RC2018 Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pernod Ricard Sales and Results H1 FY21

11 February 2021 • • • • • • • • • • • • • • • • • • • • • • • • • • ▪ ▪ ▪ ▪ • • • • • • • • • • • • Launch of Secret Speyside Single Malt Collection Martell Noblige Revamp Campaign “Dare to be the Martell Gourmet Theater 2020 editions The Glenlivet Media “Original Stand Out Swift” successfully launched in December by tradition” campaign with new communication assets • • • • • • Royal Stag new campaign “Make it Large!” featuring leading global New limited edition packs for 100 Pipers Imperial Blue latest edition of its widely popular ‘Men Will Be icons from across fields, ethnicities, nationalities & geographies Legacy Project Men’ campaign featuring Karan Wahi • • • • Jameson Tastehouse Dublin Martell boutique, Hainan, China • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • L’Atelier Martell opened groundbreaking new store in Martell offering all-new content online partnership with Angel Chen, well-known Chinese central Shenzhen, China, its first store outside France. famous chefs. Martell has rolled out concept in Malaysia designer, revisited Martell Noblige – New limited edition for festive season • • • • • • Jameson Nigeria ran a #JamesonBeardDay Content & eCRM Jameson Limited Edition bottle for exclusive sale in Japan, 'Sliders TVC' is rolled out across many of Jameson's campaign, in celebration of World Beard Day, showcasing stories designed in collaboration with founder and designer of popular European markets- Slovakia, Sweden, Romania etc. from the Bearded Brothers. Japanese apparel brand ‘PUNK DRUNKERS’ • • • • • • • • • Absolut launched a new campaign ‘It’s in Our spirit’, Absolut collaborated with Korean artist Xeva Absolut has launched the #VoteResponsibly campaign to highlighting the desire to come together and be more inclusive to create a giant eco graffiti in the heart of remind people to vote for the US elections and Pernod Ricard both on and offline. Seoul. USA has closed its offices to enable employees to go to vote. -

The Ranking of the World's Million-Case Spirits Brands 2019

THE RANKING OF THE WORLD’S MILLION-CASE SPIRITS BRANDS 2019 001 Cover DI MILLIONAIRES 2019 FINAL.indd 1 04/06/2019 14:58 The millionaires’ JUNE 2019 DRINKSINT.COM 3 COMMENT The volume game Regardless of Trump’s tariff wars, Brexit and other socio-economic issues, the spirits industry is thriving. And once again The Millionaires’ Club bears witness to the movements of million-case spirits brands all over the globe. Ninety-two of the 153 millionaire brands listed in the 2019 supplement demonstrate an increase in volumes, so the industry shows no signs of slowing down. The biggest volume players are always from Asia due to the huge populations and brand loyalty in major markets, with soju’s Jinro now boasting 87m cases. But it’s also been fascinating to see Diageo’s Indian brandy Men’s Club virtually double in growth despite it showing decline over the previous four years. Looking at Europe, Martell has had a great year. A huge 18% growth shows how cognac is returning to its former glory in terms of international sales and the same can almost be said for vodka in the US as it appears the market is no longer in free-fall, with many of the big players returning to growth. It’s possible that volume sales will dwindle in importance as future generations of consumers continue to drink less but better – quality over quantity. The assets may shrink and the players may change, but this game of volumes isn’t going to end any time soon. Shay Waterworth SUPPLEMENT EDITOR ISTOCK.COM/ GM STOCK FILMS GM STOCK ISTOCK.COM/ contents THE SPIRITS MARKET 4 -

“A Taste of the Scotland” August 19, 2021 (Thursday) @ 7:00 PM - Single Malt Tasting & Heavy Bites - $45 Event Fee Landmark Diner (Buckhead), 3652 Roswell Rd

METRO ATLANTA SCOTCH CLUB “A Taste of the Scotland” August 19, 2021 (Thursday) @ 7:00 PM - Single Malt Tasting & Heavy Bites - $45 Event Fee Landmark Diner (Buckhead), 3652 Roswell Rd. NE, Atlanta, GA 30305 - Ph: (404) 816-9090 Pay Online: https://scotchclub.com/event/Landmark081921/ or Pay at the Door WHISKY #1 SCAPA Single Malt / 10-Year / 43% ABV / IB: Gordon & MacPhail (Dist Label range) / Dist Owner: Chivas Brothers Ltd. (Pernod Ricard S.A.) / Island (Orkney) Scapa Distillery St. Ola, Kirkwall, Isle of Orkney KW15 1SE SCOTLAND Pronunciation: SKAA-pa - SWA Whisky Map Location: #41 Translation: ‘Boat’ Slogan: “The Orcadian” Region (District): Islands (Orkney) Neighbors: Highland Park Distillery & Orkney Gin Distillery Established: 1885 Founder: Macfarlane & Townsend, Speyside distillers. Operated by John Townsend from 1885 to 1919. First Distillation: October 1885 - Demonym: An resident of Orkney is called an Orcadian Status: Active/Producing Location: On the shore of the Scapa Flow (where Germany scuttled its High Seas Fleet at the end of WWI rather than surrendered them there to the Allied Forces. Scapa is location, one mile south of Highland Park Distillery, on the high cliff of a large natural harbor which is strategic to UK naval defense. House Style: Scapa is a whisky to be enjoyed, not endured. Oily in body with chocolate, salt and straw in the flavor. It’s mild and easy-drinking whisky. It’s highly rated and well-known for its unique heather notes (reminiscent of freshly-cut ripe summer pear) and honey flavor. Water Source: Lingro Burn, its cooling water source, is adjacent to the distillery. -

Sonny Molloy's Irish Whiskey

SONNY MOLLOY’S IRISH WHISKEY BAR Just a brief stroll down High Street will bring whiskey. His personal favourite being Redbreast you to the door of Sonny Molloy’s Irish 12 year old or on special occasions he would Whiskey Bar. The once famous drapery shop choose a dram of Jameson 18 year old. was run by the legendry Galweigian, Sonny In Sonny Molloy’s you will always be Molloy. Sonny was a man of considerable guaranteed a warm welcome by the staff and achievement, though very modest, he was a no visit would be complete without having the larger than life character. The building itself was ultimate high stool experience. Locals often part of a Medieval property built in the 1600’s, take to the high stool or tuck up in a snug some of which formed part of the old Galway by the fire with a whiskey taster board. It is city walls. The counter of the bar is still the very one of the best ways to unwind away from the same as when Sonny himself worked behind hustle and bustle of Galway’s busy streets. This it! With beautiful old world architecture and authentic Irish local also offers a full menu original furnishings Sonny Molloy’s is a lively of traditional Irish dishes with popular choices local at the heart of the Galway community. such as Herterich’s of Galway Bangers and The bar itself is brimming with cabinets of Mash. Before you leave, be sure to ask staff the finest Irish Whiskeys with selections such about the long standing tradition of “A Toast To as the Midleton Pearl, Inish Turk Beg and Sonny” whereby you will receive a personalised the Jameson Vintage Reserve. -

Slamb Menu 2019.Indd

- SNACKS - Nocellara Olives (vg) £3.50 Padron peppers, smoked sea salt (vg)(gf) £5 Halloumi fries, mint yogurt, Aleppo pepper (v) £6 Tempura cauliflower, korean hot sauce, sesame & coriander(v) £5 Buttermilk fried chicken, korean hot sauce, sesame & coriander £6.50 - MAINS - Fish finger bun £6.50 Fish & chips £12.5 with burger cheese, crisp lettuce & tartare Camden Hells battered haddock, mushy peas Giant rigatoni (vg) £10 Black bean burger & fries (vg) £11.5 kale pesto, toasted pumpkin seeds & vegan vegan relish, gem lettuce & gherkin Vegan Caesar Salad (vg) £9 Chargrilled beef burger & fries £12.5 croutons & vegan parmesan american cheese, bacon, relish,lettuce, onion add grilled chicken £2.50 & gherkin - SIDES - Gem salad (vg) £3.50 Bowl of fries (vg) £3.50 Fries with curry sauce (vg) £4.5 If you suffer from any allergies please speak to a member of staff and we will happily guide you through our menu www.TheSlaughteredLambPub.com - BEER - DRAUGHT BEERS Pint STOUTS & PORTERS Camden Town Hells Lager U.K. 4.6% £4.80 Mondo ‘Turnt’ Dark Fruit Stout U.K. 6.0% £5.50 Hawkes Urban Orchard Apple Cider U.K. 4.5% £4.80 Magic Rock ‘Common Grounds’ Porter U.K. 5.4% £5.50 Camden Town Pale Ale U.K. 4.0% £4.90 Loba Negra Mexico 5.5% £5.70 Camden Town ‘Wit’ Wheat Beer U.K. 4.3% £5.00 Põhjala ‘Ohtu’ Porter Estonia 5.5% £6.00 Stone & Wood Pacific Ale AUS. 4.4% £5.00 Mondo/Malmö Brewing Mole Stout U.K. 7.2% £6.50 Big Drop Citra IPA (Low-Alcohol) U.K 0.5% £5.20 Collective Arts ‘Stranger Than Fiction’ Porter Canada 5.5% £6.70 Camden ‘Harvest Hells’ Amber Lager U.K. -

Irish Mar18.Pdf

IRISH WHISKEY: THE IRISH RESURGENCE IS MORE THAN LOOKING MORE AND MORE LIKE A SUSTAINABLE TREND JUST LUCK BY JEFF CIOLETTI rish whiskey continues to be the big international growth Dining Saloon, says that the market for story in the spirits space, with another year of double- higher-end Irish whiskey has always been digit gains for the U.S. market. And it’s become a force to there, it was just a matter of making it be reckoned with, as the base it’s been growing from isn’t available to the consumers who were nearly as small as it used to be. ready for it—beyond travelers to Ireland I bringing back bottles with them. “The problem was accessibility,” says Thomas. According to Bord Bia, the Irish food American Prohibition helped hasten its “We’re finally getting it imported and into board, revenue from Irish whiskey exports fall from prominence—to be usurped, pri- broader markets in the U.S.” to the U.S. market surged 16%, slightly marily, by Scotch. Thomas points to major market events outpacing the 14% jump in exports to Eu- “It’s a really exciting time for Irish like Beam’s purchase of Cooley Distillery ropean Union countries outside of Ireland. whiskey as there’s been a category-wide from founder John Teeling in 2012 as sig- The Distilled Spirits Council reported commitment to superior taste and qual- nificant factors in Irish whiskey’s expan- 11.3% volume growth for the category in ity that has brought on its current boom,” sion. Cooley producers of such brands as 2017, now totaling over 4 million cases in says Paige Parness, Senior Brand Manager The Tyrconnell, Kilbeggan, Greenore and the U.S. -

Price List(2018-19)

Price List(2018-19) Brand Name Label Name Pack Size MRP/Bottles ADS SPIRITS PRIVATE LIMITED whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 180ML 124 whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 375ML 252 whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 750ML 504 whisky ROYAL GREEN DELUXE BLENDED WHISKY 180ML 142 whisky ROYAL GREEN DELUXE BLENDED WHISKY 375ML 290 whisky ROYAL GREEN DELUXE BLENDED WHISKY 750ML 580 whisky THE GENERATION DELUXE BLENDED WHISKY 180ML 180 whisky THE GENERATION DELUXE BLENDED WHISKY 375ML 365 whisky THE GENERATION DELUXE BLENDED WHISKY 750ML 730 ALCOBREW DISTILLERIES INDIA PRIVATE LIMITED whisky GOLFER'S SHOT BARREL AGED WHISKY 180ML 186 whisky GOLFER'S SHOT BARREL AGED WHISKY 375ML 380 whisky GOLFER'S SHOT BARREL AGED WHISKY 750ML 759 whisky OLD SMUGGLER BLENDED SCOTCH WHISKY 750ML 1278 whisky WHITE & BLUE PREMIUM WHISKY 180ML 142 whisky WHITE & BLUE PREMIUM WHISKY 375ML 290 whisky WHITE & BLUE PREMIUM WHISKY 750ML 580 whisky WHITE HILLS RESERVE WHISKY 180ML 125 whisky WHITE HILLS RESERVE WHISKY 375ML 253 whisky WHITE HILLS RESERVE WHISKY 750ML 507 ALLIED BLENDERS AND DISTILLERS PVT.LTD. Rum JOLLY ROGER DELUXE XXX RUM 180ML 111 Rum JOLLY ROGER DELUXE XXX RUM 375ML 225 Rum JOLLY ROGER DELUXE XXX RUM 750ML 449 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 180ML 137 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 375ML 281 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 750ML 559 whisky OFFICER'S CHOICE BLUE SUPERIOR GRAIN WHISKY 180ML 125 whisky OFFICER'S CHOICE BLUE SUPERIOR GRAIN WHISKY 375ML 255 whisky OFFICER'S CHOICE BLUE -

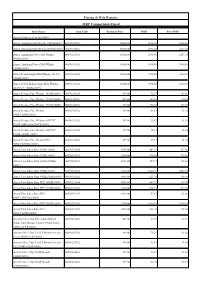

Pricing & Web Reports MRP Comparision Report

Pricing & Web Reports MRP Comparision Report Item Name Item Code Declared Price MRP Prev.MRP Amrut Distilleries Pvt Ltd (0009) Amrut Amalgam Malt Whisky 750ML(0009) 00090102901 15000.00 3894.68 3400.86 Amrut Amalgam Malt Whisky-500ML(0009) 00090102916 15000.00 2596.45 2267.24 Amrut Amalgam Peated Malt Whisky 00090103116 15000.00 2596.45 2267.24 500ML(0009) Amrut Amalgam Peated Malt Whisky 00090103101 15000.00 3894.68 3400.86 750ML(0009) Amrut Fusion Single Malt Whisky (42.8%) 00090103201 15000.00 3894.68 3400.86 750ML(0009) Amrut Peated Indian Single Malt Whisky- 00090103301 15000.00 3894.68 3400.86 42.8%V/V 750ML(0009) Amrut Prestige Fine Whisky 180 Ml (0009) 00090100304 499.00 70.27 63.10 Amrut Prestige Fine Whisky 375 Ml (0009) 00090100302 499.00 145.43 130.49 Amrut Prestige Fine Whisky 750 Ml (0009) 00090100301 499.00 290.85 260.98 Amrut Prestige Fine Whisky 00090100352 499.00 35.13 31.55 90MLx96Btls(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190352 499.00 35.13 31.55 PACK 90MLx96A PACK(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190304 499.00 70.27 63.10 PACK-180ML (0009) Amrut Prestige Fine Whisky-PET 00090102652 499.00 35.13 31.55 90MLx96P.Btls (0009) Amrut Two Indies Rum 180ML(0009) 00090301104 4554.00 467.51 397.00 Amrut Two Indies Rum 375ML(0009) 00090301102 3800.00 930.47 783.56 Amrut Two Indies Rum 60MLx150Btls 00090301107 4924.00 157.17 133.66 (0009) Amrut Two Indies Rum 750ML(0009) 00090301101 3800.00 1860.94 1567.14 Amrut Two Indies Rum 90MLx96Btls(0009) 00090301152 4554.00 233.76 198.50 Amrut Two Indies Rum-PET 180ML(0009) -

Irish Whiskey Technical File

TECHNICAL FILE SETTING OUT THE SPECIFICATIONS WITH WHICH IRISH WHISKEY/UISCE BEATHA EIREANNACH/IRISH WHISKY MUST COMPLY Food Industry Development Division Department of Agriculture, Food and the Marine October 2014 Number of pages : 17 File reference: FD/36/073 Language: English (As registered by the European Union Commission Services) Table of Contents 1. NAME AND CATEGORY OF SPIRIT DRINK INCLUDING THE GEOGRAPHICAL INDICATION: 1 1.1. Name: 1 1.2. Category of spirit drink: 1 2. DESCRIPTION OF THE SPIRIT DRINK INCLUDING PRINCIPAL PHYSICAL, CHEMICAL AND ORGANOLEPTIC CHARACTERISTICS OF THE PRODUCT: 1 2.1. Principal Physical Characteristics: 1 2.1.1. Product description 1 2.1.2. Characteristics of Irish Whiskey compared to other whiskies 1 2.2. Classifications of “Irish Whiskey/Uisce Beatha Eireannach/Irish Whisky”: 2 2.3. Principal Chemical Characteristics: 2 2.3.1. Alcoholic Content: 2 2.4. Principal Organoleptic Characteristics: 2 3. DEFINITION OF THE GEOGRAPHICAL AREA CONCERNED: 3 4. THE METHOD FOR OBTAINING THE SPIRIT DRINK: 4 4.1. Stages in the Production Process: 4 4.1.1. Stage 1: Brewing 4 4.1.2. Stage 2: Fermentation 4 4.1.3. Stage 3: Distillation 4 4.1.3.1 Distillation using Pot Stills 4 4.1.3.2 Distillation using Column Stills 5 4.1.4. Stage 4: Maturation 5 4.1.5. Stage 5: Bottling 6 4.1.5.1 Chill filtration 6 4.1.5.2 Caramel colouring E150a 6 4.2. Production Processes for the varieties of Irish Whiskey/Uisce Beatha Eireannach/Irish Whisky: 6 4.2.1. Pot Still Irish Whiskey/Irish Pot Still Whiskey 6 4.2.2. -

Code for Commercial Communications

Code for Commercial Communications January 2020 This Code for Commercial Communications is designed to enable our teams and their marketing agencies around the world to be creative while meeting the highest standards of responsible marketing. Menu CONFIDENTIAL INTRODUCTION GOLDEN RULES APPENDIX Pernod Ricard’s Code for Commercial Communications enables marketing agencies around the world to be creative while meeting the highest standards of responsible marketing set by Pernod Ricard. Marketing agencies should however always be mindful of, and comply with, applicable local constraints, which may be more stringent than these standards. The content of the code is confidential and contains proprietary information and intellectual property of Pernod Ricard. Neither this code nor any of the information contained herein may be reproduced or disclosed under any circumstances without Pernod Ricard’s express written permission. Disclosure, copying or distribution of this code and the information contained therein is strictly prohibited. The images used from third parties’ campaigns are limited, and reproduced for educational purposes only and not for commercial use. 1 CONFIDENTIAL INTRODUCTION GOLDEN RULES APPENDIX Preamble The content of our commercial communications is of critical importance for our reputation and our legitimacy as a responsible stakeholder in the alcohol industry. PERNOD RICARD has adopted this set of rules as its own internal Code for Commercial Communications which will apply to all its advertising and marketing around the world. Everyone involved in marketing or sales of our brands in PERNOD RICARD employees must comply with this Code for Commercial Communications and ensure that our advertising is also compliant with relevant national laws or codes which must be upheld, In case of conflicts, the relevant national codes must be followed. -

The Colonel Thomas J. Cunningham Jr. Division Welcomes You to the Inaugural Exceptional Irish Whiskey Taste Testing and Dinner at O’Faolain’S Pub!

The Colonel Thomas J. Cunningham Jr. Division welcomes you to the Inaugural Exceptional Irish Whiskey Taste Testing and Dinner at O’Faolain’s Pub! February 1, 2018, The Feast of St. Brigid This gathering is a fund raiser for our Military Chaplains under the leadership of Arch Bishop Timothy Broglio. Fr. James Hinkle, currently the Vicar at St. Theresa Parish in Ashburn, is a Military Chaplain and will be returning to Military service shortly. Fr. Jim, Thank you for your service. Aside from the proceeds from our ticket sales for Taste Testing and Dinner tonight, The Division will conduct a Silent Auction for a Round of Golf for Four at Lansdowne in 2018 – 100% of the winning bid will go to our Military Chaplains. Further, a new Division of the LAOH, soon to be known as the Daughters of Erin, will be selling 50/50 tickets this evening with 50% of the proceeds going to our Military Chaplains. We hope to make this evening the “first of many” over time. For those newly acquainted to the Ancient Order of Hibernians, We are an Irish Catholic fraternal organization; members must be Catholic and either born in Ireland or of Irish descent. Its largest membership is now in the United States, where it was founded in New York City in 1836. Its name was adopted by groups of Irish immigrants in the United States,[1] its purpose to act as guards to protect Catholic churches from anti-Catholic forces in the mid- 19th century, and to assist Irish Catholic immigrants, especially those who faced discrimination or harsh coal mining working conditions. -

Addendum Regarding: the 2016 Certified Specialist of Spirits Study Guide, As Published by the Society of Wine Educators Note

Addendum regarding: The 2016 Certified Specialist of Spirits Study Guide, as published by the Society of Wine Educators Note: This document outlines the substantive changes to the 2016 CSS Study Guide as compared to the 2015 version of the Study Guide. All page numbers reference the 2015 version. These items will not appear on Exams based on the 2015 SG. Page 9 – the following was added to the information under the “Fermentation” heading: Fermentation may also create small amounts of other alcohols, such as methanol (methyl alcohol) and a range of compounds collectively referred to as fusel oils which contain small amounts of amyl alcohol, n-propyl, and isobutyl alcohols. Page 17 – the following information was added to the section on Filtration: Many spirits undergo a process known as chill filtration. Chill filtration removes components common to many spirits that can cause a spirit to appear hazy or dull. Matured spirits in particular are likely to require chill filtration. To carry out this process, the spirit is chilled, which causes a haze to form that can then be removed. With all types of filtration, care must be taken to avoid filtering out desirable components that contribute to body and flavor along with those that are unwanted. Page 18 – the following information was added under the “bottling strength” heading: Most spirits are bottled at 37 to 43% alcohol by volume. Page 31 - the chart on the top-selling vodka brands has been updated to reflect 2015 statistics as follows (highlighted entries have changed): Top Selling Vodka Brands Rank Brand 1 Smirnoff 2 Absolut 3 Green Mark 4 Grey Goose 5 Skyy 6 Stolichnaya 7 Finlandia 8 Russian Standard 9 Cîroc 10 Ketel One 11 Sobieski 12 Eristoff Source: Drinks International (2015) Page 46 - the information pertaining to the PGI status of Plymouth gin was deleted, as the PGI was not submitted for renewal and has expired.