Department of Financial Institutions Summary of Pending Applications As of November 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Chinese in Hawaii: an Annotated Bibliography

The Chinese in Hawaii AN ANNOTATED BIBLIOGRAPHY by NANCY FOON YOUNG Social Science Research Institute University of Hawaii Hawaii Series No. 4 THE CHINESE IN HAWAII HAWAII SERIES No. 4 Other publications in the HAWAII SERIES No. 1 The Japanese in Hawaii: 1868-1967 A Bibliography of the First Hundred Years by Mitsugu Matsuda [out of print] No. 2 The Koreans in Hawaii An Annotated Bibliography by Arthur L. Gardner No. 3 Culture and Behavior in Hawaii An Annotated Bibliography by Judith Rubano No. 5 The Japanese in Hawaii by Mitsugu Matsuda A Bibliography of Japanese Americans, revised by Dennis M. O g a w a with Jerry Y. Fujioka [forthcoming] T H E CHINESE IN HAWAII An Annotated Bibliography by N A N C Y F O O N Y O U N G supported by the HAWAII CHINESE HISTORY CENTER Social Science Research Institute • University of Hawaii • Honolulu • Hawaii Cover design by Bruce T. Erickson Kuan Yin Temple, 170 N. Vineyard Boulevard, Honolulu Distributed by: The University Press of Hawaii 535 Ward Avenue Honolulu, Hawaii 96814 International Standard Book Number: 0-8248-0265-9 Library of Congress Catalog Card Number: 73-620231 Social Science Research Institute University of Hawaii, Honolulu, Hawaii 96822 Copyright 1973 by the Social Science Research Institute All rights reserved. Published 1973 Printed in the United States of America TABLE OF CONTENTS FOREWORD vii PREFACE ix ACKNOWLEDGMENTS xi ABBREVIATIONS xii ANNOTATED BIBLIOGRAPHY 1 GLOSSARY 135 INDEX 139 v FOREWORD Hawaiians of Chinese ancestry have made and are continuing to make a rich contribution to every aspect of life in the islands. -

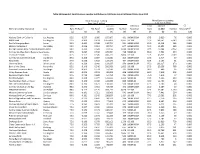

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0 -

The Large Bank Protection Act: Raising the CFPB’S Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L

The Large Bank Protection Act: Raising the CFPB’s Enforcement and Supervision Asset Threshold Would Place American Consumers at Risk Christopher L. Peterson May 3, 2018 1620 Eye Street, NW, Suite 200 | Washington, DC 20006 | (202) 387-6121 | consumerfed.org Executive Summary Congress is currently considering raising the total asset threshold for Consumer Financial Protection Bureau (CFPB) supervision and enforcement of banks from $10 billion to $50 billion. This report analyzes the effect of this change on the number of banks subject to CFPB oversight. Furthermore, this report looks at the CFPB’s enforcement track record in cases against banks within the $10-to-$50-billion-range, and highlights examples of enforcement actions previously taken by the CFPB that would have been impossible if the asset threshold were set at $50 billion under the original Dodd-Frank Act. Raising the CFPB supervision and enforcement threshold from ten to fifty billion dollars would: • Cut the number of banks subject to CFPB supervision and enforcement by 65% from 124 to 43. Currently, 124 out of 5,679 banks are subject to CFPB enforcement. Raising the CFPB oversight threshold to fifty billion dollars would place 81 of the nation’s largest banks beyond the supervisory and enforcement jurisdiction of the CFPB. • Eliminate CFPB oversight of nearly 50 of the largest banks bailed out during the financial crisis. Forty-nine of 81 large banks in the $10 to $50 billion asset range took TARP funds during the Great Recession. After bailing out these banks with taxpayer money, Congress is now considering removing them from the supervision and enforcement authority of the agency designed to prevent some of the same behavior that caused the crisis. -

CHSA HP2010.Pdf

The Hawai‘i Chinese: Their Experience and Identity Over Two Centuries 2 0 1 0 CHINESE AMERICA History&Perspectives thej O u r n a l O f T HE C H I n E s E H I s T O r I C a l s OCIET y O f a m E r I C a Chinese America History and PersPectives the Journal of the chinese Historical society of america 2010 Special issUe The hawai‘i Chinese Chinese Historical society of america with UCLA asian american studies center Chinese America: History & Perspectives – The Journal of the Chinese Historical Society of America The Hawai‘i Chinese chinese Historical society of america museum & learning center 965 clay street san francisco, california 94108 chsa.org copyright © 2010 chinese Historical society of america. all rights reserved. copyright of individual articles remains with the author(s). design by side By side studios, san francisco. Permission is granted for reproducing up to fifty copies of any one article for educa- tional Use as defined by thed igital millennium copyright act. to order additional copies or inquire about large-order discounts, see order form at back or email [email protected]. articles appearing in this journal are indexed in Historical Abstracts and America: History and Life. about the cover image: Hawai‘i chinese student alliance. courtesy of douglas d. l. chong. Contents Preface v Franklin Ng introdUction 1 the Hawai‘i chinese: their experience and identity over two centuries David Y. H. Wu and Harry J. Lamley Hawai‘i’s nam long 13 their Background and identity as a Zhongshan subgroup Douglas D. -

Investing in the Future of Mission-Driven Banks a Guide to Facilitating New Partnerships PUBLISHED BY

Federal Deposit Insurance Corporation Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships PUBLISHED BY: Federal Deposit Insurance Corporation 550 17th Street, NW, Washington, D.C. 20429 877-ASK FDIC (877-275-3342) The Federal Deposit Insurance Corporation (FDIC) has taken steps to ensure that the information and data presented in this publication are accurate and current. However, the FDIC makes no express or implied warranty about such information or data, and hereby expressly disclaims all legal liability and responsibility to persons or entities that use or access this publication and its content, based on their reliance on any information or data included. The FDIC welcomes comments or suggestions about this publication or our Minority Depository Institutions (MDI) Program. Contact the MDI Program at [email protected]. When citing this publication, please use the following: Investing in the Future of Mission-Driven Banks, Federal Deposit Insurance Corporation, Washington, D.C. (October 2020), https://www.fdic.gov/mdi. Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships Contents Executive Summary .......................................................................................................... 1 Overview ........................................................................................................................... 2 Minority Depository Institutions ................................................................................. 2 Community -

Bankname Bankstreet Bankcity 121 FINANCIAL CU 9700 TOUCHTON RD JACKSONVILLE 1ST CAPITAL BANK 5 HARRIS CT, BLDG N, STE 3 MONTEREY 1ST CIT

BankName BankStreet BankCity 121 FINANCIAL CU 9700 TOUCHTON RD JACKSONVILLE 1ST CAPITAL BANK 5 HARRIS CT, BLDG N, STE 3 MONTEREY 1ST CIT. NATL BK OF UPPER SAN 100 N SANDUSKY AVE UPPER SANDUSKY 1ST COLONIAL BANCORP, INC 1040 HADDON AVE COLLINGSWOOD 1ST CONSTITUTION BANCORP 2650 RTE 130 CRANBURY 1ST FINANCIAL BANK USA 331 DAKOTA DUNES BLVD DAKOTA DUNES 1ST MANATEE BANK 12215 US 301 NORTH PARRISH 1ST MARINER BANK 1501 S CLINTON ST BALTIMORE 1ST MIDAMERICA CU 731 E BETHALTO DR BETHALTO 1ST NATL BK - FOX VALLEY 550 S GREEN BAY RD NEENAH 1ST NATL BK & TR CO 345 E GRAND AVE BELOIT 1ST NATL BK & TR CO OF IRON M 233 S STEPHENSON AVE IRON MOUNTAIN 1ST NATL BK & TR CO OF JUNCTI 702 N WASHINGTON ST JUNCTION CITY 1ST NATL BK IN CRESTON 101 W ADAMS ST CRESTON 1ST NATL BK OF BATTLE LAKE 101 LAKE AVE SOUTH BATTLE LAKE 1ST NATL BK OF BERLIN 140 W HURON ST BERLIN 1ST NATL BK OF BUHL 121 STATE ST BUHL 1ST NATL BK OF CARMI 201 E MAIN ST CARMI 1ST NATL BK OF COLD SPRING 301 MAIN ST COLD SPRING 1ST NATL BK OF DEERWOOD 21236 ARCHIBALD RD DEERWOOD 1ST NATL BK OF ELK RIVER 812 MAIN ST ELK RIVER 1ST NATL BK OF FAIRFAX 16 SE 1ST ST FAIRFAX 1ST NATL BK OF FT SMITH 602 GARRISON AVE FORT SMITH 1ST NATL BK OF GRANT PK 119 N MAIN ST GRANT PARK 1ST NATL BK OF HENNING 106 ST HWY 78 NORTH OTTERTAIL 1ST NATL BK OF MIFFLINTOWN 2 N MAIN ST MIFFLINTOWN 1ST NATL BK OF MT DORA 714 N DONNELLY ST MOUNT DORA 1ST NATL BK OF OSAKIS 211-13 CENTRAL OSAKIS 1ST NATL BK OF PLAINVIEW 138 W BROADWAY PLAINVIEW 1ST NATL BK OF RAYMOND 403 E BROAD ST RAYMOND 1ST NATL BK OF RIVER FALLS 104 E LOCUST ST RIVER FALLS 1ST NATL BK OF SO. -

1 1St Bank Yuma 1St Capital Bank 1St Financial Bank USA 1St Security

1st Bank Yuma 1st Capital Bank 1st Financial Bank USA 1st Security Bank of Washington 1st Source Bank 21st Century Bank Academy Bank, National Association ACNB Bank ACS Association Adams Bank & Trust Affiliated Bank, National Association Affinity FCU Alaska USA FCU Albany Bank and Trust Company, National Association Alerus Financial, National Association Allegiance Bank Alliance Bank Alliance Community Bank Ally Bank Alpine Bank Altabank Altra FCU Alva State Bank & Trust Company Amarillo National Bank Amerant Bank, National Association Amerasia Bank American AG Credit, ACA American Bank & Trust American Bank Center American Bank of Baxter Springs American Bank of Commerce American Bank of the North American Bank, National Association American Bank, National Association American Business Bank American Community Bank & Trust American Continental Bank American Exchange Bank American Momentum Bank American National Bank American National Bank American National Bank of Minnesota American Plus Bank, National Association American River Bank American Riviera Bank American Savings Bank, FSB 1 American State Bank American State Bank America's Christian CU Ameris Bank ANB Bank Anchor State Bank Andover State Bank Aquesta Bank Arbor Bank Arcata Economic Development Corporation Arizona FCU Arkansas Capital Corporation Armstrong Bank Arvest Bank Assemblies of God CU Associated Bank, National Association Atlantic Capital Bank, National Association Atlantic Union Bank Austin Bank, Texas National Association Avid bank Avidia Bank Axos Bank BAC Community -

Department of Financial Institutions Summary of Pending Applications As of December 2010

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2010 Assembly Bill 1301 (Gaines) Changes Procedures for Banking Office Applications AB 1301 (Gaines) became law on January 1, 2009. Among the changes made by the new law were to: Reclassify banking offices as head office, branch office and facility; Eliminate the place of business and extension of banking office categories; Eliminate the requirement that banks give advance notice to DFI before opening or relocating a banking office, or redesignating a head office and branch office. Consequently, notice of banking offices that open, relocate or are redesignated on or after January 1, 2009 will only be published after the fact. Eliminate the Miscellaneous Powers and Provisions chapter of the Financial Code that required banks receive approval to engage in certain activities, e.g., FC 752, FC 772, etc. APPLICATION TYPE PAGE NO. BANK APPLICATION CONVERSION TO STATE CHARTER 1 MERGER 1 ACQUISITION OF CONTROL 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH OFFICE RELOCATION 4 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 7 DISCONTINUANCE OF BRANCH 7 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 7 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 9 DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 10 ACQUISITION -

Eligible Financial Institutions

Eligible & Participating Financial Institutions 1199 SEIU FEDERAL CREDIT UNION 121 FINANCIAL CREDIT UNION 1880 BANK 1ST BANK 1ST BANK OF SEA ISLE CITY 1ST BERGEN FEDERAL CREDIT UNION 1ST CAMERON STATE BANK 1ST CAPITAL BANK 1ST CHOICE CREDIT UNION 1ST COLONIAL COMMUNITY BANK 1ST COMMUNITY BANK 1ST COMMUNITY FEDERAL CREDIT UNION 1ST CONSTITUTION BANK 1ST COOPERATIVE FEDERAL CREDIT UNION 1ST FINANCIAL BANK USA 1ST GATEWAY CREDIT UNION 1ST LIBERTY FEDERAL CREDIT UNION 1ST MARINER BANK 1ST MIDAMERICA CREDIT UNION 1ST NORTHERN CALIFORNIA CREDIT UNION 1ST SECURITY BANK OF WASHINGTON 1ST STATE BANK 1ST SUMMIT BANK 1ST UNITED BANK 1ST UNITED SERVICES CREDIT UNION 2 RIVERS AREA CREDIT UNION 21ST CENTURY BANK 360 FEDERAL CREDIT UNION 4FRONT CREDIT UNION 5 STAR COMMUNITY CREDIT UNION 5STAR BANK A C P E FEDERAL CREDIT UNION A.B.&W. CU. INC. A.O.D. FEDERAL CREDIT UNION AAC CREDIT UNION ABA CARD SOLUTIONS, INC. ABACUS FEDERAL SAVINGS BANK ABBEY CREDIT UNION, INC. ABBOTT LABORATORIES ECU ABBYBANK ABERDEEN FCU ABERDEEN PROVING GROUND FCU ABILENE FEDERAL CREDIT UNION ABINGTON BANK ABNB FEDERAL CREDIT UNION ABRI CREDIT UNION ACADEMY BANK, NATIONAL ASSOCIATION ACADIA FEDERAL CREDIT UNION ACADIAN FEDERAL CREDIT UNION ACADIANA MEDICAL FEDERAL CREDIT UNION ACCENTRA CREDIT UNION ACCESS BANK ACCESS CREDIT UNION ACCESS FEDERAL CREDIT UNION ACCESS NATIONAL BANK ACCESSBANK TEXAS ACME CONTINENTAL CREDIT UNION ACTORS FEDERAL CREDIT UNION ADAMS BANK AND TRUST ADIRONDACK BANK ADIRONDACK REGIONAL FCU ADMIRALS BANK ADRIAN STATE BANK ADVANCE FINANCIAL FEDERAL CREDIT UNION -

1409549000.00

LOS ANGELES DISTRICT OFFICE Lender Ranking Report 7(a) and 504 Loan Programs Fiscal Year 2017 - 3rd Quarter (YTD) (10/01/2016 - 06/30/2017) 7(a) Loan Program 504 Loan Program 1 WELLS FARGO BANK, N.A. 318 $115,135,500 60 UNITED PACIFIC BANK 5 $10,465,000 1 CDC SMALL BUS. FINANCE CORP.* 77 $105,778,000 2 JPMORGAN CHASE BANK, N.A. 223 $53,315,600 61 BANNER BANK 5 $311,900 2 BFC FUNDING 58 $94,157,000 3 BANK OF HOPE 117 $74,575,000 62 PACIFIC WESTERN BANK 4 $7,787,000 3 CALIFORNIA STATEWIDE CDC 54 $57,020,000 4 U.S. BANK, N.A. 101 $17,389,200 63 BANK OF SANTA CLARITA 4 $5,205,000 4 MORTGAGE CAP. DEV. CORP.* 24 $34,934,000 5 EAST WEST BANK 81 $33,597,000 64 COMMERCIAL BANK OF CALIFORNIA 4 $4,767,000 5 PACIFIC WEST CDC 20 $23,808,000 6 PACIFIC CITY BANK 64 $57,539,400 65 UNITED BUSINESS BANK, F.S.B. 4 $3,943,500 6 SOUTHLAND ECONOMIC DEV. CORP. 11 $6,643,000 7 COMMONWEALTH BUSINESS BANK 56 $46,866,000 66 MISSION VALLEY BANK 4 $3,213,100 7 AMPAC TRI-STATE CDC, INC. 9 $9,315,000 8 OPEN BANK 45 $42,370,500 67 CAPITAL BANK 4 $3,190,000 8 SO CAL CDC 9 $8,710,000 9 CELTIC BANK CORPORATION 41 $12,517,800 68 OPUS BANK 4 $1,100,000 9 COASTAL BUSINESS FINANCE 5 $3,023,000 10 FIRST HOME BANK 40 $12,546,000 69 THE BANCORP BANK 4 $878,000 10 ENTERPRISE FUNDING CORPORATION 3 $2,202,000 11 SEACOAST COMMERCE BANK 38 $38,164,300 70 PCR SMALL BUSINESS DEVELOPMENT* 4 $495,000 11 SUPERIOR CA ECONOMIC DEV. -

September 2005

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF SEPTEMBER 2005 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 5 MERGER 5 ACQUISITION OF CONTROL 6 FINAL ORDER 6 NEW BRANCH 7 NEW PLACE OF BUSINESS 16 NEW EXTENSION OFFICE 18 HEAD OFFICE RELOCATION 19 BRANCH OFFICE RELOCATION 19 PLACE OF BUSINESS RELOCATION 20 DISCONTINUANCE OF BRANCH OFFICE 21 DISCONTINUANCE OF PLACE OF BUSINESS 22 DISCONTINUANCE OF EXTENSION OFFICE 22 CHANGE OF NAME 22 INDUSTRIAL BANK APPLICATION NEW BRANCH 22 NEW PLACE OF BUSINESS 23 HEAD OFFICE RELOCATION 23 BRANCH OFFICE RELOCATION 24 PLACE OF BUSINESS RELOCATION 24 DISCONTINUANCE OF BRANCH OFFICE 24 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 24 HEAD OFFICE RELOCATION 25 ACQUISITION OF CONTROL 25 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 26 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 26 RELOCATION 27 CREDIT UNION APPLICATION CONVERSION TO STATE CHARTER 28 MERGER 28 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 28 CHANGE OF NAME 29 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 29 ACQUISITION OF CONTROL 30 FINAL ORDER (Financial Code Section 1818) 31 1 BANK APPLICATION NEW BANK Filed: 5 Approved: 10 Opened: 1 BANK OF SANTA BARBARA 10 East Figueroa Street, City and County of Santa Barbara Correspondent: Joseph D. Reid III Capitol Bancorp Limited 200 Washington Square North Lansing, MI 48933 (517) 372-1376 Filed: 4/4/05 Approved: 6/16/05 CALIFORNIA BUSINESS BANK 800 West Sixth Street, Suite 1000, City and County of Los Angeles Correspondent: Maryam Hamzeh Carpenter & Company 5 Park Plaza, Suite 950 Irvine, CA 92614 Phone: (949) 261-8888 Filed: 2/1/05 Address changed: 3/30/05 from 350 South Figueroa Street, Suite 166 Approved: 4/21/05 COMMUNITY 1ST BANK 2250 Douglas Boulevard, Roseville, Placer County Correspondent: James B. -

Department of Financial Institutions Summary of Pending Applications As of January 2013

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF JANUARY 2013 Assembly Bill 1301 (Gaines) Changes Procedures for Banking Office Applications AB 1301 (Gaines) became law on January 1, 2009. Among the changes made by the new law were to: Reclassify banking offices as head office, branch office and facility; Eliminate the place of business and extension of banking office categories; Eliminate the requirement that banks give advance notice to DFI before opening or relocating a banking office, or redesignating a head office and branch office. Consequently, notice of banking offices that open, relocate or are redesignated on or after January 1, 2009 will only be published after the fact. Eliminate the Miscellaneous Powers and Provisions chapter of the Financial Code that required banks receive approval to engage in certain activities, e.g., FC 752, FC 772, etc. APPLICATION TYPE PAGE NO. BANK APPLICATION ACQUISITION OF CONTROL 1 MERGER 1 PURCHASE OF PARTIAL BUSINESS UNIT 2 NEW BRANCH 2 NEW FACILITY 2 HEAD OFFICE RELOCATION 3 BRANCH RELOCATION 3 DISCONTINUANCE OF BRANCH OFFICE 3 DISCONTINUANCE OF FACILITY 7 VOLUNTARY SURRENDER OF LICENSE 7 INDUSTRIAL BANK APPLICATION NEW BRANCH 7 NEW FACILITY 7 DISCONTINUANCE OF BRANCH OFFICE 8 DISCONTINUANCE OF FACILITY 8 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 8 VOLUNTARY SURRENDER OF LICENSE 8 TRUST COMPANY APPLICATION ACQUISITION OF CONTROL 9 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 9 RELOCATION OF OFFICE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION NEW CREDIT UNION 10 MERGER 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 10 1 BANK APPLICATION ACQUISITION OF CONTROL Filed: 1 Approved: 2 BING YANG and ALICE LIU requests DFI approval to acquire control of MEGA BANK Filed: 10/9/12 Approved: 1/24/13 TAYLOR INTERNATIONAL FUND, LTD., TAYLOR ASSET MANAGEMENT, INC.