Grocery Monitoring Report 3 Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supervalu: How a Brave Local Brand Defied the Forces of Globalisation

SuperValu: How a brave local brand defied the forces of globalisation DDFH&B COMPANY PROFILE AGENCY The DDFH&B Group consists of DDFH&B Advertising, Goosebump, The Reputations Agency, RMG and Mindshare Media – making it one of the largest Irish companies in creative advertising, media buying and customer relationship/digital marketing. Together, they provide channel-neutral, integrated marketing communications campaigns that deliver real, measurable results. They achieve this level of integration by working in a number of small, multi-disciplined teams, calling it ‘fun sizing’. They continue to be one of the most successful agencies in Ireland, working with clients such as Kerry Foods, SuperValu, The National Lottery, eir, Littlewoods, Lucozade and Molson Coors. CLIENT AWARD LONG TERM EFFECTIVENESS Sponsored by GOLD 1 SuperValu: How a brave local brand defied the forces of globalisation DDFH&B INTRODUCTION & BACKGROUND This is a story about long term effectiveness. It is a story about how a brave local retailer with daring ambition wrestled back leadership from Tesco and defied the forces of globalisation. SuperValu was founded in 1979 with a base of just 16 stores, mainly in Munster. While they had grown to 182 stores by 2004, and acquired Superquinn (another Irish retailer) in 2011, they were a retailer with two speeds, an urban speed and a rural speed. The urban speed was still reeling from the Superquinn takeover, when stores were rebranded to SuperValu in 2014. Superquinn had a more premium brand perception, much closer to the Waitrose proposition in the UK. Consumers were in a state of chassis as they felt they were paying convenience store prices in large supermarkets and were unfamiliar with the brand and mistrustful of its quality. -

Review of the Economic Impact of the Retail Cap

REVIEW OF THE ECONOMIC IMPACT OF THE RETAIL CAP Report prepared for the Departments of Enterprise, Jobs and Innovation and Environment, Community and Local Government APRIL 2011 Review of the Economic Impact of the Retail Cap Executive Summary i 1. Introduction 1 1.1 Objectives of the study 1 1.2 Structure of the report 2 2. Background 3 2.1 Policy and legislative framework for retail planning 3 2.2 Overview of the current retail caps 4 3. Overview of recent retail sector developments 6 3.1 Economy wide developments 6 3.2 Retail developments 8 3.3 Structure of the retail market 15 4. Factors driving costs and competition in retail 35 4.1 Impact of the retail caps on costs 35 4.2 Impact of the retail caps on competition 38 4.3 Other factors that impact competition/prices 41 4.4 Impact of the retail cap on suppliers 42 5. Conclusions and recommendations 44 APPENDIX: Terms of Reference 48 Review of the Economic Impact of the Retail Cap Executive Summary One of the conditions of the EU-IMF Programme for Financial Support for Ireland is that ‘the government will conduct a study on the economic impact of eliminating the cap on the size of retail premises with a view to enhancing competition and lowering prices for consumers and discuss implementation of its policy implications with the Commission services’. This process must be concluded by the end of Q3 2011. Forfás was requested to undertake the study and worked closely with a steering group comprising officials from the Departments of Enterprise and Environment. -

Britain's Tesco Scraps Irish Supplier Over Horse Meat Scare 30 January 2013

Britain's Tesco scraps Irish supplier over horse meat scare 30 January 2013 British retail giant Tesco said Wednesday it has "Ultimately Tesco is responsible for the food we axed an Irish beef supplier which sparked a food sell, so it is not enough just to stop using the scare after horse DNA was found in beefburgers in supplier." Britain and Ireland, where horse meat consumption is taboo. "We want to leave customers in no doubt that we will do whatever it takes to ensure the quality of Tesco said in a statement that it has decided to their food and that the food they buy is exactly what stop using Silvercrest after uncovering evidence the label says it is," added Smith. that it used meat from non-approved suppliers, mirroring a move by US fast-food chain Burger The consumption of horse meat is a common sight King last week. in central Asia, China, Latin America and parts of Europe. Two weeks ago, the Food Safety Authority of Ireland (FSAI) had revealed that up to 29 percent (c) 2013 AFP of the meat content of some beefburgers was in fact horse, while they also found pig DNA. The frozen burgers were on sale in high-street supermarket chains Tesco and Iceland in both Britain and Ireland, and in Irish branches of Lidl, Aldi and Dunnes Stores. The FSAI had said burgers had been made at two processing plants in Ireland and one in northern England. Following the news, Britain's biggest retailer Tesco issued an immediate apology and pledged to investigate the matter. -

Mintel Reports Brochure

Supermarket Retailing / Brand Importance - Ireland - November 2018 The above prices are correct at the time of publication, but are subject to Report Price: £1095.00 | $1478.58 | €1232.31 change due to currency fluctuations. “Supermarket retail sales are forecast for continued growth in 2018/19 but with the increasing uncertainty surrounding Brexit, many NI consumers are already feeling the pinch with food prices rising and a noticeable increase in supermarket prices. Market leaders will need to do more to deliver on price and quality whilst differentiating themselves from the pack.” – Emma McGeown, Research Analyst This report looks at the following areas: BUY THIS This Report will examine the grocery retailing sector in Ireland through exploring the issues that are REPORT NOW driving growth in IoI. Covered in this Report is the sale of all grocery items including market segmentation of supermarket retail sales via mainstream supermarkets, such as Tesco, Asda, SuperValu and Dunnes Stores. The sale of groceries through convenience format stores, such as Spar, VISIT: and the hard discounters, Aldi and Lidl, is also discussed, however, it is not included in the Market Sizes store.mintel.com and Forecast section. CALL: EMEA +44 (0) 20 7606 4533 Brazil 0800 095 9094 Americas +1 (312) 943 5250 China +86 (21) 6032 7300 APAC +61 (0) 2 8284 8100 EMAIL: [email protected] This report is part of a series of reports, produced to provide you with a DID YOU KNOW? more holistic view of this market reports.mintel.com © 2018 Mintel Group Ltd. All Rights Reserved. Confidential to Mintel. Supermarket Retailing / Brand Importance - Ireland - November 2018 The above prices are correct at the time of publication, but are subject to Report Price: £1095.00 | $1478.58 | €1232.31 change due to currency fluctuations. -

The Abuse of Supermarket Buyers

The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele, SOMO & Bob Young, Europe Economics On behalf of: AAI- Agribusiness Accountability Initiative Amsterdam, March 2009 Colophon The Abuse of Supermarket Buyer Power in the EU Food Retail Sector Preliminary Survey of Evidence Myriam Vander Stichele (SOMO) & Bob Young (Europe Economics) March 2009 Funding: This publication is made possible with funding from The Dutch Ministry of Foreign Affairs via SOMO and DGOS (Belgian Directorate General for Development Cooperation) via Vredeseilanden (VECO). Published by: AAI - Agribusiness Action Initiatives, formerly called Agribusiness Accountability Initiative The authors can be contacted at: SOMO Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl This document is licensed under the Creative Commons Attribution-NonCommercial-NoDerivateWorks 2.5 License. The Abuse of Supermarket Buyer Power in the EU Food Retail Sector 2 Contents Contents ..........................................................................................................................3 Summary .........................................................................................................................4 Introduction.....................................................................................................................6 1. Abusive buyer power problems are being discussed in many fora while a comprehensive -

Kantar Report for CMA Store Exit Survey FINAL for PUBLICATION

Consumer research to inform the Sainsbury’s/Asda merger inquiry Findings from the store exit survey February 2019 © Kantar Public 2018 Contents 1. Introduction and methods 3 2. Summary of key findings 12 3. Overview of customers 14 4. Choice attributes 24 5. Results from diversion questions 30 6. Diversion ratios to the Merger Party 46 7. London and Northern Ireland stores 53 8. Case studies 58 Appendix A – Survey Questionnaire 65 Appendix B – Store Level Diversion Ratios to the Merger Party 78 © Kantar Public 2018 1. Introduction and methods This report includes findings from an exit survey conducted as part of the Competition and Markets Authority (CMA)’s inquiry into the anticipated merger between Sainsbury’s and Asda. The survey was conducted in September and October 2018. In this introductory chapter, we set out the research objectives and provide background information on the sample and the methodology used to obtain the results. © Kantar Public 2017 3 Background and sample design This study forms part of the consumer survey research commissioned to provide evidence for the CMA’s inquiry into the anticipated merger between Sainsbury’s and Asda (the Merger Parties or Parties). The research involved short exit interviews conducted at a sample of the physical stores belonging to the Parties. The target population was customers who had just paid for grocery goods at the main supermarket checkouts (including self-checkouts). The high-level research objectives included examining: • Choice attributes • Geographical considerations • Closeness of competition, including diversion between the Merger Parties • Competitive constraints from other retailers, out of market constraints and cross-channel substitution. -

Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market

Technological University Dublin ARROW@TU Dublin Case Studies School of Retail and Services Management 2002-01-01 Multiple and Symbol Operators: the Battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Technological University Dublin, [email protected] Mary Wilcox Technological University Dublin, [email protected] Follow this and additional works at: https://arrow.tudublin.ie/buschrsmcas Part of the Business Commons Recommended Citation O'Callaghan, E., Wilcox, M.:Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market. Case Study. Irish Marketing Review VOL.14, No.2 This Article is brought to you for free and open access by the School of Retail and Services Management at ARROW@TU Dublin. It has been accepted for inclusion in Case Studies by an authorized administrator of ARROW@TU Dublin. For more information, please contact [email protected], [email protected]. This work is licensed under a Creative Commons Attribution-Noncommercial-Share Alike 4.0 License Dublin Institute of Technology ARROW@DIT Articles School of Retail and Services Management 1-1-2002 Multiple and Symbol Operators: The battle for Market Leadership in the Irish Grocery Market Edmund O'Callaghan Dublin Institute of Technology, [email protected] Mary Wilcox Dublin Institute of Technology, [email protected] This Other is brought to you for free and open access by the School of Retail and Services Management at ARROW@DIT. It has been accepted for inclusion in Articles by an authorized administrator of ARROW@DIT. For more information, please contact [email protected]. -

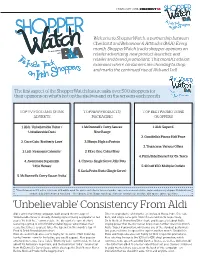

Consistency from Aldi

CK 0216 Shopperwatch_LDL_EMS Template 2012 19/02/2016 09:22 Page 7 FEBRUARY 2016 | CHECKOUT 65 Welcome to ShopperWatch, a partnership between Checkout and Behaviour & Attitudes (B&A). Every month, ShopperWatch tracks shopper opinions on retailer advertising, new product launches, and retailer and brand promotions. This month’s edition examines where consumers are choosing to shop, and marks the continued rise of Aldi and Lidl. The first aspect of the ShopperWatch feature asks over 500 shoppers for their opinions on what’s hot on the shelves and on the screens each month. TOP TV FOOD AND DRINK TOP NEW PRODUCTS/ TOP BEST PROMOTIONS ADVERTS PACKAGING OR OFFERS 1. Aldi: ‘Unbelievable Value’ / 1. McDonnell's Curry Sauces: 1. Aldi ‘Super 6’ ‘Unbelievable Dads’ New Range 2. Goodfella's Pizzas: Half Price 2. Coca-Cola: ‘Brotherly Love’ 2. Mooju: High in Protein 3. Tropicana: Various Offers 3. Lidl: ‘Firemen's Calendar’ 3. Fibre One: Cakes/Bars 4. Pizza/Side/Dessert for €5: Tesco 4. Avonmore Supermilk: 4. Chivers: Single Serve Jelly Pots ‘Little Heroes’ 5. €10 off €50: Multiple Outlets 5. Sacla Pesto Shots (Single Serve) 5. McDonnell's Curry Sauce: ‘India’ *Results based on 519 online interviews with adults aged 16+ quota controlled in terms of gender, age, socio-economic status, region and grocery shopper. Fieldwork was conducted via B&A’s Acumen Panel 2nd – 9th February, 2016. Shopperwatch questions are spontaneous in nature with open response questions. 'Unbelievable' Consistency From Aldi Aldi's latest marketing campaign, built around the message of Other new products catching the eye included Mooju, Fibre One cake 'Unbelievable Value' is already showing signs of being as popular as last bars, and single serve pots from Chivers and Sacla respectively. -

Campylobacter Risk the Threat of Campylobacter Infection Has Recently Been Highlighted by a Number of Research Studies

FOOD Campylobacter risk The threat of Campylobacter infection has recently been highlighted by a number of research studies. We review the findings and examine precautionary measures that can be taken by consumers and retailers Campylobacter is a naturally occurring Food Safety Authority (EFSA). A broiler established best practice. Seven hundred bacterium found in the intestinal tract of is a chicken that has been raised for its and eighty five samples, each consisting wild and domesticated birds and meat. The results of the study were of one swab from the exterior of the mammals. Campylobacter is the most published in March 2010 and showed chicken packaging and one swab from common cause of bacterial that there is a high level of the cabinet displaying that package, were gastroenteritis in Ireland and Europe. Campylobacter contamination in poultry taken by environmental health officers There were some 1,758 cases of carcasses in slaughter plants throughout (EHOs) from retail establishments in infections reported in Ireland in 2008 Europe (the EU prevalence was 75.8%), Ireland between September and and provisional data for 2009 shows with 98% of carcasses in Irish plants December 2008. that 1,823 cases were reported. having some level of contamination. The Almost two thirds of the packaging Human Campylobacter infections study took place from January to sampled by the FSAI was conventional cause intestinal inflammation leading to December 2008 and involved 10,132 (i.e. the plastic covering wrapped around acute gastroenteritis with diarrhoea and broiler batches sampled from 561 the tray and sealed underneath), while sometimes vomiting. The infection can slaughterhouses in 26 EU states, as well one third was leak-proof (i.e. -

Irish Foodservice Market Directory

Irish Foodservice Market Directory NOVEMBER 2014 Growing the success of Irish food & horticulture www.bordbia.ie TABLE OF CONTENTS Page No. IRISH FOODSERVICE MARKET DIRECTORY 5 Introduction 5 How to use the Directory 5 Methodology 6 TOP 10 PRODUCER TIPS FOR BUILDING A SUCCESSFUL FOODSERVICE BUSINESS 7 FOODSERVICE MAP 9 COMMERCIAL CHANNELS 11 QUICK SERVICE RESTAURANTS (QSR) 13 AIL Group 14 Domino’s Pizza 18 McDonald’s 21 Subway 24 Supermac’s 26 FORECOURT CONVENIENCE 29 Applegreen 30 Topaz 32 FULL SERVICE RESTAURANTS (FSR) 35 Avoca Handweavers 36 Brambles 39 Eddie Rocket’s 42 Entertainment Enterprise Group 45 Itsa 49 Porterhouse Brewing Company 53 Wagamama 55 COFFEE SHOPS 59 BB’s Coffee and Muffins 60 Butlers Chocolate Café 62 Esquires Coffee House 64 Insomnia 66 MBCC Foods (Ireland) Ltd. T/A Costa Coffee *NEW 68 Quigleys Café, Bakery, Deli 70 streat Cafes (The) 72 HOTELS 75 Carlson Rezidor Hotel Group 76 Choice Hotels Ireland 80 Dalata Management Services 82 The Doyle Collection 87 Limerick Strand Hotel 89 Moran & Bewley’s Hotels 92 PREM Group 95 Talbot Hotel Group *NEW 98 Tifco Hotel Group 100 1 LEISURE/EVENTS 103 Dobbins Outdoor 104 Feast 106 Fitzers Catering Ltd 108 JC Catering 111 Masterchefs Hospitality 113 Prestige Catering Ltd 115 The Right Catering Company 117 With Taste 119 TRAVEL 123 Aer Lingus Catering 124 EFG Catering 128 Gate Gourmet Ireland 131 HMS Host Ireland Ltd 133 Irish Ferries 135 Rail Gourmet 138 Retail inMotion 140 SSP Ireland 142 INSTITUTIONAL (COST) CHANNELS 145 BUSINESS & INDUSTRY (B&I) 147 ARAMARK Ireland 148 Baxter Storey 151 Carroll Foodservices Limited 153 Compass Group Ireland 155 Corporate Catering Services Limited 157 Gather & Gather *NEW 160 KSG 162 Mount Charles Group *NEW 164 Premier Dining 167 Q Café Co. -

The Great Taste of Irish Grass-Fed Dairy Starts Here

NOVEMBER 2019 Retail News Ireland’s Longest Established Grocery Magazine The great taste of Irish grass-fed dairy starts here. #LoveIrishDairy ndc.ie 24|Retail News|November 2019|www.retailnews.ie Irish Quality Food & Drink Awards Irish Quality Food & Drink Awards Celebrating the best Irish food and drinks The winners of the Irish Quality Food & Drink Awards 2019 have been announced, recognising the finest indigenous products available in Irish stores. THE winners of the prestigious Irish Quality Food & Drink Awards 2019 were announced on Thursday, October 24, to a packed house at the Clayton Hotel, Burlington Road, Dublin. Producers, retailers and wholesalers from across the Irish food and drink industry came together to celebrate the very best produce available in Ireland. Products were judged earlier this year by a panel of over 50 food experts from across Ireland and the UK over a three-week period at the University of Limerick, with awards presented to the finest products across more than 50 categories. The awards include both branded and own-label produce, and highlight the efforts made by retailers and wholesalers to provide the best quality at the best prices for their customers, both the general public and Pictured at the presentation of the Gold Q Award to North Cork Creameries the foodservice industry. are (l-r): Beckie Dart, Director, Irish Quality Food and Drink Awards; Ruairi Callaghan, North Cork Creameries; and Hector Ó hEochagáin, Irish Quality Special Awards Food and Drink host. In addition to the category winners being announced (see the full list of winners here: www.irish.qualityfoodawards.com and on page 28), a number of special awards were also announced. -

Merchants Quay Shopping Centre

FOR SALE BY PRIVATE TREATY – TENANTS NOT AFFECTED MEST. 1989 MERCHANTS QUAY SHOPPING CENTRE 1-5 ST PATRICK’S ST. CORK www.MQSCCORK.com CORK CONTENTS 02 Welcome to Merchants Quay 06 At a Glance 08 Location 10 Getting Around 12 Amenities 16 Current Opportunity 20 Planning / Future Development 22 Investment Market 24 Floor Plans 36 Contacts Welcome to Merchants Quay CORK’S MOST Shopping Centre, RENOWNED RETAIL DESTINATION. 2 3 CBRE and Savills jointly present Merchants Quay Shopping Centre for Sale by Private Treaty. Merchants Quay offers investors an excellent opportunity to acquire an established Shopping Centre in the heart of Cork City, the economic centre of the south west region. Merchants Quay provides an excellent opportunity to secure a key retail asset located on Cork’s principal retailing street. The Shopping Centre extends to 4,040 sq m (43,488 sq ft) in total and benefits from four market leading anchor tenants which include Marks & Spencer, Dunnes Stores, Debenhams and SuperValu, although not part of the sale these key anchors significantly contribute to the annual footfall which is in excess of 8.2 million visitors per year. The scheme has full planning permission to reconfigure and enhance the internal layout allowing for the provision of a number of larger and more modern retail units. The proposed redevelopment plans are designed to create a new retail focal point at the northern end of St. Patrick’s Street. 4 5 A T A GLAN C E FOOTFALL IN EXCESS OF 43,488 sq ft 8.2 million OF RETAIL SPACE PER YEAR OVER TWO 29 INTERNAL units FLOORS SHOPPERS SHOP THERE MORE THAN 36% ONCE A WEEK ADJOINING 4 ANCHOR STORES 500,000 CORK COUNTY’S POPULATION Cork 10 min WALK TO CORK TRAIN STATION APPROX.