State of Queensland, Jobs Queensland, June 2018. The Queensland Government is committed to providing accessible services to Queenslanders of all cultural and linguistic backgrounds. If you have difficulty understanding this publication and need a translator, please call the Translating and Interpreting Services (TIS National) on telephone 131 450 and ask them to contact Jobs Queensland on (07) 3436 6190. Disclaimer While every care has been taken in preparing this publication, the State of Queensland accepts no responsibility for decisions or actions taken as a results of any data, information, statement or advice, expressed or implied, contained within. To the best of our knowledge, the content was correct at the time of publishing. Introduction Tourism is a $25.4 billion industry in Queensland, providing direct and indirect employment for approximately 217,000 people or 9.1 per cent of the State’s workforce.1 Tourism encompasses multiple sectors because visitors consume goods and services sourced across the economy.2 The industry includes: transport (air, rail, road and water); accommodation; attractions; events; food services (takeaway, cafés and restaurants); clubs and casinos; retail; arts and recreation; travel agencies and tour operators; education and training; and tourism (marketing, information and planning). -

Square Eastern Pty Ltd

SQUARE EASTERN PTY LTD EXPLORATION PERMIT FOR COAL (EPC) 2055 MIMOSA ANNUAL REPORT FOR THE PERIOD 12 JUNE 2015 – 11 JUNE 2016 TENEMENT HOLDER(S): Square Eastern Pty Ltd Mitsui Matsushima International Pty Limited PREPARED BY: Peter Jorgensen & Andrea Pepper Square Eastern Pty Ltd 30/06/2016 SUBMITTED BY: Square Resource Holdings Pty Ltd 30/06/2016 EPC2055 Annual Report June 2016 CONTENTS COPYRIGHT STATEMENT ................................................................................................. 4 1.0 SUMMARY ................................................................................................................. 5 2.0 INTRODUCTION ....................................................................................................... 6 2.1 Tenure .................................................................................................................... 6 2.2 Location and Access ............................................................................................... 8 2.3 Previous Exploration ............................................................................................... 8 2.3.1 Geological Mapping ........................................................................................... 8 2.3.2 Drilling – Stratigraphy and Palynology ............................................................. 10 2.3.3 Drilling – Oil and Coal Seam Gas .................................................................... 10 2.3.4 Drilling – Oil shale .......................................................................................... -

Annual Report 2013/2014

Central Highlands Regional Council Annual Report 2013/2014 www.centralhighlands.qld.gov.au Table of Contents About our Region 5 Mayor and CEO Message 7 Our Mayor And Councillors 8 Our Executive Leadership Team 8 Our Employees 11 Community Financial Report 13 Other Statutory Disclosures 20 Other Contents 25 Financial Report 34 Central Highlands Regional Council Annual Report 2013 / 2014 | 3 The Central Highlands is located in Central Queensland, Australia, extending over 60,000 square kilometres and is home to over 30,000 people. 4 | Central Highlands Regional Council Annual Report 2013 / 2014 Tieri Capella Sapphire Gemfields EMERALD Blackwater Duaringa Comet Bluff Dingo Springsure Rolleston About Bauhinia LONGREACH our ROCKHAMPTON Region BRISBANE The Central Highlands is located in Central Queensland, We are a vibrant region with a diverse economy based on: Australia, extending over 60,000 square kilometres. It · A globally competitive coal mining industry is home to over 30,000 people, located in the unique communities of Arcadia Valley, Bauhinia, Blackwater, · Traditionally robust and resilient agriculture and Bluff, Capella, Comet, Dingo, Duaringa, Emerald, horticultural industries, including beef, grain, cotton, Rolleston, Sapphire Gemfields, Springsure and Tieri. grapes, melons and citrus The Central Highlands is rich in minerals and agriculture, · Dynamic small to medium size businesses with irrigation from water storage on the Nogoa and · Professional and government sectors Comet rivers, and boasts the largest sapphire-producing · Availability of commercial, industrial and residential land fields in the Southern Hemisphere. Major freight routes · A growing tourism market are contained in the Central Highlands region, including the north-south link between Charters Towers and · Major health and education services northern New South Wales, which has been identified as · Major infrastructure and construction projects an inland alternative between Cairns and Melbourne.