2015 a N N U a L Supervision Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crystal Reports

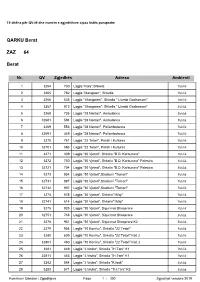

Të dhëna për QV-të dhe numrin e zgjedhësve sipas listës paraprake QARKU Berat ZAZ 64 Berat Nr. QV Zgjedhës Adresa Ambienti 1 3264 730 Lagjia "Kala",Shkolla Publik 2 3265 782 Lagjia "Mangalen", Shkolla Publik 3 3266 535 Lagjia " Mangalem", Shkolla " Llambi Goxhomani" Publik 4 3267 813 Lagjia " Mangalem", Shkolla " Llambi Goxhomani" Publik 5 3268 735 Lagjia "28 Nentori", Ambulanca Publik 6 32681 594 Lagjia "28 Nentori", Ambulanca Publik 7 3269 553 Lagjia "28 Nentori", Poliambulanca Publik 8 32691 449 Lagjia "28 Nentori", Poliambulanca Publik 9 3270 751 Lagjia "22 Tetori", Pallati I Kultures Publik 10 32701 593 Lagjia "22 Tetori", Pallati I Kultures Publik 11 3271 409 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Publik 12 3272 750 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Palestra Publik 13 32721 704 Lagjia "30 Vjetori", Shkolla "B.D. Karbunara" Palestra Publik 14 3273 854 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 15 32731 887 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 16 32732 907 Lagjia "30 Vjetori",Stadiumi "Tomori" Publik 17 3274 578 Lagjia "30 Vjetori", Shkolla"1Maji" Publik 18 32741 614 Lagjia "30 Vjetori", Shkolla"1Maji" Publik 19 3275 925 Lagjia "30 Vjetori", Sigurimet Shoqerore Publik 20 32751 748 Lagjia "30 Vjetori", Sigurimet Shoqerore Publik 21 3276 951 Lagjia "30 Vjetori", Sigurimet Shoqerore K2 Publik 22 3279 954 Lagjia "10 Korriku", Shkolla "22 Tetori" Publik 23 3280 509 Lagjia "10 Korriku", Shkolla "22 Tetori" Kati 2 Publik 24 32801 450 Lagjia "10 Korriku", Shkolla "22 Tetori" Kati 2 Publik 25 3281 649 Lagjia "J.Vruho", -

Plani Investimeve OSHEE 2018

PLANI I INVESTIMEVE I DVSH PER VITIN 2018 A: Bulevardi “Gjergj Fishta”, Ndërtesa Nr. 88, H.1, Njësia Administrative Nr. 7, 1023, Tirana, Albania NIPT: 72410014H Faqe 1 deri 136 PERMBAJTJA 1. HYRJE................................................................................................................................................... 7 1.1 Parashikimi i Planit te investimeve per vitin 2018 .............................................................................. 9 Objektivat e Planit te Investimeve 2018........................................................................................ 9 1.2 Paraqitja e situates e vitit 2017.......................................................................................................... 11 1.3 Impakti ne humbjet e energjise elektrike te kompanise oshee sha bazuar ne investimet e parashikuara me fondet e saj per vitin 2018 ............................................................................................ 13 1.3.1 Humbjet Totale te Energjise........................................................................................................... 13 1.3.2 Humbjet Teknike ............................................................................................................................ 14 1.3.2.1 Humbjet Teknike te Energjise Elektrike ne Tension te Larte (TL)............................................ 14 1.3.2.2 Humbjet në rrjetin e Tensionit te Mesem (TM 6/10/20 kV) ................................................... 16 1.3.2.3 Humbjet e energjisë elektrike -

Të Dhëna Për Qendrat E Votimit

Të dhëna për QV-të dhe numrin e zgjedhësve sipas listës paraprake QARKU SHKODER ZAZ 1 BASHKIA KOPLIK Nr. QV Zgjedhës Adresa Ambienti 1 0047 845 Shkolla 9 - vjecare "Avdyl Bajraktari" kati i pare Publik 2 00471 839 Shkolla 9 - vjecare "Avdyl Bajraktari" kati i pare Publik 3 00472 820 Shkolla 9 - vjecare "Avdyl Bajraktari" kati i pare Publik 4 0048 789 Shkolla 9 vjeçare, Kati i dyte Publik 5 00481 785 Shkolla 9 - vjecare "Avdyl Bajraktari" kati i dyte Publik 6 00482 775 Shkolla 9 - vjecare "Avdyl Bajraktari" kati i dyte Publik 7 0049 869 Shkolla e mesme , Kati i Pare Publik 8 00491 869 Shkolla e Mesme Kati i pare Publik 9 00492 858 Shkolla e Mesme "Sherif Hoxha" kati i pare Publik 10 00493 823 Shkolla e Mesme "Sherif Hoxha" Publik Total : 10 8.272 Komisioni Qëndror i ZgjedhjeveFaqe 1 / 438 Zgjedhjet për Kuvendin 2013 QARKU SHKODER ZAZ 1 KOMUNA GRUEMIRE Nr. QV Zgjedhës Adresa Ambienti 11 0001 666 Shkolla Vrakë Publik 12 0002 485 Shkolla Vrake Publik 13 00021 606 Shkolla Vrake Publik 14 0003 661 Shkolla Vrake Publik 15 0004 511 Grude , Shkolla Publik 16 0005 289 Demiraj, Shkolla Publik 17 0006 398 Shkolla , Kçar i Poshtem Publik 18 0007 316 Gruemire Cezme, Shkolla Publik 19 0008 853 Ktosh, Shkolla 9-Vjecare Publik 20 0009 231 Shkolla Cikel i Ulet Fundi i Brinjes Publik 21 0011 279 Vajush, Shkolla Publik 22 0012 555 Rrash Vorfa, Shkolla Publik 23 0013 473 Balshaj, Shkolla Publik 24 0016 588 Borice i vogel, Shkolla Vrake Publik 25 0017 684 Borice i madh 2 , Shkolla Vrake Publik 26 0018 211 Lepurosh, Shkolla Linaj Publik 27 0019 205 Linaj, Shkolla Linaj Publik 28 0020 348 Egci, Shkolla Linaj Publik 29 0023 234 Ambjent Privat - Fadil Sulaj 30 0024 445 Ambjent Privat - Rasim Mataj 31 0025 710 Gruemire , Shkolla 9- Vjecare Publik Total : 21 9.748 Komisioni Qëndror i ZgjedhjeveFaqe 2 / 438 Zgjedhjet për Kuvendin 2013 QARKU SHKODER ZAZ 1 KOMUNA KASTRAT Nr. -

Raporti Vjetor 2015

ENTI RREGULLATOR I SEKTORIT TË FURNIZIMIT ME UJË DHE LARGIMIT E PËRPUNIMIT TË UJËRAVE TË NDOTURA RAPORTI VJETOR 2015 VEPRIMTARIA E ENTIT RREGULLATOR TË SEKTORIT TË FURNIZIMIT ME UJË DHE LARGIMIT E PËRPUNIMIT TË UJËRAVE TË NDOTURA DHE GJENDJA NË SEKTORIN UJËSJELLËS-KANALIZIME JANAR, 2016 Raporti Vjetor 2015 2 Raporti Vjetor 2015 SHKURTIMET ........................................................................................................................................................ 4 FJALA HYRËSE ..................................................................................................................................................... 5 1. VEPRIMTARIA VJETORE E ERRU-SË ................................................................................................... 7 1.1. STATUSI LIGJOR DHE PËRGJEGJËSITË ................................................................................................................. 8 1.2. FORMA ORGANIZATIVE E ERRU-SË ................................................................................................................. 9 1.3. VEPRIMTARIA RREGULLATORE DHE MONITORUESE ............................................................................................ 10 Licencimi i operatorëve ujësjellës-kanalizime ....................................................................................... 10 Tarifat dhe procesi tarifor, përballueshmëria e tarifave....................................................................... 13 Monitorimi i performancës së sektorit dhe ofruesve -

2012 Supervision Annual Report

Supervision Annual Report 2012 Bank of Albania SUPERVISION 2012 ANNUAL REPORT Bank of Albania 1 2012 Supervision Annual Report If you use data of this publication, you are requested to cite the source. Bank of Albania, Sheshi “Avni Rustemi” Nr.24, Tiranë, Shqipëri Tel.: + 355 4 2419301/2/3; + 355 4 2419409/10/11 Fax: + 355 4 2419408 E-mail: [email protected] www.bankofalbania.org Printed in: 350 copies printed by AlbDesign. 2 Bank of Albania Supervision Annual Report 2012 CONTENTS SUPERVISION MISSION 7 1. SUPERVISION IN 2012: IMPLEMENTING THE MEDIUM-TERM DEVELOPMENT STRATEGY OF SUPERVISION 2009-2014 9 1.1 Development of the regulatory framework and approximation with [EU] directives 9 1.2 Cooperation with international and domestic authorities 10 2. REGULATORY FRAMEWOK AND LICENSING PROCESS 12 2.1 Regulatory framework 12 2.2 Licensing 14 3. PERFORMANCE AND RISK ANALYSIS IN THE BANKING SYSTEM AND NON-BANK FINANCIAL INSTITUTIONS 22 3.1 Economic environment 22 3.2 Banking system highlights 22 3.3 Equity ownership structure 23 3.4 Assets and liabilities 24 3.5 Managing banking activity risks 26 3.6 Capital adequacy 38 3.7 Non-bank financial institutions and savings and loan associations 42 3.8 Financial unions and savings and loan associations 45 4. ON-SITE SUPERVISION 47 4.1 On-site supervision 47 4.2 Anti-money laundering and transparency 49 5. CREDIT REGISTER 53 5.1 Overview 53 5.2 Incorporation of non-bank financial institutions 54 Annex 1. Organisational structure of the Supervision Department 55 Annex 2. Each bank’s specific share in the banking system 56 Annex 3. -

Inventarizimi Kombëtar I Strukturave Dhe Personelit Të Përkrahjes Sociale Në Bashki Pas Ndarjes Së Re Administrativo-Territoriale

Inventarizimi kombëtar i strukturave dhe personelit të përkrahjes sociale në bashki pas ndarjes së re Administrativo-Territoriale 1 Studim i realizuar nga: Qendra për Çështje të Informimit Publik, INFOÇIP Rr “Todi Shkurti”,P. 4, H. 21 Ap.34, Tiranë ALBANIA E-mail: qendra@INFOÇIPl.org Web sites: www.inforcip.org Drejtoi studimin: Gerti Shella Përpunimi i të dhënave dhe vizualizimi grafik’’ Sereta Ylli Dritjon Selmani Rezarta Sheshaj Altin Aliaj Koordinatorë rajonalë: F. Lufo Y. Hoxha E.Cenolli U realizua në kuadër të: “Rapid National Inventory of Human Resourses dealing ëith social protection issues in Local Government level” Mbeshtetur nga: Pohimet dhe rekomandimet në këtë studim janë pikëpamjet e autorëve dhe jo domosdoshmërisht paqyrojnë politikat apo këndvështrimin e UNICEF. 2 Përmbajtja Hyrje………………………………………………………………………… 25. Bashkia Korçë…………………………………… …. 95 26. Bashkia Krujë………………………………………… 99 I. Reforma në Shërbimet e Kujdesit Social…… 5 27. Bashkia Kuçovë…………………………………….. 103 II. Reforma Administrativo – Territoriale………. 6 28. Bashkia Kukës………………………………………. 106 III. Mbi organizimin e gjetjeve të studimit……… 7 29. Bashkia Kurbin……………………………………… 110 Përmbledhje ekzekutive…………………………………………… 30. Bashkia Lezhë………………………………………. 114 1. Pozicionet strukturore të inventarizuara…… 9 31. Bashkia Libohovë…………………………………. 118 2. Përvoja në punë e personelit…………………… 10 32. Bashkia Librazhd………………………………….. 121 3. Marrdhëniet e punës / statusi i punonjësit… 10 33. Bashkia Lushnjë……………………………………. 124 4. Arsimimi i stafeve…………………………………. 12 34. Bashkia Malësi e Madhe………………………… 128 5. Lloji i arsimit universitar………………………… 13 35. Bashkia Maliq……………………………………….. 132 6. Njësia për Mbrojtjen e Fëmijëve……………… 13 36. Bashkia Mallakastër……………………………….. 135 Profilet e bashkive dhe inventarizimi i stafeve………… 37. Bashkia Mat………………………………………….. 139 1. Bashkia Belsh………………………………………. 18 38. Bashkia Memaliaj………………………………….. 143 2. Bashkia Berat………………………………………… 21 39. Bashkia Mirditë……………………………………… 146 3. -

Raport Teknik

Dokumentat Standarde të Tenderit Shtojca 9 [ Shtojcë për t’u plotësuar nga Autoriteti Kontraktor] SPECIFIKIMET TEKNIKE Skicimet, parametrat teknik etj: Specifikimi i Materialeve: Drute e zjarrit ne momentin e dorezimit ne objekt duhet te jene te pregatitura gati per stufe. Drute e zjarrit nuk duhet te jene Halore dhe Frutore. Përshkrimi i kërkesave të zbatimit të shërbimeve në lidhje me to: Operatori ekonomik duhet te mare persiper me punonjesit e vet dhe me automjetet e veta te realizoje shperndarjen, ngarkim, stivosje dhe shkarkim te druve te zjarrit në sasi dhe kohën e caktuar, ne objektet e përcaktuara nga autoriteti kontraktor. 28 Dokumentat Standarde të Tenderit Shtojca 10 [ Shtojcë për t’u plotësuar nga Autoriteti Kontraktor] SASIA DHE GRAFIKU I LËVRIMIT Sasia e mallit që kërkohet: Sasia e druve të Zjarrit që kërkohet nga AK është 820 (tetëqind e njëzet) m/sterë. Çmimi Çmimi Afati i Nr. Emërtimi Njësia Sasia njësi total (lek lëvrimit (lek/m3) pa tvsh) Dru zjarri për ngrohje në 1 objektet shkollore dhe m/sterë 820 Nga data e nënshkrimit parashkollore të kontratës Çmimi neto deri më 31.12. 2016 me mjetet e TVSH 20% furinizuesit sipas kërkesës së Çmimi total AK Lista e njesive administrative te Bashkise se Tiranes qe duhet te furnizohen në sasi dhe në kohë sipas përcaktimeve të shprehura në kontratë me sasine e përgjithshme prej 820 (tetëqind e njëzet) m/sterë Dru Zjarri te pergatitura per stufe. I BALDUSHK VIII PETRELË 1 Lilaj 1 Fikas 2 Mucaj 2 Hekal 3 Shpat 3 Tagan 4 Mumajes 4 Mullet 5 Koçaj 5 Percellesh 6 Fushas 6 Stermas 7 Shpat-Baldushk -

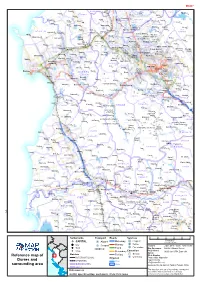

Reference Map of Durres and Surrounding Area

MA007 KRUJË Shkalle BUBQ FUSHË KRUJË Budull Buran CUDHI Perlat Verjon Zall-Mner MANËZ PREZË Zezë Mukje SUKTH Kuçok Larushk Rrushkull Palaq Rinas KRUJËS Herraj Kullë Manëz Rradhesh NIKËL Bulçesh Jubë ZAL L H ER R Borç Kameras Gjeç Kodër Tapizë Kallmet Priskë e Besh Qerek Dritas Vogël Radë Gërdec Gjeç-Fushë ZALL KATUND I RI Shargë Pinar BASTAR Katund i Ri Marqinet 2 Vadardhë Çerkez-Morinë Rinia Maelçiza Mukaj Vorë Zgafnore (Zall-Herr) Bisht Kamëz Rrubjekë Valias Brar Erzen Sukth (Çerkez-Morina) Bilalas Zall-Herr Dajt Karreç Kodër vorë Bërxullë Kamez Allushaj (Zall-Herr) Ferraj Maminas VORË Tujan Fllakë Marikaj Bathore Sukth Picar BËRXULLË Laknas KAMËZ Vlashaj Drazhit (Domje) (Kamëz) Shtish (Shtish-Tufina) Sukth i Ri Shermina Borakë Rrapaj (Babrru) Shëngjin Valis (Linza) i Vogël XHAFZOTAJ MAMINAS Gjokaj Prengaj Karpën (Kashar) Katund Isuf (Paskuqan) (Babrruja) Sallmonaj Koxhas Mazrek i Ri Shënavlash Shehu Paskuqan Linzë Metallaj (Mëzez) Qesarak DAJT Xhafzotaj Sorret Spitallë Shijak (Linsa) SHIJAK (Kashar) Maliq Muço Egër (Mëzez) Gjepalaj Shtrazë Kuç DURRËS (Xhafzotaj) KASHAR TIRANË Lanabregas Rreth Shkozë Kus Surrel Rrashbull Likesh Kënetë Gropaj TIRANË DURRËSIT Xhafët Çollak (Farka Durrës Shetel Allgjatë (Selita e Vogël) DURRËS Prush e Vogël) Ballej (Farka Pejzë GJEPALAJ Arapaj e Vogël) Eminas FARKË Hardhishtë NDROQ Lalm RRASHBULL i Vogël Sauqet Mënik Aga (Lundra) Shkallnur Poshtërak (Mënik) Gurrë e Manskuri Rromanat Çizmeli Mjull-Bathore Lundër Domjan-Fortuzaj Vogël Gurrë Pinet Çeliku Picallë Daias Barbas Gerbllesh Pezë-Helmës Bulticë -

Specifikim Teknik

Shtojca 9 [ Shtojcë për t’u plotësuar nga Autoriteti Kontraktor] SPECIFIKIMET TEKNIKE Skicimet, parametrat teknik etj: Specifikimi i Materialeve: Drute e zjarrit ne momentin e dorezimit ne objekt duhet te jene te pregatitura gati per stufe. Drute e zjarrit nuk duhet te jene Halore dhe Frutore. Përshkrimi i kërkesave të zbatimit të shërbimeve në lidhje me to: Operatori ekonomik duhet te mare persiper me punonjesit e vet dhe me automjetet e veta te realizoje shperndarjen, ngarkim, stivosje dhe shkarkim te druve te zjarrit në sasi dhe kohën e caktuar, ne objektet e përcaktuara nga autoriteti kontraktor. Shtojca 10 [ Shtojcë për t’u plotësuar nga Autoriteti Kontraktor] SASIA DHE GRAFIKU I LËVRIMIT Sasia e mallit që kërkohet: Sasia e druve të Zjarrit që kërkohet nga AK është 820 (tetëqind e njëzet) m/sterë. Çmimi Çmimi Afati i Nr. Emërtimi Njësia Sasia njësi (lek total lëvrimit (lek/m/sterë) pa tvsh) Dru zjarri për ngrohje në 1 objektet shkollore dhe m/sterë 820 Nga data e nënshkrimit parashkollore të kontratës Çmimi neto deri më 31.12. 2016 me mjetet e TVSH 20% furinizuesit sipas kërkesës së Çmimi total AK Lista e njesive administrative te Bashkise se Tiranes qe duhet te furnizohen në sasi dhe në kohë sipas përcaktimeve të shprehura në kontratë me sasine e përgjithshme prej 820 (tetëqind e njëzet) m/sterë Dru Zjarri te pergatitura per stufe. I BALDUSHK VIII PETRELË 1 Lilaj 1 Fikas 2 Mucaj 2 Hekal 3 Shpat 3 Tagan 4 Mumajes 4 Mullet 5 Koçaj 5 Percellesh 6 Fushas 6 Stermas 7 Shpat-Baldushk 7 Kryezi Siperm 8 Parret 8 Shylaj 9 Vrap 9 Shen Koll -

Monitorim I Strategjisë Kombëtare Për Barazinë Gjinore Bashkia Tiranë

Monitorim i Strategjisë Kombëtare për Barazinë Gjinore Bashkia Tiranë 2017 1 Ky raport është hartuar nga Qendra Aleanca Gjinore për Zhvillim (QAGJZH) dhe Rrjeti i Fuqizimit të Gruas në Shqipëri (RrFGSh), në kuadrin e projektit “Ndërtimi i kapaciteteve të Organizatave të Shoqërisë Civile (OSHC-ve) për të monitoruar zbatimin e aktiviteteve të lidhura me reduktimin e dhunës në baza gjinore dhe dhunës në familje të Strategjisë Kombëtare dhe Planit të Veprimit për Barazi Gjinore 2016-2020”. Projekti zbatohet nga QAGJZH dhe RrFGSh ne kuadër të programit rajonal kundër dhunes ndaj grave në Ballkanin Perendimor dhe Turqi ‘Zbatojmë Standartet, Ndryshojmë Mendësitë”, të zbatuar nga UN Women me mbështetjen financiare të Komisionit Evropian. Programi synon krijimin e një mjedisi legjislativ dhe politik të përshtatshëm për eliminimin e dhunës ndaj grave dhe të gjitha formave të diskriminimit, në përputhje me standardet ndërkombëtare, për të mundësuar ulje të fenomenit të dhunës ndaj grave dhe vajzave dhe të gjitha formave të tjera të diskriminimit në Shqipëri. Përmbajtja e këtij manuali është vetëm përgjegjësi e Qendrës Aleanca Gjinore për Zhvillim dhe Rrjetit të Fuqizimit Të Gruas në Shqipëri, dhe nuk reflekton opinionin e Komisionit Evropian dhe UN Women. Autorët Megi Llubani Esmeralda Hoxha Albana Konci Ines Leskaj 2 Tabela e përmbajtjes SHKURTIME ........................................................................................................................................................... 4 HYRJE ................................................................................................................ -

2014 Supervision Annual Report

Supervision Annual Report 2014 Bank of Albania SUPERVISION 2014 ANNUAL REPORT Bank of Albania 1 2014 Supervision Annual Report You may use data of this publication, provided the source is acknowledged. Bank of Albania, Sheshi “Skënderbej”, nr. 1, Tiranë, Shqipëri Tel.: + 355 4 2419301/2/3; + 355 4 2419409/10/11 Faks: + 355 4 2419408 E-mail: [email protected] www.bankofalbania.orgPrinted in: 350 copies 2 Bank of Albania Supervision Annual Report 2014 CONTENT MISSION OF SUPERVISION 7 1. MAIN PROJECTS INVOLVING THE SUPERVISION DEPARTMENT DURING 2014 9 1.1 Compliance with Development Policy Loans criteria 9 1.2 Risk-based supervision 9 1.3 From Basel I to Basel II 10 1.4 Treatment of non-performing loans 11 2. REGULATORY FRAMEWORK AND LICENSING 12 2.1 Regulatory framework 12 2.2 Licencing 15 3. PERFORMANCE AND RISK ANALYSIS IN THE BANKING SYSTEM AND NON-BANK FINANCIAL INSTITUTIONS 19 3.1 Banking system highlights 19 3.2 Equity ownership structure by country of origin 20 3.3 Banking system structure 20 3.4 Management of banking activity risks 23 3.5 Non-bank financial instiutions and savings and loan associations 42 3.6 ON-SITE EXAMINATIONS 46 3.7 Credit registry 48 ANNEXES 51 Annex 1 Supervision Department Structure 50 Annex 2 Each bank’s specific share in the banking system 51 Annex 3 Assets and liabilities 52 Annex 4 Core financial indicators 54 Annex 5 Banks’ shareholders, as at 31.12.2014 55 Annex 6 Data on the shareholders/partners of the non-bank financial institution as at 31.12.2014 56 Annex 7 Bank branches and agencies in Albania, by prefecture over 2007 - 2014 57 Annex 8 E-banking products over 2006 - 2014 57 Annex 9 E-banking products/services, by commercial bank, as at end-2014 57 Annex 10 Number of entities licensed by the Bank of Albania, by year 58 Annex 11 Banking services statistics as at 31.12.2014 58 Annex 12 Banks’ network as at end 2014 58 Annex 13 List of banking supervision regulations in force as at December 2014 59 Annex 14 Banks and branches of foreign banks licensed by the Bank of Albania (31.12.2014) 62 Annex 15. -

Përmbledhje Legjislacioni Për Pushtetin Vendor

PËRMBLEDHJE LEGJISLACIONI PËR PUSHTETIN VENDOR Botim i Qendrës së Publikimeve Zyrtare Nëntor 2010 1 © I këtij botimi Qendra e Publikimeve Zyrtare ISBN: 978-9928-01-008-7 2 PËRMBAJTJA ORGANIZIMI I QEVERISJES VENDORE, TRANSFERIMI I PRONAVE Ligj nr.8652 Për organizimin dhe funksionimin e qeverisjes vendore 9 datë 31.7.2000 ndryshuar me: - ligjin nr.9208, datë 18.3.2004 Vendim i KM Për organizimin e strukturës së zyrave të gjendjes civile 37 nr.55, datë 2.2.2001 Udhëzim i MRTT Për mënyrën e ushtrimit të kompetencës për planifikimin e territorit nga nr.4, datë 11.8.2004 njësitë e qeverisjes vendore 38 Vendim i KM Për përcaktimin e përgjegjësive të qarkut për shpërndarjen e shërbimeve nr.563, datë 12.8.2005 të përkujdesjes shoqërore 41 Ligj nr.8744 Për transferimin e pronave të paluajtshme publike të shtetit në njësitë e datë 22.2.2001 qeverisjes vendore 43 ndryshuar me: - ligjin nr.9561,datë 12.6.2006 - ligjin nr.9797,datë 23.7.2007 Vendim i KM Për transferimin e pasurive, troje dhe objekte, me interes vendor, në nr.610, datë 12.9.2007 pronësi të bashkisë së Tiranës 50 Vendim i KM Për klasifikimin e funksioneve, grupimin e njësive të qeverisjes vendore, nr.1619, datë 2.7.2008 për efekt page, dhe caktimin e kufijve të pagave të punonjësve të organeve të qeverisjes vendore 61 ndryshuar me: - vendim të KM nr.693, datë 18.8.2010 Ligj nr.9869 Për huamarrjen e qeverisjes vendore 67 datë 4.2.2008 Ligj nr.10 158 Për obligacionet e shoqërive aksionare dhe të qeverisë vendore 77 datë 15.10.2009 Vendim i KM Për dhënien e fondit për subjektet, pjesëmarrëse