Post 2020 Regulatory Framework for Fixed Line Services

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Stoxx® Australia 150 Index

STOXX® AUSTRALIA 150 INDEX Components1 Company Supersector Country Weight (%) Commonwealth Bank of Australia Banks Australia 8.37 CSL Ltd. Health Care Australia 7.46 BHP GROUP LTD. Basic Resources Australia 7.23 National Australia Bank Ltd. Banks Australia 4.37 Westpac Banking Corp. Banks Australia 4.09 Australia & New Zealand Bankin Banks Australia 3.75 Wesfarmers Ltd. Retail Australia 3.30 WOOLWORTHS GROUP Personal Care, Drug & Grocery Australia 2.87 Macquarie Group Ltd. Financial Services Australia 2.84 Rio Tinto Ltd. Basic Resources Australia 2.48 Fortescue Metals Group Ltd. Basic Resources Australia 2.27 Transurban Group Industrial Goods & Services Australia 2.20 Telstra Corp. Ltd. Telecommunications Australia 2.05 Goodman Group Real Estate Australia 1.77 AFTERPAY Industrial Goods & Services Australia 1.54 Coles Group Personal Care, Drug & Grocery Australia 1.39 Woodside Petroleum Ltd. Energy Australia 1.28 Newcrest Mining Ltd. Basic Resources Australia 1.27 Aristocrat Leisure Ltd. Travel & Leisure Australia 1.11 XERO Technology Australia 1.00 SYDNEY AIRPORT Industrial Goods & Services Australia 0.93 Brambles Ltd. Industrial Goods & Services Australia 0.91 Sonic Healthcare Ltd. Health Care Australia 0.90 ASX Ltd. Financial Services Australia 0.82 SCENTRE GROUP Real Estate Australia 0.80 Cochlear Ltd. Health Care Australia 0.74 QBE Insurance Group Ltd. Insurance Australia 0.73 SUNCORP GROUP LTD. Insurance Australia 0.71 South32 Australia Basic Resources Australia 0.71 Santos Ltd. Energy Australia 0.68 Ramsay Health Care Ltd. Health Care Australia 0.66 Insurance Australia Group Ltd. Insurance Australia 0.65 Mirvac Group Real Estate Australia 0.60 DEXUS Real Estate Australia 0.59 SEEK Ltd. -

Annual Report 2020 Report Annual Oh!Media

o OH!MEDIA ANNUAL REPORT 2020 2020 ANNUAL REPORT CONTENTS 2 COMPANY OVERVIEW 4 2020 SUMMARY 6 CHAIR REVIEW 8 CEO REVIEW 11 OPERATING AND FINANCIAL REVIEW 18 BOARD OF DIRECTORS 21 DIRECTORS’ REPORT 31 REMUNERATION REPORT 49 SUSTAINABILITY REPORT 65 FINANCIAL STATEMENTS 112 DIRECTORS’ DECLARATION 113 INDEPENDENT AUDITOR’S REPORT 119 SHAREHOLDER INFORMATION 122 GLOSSARY 124 CORPORATE DIRECTORY The Annual Report was authorised for issue, in accordance with a resolution of the Directors. The Directors have the power to amend and reissue the Annual Report. Through the use of the internet, we have ensured that our corporate reporting is timely, complete and available globally at minimum cost to the Company. All media releases, financial reports and other information are available at the Investors section on our website: ww w.oohmedia. com.au. 3 011 COMPANY OVERVIEWoOh!media is a leading Out of Home media company that is enhancing public spaces through the creation of engaging environments that help advertisers, landlords, leaseholders, community organisations, local councils and governments reach large and diverse public audiences. The company’s extensive network of more than 37,000 digital and static asset locations includes roadsides, retail centres, airports, train stations, bus stops, office towers, cafes, bars and universities. Listed on the ASX, oOh! employs around 800 people across Australia and New Zealand, and had revenues of $426.5 million in 2020 and $649 million in 2019. The company invests strategically in technology, and is pioneering the use of sophisticated data techniques that enable clients to maximise their media spend through unrivalled and accurate audience targeting. -

Portfolio Holdings Disclosure - Renewables Plus

Portfolio Holdings Disclosure - Renewables Plus Alternatives Name Instrument Type GPT Wholesale Office Fund Property Trust Green Squares Energy Pty Ltd Debt Unit Trust Green Squares Energy Pty Ltd Equity Unit Trust IIG Solar Asset Fund Managed Fund IIG Solar Income Fund Loan Notes Capital Note IIG Solar Income Fund Ordinary Units Unit Trust Juice Capital Energy Pty Ltd Fixed Rate Bond Macquarie GIG Renewable Energy Fund Unit Trust Cash Cash at Bank Cash Domestic Fixed Interest Ausgrid Finance Bond Aust Capital Territory Fixed Rate Bond Australian Capital Territory Treasury Corp Fixed Rate Bond Australian, Capital Territory of Fixed Rate Bond Bank Australia Floating Rate Note Bank Of Queensland Ltd Exchange Traded Notes Bank Of Queensland Ltd Floating Rate Note Bendigo And Adelaide Bank Exchange Traded Notes Challenger Floating Rate Note Challenger Ltd Exchange Traded Notes European Investment Bank (Green Bond) Fixed Rate Bond Germany, Federal Republic of (Government) Fixed Rate Bond Infradebt Ethical Infrastructure Debt Fund Unit Trust Insurance Australia Group Floating Rate Note Insurance Australia Group Ltd Floating Rate Note Liberty Financial Pty Ltd Floating Rate Note Members Equity Bank Floating Rate Note NAB (Green Bond) Fixed Rate Bond NAB Low Carbon Note Floating Rate Note New South Wales Treasury Corp Bond New South Wales Treasury Corp Fixed Rate Bond New South Wales Treasury Corp (Green Bond) Fixed Rate Bond NextDC Floating Rate Note Queensland Treasury Corp Bond Queensland Treasury Corp Fixed Rate Bond Rate Setter Unit Trust South Australian Government Financing Authority Fixed Rate Bond Suncorp Exchange Traded Notes Suncorp-Metway Ltd Covered Bond Tasmanian Public Finance Fixed Rate Bond Tasmanian Public Finance Corp Fixed Rate Bond Telstra Medium Term Note Treasury Corp Victoria Bond This information is accurate as at 29 May 2020 and is subject to change. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Appendix 4D and Half Year FY17 Result FEB 22, 2017 Download

22 FEBRUARY 2017 THE MANAGER COMPANY ANNOUNCEMENTS OFFICE AUSTRALIAN SECURITIES EXCHANGE 4TH FLOOR, 20 BRIDGE ST SYDNEY NSW 2000 ELECTRONIC LODGEMENT DEAR SIR/MADAM, FY17 HALF YEAR RESULTS Vocus Group (ASX: VOC) today releases its financial results for the half year ended 31 December 2016. Please find attached an Appendix 4D half year report. The Company will conduct an investor briefing commencing at 9.30am this morning. The briefing will be webcast and can be accessed through the Company’s website at www.vocusgroup.com.au. The investor briefing pack is attached to this announcement. YOURS FAITHFULLY, ASHE-LEE JEGATHESAN GROUP GENERAL COUNSEL & COMPANY SECRETARY Vocus Group | vocusgroup.com.au 1 Vocus Group Limited Appendix 4D Half-year report 1. Company details Name of entity: Vocus Group Limited ABN: 96 084 115 499 Reporting period: For the half-year ended 31 December 2016 Previous period: For the half-year ended 31 December 2015 2. Results for announcement to the market $'000 Revenues from ordinary activities up 403.9% to 888,241 Underlying EBITDA * up 200.8% to 187,248 Profit from ordinary activities after tax attributable to the owners of Vocus Group Limited up 94.9% to 47,181 Profit for the half-year attributable to the owners of Vocus Group Limited up 94.9% to 47,181 Underlying net profit after tax ** up 235.6% to 91,854 31 Dec 2016 31 Dec 2015 Cents Cents Basic earnings per share 7.72 10.58 Diluted earnings per share 7.71 10.56 Underlying diluted earnings per share *** 15.01 11.94 Basic and diluted earnings per share for the half-year ended 31 December 2016 includes the impact of significant items after tax of $44,673,000 (31 December 2015: $3,163,000). -

Dimensional International Core Equity Market ETF SCHEDULE of INVESTMENTS April 30, 2021 (Unaudited)

Dimensional International Core Equity Market ETF SCHEDULE OF INVESTMENTS April 30, 2021 (Unaudited) Security Description Shares Fair Value ($) COMMON STOCKS (98.4%) AUSTRALIA (6.7%) 5G Networks, Ltd. 40 37 *A2B Australia, Ltd. 92 91 Accent Group, Ltd. 272 618 Adairs, Ltd. 92 330 Adbri, Ltd. 288 716 *Advance NanoTek, Ltd. 16 48 *Aeris Resources, Ltd. 1,048 81 *Afterpay, Ltd. 1,438 130,684 AGL Energy, Ltd. 14,736 101,649 #*»Alkane Resources, Ltd. 276 157 *Alliance Aviation Services, Ltd. 368 1,194 ALS, Ltd. 11,346 92,375 Altium, Ltd. 1,925 44,089 Alumina, Ltd. 4,497 6,009 *AMA Group, Ltd. 1,351 579 Ampol, Ltd. 3,655 72,249 Ansell, Ltd. 2,657 86,735 APA Group 19,887 154,078 Appen, Ltd. 1,204 14,564 ARB Corp., Ltd. 40 1,209 *Ardent Leisure Group, Ltd. 420 281 Aristocrat Leisure, Ltd. 8,793 252,465 *Artemis Resources, Ltd. 496 44 Asaleo Care, Ltd. 260 283 ASX, Ltd. 2,886 162,694 Atlas Arteria, Ltd. 18,915 88,250 AUB Group, Ltd. 109 1,718 Aurelia Metals, Ltd. 8,745 2,837 Aurizon Holdings, Ltd. 41,513 120,250 AusNet services 1,164 1,704 Austal, Ltd. 264 492 Austin Engineering, Ltd. 396 44 Australia & New Zealand Banking Group, Ltd. 35,542 789,041 *Australian Agricultural Co., Ltd. 990 879 Australian Ethical Investment, Ltd. 56 378 Australian Finance Group, Ltd. 965 2,102 Australian Pharmaceutical Industries, Ltd. 1,902 1,741 Australian Vintage, Ltd. 136 78 Auswide Bank, Ltd. 45 223 #Ava Risk Group, Ltd. -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 19 May 2017 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 3.27 0.31 9.36 62.69 125.52 158.33 - - - - ABC Adelaide Brighton 5.61 -2.94 0.54 10.95 8.19 16.12 18.37 17.52 7.59 37 ABP Abacus Property Group 3.42 0.89 0.29 27.08 11.22 14.30 17.39 17.37 -4.79 111 AFI Australian Foundation 5.80 -1.53 0.52 2.97 7.09 0.40 3.45 10.62 3.45 67 AGL AGL Energy Limited 26.57 -2.06 -3.14 34.43 48.18 37.31 23.60 16.71 8.17 34 AIA Auckland Internation 6.37 -0.62 0.00 8.07 9.13 24.60 22.20 28.64 11.99 20 AIZ Air New Zealand 2.66 2.70 13.68 46.06 51.17 11.77 23.93 40.03 5.16 53 ALL Aristocrat Leisure 20.20 2.28 6.32 38.91 64.79 63.22 61.32 48.77 3.74 63 ALQ ALS Limited 5.81 -8.36 -7.78 -6.46 40.74 4.10 -3.39 -7.38 6.12 49 AMC Amcor Limited 15.00 -1.77 -1.32 6.91 -4.77 7.76 16.88 20.78 11.42 23 AMP AMP Limited 5.08 -3.61 -2.31 10.36 -2.37 -5.31 4.30 10.46 -2.30 103 ANN Ansell Limited 24.18 -0.45 4.13 10.86 33.44 -0.94 12.31 12.86 8.78 33 ANZ ANZ Banking Grp Ltd 28.50 -2.46 -5.97 4.72 20.84 -0.23 1.01 12.12 3.80 62 AOG Aveo Group 3.30 0.00 5.43 6.11 2.11 12.92 19.57 8.48 -13.15 122 APA APA Group 9.35 -0.85 3.09 27.40 8.91 7.53 17.29 18.72 12.16 18 APE AP Eagers Limited 7.95 1.92 -8.20 -11.20 -19.96 -3.78 18.44 25.11 14.35 13 ARG Argo Investments 7.61 -1.42 0.13 6.16 9.93 1.56 5.27 12.21 2.40 76 AST AusNet Services Ltd 1.75 0.86 4.48 21.63 14.27 14.32 13.81 -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

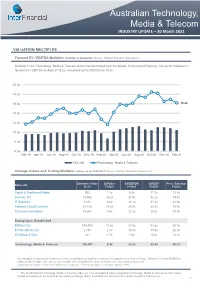

Australian Technology, Media & Telecom

Australian Technology, Media & Telecom INDUSTRY UPDATE – 30 March 2021 VALUATION MULTIPLES Forward EV / EBITDA Multiples (monthly to 28/02/2021) Source: FactSet Research Systems Inc. Multiples in the Technology, Media & Telecom sector has decreased over the period. At the end of February, the sector traded on a forward EV / EBITDA multiple of 16.2x, compared to the ASX200 on 10.5x. 20.0x 18.0x 16.0x 16.2x 14.0x 12.0x 10.0x 8.0x 6.0x Feb-19 Apr-19 Jun-19 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20 Jun-20 Aug-20 Oct-20 Dec-20 Feb-21 ASX 200 Technology, Media & Telecom Average Values and Trading Multiples (values as at 29/03/2021) Source: FactSet Research Systems Inc. Enterprise Value EV/Sales EV/EBITDA EV/EBIT Price / Earnings Subsector ($ m) FY2021 FY2021 FY2021 FY2021 Digital & Traditional Media 903 1.1x 6.8x 11.1x 13.8x Internet, IoT 23,592 16.2x 27.5x 32.2x 43.4x IT Services 5,181 2.6x 11.1x 17.4x 24.3x Software (SaaS/Licence) 43,410 14.8x 35.9x 55.8x 79.6x Telecommunications 73,861 4.6x 12.2x 28.5x 30.9x Emerging vs. Established $500m+ EV 144,054 11.6x 27.8x 42.8x 60.7x $100m-$500m EV 2,751 2.9x 10.7x 19.6x 26.3x EV Below $100m 141 1.7x 7.6x 9.3x 12.1x Technology, Media & Telecom 146,947 8.3x 21.0x 33.3x 46.1x Note: Multiples are based on the forward year of the unreported period, which for the majority of companies in the sector is FY2021. -

KIDS10 Attribution Report 201902

Realindex Australian Small Companies - Class A (Net of Fees) Factsheet 28 Feb 2019 Fund strategy Fund facts Realindex forms a universe of companies listed on the Australian Securities Exchange that are Benchmark ASX Small Ords Accum outside both the ASX 100 and the 100 largest companies based on accounting measures. Factors Funds under management $1023.8 million such as quality, near-term value and momentum are applied to form a final portfolio of companies. Inception Date 17 November 2008 The resulting portfolio has a value tilt relative to the benchmark and provides the benefits of being lower in cost, lower turnover and highly diversified compared to traditional active investment strategies. By weighting the portfolio based on accounting measures and factors such as quality, value and momentum Realindex aims to generate higher returns versus the benchmark over the long term. Commentary The Realindex Australian Small Companies Fund returned 5.43% (net of fees) during February, versus the S&P/ASX Small Ordinaries benchmark which returned 6.78%. From a style perspective, the S&P Australia Small Cap Growth Index (+6.7%) outperformed its Value (+4.4%) counterpart by 2.3%. This was a significant headwind for performance, given the methodology’s inherent tilt towards cheaper companies. Underweights within the expensive Information Technology sector were by far the largest detractors of performance. The portfolio does not hold many of these high growth market darlings including Appen (+46.9%) and Afterpay (+15.9%) and has a large underweight position in Altium (+32.3%). These three stocks collectively accounted for almost two-thirds of the entire underperformance.