The Banking Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Department of Financial Institutions

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF JUNE 2007 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 5 MERGER 5 ACQUISITION OF CONTROL 6 PURCHASE PARTIAL BUSINESS UNIT 6 PURCHASE OF WHOLE BUSINESS UNIT 6 SALE OF PARTIAL BUSINESS UNIT 7 FINAL ORDER (FINANCIAL CODE SECTION 1913) 7 NEW BRANCH 7 NEW PLACE OF BUSINESS 15 NEW EXTENSION OFFICE 19 HEAD OFFICE RELOCATION 19 BRANCH OFFICE RELOCATION 20 PLACE OF BUSINESS RELOCATION 22 EXTENSION OFFICE RELOCATION 23 DISCONTINUANCE OF BRANCH OFFICE 23 DISCONTINUANCE OF PLACE OF BUSINESS 23 APPLICATION PURSUANT TO SECTION 772 25 APPLICATION PURSUANT TO SECTION 3580 25 CHANGE OF NAME 25 ERRATA 25 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 26 FINAL ORDER (FINANCIAL CODE SECTION 1913) 26 NEW BRANCH 26 NEW PLACE OF BUSINESS 26 DISCONTINUANCE OF BRANCH OFFICE 26 DISCONTINUANCE OF PLACE OF BUSINESS 27 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 27 ACQUISITION OF CONTROL 28 HEAD OFFICE RELOCATION 29 TRUST COMPANY APPLICATION NEW TRUST COMPANY 29 DISCONTINUANCE OF PLACE OF BUSINESS 29 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 29 RELOCATION 30 DISCONTINUANCE OF OFFICE 30 ii SUMMARY OF PENDING APPLICATIONS AS OF JUNE 2007 APPLICATION TYPE PAGE NO. FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 30 RELOCATION 31 DISCONTINUANCE OF FACILITY 31 CREDIT UNION APPLICATION NEW CREDIT UNION 31 CONVERSION TO STATE CHARTER 32 MERGER 32 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 33 CHANGE OF NAME 33 ERRATA 33 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 34 ACQUISITION OF CONTROL 34 VOLUNTARY SURRENDER OF LICENSE 34 1 BANK APPLICATION NEW BANK Filed: 5 Approved: 12 ACCESS BUSINESS BANK 7700 Irvine Center Drive, Irvine, Orange County Correspondent: Tom S. -

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

US Accounts in 24 Hours

U.S. Accounts In 24 Hours - eBook Thank you for purchasing our featured "U.S. Accounts In 24 Hours" eBook / Online Information Packet offered at our web site, U.S. Account Setup.com Within our featured online information packet, you will find all of the resources, tools, information, and contacts you'll need to quickly & easily open a NON-U.S. Resident Bank Account within 24 hours. You'll find lists of U.S. Banks, Account Application Forms, Information on how to obtain a U.S. Mailing Address, plus so much more. Just point and click your way through our Online Information Packet using the links above. If you should have any questions or experience any difficulties in opening your Non-U.S. Resident Account, please feel free to email us at any time, and one of our representatives will get back with you promptly. For Support, Email: [email protected] Homepage: www.usaccountsetup.com Application Forms UPDATE - E-TRADE'S NEW ACCOUNT OPENING POLICIES Etrade is changed the rules in which they open International Banking/ Brokerage accounts for foreigners. They now require all new applications be submitted to the local branch office in your region. Once account is opened, you will be able to use it as a U.S. Bank/Brokerage Account out of your home country. Below, you will find a list of International Etrade Phone Numbers & Addresses. Contact the etrade office that best reflects where you reside or would like your account based out of and where you would like to receive your debit card. U.S. -

2008 Handbook on Client Trust Accounting for California Attorneys

Handbook on Client Trust Accounting for California Attorneys Publication of The State Bar of California 2009* This Handbook on Client Trust Accounting for California Attorneys is issued by the State Bar's Office of Professional Competence, Planning and Development. It has not been adopted or endorsed by the State Bar's Board of Governors, and does not constitute the official position or policy of the State Bar of California. It is advisory only and is not binding upon the California Supreme Court, the State Bar Court, or any office or person charged with responsibility for attorney discipline or regulation. The Handbook contains legal information, not legal advice. Nothing contained in this Handbook is intended to address any specific legal inquiry, nor is it a substitute for independent legal research to original sources or for obtaining the advice of legal counsel with respect to legal problems. The workbook may not be reproduced or copied in any manner without the express, written permission of the State Bar of California. For information or a copy of this workbook, contact the Office of Professional Competence, Planning and Development, State Bar of California, 180 Howard Street, San Francisco, California 94105 (415) 538-2112. © Copyright 1992, 2003, 2006, 2008, 2009 by The State Bar of California All rights reserved. Acknowledgments he State Bar of California gratefully acknowledges that the idea for this Handbook arose out of the exhaustive book on client trust T accounting prepared by David Johnson, Jr., the Director of Attorney Ethics of the Supreme Court of New Jersey. Although the client trust accounting rules in New Jersey differ from those in California, the same basic principles of accounting apply. -

A Comparison of Korean and Chinese American Banks in California*

한국지역지리학회지 제12 권 제 1 호 (2006) 154-171 The Financial Development of Korean Americans: A Comparison of Korean and Chinese American Banks in California* Hyeon-Hyo Ahn**, Yun-Sun Chung*** 미국에서의 한인 금융: 캘리포니아에서 한국계와 중국계 은행의 비교* 안현효**․ 정연선 *** 요약:본 논문은 캘리포니아의 중국계와 한국계의 양 소수민족은행을 비교하여 한국계 민족은행과 한국계 이민사회의 경제적 관계를 해명하고자 한다. 통상 미국 내 소수민족경제권의 경제적 성과 차이는 문화적 차이 또는 비공식금융의 기여로 설명되는 경우가 많으나 우리는 공식금융제도의 적극적 역할에 주목하여 금융제도와 소수민족경제의 관련성을 강조한다.,, 동시에 한국계 미국은행은 성장 수익성 은행전략 면에서 중국계 소수민족은행과 구분된다는 점을 중시하여, 은행전략 측면에서, 중국계와 한국계가 고객과의 장기적 거래를 중시하는 유사한 관계은행전략을 구사하지만, 은행의 대출분포와 예금분포는 서로 다르다는 점을 지적하였다. 이는 각 소수민족은행이 다른 경영성과를 낳는 이유가 된다. 한국계은행의 경우 대출구조가 사업대출 중심이며, 이자 낳지 않는 예금의 비중이 중국계 민족은행보다 상대적으로 높 은 사실이 한국계 소수민족은행이 높은 성장을 하게 된 배경이다. 따라서 관계은행전략이라는 개념만으로는 다수의 소 수민족은행의 차이를 설명할 수 없으므로, 본 연구는 한국계와 중국계의 이민사회 그 자체의 특수성에 주목하였다. 중 국계 미국인의 경우 인구구성의 이질성과 해외자본의 영향이, 한국계 미국인의 경우 동질적 인구 및 사업구성과 착 한 국계 미국인 금융기관의 경쟁력이 특징적이다. 주요어:소수민족은행, 한국계 미국은행 , 중국계 미국은행 , 관계은행 Abstract :By comparing to Chinese American banks, this research shows the uniqueness of Korean American banks. This article argues that instead of the cultural attributes and/or informal financial institutions, formal financial institutions, such as the ethnic banks studied here, are responsible for the business success of Asians abroad. However, ethnic banks have different development trajectories depending on their respective ethnic communities. Korean American banks are notably different from Chinese American banks in terms of growth, profitability, and banking strategies. -

Department of Financial Institutions Summary of Pending Applications As of November 2010

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF NOVEMBER 2010 Assembly Bill 1301 (Gaines) Changes Procedures for Banking Office Applications AB 1301 (Gaines) became law on January 1, 2009. Among the changes made by the new law were to: Reclassify banking offices as head office, branch office and facility; Eliminate the place of business and extension of banking office categories; Eliminate the requirement that banks give advance notice to DFI before opening or relocating a banking office, or redesignating a head office and branch office. Consequently, notice of banking offices that open, relocate or are redesignated on or after January 1, 2009 will only be published after the fact. Eliminate the Miscellaneous Powers and Provisions chapter of the Financial Code that required banks receive approval to engage in certain activities, e.g., FC 752, FC 772, etc. APPLICATION TYPE PAGE NO. BANK APPLICATION CONVERSION TO STATE CHARTER 1 MERGER 1 ACQUISITION OF CONTROL 1 NEW BRANCH 2 NEW FACILITY 3 BRANCH OFFICE RELOCATION 3 FACILITY RELOCATION 4 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 7 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 7 DISCONTINUANCE OF BRANCH 7 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 9 DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 10 ACQUISITION OF CONTROL 10 ISSUER OF PAYMENT INSTRUMENT -

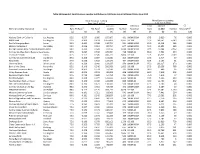

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0 -

Summary of Pending Applications As of Dec 2001

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2001 APPLICATION TYPE PAGE NO. BANK APPLICATIONS NEW BANKS 1 CONVERSION TO STATE CHARTER 3 MERGERS 3 ACQUISITION OF BRANCH OFFICE 4 ACQUISITION OF TRUST BUSINESS 4 APPLICATION FOR TRUST POWERS 4 TRANSFORMATION OF TRUST COMPANY TO COMMERCIAL BANK WITH TRUST POWERS 4 NEW BRANCHES 5 NEW PLACES OF BUSINESS 10 EXTENSION OF BANKING OFFICE 12 HEAD OFFICE RELOCATIONS 12 BRANCH OFFICE RELOCATIONS 12 PLACE OF BUSINESS RELOCATIONS 14 DISCONTINUANCE OF BRANCH OFFICES 14 DISCONTINUANCE OF PLACES OF BUSINESS 16 CHANGE OF NAME 16 APPLICATION PURSUANT TO SECTION 772 17 INDUSTRIAL BANK APPLICATIONS NEW PLACES OF BUSINESS 17 DISCONTINUANCE OF BRANCH OFFICES 17 INDUSTRIAL LOAN COMPANY APPLICATIONS NEW INDUSTRIAL LOAN COMPANY 18 CHANGE OF NAME 18 FOREIGN (OTHER NATION) BANK APPLICATIONS NEW OFFICES 19 RELOCATIONS 19 DISCONTINUANCE OF OFFICES 20 FOREIGN (OTHER STATE) BANK APPLICATIONS NEW FACILITY 20 CREDIT UNION APPLICATIONS CONVERSIONS TO STATE CHARTER 21 MERGERS 22 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 24 CHANGE OF NAME 24 TRANSMITTERS OF MONEY ABROAD APPLICATIONS NEW TRANSMITTERS 24 BUSINESS AND INDUSTRIAL DEVELOPMENT CORPORATION HEAD OFFICE RELOCATION 25 1 BANK APPLICATIONS NEW BANKS Filed: 4 Approved: 3 Opened: 1 AMERICAN PREMIER BANK Proposed Location: in the vicinity of East Huntington Drive between Baldwin and Fifth Avenue, Arcadia, Los Angeles County Correspondent: Henry M. Fields Morrison & Foerster, LLP, 555 West Fifth Street, Los Angeles, CA 90013-1024 Phone: (213) 892-5200 Filed: 1/31/01 Approved: 6/21/01 GB INTERIM BANK 800 West Sixth Street, Los Angeles, Los Angeles County Correspondent: T. -

The Large Bank Protection Act: Raising the CFPB’S Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L

The Large Bank Protection Act: Raising the CFPB’s Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L. Peterson May 3, 2018 1620 Eye Street, NW, Suite 200 | Washington, DC 20006 | (202) 387-6121 | consumerfed.org Executive Summary Congress is currently considering raising the total asset threshold for Consumer Financial Protection Bureau (CFPB) supervision and enforcement of banks from $10 billion to $50 billion. This report analyzes the effect of this change on the number of banks subject to CFPB oversight. Furthermore, this report looks at the CFPB’s enforcement track record in cases against banks within the $10-to-$50-billion-range, and highlights examples of enforcement actions previously taken by the CFPB that would have been impossible if the asset threshold were set at $50 billion under the original Dodd-Frank Act. Raising the CFPB supervision and enforcement threshold from ten to fifty billion dollars would: • Cut the number of banks subject to CFPB supervision and enforcement by 65% from 124 to 43. Currently, 124 out of 5,679 banks are subject to CFPB enforcement. Raising the CFPB oversight threshold to fifty billion dollars would place 81 of the nation’s largest banks beyond the supervisory and enforcement jurisdiction of the CFPB. • Eliminate CFPB oversight of nearly 50 of the largest banks bailed out during the financial crisis. Forty-nine of 81 large banks in the $10 to $50 billion asset range took TARP funds during the Great Recession. After bailing out these banks with taxpayer money, Congress is now considering removing them from the supervision and enforcement authority of the agency designed to prevent some of the same behavior that caused the crisis. -

CHSA HP2010.Pdf

The Hawai‘i Chinese: Their Experience and Identity Over Two Centuries 2 0 1 0 CHINESE AMERICA History&Perspectives thej O u r n a l O f T HE C H I n E s E H I s T O r I C a l s OCIET y O f a m E r I C a Chinese America History and PersPectives the Journal of the chinese Historical society of america 2010 Special issUe The hawai‘i Chinese Chinese Historical society of america with UCLA asian american studies center Chinese America: History & Perspectives – The Journal of the Chinese Historical Society of America The Hawai‘i Chinese chinese Historical society of america museum & learning center 965 clay street san francisco, california 94108 chsa.org copyright © 2010 chinese Historical society of america. all rights reserved. copyright of individual articles remains with the author(s). design by side By side studios, san francisco. Permission is granted for reproducing up to fifty copies of any one article for educa- tional Use as defined by thed igital millennium copyright act. to order additional copies or inquire about large-order discounts, see order form at back or email [email protected]. articles appearing in this journal are indexed in Historical Abstracts and America: History and Life. about the cover image: Hawai‘i chinese student alliance. courtesy of douglas d. l. chong. Contents Preface v Franklin Ng introdUction 1 the Hawai‘i chinese: their experience and identity over two centuries David Y. H. Wu and Harry J. Lamley Hawai‘i’s nam long 13 their Background and identity as a Zhongshan subgroup Douglas D. -

Department of Financial Institutions

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF NOVEMBER 2005 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 6 MERGER 6 ACQUISITION OF CONTROL 7 FINAL ORDER (Financial Code Section 1913) 7 NEW BRANCH 8 NEW PLACE OF BUSINESS 16 NEW EXTENSION OFFICE 19 HEAD OFFICE RELOCATION 19 HEAD OFFICE RELOCATION WITH ESTABLISHMENT OF BRANCH OFFICE 20 HEAD OFFICE REDESIGNATION 20 BRANCH OFFICE RELOCATION 20 PLACE OF BUSINESS RELOCATION 21 DISCONTINUANCE OF BRANCH OFFICE 22 DISCONTINUANCE OF PLACE OF BUSINESS 23 DISCONTINUANCE OF EXTENSION OFFICE 24 CHANGE OF NAME 25 PURCHASE WHOLE BUSINESS UNIT 25 INDUSTRIAL BANK APPLICATION NEW BRANCH 25 NEW PLACE OF BUSINESS 25 HEAD OFFICE RELOCATION 26 BRANCH OFFICE RELOCATION 26 PLACE OF BUSINESS RELOCATION 26 DISCONTINUANCE OF BRANCH OFFICE 26 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 27 HEAD OFFICE RELOCATION 28 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 28 CHANGE OF NAME 28 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 29 RELOCATION 30 CREDIT UNION APPLICATION CONVERSION TO STATE CHARTER 30 MERGER 30 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 31 CHANGE OF NAME 31 ii SUMMARY OF PENDING APPLICATIONS AS OF NOVEMBER 2005 Page 2 APPLICATION TYPE PAGE NO. TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 31 ACQUISITION OF CONTROL 32 FINAL ORDER (Financial Code Section 1818) 33 1 BANK APPLICATION NEW BANK Filed: 14 Approved: 5 Opened: 2 AMERICAN RIVIERA BANK 1033 Anacapa Street, City and County of Santa Barbara Correspondent: Michael Salsbury 735 State Street, Suite 633 Santa Barbara, CA 93101 (805) 965-5942 Filed: 10/25/05 ATLANTIC PACIFIC BANK 3725 Westwind Boulevard, Santa Rosa, Sonoma County Correspondent: Maryam Hamzeh Carpenter & Company Five Park Plaza, Suite 950 Irvine, CA 92614 (949) 261-8888 Filed: 10/14/05 BANK OF SANTA BARBARA 10 East Figueroa Street, City and County of Santa Barbara Correspondent: Joseph D. -

Investing in the Future of Mission-Driven Banks a Guide to Facilitating New Partnerships PUBLISHED BY

Federal Deposit Insurance Corporation Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships PUBLISHED BY: Federal Deposit Insurance Corporation 550 17th Street, NW, Washington, D.C. 20429 877-ASK FDIC (877-275-3342) The Federal Deposit Insurance Corporation (FDIC) has taken steps to ensure that the information and data presented in this publication are accurate and current. However, the FDIC makes no express or implied warranty about such information or data, and hereby expressly disclaims all legal liability and responsibility to persons or entities that use or access this publication and its content, based on their reliance on any information or data included. The FDIC welcomes comments or suggestions about this publication or our Minority Depository Institutions (MDI) Program. Contact the MDI Program at [email protected]. When citing this publication, please use the following: Investing in the Future of Mission-Driven Banks, Federal Deposit Insurance Corporation, Washington, D.C. (October 2020), https://www.fdic.gov/mdi. Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships Contents Executive Summary .......................................................................................................... 1 Overview ........................................................................................................................... 2 Minority Depository Institutions ................................................................................. 2 Community