Pernod Ricard Sales and Results H1 FY21

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Ranking of the World's Million-Case Spirits Brands 2019

THE RANKING OF THE WORLD’S MILLION-CASE SPIRITS BRANDS 2019 001 Cover DI MILLIONAIRES 2019 FINAL.indd 1 04/06/2019 14:58 The millionaires’ JUNE 2019 DRINKSINT.COM 3 COMMENT The volume game Regardless of Trump’s tariff wars, Brexit and other socio-economic issues, the spirits industry is thriving. And once again The Millionaires’ Club bears witness to the movements of million-case spirits brands all over the globe. Ninety-two of the 153 millionaire brands listed in the 2019 supplement demonstrate an increase in volumes, so the industry shows no signs of slowing down. The biggest volume players are always from Asia due to the huge populations and brand loyalty in major markets, with soju’s Jinro now boasting 87m cases. But it’s also been fascinating to see Diageo’s Indian brandy Men’s Club virtually double in growth despite it showing decline over the previous four years. Looking at Europe, Martell has had a great year. A huge 18% growth shows how cognac is returning to its former glory in terms of international sales and the same can almost be said for vodka in the US as it appears the market is no longer in free-fall, with many of the big players returning to growth. It’s possible that volume sales will dwindle in importance as future generations of consumers continue to drink less but better – quality over quantity. The assets may shrink and the players may change, but this game of volumes isn’t going to end any time soon. Shay Waterworth SUPPLEMENT EDITOR ISTOCK.COM/ GM STOCK FILMS GM STOCK ISTOCK.COM/ contents THE SPIRITS MARKET 4 -

“A Taste of the Scotland” August 19, 2021 (Thursday) @ 7:00 PM - Single Malt Tasting & Heavy Bites - $45 Event Fee Landmark Diner (Buckhead), 3652 Roswell Rd

METRO ATLANTA SCOTCH CLUB “A Taste of the Scotland” August 19, 2021 (Thursday) @ 7:00 PM - Single Malt Tasting & Heavy Bites - $45 Event Fee Landmark Diner (Buckhead), 3652 Roswell Rd. NE, Atlanta, GA 30305 - Ph: (404) 816-9090 Pay Online: https://scotchclub.com/event/Landmark081921/ or Pay at the Door WHISKY #1 SCAPA Single Malt / 10-Year / 43% ABV / IB: Gordon & MacPhail (Dist Label range) / Dist Owner: Chivas Brothers Ltd. (Pernod Ricard S.A.) / Island (Orkney) Scapa Distillery St. Ola, Kirkwall, Isle of Orkney KW15 1SE SCOTLAND Pronunciation: SKAA-pa - SWA Whisky Map Location: #41 Translation: ‘Boat’ Slogan: “The Orcadian” Region (District): Islands (Orkney) Neighbors: Highland Park Distillery & Orkney Gin Distillery Established: 1885 Founder: Macfarlane & Townsend, Speyside distillers. Operated by John Townsend from 1885 to 1919. First Distillation: October 1885 - Demonym: An resident of Orkney is called an Orcadian Status: Active/Producing Location: On the shore of the Scapa Flow (where Germany scuttled its High Seas Fleet at the end of WWI rather than surrendered them there to the Allied Forces. Scapa is location, one mile south of Highland Park Distillery, on the high cliff of a large natural harbor which is strategic to UK naval defense. House Style: Scapa is a whisky to be enjoyed, not endured. Oily in body with chocolate, salt and straw in the flavor. It’s mild and easy-drinking whisky. It’s highly rated and well-known for its unique heather notes (reminiscent of freshly-cut ripe summer pear) and honey flavor. Water Source: Lingro Burn, its cooling water source, is adjacent to the distillery. -

Price List(2018-19)

Price List(2018-19) Brand Name Label Name Pack Size MRP/Bottles ADS SPIRITS PRIVATE LIMITED whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 180ML 124 whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 375ML 252 whisky DOUBLE BLUE PREMIUM BLENDED WHISKY 750ML 504 whisky ROYAL GREEN DELUXE BLENDED WHISKY 180ML 142 whisky ROYAL GREEN DELUXE BLENDED WHISKY 375ML 290 whisky ROYAL GREEN DELUXE BLENDED WHISKY 750ML 580 whisky THE GENERATION DELUXE BLENDED WHISKY 180ML 180 whisky THE GENERATION DELUXE BLENDED WHISKY 375ML 365 whisky THE GENERATION DELUXE BLENDED WHISKY 750ML 730 ALCOBREW DISTILLERIES INDIA PRIVATE LIMITED whisky GOLFER'S SHOT BARREL AGED WHISKY 180ML 186 whisky GOLFER'S SHOT BARREL AGED WHISKY 375ML 380 whisky GOLFER'S SHOT BARREL AGED WHISKY 750ML 759 whisky OLD SMUGGLER BLENDED SCOTCH WHISKY 750ML 1278 whisky WHITE & BLUE PREMIUM WHISKY 180ML 142 whisky WHITE & BLUE PREMIUM WHISKY 375ML 290 whisky WHITE & BLUE PREMIUM WHISKY 750ML 580 whisky WHITE HILLS RESERVE WHISKY 180ML 125 whisky WHITE HILLS RESERVE WHISKY 375ML 253 whisky WHITE HILLS RESERVE WHISKY 750ML 507 ALLIED BLENDERS AND DISTILLERS PVT.LTD. Rum JOLLY ROGER DELUXE XXX RUM 180ML 111 Rum JOLLY ROGER DELUXE XXX RUM 375ML 225 Rum JOLLY ROGER DELUXE XXX RUM 750ML 449 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 180ML 137 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 375ML 281 whisky OFFICER'S CHOICE BLACK AGED RARE WHISKY 750ML 559 whisky OFFICER'S CHOICE BLUE SUPERIOR GRAIN WHISKY 180ML 125 whisky OFFICER'S CHOICE BLUE SUPERIOR GRAIN WHISKY 375ML 255 whisky OFFICER'S CHOICE BLUE -

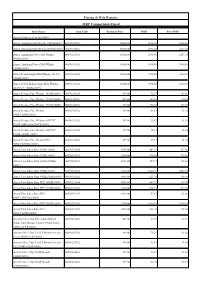

Pricing & Web Reports MRP Comparision Report

Pricing & Web Reports MRP Comparision Report Item Name Item Code Declared Price MRP Prev.MRP Amrut Distilleries Pvt Ltd (0009) Amrut Amalgam Malt Whisky 750ML(0009) 00090102901 15000.00 3894.68 3400.86 Amrut Amalgam Malt Whisky-500ML(0009) 00090102916 15000.00 2596.45 2267.24 Amrut Amalgam Peated Malt Whisky 00090103116 15000.00 2596.45 2267.24 500ML(0009) Amrut Amalgam Peated Malt Whisky 00090103101 15000.00 3894.68 3400.86 750ML(0009) Amrut Fusion Single Malt Whisky (42.8%) 00090103201 15000.00 3894.68 3400.86 750ML(0009) Amrut Peated Indian Single Malt Whisky- 00090103301 15000.00 3894.68 3400.86 42.8%V/V 750ML(0009) Amrut Prestige Fine Whisky 180 Ml (0009) 00090100304 499.00 70.27 63.10 Amrut Prestige Fine Whisky 375 Ml (0009) 00090100302 499.00 145.43 130.49 Amrut Prestige Fine Whisky 750 Ml (0009) 00090100301 499.00 290.85 260.98 Amrut Prestige Fine Whisky 00090100352 499.00 35.13 31.55 90MLx96Btls(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190352 499.00 35.13 31.55 PACK 90MLx96A PACK(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190304 499.00 70.27 63.10 PACK-180ML (0009) Amrut Prestige Fine Whisky-PET 00090102652 499.00 35.13 31.55 90MLx96P.Btls (0009) Amrut Two Indies Rum 180ML(0009) 00090301104 4554.00 467.51 397.00 Amrut Two Indies Rum 375ML(0009) 00090301102 3800.00 930.47 783.56 Amrut Two Indies Rum 60MLx150Btls 00090301107 4924.00 157.17 133.66 (0009) Amrut Two Indies Rum 750ML(0009) 00090301101 3800.00 1860.94 1567.14 Amrut Two Indies Rum 90MLx96Btls(0009) 00090301152 4554.00 233.76 198.50 Amrut Two Indies Rum-PET 180ML(0009) -

Addendum Regarding: the 2016 Certified Specialist of Spirits Study Guide, As Published by the Society of Wine Educators Note

Addendum regarding: The 2016 Certified Specialist of Spirits Study Guide, as published by the Society of Wine Educators Note: This document outlines the substantive changes to the 2016 CSS Study Guide as compared to the 2015 version of the Study Guide. All page numbers reference the 2015 version. These items will not appear on Exams based on the 2015 SG. Page 9 – the following was added to the information under the “Fermentation” heading: Fermentation may also create small amounts of other alcohols, such as methanol (methyl alcohol) and a range of compounds collectively referred to as fusel oils which contain small amounts of amyl alcohol, n-propyl, and isobutyl alcohols. Page 17 – the following information was added to the section on Filtration: Many spirits undergo a process known as chill filtration. Chill filtration removes components common to many spirits that can cause a spirit to appear hazy or dull. Matured spirits in particular are likely to require chill filtration. To carry out this process, the spirit is chilled, which causes a haze to form that can then be removed. With all types of filtration, care must be taken to avoid filtering out desirable components that contribute to body and flavor along with those that are unwanted. Page 18 – the following information was added under the “bottling strength” heading: Most spirits are bottled at 37 to 43% alcohol by volume. Page 31 - the chart on the top-selling vodka brands has been updated to reflect 2015 statistics as follows (highlighted entries have changed): Top Selling Vodka Brands Rank Brand 1 Smirnoff 2 Absolut 3 Green Mark 4 Grey Goose 5 Skyy 6 Stolichnaya 7 Finlandia 8 Russian Standard 9 Cîroc 10 Ketel One 11 Sobieski 12 Eristoff Source: Drinks International (2015) Page 46 - the information pertaining to the PGI status of Plymouth gin was deleted, as the PGI was not submitted for renewal and has expired. -

Millionaires' Club

THE DEFINITIVE RANKING OF THE WORLD'S MILLION-CASE SPIRITS BRANDS 2014 TPSSPVUHPYLThe Z» The TPSSPVUHPYLZ» JUNE 2014 DRINKSINT.COM 3 GRAND DESIGNS t was once a case of the worldly and the parochial – the global brands and the local brands. But what happens when local goes international, when low- value operators premiumise? In The Millionaires’ IClub 2014, we have learned of such grand plans. Take our immovable champion, Jinro. Far from content with 66.5m case sales concentrated in South Korea and nearby Japan, Hite-Jinro has set about achieving 100m cases in the next 10 years, by seeding the brand in the 11 world markets with a population of more than 100m. That includes the US – a market now inhabited by Philippine rum Tanduay and the world’s latest largest whisky brand, Officer’s Choice, which has entered New York. In the west there is a tendency to think the flow of globalisation only works in one direction, from traditional to emerging markets. But the growth obsession is an instinct of business, not the preserve of the elite. Spirits companies propagated in volatile emerging markets are all too aware that a one-market policy can build volumes but not a secure future. Market plurality is the best way to mitigate exposure. Johnnie Walker is the exemplar. With Asia ailing in 2013, the brand’s worldwide distribution kept sales walking in the right direction. Of course, emerging brands will have to climb the premium ladder quickly if they are to take on Johnnie contents Walker’s ilk in the likes of the US and western Europe. -

Gurdaspur Punjab Kings Whisky 180 35 2 Ab Grains Spirits Pvt

Sr. No. WHOLESALE_VEND_NAME BRAND_NAME SIZE_CODE MRP 1 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 180 35 2 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 375 65 3 AB GRAINS SPIRITS PVT. LTD. - GURDASPUR PUNJAB KINGS WHISKY 750 130 4 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 180 100 5 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 375 200 6 ALCOBREW DIST (I) PVT LTD. - DERABASSI AUBERGE PREMIUM VODKA GR APPLE 750 400 7 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGGLER BL SCOTCH WHISKY 750 1050 8 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 180 60 9 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 375 120 10 ALCOBREW DIST (I) PVT LTD. - DERABASSI OLD SMUGL. XXX MATURED RUM 750 240 11 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 180 100 12 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 375 205 13 ALCOBREW DIST (I) PVT LTD. - DERABASSI WHITE & BLUE PREMIUM WHISKY 750 410 14 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA GREEN APPLE 180 145 15 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA GREEN APPLE 750 580 16 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA ORANGE 180 145 17 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORB. VODKA ORANGE 750 580 18 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 60 45 19 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 90 70 20 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 180 135 21 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 375 275 22 ALLIED BLEND&DIST P LTD - AURANGABAD WODKA GORBATSCHOW VODKA 750 550 23 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 180 50 24 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 375 100 25 A-ONE WINERIES - SANGRUR ORIGINAL CH RARE DEL WHISKY 750 200 26 BACARDI INDIA PRIVATE LTD. -

Download the Press Release

9M FY20 Sales Press release - Paris, 23 April 2020 COVID-19 LEADING TO ORGANIC SALES DECLINE OF -2.1% YTD AND -14.5% IN Q3, DESPITE SOLID H1 FY20 AND Q3 START (STABLE YTD REPORTED SALES) INTERIM DIVIDEND OF €1.18 PER SHARE TO BE PAID ON 10 JULY 2020 REMAINING SHARE BUY-BACK OF UP TO €0.5BN SUSPENDED CONFIRMATION OF REVISED FY20 GUIDANCE1: ORGANIC DECLINE IN PROFIT FROM RECURRING OPERATIONS OF C. -20% Year-to-date Sales Sales for the first 9 months of FY20 totalled €7,210m, with an organic decline of -2.1%: • USA: +3%, with good start to Q3, following solid H1 FY20, thanks in particular to Jameson, The Glenlivet, Malibu and Specialty brands. Slowdown in March due to confinement and physical distancing measures implemented in most States • China: -11%, after strong H1 at +11%, due to severe decline in Q3 resulting primarily from On-Trade closures starting end of January as well as earlier Chinese New Year2, despite strong execution of Chinese New Year programme • India: +1%, on high basis of comparison (+19% in 9M FY19), with mid-single digit growth until February, but nationwide lockdown imposed on 24 March softening Q3 performance • Global Travel Retail: -13%, with severe decline from February, driven by restrictions and lockdowns imposed across the world. Solid underlying sell-out pre-Covid-19 crisis • Europe: Stable, with good performance to February (8M FY20: +2%) impacted by double-digit decline in March as result of Covid-19. By category: • Strategic International Brands: -2%, in decline due to Q3 at -20%, largely driven by Martell and Chivas Regal in China and Global Travel Retail. -

The Millionaires' Club

The definiTive ranking of The world's million-case spiriTs brands June 2012 The definiTive ranking of The world's million-case spiriTs brands 2012 The The June 2012 drinksint.com 3 welcome to the club here are clubs for ladies, for gentlemen, the gentry and the socially sedentary. Clubs where handshakes, back-slaps and ridiculous blazers Tmaintain a cosy elitism. The Millionaires’ Club is not one of these clubs. Here we favour meritocracy over cronyism – if a spirits or liqueur brand sells a million 9-litre cases it’s in, if it doesn’t, it’s out. This year the revolving door has welcomed more brands than it has ejected, with membership now numbering 181. We have a slew of novice Millionaires – affirmation to burgeoning brands that if you get the proposition and market right, the million-case mark is eminently achievable. contents Of the newcomers to Millionaire status there’s La leADer voDkA Martiniquaise’s Poliakov vodka, which inched its way past the Hamish Smith plays secretary 3 Lowdown on Europe’s favourite 23 million-case mark, presumably in the very last knockings of 2011. Then you have Cîroc which, through P Diddy’s notoriety mArket overvIew rum & cAchAçA and Diageo’s know-how, managed to pole-vault nearly 50 of its By Euromonitor International 5 Latin America’s heavyweights 29 competitors to debut at 133. The global analysts at Euromonitor International have also Full lIStIng cognAc & brAnDy unearthed some new names. There are those that have quietly All 181 Millionaire brands 9 The little and large grape spirits 30 amassed sales but been shy up to now about opening their ledgers. -

Wedding Packages Include the Following

wedding packages include the following: Planning and coordination of your event details with experienced staff. Event Manager to lead your event. Ornate table settings: chairs, floor length linens, round guest tables (sizes may vary), glassware, flatware, barware and dinnerware. Five-hour wedding reception. (Addition of ceremony adds 30 minutes to your timeline.) Open Bar with optional wine service. Glass of champagne provided to all guests. Cocktail hour with butlered and stationary hors d’oeuvres. Two-course dinner: served salad course and plated dinner course with the inclusion of two entrée selections. Gluten-free and vegetarian/vegan options available. Complimentary cake cutting service with coffee station. Complimentary bridal changing space up to three hours prior to your event. Option to reserve on-site overnight accommodations for bridal couple, wedding guests and bridal party—special room rates for your guests with a minimum of 10 rooms reserved. $200 credit to The Imperial Restaurant for your rehearsal dinner or post-wedding brunch. List of The Imperial’s suggested professional vendors—includes photographers, DJs, musicians, bakers, florists, wedding planners, shuttle services, officiants and others. Don’t forget all the wonderful photo ops the beautiful historic City of Lancaster has to offer! Preference on booking other functions at The Imperial to celebrate your special day—rehearsal dinners, post reception parities, brunches, showers and more! Page 1 of 11 26 east chestnut street lancaster, pa 17602 717.393.2131 theimperialballrooms.com Throw a party like royalty! ELEGANT WEDDING PACKAGE Selection of 3 butlered hors d’oeuvres Selection of 1 stationary hors d’oeuvres display Served dinner includes: salad and entrée Complimentary cake cutting service with coffee station Four-hour consecutive bar with premium brands GRAND WEDDING PACKAGE WeddingPACKAGES Selection of 4 butlered hors d’oeuvres Listed rates are per person plus 22% service Selection of 1 stationary hors d’oeuvres display charge and 6% Pennsylvania sales tax. -

K-Lounge Menu

LOUNGE BAR MENU NIBBLES TAPENADE OLIVE DANESE Olive tapenade, danish cheese & walnut, sundried tomato & virgin olive oil BRUSCHETTA ANCHOVIES Loaf crusted bread topped with tomato, olive, basil, roasted garlic, anchovies, parmesan cheese, balsamic oil HOT & SPICY PUMPKIN BALL deep-fried pumpkin ball stuffed with ginger-tomato concasse & sweet potato RADISH FERMENTED PRAWN CAVIAR Braised prawn topped with caviar, on mustard fermented radish CANAPE CAVIAR Sponge herbs buttered bread, topped with caviar, lime ENTRADAS ESPADIN Fried & crispy whitebait, served with dill-mayo & olive oil french pain de campagne GAMBAS A LA PLANCHA Grilled prawn served with guacamole sauce SUNBLACHED DE ROMA Grilled focaccia topped with roasted shallots & tomatoes tossed in olivio balsamico CRAB PAKORA Golden crispy crab cake, tarte tatin d'aubergine, sweet & spicy tomato glaze (SRIRACHA) AVOCADO PRAWN COCKTAIL Served with fresh avocado cut & cocktail sauce SALADS ARAGULA Rocket leaves & lettuce, walnut, cherry tomato, beetroot, parmesan cheese, orange balsamic sauce QUINOA PRAWN SALAD Black & white quinoa, avocado, cherry tomato, cilantro, scallion, chefonade, grilled prawns & grainy citrus sauce IN BETWEEN CHEESE PLATTER Gouda, edam, danish, goat cheese, cheddar, served with olive, cereal bread & assorted CHARCUTERIE ON HOLD Edam, danish, chedder, mortadella, parma ham, salami, prosciutto, served with olive, cereal bread & assorted TEPPANYAKI CHICKEN Pan-fried chicken strips & sizzling assorted vegetables served with yakiniku sauce HONEY GLAZED FISH CUTS Pan-seared -

THE DEFINITIVE RANKING of the WORLD's MILLION-CASE SPIRITS BRANDS 2014 Tpsspvuhpylthe Z» the TPSSPVUHPYLZ» JUNE 2014 DRINKSINT.COM 3

THE DEFINITIVE RANKING OF THE WORLD'S MILLION-CASE SPIRITS BRANDS 2014 TPSSPVUHPYLThe Z» The TPSSPVUHPYLZ» JUNE 2014 DRINKSINT.COM 3 GRAND DESIGNS t was once a case of the worldly and the parochial – the global brands and the local brands. But what happens when local goes international, when low- value operators premiumise? In The Millionaires’ IClub 2014, we have learned of such grand plans. Take our immovable champion, Jinro. Far from content with 66.5m case sales concentrated in South Korea and nearby Japan, Hite-Jinro has set about achieving 100m cases in the next 10 years, by seeding the brand in the 11 world markets with a population of more than 100m. That includes the US – a market now inhabited by Philippine rum Tanduay and the world’s latest largest whisky brand, Officer’s Choice, which has entered New York. In the west there is a tendency to think the flow of globalisation only works in one direction, from traditional to emerging markets. But the growth obsession is an instinct of business, not the preserve of the elite. Spirits companies propagated in volatile emerging markets are all too aware that a one-market policy can build volumes but not a secure future. Market plurality is the best way to mitigate exposure. Johnnie Walker is the exemplar. With Asia ailing in 2013, the brand’s worldwide distribution kept sales walking in the right direction. Of course, emerging brands will have to climb the premium ladder quickly if they are to take on Johnnie contents Walker’s ilk in the likes of the US and western Europe.