Download the Paper In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa](https://docslib.b-cdn.net/cover/7622/banking-law-time-1-30-hours-maximum-marks-100-tc-rd-dgk-u-tk-bl-%C3%A1-uiqflrdk-dks-u-kksysa-147622.webp)

BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa

Á’uiqfLrdk Øekad Roll No.-------------------- Question Booklet No. Á’uiqfLrdk fljht O.M.R. Serial No. Question Booklet Series A L.L.B (Fifth Semester) Examination, 2021 LLB504 BANKING LAW Time : 1:30 Hours Maximum Marks-100 tc rd dgk u tk;] bl Á’uiqfLrdk dks u [kksysa funsZ’k % & 1. ijh{kkFkhZ vius vuqØekad] fo”k; ,oa Á’uiqfLrdk dh fljht dk fooj.k ;FkkLFkku lgh& lgh Hkjsa] vU;Fkk ewY;akdu esa fdlh Hkh Ádkj dh folaxfr dh n’kk esa mldh ftEesnkjh Lo;a ijh{kkFkhZ dh gksxhA 2. bl Á’uiqfLrdk esa 100 Á’u gSa] ftues ls dsoy 75 Á’uksa ds mRrj ijh{kkfFkZ;ksa }kjk fn;s tkus gSA ÁR;sd Á’u ds pkj oSdfYid mRrj Á’u ds uhps fn;s x;s gSaA bu pkjksa esa ls dsoy ,d gh mRrj lgh gSA ftl mRrj dks vki lgh ;k lcls mfpr le>rs gSa] vius mRrj i=d (O.M.R. ANSWER SHEET) esa mlds v{kj okys o`Rr dks dkys ;k uhys cky IokabV isu ls iwjk Hkj nsaA ;fn fdlh ijh{kkFkhZ }kjk fu/kkZfjr Á’uksa ls vf/kd Á’uksa ds mRrj fn;s tkrs gSa rks mlds }kjk gy fd;s x;s ÁFker% ;Fkk fufnZ”V Á’uksRrjksa dk gh ewY;kadu fd;k tk;sxkA 3. ÁR;sd Á’u ds vad leku gSaA vki ds ftrus mRrj lgh gksaxs] mUgha ds vuqlkj vad Ánku fd;s tk;saxsA 776 4. lHkh mRrj dsoy vksŒ,eŒvkjŒ mRrj i=d (O.M.R. -

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo All SUPER Current Affairs Product Worth Rs 1200 @ 399/- ( DEAL Of The Year ) Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 3rd August 2021 By Dream Big Institution: (SUPER Current Affairs) © Copyright 2021 Q.World Sanskrit Day 2021 was celebrated on ___________. A) 3 August C) 5 August B) 4 August D) 6 August Answer - A Sanskrit Day is celebrated every year on Shraavana Poornima, which is the full moon day in the month of Shraavana in the Hindu calendar. In 2020, Sanskrit Day was celebrated on August 3, while in 2019 it was celebrated on 15 August. Sanskrit language is believed to be originated in India around 3,500 years ago. Q.Nikol Pashinyan has been re-appointed as the Prime Minister of which country? A) Ukraine C) Turkey B) Armenia D) Lebanon Answer - B Nikol Pashinyan has been re-appointed as Armenia’s Prime Minister by President Armen Sarkissian. Pashinyan was first appointed as the prime minister in 2018. About Armenia: Capital: Yerevan Currency: Armenian dram President: Armen Sargsyan Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Q.Min Aung Hlaing has taken charge as the Prime Minister of which country? A) Bangladesh C) Thailand B) Laos D) Myanmar Answer - D The Chief of the Myanmar military, Senior General Min Aung Hlaing has taken over as the interim prime minister of the country on August 01, 2021. About Myanmar Capital: Naypyitaw; Currency: Kyat. NEWLY Elected -

Influence of Merger on Performance of Indian Banks: a Case Study

Journal of Poverty, Investment and Development www.iiste.org ISSN 2422-846X An International Peer-reviewed Journal Vol.32, 2017 Influence of Merger on Performance of Indian Banks: A Case Study Gopal Chandra Mondal Research Scholar, Dept. of Economics, Vidyasagar University, India& Chief Financial Officer,IDFC Foundation,New Delhi, India Dr Mihir Kumar Pal Professor,Dept. Of Economics, Vidyasagar University, India Dr Sarbapriya Ray* Assistant Professor, Dept. of Commerce, Vivekananda College, Under University of Calcutta, Kolkata,India Abstract The study attempts to critically analyze and evaluate the impact of merger of Nedungadi bank and Punjab National Bank on their operating performance in terms of different financial parameters. Most of the financial indicators of Nedungadi bank and Punjab National Bank display significant improvement in their operational performance during post merger period. Therefore, the results of the study reveal that average financial ratios of sampled banks in Indian banking sector showed a remarkable and significant improvement in terms of liquidity, profitability, and stakeolders wealth. Keywords: Merger, India, Nedungadi bank, Punjab National Bank. 1. Introduction: Concept of merger and acquisition has become very trendy in present day situation, especially, after liberalization initiated in India since 1991. The emergent tendency towards mergers and acquisitions (M&As) world-wide, has been ignited by intensifying competition. Mergers and acquisitions have been taking place in corporate as well as banking sector to abolish financial, operation and managerial weakness as well as to augment growth and expansion , to create shareholders value, stimulate health of the organization with a view to confront challenges in the face of stiff competitive in globalized environment. -

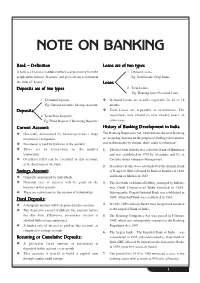

Note on Banking

NOTE ON BANKING Bank – Definition Loans are of two types A bank is a financial institution which accepts money from the 1. Demand Loans: people in the form of ‘Deposits’ and gives advances to them in Eg: Gold Loans, Crop loans. the form of “Loans”. Loans Deposits are of two types 2. Term Loans: Eg: Housing loan / Personal Loan. 1. Demand Deposits Y Demand Loans are usually repayable in 12 to 18 Eg: Current Account / Savings Account. months. Deposits Y Term Loans are repayable in instalments. The 2. Term/Time Deposits repayment may extend to over twenty years, in Eg: Fixed Deposits / Recurring Deposits. some cases. Current Account: History of Banking Development in India Y Generally maintained by businesspersons / large The Banking Regulation Act, 1949 defines the term Banking institutions / companies. as “accepting, deposits for the purpose of lending or investment, Y No interest is paid for balances in the account. and withdrawable by cheque, draft, order or otherwise”. Y There are no restrictions on the number 1. The first bank in India was called the Bank of Hindustan transactions. and was established in 1770 by Alexander and Co, at Y Overdraft (OD) can be extended in this account, Calcutta, under European Management. at the discretion of the bank. 2. Presidency Banks were established by the British: Bank Savings Account: of Bengal in 1806, followed by Bank of Bombay in 1840, Y Generally maintained by individuals. and Bank of Madras in 1843. Y Nominal rate of interest will be paid on the 3. The first bank with limited liability, managed by Indians, balances in this account. -

FACTORS INFLUENCING CHOICE of BANKS in a MILLENNIAL CUSTOMER PERSPECTIVE Dr

G.J.C.M.P.,Vol.7(1):1-6 (January-February, 2018) ISSN:2319–7285 FACTORS INFLUENCING CHOICE OF BANKS IN A MILLENNIAL CUSTOMER PERSPECTIVE Dr. Cris Abraham Kochukalam , Jithin K Thomas & Merlin B Joseph Berchmans Institute of Management Studies, Kerala,India Abstract There has been a tremendous improvement in the way financial institutions operate and this is primarily based on the need to generate sufficient competitive advantage in the competitive scenario within the regulatory boundaries. Customer knowledge about the financial institutions and the choice of a large portfolio of products and services has resulted in enhancing the customer perspectives towards the financial institutions and their products and services. This study is to present the most important factor influencing customers in respect of selecting a bank by customer in Kerala with specific reference to the age group of 21 to 30 years typically termed as the Millennial customer segment. In particular, it finds factors of relevance , which have become significantly important in motivating the choice of banks . The finding shows that the 24 hour availability of ATMs , speed and quality of services, Online banking facility , convenient ATM locations , effective and efficient customer service and several number of branches are significantly relevant Keywords: Bank selection, perceived influences, millennial customers, decision making I. Introduction History of banks in India has a trace to be identified from the southern tip of the continent dating back to 19th century when five banking establishments could be found in the country. Nedungadi Bank in Calicut established in 1899 has to its credit the legacy of banking in Kerala with its registration as the first bank in Kerala in 1910. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

List of Indian Public Sector Banks :- (Click to Visit the Website of the Bank)

List of Banks in India - 2014 Directory of Public Sector / Private Sector / Foreign Banks List of Indian Public Sector Banks :- (Click to visit the website of the Bank) Nationalized Banks, State Bank Group Banks have been included here as PS Banks : Allahabad Bank Andhra Bank Bank of Baroda Bank of India Bank of Maharashtra Canara Bank Central Bank of India Corporation Bank Dena Bank IDBI Bank Limited Indian Bank Indian Overseas Bank IDBI Bank Industrial Development Bank of India Oriental Bank of Commerce Punjab & Sind Bank Punjab National Bank State Bank of Bikaner and Jaipur State Bank of Hyderabad State Bank of India State Bank of Mysore State Bank of Patiala State Bank of Travancore Syndicate Bank UCO Bank Union Bank of India United Bank Of India Vijaya Bank (a) The following two State Bank Group Banks have since been merged with SBI) State Bank of Indore (since merged with SBI) State Bank of Saurashtra (since merged with SBI) ( b) New Bank of India (a nationalised bank) was merged with Punjab National Bank in 1993 List of Private Sector Banks in India Ads by Google Axis Bank Catholic Syrian Bank Ltd. IndusInd Bank Limited ICICI Bank ING Vysya Bank Kotak Mahindra Bank Limited Karnataka Bank Karur Vysya Bank Limited. Tamilnad Mercantile Bank Ltd. The Dhanalakshmi Bank Limited. The Federal Bank Ltd. The HDFC Bank Ltd. The Jammu & Kashmir Bank Ltd. The Nainital Bank Ltd. The Lakshmi Vilas Bank Ltd Yes Bank copied from www,allbankingsolutions.com List of Private Sector Banks Since Merged with other banks The Nedungadi Bank (merged with -

Introduction Banking in India

Introduction Banking in India Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India’s Independence became the State Bank of India. Origin of Banking in India Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company’s debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton. -

A Study on Customer Satisfaction of Bharat Interface for Money (BHIM)

International Journal of Innovative Technology and Exploring Engineering (IJITEE) ISSN: 2278-3075, Volume-8 Issue-6, April 2019 A Study on Customer Satisfaction of Bharat Interface for Money (BHIM) Anjali R, Suresh A Abstract: After demonetization on November 8th, 2016, India saw an increased use of different internet payment systems for Mobile banking saw its growth during the period of 2009- money transfer through various devices. NPCI (National 2010 with improvement in mobile internet services across Payments Corporation India) launched Bharat interface for India. SMS based applications along with mobile Money (BHIM) an application run on UPI (Unified Payment application compatible with smartphones offered improved Interface) in December 2016 to cater the growing online payment banking services to the customers. Apart from the bank’s needs. The different modes of digital payments saw a drastic mobile applications other applications like BHIM, Paytm, change in usage in the last 2 years. Though technological Tez etc. offered provided enhanced features that lead to easy innovations brought in efficiency and security in transactions, access to banking services. In addition to this, The Reserve many are still unwilling to adopt and use it. Earlier studies Bank of India has given approval to 80 Banks to start mobile related to adoption, importance of internet banking and payment systems attributed it to some factors which are linked to security, banking services including applications. Bharat Interface for ease of use and satisfaction level of customers. The purpose of money (BHIM) was launched after demonetization by this study is to unfold some factors which have an influence on National Payments Corporation (NPCI) by Prime Minister the customer satisfaction of BHIM application. -

Unit 1. Evolution of Banking

DNYANSAGAR ARTS AND COMMERCE COLLEGE, BALEWADI, PUNE – 45 Subject – Banking And Finance - I (115 B) Class: FYB.COM (2019 Pattern) Unit 1. Evolution of Banking Introduction Money in the Economy is like blood in the human body”. The flow of money in the economy determines the characteristics of any economy. Robust money and capital markets are essentials for a developed economy. The short term and long term needs of money of individuals and institutions can be efficiently met by financial intermediaries. Pooling of scanty deposits into a large capital base and lending it to the desirable sectors is the core of banking business. In a developing economy like India, the role of banking sector becomes even more critical. In the initial years of economic development, when other sophisticated financial institutions were not present, banks were the only financial intermediaries which helped in bring about the change. The sense of confidence in the ethical functioning of financial intermediaries, in the minds of common man, was brought about by well-regulated commercial banks. The word ‘bank’ is of Germanic origin though some persons trace its origin to the French word ‘Banqui’ and the Italian word ‘Banca’. It referred to a bench for keeping, lending, and exchanging of money or coins in the market place by money lenders and money changers. According to Banking Regulation Act, 1949 of India, “Banking means the accepting for the purpose of lending or investment of deposits of money from the public, repayable on demand or otherwise and withdrawable by cheque, draft, and an order or otherwise”. A bank is a financial institution which deals with deposits and advances and other related services. -

Analyzing the Impact of Mergers and Acquisitions on Customers And

Mukt Shabd Journal ISSN NO : 2347-3150 Analyzing the Impact of Mergers and Acquisitions on Customers and Employees in Indian Banking Sector Ankit Dhamija Assistant Professor, Amity Business School, Amity University Gurugram, Haryana, India Deepika Dhamija Assistant Professor, Amity College of Commerce, Amity University Gurugram, Haryana, India Dr Ravi Ranjan Assistant Professor, Amity College of Commerce, Amity University Gurugram, Haryana, India ABSTRACT The Indian banking industry has become so volatile that every few months; there is news of one or few smaller banks being merged into a bank with larger presence across the nation or a bigger bank acquiring few smaller banks. This merging and acquisition of banks has become a necessity for Indian Economy to grow since, the non performing banks are increasing the burden on economy in the form of bad debts/loans, inability to generate profits, sell their banking products, inability to attract and retain customers and many more. Also, Mergers and acquisitions have become vital methods within the industry to form money gains enormously and to enhance the economies of scale. Through this, banks are able to get established brand names, new geographies, and complementary product offerings; however an additional opportunity to cross-sell to new accounts acquired is also there. Throughout the merging method, one company survives and therefore the other company loses its company existence. On the opposite hand, the acquisition means takeover. The biggest impact in such cases is on the bank employees and customers. There are a lot of issues that customers and employees have to deal with and there are also some benefits of this situation.This paper assesses the impact of Mergers and Acquisitions on bank employees and customers, their position before and after Mergers & Acquisitions and finding out the reasons behind these Mergers & Acquisitions. -

Corporate Investor Presentation

Corporate Investor Presentation March 2013 Disclaimer This presentation has been prepared by Dhanlaxmi Bank (the “Bank”) solely for your information and for your use and may not be taken away, reproduced, redistributed or passed on, directly or indirectly, to any other person (whether within or outside your organization or firm) or published in whole or in part, for any purpose. By attending this presentation, you are agreeing to be bound by the foregoing restrictions and to maintain absolute confidentiality regarding the information disclosed in these materials. The information contained in this presentation does not constitute or form any part of any offer, invitation or recommendation to purchase or subscribe for any securities in any jurisdiction, and neither the issue of the information nor anything contained herein shall form the basis of, or be relied upon in connection with, any contract or commitment on the part of any person to proceed with any transaction. This presentation is not and should not be construed as a prospectus (as defined under Companies Act, 1956) or offer document under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulation, 2009, as amended, or advertisement for a private placement or public offering of any security or investment. The information contained in these materials has not been independently verified. No representation or warranty, express or implied, is made and no reliance should be placed on the accuracy, fairness or completeness of the information presented or contained in these materials. Such information and opinions are in all events, not current after the date of the presentation.