The Dow Jones Total Market Portfolio, Enhanced Index Strategy 2021-3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Oakworth Capital, Inc. Form 13F-HR Filed 2021-07-20

SECURITIES AND EXCHANGE COMMISSION FORM 13F-HR Initial quarterly Form 13F holdings report filed by institutional managers Filing Date: 2021-07-20 | Period of Report: 2021-06-30 SEC Accession No. 0001567619-21-013688 (HTML Version on secdatabase.com) FILER Oakworth Capital, Inc. Mailing Address Business Address 850 SHADES CREEK 850 SHADES CREEK CIK:1588871| IRS No.: 463019611 | State of Incorp.:AL | Fiscal Year End: 1231 PARKWAY PARKWAY Type: 13F-HR | Act: 34 | File No.: 028-15704 | Film No.: 211100272 BIRMINGHAM AL 35209 BIRMINGHAM AL 35209 205-263-4700 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE OMB Number: 3235-0006 COMMISSION Expires: July 31, 2015 Washington, D.C. 20549 Estimated average burden hours per response: 23.8 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 06-30-2021 Check here if Amendment: ☐ Amendment Number: This Amendment (Check only one.): ☐ is a restatement. ☐ adds new holdings entries. Institutional Investment Manager Filing this Report: Name: Oakworth Capital, Inc. Address: 850 SHADES CREEK PARKWAY BIRMINGHAM, AL 35209 Form 13F File Number: 028-15704 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: COLBY BARNETT Title: CONTROLLER Phone: 205-263-4733 Signature, Place, and Date of Signing: /s/ COLBY BARNETT BIRMINGHAM, ALABAMA 07-13-2021 [Signature] [City, State] [Date] Report Type (Check only one.): ☒ 13F HOLDINGS REPORT. -

The Sure Dividend Newsletter, Where It Ranked 9Th in Our Top 10

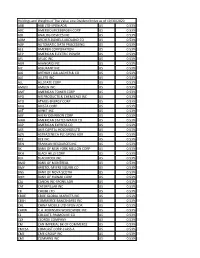

Sure Dividend LONG-TERM INVESTING IN HIGH-QUALITY DIVIDEND SECURITIES April 2021 Edition By Ben Reynolds, Bob Ciura, Josh Arnold, & Eli Inkrot Edited by Brad Beams Published on April 4th, 2021 2 Table of Contents Opening Thoughts - Today’s Market Is Overvalued & Could Correct- ................................. 3 Sell Recommendations .................................................................................................................. 4 Kohl’s Corporation (KSS) .......................................................................................................... 4 UMB Financial Corporation (UMBF) ........................................................................................ 4 The Sure Dividend Top 10 – April 2021 ..................................................................................... 5 Analysis of Top 10 Securities ....................................................................................................... 6 L3Harris Technologies Inc. (LHX) ............................................................................................ 6 Northrop Grumman Corp. (NOC) .............................................................................................. 9 Enterprise Bancorp Inc. (EBTC) .............................................................................................. 12 AbbVie Inc. (ABBV) ................................................................................................................ 15 Bristol-Myers Squibb Co. (BMY) ........................................................................................... -

Ariel Focused Value Composite Quarter Ended June 30, 2021

Ariel Focused Value Composite Quarter Ended June 30, 2021 Quarter Ended June 30, 2021 Markets worldwide continued their upward trajectory in current levels, given favorable business trends, continued the second quarter. Record levels of fiscal support, pent-up positive momentum on strategic initiatives and active consumer demand and rising COVID-19 vaccination rates expense/capital management programs. continue to fuel the global economic recovery. As the re- In addition, Global leader in enterprise software, Oracle opening progresses, implications for inflation and the Corporation (ORCL) outperformed in the period and delivered a timing of rate hikes has ignited investor anxiety. While we robust earnings beat. ORCL currently holds the top two market expect volatility to elevate, we view such jitters as short- share spots for cloud ERP businesses and management is term noise within the context of our long-term investment optimistic about the Oracle Database business, whose latest horizon. Against this backdrop, the Ariel Focused Value version has been upgraded to include a new ultra-high- Composite delivered +3.18% gross of fees (+3.02% net performance parallel processing query engine called HeatWave. of fees) in the quarter, underperforming both the Russell As a result, industry analysts are seeing a 10x increase in 1000 Value Index and S&P 500 returns of +5.21% and Oracle Cloud Infrastructure customer inquiries. In our view, this +8.55%, respectively. bodes well for the future of ORCL’s cloud business. Several stocks in the portfolio had strong returns in the Alternatively, several positions weighed on performance. quarter. Oil and natural gas explorer APA Corporation Leading provider of specialty industrial services, Team, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

Notes to Portfolio of Investments—March 31, 2021 (Unaudited)

Portfolio of investments—March 31, 2021 (unaudited) Shares Value Common stocks: 59.94% Communication services: 6.55% Diversified telecommunication services: 0.84% AT&T Incorporated 10,125 $ 306,484 Lumen Technologies Incorporated 1 , 4 0 0 1 8 , 6 9 0 Verizon Communications Incorporated 5,863 340,933 666,107 Entertainment: 1.27% Activision Blizzard Incorporated 1 , 1 0 2 1 0 2 , 4 8 6 Electronic Arts Incorporated 4 0 7 5 5 , 0 9 6 Live Nation Entertainment Incorporated † 204 17,269 Netflix Incorporated † 630 328,646 Take-Two Interactive Software Incorporated † 163 28,802 The Walt Disney Company † 2,573 474,770 1,007,069 Interactive media & services: 3.52% Alphabet Incorporated Class A † 425 876,571 Alphabet Incorporated Class C † 408 844,001 Facebook Incorporated Class A † 3,385 996,984 Twitter Incorporated † 1,128 71,775 2,789,331 Media: 0.79% Charter Communications Incorporated Class A † 200 123,404 Comcast Corporation Class A 4 7 4,6 3 5 0 , 3 0 8 Discovery Incorporated Class A † 225 9,779 Discovery Incorporated Class C † 408 15,051 DISH Network Corporation Class A † 351 12,706 Fox Corporation Class A 470 16,972 Fox Corporation Class B 216 7,545 Interpublic Group of Companies Incorporated 555 16,206 News Corporation Class A 553 14,063 News Corporation Class B 172 4,035 Omnicom Group Incorporated 304 22,542 ViacomCBS Incorporated Class B 827 37,298 629,909 Wireless telecommunication services: 0.13% T-Mobile US Incorporated † 827 103,615 Consumer discretionary: 7.50% Auto components: 0.09% Aptiv plc † 383 52,816 BorgWarner Incorporated -

GROW with US Essential Utilities, Inc

GROW WITH US Essential Utilities, Inc. 2021 Annual Meeting of Shareholders NYSE: WTRG 47998_EU_Proxy-21_Covers_4c_v6.indd 1 3/19/21 4:26 PM OUR KEY PILLARS Infrastructure We are committed to thoughtful and continuous investment in the infrastructure that delivers water and wastewater service and natural gas to our customers safely and reliably. Operations We are committed to responsibly leveraging our industry expertise, purchasing power, economies of scale and efficiencies and to operational excellence benefiting our customers and shareholders. Environment We take our role as a provider of water and natural gas very seriously, and we return wastewater safely back to the environment. We are committed to sustainable business practices that protect these valuable natural resources and work to ensure the environment is safeguarded for future generations. Safety We are committed to creating a culture that empowers employees to prioritize their safety and well-being and the safety of others above all else. We strive for safe treatment and delivery of water and gas to each customer we serve. 47998_EU_Proxy-21_Covers_4c_v6.indd 2 3/19/21 4:26 PM March 22, 2021 To Our Shareholders On behalf of your Board of Directors, I am pleased to invite you to attend the 2021 Annual Meeting of the Shareholders of Essential Utilities, Inc. to be held virtually on Wednesday, May 5, 2021. I’m sure you will agree that 2020 was a transformative year for the company, as well as the country. Just as the COVID-19 pandemic began to sweep the U.S. and the country started to shut down and begin social distancing, Essential completed our momentous acquisition of Peoples Natural Gas. -

2021 BMO Energy Conference

2021 BMO Energy Conference TIME WEDNESDAY, JUNE 2 1ON1 MEETINGS 8:00 AM – 9:45 AM EST 1on1 Meetings are 45 minutes in length with 15 minutes transition time OPENING REMARKS Bert Powell, Global Director of Research, BMO Capital Markets 9:45 AM EST OVERVIEW Doug Morrow, ESG Strategy Analyst, BMO Capital Markets OIL SANDS ESG TRENDS, STRATEGIES AND SUSTAINABLE PATHWAYS Rhona DelFrari, Chief Sustainability Officer & SVP, Stakeholder Engagement, Cenovus Energy (CVE) 10:00 AM EST Sherri Evers, VP, Commercial & Corporate Development, Imperial Oil (IMO) Derek Evans, CEO, MEG Energy (MEG) Moderated by: Jared Dziuba, Director, Research, BMO Capital Markets US E&P PERSPECTIVES PANEL Tom Jorden, President & CEO, Cimarex Energy (XEC) 11:00 AM EST Lloyd Visser, VP, Sustainable Development , ConocoPhillips (COP) Brendan McCracken, President, Ovintiv (OVV) Moderated by: Phillip Jungwirth, MD, BMO Capital Markets CCUS OPPORTUNITIES & CHALLENGES FOR THE OIL & GAS SECTOR Mike Belenkie, President & COO, Advantage Energy (AAV) 12:00 PM EST Joy Romero, VP, Technology & Innovation, Canadian Natural Resources (CNQ) April Hillier, Senior Technical Specialist, Lead Climate Policy Consultant, ICF International (ICF) Moderated by: Jared Dziuba, Director, Research, BMO Capital Markets 1ON1 MEETINGS 2:00 PM – 4:45 PM EST 1on1 Meetings are 45 minutes in length with 15 minutes transition time TIME THURSDAY, JUNE 3 1ON1 MEETINGS 8:00 AM – 4:45 PM EST 1on1 Meetings are 45 minutes in length with 15 minutes transition time 1ON1 MEETINGS: 1on1 meetings will run prior to and following the panels on June 2, and all day on June 3. *Agenda is current as of May 31, 2021; subject to change. -

U.S. Investor-Owned Electric Companies International Members Associate Members EEI the Edison Electric Institute, Is the Association That Represents All U.S

Members List U.S. Investor-Owned Electric Companies International Members Associate Members EEI The Edison Electric Institute, is the association that represents all U.S. investor-owned electric companies. Our members provide electricity for about 220 million Americans, and operate in all 50 states and the District of Columbia. As a whole, the electric power industry supports more than 7 million jobs in communities across the United States. In addition to our U.S. members, EEI has more than 65 international electric companies with operations in more than 90 countries, as International Members, and hundreds of industry suppliers and related organizations as Associate Members. Organized in 1933, EEI provides public policy leadership, strategic business intelligence, and essential conferences and forums. U.S. Energy Companies AES Corporation Entergy Corporation Otter Tail Corporation Dayton Power & Light Company Entergy Arkansas Otter Tail Power Company Indianapolis Power & Light Company Entergy Louisiana PG&E Corporation Alaska Power & Telephone Company Entergy Mississippi Pacific Gas & Electric Company ALLETE Entergy New Orleans Pinnacle West Capital Corporation Minnesota Power Entergy Texas Arizona Public Service Company Superior Water, Light and Power Company Evergy PNM Resources Alliant Energy Eversource Energy PNM Ameren Corporation Exelon Corporation TNMP Ameren Illinois Atlantic City Electric Portland General Electric Ameren Missouri BGE PPL Corporation American Electric Power ComEd PPL Electric Utilities AEP Ohio Delmarva Power LG&E -

2020 Annual Report

2020 Annual Report 1 THE GIRL SCOUT MISSION THE GIRL SCOUT LAW Girl Scouting builds girls of courage, I will do my best to be confidence, and character, honest and fair, who make the world a better place. friendly and helpful, considerate and caring, courageous and strong, and THE GIRL SCOUT PROMISE responsible for what I say and do, and to On my honor, I will try: respect myself and others, To serve God and my country, respect authority, To help people at all times, use resources wisely, And to live by the Girl Scout Law. make the world a better place, and be a sister to every Girl Scout. Annual Report Cover – The cover of the Annual Report this year represents the tale of two half years that we experienced in 2020 with color and a girl journey. The two half years are represented by the two Pantone colors of the year, Ultimate Gray and Illuminating Yellow. The gradient and movement of the two colors interacting with one another share how the year started out yellow, exciting and normal and moved into the gray with uncertainty and overwhelming change of the world around us. The girl’s journey ultimately reverts back to yellow as we take our new normal in stride and look into our future with resilience. 2 TABLE OF CONTENTS Executive Message 4 Take the Lead 22 Transformation Strategy 6 Thank you to our Donors 24 Program Accomplishments FY20 10 Board of Directors 30 Financial Report 20 Our Footprint 31 3 GIRL SCOUT LEADERSHIP EXPERIENCE (GSLE) IN ACTION: GIRL SCOUTS GIVING BACK DURING THE PANDEMIC Making masks for frontline healthcare workers Writing letters to isolated elderly people in retirement communities Organizing food and supply drives for increased at-risk population Staying connected while physically apart EXECUTIVE MESSAGE 4 Working Together to help create the next generation of female leaders. -

Holdings and Weights of the Value Line Dividend

Holdings and Weights of The Value Line Dividend Index as of 10/30/2020 ABB ABB LTD-SPON ADR US 0.53% ABC AMERISOURCEBERGEN CORP US 0.53% ADI ANALOG DEVICES INC US 0.53% ADM ARCHER-DANIELS-MIDLAND CO US 0.53% ADP AUTOMATIC DATA PROCESSING US 0.53% AEE AMEREN CORPORATION US 0.53% AEP AMERICAN ELECTRIC POWER US 0.53% AFL AFLAC INC US 0.53% AGR AVANGRID INC US 0.53% AIZ ASSURANT INC US 0.53% AJG ARTHUR J GALLAGHER & CO US 0.53% ALE ALLETE INC US 0.53% ALL ALLSTATE CORP US 0.53% AMGN AMGEN INC US 0.53% AMT AMERICAN TOWER CORP US 0.53% APD AIR PRODUCTS & CHEMICALS INC US 0.53% ATO ATMOS ENERGY CORP US 0.53% AVA AVISTA CORP US 0.53% AVT AVNET INC US 0.53% AVY AVERY DENNISON CORP US 0.53% AWR AMERICAN STATES WATER CO US 0.53% AXP AMERICAN EXPRESS CO US 0.53% AXS AXIS CAPITAL HOLDINGS LTD US 0.53% AZN ASTRAZENECA PLC-SPONS ADR US 0.53% BCE BCE INC US 0.53% BEN FRANKLIN RESOURCES INC US 0.53% BK BANK OF NEW YORK MELLON CORP US 0.53% BKH BLACK HILLS CORP US 0.53% BLK BLACKROCK INC US 0.53% BMO BANK OF MONTREAL US 0.53% BMY BRISTOL-MYERS SQUIBB CO US 0.53% BNS BANK OF NOVA SCOTIA US 0.53% BOH BANK OF HAWAII CORP US 0.53% CAJ CANON INC-SPONS ADR US 0.53% CAT CATERPILLAR INC US 0.53% CB CHUBB LTD US 0.53% CBOE CBOE GLOBAL MARKETS INC US 0.53% CBSH COMMERCE BANCSHARES INC US 0.53% CHL CHINA MOBILE LTD-SPON ADR US 0.53% CHRW C.H.