Pdfroster of Attendees

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3 OECD/GFLEC Global Policy Research Symposium to Advance

PROGRAMME 3rd OECD/GFLEC Global Policy Research Symposium to Advance Financial Literacy HARNESSING FINANCIAL EDUCATION TO SPUR ENTREPRENEURSHIP AND INNOVATION 7 May 2015 OECD Conference Centre Paris, France Connect now to answer the current question. We will ask more questions and take polls during session 3 of the symposium: https://app.wisembly.com/fe2015 To live tweet the Symposium, use the hashtag #OECDfe Connect to the Internet with Wi-Fi hotspots. Network name: HotspotOECD (no access code) PROGRAMME 08:00 – 09:30 Registration 09:30 – 09:40 Opening remarks by Mr. Rintaro Tamaki, OECD Deputy Secretary-General 09:40 – 09:50 Video Message by H.M. Queen Máxima of the Netherlands, UN Secretary General’s Special Advocate for Inclusive Finance for Development and Honorary Patron of the G20 Global Partnership on Financial Inclusion 09:50 – 11:30 Session 1: Financial literacy and entrepreneurship: What does the evidence show? Moderator: Mr. Adrian Blundell-Wignall, Director, Directorate for Financial and Enterprise Affairs (DAF), OECD Speakers: Prof. Annamaria Lusardi, Academic Director, GFLEC, Chair of OECD/International Network on Financial Education (INFE) Research Committee Ms. Miriam Koreen, Deputy Director and Head of SME and Entrepreneurship Division, OECD Mr. Gert Wehinger, Senior Expert, DAF, OECD Ms. Adele Atkinson, Policy Analyst, DAF, OECD Commentators: Mr. E.J. Reedy, Director, Research and Policy, Kauffman Foundation Prof. Carmela Aprea, Chair of Business and Economic Education, Friedrich-Schiller-University, Jena, Germany 11:30 – 12:00 BREAK 12:00 – 13:00 Session 2: Financial literacy and MSMEs: What do entrepreneurs and business owners need? Moderator: Ms. Merril Stevenson, European Business Editor, The Economist Ms. -

Georges Hübner, Phd Accounting, Law, Finance and Economics Department Affiliated Professor - Speciality: Finance

Georges Hübner, PhD Accounting, Law, Finance and Economics Department Affiliated Professor - Speciality: Finance Phone : (+32) 42324728 / (+31) 433883817 E-mail : [email protected] / [email protected] Georges Hübner (Ph.D., INSEAD) holds the Deloitte Chair of Portfolio Management and Performance at HEC Management School – University of Liège (HEC-ULg), where he is member of the Board of Directors and chairman of the Master in Management Sciences program. He is also Associate Professor of Finance at Maastricht University, an Affiliate Professor at EDHEC (Lille/Nice) and an Invited Professor at the Solvay Brussels School of Economics and Management. He has taught at the executive and postgraduate levels in several countries in Europe, North America, Africa and Asia. Georges Hübner regularly provides executive training seminars for the preparation of the GARP (Global Association of Risk Professionals) certification. Georges has published numerous research articles about credit risk, hedge funds and derivatives in leading scientific journals including Journal of Business Venturing, Review of Finance, Journal of Banking and Finance, Journal of Empirical Finance, Financial Management and Journal of Portfolio Management. He has written and co-edited several books on hedge funds, operational risk and corporate finance. He is the elected Chairman of the French Finance Association (AFFI) in 2016. Georges Hübner was the recipient of the best paper awards of the Journal of Banking and Finance in 2001 and of “Finance” in 2011, and the co-recipient of the Operational Risk & Compliance Achievement Award 2006, hosted by Operational Risk Magazine, in the best academic paper category. He is also the inventor of the Generalized Treynor Ratio, a simple performance measure for managed portfolios that competes with the traditional performance measures used to assess active portfolio managers. -

1 Conversation Between Carlos Da Silva Costa, Governor, Banco De

Conversation between Carlos da Silva Costa, Governor, Banco de Portugal, and David Marsh, Chairman, OMFIF, 8 July 2020 David Marsh: Thank you for agreeing to this conversation, Mr Governor. You are within a few weeks of stepping down from your post as governor of the central bank and a member of the Governing Council of the European Central Bank. You have seen a lot in this time. How would you say that this crisis is different from the one in Europe in 2010-15? What lessons have we learned? Carlos da Silva Costa: The two crises are totally different. The one in 2008-09 originated in the financial sector. It came from the US and spread around Europe, at a different speed for different countries. It first hit the northern countries, with a savings surplus, because they invested a lot in American paper and junk bonds. The first banks hit were from the UK, Belgium, the Netherlands, France and Germany. Only after we had the second wave did it hit the southern banks, because they were unable to access the capital markets. The third wave was the sovereign crisis affecting countries with high debts and deficits. DM: And now we have a crisis that impacts all countries at the same time… CC: An external shock, not an economic or financial shock, impacting first the sanitary conditions, then the supply side through policies to contain contagion, then cash flows and income, and then demand. In parallel, we have seen an impact on the financial sector because as people were unable to reimburse capital or to pay interest, which led to wise decisions to accept moratoria on interest payments and reimbursements. -

10Th Anniversary of the ECB a Nni V E Rsar Th 10

EN EUROPEAN CENTRAL BANK MONTHLY BULLETIN 10TH ANNIVERSARY OF THE ECB 1998 - 2008 10 TH MONTHLY BULLETIN MONTHLY A NNI V E RSAR Y OF THE ECB OF MONTHLY BULLETIN 10TH ANNIVERSARY OF THE ECB In 2008 all ECB publications feature a motif taken from the €10 banknote. © European Central Bank 2008 Address Kaiserstrasse 29 60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Website http://www.ecb.europa.eu Fax +49 69 1344 6000 This Bulletin was produced under the responsibility of the Executive Board of the ECB. Translations are prepared and published by the national central banks. All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. Photographs: ESKQ EUMETSAT Claudio Hils Martin Joppen The cut-off date for the statistics included in this issue was 9 April 2008. ISSN 1561-0136 (print) ISSN 1725-2822 (online) CONTENTS Boxes: FOREWORD 5 1 Modelling the euro area economy 36 HISTORICAL CONTEXT 8 2 Key communication tools and channels used by the ECB 50 INTRODUCTION 11 3 The Eurosystem’s collateral framework 54 4 The transmission mechanism of monetary INSTITUTIONAL SETTING AND WORKINGS policy 59 OF THE EURO AREA 21 5 Understanding infl ation persistence and THE ECB’S MONETARY POLICY STRATEGY determinants of wage dynamics 80 AND ITS IMPLEMENTATION 33 6 Preliminary fi ndings of the ECB’s work on fi nancial development 104 ECONOMIC POLICY CHALLENGES AND 7 Role of the Harmonised Index of ENLARGEMENT 65 Consumer -

Monetary and Financial Thinking in Europe Evidence from Four Decades of Suerf

MONETARY AND FINANCIAL THINKING IN EUROPE EVIDENCE FROM FOUR DECADES OF SUERF By Jean-Paul Abraham Introduction by David T. Llewellyn SUERF – The European Money and Finance Forum Vienna 2003 CIP Monetaryand Financial Thinking in Europe – Evidence from Four Decades of SUERF by Jean-Paul Abraham Vienna: SUERF (SUERF Studies: 2003/3) ISBN 3-902109-17-3 Keywords: Economic History, Monetary Policy, Financial Stability, Central Banking, International Monetary System, International Monetary Arrangements, European Monetary Integration, Financial Institutions and Services. JEL Classification Numbers: E42, E44, E52, E58, F33, F34, F36, G10, G20, G21, N14, N24 © 2003 SUERF, Vienna Copyright reserved. Subject to the exception provided for by law, no part of this publication may be reproduced and/or published in print, by photocopying, on microfilm or in any other way without the written consent of the copyright holder(s); the same applies to whole or partial adaptations. The publisher retains the sole right to collect from third parties fees payable in respect of copying and/or take legal or other action for this purpose. TABLE OF CONTENTS Introduction (D.T. Llewellyn) 5 A Short Reader’s Manual 90 Part 1: A Survey of SUERF Colloquia Publications 1969-2003 (J-P. Abraham) 11 Section 1: An Overall Presentation 13 Section 2: Major Events, Dominant Themes and Outstanding Contributions in Five Distinct Periods 19 Period I: 1969- early 1974: The Demise of the Bretton Woods International Monetary System 19 Period II: Late 1974- early 1979: the Aftermath of Oil Shocks and Bank Failures 21 Period III: The Eighties: Disinflation, Exchange Rate Stabilisation, ‘Marketisation’ of Banking and Finance 24 Period IV: The Nineties: The Dominance of (unstable) Markets. -

Pdfroster of Attendees

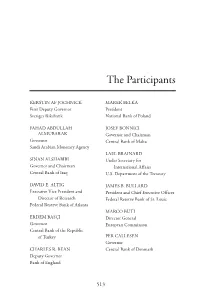

The Participants KERSTIN AF JOCHNICK MAREK BELKA First Deputy Governor President Sveriges Riksbank National Bank of Poland FAHAD ABDULLAH JOSEF BONNICI ALMUBARAK Governor and Chairman Governor Central Bank of Malta Saudi Arabian Monetary Agency LAEL BRAINARD SINAN ALSHABIBI Under Secretary for Governor and Chairman International Affairs Central Bank of Iraq U.S. Department of the Treasury DAVID E. ALTIG JAMES B. BULLARD Executive Vice President and President and Chief Executive Officer Director of Research Federal Reserve Bank of St. Louis Federal Reserve Bank of Atlanta MARCO BUTI ERDEM BASÇI Director General Governor European Commission Central Bank of the Republic of Turkey PER CALLESEN Governor CHARLES R. BEAN Central Bank of Denmark Deputy Governor Bank of England 513 514 The Participants AGUSTÍN CARSTENS DOUGLAS W. ELMENDORF Governor Director Bank of Mexico Congressional Budget Office NORMAN CHAN WILLIAM B. ENGLISH Chief Executive Director of Monetary Affairs Hong Kong Monetary Authority Board of Governors of the Federal Reserve System LUC COENE Governor CHARLES L. EVANS National Bank of Belgium President and Chief Executive Officer Federal Reserve Bank of Chicago JULIA LYNN CORONADO Chief Economist for North America MARTIN FELDSTEIN BNP Paribas President Emeritus, National Bureau of Economic Research CARLOS DA SILVA COSTA Professor, Harvard University Governor Bank of Portugal JACOB A. FRENKEL Chairman CHARLES H. DALLARA JP Morgan Chase International Managing Director Institute of International Finance ARDIAN FULLANI Governor TROY DAVIG Bank of Albania Senior Vice President and Director of Research JOHN GEANAKOPLOS Federal Reserve Bank of Kansas City Professor Yale University PAUL DEBRUCE CEO and Founder, ESTHER L. GEORGE DeBruce Grain Inc. -

Banks and Cross‐Border Collaboration

SUERF, CEPS and Belgian Financial Forum Conference Crisis Management at Cross-Roads 16 November, 2009 Auditorium, National Bank of Belgium Rue Montagne aux Herbes Potagères, 61 B-1000 Brussels Conference documents p. 2 Conference programme p. 4 Johan Evenepoel : Provision of liquidity and Lender of Last Resort operations p. 25 Ingimundur Fridriksson : The collapse of Icelandic banks and cross‐border collaboration p. 49 Charles Goodhart : Limits of the Lender of Last Resort p. 53 Philipp Hartmann : The Lender of Last Resort, its limits and 2X2 fail issues p. 63 Dirk Schoenmaker : Too big to save: small banks? p. 78 Dirk Cupei : Deposit guarantee schemes: how to re-establish clients´confidence p. 92 Hans Groeneveld : Deposit guarantee schemes: how to re-establish clients´confidence p. 102 María J. Nieto : Deposit insurance : the neglected dimension of the EU safety net p. 114 Robert Priester : Deposit guarantee schemes: how to re-establish clients´confidence p. 118 Guy Quaden : Closing speech p. 127 Jaime Caruana : Unconventional monetary policies in time of crisis The presentations should not be quoted without consent of the author. SUERF, CEPS and Belgian Financial Forum Conference Crisis Management at Cross-Roads 16 November, 2009 Auditorium, National Bank of Belgium Rue Montagne aux Herbes Potagères, 61 B-1000 Brussels Programme Brussels, 16 November, 2009 – Auditorium, National Bank of Belgium 8.30-9.00 Registration and coffee 9.00-9.15 Opening Jan Smets , Belgian Financial Forum & National Bank of Belgium Onno Ruding , CEPS Catherine -

Offshoring a Top Priority for European Ceos

Board EuropeA newsletter for members of The Conference Board in Europe Volume 20 • Number 1/2 • January/February 2005 OffshoringOffshoring aa TopTop PriorityPriority forfor EuropeanEuropean CEOsCEOs In this issue ore European chief executives regard relocating operations abroad as a top priority than their counterparts in either the US or Asia, according to a new 1 CEO Challenge 2004 M Conference Board study of CEO opinions, “CEO Challenge 2004”. In a sign that European companies are beginning to recognise the inevitability of the EU KLEMS project outsourcing and offshoring trend and the consequences of an ageing workforce, 31% 2 of chief executives of European companies see relocating to cross-border labour 3 Economic Briefing: markets as one of their key business issues. This compares with 24% of CEOs in the Strategic Choices US and 21% of Asian CEOs who share a similar priority. for Global Business Sir Martin Sorrell, CEO of WPP and Trustee of The Conference Board said: “As a The Future of the AGM great many European companies have found to their cost, the slightest reluctance 4 to respond to demographic and economic change can prove painfully expensive. 5 Conference: This Conference Board research confirms that, for many European businesses, Enterprise Risk Management offshoring has become not just desirable but crucial.” 6 Council News “CEO Challenge 2004”, sponsored by Heidrick and Struggles International, Inc. and • Three new Council directors PeopleSoft, is based on the responses of over 500 global business leaders from • Strategic Manufacturing 40 countries. Initial results, “CEO’s Top Ten Challenges” were published last summer. • Global Supply Chain • Health & Safety Top three priorities for CEOs worldwide, identified in the study, are: ● Adapting to change 8 Business Information Service ● Maintaining top-line growth ● Retaining customer loyalty. -

Collective Wisdom of Executives Worldwide

annual report 2005 Collective Wisdom of Executives Worldwide annual essay Douglass North on Leadership in an Uncertain World “A bend in the road is not the end of the road, unless you fail to make the turn. For business leaders, the key is to identify the bend in the road very early, to prepare changes in strategy. The Conference Board provides a world-class forum for business leaders to discuss new trends and burning issues. It helps evolve practices and standards that enable the smooth functioning of mar- kets. Most importantly, The Conference Board’s work enables us to share and understand best practices across industries, countries and corporations.” Nandan Nilekani CEO, President and Managing Director of Infosys Vice Chairman of The Conference Board 2 the conference board 2005 annual report Leaders Working Together to Strengthen Performance and Values To grow and thrive in an ever-changing business climate, leaders need great ideas they can use today. We believe that ideas that work come from building the right relationships with the right people. Leaders need a place where they can hone their ideas with trusted peers who offer experienced, practical advice — and expect the same in return. Where a diverse mix of perspectives draws out the most useful problem-solving insights from the most unexpected places. Where they participate in a global conversation with one ground rule: Challenge all assumptions in favor of what actually works. The Conference Board brings respected economic and management experts together with experienced leaders in business, government and academia to create an unrivaled global community of leaders who bring their collective wisdom to bear on today’s most pressing business, economic and social concerns. -

BIS 81St Annual Report Iii IV

BANK FOR INTERNATIONAL SETTLEMENTS 81st Annual Report 1 April 2010–31 March 2011 Basel, 26 June 2011 Copies of publications are available from: Bank for International Settlements Communications CH-4002 Basel, Switzerland E-mail: [email protected] Fax: +41 61 280 9100 and +41 61 280 8100 © Bank for International Settlements 2011. All rights reserved. Limited extracts may be reproduced or translated provided the source is stated. ISSN 1021-2477 (print) ISSN 1682-7708 (online) ISBN 92-9131-174-X (print) ISBN 92-9197-174-X (online) Also published in French, German, Italian and Spanish. Available on the BIS website (www.bis.org). Contents Letter of transmittal ............................................. ix Overview of the economic chapters ........................... xi I. Building a stable future ....................................... 1 The year in retrospect ................................................. 2 Recovery in advanced economies . 2 Inflation pressures prompt revisions to monetary policy expectations .... 4 Lingering fiscal policy concerns in the euro area ...................... 7 Fiscal policy elsewhere ............................................ 8 Banks’ balance sheets improve but remain vulnerable ................. 8 The year in prospect .................................................. 10 Fiscal challenges ................................................. 10 Private sector balance sheet challenges ............................. 11 International imbalances .......................................... 12 Monetary policy -

Carlos Da Silva Costa: the Portuguese Economy – Structural Saving Gap and Policy Options

Carlos da Silva Costa: The Portuguese economy – structural saving gap and policy options Address by Mr Carlos da Silva Costa, Governor of the Bank of Portugal, at the inauguration of the academic year of the University of Porto School of Economics and Business, Porto, 31 October 2012. * * * I. Introduction Good afternoon ladies and gentlemen. I would like to begin by thanking you for the great honour of addressing you at this inauguration of the academic year of the University of Porto School of Economics and Business, which this year happens to coincide with World Savings Day. There could not be a better occasion for an address on the structural saving gap of the Portuguese economy and the policy options which best ensure the success of the on-going adjustment. II. Structural saving gap and policy options for the Portuguese economy 1. Public and private structural saving gap Saving insufficiency is a structural trait of the Portuguese economy. This is shown clearly in the external accounts: over the last 60 years, the current and capital accounts, which measure the economy’s financing capacity, posted a surplus only twice in 16 occasions; meanwhile over the same period, the balance of goods and services was always negative. The chronic external imbalance led to the two adjustment programmes negotiated with the International Monetary Fund in 1978 and 1983. Over the last 15 years, cheaper and more accessible financing afforded by monetary union led to a strong expansion in credit, and to a lesser extent, the contraction of private saving. The increase in indebtedness and decrease in saving were mainly used to finance consumption and low-return investments, and therefore did not result in the expansion of the economy’s growth potential. -

List of Symposium Participants

LIST OF SYMPOSIUM PARTICIPANTS List of Symposium Participants Zeti Akhtar Aziz Bank Negara Malaysia Halim Alamsyah Bank Indonesia Muhammad Al-Jasser Saudi Arabian Monetary Agency Saeed Al-Qahtani Saudi Arabian Monetary Agency Elisabeth Ardaillon-Poirier European Central Bank Loi Bakani Bank of Papua New Guinea Ric Battellino Reserve Bank of Australia Michael Blythe Commonwealth Bank of Australia Alan Bollard Reserve Bank of New Zealand Adam Cagliarini Reserve Bank of Australia Frank Campbell Reserve Bank of Australia Jaime Caruana Bank for International Settlements Stephen Cecchetti Bank for International Settlements KC Chakrabarty Reserve Bank of India Norman TL Chan Hong Kong Monetary Authority Terrence Checki Federal Reserve Bank of New York Lillian Cheung Hong Kong Monetary Authority Jule Chong Hong Kong Monetary Authority Deborah Cobb-Clark Australian National University Tim Colebatch The Age Max Corden University of Melbourne Selwyn Cornish Australian National University Andrew Crockett JPMorgan Chase International Kevin Davis University of Melbourne Guy Debelle Reserve Bank of Australia Ettore Dorrucci European Central Bank William Dudley Federal Reserve Bank of New York Teresa Dueñas Bangko Sentral ng Pilipinas Mardi Dungey University of Tasmania Malcolm Edey Reserve Bank of Australia Mohamed El-Erian Pacific Investment Management Company LLC Luci Ellis Reserve Bank of Australia Saul Eslake Grattan Institute Bill Evans Westpac Banking Corporation 124 RESERVE BANK OF AUSTRALIA LIST OF SYMPOSIUM PARTICIPANTS Ted Evans Westpac Banking