NESTLÉ HOLDINGS, INC. and SUBSIDIARIES Annual Financial

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Rapid Evidence Assessment: Does Marketing of Commercially Available

A rapid evidence assessment Does marketing of commercially available complementary foods affect infant and young child feeding? Commissioned by the World Health Organization May 2015 Authors Dr Julie P Smith 1 Dr Ginny M Sargent 2 Dr Kaye Mehta 3 Dr Jennifer James 4 Dr Nina Berry 5 Colleen Koh 7 Libby Salmon 1 Miranda Blake 6 1. Regulatory Institutions Network, The Australian National University, Canberra ACT 2601 Australia www.anu.edu.au CRICOS Provider No. 00120C. 2. National Centre for Epidemiology and Population Health, Research School of Population Health, The Australian National University. 3. Nutrition & Dietetics, Flinders University, Adelaide, South Australia. 4. RMIT University, Bundoora, Victoria. 5. Sydney School of Public Health, University of Sydney NSW 2006. 6. School of Public Health and Preventative Medicine, Monash University, Australia. 7. Epidemiology Branch, Western Australia Department of Health, Western Australia Study expert panel Alessandro Iellamo, Independent Consultant, member of WHO STAG, formerly WHO WPRO. Dr Adriano Cattaneo, Health Services Research and International Health, Institute for Maternal and Child Health, Via dell'Istria 65/1, Trieste 34137, Italy. Professor Gerard Hastings, OBE, Professor of Social Marketing, University of Stirling and the Open University and L’École des Hautes Etudes en Santé Publique. Dr Peter Mansfield, OAM, Visiting Research Fellow, Discipline of General Practice, University of Adelaide. Corresponding author Dr Julie P Smith, Ph. +61 4 16099630, Email: [email protected] Rapid review on the effects of marketing of complementary foods page ii Acknowledgments The assistance of Dr Lucinda Bell, Nutrition & Dietetics, Flinders University, Ms Claire Caldwell and Dr Phil Baker, The Australian National University, in the preparation of this study is gratefully acknowledged. -

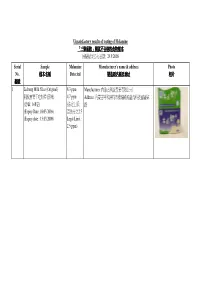

List of Food Samples for Testing of Melamine IO 29.9.2008 V3

Unsatisfactory results of testing of Melamine 「「「三聚氰胺「三聚氰胺」」」測試不合格的食物樣本」測試不合格的食物樣本 抽驗結果公布日期: 29.9.2008 Serial Sample Melamine Manufacturer’s name & address Photo No. 樣本名稱 Detected 製造商名稱及地址 相片 編號 1 Licheng Milk Slice (Original) 8.3 ppm Manufacturer: 內蒙古利誠實業有限公司 利誠實業干吃奶片(原味) 4.7 ppm Address: 內蒙古呼和浩特市機塲路鴻盛高科技園區緯二 (淨重: 168 克) (法定上限: 路 (Expiry Date: 10.03.2009) 百萬分之2.5 (Expiry date : 13.03.2009) Legal Limit : 2.5 ppm) Satisfactory results of testing of Melamine 「「「三聚氰胺「三聚氰胺」」」測試合格的食物樣本」測試合格的食物樣本 抽驗結果公布日期: 29.9.2008 Serial Sample Manufacturer’s name & address Photo No. 樣本名稱 製造商名稱及地址 相片 編號 1 Meiji Hohoemi Milkpowder Cube (Net Weight: Manufacturer: Meiji Dairies Corporation 108 g) Address: 1-2-10, Shinsuna, Koto-ku, Tokyo (Expiry date : 21.6.2009) 明治乳業株式會社KS 東京都江東區新砂1-2-10 2 Icero Follow Momo Milk Powder Above 9 Month Manufacturer: Icero Co., Ltd. (Net Weight: 900 g) Address: 16-23, Minato 4-Shibaura, Minato-ku, (Expiry date : 14.10.2009) Tokyo, Japan 3 Gerber Graduates Finger Foods Biter Biscuits Manufacturer: Gerber Products Company (Net weight 5 oz (142g)) Address: Fremont, MI 49413, USA (Expiry date : 25.4.2010) Satisfactory results of testing of Melamine 「「「三聚氰胺「三聚氰胺」」」測試合格的食物樣本」測試合格的食物樣本 抽驗結果公布日期: 29.9.2008 Serial Sample Manufacturer’s name & address Photo No. 樣本名稱 製造商名稱及地址 相片 編號 4 Heinz Smooth Strawberry Yoghurt Dessert (110g Manufacturer: H.J. Heinz Company Australia Limited Net) Address: 105 Camberwell Road, Hawthorn East, Victoria 3123 (All ages from 6 months) Australia (Expiry date : 24.3.2010) 5 Kameda Haihain (Weight 53g) Manufacturer: Kameda Seika Company Limited (Expiry date : 22.12.2008) Address: 3-1-1 Kamedakogyodanch Konan Nigata Nigata, Japan Product of Japan 6 Takara Animal Mate Biscuits (Net Weight 340g) Manufacturer: Takara Confectionery Co., Ltd. -

Nestlé Waters, to Succeed Him

Nestlé – Annual Review 2016 Annual Review 2016 WorldReginfo - 8a7d5213-eb65-4648-8062-2f092a53a929 Contents 2 Letter to our shareholders 10 The strategy 14 The highlights 34 150 years 42 Financial review 44 Group overview 48 Product category and operating segment review 55 Principal risks and uncertainties 57 Factories 58 Corporate Governance and Compliance 59 Corporate Governance 60 Board of Directors of Nestlé S.A. 62 Executive Board of Nestlé S.A. 64 Compliance 65 Shareholder information Accompanying reports Nestlé in society Corporate Governance Report 2016 Creating Shared Value and Compensation Report 2016 meeting our commitments 2016 Financial Statements 2016 Nestlé in society Corporate Governance Report 2016 Creating Shared Value Compensation Report 2016 and meeting our Financial Statements 2016 commitments 2016 WorldReginfo - 8a7d5213-eb65-4648-8062-2f092a53a929 Our business For 150 years, Nestlé has created products that enhance quality of life and contribute to a healthier future. Across the globe we provide What we sell (in CHF billion) safe nutritious products for individuals and families. We Powdered and Nutrition and Milk products Prepared dishes Liquid Beverages Health Science and Ice cream and Cooking aids have seven categories in our product portfolio, offering tastier and healthier choices for every life stage, at all 19.8 15.0 14.3 12.1 times of the day. PetCare Confectionery Water 12.1 8.7 7.4 Our continued growth has Where we sell (in CHF billion) enabled us to help improve the lives of millions of people through the products and EMENA services we provide, creating 26.8 value for both our business and the communities where we operate. -

Caring and Curing

Caring and Curing Annual Report 2002 Novartis www.novartis.com Annual Report 2002 …molecules for medicines… Martin Klumpp, PhD, Lukas Leder, PhD, and Aline Tirat, Novartis Lead Discovery Center, Basel, Switzerland ...writing in sand... Sarvodaya Pre-School, Paluchera, Sri Lanka Contents Financial Highlights2 News in 20023 Letter from Daniel Vasella5 Amazing Patient Stories9 Division and Product Review Pharmaceuticals14 Joining Forces in the Quest for Cures22 Consumer Health29 Corporate Citizenship37 Animal Welfare46 Health, Safety and Environment49 Human Resources60 Corporate Governance Corporate Governance67 Board of Directors79 Executive Committee82 Business Unit Heads84 Financial Report Operating and Financial Review87 Equity Strategy and Share Information98 Group Consolidated Financial Statements and Notes104 Principal Companies138 Reconciliation to US GAAP140 Financial Statements of Novartis AG151 Due Dates for Reporting and Contacts157 Front cover: Svenja, a young eczema patient during an examination at the Center for Dermatology, University of Frankfurt am Main, Germany. Back cover: Svenja with her brother, Jan Patrick in the pediatric ward. Novartis Group 1 Financial Highlights Sales CHF millions Free cash flow2 CHF millions 2002 32 412 2002 4 463 2001 31 643 2001 4 073 20001 29 112 20001 3 254 Operating income CHF millions Research and development CHF millions 2002 7 887 2002 4 339 2001 7 277 2001 4 189 20001 6 727 20001 4 011 Net income CHF millions Employees at year end 2002 7 313 2002 72 877 2001 7 024 2001 71 116 20001 6 -

NESTLÉ HOLDINGS, INC. and SUBSIDIARIES Annual Financial

NESTLÉ HOLDINGS, INC. AND SUBSIDIARIES Annual Financial Report Management Report Responsibility Statement Consolidated Financial Statements December 31, 2019 and 2018 (With Independent Auditors’ Report Thereon) NESTLÉ HOLDINGS, INC. AND SUBSIDIARIES Table of Contents Page Management Report 3 Responsibility Statement 8 Independent Auditors’ Report 9 Consolidated Financial Statements Consolidated Balance Sheet 14 Consolidated Income Statement 15 Consolidated Statement of Comprehensive Income 16 Consolidated Statement of Changes in Equity 17 Consolidated Statement of Cash Flows 18 Notes to Consolidated Financial Statements (1) Accounting Policies 19 (2) Analyses by Segment 22 (3) Trade and Other Receivables, net 26 (4) Inventories, net 27 (5) Derivative Assets and Liabilities and Hedge Accounting 28 (6) Property, Plant and Equipment, net 31 (7) Employee Benefits 34 (8) Investments in Associated Companies 40 (9) Deferred Taxes 41 (10) Goodwill and Intangible Assets 42 (11) Financial Instruments 47 (12) Financial Risks 55 (13) Assets Held for Sale 60 (14) Accruals 61 (15) Provisions and Contingencies 61 (16) Net Financial Income/(Expense) 63 (17) Net Other Trading and Operating Income/(Expenses) 64 (18) Income Tax Expense 66 (19) Acquisitions and Disposals of Businesses 67 (20) Transactions with Related Parties 71 (21) Events after the Balance Sheet 73 2 NESTLÉ HOLDINGS, INC. AND SUBSIDIARIES December 31, 2019 and 2018 Management Report Nestlé Holdings, Inc. (“NHI”) (hereinafter, together with its subsidiaries, referred to as the “Company”) incorporated in the State of Delaware, United States, is a wholly owned subsidiary of NIMCO US, Inc., which is an indirect wholly owned subsidiary of Nestlé S.A., incorporated in Switzerland, which is the holding company of the Nestlé group of companies (hereinafter, referred to as the “Nestlé Group”). -

Finanzielle Berichterstattung 2008

Finanzielle Berichterstattung 2008 Konzernrechnung der Nestlé-Gruppe Jahresrechnung der Nestlé AG © 2009, Nestlé AG, Cham und Vevey (Schweiz) Konzept Nestlé AG, Group Accounting & Reporting Design Nestec AG, SGDU, Corporate Identity & Design Druck Neidhart + Schön Group AG (Schweiz) Papier Dieser Bericht ist auf LuxoArt gedruckt, einem Papier aus nachhaltiger Forstwirtschaft und anderen kontrollierten, vom Forest Stewardship Council (FSC) zertifi zierten Quellen. Konzernrechnung der Nestlé-Gruppe Umrechnungskurse der wichtigsten Währungen 2 15. Immaterielle Werte 38 Konsolidierte Erfolgsrechnung für das Jahr 2008 3 16. Leistungen an Arbeitnehmer 40 Konsolidierte Bilanz per 31. Dezember 2008 4 17. Aktienbasierte Vergütungen 46 Konsolidierte Mittelfl ussrechnung für das Jahr 2008 6 18. Rückstellungen und Eventualverbindlichkeiten 51 Veränderung des konsolidierten Eigenkapitals mit 19. Finanzanlagen und fi nanzielle Verbindlichkeiten 52 Aufstellung der erfassten Erträge und 20. Finanzrisiken 56 Aufwendungen für das Jahr 2008 7 21. Eigenkapital 65 Anmerkungen 9 22. Mittelfl ussrechnung 68 1. Grundsätze der Rechnungslegung 9 23. Erwerbungen von Geschäftsbereichen 70 2. Veränderung des Konsolidierungskreises 21 24. Veräusserungen von Geschäftsbereichen 71 3. Segmentinformationen 22 25. Verpfl ichtungen aus Leasingobjekten 72 4. Sonstige Erträge/(Aufwendungen), netto 26 26. Transaktionen mit nahestehenden 5. Nettofi nanzierungskosten 26 Gesellschaften oder Personen 73 6. Kosten pro Kostenarten 27 27. Joint Ventures 74 7. Steuern 27 28. Garantien 75 8. Assoziierte Gesellschaften 29 29. Group Risk Management 75 9. Gewinn pro Aktie 30 30. Ereignisse nach dem Bilanzstichtag 76 10. Forderungen aus Warenlieferungen und andere 31. Gesellschaften der Gruppe 76 Forderungen 31 32. Anpassung der Vergleichszahlen infolge der 11. Derivative Vermögenswerte und Verbindlichkeiten 32 Erstanwendung von IFRIC 14 76 12. Vorräte 33 Bericht der Revisionsstelle zur Konzernrechnung 77 13. -

Nestlé and L'oréal: the “Elephant in the Room”1

For the exclusive use of A. Mansouri, 2020. W19607 NESTLÉ AND L’ORÉAL: THE “ELEPHANT IN THE ROOM”1 Ram Subramanian wrote this case solely to provide material for class discussion. The author does not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized, or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G 0N1; (t) 519.661.3208; (e) [email protected]; www.iveycases.com. Our goal is to publish materials of the highest quality; submit any errata to [email protected]. Copyright © 2019, Ivey Business School Foundation Version: 2019-10-29 On July 26, 2018, Ulf Mark Schneider, was the chief executive officer (CEO) of the Switzerland-based Nestlé S.A. (Nestlé). For the first time in his 18-month tenure as the head of the global consumer-packaged goods company, Nestlé’s results indicated the positive effects of the many strategic changes he had spearheaded. Organic growth had shown a period-to-period increase of 2.6 per cent (versus 2.4 per cent for 2017) and operating margin had risen to 16.1 per cent (versus 15.9 per cent in 2017).2 The company was midway through its US$20 billion3 share buyback4 and, in March 2018, had signed a $7 billion contract to sell Starbucks-branded coffee and tea in retail stores globally.5 Schneider had divested the company’s US confectionary business and made several key acquisitions in its branded foods business.6 However, Nestlé had not publicly responded to a hedge fund’s insistence that the company sell its nearly $32 billion7 stake in the French cosmetics company, L’Oréal S.A. -

Corporate Governance Report 2020 Compensation Report 2020

Financial Statements 2020 Compensation Report 2020 Corporate Governance Report 2020 Nestlé – Corporate Governance Report 2020 | Compensation Report 2020 | Financial Statements 2020 Contents 1 Corporate Governance Report 2020 3 Group structure and shareholders 4 Capital structure 6 Board of Directors 20 Executive Board 24 Compensation, shareholdings and loans 25 Shareholders’ participation rights 26 Change of control and defence measures 27 Auditors 28 Information policy 29 General Organization of Nestlé S.A. 31 Compensation Report 2020 51 Report of the statutory auditor on the compensation report 53 Articles of Association of Nestlé S.A. 63 Financial Statements 2020 65 Consolidated Financial Statements of the Nestlé Group 2020 67 Principal exchange rates 68 Consolidated income statement for the year ended December 31, 2020 69 Consolidated statement of comprehensive income for the year ended December 31, 2020 70 Consolidated balance sheet as at December 31, 2020 72 Consolidated cash flow statement for the year ended December 31, 2020 73 Consolidated statement of changes in equity for the year ended December 31, 2020 75 Notes 152 Statutory auditor’s report on the audit of the consolidated financial statements 162 Financial information – 5 year review 164 Companies of the Nestlé Group, joint arrangements and associates 183 154th Financial Statements of Nestlé S.A. 185 Income statement for the year ended December 31, 2020 186 Balance sheet as at December 31, 2020 187 Notes to the annual accounts 196 Proposed appropriation of profit 198 Report of the statutory auditor on the financial statements Front cover Nescafé: The world’s number one coffee A truly global brand, Nescafé is coffee in any language, giving consumers a strong start to their day. -

Nestlé Waters Is Leading a Fast‑Growing Category, with a Unique Brand Portfolio Including the World’S Largest Water Brand, Nestlé Pure Life

Nestlé – Annual Review 2017 Good Food, Good Life Annual Review 2017 Nestlé. Enhancing quality of life and contributing to a healthier future. WorldReginfo - d1a94fd3-260e-4ebe-b3d1-b77a35d9f812 Our purpose Nestlé. Enhancing quality of life and contributing to a healthier future. Nestlé is the world’s largest food and beverages company and is present in 189 countries around the world. We offer a wide portfolio of products and services for people and their pets throughout their lives. Our more than 2000 brands range from global icons like Nescafé and Nespresso to local favourites like Ninho. Nestlé is based in the Swiss town of Vevey where it was founded more than 150 years ago. Contents Accompanying reports 2 Letter to our shareholders Annual Review 2017 6 Our strategy Corporate Governance Report 2017 Compensation Report 2017 10 Innovating for a changing world Financial Statements 2017 14 Connecting through our brands 26 Creating Shared Value 38 Financial review Online 54 Corporate Governance and Compliance You can find more information about the Nestlé Group at 61 Shareholder information www.nestle.com Find out more about Creating Shared Value at www.nestle.com/csv WorldReginfo - d1a94fd3-260e-4ebe-b3d1-b77a35d9f812 Our performance Our performance is driven by our Nutrition, Health and Wellness strategy, the engine of our value creation. Our 2017 organic sales Group sales (in CHF) Organic growth * Real internal growth * growth was within the guided range but below our 89.8 billion 2.4% 1.6% expectations. Our cost reduction initiatives delivered margin improvement ahead of expectations. On the right is a summary of the results Underlying trading Underlying trading Underlying trading we achieved during the year. -

Notes on Contributors and Index

Notes on Contributors arlene voski avakian is professor and director of women’s studies at the University of Massachusetts Amherst. She is editor of Through the Kitchen Window: Women Explore the Intimate Meanings of Food and Cook- ing (1997), author of Lion Woman’s Legacy: An Armenian American Mem- oir (1992), and co-editor of African American Women and the Vote, 1837– 1965 (1997). Avakian has also written numerous articles on a variety of topics centering on gender, race, class, and sexuality, some fiction, and a bit of poetry. amy bentley is an associate professor in the Department of Nutrition, Food Studies, and Public Health at New York University. A cultural historian by training, Bentley is the author of Eating for Victory: Food Rationing and the Politics of Domesticity (1998), as well as several articles examining the cultural and historical landscapes of food. “Feeding Baby, Teaching Mother” is part of a larger history of baby food in the United States currently in progress. carole counihan is professor of anthropology at Millersville Univer- sity in Pennsylvania. She is author of Around the Tuscan Table: Food, Family, and Gender in Twentieth Century Florence (2004) and The Anthro- pology of Food and Body: Gender, Meaning, and Power (1999). She is editor of Food in the USA: A Reader (2002) and co-editor with Penny Van Esterik of Food and Culture: A Reader (1997). Counihan is editor of the scholarly journal Food and Foodways and a member of the editorial board of Slow: The Magazine of the International Slow Food Movement. She is working on a book on women and food in the San Luis Valley of Colorado. -

CCC-Clemente 1 (1-81)

Part One STRATEGIC PERSPECTIVE ON M&A PLANNING 1 “Marketing Due Diligence” in Strategic Mergers and Acquisitions In the 1990s, seemingly not a day goes by when the business press does not report on multimillion-dollar mergers and acquisitions. Companies of all sizes and all industries worldwide are seizing the opportunities to broaden their competitiveness by forging cor- porate combinations with strategically synergistic partners. The goals of achieving growth, tapping into new markets, and creating unassailable strategic advantage underlie each transaction. Corporate merger and acquisition activity continues to thrive, with the annual dollar volume of M&A transactions steadily increasing. For example, in 1994 there were ap- proximately $350 billion in M&A deals in the United States. In 1995, that figure rose to almost $400 billion. The year 1996 saw total deal volume in the United States exceed $620 billion, a figure based on the dollar volume of known deals and projections of unannounced transactions and deal prices. And in 1997, M&A transactions totaled more than $900 billion. Several factors are fueling the continuing explosion in merger activity. The ability of businesses to successfully achieve economies of scale, broaden geographic market cov- erage, and more effectively compete globally have helped create an aggressive acquisi- tion marketplace. In addition, the search for cost reductions through M&A—particularly in such mature industries as retailing, banking, and health care—is being used to offset companies’ inability to increase profits through price or production increases. In all like- lihood, the merger mania of the late 1990s will carry over into the new millennium as these and other factors drive corporate growth planning. -

Caring and Curing Annual Report 2003 UG E RZ Innen 27.2.2004 10:32 Uhr Seite 1

UG_e_RZ_neu_Aussen 27.2.2004 10:36 Uhr Seite 1 www.novartis.com Caring and Curing Novartis Annual Report 2003 Annual Report 2003 UG_e_RZ_innen 27.2.2004 10:32 Uhr Seite 1 Novartis pharmaceutical production, Stein, Switzerland Novartis pharmaceutical production, Changping, Beijing, China Contents Overview 2 Financial Highlights 3 News in 2003 Letter from Daniel Vasella 5 The New Number Five in Pharmaceuticals Division and Business Units 9 Pharmaceuticals Giving Thalassemia Patients a Choice Discovering Pharmaceuticals Reliably and Predictably The Long Road to Blood-Pressure Control Treating Breast Cancer Will Never Be the Same Epilepsy - Putting Children First A New Frontier in the Fight Against Severe Allergic Asthma Two Decades of Leadership in Transplantation Hearing the Patient, Healing the Patient - Irritable Bowel Syndrome The Right Note: Saving a Singer’s Sight 32 Consumer Health Sandoz - Building a World Leader in Generics OTC - The Value of Global Brands Animal Health - Up and Running, Despite Arthritis Medical Nutrition - A New Relevance for Cancer Patients Infant & Baby - Alerting Parents to the Dangers of Childhood Obesity CIBA Vision - Innovation in Focus Corporate Citizenship 45 Active Societal Engagement Health, Safety and Environment 57 Turning Strong Commitment Into Firm Actions Human Resources 69 Fulfilling Career Aims Corporate Governance Section 77 Corporate Governance 90 Board of Directors 94 Executive Committee 96 Business Unit Heads Financial Report 99 Operating and Financial Review 111 Equity Strategy and Share Information