2012 Supervision Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crystal Reports

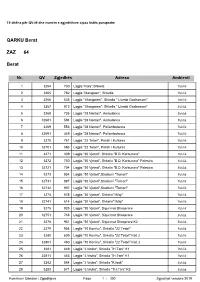

Të dhëna për QV-të dhe numrin e zgjedhësve sipas listës paraprake QARKU Berat ZAZ 64 Berat Nr. QV Zgjedhës Adresa Ambienti 1 3264 730 Lagjia "Kala",Shkolla Publik 2 3265 782 Lagjia "Mangalen", Shkolla Publik 3 3266 535 Lagjia " Mangalem", Shkolla " Llambi Goxhomani" Publik 4 3267 813 Lagjia " Mangalem", Shkolla " Llambi Goxhomani" Publik 5 3268 735 Lagjia "28 Nentori", Ambulanca Publik 6 32681 594 Lagjia "28 Nentori", Ambulanca Publik 7 3269 553 Lagjia "28 Nentori", Poliambulanca Publik 8 32691 449 Lagjia "28 Nentori", Poliambulanca Publik 9 3270 751 Lagjia "22 Tetori", Pallati I Kultures Publik 10 32701 593 Lagjia "22 Tetori", Pallati I Kultures Publik 11 3271 409 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Publik 12 3272 750 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Palestra Publik 13 32721 704 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Palestra Publik 14 3273 854 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 15 32731 887 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 16 32732 907 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 17 3274 578 Lagjia "30 Vjetori", Shkolla"1Maji" Publik 18 32741 614 Lagjia "30 Vjetori", Shkolla"1Maji" Publik 19 3275 925 Lagjia "30 Vjetori", Sigurimet Shoqerore Publik 20 32751 748 Lagjia "30 Vjetori", Sigurimet Shoqerore Publik 21 3276 951 Lagjia "30 Vjetori", Sigurimet Shoqerore K2 Publik 22 3279 954 Lagjia "10 Korriku", Shkolla "22 Tetori" Publik 23 3280 509 Lagjia "10 Korriku", Shkolla "22 Tetori" Kati 2 Publik 24 32801 450 Lagjia "10 Korriku", Shkolla "22 Tetori" Kati 2 Publik 25 3281 649 Lagjia "J.Vruho", -

Tabela Nr 1. Tabela Me Te Dhëna Mbi Subjektet E Paisur Me Leje Minerare

TABELA NR 1. TABELA ME TE DHËNA MBI SUBJEKTET E PAISUR ME LEJE MINERARE Nr i Lloji i Nr. Date Emri i subjektit Rrethi Emertimi i vendburimit Lloji i Mineralit Adresa e selise lejes Lejes Lloji I vendburimit 1 126/1 10.10.2017 Kumega shpk Mat Dukagjin, Rrethi Mat Kuarc Shfrytëzimi Lagjia "Partizani", Burrel Jometalor Oskeola shpk.(Ish Kuarci- Bllacë Vrith, Pukë(Transfer. me Akt- Miratimin Lagjia 17, Rruga "Jehona",Përball 2 223/1 25.02.2016 Puke Krom Shfrytëzimi shpk) Nr.1638, dt 20.06.2013.) Roal Gaz, Shkozet, Durrës Metalor Lagjia Nr. 4, Rruga "Mithat Hoxha", Lukovë Sarandë( Riaktivizuar mbas Urdhrit të 3 226 26.12.1995 Inerto Beton shpk Sarandë Gur gelqeror Shfrytëzimi Apartamenti 10, Ministrit Nr.1057, dt 29.12.2011) Sarandë.(Skënder.Muç[email protected]) Jometalor Mineral Invest sh.p.k (ish Maja e Gjate 2 (Akt- Miratim Nr.1700,dt. 4 232/1 10.02.2016 Tropoje Krom Shfrytëzimi Pallati Kulturës, Kati II, Tiranë Lahaze) 22.04.2014) Metalor Lagjia 4, Rruga Egnatia, Pallati Fly 5 234/1 05.11.2015 BLEDI shpk Has Qafe Prushit 3 Krom Shfrytëzimi Kati 7, Durrës Metalor Rruga "Ferit Xhajko",Nr. 56/1, 6 253 01.04.1996 XHIRETON shpk Bulqize Mali Lopes Krom Shfrytëzimi Apart.3, Tiranë Metalor Per minieren e Bria e Minit (Kërkuar mbyllje 7 276 15.05.1996 OFMAN shpk Kukes Krom Shfrytëzimi Surroj, Kukës aktiviteti) Metalor 8 297/1 28.12.2016 MALI shpk Tropoje Per minieren e Ragam 2 Krom Shfrytëzimi Lagjia "Dardania", Bajram Curri Metalor 9 308 19.07.1996 DIANI shpk Bulqize Per minieren e Theken Lindore Krom Shfrytëzimi Krastë, Martanesh, Rrethi Bulqizë Metalor -

Barra E Vrame

Viktor Gjikolaj BarraEtnotregime e vrame Tirane 2019 Ermal Lala Autori: Viktor Gjikolaj Titulli i librit: Barra e vrame Botues: Mark Simoni Redaktor: Luan M. Rama Kujdesi grafik: Leandro Xhafa Korrektor: Preng Gj. Gjomarkaj Mundësuan botimin; Kthella Sh.p.k, me president z.Pjetër Nikolli & Kostandin Gjikolaj Të gjitha të drejtat janë të autorit Adresa: Shtëpia botuese “Muzgu”, Lagja “Komuna e Parisit” , Rruga “Osman Myderizi” , T iranë, Albania Mobile phone: +355 (0) 68 21 47 538; ` +355 42 320 004; e-mail: [email protected]; Ky botim u hodh në qarkullim në djetor 2019 2 Kolana e autorëve bashkëkohorë shqipëtarë Viktor Gjikolaj VIKTOR GJIKOLAJ, ETNOTREGIMTAR Nuk është e papritur dhe as befasuese ardhja e Viktor Gjikolës me një përmasë tjetër të krijimtarisë së tij, e njohur më së shumti deri më tash e nga shumëkush prej poezisë. Kush e njeh Viktorin dhe krijimtarinë e tij e raportet që ajo ka me njeriun, me vendlindjen, atdheun, por edhe me traditën, me historinë, mitet, legjendat, doket, zakonet, ritet e gojëdhënat, nuk e ka të vështirë të gjejë në të jo vetëm qëmtuesin e vëmendshëm dhe pasionant ndaj etnokulturë, por edhe bartësin e lëvruesin në një mënyrë krejt të veten të elementëve të saj. Duke u kthyer në kohë gati katër dekada më pas e duke bërë një analizë jo thjeshtë të krijimtarisë, por të të gjithë korpusit të sjelljes e qëndrimit, të gjykimit, mendimeve, vlerësimit e deduksioneve prej krijuesi të Viktor Gjikolës, që jo rastësisht veprën e Kadaresë “Autobiografi e popullit në vargje” e ka një prej librave që ai nuk e -

PRESENZA ITALIANA in ALBANIA Elenco Delle Imprese Italiane E

Sezione per la promozione degli scambi dell’Ambasciata d’Italia a Tirana PRESENZA ITALIANA IN ALBANIA Elenco delle imprese italiane e delle joint ventures italo – albanesi. La lista è parziale, ulteriori aziende in via di verifica. L’Ufficio ICE di Tirana non si assume alcuna responsabilità in merito all’esatezza dei dati forniti, che sono stati raccolti nel Paese presso le aziende italiane ivi operanti. No. Ragione sociale Attività Titolare Indirizzo Città Tel Fax E-mail Web Responsabile 1 Alfa Cleaning Lavaggio a secco, Eduart Mance Via "Ismail Tirana [email protected] servizio di lavanderia Qemali" , n11 2 A Bi Esse Shpk Commercio Riko Pilika/ Raf Pilika/ Ret Pilika Superstrada Tirane Tirana +35542407290 /91 +355 42407292 [email protected]; www.a-biesse.com [email protected]; [email protected]; materiale elettrico –Durres, Km 6 [email protected]; 3 A.S.G sh.p.k Gruppo di aziende Gazmend Haxhia Via "Papa Gjon Pali Tirana +35542255655; +3552271960; [email protected] www.avis.al con interessi nel business auto GM, noleggio auto-AVIS, gestione dei viaggi e dell'editoria (Avis) aziendale II, pal 11 4 ABB Albania Tecnologie per Mihal Jorgoni Via "Ibrahim Tirana +355 422 343 68 +355 422 343 68 [email protected] www.it.abb.com l’energia e Rugova"; Skytower, l’innovazione ufficio 7/4 5 ACMAR Edilizia Zana Aliaj (econimista) Viale "Dëshmorët e Tirana +355 42280460; +355 42280456; [email protected] www.acmar.it Kombit", Twin s.c.p.a – Tower Building, Albania Branch Tower 1, Floor 14 +355 42280463; 6 Adriatex Shpk Commercio Lindita Legisi Via " Siri -

Datë 06.03.2021

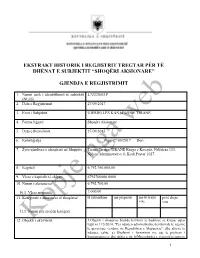

EKSTRAKT HISTORIK I REGJISTRIT TREGTAR PËR TË DHËNAT E SUBJEKTIT “SHOQËRI AKSIONARE” GJENDJA E REGJISTRIMIT 1. Numri unik i identifikimit të subjektit L72320033P (NUIS) 2. Data e Regjistrimit 27/09/2017 3. Emri i Subjektit UJËSJELLËS KANALIZIME TIRANË 4. Forma ligjore Shoqëri Aksionare 5. Data e themelimit 27/09/2017 6. Kohëzgjatja Nga: 27/09/2017 Deri: 7. Zyra qëndrore e shoqërisë në Shqipëri Tirane Tirane TIRANE Rruga e Kavajës, Ndërtesa 133, Njësia Administrative 6, Kodi Postar 1027 8. Kapitali 6.792.760.000,00 9. Vlera e kapitalit të shlyer: 6792760000.0000 10. Numri i aksioneve: 6.792.760,00 10.1 Vlera nominale: 1.000,00 11. Kategoritë e aksioneve të shoqërisë të zakonshme me përparësi me të drejte pa të drejte vote vote 11.1 Numri për secilën kategori 12. Objekti i aktivitetit: 1.Objekti i shoqerise brenda territorit te bashkise se krijuar sipas ligjit nr.l 15/2014, "Per ndarjen administrative-territoriale te njesive te qeverisjes vendore ne Republiken e Shqiperise", dhe akteve te ndarjes, eshte: a) Sherbimi i furnizimit me uje te pijshem i konsumatoreve dhe shitja e tij; b)Mirembajtja e sistemit/sistemeve 1 te furnizimit me ujë te pijshem si dhe të impianteve te pastrimit te tyre; c)Prodhimi dhe/ose blerja e ujit per plotesimin e kerkeses se konsumatoreve; c)Shërbimi i grumbullimit, largimit dhe trajtimit te ujerave te ndotura; d)Mirembajtja e sistemeve te ujerave te ndotura, si dhe të impianteve të pastrimit të tyre. 2.Shoqeria duhet të realizojë çdo lloj operacioni financiar apo tregtar që lidhet direkt apo indirect me objektin e saj, brenda kufijve tè parashikuar nga legjislacioni në fuqi. -

Economic Bulletin Economic Bulletin September 2007

volume 10 volume 10 number 3 number 3 September 2007 Economic Bulletin Economic Bulletin September 2007 E C O N O M I C September B U L L E T I N 2 0 0 7 B a n k o f A l b a n i a PB Bank of Albania Bank of Albania 1 volume 10 volume 10 number 3 number 3 September 2007 Economic Bulletin Economic Bulletin September 2007 Opinions expressed in these articles are of the authors and do not necessarily reflect the official opinion of the Bank of Albania. If you use data from this publication, you are requested to cite the source. Published by: Bank of Albania, Sheshi “Skënderbej”, Nr.1, Tirana, Albania Tel.: 355-4-222230; 235568; 235569 Fax.: 355-4-223558 E-mail: [email protected] www.bankofalbania.org Printed by: Bank of Albania Printing House Printed in: 360 copies 2 Bank of Albania Bank of Albania 3 volume 10 volume 10 number 3 number 3 September 2007 Economic Bulletin Economic Bulletin September 2007 C O N T E N T S Quarterly review of the Albanian economy over the third quarter of 2007 7 Speech by Mr. Ardian Fullani, Governor of the Bank of Albania At the signing of the Memorandum of Understanding with the Competition Authority. Tirana, 17 July 2007 41 Speech by Mr. Ardian Fullani, Governor of the Bank of Albania At the seminar “Does Central Bank Transparency Reduce Interest Rates?” Hotel “Tirana International”. August 22, 2007 43 Speech by Mr. Ardian Fullani, Governor of the Bank of Albania At the conference organized by the Central Bank of Bosnia and Herzegovina September 13, 2007 46 Speech by Mr. -

Ligjvënësit Shqipëtarë Në Vite

LIGJVËNËSIT SHQIPTARË NË VITE Viti 1920 Këshilli Kombëtar i Lushnjës (Senati) Një dhomë, 37 deputetë 27 mars 1920–20 dhjetor 1920 Zgjedhjet u mbajtën më 31 janar 1920. Xhemal NAIPI Kryetar i Këshillit Kombëtar (1920) Dhimitër KACIMBRA Kryetar i Këshillit Kombëtar (1920) Lista emërore e senatorëve 1. Abdurrahman Mati 22. Myqerem HAMZARAJ 2. Adem GJINISHI 23. Mytesim KËLLIÇI 3. Adem PEQINI 24. Neki RULI 4. Ahmet RESULI 25. Osman LITA 5. Bajram bej CURRI 26. Qani DISHNICA 6. Bektash CAKRANI 27. Qazim DURMISHI 7. Beqir bej RUSI 28. Qazim KOCULI 8. Dine bej DIBRA 29. Ramiz DACI 9. Dine DEMA 30. Rexhep MITROVICA 10. Dino bej MASHLARA 31. Sabri bej HAFIZ 11. Dhimitër KACIMBRA 32. Sadullah bej TEPELENA 12. Fazlli FRASHËRI 33. Sejfi VLLAMASI 13. Gjergj KOLECI 34. Spiro Jorgo KOLEKA 14. Halim bej ÇELA 35. Spiro PAPA 15. Hilë MOSI 36. Shefqet VËRLACI 16. Hysein VRIONI 37. Thanas ÇIKOZI 17. Irfan bej OHRI 38. Veli bej KRUJA 18. Kiço KOÇI 39. Visarion XHUVANI 19. Kolë THAÇI 40. Xhemal NAIPI 20. Kostaq (Koço) KOTA 41. Xhemal SHKODRA 21. Llambi GOXHAMANI 42. Ymer bej SHIJAKU Viti 1921 Këshilli Kombëtar/Parlamenti Një dhomë, 78 deputetë 21 prill 1921–30 shtator 1923 Zgjedhjet u mbajtën më 5 prill 1921. Pandeli EVANGJELI Kryetar i Këshillit Kombëtar (1921) Eshref FRASHËRI Kryetar i Këshillit Kombëtar (1922–1923) 1 Lista emërore e deputetëve të Këshillit Kombëtar (Lista pasqyron edhe ndryshimet e bëra gjatë legjislaturës.) 1. Abdyl SULA 49. Mehdi FRASHËRI 2. Agathokli GJITONI 50. Mehmet PENGILI 3. Ahmet HASTOPALLI 51. Mehmet PILKU 4. Ahmet RESULI 52. Mithat FRASHËRI 5. -

Kalendari I Kujtesës 2021

KALENDARI I KUJTESËS 2021 TË DHËNAT PERSONALE EMËR, MBIËMER TELEFON ADRESA FAX VENDI E-MAIL IDMC - Instituti për Demokraci, Media dhe Kulturë është një organizatë e pavarur, jo- © IDMC 2020 fitimprurëse dhe joqeveritare me qendër në Tiranë. IDMC promovon zhvillimin e vlerave Institute for Democracy, Media & Culture demokratike, rolin dhe impaktin e medias e të kulturës brenda dhe jashtë vendit. IDMC Address: Bardhok Biba Street, Entrance A, synon të promovojë vlerat demokratike duke shërbyer si një Think Tank, duke inkurajuar Trema Building, 11th Fl., Apt. 36, Tirana, Albania sondimin e opinionit publik për çështje të ndryshme të politikbërjes. Si dhe përmes www.idmc.al mbështetjes dhe motivimit të brezit të ri drejt formave të reja të pjesëmarrjes politike. Duke marrë si shembull Shqipërinë, ku reflektimi mbi të shkuarën e saj totalitare nuk Kalendari i Kujtesës botohet me mbështetjen e ka zënë në këto 25 vjet vendin që meriton, IDMC ka si mision që përmes aktiviteteve Fondacionit Konrad Adenauer në Tiranë. sensibilizuese ta inkurajojë brezin e ri të njohë historinë dhe të reflektojë mbi të shkuarën për një të ardhme më të sigurt demokratike. Konrad Adenauer Stiftung Address: “Dëshmorët e Kombit” Blvd. Twin Tower 1, 11th Fl., Tirana, Albania www.kas.de/albanien/ Për kalendarin online kanë punuar disa autorë. IDMC falënderon historianin Uran Butka, i cili përpiloi versionin e parë më 2016 me 130 data përkujtimore. Gjatë vitit 2020, kalendari online u pasurua me rreth 65 data të reja përkujtimore për periudhën kohore 1944–1992 nga historiani i ri Pjerin Mirdita, drejtor i Muzeut të Dëshmisë dhe Kujtesës në Shkodër. -

1 LIGJVËNËSIT SHQIPTARË NË VITE Viti 1920 Këshilli Kombëtar I

LIGJVËNËSIT SHQIPTARË NË VITE Viti 1920 Këshilli Kombëtar i Lushnjës (Senati) Një dhomë, 37 deputetë 27 mars 1920–20 dhjetor 1920 Zgjedhjet u mbajtën më 31 janar 1920. Xhemal NAIPI Kryetar i Këshillit Kombëtar (1920) Dhimitër KACIMBRA Kryetar i Këshillit Kombëtar (1920) Lista emërore e senatorëve 1. Abdurrahman Mati 22. Myqerem HAMZARAJ 2. Adem GJINISHI 23. Mytesim KËLLIÇI 3. Adem PEQINI 24. Neki RULI 4. Ahmet RESULI 25. Osman LITA 5. Bajram bej CURRI 26. Qani DISHNICA 6. Bektash CAKRANI 27. Qazim DURMISHI 7. Beqir bej RUSI 28. Qazim KOCULI 8. Dine bej DIBRA 29. Ramiz DACI 9. Dine DEMA 30. Rexhep MITROVICA 10. Dino bej MASHLARA 31. Sabri bej HAFIZ 11. Dhimitër KACIMBRA 32. Sadullah bej TEPELENA 12. Fazlli FRASHËRI 33. Sejfi VLLAMASI 13. Gjergj KOLECI 34. Spiro Jorgo KOLEKA 14. Halim bej ÇELA 35. Spiro PAPA 15. Hilë MOSI 36. Shefqet VËRLACI 16. Hysein VRIONI 37. Thanas ÇIKOZI 17. Irfan bej OHRI 38. Veli bej KRUJA 18. Kiço KOÇI 39. Visarion XHUVANI 19. Kolë THAÇI 40. Xhemal NAIPI 20. Kostaq (Koço) KOTA 41. Xhemal SHKODRA 21. Llambi GOXHAMANI 42. Ymer bej SHIJAKU Viti 1921 Këshilli Kombëtar/Parlamenti Një dhomë, 78 deputetë 21 prill 1921–30 shtator 1923 Zgjedhjet u mbajtën më 5 prill 1921. Pandeli EVANGJELI Kryetar i Këshillit Kombëtar (1921) Eshref FRASHËRI Kryetar i Këshillit Kombëtar (1922–1923) 1 Lista emërore e deputetëve të Këshillit Kombëtar (Lista pasqyron edhe ndryshimet e bëra gjatë legjislaturës.) 1. Abdyl SULA 49. Mehdi FRASHËRI 2. Agathokli GJITONI 50. Mehmet PENGILI 3. Ahmet HASTOPALLI 51. Mehmet PILKU 4. Ahmet RESULI 52. Mithat FRASHËRI 5. -

Plani Investimeve OSHEE 2018

PLANI I INVESTIMEVE I DVSH PER VITIN 2018 A: Bulevardi “Gjergj Fishta”, Ndërtesa Nr. 88, H.1, Njësia Administrative Nr. 7, 1023, Tirana, Albania NIPT: 72410014H Faqe 1 deri 136 PERMBAJTJA 1. HYRJE................................................................................................................................................... 7 1.1 Parashikimi i Planit te investimeve per vitin 2018 .............................................................................. 9 Objektivat e Planit te Investimeve 2018........................................................................................ 9 1.2 Paraqitja e situates e vitit 2017.......................................................................................................... 11 1.3 Impakti ne humbjet e energjise elektrike te kompanise oshee sha bazuar ne investimet e parashikuara me fondet e saj per vitin 2018 ............................................................................................ 13 1.3.1 Humbjet Totale te Energjise........................................................................................................... 13 1.3.2 Humbjet Teknike ............................................................................................................................ 14 1.3.2.1 Humbjet Teknike te Energjise Elektrike ne Tension te Larte (TL)............................................ 14 1.3.2.2 Humbjet në rrjetin e Tensionit te Mesem (TM 6/10/20 kV) ................................................... 16 1.3.2.3 Humbjet e energjisë elektrike -

Preventivues Pergj.Sek.Projektimi Ing.Ademar QOSHJA Ing

DEPARTAMENTI INXHINIERIK MIRATOI SEKTORI I PROJEKTIMIT DREJTORI I PËRGJITHSHËM REDI MOLLA P R E V E N T I V TOTAL EMERTIMI I OBJEKTIT: SHERBIME TE INTEGRUARA DHE FURNIZIM VENDOSJE TE PAISJEVE ELEKTRONIKE INVESTITORI: U.K.T.Sh.a SIPERMARRESI: U.K.T.sh.a Furnizim me Sistem Energji Punime Nr. Emërtimi I Objektit Kamera+Siste Elektrike dhe Ndertimore+Puni m Alarmi Ndricim me te Ndryshme Territori 1 STP+Depo Picalle - - - 2 STP Hekal - - - 3 STP Shytqj - - - 4 STP Qeha - - - 5 STP+Depo Kacone - - - 6 STP+Depo Mullet - - - 7 Depo Daias - - - 8 Depo Barbas - - - 9 Depo Fikas - - - 10 Depo Qeha - - - 11 Depo Shytaj - - - 12 Depo Tagan - - - 13 Depo Mullet - - - 14 Depo Picalle - - - 15 Depo Petrele - - - 16 Depo Hekal - - - 17 Depo Gurre e Madhe - - - 18 Depo Vishnje - - - 19 STP Liqeni Thate - - - 20 Depo Liqeni Thate - - - 21 Depo Kala Preze - - - 22 STP Preze - - - 23 STP Preze 2 (Koder Preze) - - - 24 STP Fushe Preze - - - 25 Depom Kukunje - - - 26 Depo Arbane Vaqarr - - - 27 STP Vishnje - - - 28 Depo Sharre - - - 29 STP Zhurje - - - 30 STP Grece - - - 31 STP+Depo Lagje e Re - - - 32 STP+Depo Peze Celje - - - 33 STP+Depo Peze Helmes - - - 34 STP Vaqarr - - - 35 STP Bulltice Vaqarr (Arbane) - - - 36 Depo Peze e Vogel - - - 37 Depo Varrosh - - - 38 Depo Maknor - - - 39 Depo Pajan 1 - - - 40 Depo Pajan - - - 41 Depo Grece - - - 42 Depo Alshet - - - 43 Depo Gellbresh Lagjia Ceke - - - 44 Depo Curret Lagje e Re - - - 45 Depo Dedjet - - - 46 Depo Lagje e Re Pajont - - - 47 Depo Vaqarr 2 - - - 48 Depo Zhurje - - - 49 Depo Vaqarr - - - 50 Depo Bulqve -

La Biographie En Albanie Sous Le Régime Communiste

UNIVERSITE DE LIMOGES FACULTE DES LETTRES ET DES SCIENCES HUMAINES DEPARTEMENT DE SOCIOLOGIE MEMOIRE DE MASTER 1 Arber Shtembari La biographie en Albanie sous le régime communiste sous la direction de Marie-Pierre Pouly, PRAG docteure à l’Université de Limoges et Nathalie Clayer, directrice d’études à l’EHESS Juin 2010 1 2 Remerciements En préambule à ce mémoire, je souhaitais adresser mes remerciements les plus sincères aux personnes qui m'ont apporté leur aide et qui ont contribué à l'élaboration de ce mémoire ainsi qu’à la réussite de cette formidable année universitaire. Je tiens à remercier tout particulièrement mes Directrices de mémoire, Mesdames Marie-Pierre Pouly et Nathalie Clayer, qui se sont toujours montrées à l'écoute et très disponibles tout au long de la réalisation de ce mémoire, et à leur exprimer ma sincère reconnaissance d’avoir eu la gentillesse et la patience de lire et corriger ce travail. Je n'oublie pas mes chers parents pour leur contribution, leurs conseils et leur soutien. Qu’ils me pardonnent pour toute mon absence à la maison. Ce mémoire leur est dédié. Enfin, j'adresse mes plus sincères remerciements à toute l’équipe pédagogique du Département de Sociologie de la Faculté des Lettres et des Sciences Humaines de Limoges, à mes proches et amis, qui m'ont toujours soutenu et encouragé au cours de la réalisation de ce mémoire. Merci à tous et à toutes. 3 TABLE DES MATIERES Introduction .............................................................................................................................. 9 Contexte et problématique ..................................................................................................... 9 Hypothèses ........................................................................................................................... 15 Méthodologie - définition spatio-temporelle du terrain d’enquête ...................................... 22 Annonce du plan..................................................................................................................