The Oscartek Journal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Training Coordinator Job Description Direct Report Relationship: Vice President, Training & Customer Service Location: Scottsdale, Arizona FLSA Status: Exempt

Training Coordinator Job Description Direct Report Relationship: Vice President, Training & Customer Service Location: Scottsdale, Arizona FLSA Status: Exempt Equal Opportunity Employer M/F/D/V TRAINING COORDINATOR POSITION SUMMARY Help maximize the efforts and effectiveness of the Kahala Training Team by managing franchisee training registration, identifying gaps and efficiencies in processes, developing resources and providing training support. This position supports all of the Quick Service Restaurant (QSR) brands under the Kahala Brands umbrella (e.g., Cold Stone Creamery, Blimpie, TacoTime, Planet Smoothie, Pinkberry, etc.). TRAINING COORDINATOR KEY RESPONSIBILITIES Oversee all training registrations, communicating regularly with franchisees, training stores, field and office team Maintain training records Proctor monthly ServSafe exams Provide team support (e.g., room set up, scheduling, formatting PowerPoints) for the successful execution of classroom training and other training efforts Ensure training stores have the information and resources needed to successfully train franchisees Process training store payments Work with our print vendor to maintain and order all brand resources Manage content on franchisee portal Continuously provide innovative training solutions (e.g., quizzes, handouts, best practices, apps, etc.) Support team in executing company-wide events TRAINING COORDINATOR PERSONAL ATTRIBUTES Optimistic, enthusiastic and service-minded (to model values of the hospitality industry) Strong organizational -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

Agenda Item 7

Item Number: AGENDA ITEM 7 TO: CITY COUNCIL Submitted By: Douglas D. Dumhart FROM: CITY MANAGER Community Development Director Meeting Date: Subject: Conceptual Review of a Proposal for the July 19, 2011 Development of a Chase Bank at 5962 La Palma Avenue RECOMMENDATION: It is recommended that the City Council conceptually approve a proposal for the development of a Chase Bank at 5962 La Palma Avenue and direct staff to draft a Zoning Code Text Amendment and Development Agreement for further consideration. SUMMARY: The City has received a letter from Studley, the real estate brokerage firm representing the property owner at 5962 La Palma Avenue, requesting that the City consider the development of a JP Morgan Chase Bank on their property. The letter is provided as Attachment 1 to this report. The site is located at the southwest corner of Valley View Street and La Palma Avenue and has been vacant for over 10 years. Late last year, the subject parcel was rezoned from Neighborhood Commercial (NC) to Planned Neighborhood Development (PND) land use designation, which prohibits financial institutions and banks. The Broker has stated that they have exhausted attempts to find end users for his client’s property that are consistent with the goals of the new PND Zone and that meet the needs of his client. They have a ground lease offer from Chase to develop a free-standing bank. The financial institution use alone does not meet the requirements in the PND Zoning District to develop the commercial corner with retail uses that are lacking in the community. -

Notice to Shareholders and Proxy Statement

KAHALA BRANDS, LTD. 9311 East Via De Ventura Scottsdale, Arizona 85258 NOTICE OF A SPECIAL MEETING OF THE STOCKHOLDERS To be held July 21, 2016 Dear Kahala Brands, Ltd. Stockholder, You are cordially invited to attend a Special Meeting of the Stockholders of Kahala Brands, Ltd. (the “Company”) to be held on July 21, 2016, commencing at 10 a.m. Arizona time at the Company’s headquarters, located at 9311 East Via De Ventura, Scottsdale, Arizona 85258 (the “Meeting”). As stated in the press release distributed on behalf of the Company by the OTC Disclosure & News Service on May 25, 2016 (a copy of which is attached as Appendix E), the Company entered into a Transaction Agreement (the “Transaction Agreement”) providing for the merger (the “Merger”) of 113 Acquisition Corp. (“Merger Sub”), an indirect wholly-owned subsidiary of MTY Food Group Inc. (“Parent” or “MTY”), with and into the Company, and pursuant to which the Company will be the surviving corporation and will become an indirect wholly-owned subsidiary of Parent. Only holders of record of shares of the Common Stock, par value $0.001 per share (“Common Stock”), at the close of business on May 24, 2016 are entitled to notice of and to vote at the Meeting or at any adjournments or postponements thereof that may take place. All stockholders of record or their duly authorized proxies are cordially invited to attend the Meeting in person. The Company may require reasonable documentation to evidence ownership of Common Stock. Please note that cameras, recording devices and other electronic devices will not be permitted at the Meeting. -

Tacotime Introduces Chicken Jicama Burrito Scottsdale

FOR IMMEDIATE RELEASE Contact: Jessica Benedick TacoTime 480.622.3349 [email protected] TACOTIME INTRODUCES CHICKEN JICAMA BURRITO A Menu Item with a Unique Mexican Ingredient, Available for a Limited Time SCOTTSDALE, Ariz. – (June 28, 2016) – TacoTime® (www.TacoTime.com) incorporates jicama, a vegetable that is growing in popularity, into its latest limited time offer, the Chicken Jicama Burrito, available June 29 through August 30. The Chicken Jicama Burrito features crunchy jicama, homemade salsa fresca, black beans, crisp baby leaf spinach and all white meat chicken, topped with a creamy poblano sauce and wrapped in a warm home-style tortilla. “This burrito is unique because of the jicama, which is a root vegetable typically used in Mexican cuisine to add a light crisp crunch,” said Julie Hoefling, director of marketing for TacoTime. “The addition of this special ingredient sets it apart and brings a traditional element to the overall flavor of the Chicken Jicama Burrito that customers are going to love.” Jicama is known for being low in calories with added health benefits. Its thick skin must be peeled before eating but the Mexican root can be consumed raw or lightly cooked to add a deliciously crisp taste to any culinary creation like the Chicken Jicama Burrito. The Chicken Jicama Burrito goes great with a side of Mexi-Fries, TacoTime’s popular seasoned, crispy golden potatoes and is available until August 30 at your nearest TacoTime. About TacoTime® Headquartered in Scottsdale, Ariz., TacoTime® has been an industry leader in quality quick-service Mexican food for over 50 years. Founded in 1960, TacoTime has grown to nearly 400 franchised restaurants across the U.S. -

Franchise Disclosure Document

FRANCHISE DISCLOSURE DOCUMENT Kahala Franchising, L.L.C. an Arizona limited liability company 9311 E. Via De Ventura Scottsdale, Arizona 85258 Telephone: (480) 362-4800 Website: www.kahalamgmt.com www.americastacoshop.com Facebook: http://www.facebook.com/americastacoshop Twitter: @AmericasTaco We offer America’s Taco Shop franchises and area representative agreements. As a franchisee, you will operate a restaurant called America’s Taco Shop, preparing and serving specialized freshly prepared Mexican fast food and related menu items. As an area representative (if applicable), you will operate as an America’s Taco Shop franchise broker and service representative for us within a defined geographic area. The total investment necessary to begin operation of an America’s Taco Shop franchise ranges from $239,350 to $821,550 for a traditional franchise unit; from $228,150 to $806,050 for a non-traditional franchise full-menu unit located within an airport, convenience store, mall food court, stadium, or similar venue; and from $224,150 to $799,050 for a non-traditional limited menu franchise unit. This includes $20,450 to $149,500 for a traditional location and $5,250 to $134,500 for a non-traditional location that must be paid to the franchisor or its affiliate. The total investment necessary to begin operation as an Area Representative under an ARA ranges from $22,500 to $168,000 plus the Area Representative Fee which is the greater of: (i) the estimated population in the ARA Territory multiplied by $.125; or (ii) the estimated population in the ARA Territory multiplied by $.03 plus 4 times the royalty payments we received in the last 12 months on existing stores within the ARA Territory, plus a Performance Deposit, which is calculated by taking 10% of the potential Initial Franchise Fees for the Territory based on the store development schedule. -

The Tacotime Crisp Meat Burrito Now Offered for a Special Price for a Limited Time Only

FOR IMMEDIATE RELEASE Contact: Jessica Benedick TacoTime 480.362.4837 [email protected] THE TACOTIME CRISP MEAT BURRITO NOW OFFERED FOR A SPECIAL PRICE FOR A LIMITED TIME ONLY SCOTTSDALE, Ariz. – (December 30, 2015) – TacoTime® (www.TacoTime.com) is offering the delicious Crisp Meat Burrito for $1.99 beginning December 30, for a limited time only, through March 1, 2016. “Our Crisp Meat Burrito is one of the most popular items on our menu,” said Julie Hoefling, director of marketing for TacoTime. “During the busy holiday season people are often spending a lot of money on gifts and special occasions, so we wanted to ease holiday spending by offering a special value price on a TacoTime favorite.” The Crisp Meat Burrito recipe was created over 40 years ago and is a brand staple as a signature menu item. Each Crisp Meat Burrito is rolled by hand daily in every TacoTime kitchen. The home-style flour tortilla is rolled with delicious seasoned beef and creamy jalapeno cheese sauce and then cooked to crispy perfection. About TacoTime® Headquartered in Scottsdale, Ariz., TacoTime® has been an industry leader in quality quick-service Mexican food for over 50 years. Founded in 1960, TacoTime has grown to nearly 400 franchised restaurants across the U.S. and Canada. In 2003, TacoTime became part of Kahala Brands™, one of the fastest growing franchising companies in the world with a portfolio of 18 quick-service restaurant brands. About Kahala Brands™ Headquartered in Scottsdale, Ariz., Kahala Brands™ is one of the fastest growing franchising companies in the world with a portfolio of 18 quick-service restaurant brands including: Cold Stone Creamery®, Pinkberry®, Maui Wowi Hawaiian®, Blimpie®, Planet Smoothie®, Tasti D-Lite, TacoTime®, Samurai Sam’s Teriyaki Grill®, The Great Steak™, NrGize Lifestyle Cafe®, Surf City Squeeze®, Johnnie’s New York Pizzeria™, Cereality, Kahala Coffee Traders, Frullati Cafe & Bakery™, Rollerz™, Ranch One® and America’s Taco Shop®. -

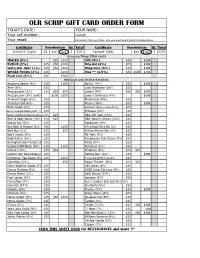

Scrip Order Form OLR-2.Xls

OLR SCRIP GIFT CARD ORDER FORM TODAY'S DATE: YOUR NAME: Your cell number: Contact: Your email: Instructions: Circle your choice, write your quantity and total in the blanks below. Certificate Denominations Qt. Total Certificate Denominations Qt. Total Example: Ingles $5 $10 $25 2 $50 Example: Publix $25 $100 1 $100 Grocery/Drug/VISA cards INGLES (5%) $50 $100 CVS (4%) $25 $100 PUBLIX (3%) $25 $50 $100 Rite Aid (4%) $25 $100 SAM'S/WAL-MART (1.5%) $25 $50 $100 Walgreens (6%) $25 $100 WHOLE FOODS (3%) $25 $100 Visa ** (1.5%) $50 $100 $250 Food Lion (3%) $25 $100 National and Online Retailers Academy Sports (4%) $25 $100 Kohl's* (4%) $25 $100 Aerie (6%) $25 Lady Footlocker (8%) $25 Amazon.com (3%) $10 $25 $50 Lowe's (4%) $25 $50 $100 Amazon.com (3%) (cont) $100 $250 Lowe's Continued (4%) $500 American Eagle (6%) $25 MasterCuts (9%) $25 American Girl (9%) $25 Macy's (10%) $25 $100 Baby Depot (8%) $25 Marshalls/TJ Max/HomeGoods(7%) $25 BananaRepublic/OldNavy/GAP (14%) $25 Michaels (4%) $25 Barnes & Noble/Colege Bookstores(8%) $25 Nike Gift Card (12%) $25 Bath & Body Works (18%) $10 $25 Nike Women Stores (12%) $25 Beauty Bar (9%) $25 Nordstrom (4%) $25 Bed Bath & Beyond (6%) $25 $100 Office Depot/Office Max (4%) $25 Best Buy (2%) $25 $50 Old Navy/Banana Rep. (14%) $25 Bob's Stores (9%) $25 PB Teen (8%) $25 Build-A-Bear (8%) $25 Panopoulos Hair Salons (9%) $25 Burlington Coat Factory (8%)$25 Petco (5%) $25 buybuy BABY-New! (6%) $25 $100 PetSmart (5%) $25 Cabela's (9%) $25 $50 Pinkberry (8%) $10 $25 Carlton Hair International (9%)$25 Pottery Barn -

Global Frozen Yogurt Market 2018 : Market Share, Outlook, Future Growth

2018-07-03 15:39 CEST Global Frozen Yogurt Market 2018 : Market Share, Outlook, Future Growth The Global Frozen Yogurt Market report is a basic structure of the key segments of the Frozen Yogurt market. Each section is quickly and consistently making and examined through this research. Market evaluation, an offering of the Frozen Yogurt market, and size of each segment and sub- part. The key conceivable outcomes related to the fundamental rapidly making parts of the market additionally are fused into this report. Furthermore, organize fortified geologies in the cases driving the essential regional Frozen Yogurt markets are considered. The Global Frozen Yogurt market report wraps nearby and sub-common market: South America, Asia- Pacific, Europe, Latin America, North America, Africa, and The Middle East Sub-Region. Central and fundamental sources are generally, Frozen Yogurt market from developed undertakings, and players, makers, dealers, professional networks, and affiliations identified with all sections of the business age classification. The Frozen Yogurt base up approach was utilized to assess the global market judge the given value to the end-applications industry and regions. Grab FREE PDF Sample Report Click Here @ https://marketdesk.org/report/global-frozen-yogurt-market-2018- hc/10044/#requestForSample Manufacturers Inlcuded In Frozen Yogurt Market: Yogen Fruz Menchie's Pinkberry Red Mango TCBY Yogurtland llaollao Perfectime Ben & Jerry's Micat Orange Leaf Yogiboost Type Inlcuded In Frozen Yogurt Market: Plain Frozen Yogurt Flavored Frozen Yogurt Application Inlcuded In Frozen Yogurt Market: Minor (age50) Geographical Analysis In Frozen Yogurt Market: ➥ Asia-Pacific Frozen Yogurt (China, South Korea, Thailand, India, Vietnam, Malaysia, Indonesia, Southeast Asia, and Japan). -

ACA-0004- Web Design Press Releases Tasti D-Lite

PRESS RELEASE Arlington Advises Planet About Planet Smoothie Smoothie and Tasti D–Lite on The first Planet Smoothie store opened in Atlanta in 1995. The Sale to Kahala Brands concept quickly grew into a dominant smoothie brand in the Southeast and now has more than 100 locations. Planet Smoothie uses real fruits and vegetables in its smoothies and has its own line of Birmingham, AL – June 2, 2015 Arlington Capital Advisors, proprietary sweeteners and supplements. For further information, LLC, a boutique investment bank that specializes in advising visit www.planetsmoothie.com. closely- held consumer businesses, announced today that it served as exclusive financial advisors to Planet Smoothie and Tasti D-Lite on the concepts’ sale to Kahala Brands. The About Tasti D–Lite purchase expands Kahala Brands’ smoothie concept portfolio to three nationally recognized brands, strengthening its leadership Founded in 1987 in New York City, Tasti D-Lite is an iconic New York position in the healthy treats segment. brand with a long history of serving delicious treats that satisfy devotedly loyal customers. Featured on classic television shows and "Planet Smoothie, currently operating over 100 stores with praised by numerous celebrities, the Tasti D-Lite brand is recognized many openings slated over the next three months, is a great nationally and internationally. For further information, visit addition to our family of smoothie brands. This purchase www.tastidlite.com. expands our smoothie footprint to more than 400 locations and further enables us to satisfy the ever- growing demand from About Kahala Brands consumers for healthy food options that fit just about every budget," said Michael Serruya, Chairman and CEO of Kahala Headquartered in Scottsdale, Arizona, Kahala Brands is one of the Brands. -

Area Resource Guide

Area Resource Guide Area Resource Guide The following is a resource guide of the hotels, restaurants (organized by type of food), grocery stores, drugstores, shopping centers, banks, transportation (taxis and buses), notaries public and churches/places of worship in the surrounding area. Please keep in mind that the listing does not provide an endorsement or recommendation from CHOC Children’s and is for informational purposes only. If you have any questions or concerns, or if you come across any portion of the guide that is incorrect or outdated, please contact the marketing department at CHOC. Thank you. Listing does not provide an endorsement or recommendation from CHOC. This is for information purposes only. Hotels Orange County Ronald McDonald House 383 S. Batavia Street Orange, CA 92868 (714) 639‐3600 To check for availability at the Ronald McDonald House, please contact your hospital Social Worker. Ayres Hotel Anaheim 2550 E. Katella Ave. Anaheim, CA 92806 (714) 634‐2106 Ayres Hotel Orange 200 N. The City Drive Orange, CA 92868 (714) 919‐4940 ALO Hotel 3737 W. Chapman Ave. Orange, CA 92868 (714) 978‐9168 Best Western Orange Plaza 1302 W. Chapman Ave. Orange, CA 92868 (714) 633‐7720 Candlewood Suites Garden Grove 12901 Garden Grove Blvd. Garden Grove, CA 92843 (714) 539‐4200 Civic Center Inn & Suites 2720 N. Grand Ave. Santa Ana, CA 92705 (714) 997‐2330 Clementine Hotel & Suites Anaheim 1700 S. Clementine St. Anaheim, CA 92802 (714)533‐3555 Listing does not provide an endorsement or recommendation from CHOC. This is for information purposes only. Courtyard Anaheim Resort/Convention Center 2045 S.