Notes to Consolidated Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dnx997xr Dnx697s Dnx577s

DNX997XR DNX697S DNX577S GPS NAVIGATION SYSTEM INSTRUCTION MANUAL • Updated information (the latest Instruction Manual, system updates, new functions, etc.) is available from <https://www.kenwood.com/cs/ce/>. • The Instruction manual is subject to change for modification of specifications and so forth. Be sure to download the latest edition of the Instruction manual for reference. <http://manual.kenwood.com/edition/im402/> Take the time to read through this instruction manual. Familiarity with installation and operation procedures will help you obtain the best performance from your new GPS Navigation System. For your records Record the serial number, found on the top of the unit, in the spaces designated on the warranty card, and in the space provided below. Refer to the model and serial numbers whenever you call upon your KENWOOD dealer for information or service on the product. Model DNX997XR / DNX697S / DNX577S Serial number US Residence Only Register Online Register your KENWOOD product at www.kenwood.com/usa/ © 2020 JVCKENWOOD Corporation IM402_ref_K_En_10 (K) Important Notice on Software JVCKENWOOD Corporation, the original (English) of the license is presented. Ñ Software License on This EULA Product The software embedded in this product Ñ Software License Agreement comprises a number of independent software JVCKENWOOD Corporation (hereinafter called components, each of which is copyrighted by “Licensor”) holds either the copyright to the JVCKENWOOD Corporation or by a third party. embedded software or the right to sublicense it. This product uses software components that This agreement establishes the conditions under are based on an End-User License Agreement which the customer uses this “Licensed Software.” (hereinafter called “EULA”) stipulated by The customer shall agree to the terms of this JVCKENWOOD Corporation and by third parties. -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Vr-9070 Instruction Manual Kenwood Corporation

AUDIO VIDEO SURROUND RECEIVER VR-9070 INSTRUCTION MANUAL KENWOOD CORPORATION About the supplied remote control Compared to standard remote controls, the remote control supplied with this receiver has several operation modes. These modes enable the remote control to control other audio/video components. In order to effectively use the remote control, it is important to read the operating instructions and obtain a proper understanding of the remote control and how to switch its operation modes (etc.). Using the remote control without completely understanding its design and how to switch the operation modes may result in incorrect operations. For the U.S.A. Register Online Register your Kenwood Home Audio product at www.kenwoodusa.com Plus opt in to receive e-mail updates and other offers when you register at our web site. B60-5553-00 00 CS (K, P) 0412 *5553/01-09/EN 1 05.2.8, 0:46 PM Caution : Read this page carefully to ensure safe Before applying the power operation. Units are designed for operation as follows. For the U.S.A. U.S.A. and Canada ........................................... AC 120 V only FCC WARNING Australia ........................................................... AC 240 V only This equipment may generate or use radio frequency energy. Europe ............................................................... AC 230 V only Changes or modifications to this equipment may cause harmful Other countries ............ AC 110-120 / 220-240 V switchable interference unless the modifications are expressly approved in the instruction manual. The user could lose the authority to operate this equipment if an unauthorized change or modification is made. NOTE: Safety precautions This equipment has been tested and found to comply with the limits for a Class B digital device, pursuant to Part 15 of the FCC Rules. -

Vrs-7100 Instruction Manual Kenwood Corporation

AUDIO VIDEO SURROUND RECEIVER VRS-7100 INSTRUCTION MANUAL KENWOOD CORPORATION Quick Start Reference Please read the following pages so that you can enjoy the surround sound at the best condition. (These pages give shortcut explanations on how to connect the speaker system to the receiver, set up the speakers and play a source.) "Let's play DVD video software" )¡, ™£ About the supplied remote control Compared to standard remote controls, the remote control supplied with this receiver has several operation modes. These modes enable the remote control to control other audio/video components. In order to effectively use the remote control it is important to read the operating instructions and obtain a proper understanding of the remote control and how to switch its operation modes (etc.). Using the remote control without completely understanding its design and how to switch the operation modes may result in incorrect operations. B60-5462-10 02 MA ( K, P, E, X ) 0312 Before applying power Caution : Read this page carefully to ensure safe operation. Units are designed for operation as follows. U.S.A. and Canada ........................................... AC 120 V only Europe ............................................................... AC 230 V only Australia ........................................................... AC 240 V only Safety precautions WARNING : TO PREVENT FIRE OR ELECTRIC SHOCK, DO NOT EXPOSE THIS APPLIANCE TO RAIN OR MOISTURE. CAUTION: TO REDUCE THE RISK OF ELECTRIC SHOCK, DO CAUTION NOT REMOVE COVER (OR BACK). NO USER-SERVICEABLE RISK OF ELECTRIC SHOCK DO NOT OPEN PARTS INSIDE. REFER SERVICING TO QUALIFIED SERVICE PERSONNEL. THE LIGHTNING FLASH WITH ARROWHEAD SYMBOL, WITHIN AN EQUILATERAL TRIANGLE, IS INTENDED TO ALERT THE USER TO THE PRESENCE OF UNINSULATED “DANGEROUS VOLTAGE” WITHIN THE PROD- UCT’S ENCLOSURE THAT MAY BE OF SUFFICIENT MAGNITUDE TO CONSTITUTE A RISK OF ELECTRIC SHOCK TO PERSONS. -

Proposal of a Data Processing Guideline for Realizing Automatic Measurement Process with General Geometrical Tolerances and Contactless Laser Scanning

Proposal of a data processing guideline for realizing automatic measurement process with general geometrical tolerances and contactless laser scanning 2018/4/4 Atsuto Soma Hiromasa Suzuki Toshiaki Takahashi Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 1 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for point cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 2 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for Point Cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 3 Introduction of JEITA What is JEITA? The objective of the Japan Electronics and Information Technology Industries Association (JEITA) is to promote healthy manufacturing, international trade and consumption of electronics products and components in order to contribute to the overall development of the electronics and information technology (IT) industries, and thereby to promote further Japan's economic development and cultural prosperity. JEITA’s Policy and Strategy Board > Number of full members: 279> Number of associate members: 117(as of May 13, 2014) - Director companies and chair/subchair companies - Policy director companies (alphabetical) Fujitsu Limited (chairman Masami Yamamoto) Asahi Glass Co., Ltd. Nichicon Corporation Sharp Corporation Azbil Corporation IBM Japan, Ltd. Hitachi, Ltd. Advantest Corporation Nippon Chemi-Con Corporation Panasonic Corporation Ikegami Tsushinki Co., Ltd. Japan Aviation Electronics Industry, Ltd. SMK Corporation Mitsubishi Electric Corporation Nihon Kohden Corporation Omron Corporation NEC Corporation JRC Nihon Musen Kyocera Corporation Sony Corporation Hitachi Metals, Ltd KOA Corporation Fuji Xerox Co., Ltd. -

Dv-502 Dvf-3050 Instruction Manual

DVD / VCD / CD PLAYER DV-502 DVF-3050 INSTRUCTION MANUAL KENWOOD CORPORATION COMPACT DIGITAL VIDEO B60-5075-18 01 (K/P/T/M/Y) OC 01/03 2 Introduction DV-502/DVF-3050 (EN/K,P,T,M,Y) Before applying power Caution : Read this page carefully to ensure safe operation. Units are designed for operation as follows. U.S.A. and Canada ....................................................... AC 120V only Europe and U.K. ............................................................ AC 230V only Australia ....................................................................... AC 240 V only *Other countries .................... AC 110-120 / 220-240 V switchable For the United Kingdom Factory fitted moulded mains plug 1. The mains plug contains a fuse. For replacement, use only a 3-Amp ASTA-approved (BS 1362) fuse. 2. The fuse cover must be refitted when replacing the fuse in the moulded plug. 3. Do not cut off the mains plug from this equipment. If the plug fitted is not suitable for the power points in your home or the cable is too short to reach. Preparations A power point, then obtain an appropriate safety approved extension lead or adapter, or consult your dealer. If nonetheless the mains plug is cut off, remove the fuse and dispose of the plug immediately, to avoid a possible shock hazard by inadvertent. Connection to the mains supply. IMPORTANT : The wires in the mains lead are coloured in accordance with the following code: Blue : Neutral Brown : Live Do not connect those leads to the earth terminal of a three-pin plug. Safety precautions Caution : Read this page carefully to ensure safe operation. WARNING :TO PREVENT FIRE OR ELECTRIC SHOCK, DO NOT EXPOSE THIS APPLIANCE TO RAIN OR MOISTURE. -

Kenwood DMX4707S Owner's Manual

DMX4707S DMX47S DMX5020S MONITOR WITH RECEIVER INSTRUCTION MANUAL • Updated information (the latest Instruction Manual, system updates, new functions, etc.) is available from <https://www.kenwood.com/cs/ce/>. Take the time to read through this instruction manual. Familiarity with installation and operation procedures will help you obtain the best performance from your new receiver. For your records Record the serial number, found on the back of the unit, in the spaces designated on the warranty card, and in the space provided below. Refer to the model and serial numbers whenever you call upon your KENWOOD dealer for information or service on the product. Model DMX4707S / DMX47S / DMX5020S Serial number US Residence Only Register Online Register your KENWOOD product at www.kenwood.com/usa/ © 2020 JVCKENWOOD Corporation B5H-0358-00 EN (K/R) !B5H-0358-20_DMX_KR_En.indb 1 2020/04/20 8:11 Contents Before Use 4 Radio 18 Precautions ................................................................... 4 Radio Basic Operation ............................................18 How to read this manual ......................................... 4 Memory Operation ..................................................19 Selecting Operation ................................................19 Basic Operations 5 Traffic Information ...................................................20 Radio Setup ................................................................20 Functions of the Buttons on the Front Panel ... 5 Turning on the Unit .................................................. -

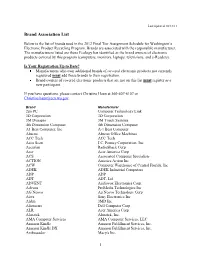

2009 Preliminary Tier Assignment, Alphabetic by Manufacturer

Last updated 10/13/11 Brand Association List Below is the list of brands used in the 2012 Final Tier Assignment Schedule for Washington’s Electronic Product Recycling Program. Brands are associated with the responsible manufacturer. The manufacturers listed are those Ecology has identified as the brand owners of electronic products covered by this program (computers, monitors, laptops, televisions, and e-Readers). Is Your Registration Up to Date? Manufacturers who own additional brands of covered electronic products not currently registered must add those brands to their registration. Brand owners of covered electronic products that are not on this list must register as a new participant. If you have questions, please contact Christine Haun at 360-407-6107 or [email protected]. Brand Manufacturer 2go PC Computer Technology Link 3D Corporation 3D Corporation 3M Dynapro 3M Touch Systems 4th Dimension Computer 4th Dimension Computer A1 Best Computer, Inc A-1 Best Computer Abacus Abacus Office Machines ACC Tech ACC Tech Accu Scan J.C. Penney Corporation, Inc. Accurian RadioShack Corp Acer Acer America Corp ACS Associated Computer Specialists ACTION America Action Inc ACW Computer Warehouse of Central Florida, Inc ADEK ADEK Industrial Computers ADP ADP ADT ADT, Ltd ADVENT Audiovox Electronics Corp. Advueu ProMedia Technologies Inc AG Neovo Ag Neovo Technology Corp Aiwa Sony Electronics Inc Alden 3MD Inc. Alienware Dell Computer Corp ALR Acer America Corp Aluratek Aluratek, Inc. AMA Computer Services AMA Computer Services, LLC Amazon Kindle Amazon Fulfillment Services, Inc. Amazon Kindle DX Amazon Fulfillment Services, Inc. Ambassador Macy's Inc. 1 AMBRA International Business Machines Corp. -

Justice Management Division

Federal Register / Vol. 75, No. 5 / Friday, January 8, 2010 / Notices 1081 708–2532. Copies of non-confidential 337 by Pioneer. On November 23, 2009, obtain comments from the public and documents filed in connection with this the Commission determined, upon affected agencies. Comments are investigation are or will be available for Honeywell’s motion and Pioneer’s encouraged and will be accepted for 60 inspection during official business contingent motion, to review in part the days until March 9, 2010. This process hours (8:45 a.m. to 5:15 p.m.) in the ID. 74 FR 62589 (Nov. 30, 2009). On is conducted in accordance with 5 CFR Office of the Secretary, U.S. November 30, 2009, Honeywell and 1320.10. International Trade Commission, 500 E Pioneer moved the Commission to Written comments and/or suggestions Street, SW., Washington, DC 20436, extend the briefing deadlines because regarding the item(s) contained in this telephone (202) 205–2000. General the parties were engaged in settlement notice, especially regarding the information concerning the Commission discussions. The Commission granted estimated public burden and associated may also be obtained by accessing its that motion, extending briefing for response time, should be directed to the Internet server (http://www.usitc.gov). approximately three weeks. 74 FR 64100 Office of Management and Budget, The public record for this investigation (Dec. 7, 2009). Office of Information and Regulatory may be viewed on the Commission’s On December 22, 2009, Honeywell Affairs, Attention: Department of Justice electronic docket (EDIS) at http:// and Pioneer filed their Joint Motion to Desk Officer, Washington, DC, 20530. -

A Century of Sincerity and Creativity

Sharp 100th Anniversary A Century of Sincerity and Creativity Business Creed Business Philosophy Sharp Corporation is dedicated to two principal ideals: We do not seek merely to expand our business volume. Rather, we are dedicated to the use of our “Sincerity and Creativity” unique, innovative technology to contribute to the By committing ourselves to these ideals, we can culture, benefits and welfare of people throughout derive genuine satisfaction from our work, while the world. making a meaningful contribution to society. It is the intention of our corporation to grow Sincerity is a virtue fundamental to humanity ... hand-in-hand with our employees, encouraging always be sincere. and aiding them to reach their full potential and Harmony brings strength ... trust each other and improve their standard of living. work together. Our future prosperity is directly linked to the Politeness is a merit ... always be courteous and prosperity of our customers, dealers and respectful. shareholders …indeed, the entire Sharp family. Creativity promotes progress ... remain constantly aware of the need to innovate and improve. Courage is the basis of a rewarding life ... accept every challenge with a positive attitude. SHARP CORPORATION Sharp has a history of creating market demand by coming out with original, innovative products that make people’s lives richer and their work more efficient. It is the Through sincerity and creativity, patronage and support of these people that have brought Sharp to 2012, the company’s 100th anniversary. Sharp is contributing to From its humble beginnings in Japan, Sharp has expanded its business across the globe, in the process the world by creating products amazing and capturing the hearts of people with products created through the company creed of ‘Sincerity and that instill passion in Creativity’. -

Annual Report

VCCI Council VCCI VCCI Council April2018March 2018 - 2019 ANNUAL REPORT English This publication is printed on an environment-friendly ink. VCCI Council The purpose of this corporate body is to promote, in cooperation with related industries, the Greetings voluntary control of radio disturbances emitted from multimedia equipment (MME) on the one Thank you for your continuing support for the activities of VCCI. hand, and improvement of robustness of MME against radio disturbances on the other hand, so This is a report on our activities in FY 2018. that the interests of Japanese consumers are protected with respect to anxiety-free use of MME. At the world's largest CPS and IoT general exhibition, "CEATEC JAPAN 2018", held in October last year, Japan's growth strategy to achieve "Society 5.0" and its vision for the future were announced to the world based on the theme "Connecting Society, Co-Creating the Future". 5G Description mobile communications system services are planned to finally begin operation in Japan next year, and steady initiatives are underway to make "Society 5.0", a.k.a. a "super-smart society", a reality. Formulate…basic…policies… on… voluntary… control… of… electromagnetic… Hold …measurement…skills…courses…to…prepare…members’…engineers… 1 disturbances…emitted…by…multimedia…equipment 6 for…adequate…conformity…assessment We have high hopes for further developments in the IT and electronics industry, which holds deep ties to VCCI, as a key player in providing a platform for achieving "Society 5.0". By VCCI Council leveraging its growing technological prowess in an increasingly competitive world, the IT and Coordinate… the…interest… of…member… organizations… and…liaise… with… Study…trends…in…overseas…EMC…regulations…and…seek…opportunities… President: 2 the…government…and…related…agencies 7 for…mutual…recognition…agreement electronics industry will help solve a variety of social problems through collaborative creation.