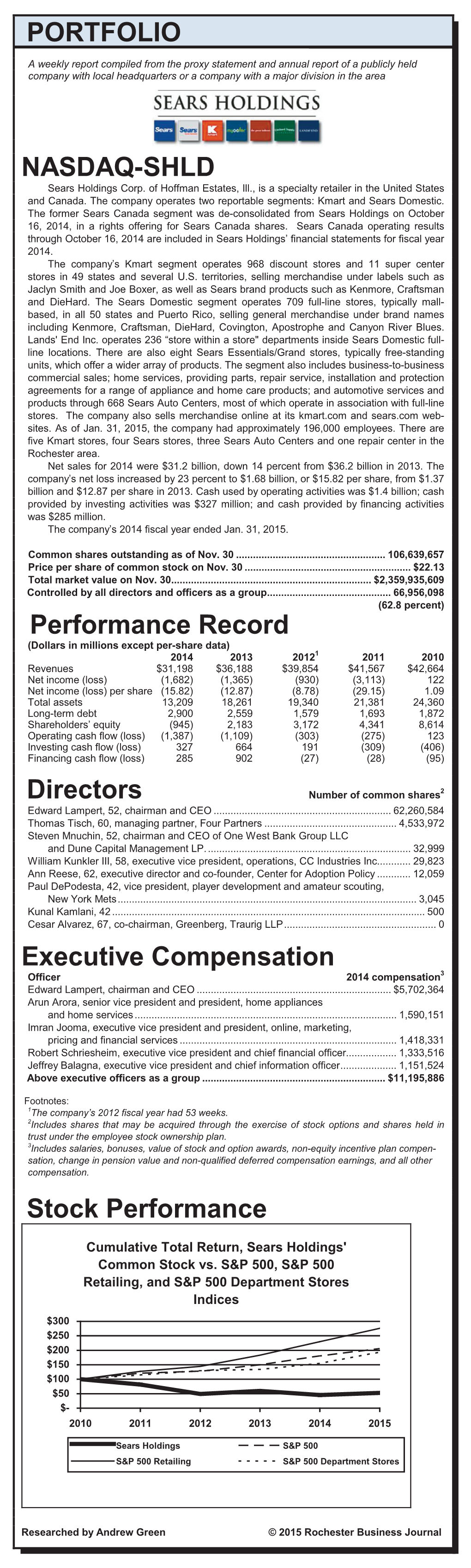

PORTFOLIO NASDAQ-SHLD Performance Record Directors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We're Still LENDING

INSIDE Health & Fitness MAY 6, 2010 SentineNORTH BRUNSWICK • SOUTH BRUNSWICK l gmnews.com 50< S.B. introduces budget with 8c tax increase Council assures public that there is still much work to be done BY JENNIFER BOOTON Staff Writer "though the South Brunswick Town- ship Council introduced a municipal T budget last week that carries an 8-cent tax increase, officials were sure to note that there is still much work to be done. The budget introduced on April 27 ab- sorbs an unexpected $1.1 million slash in state aid. The township took a 17.5 percent hit in its energy tax receipts, which brought expected state revenue down from $6.4 mil- lion last year to $5.2 million this year. "Budget problems in Trenton get fixed in the suburbs, not in Trenton," said Deputy Mayor Chris Killmurray. "The playing field is not level with Trenton, but we have to deal with it. " The $46 million budget was introduced last week for statutory purposes, since the state requires municipalities to introduce their budgets by May 11, but it will most likely see many amendments before the public hearing and possible adoption on June 22, according to Township Manager Matthew Watkins. "While you're introducing this today in April, we're not looking for a final adoption on this for some time," Watkins said to the SCOTT (TRIEDMAN council. "We reworked some of the budget, Ryan Kloos, 13, of East Brunswick, checks out a huge towing truck from l,x>gan Towing of North Brunswtek during the IG** annual North (Continued on page 38) Brunswick Cops & Rodders car show at DeVry University Sunday. -

Brands We Love

Brands We Love # D I N T DENIM 3.1 PHILLIP LIM DANSKO IRO NICOLE MILLER THEORY AG 360 CASHMERE DAVID YURMAN ISABEL MARANT NILI LOTAN THE GREAT AGOLDE We Do Not Accept: DEREK LAM ISSEY MIYAKE NO 6 STORE THE ROW AMO DL1961 NORTH FACE TIBI CITIZENS OF HUMANITY ABERCROMBIE & FITCH H&M A DOLCE & GABBANA TIFFANY & CO CURRENT/ELLIOTT AMERICAN APPAREL HOLLISTER ACNE STUDIOS AMERICAN EAGLE HOT TOPIC DONNA KARAN J TOCCA DL1961 ANN TAYLOR AG INC DOSA J BRAND O TOD’S FRAME ANGIE JACLYN SMITH AGL DRIES VAN NOTEN J CREW OBAKKI TOM FORD GOLDSIGN APT 9 JOE BOXER AGOLDE DVF JAMES PERSE OFFICINE CREATIVE TOP SHOP HUDSON ATTENTION JUICY COUTURE ALAIA JEAN PAUL GAULTIER OPENING CEREMONY AX PARIS LAND’S END TORY BURCH J BRAND BANANA REPUBLIC ALC OSCAR DE LA RENTA LOVE 21 JIL SANDER TRINA TURK JOES BDG LUX ALEXANDER MCQUEEN E JIMMY CHOO LEVIS BEBE MAX STUDIO ALEXANDER WANG EILEEN FISHER JOIE MOTHER BLUES METAPHOR BONGO ALICE & OLIVIA EMANUEL UNGARO P U MOUSSY MISS ME PAIGE CANDIE’S MISS TINA ANNA SUI ELIZABETH & JAMES UGG PAIGE CANYON RIVER PARKER MOSSIMO ANN DEMEULEMEESTER EMILIO PUCCI K ULLA JOHNSON R13 CATALINA NICKI MINAJ ANTHROPOLOGIE BRANDS ENZA COSTA KATE SPADE PATAGONIA RE/DONE CATHY DANIELS OLD NAVY ATM ERDEM PIERRE HARDY CHAPS ROCK & REPUBLIC SIMON MILLER CHARLOTTE RUSSE AUTUMN CASHMERE EVERLANE PRADA ROUTE 66 V CHIC ROXY AVANT TOI L PROENZA SCHOULER VALENTINO CHICOS L’AGENCE SAG HARBOR VANESSA BRUNO ATHLETIC CHRISTINALOVE SIMPLY VERA WANG F LANVIN VELVET ALO COVINGTON SO... CROFT & BARROW FENDI LEM LEM R VERONICA BEARD ATHLETA SONOMA LEVIS RACHEL COMEY DAISY FUENTES SOFIA VERGARA B FIORENTINI + BAKER VERSACE LULULEMON DANSKIN LOEFFLER RANDALL RAG & BONE STUDIO TAHARI BABATON FREE PEOPLE VICTORIA BECKHAM OUTDOOR VOICES ECOTE TARGET BALENCIAGA FRYE LOEWE RAILS VINCE NORTH FACE ELLE URBAN OUTFITTERS ETC.. -

Here Comes the Budget Bride the Biggest News in Fashion This Week Isn’T on the Milan Runways

The Inside: Pg. 18 ICAHN’S FEDERATED MOVE/3 KELLWOOD’S BUY/3 Where LoyaltyWWD Lies WWDWomen’s Wear Daily • The Retailers’THURSDAY Daily Newspaper • September 28, 2006 • $2.00 List Sportswear Here Comes the Budget Bride The biggest news in fashion this week isn’t on the Milan runways. Rather, it hails from the wonderful world of high- low, where Viktor & Rolf and H&M have gotten hitched for a short-term marriage. It’s that very idea that inspired Viktor Horsting and Rolf Snoeren, who discussed details of the collaboration exclusively with WWD. The ultimate object of their wedded bliss: this 298 euro, or $380, wedding gown, pictured here with Horsting and Snoeren in the ad campaign shot by Inez van Lamsweerde and Vinoodh Matadin. For more on the season, see pages 6 to 9. Chloé to Name Marni’s Paolo Melin Anderson as Head Designer By Miles Socha French fashion house later this about its succession plan after its hloé has tapped a senior, but year. show during Paris Fashion Week. Chidden, talent from Marni to Reached late on Wednesday, a Anderson, a Swedish native who succeed Phoebe Philo, WWD has Chloé spokesman said only, “We has worked at Marni for several learned. do not comment on rumors.” years, will assume the design According to sources, Paolo However, the house said recently helm at one of the fastest-growing Melin Anderson will join the it would make an announcement See Chloé, Page 10 WWDTHURSDAYWWD.COM Sportswear FASHION ™ For better or worse, themes played a big role in the Milan collections, from a silvery space theme to a football game to a fashion safari. -

FORWARD THINKING New Insights Into How Sears Gains Strength by Better Understanding Customers

SEARS CANADA INC. SEARS CANADA INC. SEARS CANADA INC. 1997 Annual Report FORWARD THINKING New insights into how Sears gains strength by better understanding customers TRANSFORMING SEARS INSIDE OUT An inside look at Sears $300 million nationwide revitalization program CLOSER TO HOME Sears Whole Home Furniture Stores and dealer stores key to Sears innovative off-mall growth strategy 2 CHAIRMAN’S MESSAGE Paul Walters reflects on 21 FINANCIAL INFORMATION 1997 the gratifying results of 1997, and shares his perspective on Sears strategy for growth 22 Eleven Year Summary 6 FORWARD THINKING Sears reinvents the way it 23 Management’s Discussion and Analysis does business to become more relevant to customers 33 Quarterly Results and Common Share Market 8 BRAND NEW LIFE Creating a brand image for Information and Dividend Highlights Sears helps grow lifetime customer relationships 34 Statement of Management Responsibility 10 TRANSFORMING SEARS INSIDE OUT and Auditors’ Report Revitalization of 9 GTA stores first stage of $300 35 Consolidated Statements of Financial Position million capital investment program to totally transform Sears by the beginning of the new 36 Consolidated Statements of Earnings millennium 36 Consolidated Statements of Retained Earnings 14 THE MANY SIDES OF SEARS Customers see how Sears meets their many needs in new 37 Consolidated Statements of advertising campaign Changes in Financial Position 16 BEST SELLER Sears reveals why catalogue 38 Notes to Consolidated Financial Statements shopping has an exciting future CORPORATE INFORMATION 18 CLOSER TO HOME Off-mall strategy brings 46 Corporate Governance customers closer to Sears 47 Directors and Officers 20 COMMUNITY RELATIONSHIPS Communities benefit from Sears caring side 48 Corporate Information Sears is Canada’s largest single retailer of general merchandise, with department and specialty stores as well as catalogue locations across Canada. -

+$10 in Points) $79.99

Estos precios solo muestran un ejemplo de lo que será la venta del madrugador en Estados Unidos. En Doctorshoper.com no somos responsables de cualquier problema que este listado pueda presentar. Tablets Fire HD 6 Tablet (+$10 in Points) $79.99 Nabi2 7" Android Tablet for Kids (+$50 in Points) $149.99 Samsung Galaxy Tab 4 7" Tablet (+$20 in Points) $149.99 Samsung Galaxy Tab4 10.1-Inch Tablet $249.99 Samsung Galaxy Tab4 8-Inch Tablet $199.99 Trio Stealth G4 7" Quad Core Tablet (+$10 in Points) $59.99 Trio Stealth G4 7.85-Inch Quad Core Tablet (+$20 in Points) $89.99 Trio Stealth G4 Accessory Kit (case, stylus, cloth, 2 screen 50% off protectors) Xtreme 7" Tablet (+$10 in Points) $39.99 Zeki 8" Quad Core Tablet (+$20 in Points) $89.99 Televisions RCA 24" Class LED/DVD Combo 1080p HDTV (+$20 in $149.99 Points) RCA 32" Class LED Smart HDTV (+$50 in Points) $249.99 RCA 32-Inch Class LED HDTV (+$40 in points) $179.99 RCA 40-Inch Class LED 1080p HDTV (+$50 in points) $249.99 RCA 46" Class LED 1080p HDTV (LED46C45RQ) $299.99 RCA 50" Class LED 1080p HDTV $399.99 RCA 50" Class LED 1080p HDTV (LED50B45RQ) (+$50 in $399.99 Points) RCA 55-Inch Class 1080p 120 Hz LED HDTV (+$60 in points) $499.99 RCA 60" Class LED 1080p 120Hz HDTV $699.99 Sanyo 50-Inch Class LED 1080p HDTV $399.99 Seiki 20" Class LED HDTV (+$20 in Points) $99.99 Seiki 32" Class LED DVD Combo HDTV (SE32HY27-D) (+$20 $179.99 in Points) Seiki 32-Inch Class LED HDTV (+$30 in Points) $169.99 Seiki 40" Class LED 1080p HDTV $239.99 Toshiba 40-Inch Class LED 1080p HDTV (40L1400U) (+$30 in -

Branded Apparel: Market Research Report

+44 20 8123 2220 [email protected] Branded Apparel: Market Research Report https://marketpublishers.com/r/B6F5A10E0D0EN.html Date: September 2010 Pages: 757 Price: US$ 4,500.00 (Single User License) ID: B6F5A10E0D0EN Abstracts This report analyzes the worldwide markets for Branded Apparel in US$ Billion by the following Product Segments: Men's Branded Apparel, Women's Branded Apparel, Children's Branded Apparel, and Sports Branded Apparel. The report provides separate comprehensive analytics for the US, Canada, Japan, Europe, Asia-Pacific, Latin America, and Rest of World. Annual estimates and forecasts are provided for each region for the period 2007 through 2015. Also, a seven-year historic analysis is provided for these markets. The report profiles 400 companies including many key and niche players such as Adidas AG, Reebok International Ltd., Arvind Limited, Benetton Group SpA, Ermenegildo Zegna Group, Escada AG, Esprit Europe GmbH, Fruit of the Loom, Inc., Giorgio Armani SpA, Guess?, Inc., HartMarx Corp., Hobo Clothing Company, H&M (Hennes & Mauritz) AB, Inditex, Joe Boxer Company, LLC, Jones Apparel Group, Inc., Levi Strauss & Co., Liz Claiborne, Inc., Naigai Co., Ltd., Nautica Enterprises, Inc., Nike, Inc., Nygård International Ltd., Onward Holdings & Co. Ltd., OshKosh B'Gosh Inc., Oxford Industries Inc., Phillips-Van Heusen Corp., Picadilly Fashions, Raymond Limited, Sanyo Shokai Co., Ltd., The Athletic Sportshow Inc., Tommy Hilfiger U.S.A., Inc., Tribal Sportswear Inc., Triumph Apparel Corporation, Valentino Fashion Group S.p.A., Vanity Fair Corp., and Warnaco Group Inc. Major retailers also discussed in the report include Ann Taylor Stores Corporation, Beall's Department Stores, Inc., Berkshire Hathaway, Charming Shoppes, Inc., Chico’s FAS, Inc., Coldwater Creek, Inc., Gap Inc., Gymboree Corp., J. -

A Postmortem for Sears - Transcript

A Postmortem for Sears - Transcript Tom Mullooly: In episode 123, we're going to do a postmortem on Sears Roebuck. Stick around. Welcome to the Mullooly Asset show. I'm your host, Tom Mullooly, and this is episode number 123. One, two, three red light. So today, the day that we're recording this, it looks like Sears Roebuck is going to ask the bankruptcy court to enter liquidation, and that's the end of Sears as we know it. So I thought it would be a good time to just kind of take a walk down memory lane. There's a lot of people in the media today who are comparing Amazon to Sears saying, "Hey, Sears was the Amazon of its day." And I just want to share a couple of things that I've learned over the years about Sears. It was started in 1886 as a mail order company. Richard Sears actually sold watches through a catalog that he put together. A year later, in 1887, he hires a guy named Alvah Roebuck to repair watches. So I guess they had problems with some of the watches that they were selling through their catalog. They then added jewelry, and the mail order business really took off. What helped them, a little bit of history for you, is that in the late 1880s, the US government started a program called rural free delivery, or RFD. Some of you are around my age may remember a TV show after Andy Griffith left. It was called Mayberry RFD, and everybody always wanted to know what RFD stood for. -

COMPLAINT Savings Plan, and All Other Similarly Situated Plan Participants and Beneficiaries, JURY TRIAL DEMANDED

Case: 1:17-cv-05825 Document #: 1 Filed: 08/10/17 Page 1 of 102 PageID #:1 UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION LAVARITA D. MERIWETHER, individually, and in her representative CASE NO. 1:17-cv-5825 capacity on behalf of the Sears Holdings Savings Plan, the Sears Holdings Puerto Rico CLASS ACTION COMPLAINT Savings Plan, and all other similarly situated Plan participants and beneficiaries, JURY TRIAL DEMANDED Plaintiff, v. SEARS HOLDINGS CORPORATION, EDWARD S. LAMPERT, SEARS HOLDINGS CORPORATION ADMINISTRATIVE COMMITTEE, MICHAEL O’MALLEY, SEARS HOLDINGS CORPORATION INVESTMENT COMMITTEE, CAROL HINES WACASER, and JOHN DOES 1 -10, Defendants. Case: 1:17-cv-05825 Document #: 1 Filed: 08/10/17 Page 2 of 102 PageID #:2 Table of Contents I. INTRODUCTION ............................................................................................................ 1 II. NATURE OF THE ACTION ........................................................................................... 1 III. JURISDICTION AND VENUE ....................................................................................... 6 IV. PARTIES .......................................................................................................................... 6 A. Plaintiff ................................................................................................................. 6 B. Defendants And Their Fiduciary Status ................................................................ 6 1. Company Defendant ................................................................................ -

Tracking Corporate Accountability in the Apparel Industry

Tracking Corporate Accountability in the Apparel Industry Updated August 3, 2015 COMPANY COUNTRY BANGLADESH ACCORD SIGNATORY FACTORY TRANSPARENCY COMPENSATION FOR TAZREEN FIRE VICTIMS COMPENSATION FOR RANA PLAZA VICTIMS BRANDS PARENT COMPANY NEWS/ACTION Cotton on Group Australia Y Designworks Clothing Company Australia Y Republic, Chino Kids Forever New Australia Y Kathmandu Australia K-Mart Australia Australia Y Licensing Essentials Pty Ltd Australia Y Pacific Brands Australia Y Pretty Girl Fashion Group Pty Australia Y Speciality Fashions Australia Australia Y Target Australia Australia Y The Just Group Australia Woolworths Australia Australia Y Workwear Group Australia Y Fashion Team HandelsgmbH Austria Y Paid some initial relief and C&A Foundation has committed to pay a Linked to Rana Plaza. C&A significant amount of Foundation contributed C&A Belgium Y compensation. $1,000,000 to the Trust Fund. JBC NV Belgium Y Jogilo N.V Belgium Y Malu N.V. Belgium Y Tex Alliance Belgium Y Van Der Erve Belgium Y Brüzer Sportsgear LTD Canada Y Canadian Tire Corporation Ltd Canada Giant Tiger Canada Discloses cities of supplier factories, but not full Anvil, Comfort Colors, Gildan, Gold Toe, Gildan Canada addresses. TM, Secret, Silks, Therapy Plus Contributed an undisclosed amount to the Rana Plaza Trust Hudson’s Bay Company Canada Fund via BRAC USA. IFG Corp. Canada Linked to Rana Plaza. Contributed $3,370,620 to the Loblaw Canada Y Trust Fund. Joe Fresh Lululemon Athletica inc. Canada Bestseller Denmark Y Coop Danmark Denmark Y Dansk Supermarked Denmark Y DK Company Denmark Y FIPO China, FIPOTEX Fashion, FIPOTEX Global, Retailers Europe, FIPO Group Denmark Y Besthouse Europe A/S IC Companys A/S Denmark Y Linked to Rana Plaza. -

Full Clothing Lists.Xlsx

Detailed Clothing List - Alphabetically By Brand Brand Season Item Type Gender Detail 2000 Gymboree N/A Bodysuit Boys Green or red with wheel-shaped zipper pull N/A Pants N/A Fleece pants with cord lock in blue, red, green or gray with gray elastic waistband and "Gymboree" on back pocket 21 Pro USA N/A Hooded Sweatshirts N/A Pullover & zip styles. RN#92952 2b REAL N/A Hooded Sweatshirts Girls Velour, zip front wth "Major Diva" printed on front A.P.C.O. N/A Hooded Sweatshirts N/A Navy or burgundy; "Artic Zone" is printed on front abcDistributing N/A Jacket/Pant Set N/A Fleece, pink or royal blue with waist drawstring; may say "Princess" or "Angel" on it Academy N/A Pajama Pants and Boxers Both Pull-on pants for boys and girls and boxers for girls - see recall for details Active Apparel N/A Hooded Sweatshirts Boys Zipper hooded sweatshirt Adio N/A Hooded Sweatshirts Boys Zip fleece, white with blue stripes and red panels on sides. Adio on front Aeropostale N/A Hooded jackets/sweatshirts N/A Multiple brands and models - see recall Agean N/A Robes Both Variety of colors; wrap style with waist belt, two front patch pockets and hood Akademiks N/A Hooded Sweatshirts Girls 4 styles - see recall All Over Skaters N/A Hooded Sweatshirts Boys With padlocks, skaters or black with imprint Almar Sales Company N/A Watches N/A Clear plastic watches with white snaps; bands have clear, glitter-filled liquid and colored liquid inside, including pink, blue, red and yellow. -

From Cradle to Cane: the C St of Being a Female C Nsumer

From Cradle to Cane: The C st of Being a Female C nsumer A Study of Gender Pricing in New York City Consumer Affairs Bill de Blasio Julie Menin Mayor Commissioner From Cradle to Cane: The Cost of Being a Female Consumer A Study of Gender Pricing in New York City Bill de Blasio Mayor Julie Menin Commissioner © December 2015. New York City Department of Consumer Affairs. All rights reserved. 2 Acknowledgments The Department of Consumer Affairs (DCA) acknowledges the author of this report, Anna Bessendorf, Policy Analyst, and its editor, Shira Gans, Senior Policy Director. DCA would also like to acknowledge the following staff for their contributions: Sandra Abeles, Deputy Chief of Staff; Silvia Alvarez, Acting Associate Commissioner for Communications and Marketing; Amit Bagga, Deputy Commissioner for External Affairs; Yi Seul Chun, Creative Specialist; Debra Halpin, Assistant Commissioner for Creative Services; Eli Jacobs, Senior Analyst, Quality and Data Management; Abigail Lootens, Director of Communications & Marketing; Matthew Petric, Executive Director of Analysis and Strategic Planning; Alba Pico, First Deputy Commissioner; and Carla Van de Walle, Deputy Commissioner for Finance and Administration. DCA also thanks the experts who lent their knowledge to this study: Michael Cone, Managing Partner of FisherBroyles, LLP; Ingrid Johnson, Acting Associate Chairperson for the Home Products Development Department, Fashion Institute of Technology; Dr. Gary Kelm, Professor and Director, James L. Winkle College of Pharmacy, University of Cincinnati; Robin Litwinsky, Chairperson of the Fashion Business Management Department, Fashion Institute of Technology; and Nancy Youman, Co-Director of the Program on Independent Journalism, Open Society Foundations. 3 Table of Contents Executive Summary 5 Methodology 5 Findings 5 Impact 6 Detailed Industry Findings 7 I. -

Chapter 11 for an American Icon: What Sears Shows Us About Failed Leadership

DECEMBER 6, 2018 Chapter 11 for an American Icon: What Sears Shows Us About Failed Leadership On October 15 — a few months after the 125th birthday of what was once the world’s largest retailer — Sears Holdings sought Chapter 11 protection from a $134 million debt payment and announced it would close 142 stores. Thirty years ago, Sears was a retail and mail order giant. For many of its 125 years, the company dominated the retail industry, bringing quality products at affordable prices to much of America. Customer loyalty to Sears was legendary. Workshops were filled with Craftsman tools, homes were equipped with Kenmore appliances and decorated with Sears furnishings, while Sears clothing filled closets and cars ran on DieHard batteries. The Christmas shopping season wasn't complete without the Sears "Wish Book." Sears was dependable, with reliable products you could trust and a warranty that placed customer service above everything else. So, what happened? In a recent article for Total Retail, global leadership and customer service expert Shaun Belding observed that, “There is, of course, never just one thing that leads to the downfall of a company. It’s almost always a progressive and insidious erosion created by poor leadership and short-sighted decisions.” In the case of Sears, the company lost sight of what made it successful. Sears, after all, had been an innovator for much of its history. To put the Sears loss in context, here are some milestones: “Founded shortly after the Civil War, the original Sears, Roebuck & Company built a catalog business that sold Americans the latest dresses, toys, build-it-yourself houses and even tombstones.